Markets

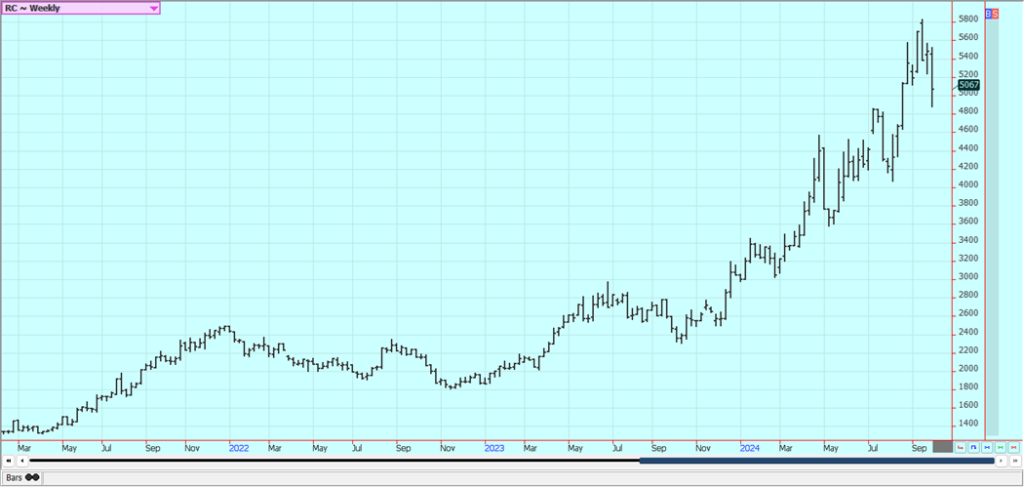

Rice Prices Hold Steady Amid Lower Asian Rates, Brazil’s Surge, and US Weather Threats

Rice prices remained steady despite India reopening non-Basmati White Rice exports, which lowered Asian prices. Brazil’s prices remain strong, exceeding US levels. Another hurricane forming in the Gulf could threaten unharvested crops in the Delta and Mid-South. Weather has impacted the US growing season, with early rain and current heat, notably reducing Texas yields.

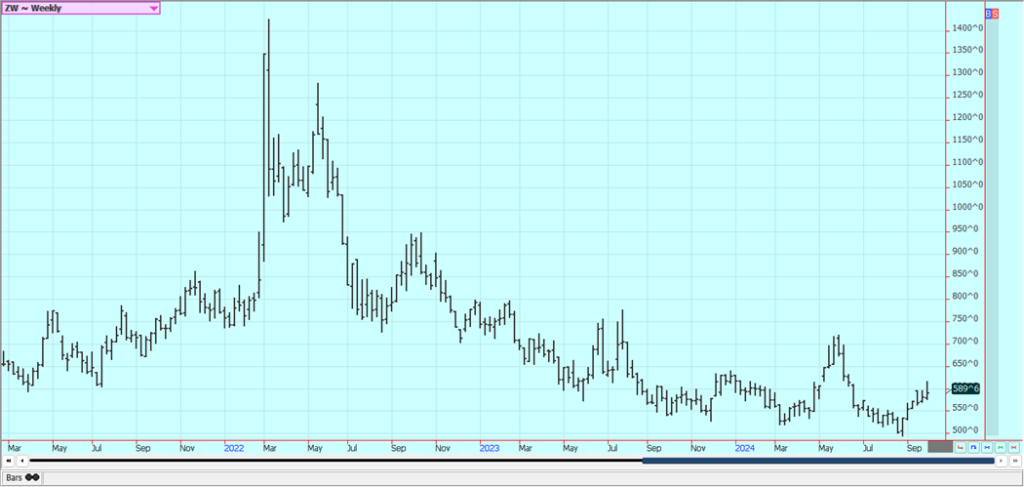

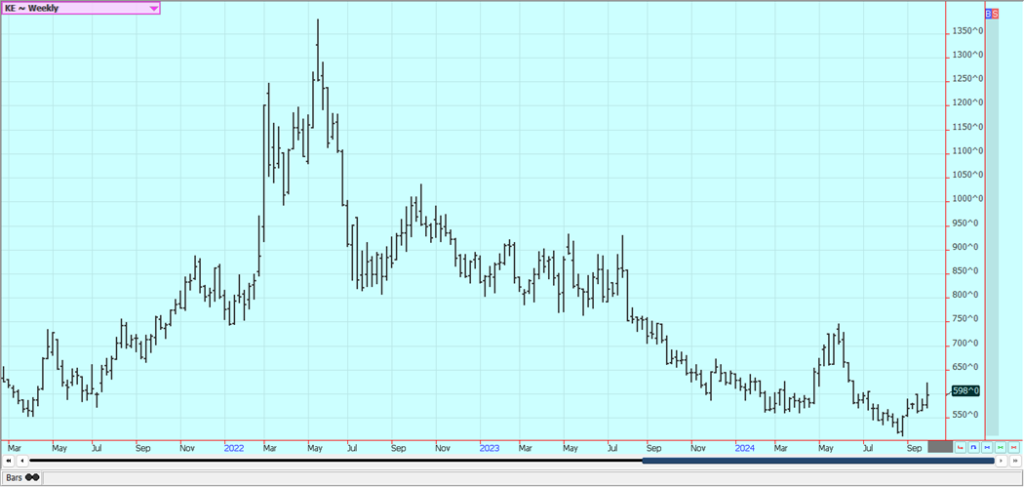

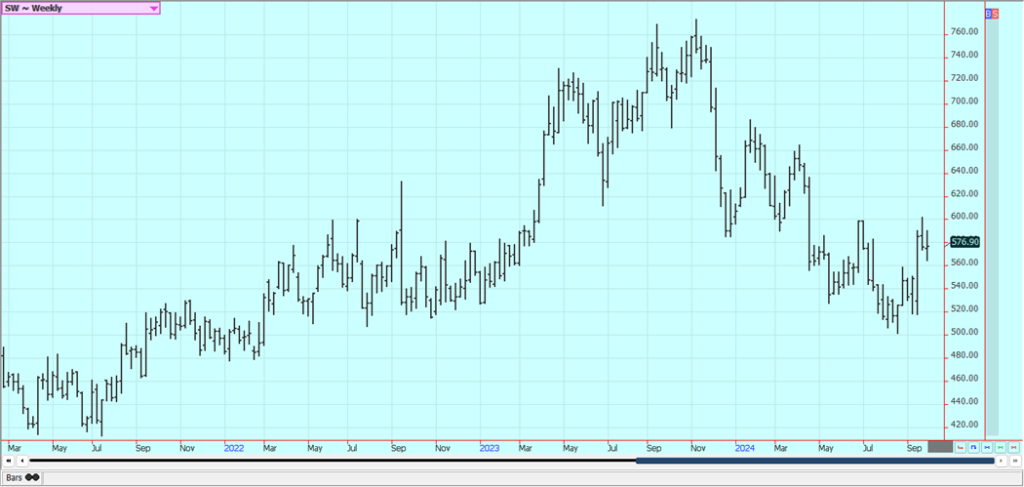

Wheat: All three markets closed higher last week despite some late week profit taking from speculators as the dry weather outlook continues for Russia. The export sales report showed moderate sales. At least two Wheat producing regions have declared a state of emergency for Wheat producers due to a lack of rain. World prices were higher amid weather problems here in the US and around the globe. Ideas are that the Great Plains are too hot and dry for best Wheat development are still around as the Winter crop gets planted. It is also hot and dry in western Canada.

Cash markets in Russia were higher as production estimates remain lower and two regions have now declared a farming emergency due to the hot and dry weather. Ideas of good crops just harvested in the US and Canada went against reports of dry weather in eastern Europe and Russia and too wet weather in France and Germany along with Spring Wheat areas of Russia are still heard and the weather there affecting world production estimates.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn and Oats closed higher as buying continued even with active harvest conditions in the midwest. The weekly export sales report was strong. It remains dry in the Midwest, and there are now forecasts for dry conditions and cooler temperatures in the Midwest for the coming week.

Ideas are that the production data seen last month will be the biggest seen all year due to the dry August and September in most of the Midwest. Producers plan to hold new crop supplies in hopes for higher prices. Yield reports heard so far show strong production potential for the national crop. Increased US demand comes from the fact that Corn prices are already the cheapest in the world.

Weekly Corn Futures

Weekly Oats Futures

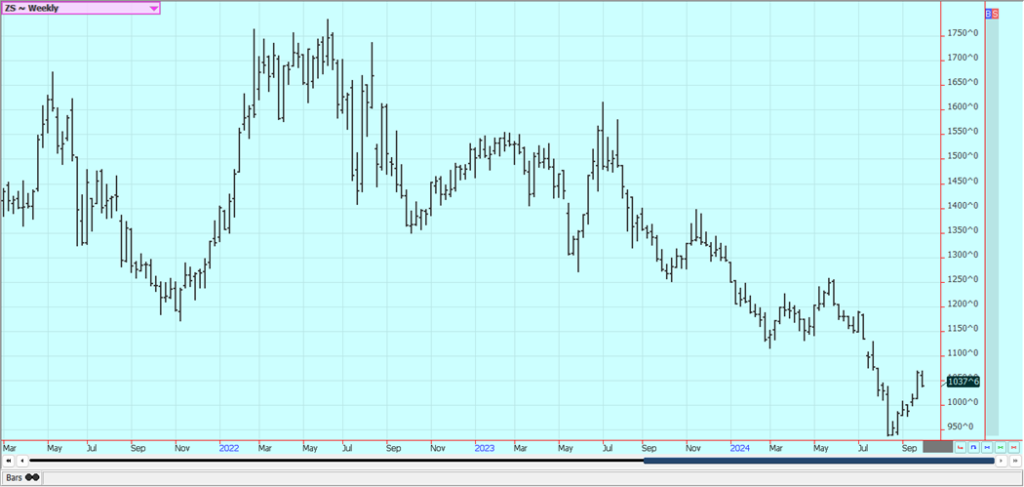

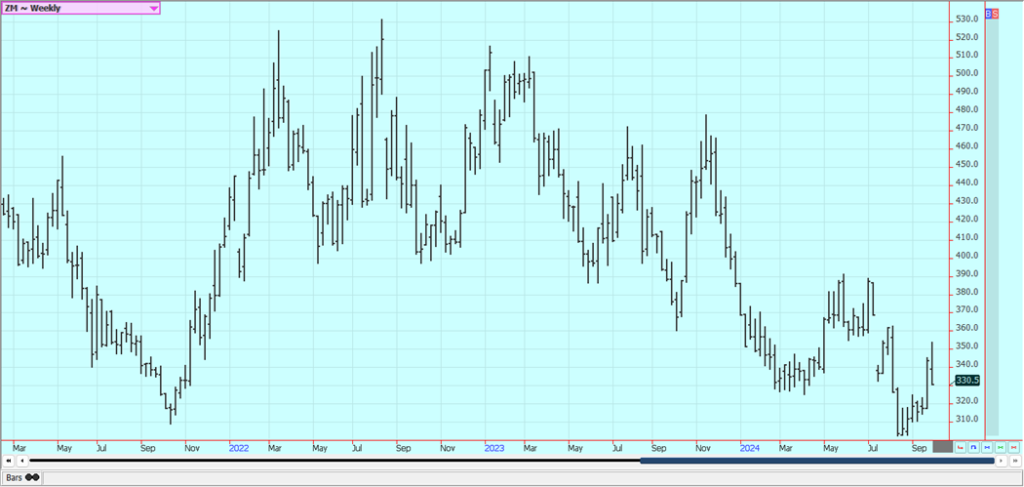

Soybeans and Soybean Meal: Soybeans and Soybean Meal were lower last week as China was closed for the week due to a holiday and the port strike in the US interrupting shipments from the East Coast and Gulf Coast. China is back zto work zthis week and the port strike was settled on Thursday afternoon. The weekly export sales report was strong. Soybean Oil closed lower. Warm and dry weather in the Midwest recently has hurt production ideas due to ideas of small beans in the pods. Dry weather will last all week.

Ideas are that the production reports are the biggest that will be seen this year. There is concern about the dry weather seen in the Midwest could hurt pod fill. Ideas are that the beans could be smaller in the pods, but this will not be seen in this report that will include mainly pod counts. Bean sizes will be measured in subsequent months. Central and northern Brazil has also been dry and reports indicate that soil moisture levels are at 30 year lows. Soils are in much better shape in southern Brazil and Argentina. There are some forecasts for showers to return to central and northern areas starting this week.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

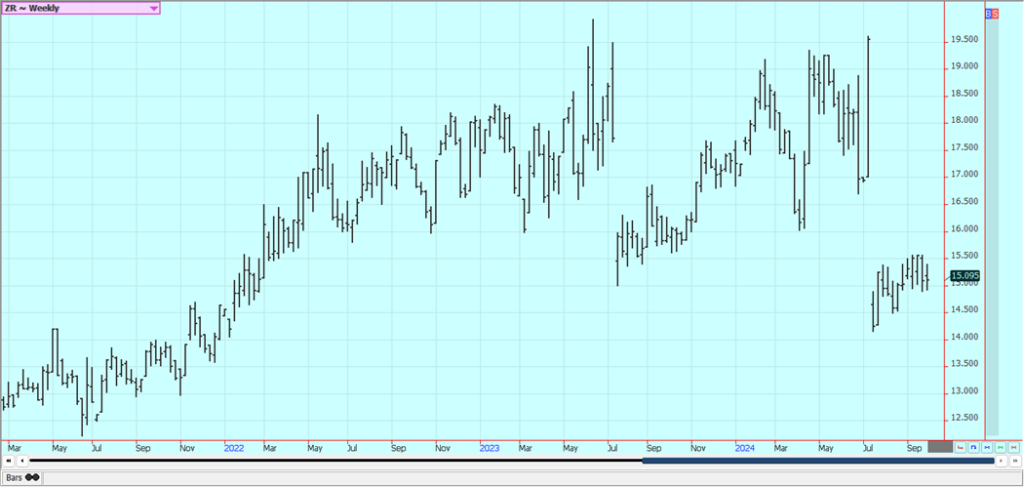

Rice: Rice closed little changed despite news of lower Asian prices after India opened up rice exports for non Basmati White Rice. Brazil rice prices have been strong and well above US prices. Another hurricane is forming in the Atlantic but it is appears likely to miss the US. Yet another system is trying to form in the Gulf of Mexico that could present a threat to whatever rice remains unharvested in the Delta and Mid South.

It is forecast to move into Florida for now. There was concern to damage to unharvested rice crops in the region from the hurricane that het a couple of weeks ago. The US weather has been an issue much of the growing season with too much rain early in the year. Some areas are now too hot and dry, especially in Texas, and Texas yields are down as the rice harvest is now over in the state.

Weekly Chicago Rice Futures

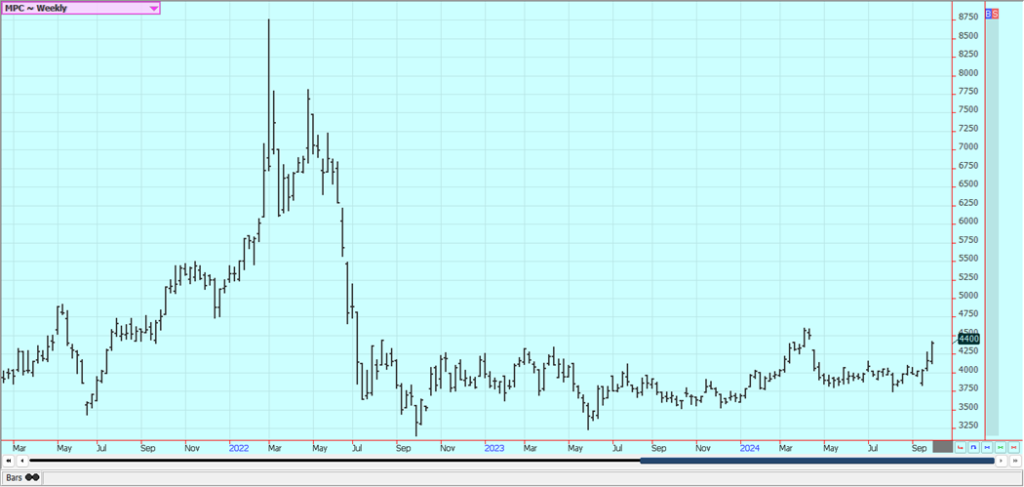

Palm Oil and Vegetable Oils: Palm Oil was higher last week and closed at new contract highs for the active December month. The production could be reduced by flooding that can keep workers from the fields. Demand has held together despite India increasing import taxes on Palm Oil and China is now back from a holiday week to help demand ideas hold together.

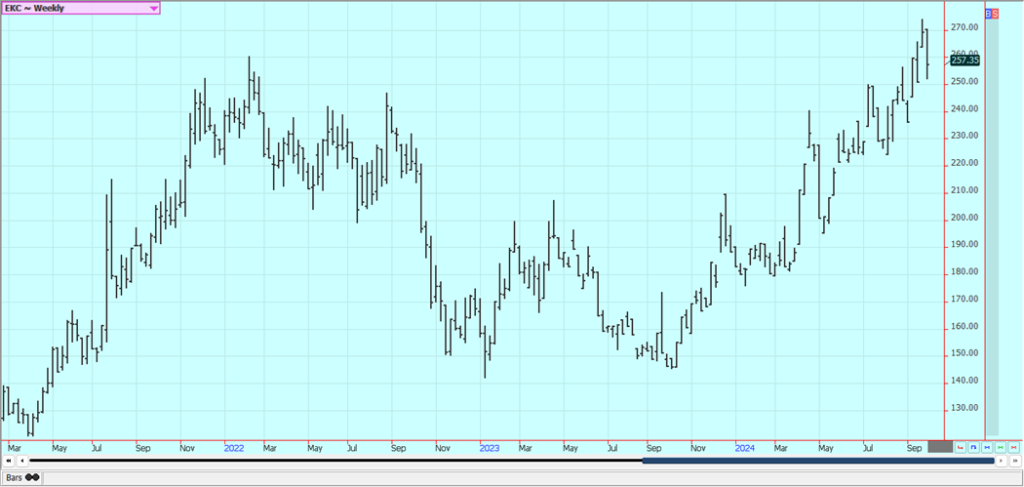

Canola was higher last week and continues to pull away from the early harvest lows set several week ago in part on a weaker Canadian Dollar against the US Dollar and in part on reports of somewhat less production. The weather has been hot and dry in Canada, and it looks like Canola production has been impacted. The weather has called for dry conditions in the Prairies and yields are expected to be the same or less. Demand concern remain at the forefront with less demand expected from China with that country now in a trade war with Canada, but so far demand has held together well.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was a little higher last week in range trading as continued stressful weather was seen in the south but export demand was less. There are still ideas and reports of weaker demand potential against an outlook for improved US production in the coming year. There have been demand concerns about Bangladesh and China and ideas are that production is strong enough.

However, Chinese demand could start to improve as the government there is injecting a lot of money into the economy in an effort to get the country moving again China was on holiday last week but is back to work this week. Texas and the Southeast have seen some extreme heat so far this year, and Texas has also seen dry conditions at times during the growing season. The Delta has had somewhat better growing conditions but overall the entire crop has seen some stress.

Weekly US Cotton Futures

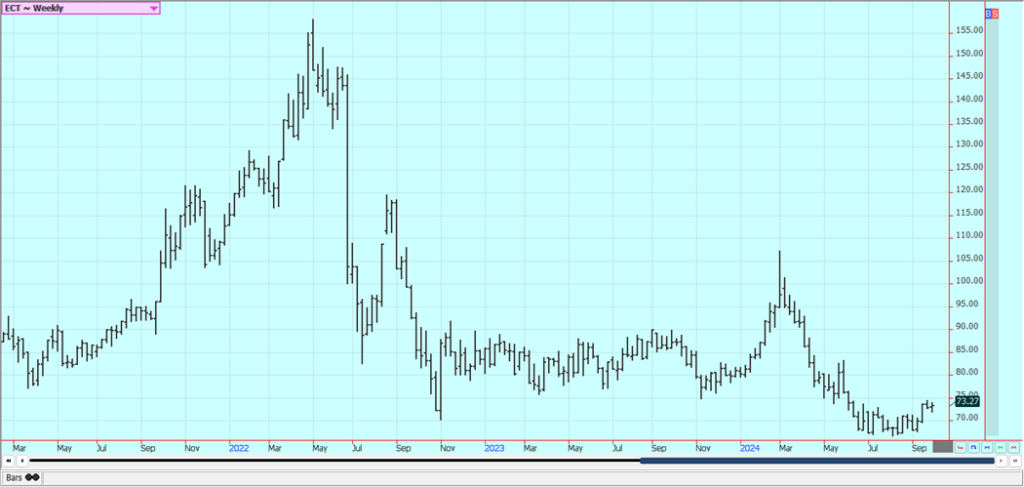

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little lower in quiet trading last week as a new tropical system is forming in the Atlantic but is not forecast to hit Florida. Yet another system could be forming in the Gulf of Mexico but it needs to develop. Significant rains are likely for parts of the Florida peninsula this week from the Gulf storm no matter how it develops. Growing conditions appear to be generally good for now.

The market remains well supported in the longer term based on forecasts for tight supplies in Florida. The reduced production appears to be mostly at the expense of the greening disease. There are no weather concerns to speak of for Brazil right now although reports indicate that Brazil has been hot and dry. Rain is expected this week.

Weekly FCOJ Futures

Coffee: Both markets were lower last week as rain remains in the forecast for Brazil crop areas. There are now forecasts for some rains starting early this week in Brazil after very dry conditions until now. It appears that the rainy season is finally underway, but losses are still possible in Brazil and also Vietnam from previous bad weather.

Relief was felt as the EU moved to delay implementation of its deforestation regulations for third world countries and is likely to succeed. Indonesian offers are still less as producers wait for higher prices before selling. Damage was done to crops earlier in the growing season in Vietnam and lower production is now expected for the next crop. It is still dry there.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

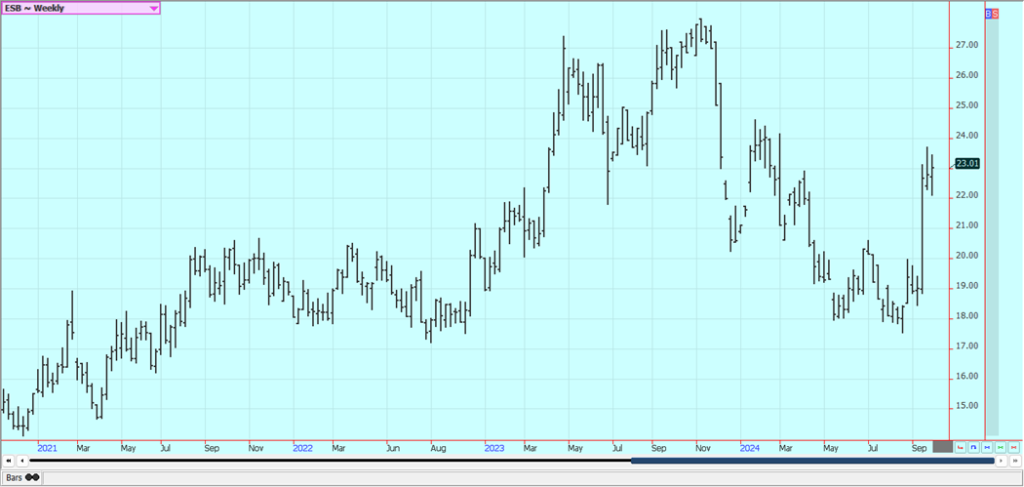

Sugar: New York and London closed a little higher last week on strength in world petroleum prices based on the current problems in the Middle East. A cold front is expected in southern Brazil this week that could spread north and bring much needed rains to Sugar areas. Dry conditions seen generally in Brazil continued to support both markets overall. Harvest progress in Brazil and improved growing con-ditions in India and Thailand are the important fundamentals and growing conditions are dry in Brazil. Indian and Thai monsoon rains have been very beneficial and mills are expecting strong crops of cane.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

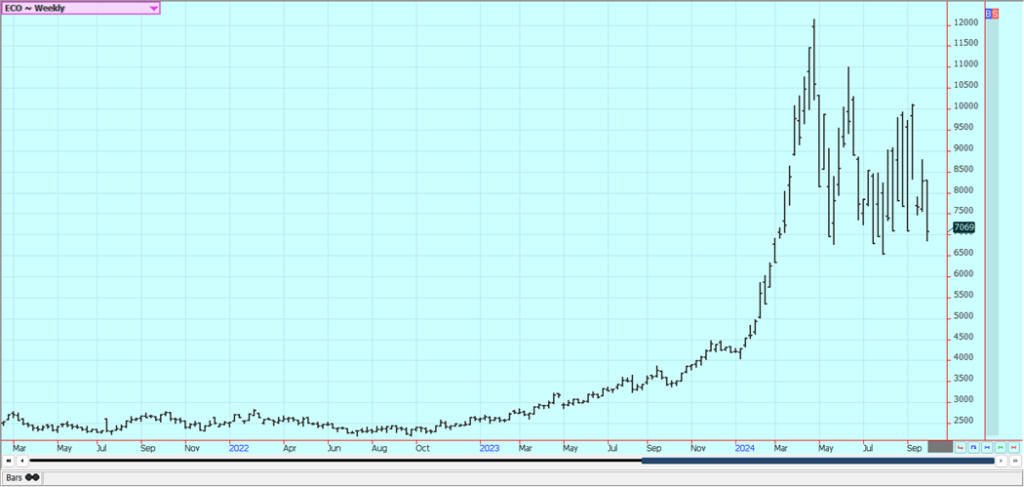

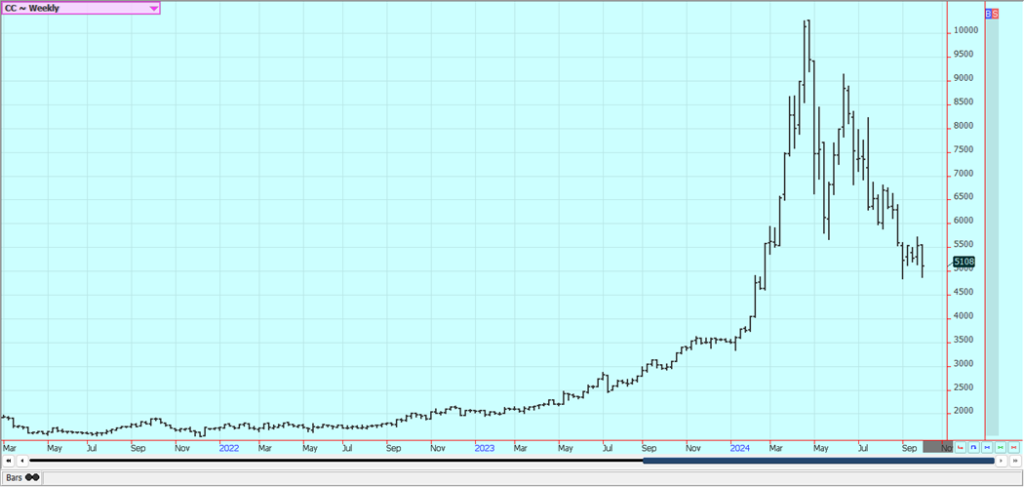

Cocoa: New York and London closed sharply lower last week and both markets are still acting heavy as the harvest of the next crop is about to start. Relief was felt as the EU moved to delay implementation of its deforestation regulations for third world countries. Production in West Africa could be stronger this year on currently wetter weather in Ivory Coast.

Above average rain is now forecast for the next couple of weeks to improve conditions in West Africa. Sources told wire services that the rains seen last week were beneficial for crop development. The availability of Cocoa from West Africa remains very restricted, but surplus production against demand is expected in the next crop year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Quangpraha via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding1 week ago

Crowdfunding1 week agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Cannabis7 days ago

Cannabis7 days agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Crypto2 weeks ago

Crypto2 weeks agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments

-

Cannabis2 days ago

Cannabis2 days agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed