Business

Resource investing: why mining investors believe this small-cap gold producer will soar

With the world still grappling with a looming recession investors are looking into precious metals as a way to protect their assets. The spot price of gold and silver looks set to soar and it is companies like Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F) that are positioning themselves to ride the wave.

As the stock markets are experiencing a rally many investors will release a long held sigh of relief but it will likely be short-lived. While many nations are looking at loosening their COVID-19 lockdowns, the risk of a second surge in protections is very real. This uncertainty means that the price of gold and silver is likely to experience relative instability in the face of a deeply unpredictable stock market. Investors are quite rightly looking at inventive ways to protect and grow their portfolios in troubled times and precious metal extraction companies like Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F), like Newmont Goldcorp (NYSE: NEM, TSX: NGT) and GFG Resources Inc. (TSX-V: GFG, OTCQB: GFGSF), are positioning themselves to thrive in a difficult environment.

Gold and silver mining companies are a good bet in turbulent times

We’re looking at a year or more before a vaccine for COVID-19 can be perfected. This means that periodic lockdowns, and the economic damage they bring, are likely to continue for the foreseeable future. This means that many traditionally safe investments are now questionable, and a huge number or barely viable businesses may just fold.

Gold and silver, on the other hand, look set to soar amidst the instability. Gold could go as high as $3,000, even if the path there may be winding, and this has created a unique opportunity for precious metal mining companies. High gold prices will undoubtedly help drive higher profits and this is particularly beneficial for emerging operators.

Why gold mining companies are such a strong bet

The natural inclination of many investors is to purchase actual gold or silver bullets. This seems logical, precious metals tend to hold their value even in turbulent markets and can be stored indefinitely. Despite this directly purchasing precious metals may not be the optimal strategy, unless you’re planning for the end of the world of course.

The key thing to keep in mind is that the real beneficiaries of high gold prices are mining and prospecting companies. It logically follows that investing in the right precious metals extraction company will provide the biggest opportunity for a return on your investment. To understand how that works let’s take a look at Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F),

Why Inca One Gold should be on every precious metals investor’s radar

Inca One Gold Corp. is a Canadian-based small cap gold producer with two gold milling facilities in Peru. Peru is one of the world’s top producers of gold and silver with around 20% of production coming from small-scale, or artisanal, miners who need government authorized milling facilities.

Inca One is the first publicly traded gold processing company to complete permitting under Peru’s formalization legislation and has operated in the company for more than six years. The company is the largest public trading gold processor in Peru via its two facilities Chala One and Kori One, which are capable of processing 450 tonnes of gold ore per day.

Small operators bring big returns

Rather than targeting larger multinational companies, the team at Inca One identified small-scale producers as the perfect target market. Despite representing just 20% of production in Peru, small-scale mining is already a billion-dollar industry that has grown 82% since 2001. This figure is likely to increase over the coming years.

Targeting smaller producers has a lot of benefits. By helping stimulate the local economy Inca One grows their own customer base and reduces the risk of a large rival setting up shop and muscling them out of their turf. There are also significant non-economic benefits. Smaller producers have a bigger local economic impact, which means that an investment in Inca One Gold will help directly benefit the Peruvian economy.

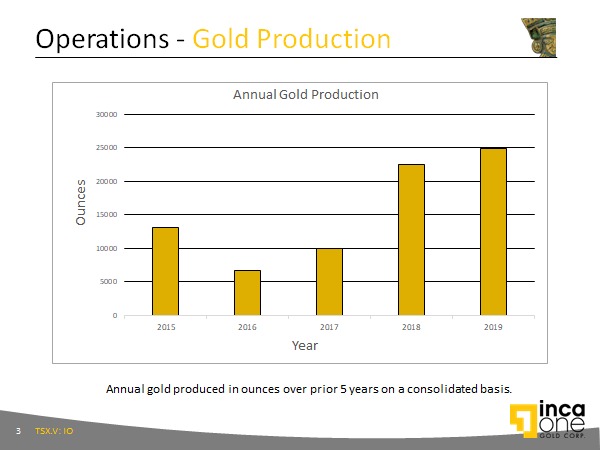

This approach has helped Inca One grow for three consecutive years and make over $100 million in sales and there’s still room for growth. Inca One Gold is using just 35% of its current capacity, which means that as the Peruvian market grows the company will be able to generate even more revenue.

A unique opportunity for gold investors

Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F) represents a unique opportunity for gold investors. Particularly those who are interested in sourcing ethical gold that has a positive impact on the site of extraction. Inca One’s focus on small-scale miners is not just profitable but it ensures that the company isn’t simply extracting wealth from a region but helping it thrive. This ethical approach ensures the longevity of Inca One’s operations and represents a new gold standard for how the mining industry can help to restore its reputation in a wider audience.

Additionally, Inca One still has significant room for growth and has excellent relations with the Peruvian government. These factors, combined with the high potential for gold prices to rise in the near future, make Inca One a unique opportunity that precious metal investors should be studying closely

Five reasons to invest in Inca One Gold Corp.

- The company’s ethical approach ensures sustainability and creates a positive impact beyond your investment

- The small-scale Peruvian mining sector has grown 80% since 2011 and is worth over $1 billion

- Inca One has 65% of its milling capacity remaining, giving it excellent room for growth

- The company’s management team, both in Canada and Peru, bring decades of experience in the sector

- Investing in milling operations ensures that your investment isn’t tied to the fate of a particular property or prospect, maximizing the sustainability of your investment

__

(Featured image by Pixabay via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Business6 days ago

Business6 days agoDow Jones Near Record Highs Amid Bullish Momentum and Bearish Long-Term Fears

-

Business2 weeks ago

Business2 weeks agoDow Jones Breaks 50,000 as Bull Market Surges Amid Caution and Volatility

-

Crowdfunding3 days ago

Crowdfunding3 days agoThe Youth Program at Enzian Shooting Club Is Expanding Thanks to Crowdfunding

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEU Backs 90% Emissions Cut by 2040 and Delays ETS2 Rollout