Business

Soybeans, cotton and rice futures soar higher in weekly charts

China threatens to tax US soybeans by 25 percent above the normal rate but supply and demand continue to rise, owing to the wet weather.

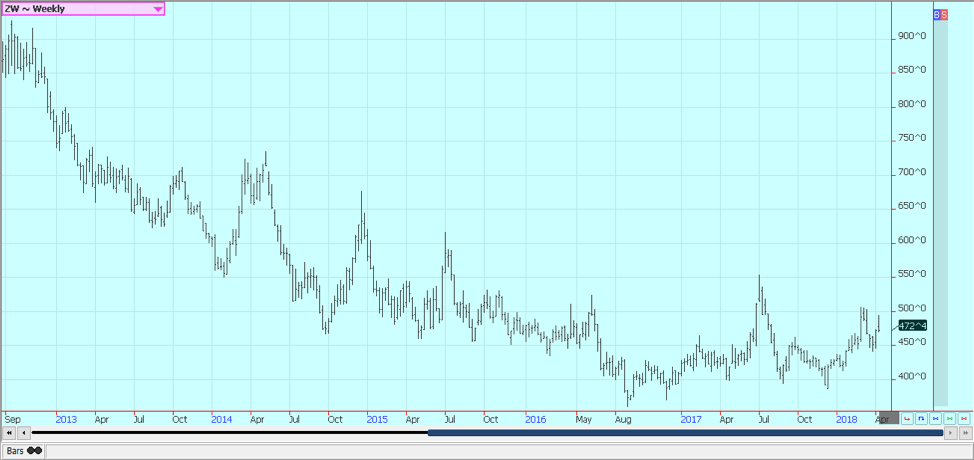

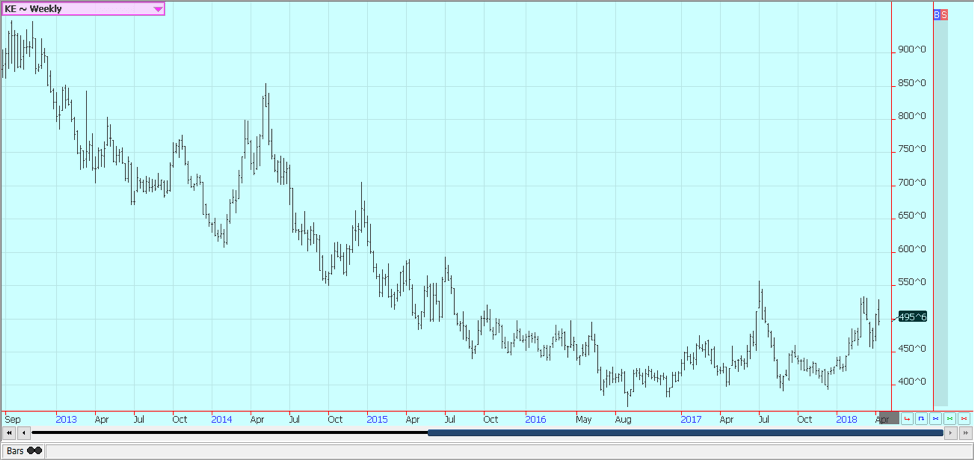

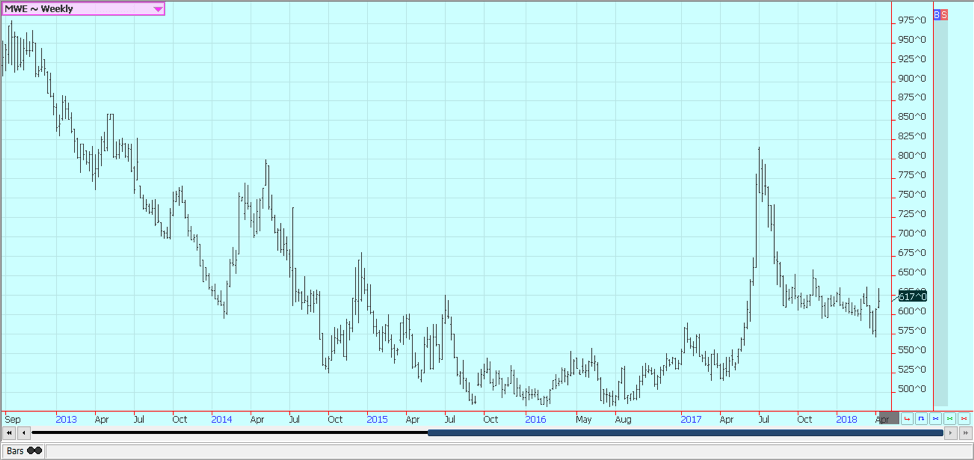

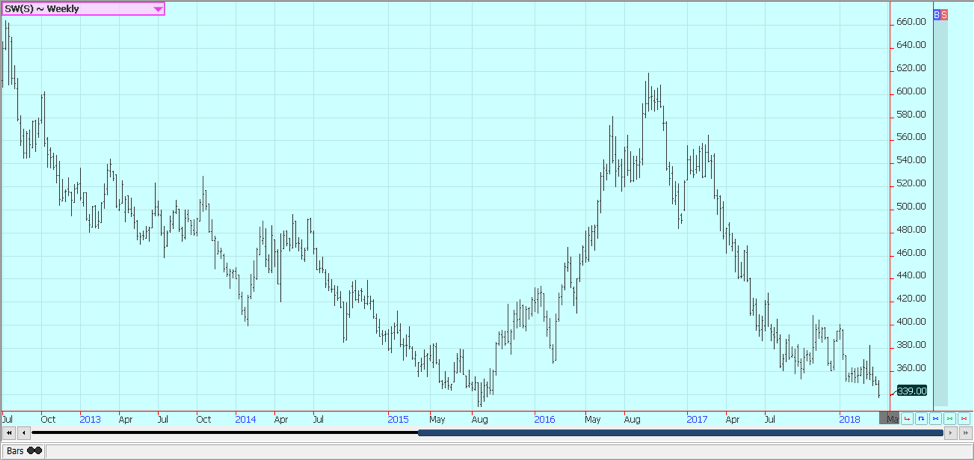

Wheat

Wheat markets were near unchanged in Chicago as weather and demand remained the dominant factors in the market. Kansas City was lower for the week, while Minneapolis was higher. Forecasts still call for dry weather in Texas, Oklahoma, and Kansas. There is no real relief in sight although there have been some forecasts for some precipitation in the longer range forecasts. The United States Department of Agriculture (USDA) showed generally poor crop ratings in its crop progress and condition reports last week, and the crop seems to be regressing. New crop ratings will be released by the department on Monday afternoon, and no improvement is expected. The weekly export sales report was poor, and cumulative sales and shipments remain behind the pace needed to meet USDA targets. The daily charts for all three markets show stability in prices, while the weekly charts still show weakness. However, the markets seem to be cheap enough due to the ongoing weather problems in the Great Plains. Minneapolis is also starting to turn to at least sideways trends as the weather remains very cold in Canada and the northern Great Plains. Farmers want to start on fieldwork, but the cold temperatures have pushed them back. The Canadian Prairies and northern Great Plains look to stay cold this week.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

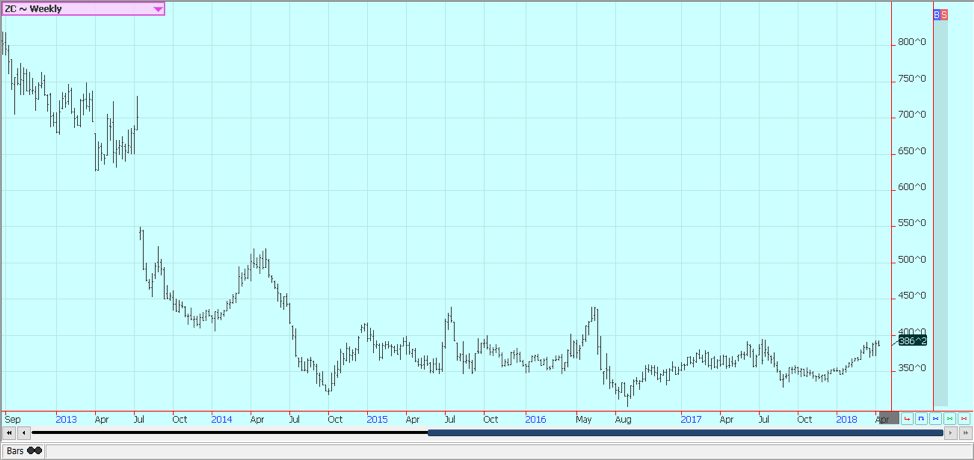

Corn

Corn closed a little lower for the week in quiet trading. Futures found support early in the week from buying related to the cold and wet weather seen in much of the Midwest. Farmers have been unable to get fieldwork going, and this week looks like another week when farmers will stay inside as cool and wet weather should continue. The market tried to sell off in reaction to the weaker-than-expected weekly export sales report. The report showed less than expected sales, and sales could be less again this week as no new sales were reported last week on the daily reporting system. Weather in the Midwest is still too cold, and it has been very wet in southern production areas. Fieldwork has been stalled in almost all areas. The market focus will move more from old crop to new crop from now on as traders start to monitor new crop progress and condition along with the old crop demand.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

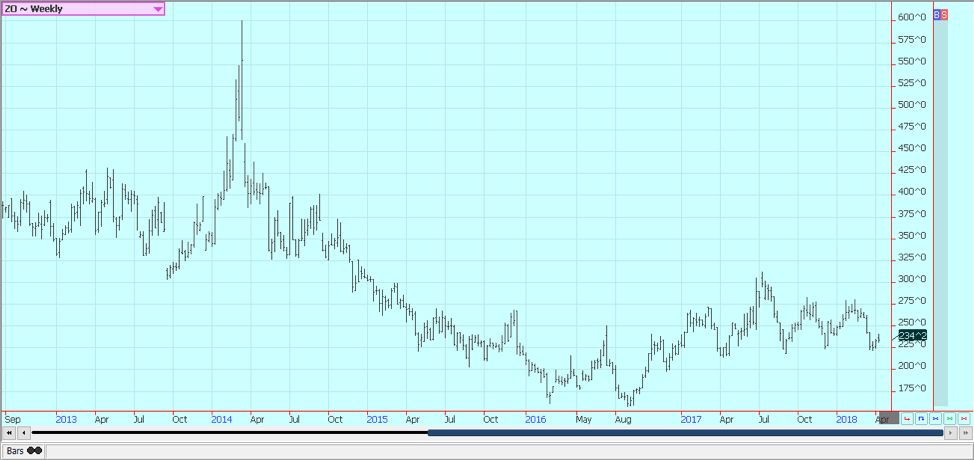

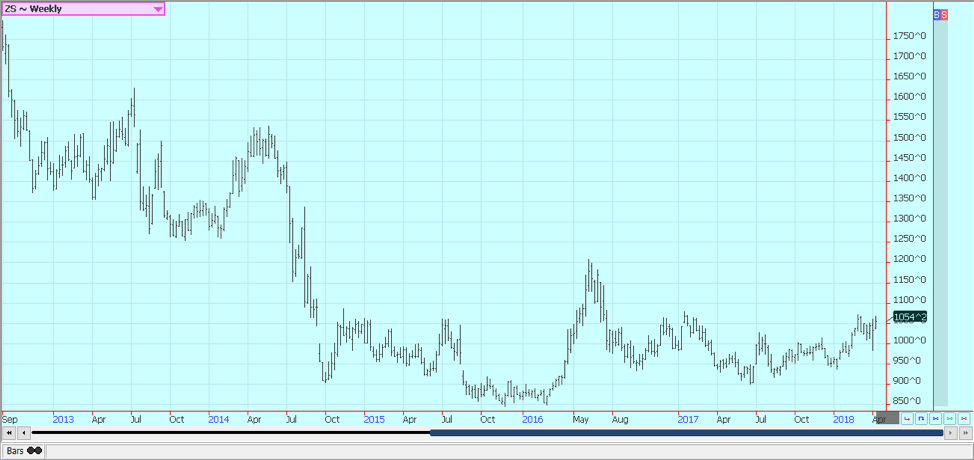

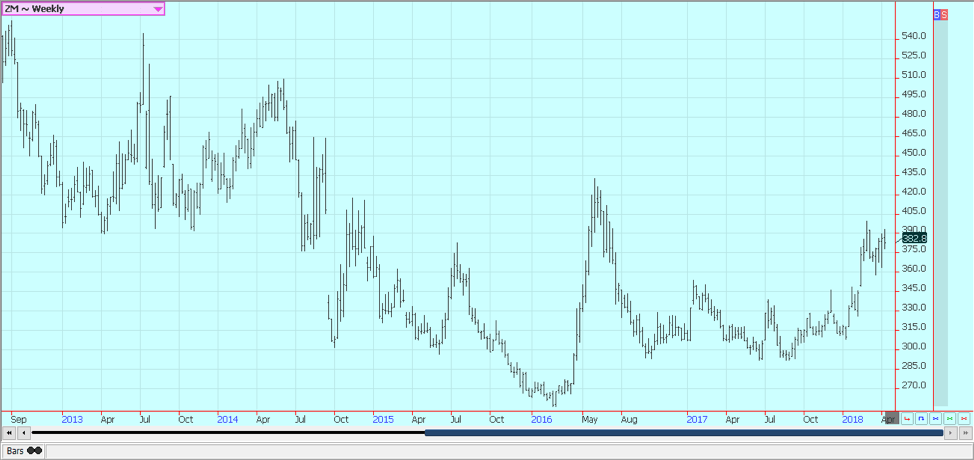

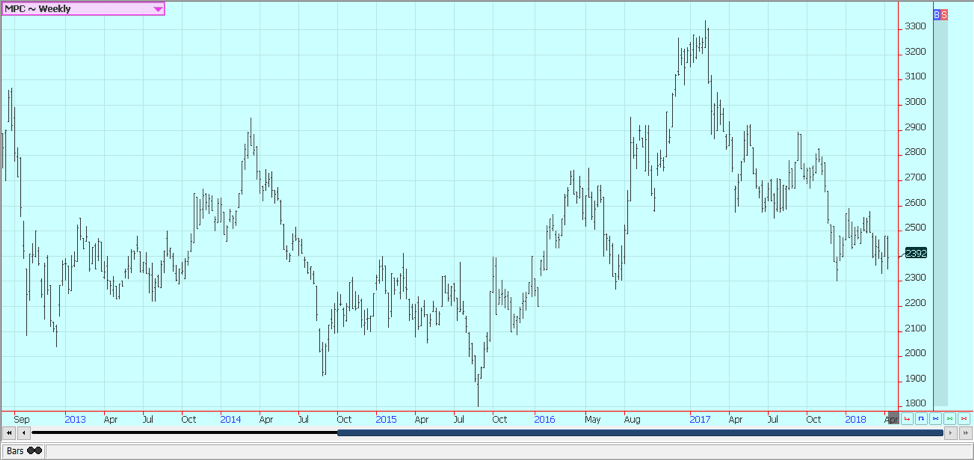

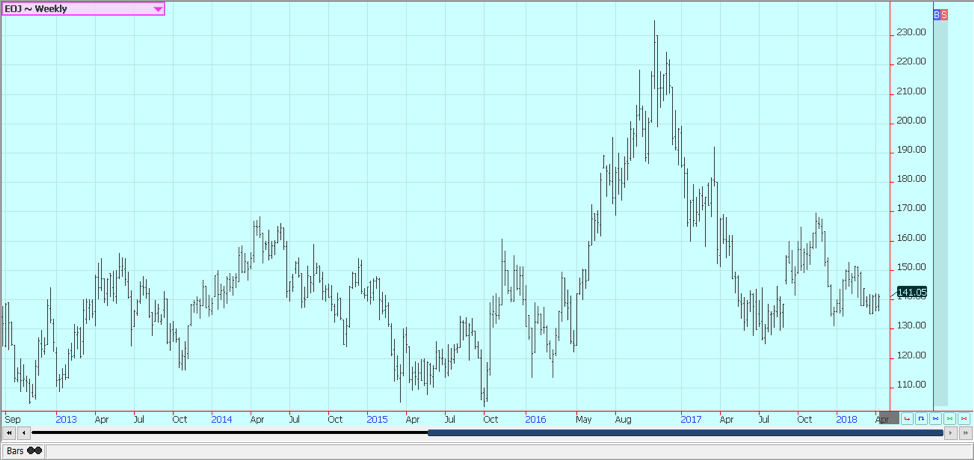

Soybeans and soybean meal

Soybeans were higher in wet weather in the Midwest and strong demand despite the threat to impose tariffs on China. China said it would retaliate in part by taxing U.S. Soybeans by 25% above the normal tax rate. China accounts for about one-third of U.S. Soybeans demand, so the threat sent prices sharply lower in the American futures markets. News that Chinese buyers were leaving the U.S. market and increasing purchases in Brazil sent Brazil premiums soaring to cover a big amount of the potential percentage increase in taxes. The premiums in Brazil faded from their strongest levels late in the week, and the demand news also faded. All these cash market trends can continue this week. The weather in the Midwest was bad over the weekend as it was cold and there was a lot of precipitation around. Northern areas got a lot of snow, and southern areas saw a lot of rain. Generally, cool and wet conditions should continue this week, and no fieldwork is likely to get done. The Delta and Southeast also have seen little in the way of fieldwork due to the cool and wet weather, and these weather trends should also continue this week.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

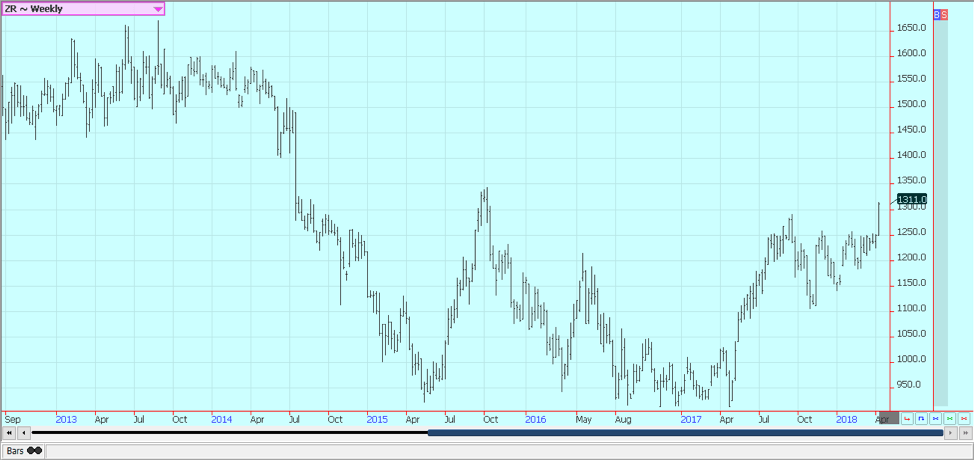

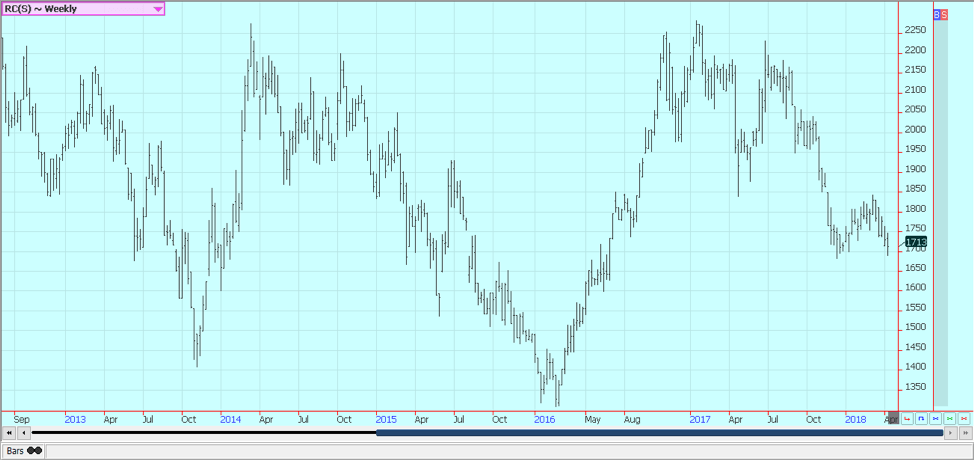

Rice

Rice was higher and closed near the highs for the week. The market made a breakout from resistance on the weekly charts and closed at price levels not seen since 2015. Further price gains are likely in coming weeks. Ideas are that little old crop Rice is available in the cash market, and the situation is not likely to improve before the new crop becomes available late this Summer. The situation might not get much better next year. On-farm stocks are very low as most farmers have already sold. Farmers will plant more Rice this year, but the increase in planted area is not considered burdensome. Planting progress had been ahead of average but has stalled recently due to the cool and wet weather in Gulf coastal areas. It has been very wet and cold in the northern Delta states as well. Indications are that producers are more willing to plant other crops instead of Rice, and early ideas of a significant increase in planted Rice area have gone away. Farmers and bankers are worried about profitability, and planting other crops such as Soybeans or Cotton could mean better returns for some producers.

Weekly Chicago Rice Futures © Jack Scoville

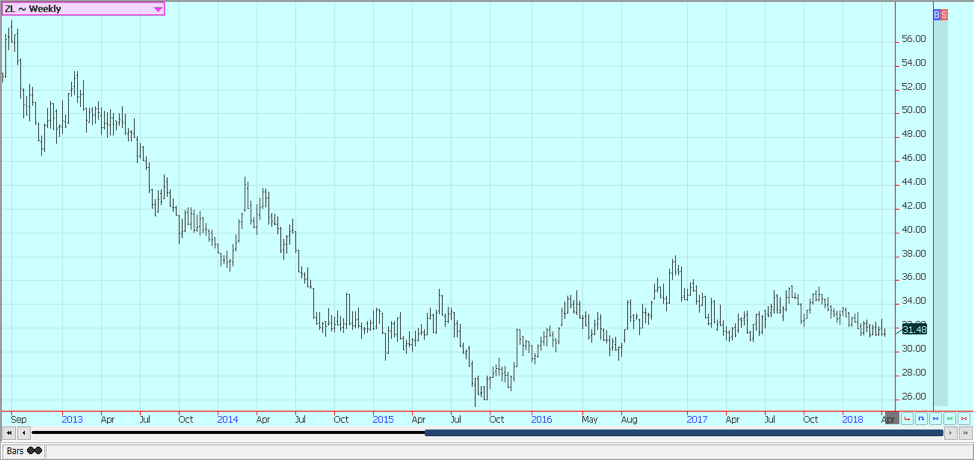

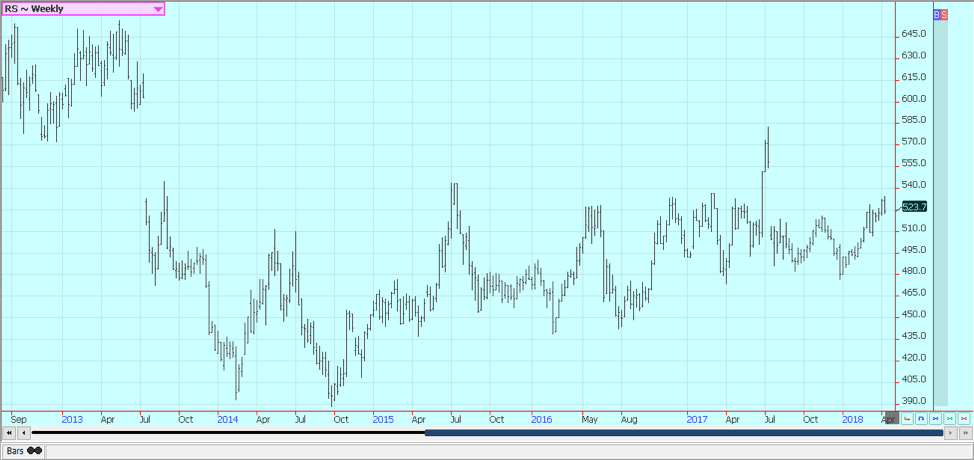

Palm oil and vegetable oils

World vegetable oils prices were mostly lower last week. Palm Oil moved lower in reaction to the MPOB reports. MPOB showed that production was 1.57 million tons, above trade estimates. Ending stocks were also higher than trade estimates at 2.32 million tons. Exports were as expected at 1.57 million tons. There were hopes for a lot of new Chinese demand, but those hopes faded as the U.S. and China did not ramp up the rhetoric about a trade war. The latter has been crushing a lot of Soybeans and has been producing its own Soybean Oil, but any disruption in the crush could mean that more Palm Oil is needed. The weekly charts show that Palm Oil remains in a trading range as the better demand is being met by reports of better production. A sideways trend can continue. Soybean Oil was locked in a sideways trend all week. Canola found some support from the trade war and also from the very cold weather in the Canadian Prairies. The cold weather has made any fieldwork impossible at this time. The region looks to stay cold this week. It is not likely to get warm enough for any work to get done for at least a couple of weeks now, so the market will keep the weather forecasts in focus.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

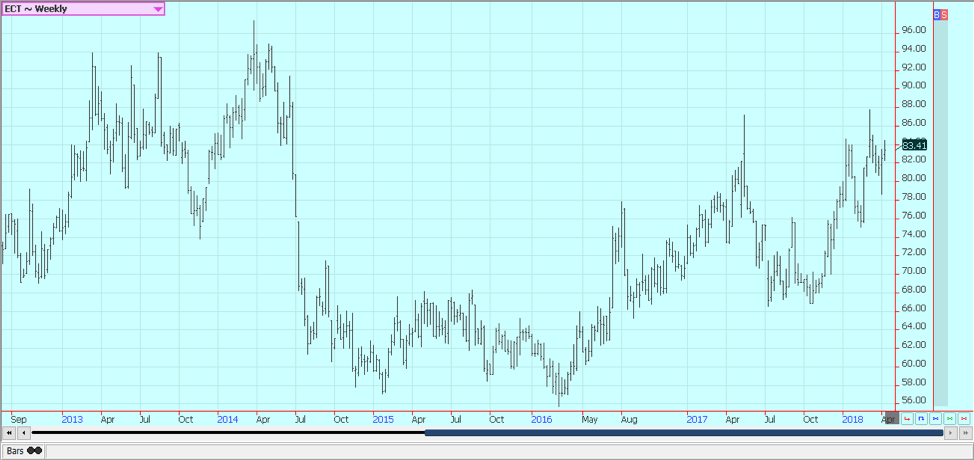

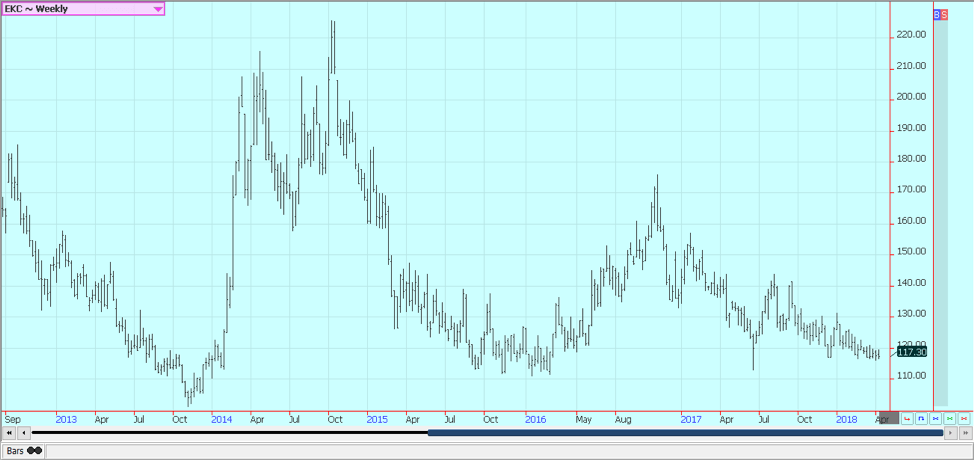

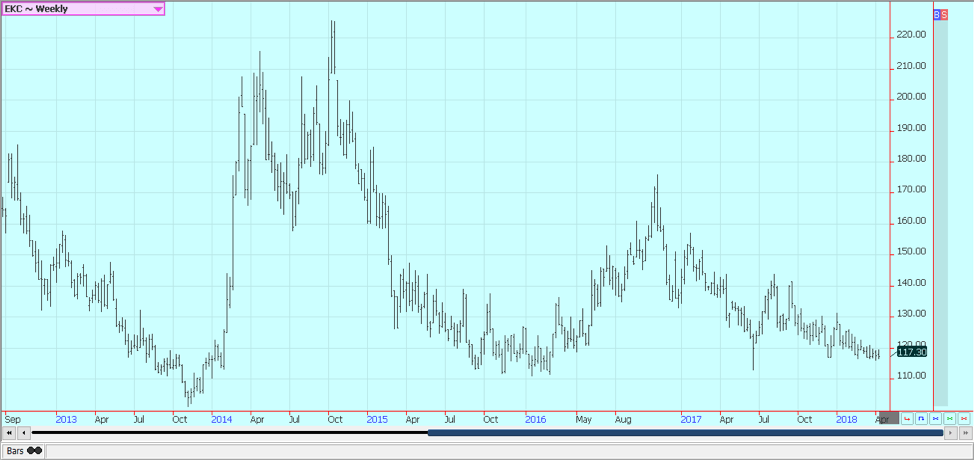

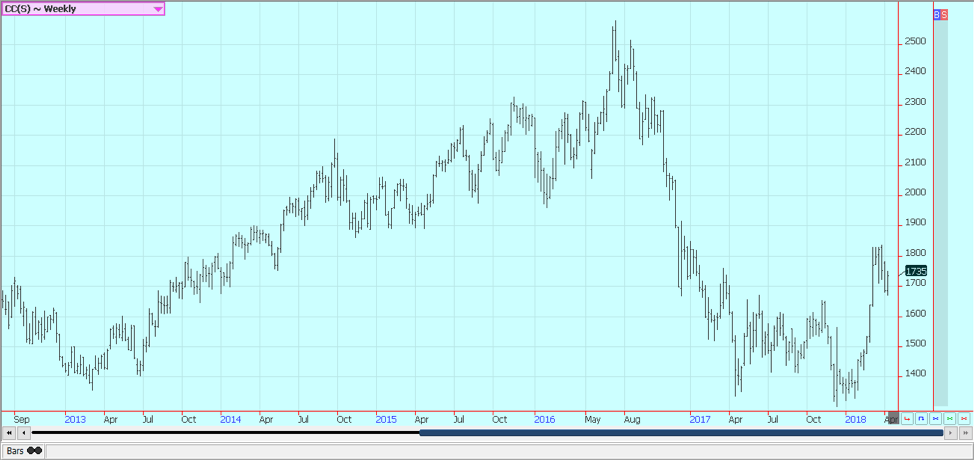

Cotton

Cotton was higher last week as this market saw good demand in the weekly export sales report and as concern faded about a U.S.-China trade war as both sides seemed willing to talk. China is a good buyer of U.S. Cotton as it uses the high-quality U.S. product to blend with its own production. The U.S. also sells a lot of Cotton to Southeast Asia, and some of this makes its way to China in the form of finished products. The U.S. farmers in just about all production areas plan to plant more Cotton. It is drier in the Delta and Texas after another batch of big rains in the second half of last week, and drier weather will be seen in the Southeast. The drier Delta and Southeast weather will be welcomed after some rainy days lately. Warmer temperatures would be beneficial. Prices overall have been much higher than most commercials had expected, but the recent carry spread weakness could be a sign that merchants have been able to get covered in recent weeks.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was higher in range trading last week. The market is still dealing with a short crop against weak demand. USDA should highlight the short crop when it releases its citrus reports tomorrow. It last estimated the crop at 45 million boxes, and there is no real reason to expect any big changes to that estimate. The current weather is good as temperatures are warm and it is mostly dry, but some big rains are reported in northern parts of the state. The harvest is progressing well, and fruit is being delivered to processors. Producers are now into the Valencia crop with the early and mid harvest completed. Florida producers are actively harvesting and performing maintenance on land and trees. Flowering is mostly over, and fruit is forming and starting to develop. Irrigation is being used.

Weekly Frozen Concentrated Orange Juice Futures © Jack Scoville

Coffee

Futures in New York were little changed last week. London was lower and is now at an important support area left from last fall. Trends are sideways to down on the charts. Funds and other speculators were the best sellers, and industry is the best buyer. Traders still sense the underlying interest in buying the market due to the industry buying, but the buy side of the market has not shown interest in pushing prices higher. They have been able to let the speculators come to their price level. Origin is still offering in Central America and is still finding weak differentials. Good business is getting done, and exports are active. Traders anticipate big crops from Brazil and Vietnam this year and have remained short in the market. New York traders are talking about good weather currently being reported in Brazil and expect another bumper crop. Robusta remains the stronger market as Vietnamese producers and merchants are not willing to sell at current prices and are willing to wait for a rally.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were lower for the week in both New York and London. Trends are down in both markets. The fundamentals remain little changed, and there does not seem to be much, for now, that can shake the market out of its current trend. Traders hear about big production from the world producers and little in the way of special demand that could absorb some of the surplus. Ideas that Sugar supplies available to the market can increase in the short term have been key to any selling. India will export up to four million tons of Sugar this year after being a net importer for the last couple of years. The government there is reducing or eliminating export taxes in an effort to promote selling in world markets. It has a significant surplus after several years of lower production. Thailand has produced a record crop and is selling. Mills in Brazil have decided to make more Ethanol as world Crude Oil and products prices have been very strong. Brazil still has plenty of Sugar to sell even with the different refining mix.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

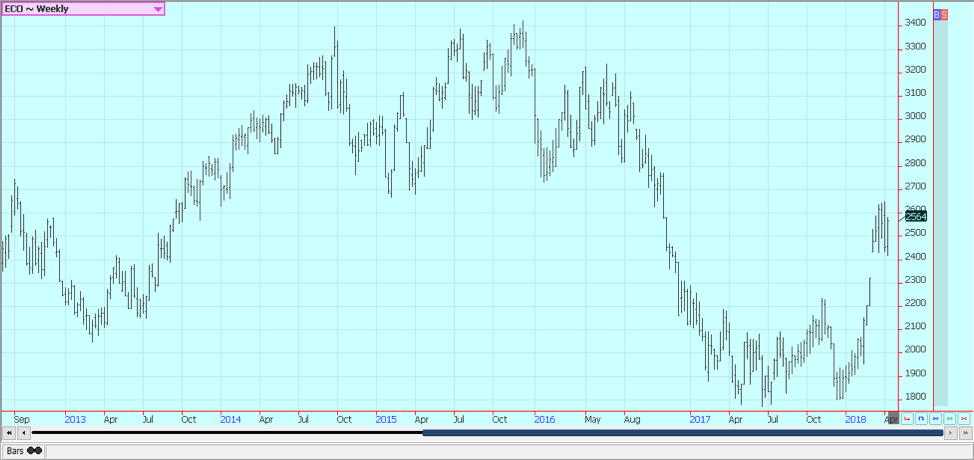

Cocoa

Futures were higher last week. Ideas of smaller world production that has been largely sold remain part of the rally, and ideas of strong demand from processors remain the other part of the rally. Most in the trade anticipate the increased demand, and current West Africa weather is hot enough and dry enough to create production concerns. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions. The mid-crop harvest is starting, and wire reports indicate that some initial mid-crop harvest is underway in Nigeria. No yield reports have been seen yet, but estimates from the country imply that variable yields can be expected. The harvest should begin soon in Ivory Coast and Ghana. Demand has been improving and is likely to continue to improve as processing margins are said to be very strong.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech2 weeks ago

Biotech2 weeks agoEurope Launches Personalized Cancer Medicine Initiative

-

Markets2 days ago

Markets2 days agoRice Market Slips as Global Price Pressure and Production Concerns Grow

-

Crypto1 week ago

Crypto1 week agoBitcoin Wavers Below $70K as Crypto Market Struggles for Momentum

-

Africa1 week ago

Africa1 week agoMorocco’s Tax Reforms Show Tangible Results

You must be logged in to post a comment Login