Markets

Ways to organize your retirement savings before tax day

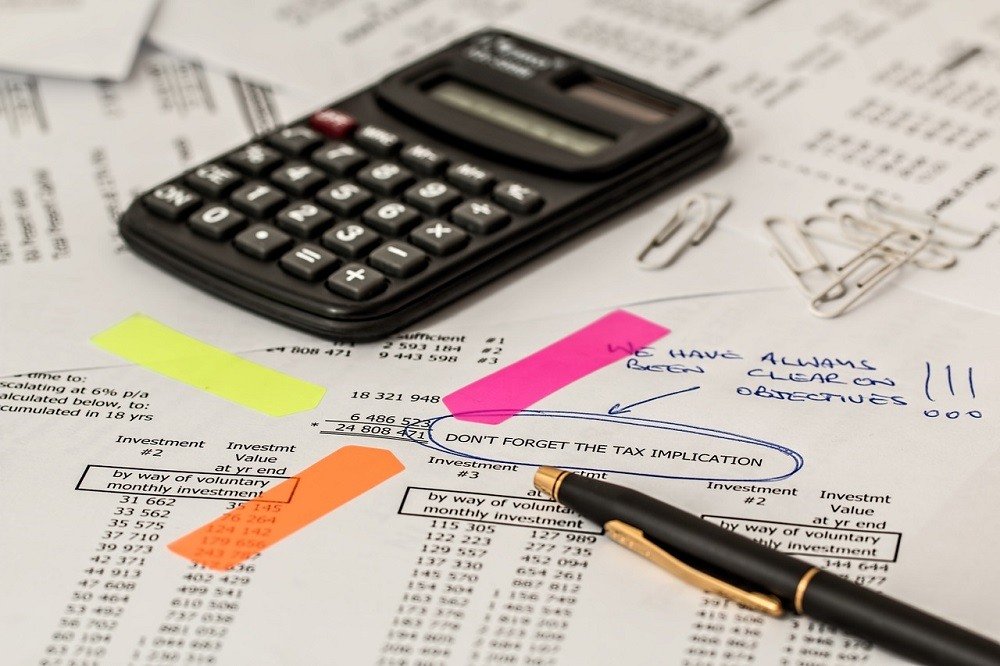

Tax Day 2017 is only a few weeks away. While you’re scrambling to get everything in order and get your return out the door by April 18th, take the time to consider making any last-minute contributions to your retirement accounts.

With the bulk of February now behind us, tax season is heading into full swing. As a result now is the perfect time to take a closer look at your retirement savings and considering ways to improve it.

In fact, it’s not too late to make your retirement account contributions count toward your 2016 tax bill.

IRA tax deadline and limits

A quick glance at a calendar or newspaper will indicate that 2016 is officially over. However, as in previous years, any contributions made to your IRA before Tax Day (which is actually April 18th this time around) can be applied to your 2016 taxes. Since traditional IRA contributions are tax deductible, this could be a great way to help reduce your bill.

Keep in mind that there are limits to how much you can contribute to your IRA in a single year. For 2016 that limit is $5,500 for those under the age of 50 and $6,500 for those over 50. Incidentally, those figures will remain the same for 2017 as well.

It’s also worth noting that, while Roth IRAs provide great tax benefits at retirement age, taxes on contributions are paid up front. As a result making a last minute addition to your Roth won’t help cut your tax bill now. That said you can still make contributions for 2016 up until April 18th as long as you’re below the $5,500 ($6,500 if you’re over age 50) limit.

Refunds and thinking beyond tax time

Even if you don’t have extra funds to put toward your retirement now, many Americans will be receiving a bit of a bonus over the next few months: their tax refund. While you surely have a list of splurges earmarked for your refund check, it may be worth considering applying at least a portion of it to your retirement account. It may not seem like the most fun idea for your money, but the gains you’ll receive when it’s time to retire will certainly be worth it.

Lastly, now is also a great time to assess your retirement contributions overall, including your 401(k). For one, if you’re not maxing out your employer matching offer, it’s imperative that you work to correct that. After all, this is essentially free money! Beyond that, it’s always worth taking a closer look at your budget and making some extra room for retirement savings — in the long run, you’ll be happy you did.

The bottom line

Tax Day 2017 is only a few weeks away. While you’re scrambling to get everything in order and get your return out the door by April 18th, take the time to consider making any last-minute contributions to your retirement accounts. Additionally, don’t forget about paying yourself and investing in your future once your refund check comes. Happy Tax Season!

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto6 days ago

Crypto6 days agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip

-

Business2 weeks ago

Business2 weeks agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Cannabis3 days ago

Cannabis3 days agoCanopy Growth Launches Cheaper 15g Medical Cannabis in Poland

-

Fintech1 week ago

Fintech1 week agoFirst Regulated Blockchain Stock Trade Launches in the United States

You must be logged in to post a comment Login