Markets

Soybean Markets Weighed Down by Rising Supplies and Bearish USDA Outlook

Soybeans and soybean meal declined last week, while soybean oil rose. Despite strong weekly export sales, USDA reports were bearish, raising production, domestic demand, and ending stocks while cutting exports. Increased Brazilian output and advancing South American harvest pressured markets, with high U.S. prices limiting sales beyond Canada and Mexico.

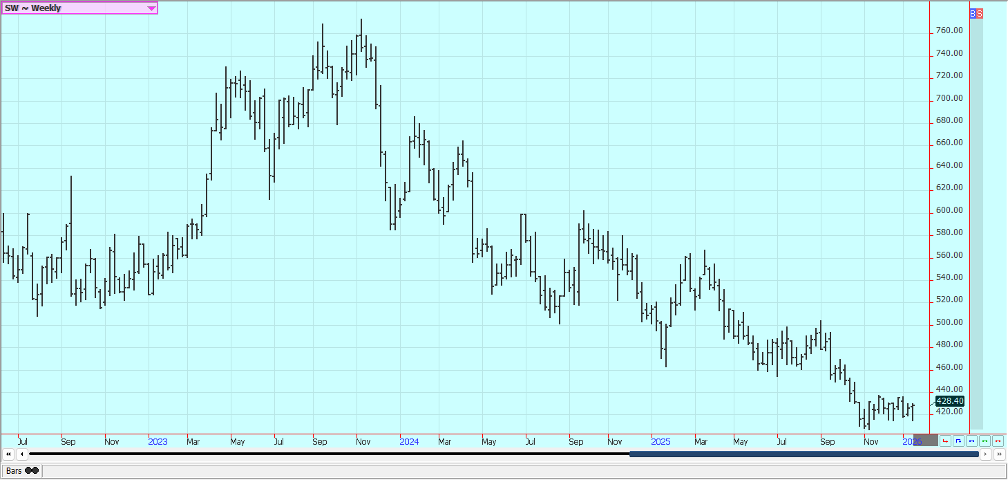

Wheat: Wheat closed a little higher and KC closed a little lower last week as the USDA weekly export sales report showed only meager sales. Better export sales are now anticipated due the move lower seen Monday in reaction to the USDA reports. USDA released its Winter Wheat seedings report on Monday that showed increased planted are for SRW and reduced White Winter Wheat seedings. HRW seedings were unchanged from a year ago.

Ending stocks were also increased for the US and the world, so the report was considered bearish. Ending stocks estimates and the quarterly stocks estimates were on the high side of expectations. Concerns on the condition of the Winter Wheat crops moving forward are growing as there is little snow cover and some very cold temperatures in the forecast that could create Winterkill.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Kansas City Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Unavaiable today

Corn: Corn was last week in response to the USDA reports. USDA showed solid sales last week. The USDA reports that were released on Monday. USDA increased production by raising harvested area and trimming yields and increased ending stocks through the increased production and a smaller increase in demand.

The demand for export and for bio energy needs has held strong, but the export demand was cut back in the WASDE reports even as feed demand remained untouched. Traders had expected a cut to the feed demand. Trends are down. Temperatures should average near to above normal today, then near to below normal. Oats were slightly lower.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and Soybean Meal were lower last week, but Soybean Oil was higher. The weekly export sales report showed very strong sales. The USDA reports were bearish for Soybeans. Production was increased as was domestic demand. Export demand was cut back and ending stocks were increased.

Soybean Brazil production was increased. It seems that the market is now more concerned about big supplies coming soon from South America with the Soybeans harvest there now underway. US prices are currently too high to complete many new sales anywhere in the world market except Canada and Mexico. Temperatures will average near to below normal in the Midwest.

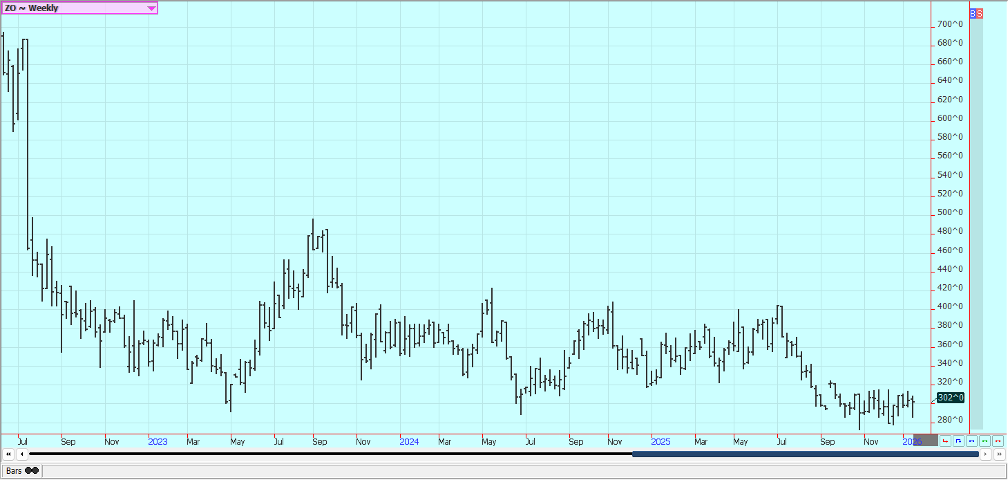

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher last week. The market might have finished a bottom formation on the daily and weekly charts. USDA on Monday cut its production estimate for All Rice but left Long Grain production higher than last month. Domestic demand was increased and exports were cut for all classes. Ending stocks were reduced. The average farm price was increased for all Rice but left unchanged for Long Grain. Weaker world prices are expected by the FAO in the coming year. Trends are turning up in the market.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil futures were higher last week. There are still ideas of increasing production. Demand ideas are in a state of flux right now with some looking for weaker demand and other looking for improved demand. Canola was higher last week on strong demand ideas. Canada and China reached agreement on a new trade deal which is expected to result in part in new sales of Canola to China There are ideas of a big Soybeans harvest coming from South America.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was a little higher last week in range trading and a strong weekly export sales report. The weekly sales total was over 400,000 bales and much higher than what has been reported for the last couple of years. The USDA reports released on Monday showed less production and unchanged demand. Ending stocks were less.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: Futures were a little higher last week as the Florida harvest is active. USDA on Monday showed US production at 54.8 million boxes and Florida production at 12.0 million boxes. Both estimates are unchanged from previous reports. Chart trends are mixed.

There is no freeze in the forecast, but areas north of the state have been very cold and more cold weather is possible later this week. Florida has also been dry and irrigation is needed. Traders are worried about demand even with overall lower prices. The weather is considered good for production in Brazil and Mexico. Scattered showers are reported in Brazil.

Weekly FCOJ Futures

Coffee: New York closed a little lower and London closed higher last week, and trends are mixed in both markets. There are still ideas and reports of increasing harvest sales from Vietnam. There are reports of very good conditions in Brazil. Most farmers are holding for better prices. Scattered showers are being reported now to improve tree condition in Brazil. Mexico is in good condition, as is Central America. Vietnam has scattered showers lately and conditions there are called good. Vietnamese producers are selling.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London were a li9ttle higher last week. There are good supplies for the market from good growing conditions for cane and beets around the world continue. The prospect of a big global surplus in the 2025/26 season was keeping the market on the defensive with a rise in production in India and Thailand set to increase supplies while global consumption is expected to remain steady.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: New York and London closed lower again last week. Short term trends are down. A big main crop harvest is anticipated in West Africa and rains have been positive for crops lately. Light rains mixed with heat in Ivory Coast’s cocoa-growing regions last week signaled a positive outlook for the main crop. There are still reports of increased production potential in other countries outside of West Africa, including Asia and Central America. The market feels that there is less demand and the lack of demand is expected to continue.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Thomas Kinto via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Cannabis1 week ago

Cannabis1 week agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Crypto2 weeks ago

Crypto2 weeks agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments

-

Cannabis2 days ago

Cannabis2 days agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed

-

Markets1 week ago

Markets1 week agoRice Market Slips as Global Price Pressure and Production Concerns Grow