Business

Soybean moves lower amid Trump’s trade tariffs

More soybean and soybean meals were sold last week in anticipation of China’s retaliation against the Trump administration’s trade tariffs.

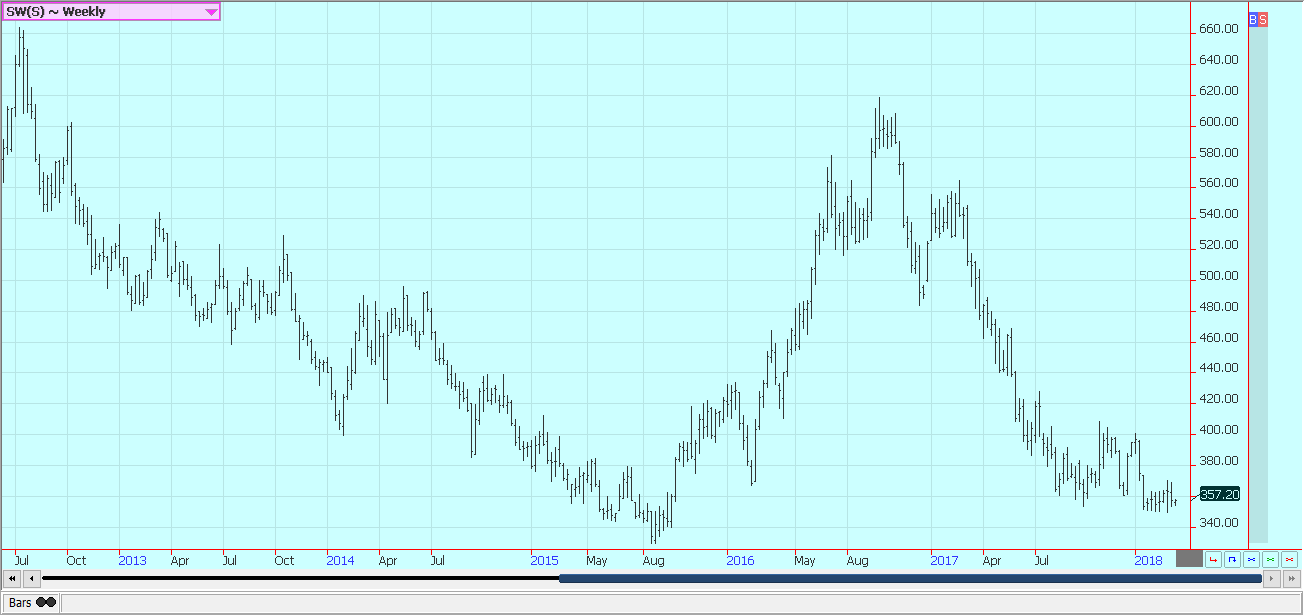

Wheat

Wheat markets were lower last week on some reports of beneficial rains in the western Great Plains, mostly in Kansas. Forecasts still call for dry weather in Texas and Oklahoma and it is dry again in Kansas.

The weekly export sales report was improved, but cumulative sales and shipments remain behind the pace needed to make USDA targets. There is some talk now that USDA will be forced to increase ending stocks estimates for the current crop in the next couple of monthly reports.

US prices are too high when compared to the world competition, but the situation has improved in the last couple of weeks. Lower futures prices and a weaker US Dollar have put US Wheat back into the mix for world buyers.

Wheat futures are still in a weather market, and it remains very dry in the western Great Plains. La Nina conditions are still affecting the production potential for Hard Red Winter areas, but La Nina is fading, so chances for rains should start to improve. However, the systems keep missing the area and go to the north instead.

A large part of the HRW crop is still rated in poor to a very poor condition as crops start to come out of dormancy. Minneapolis prices remain weaker in part on high Canadian production and in part on ideas of an increased planted area for Spring Wheat in the US this coming season. Black Sea prices remain firm.

USDA releases its quarterly stocks report and prospective plantings report on Thursday. Price Group expects stocks near 1.510 billion bushels. The planted area could be near 46.68 million acres for All Wheat. Winter Wheat area should be about 32.55 million acres, Durum should total about 2.48 million acres, and Other Spring Wheat area should be near 11.65 million acres.

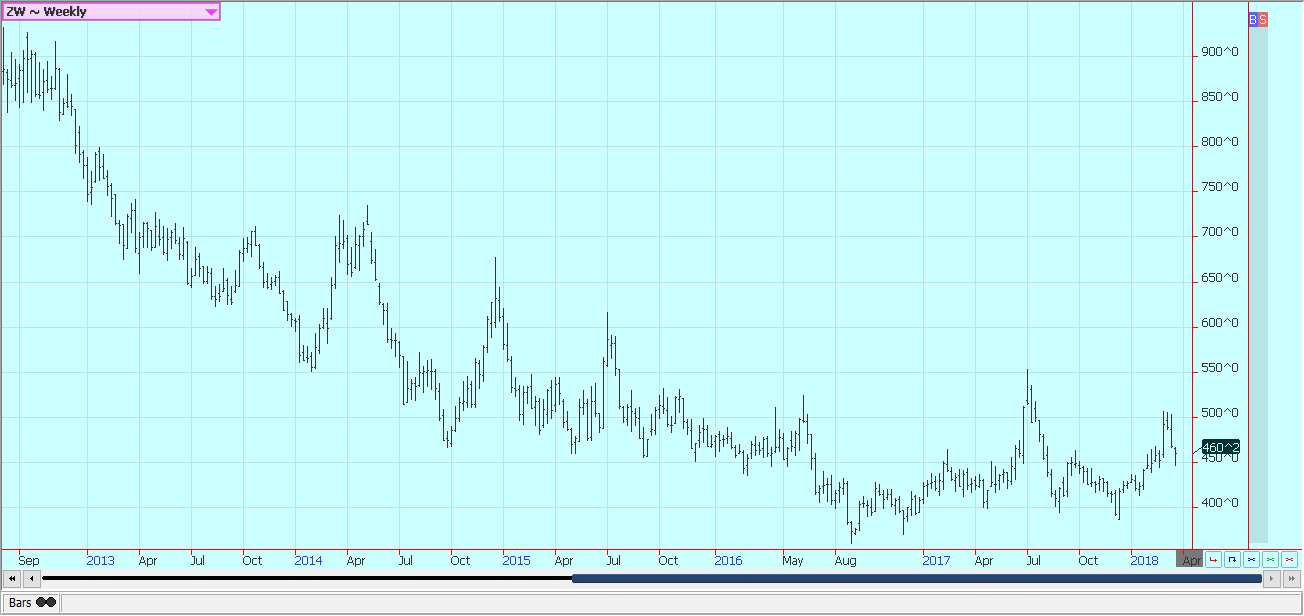

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

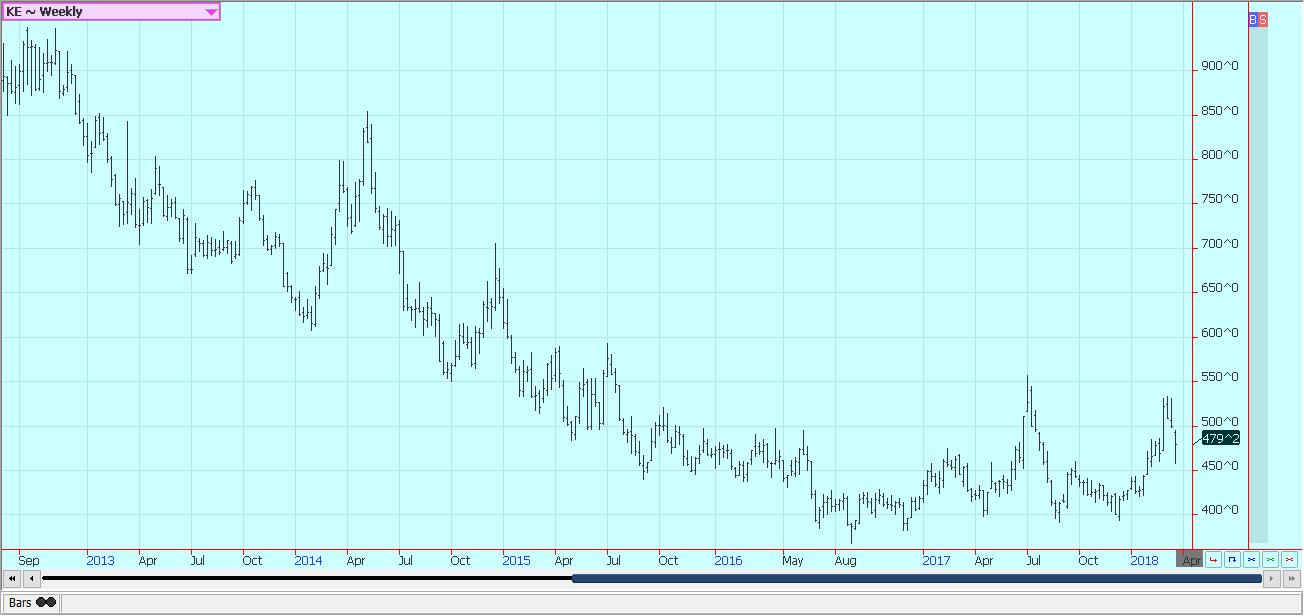

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

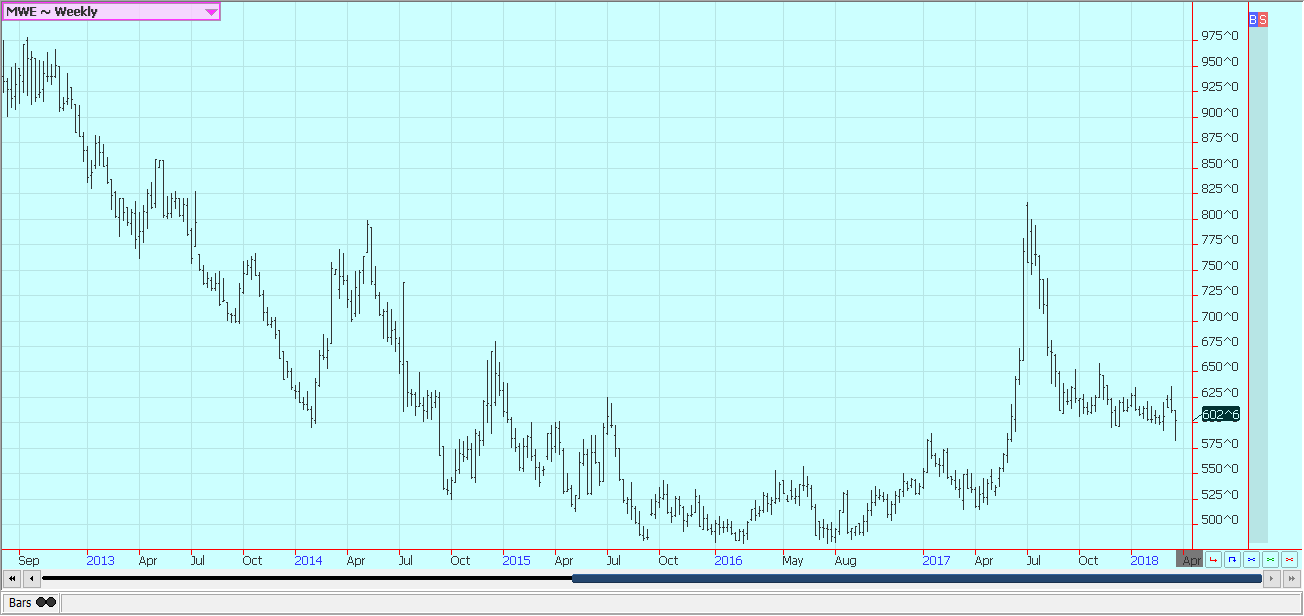

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

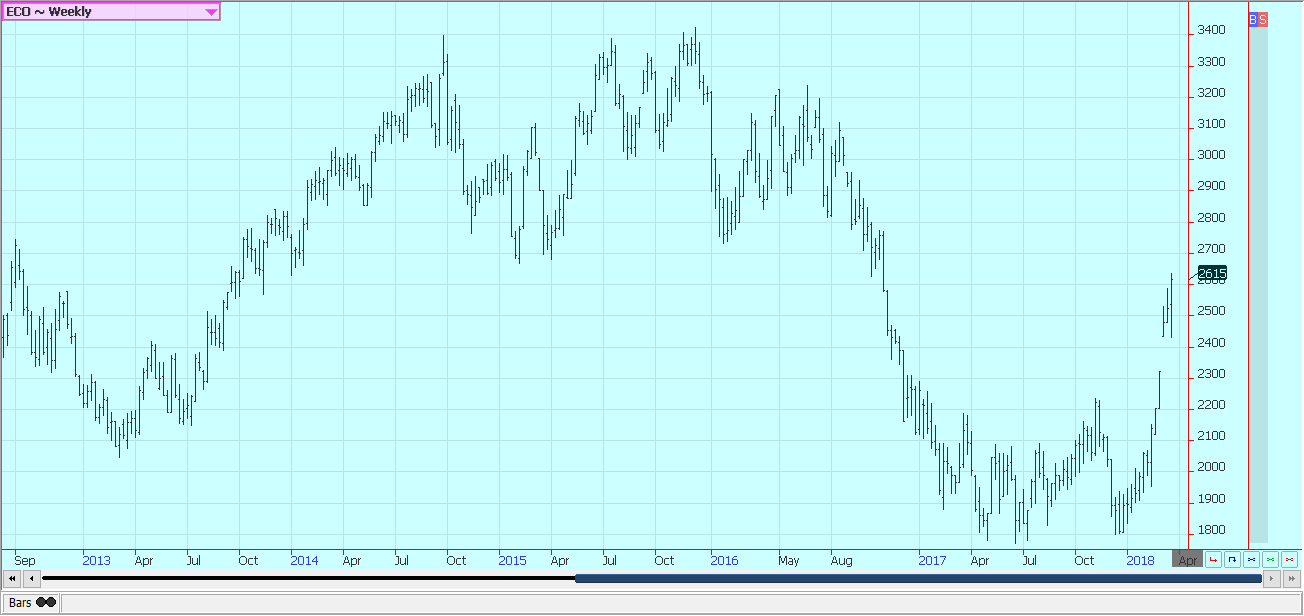

Corn

Corn closed lower last week on what appeared to be speculative long liquidation. Trends have turned down on the daily charts and are sideways to down on weekly charts. Oats saw selling pressure much of last week and trends are down in this market. Speculators had become very long in these markets and a corrective trade has begun.

USDA showed strong demand in its latest weekly export sales report. Export demand was still down from recent weeks, but overall export demand is great at this time. Corn remains a demand market, and the sales pace is still well above USDA projections for the marketing year. Ethanol demand also remains very strong.

The US Dollar still appears to be in a longer term downtrend and showed renewed weakness in the wake of the Trump tariff announcements. More demand is expected due to the problems in South America due to the weather.

Brazil is not offering Corn until at least July, while Argentina continues to struggle with dry weather problems of its own that are being caused by La Nina. The bulk of the Argentine growing areas could stay dry again this week Brazil is still too wet in central and northern areas to get the corn planted well and saw a lot of rain last week in southern parts of the country to interrupt harvest activities.

USDA will release its quarterly stocks estimates and prospective plantings reports this Thursday. Price Group expects planted area near 88.55 million acres for Corn and 3.15 million acres for Oats. Barley area could be about 2.81 million acres, and Sorghum area should be near 6.15 million acres. Corn stocks should be about 8.755 billion bushels.

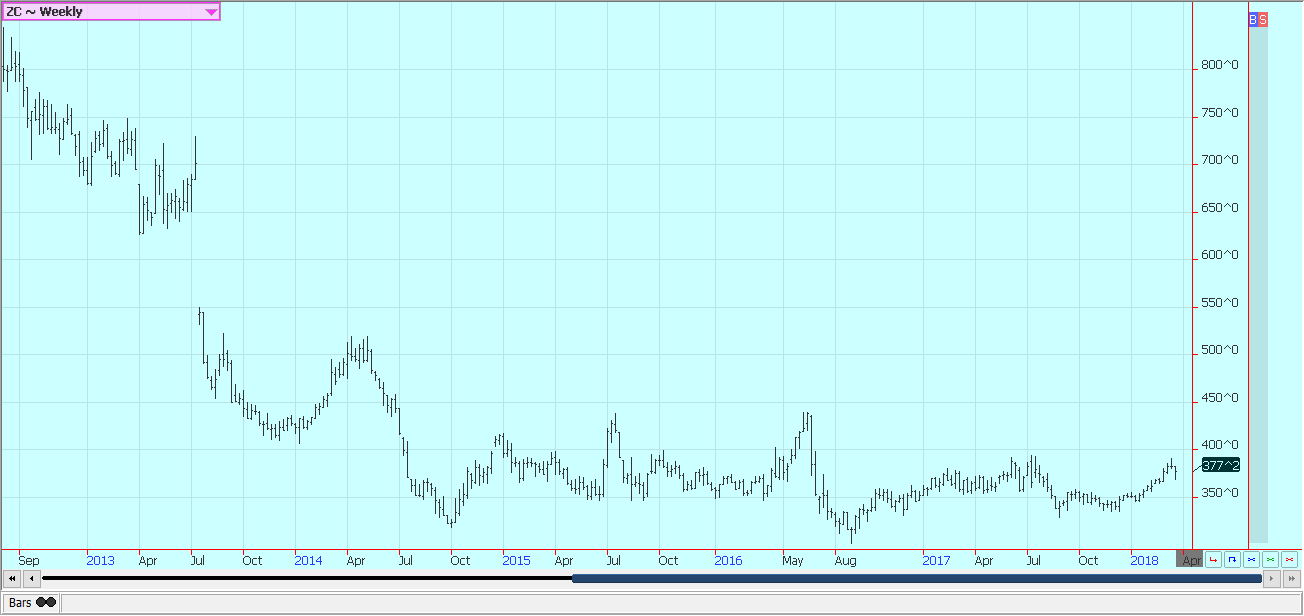

Weekly Corn Futures © Jack Scoville

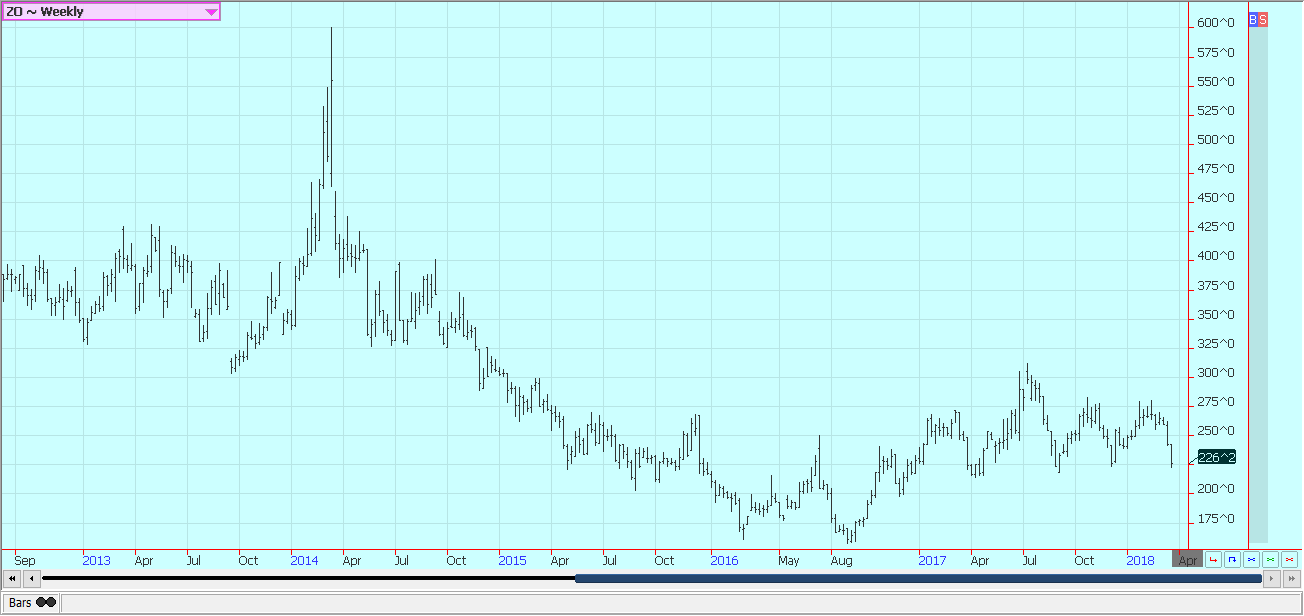

Weekly Oats Futures © Jack Scoville

Soybeans and Soybean Meal

Soybeans and Soybean Meal were lower last week, with much of the selling seen because of the tariff moves by the Trump administration. However, China did not include US Soybeans on it initial list for retaliatory tariffs. Pork was included, and this hurt demand potential for hogs and feed.

Futures prices remain supported due to high prices in South America that have come from the drought in Argentina. Some rains were reported in northern growing areas of the country. The rains were not enough to change the overall perspective of significant production losses for the country.

USDA noted big supplies from previous crops still in Argentina and Argentina will probably sell some of these older supplies. Some demand has finally started to shift to the US as Argentine cash market offers are very high priced and Brazil ports are operating at or near capacity already. Stronger domestic demand has helped support Soybeans and Soybean Meal.

USDA will issue its prospective plantings and quarterly stocks reports on Thursday. Price Group expects Soybeans planted area near 91.05 million acres and stocks near 2.110 billion bushels.

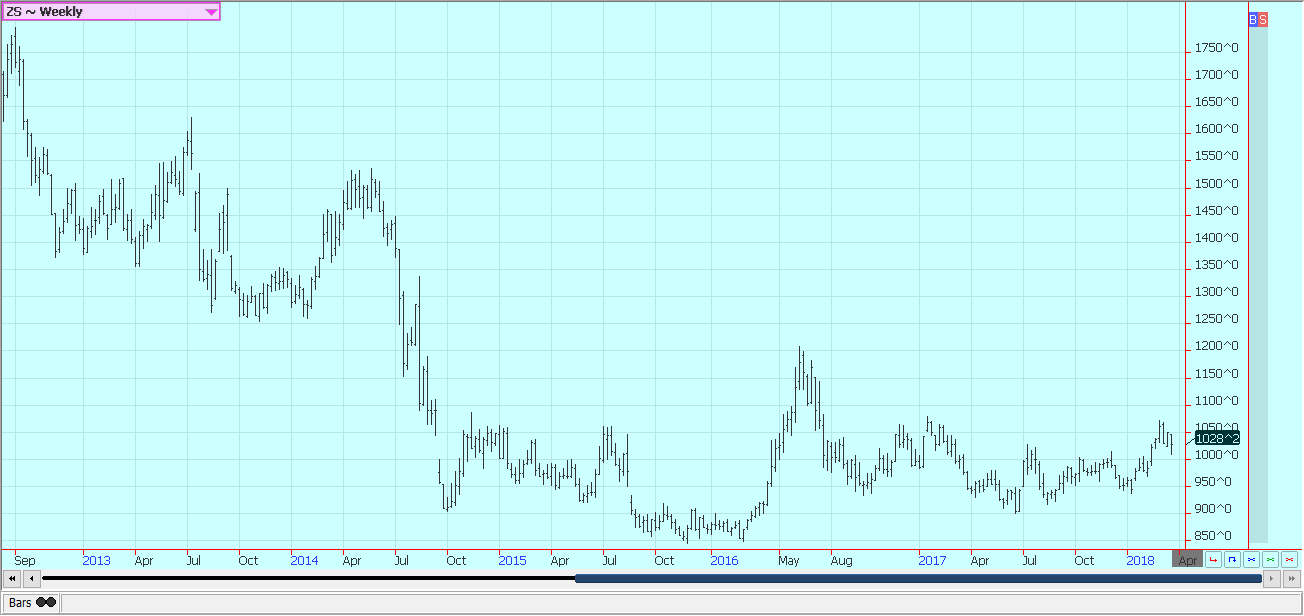

Weekly Chicago Soybeans Futures © Jack Scoville

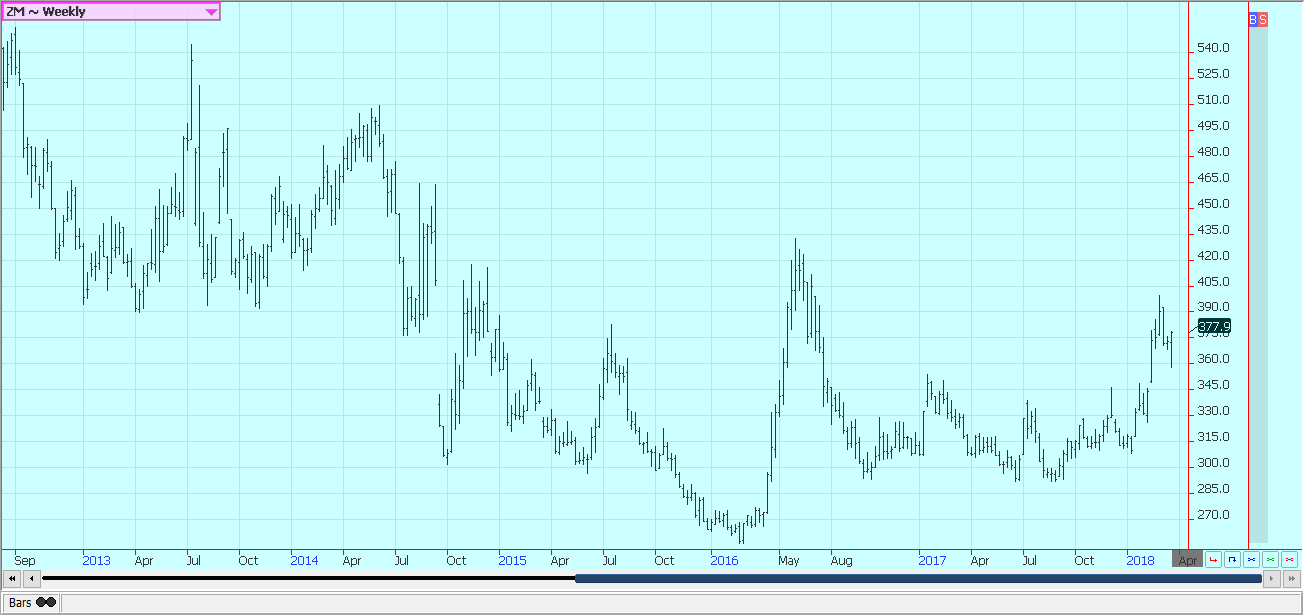

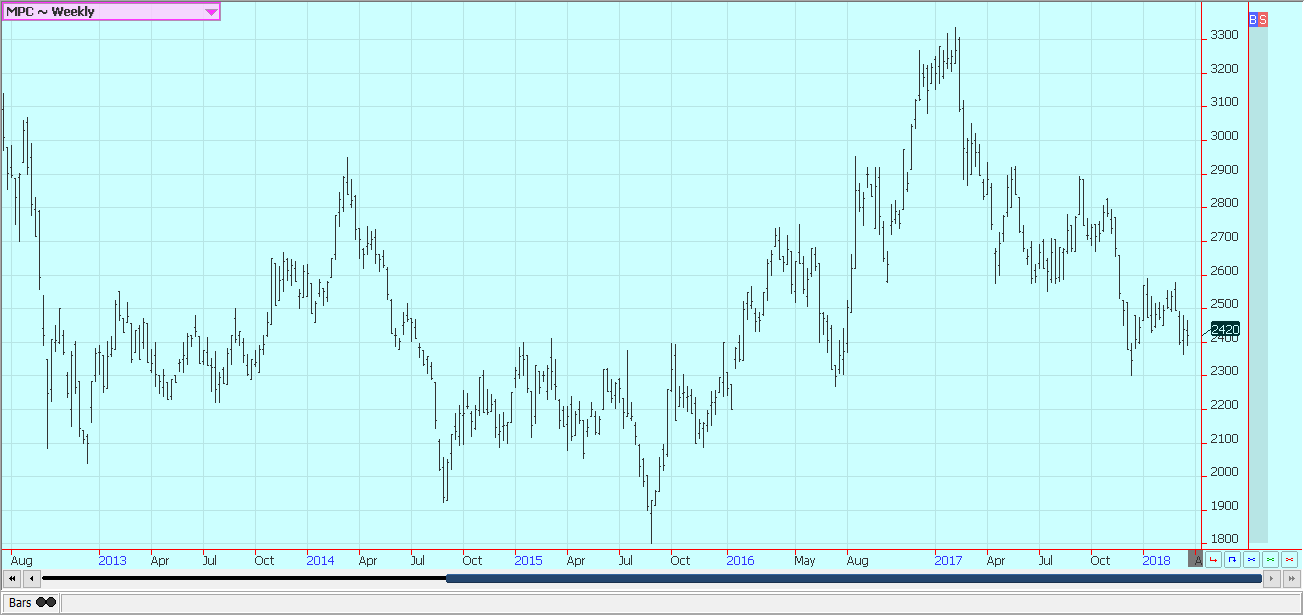

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice was higher on Friday and was a little lower for the week. Short-term trends have turned up, and weekly charts show that futures are testing some very important resistance areas. Moves higher this week could create some significant fund buying and short covering. Indications are that producers are more willing to plant other crops instead of Rice, and early ideas of a significant increase in planted Rice area have gone away.

The export sales report showed sales over 100,000 tons and was considered supportive for higher prices. Traders are hoping for strong export demand to continue, but the limited supplies alone should be enough to keep the market supported. Any move lower might not last long and go very deep as the fundamental situation still remains bullish in the eyes of most analysts.

The US cash market bids remain generally strong amid tight supplies. Reports indicate that there is a limited amount of Rice still owned by farmers, so commercials are raising bids to try to buy what is left. The focus is turning to the end of the month and the quarterly stocks reports and the prospective plantings reports. The stocks on and off farm should be very low.

Prospective plantings should not show major increases in planted area as other crops are still more profitable to plant. Planting is active in Texas and southern Louisiana, and reports indicate that over half of the Texas crop is in the ground. USDA will issue its latest quarterly stocks and planted area reports on Thursday. Price Group expects the planted area of 2.63 million acres and stocks near 80 million hundredweight.

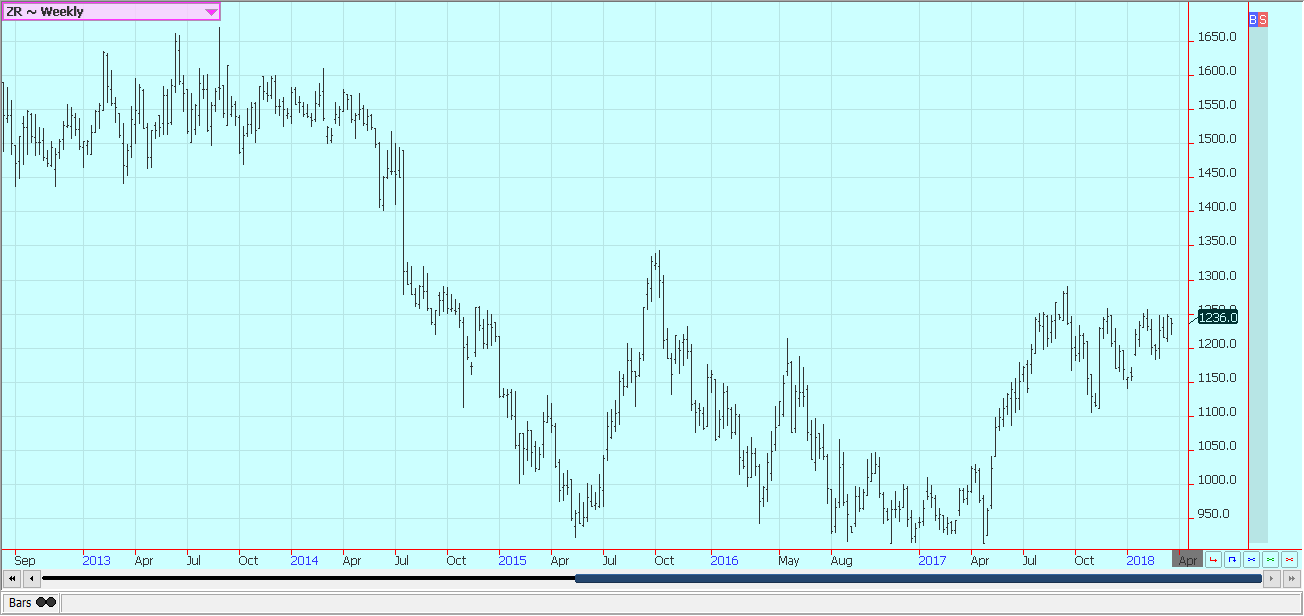

Weekly Chicago Rice Futures © Jack Scoville

Palm Oil and Vegetable Oils

World vegetable oils prices were mixed to lower last week. The market sees big supplies of Palm Oil right now in both Indonesia and Malaysia and has big questions about demand. Indonesian sources told the press last week that production could be about 40.5 million tons this year.

Palm Oil is effectively shut out of the Indian market for now, and buyers there are now looking to cancel purchases made earlier due to the tariffs imposed on imports by the Indian government. Demand from China remains a question. Many analysts now note the big Soybeans imports by China and think that China will have more than enough Soybean Oil produced from the imported Soybeans to cut import demand for all vegetable oils including Palm Oil. Malaysia has moved to impose its own export taxes of 5 percent starting with the month of April.

The trade is looking for Palm Oil production to continue to decrease in line with seasonal trends, and this expectation has provided the primary support. The Malaysian Ringgit has been moving higher against the US Dollar, and this has firmed up prices for Palm Oil in the world market in Dollar terms. Canola markets remain mostly in up trends as the trade is hoping for new business from any US-China tariff fight.

Deliveries to elevators have been strong due in part to forward selling earlier in the year, but new sales are hard to come by. US demand for Soybean Oil in bio fuels should remain strong, and stronger export demand is anticipated due to the threat of reduced production in Argentina. NOPA showed a very strong February crush rate last week, and stocks of Soybean Oil were higher than expected as a result. The big supplies renewed the selling pressure on Soybean Oil.

Weekly Malaysian Palm Oil Futures © Jack Scoville

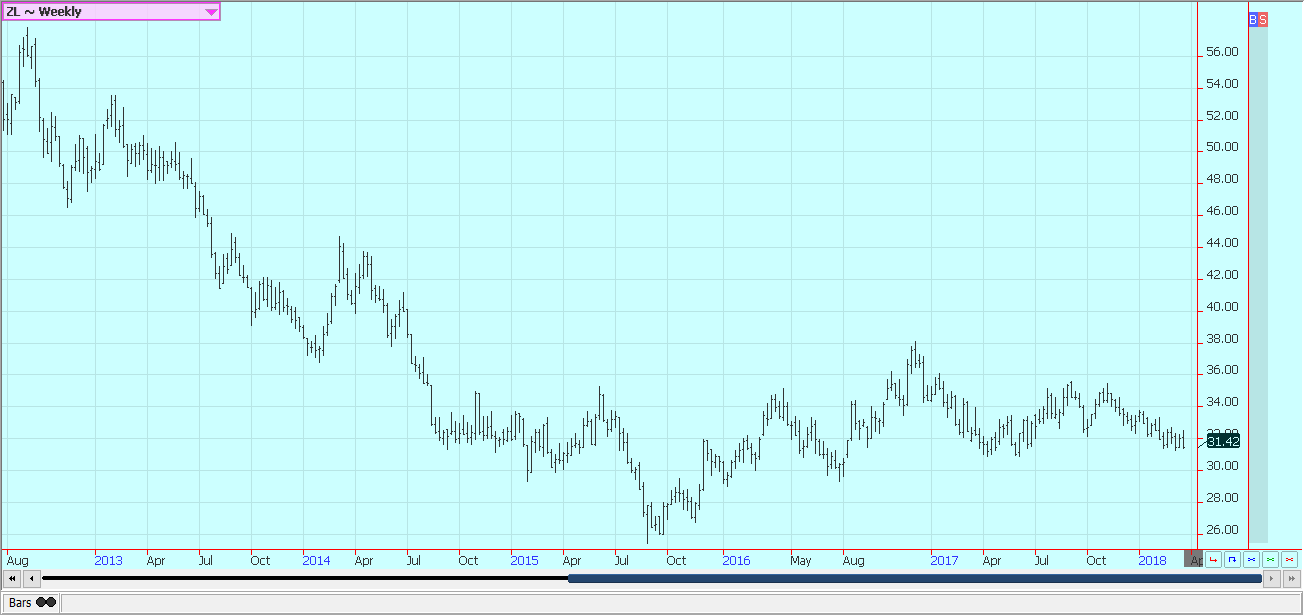

Weekly Chicago Soybean Oil Futures © Jack Scoville

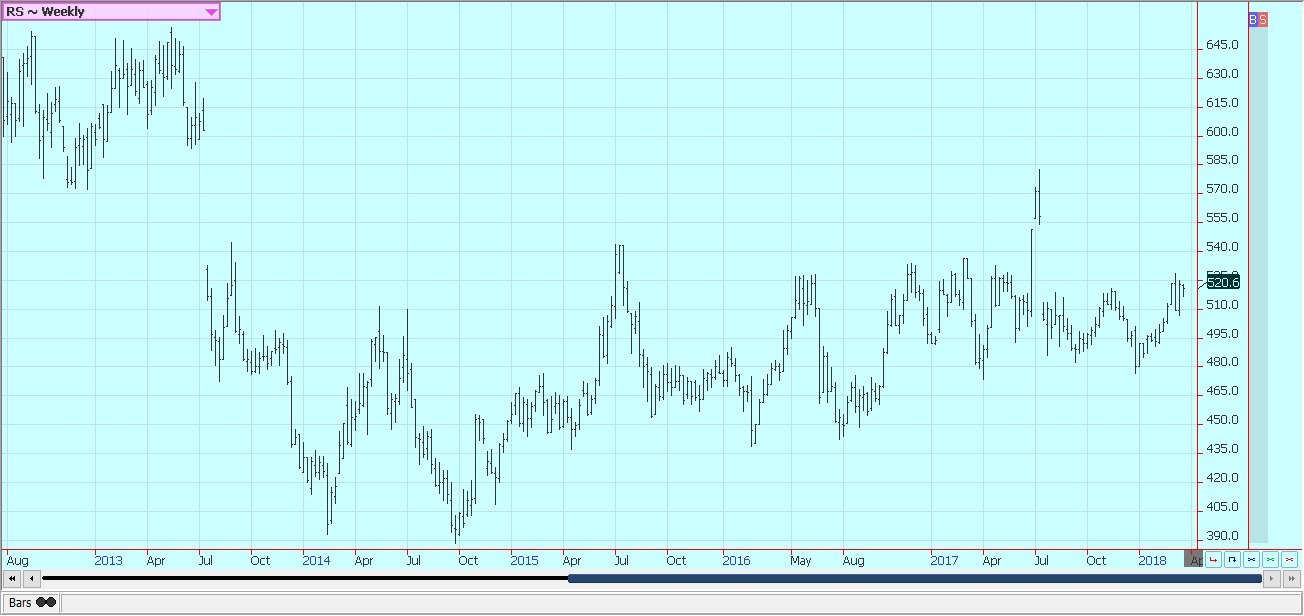

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was lower on follow through selling and also closed lower for the week. Speculators were getting out of long positions before the weekend and also before the USDA reports that will be released later this week. The prospective plantings report is expected to show a sharp increase in Cotton plantings potential in the US.

Price Group expects US All Cotton planted área to be near 13.45 million acres. It is drier in the Delta and Texas after some big rains, and drier weather will be seen in the Southeast once the latest storm moves out, or so producers hope. Demand has been strong and merchants have had trouble finding the Cotton in domestic cash markets.

USDA showed another week of strong export sales on Friday, although the sales were lower than in the previous week. Export sales have been very strong and above many trade expectations at the beginning of the marketing year.

Prices overall have been much higher than most commercials had expected, but the carry spread weakness could be a sign that merchants have been able to get covered in the last couple of weeks. Prices could remain strong until closer to harvest, but there is a chance that the highs have been seen. The market expects increased plantings in the western Great Plains due to all of the problems with the Winter Wheat crops in the region.

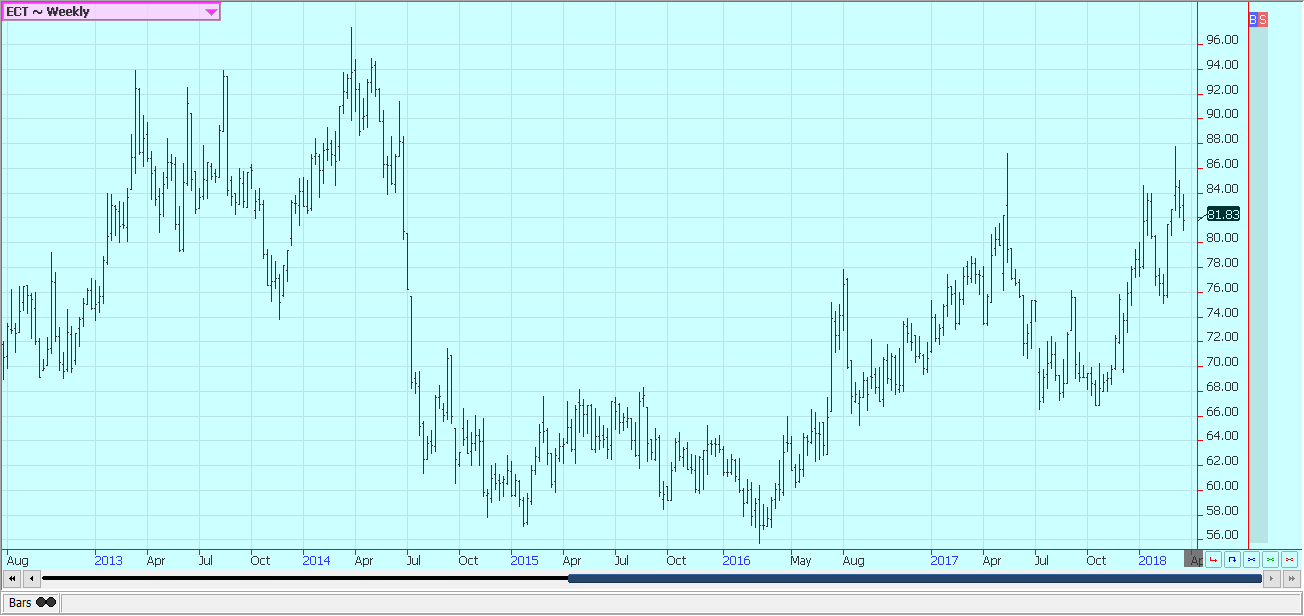

Weekly US Cotton Futures © Jack Scoville

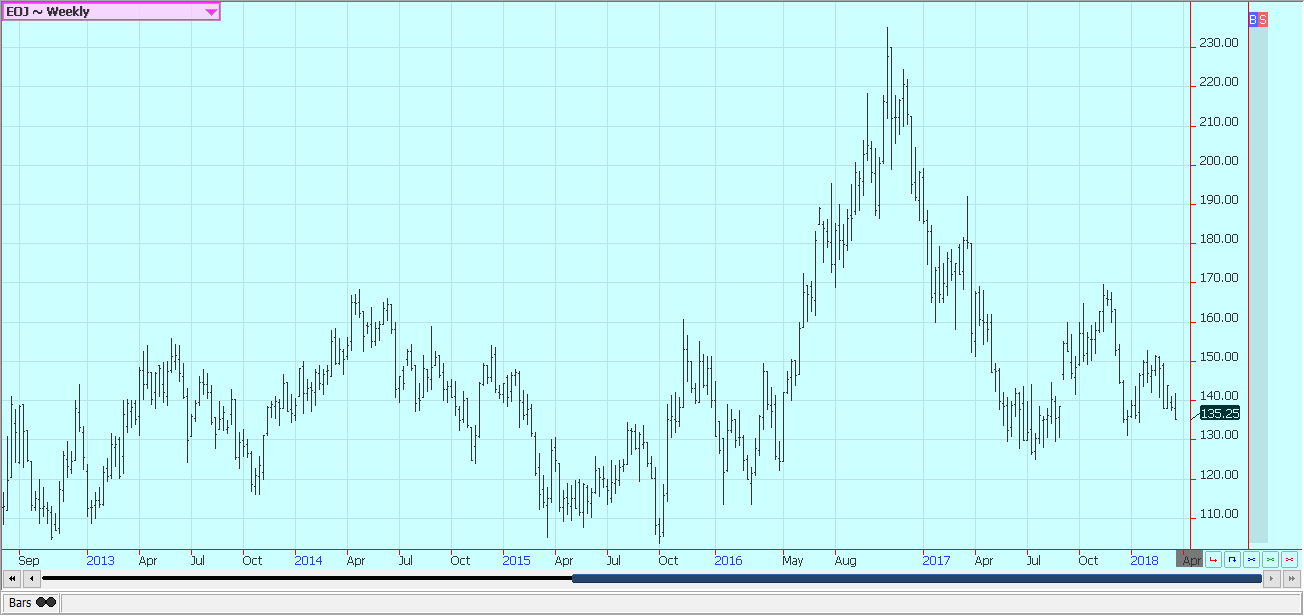

Frozen Concentrated Orange Juice and Citrus

FCOJ was a little lower again on Friday and made new lows for the move last week. The market seems to be losing small amounts each day while it waits for some news to excite buyers. Futures show a weak appearance on both the daily and weekly charts and Florida remains mostly warm and dry.

The market is still dealing with a short crop against weak demand. The current weather is good as temperatures are warm and it is mostly dry, but some big rains are reported in northern parts of the state. The harvest is progressing well and fruit is being delivered to processors. Producers are now into the Valencia crop with the early and mid-harvest completed. Florida producers are actively harvesting and performing maintenance on land and trees. Flowering has been reported in the groves, and some fruit is forming. Irrigation is being used.

Weekly FCOJ Futures © Jack Scoville

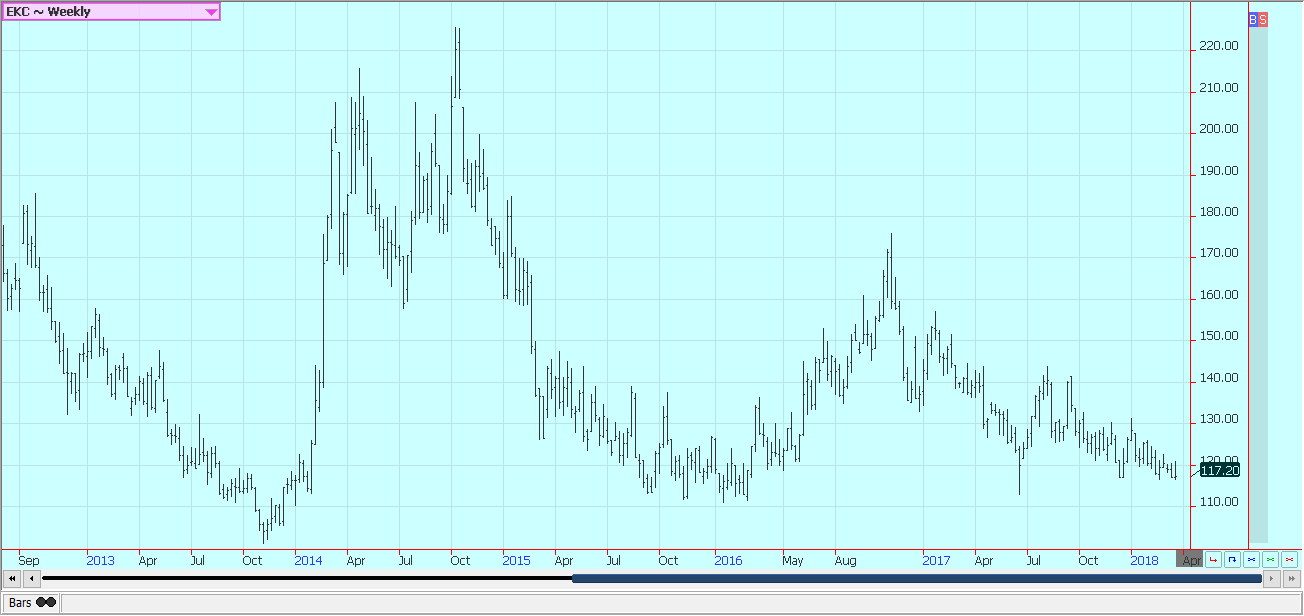

Coffee

Futures were lower in quiet trading on Friday but managed to close slightly higher for the week. Trends are sideways to down on the charts. Funds and other speculators were on both sides of the market. But the funds were better sellers on Friday. Traders sense an underlying interest in buying the market amid ideas that the bearish news is finally priced in. Origin is offering in Central America and is still finding weak differentials. Some business is getting done.

Traders anticipate big crops from Brazil and from Vietnam this year and have seen no reason to cover the short position in a big way. New York traders are talking about good weather currently being reported in Brazil and expect another bumper crop. Robusta remains the stronger market as Vietnamese producers and merchants are not willing to sell at current prices and are willing to wait for a rally

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

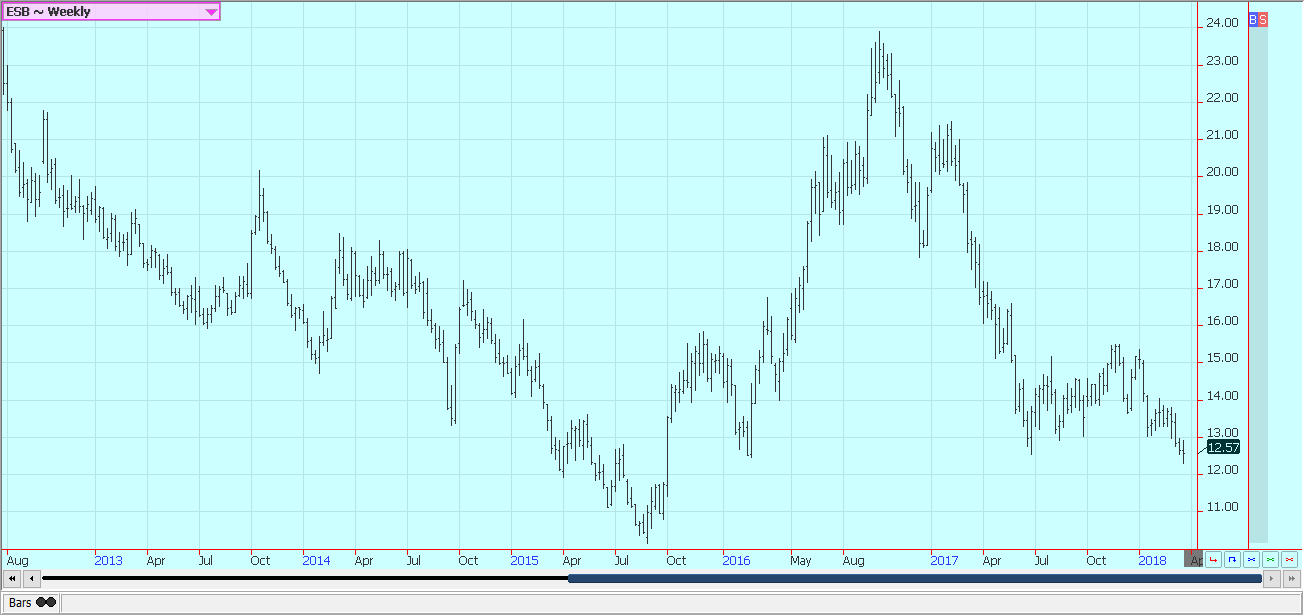

Sugar

Futures were lower for the week. Trends are down again in both markets and both markets are making new contract lows. Traders hear about big production form the world producers and have no real reason to buy even if they have no interest in selling. Ideas that Sugar supplies available to the market can increase in the short term have been key to any selling.

India will export up to 4.0 million tons of Sugar this year after being a net importer for the last couple of years. The government there is reducing or eliminating export taxes in an effort to promote selling in world markets. It has a significant surplus after several years of lower production. Thailand has produced a record crop and is selling. Mills in Brazil have decided to make more Ethanol as world Crude Oil and products prices have been very strong. Brazil still has plenty of Sugar to sell even with the different refining mix.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

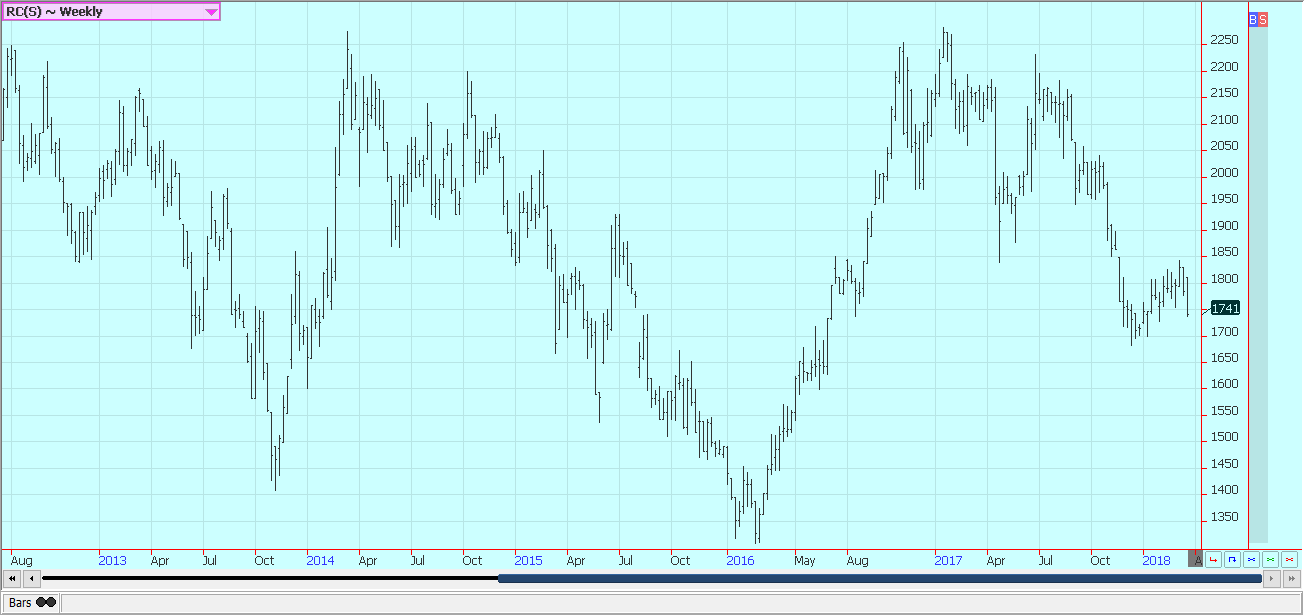

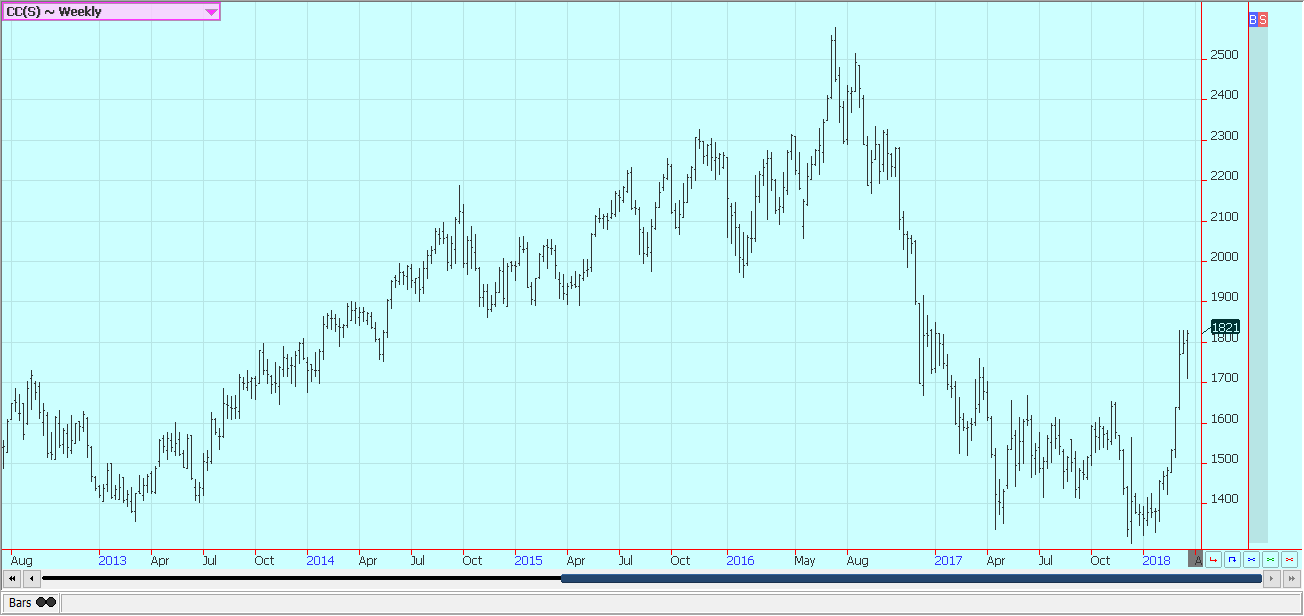

Cocoa

Futures closed higher on Friday and for the week on follow-through buying and bullish stories on the newswires. It has been a big supply based rally that could be running out of steam right now, but the rally overall has been impressive. Ideas of smaller world production that has been largely sold remain part of the rally, and ideas of strong demand from processors remain the other part of the rally.

Most of the trade anticipate the increased demand, and current West Africa weather is hot enough and dry enough to create production concerns. There have been reports recently of delayed deliveries to ports. It has been hot and dry in many parts of West Africa, but showers and more seasonal temperatures have been seen in the last week to improve overall production conditions. The mid-crop harvest is starting, and wire reports indicate that some initial mid-crop harvest is underway in Nigeria. No yield reports have been seen yet. Demand has been improving and is likely to continue to improve as processing margins are said to be very strong.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

_

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

(Featured image via DepositPhotos)

-

Fintech7 days ago

Fintech7 days agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Cannabis2 weeks ago

Cannabis2 weeks agoCannabis and the Aging Brain: New Research Challenges Old Assumptions

-

Biotech4 days ago

Biotech4 days agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter

You must be logged in to post a comment Login