Featured

Rebalancing investments can be stressful—but it shouldn’t have to be

Rebalancing investments include asset allocation. The latter means buying and selling assets in order to maximize gains and minimize potential losses.

I’m practically cringing as I write this article. There are so many real problems in this world, that rebalancing your investment portfolio shouldn’t even make the top 10,000. But, with that caveat, I’ll tell you that there’s some stress and anxiety when buying and selling investments.

The need for more fixed assets

In January, I manually updated our family accounts and input the amounts into an Excel spreadsheet to track the asset allocation. Although I use Quicken and Personal Capital, I’m old school and like the control of my own, personally designed excel sheet. I programmed it so that I can tell exactly how much I need to add or subtract from each asset class.

With the recent run-up in the stock market, as you would imagine. I need to redeploy cash into fixed assets.

So, here’s where the anxiety comes in.

Fixed asset rates are still low, despite several Fed interest rate hikes this past year. Investing in bonds today means that as interest rates rise, the principal value will decline. CD rates are also low. Then there are municipal bonds and funds — rates are lowish in these assets too.

I finally decided to invest some of our cash into Vanguard’s intermediate-term California municipal bond fund.

Then I got an email about a 7.5-year CD paying 3 percent, available through TD Ameritrade. Here’s the catch — if interest rates rise, and I want to sell the CD, it’s likely I’ll sell it for a loss. Yet, if I hold it until maturity, I’m guaranteed to receive the full investment amount back in 7.5 years. It’s actually similar to a bond, in that respect.

Now, here’s where I get anxious.

If I keep the funds in the cash money market account waiting for rates to rise, I’ll receive less than 1 percent interest. But, as interest rates rise, I’ll have available cash to invest in higher return CD’s and bond’s.

There’s risk in every investment decision

I finally decided to invest a portion of our cash in the 3 percent CD. I’ll deploy some into the California muni bond fund as well. As time goes on, and interest rates rise, I can invest cash into the fixed asset portion of our portfolio in higher-yielding assets.

And, if the markets fall, I’ll have the opportunity to buy more stock funds at bargain prices.

Making a financial decision today, means you’re choosing one investment over another. You can’t always buy low and sell high—or can you? Rebalancing is a strategy to buying more shares when prices are lower and fewer when they’re high.

Ultimately, you don’t know the future, you won’t know whether you made the best choice or not — until later. That’s where diversification comes in.

Eight years ago it would have been the right decision to invest all of your money in stocks. But, you had no way of knowing that we were at the outset of a long bull market.

Today, the best investment decision is unknown. And that’s why I diversify.

If stocks fall in value, I have some bonds and cash to cushion the fall.

Next January, I’ll have another opportunity to rebalance our portfolio.

If 2018 is another stellar year in the stock market, and interest rates continue to rise, then I can sell some stock assets and deploy that cash in higher-yielding fixed assets.

Despite the anxiety of investment portfolio rebalancing, having a predetermined asset allocation makes it easier to sell overperforming assets and buy more of underperforming assets.

Insider secret

So, despite my rebalancing anxiety, I do it every year.

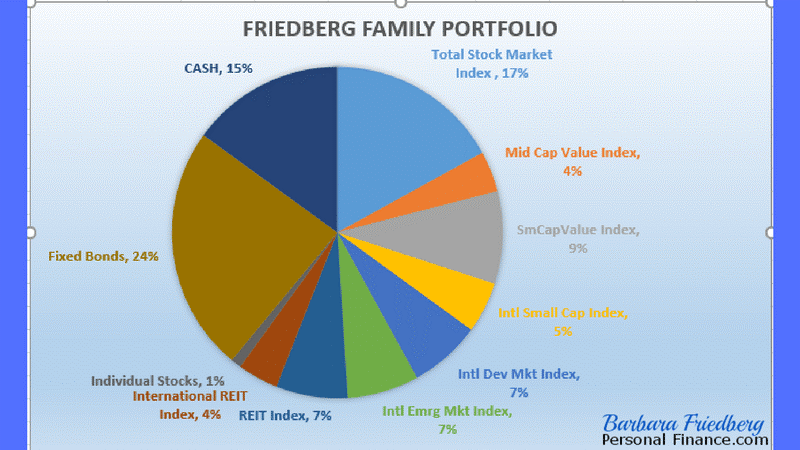

Are you interested in my asset allocation?

- US Stock Funds – 30 percent

- International Stock Funds – 19 percent

- Real Estate Funds – 11 percent

- Individual Stocks – 1 percent

- Fixed Assets – 39 percent

Take a peek under our family’s investing hood.

Here’s our current asset allocation breakdown and the rationale for our choices:

How I chose our asset allocation

I’m conservative by nature and looking to preserve some of our hard-earned capital. So, I decided on a 60 percent stock vs. 40 percent fixed portfolio.

The U.S. is a small part of the world economy. The U.S. is growing slower than many emerging economies, so I wanted a solid allocation to international stocks.

Real Estate Investment Trusts (REIT) pay a juicy dividend and diversify away from stocks and bonds. Fixed assets, such as cash and bonds stabilize a portfolio during downturns and limit the losses. And I can live with reduced gains during market advances, to minimize losses during the drops.

Individual investment drill down

With the exception of a few individual stocks and individual bonds, our investments are in low fee, diversified index funds.

Stock funds

To cover the U.S. investment market, I invest in a total U.S. stock market index mutual or exchange-traded fund (ETF).

Because value stocks historically outperform growth stocks, and small caps typically outperform large-cap stocks, I chose both mid and small-cap value index funds.

It’s important to invest across the globe and in emerging markets. Companies from less developed countries have greater growth potential but are more volatile than those from older developed markets. That’s why I invested in both emerging and developed market index funds.

Real estate is an important asset class, with typically high dividend payouts. I invested in both domestic and global real estate ETFs.

Bond funds and cash

I like cash. I know that the returns on cash today are low, but I like the security that holding cash provides.

Bonds typically return less than stocks but also shore up an investment portfolio during market downturns. I typically invest in individual bonds and add in a few inflation-protected government bonds.

To wit, some portfolio takeaways:

- Invest in a diversified asset allocation, in line with your risk tolerance.

- Invest regularly.

- Rebalance annually.

- Investing is risky, and so is life. If you keep your money in cash, you’ll lose buying power due to inflation.

- Rebalancing is a systematic way to buy low and sell high.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business1 week ago

Business1 week ago2.5 Billion People Watch Quiz Shows Every Day. Masters of Trivia (MOT) Is Letting Them Compete

-

Crypto5 days ago

Crypto5 days agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip

-

Business2 weeks ago

Business2 weeks agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Cannabis2 days ago

Cannabis2 days agoCanopy Growth Launches Cheaper 15g Medical Cannabis in Poland

You must be logged in to post a comment Login