Fintech

Why Spanish Companies Invest in Cybersecurity and Fintech

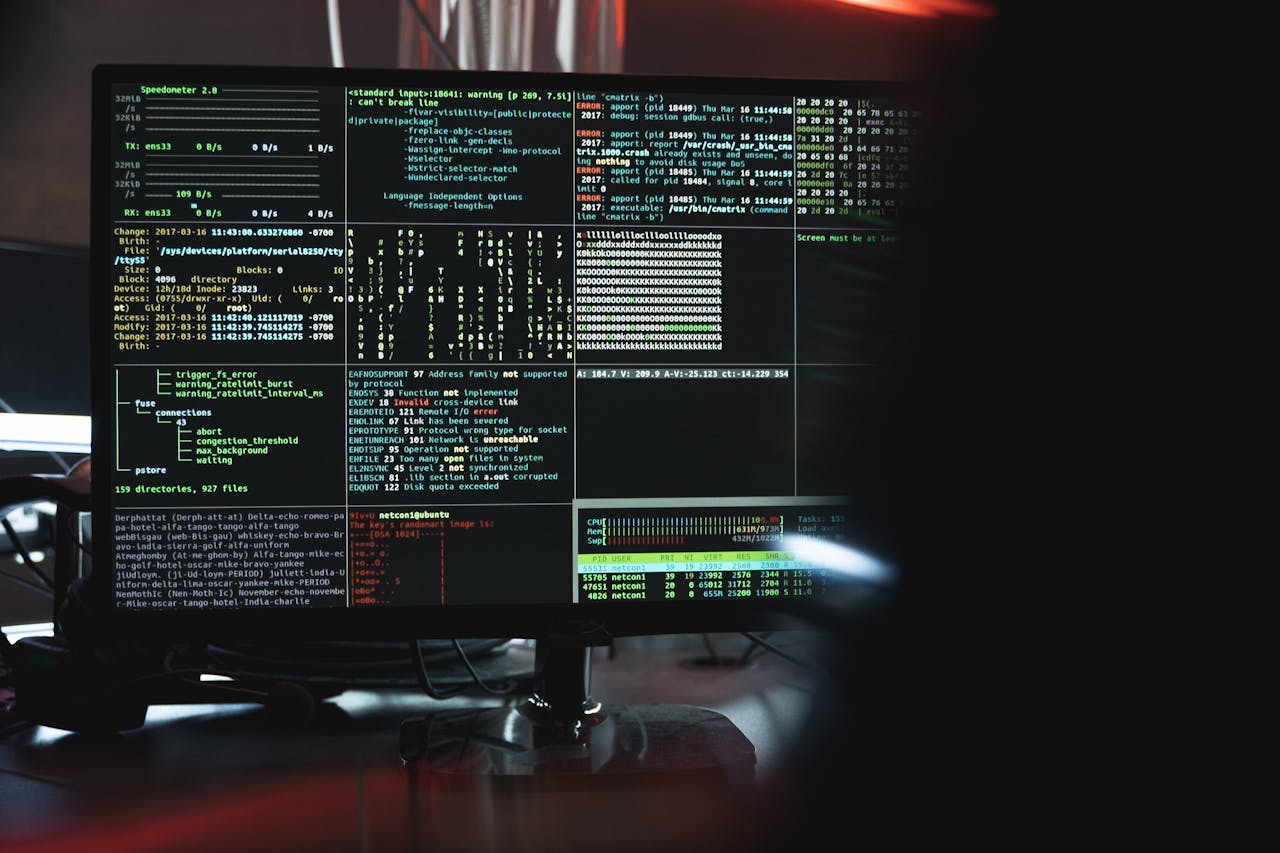

Interest in cybersecurity in Spain is growing, with over half of companies planning to increase investments in 2023. According to Secure&Magazine, 32% will boost budgets by 20%, and 11.6% by 21-50%. Spain leads in collaborating with startups, with 79% of companies involved, emphasizing cybersecurity culture through regular employee training programs.

Interest in cybersecurity in Spain continues to increase, in a context where cyber threats continue to evolve. More than half of Spanish companies have planned to increase their investments in this field during 2023.

According to Secure&Magazine, 32% of Spanish companies will increase their cybersecurity budget by 20%, and 11.6% will increase it between 21% and 50%. Spain, standing out as one of the European countries most committed to collaborating with startups in this sector, has also established business units dedicated exclusively to managing open innovation projects, with a notable 79% of companies involved.

This growth in investment not only focuses on protection against attacks, but also seeks to promote a comprehensive cybersecurity culture. Cybersecurity training and education have become essential components, with many Spanish companies implementing regular employee training programs.

Fintech: Innovation and expansion in the financial market

The fintech sector in Spain has not only quickly adapted to market demands but has also experienced a significant influx of investments, especially in areas such as payments and cryptocurrency adoption. Despite the challenges imposed by an uncertain economic context, investments in fintech reached $107.2 billion globally in the first half of 2022, with considerable activity in the payments sector, which recorded an investment of $43.6 billion .

This dynamism reflects the fintech sector’s ability to accelerate the digital transformation of traditional entities, providing opportunities for both emerging startups and experienced investors in Spain’s technological ecosystem.

Within the fintech landscape, altcoins—alternative currencies to Bitcoin—are gaining ground as an investment and operating option in the financial market. Its integration into fintech platforms not only diversifies payment options but also opens new avenues for the development of more integrated and secure financial solutions. To use them correctly, it is essential to obtain information from expert sites, where they evaluate the best altcoins on the market

Growing interest in technologies such as blockchain, which underpins these cryptocurrencies, is transforming the way businesses and consumers interact with the financial sector, offering greater transparency and efficiency in transactions.

Spanish companies: Adaptation and resistance to global challenges

Investment in cybersecurity and fintech by Spanish comapnies not only reflects a proactive approach towards technological innovation, but also an adaptation strategy in the face of global economic and geopolitical challenges.

Spanish companies are strengthening their digital infrastructures to guarantee greater resilience against possible cyberattacks, which have increased with digitalization accelerated by the pandemic. This preventative approach is crucial to protecting assets and critical information, which in turn sustains consumer confidence and strengthens market stability.

With the advancement of technology and the growing dependence on digital solutions, collaboration between large corporations and fintech startups becomes essential. These alliances allow traditional companies to integrate disruptive innovations and adapt more quickly to market changes. Furthermore, collaborations with startups not only focus on technology, but also on the creation of new products and the optimization of processes, which allows Spanish companies to remain competitive internationally.

Finally, the Spanish government has played a fundamental role in promoting these investments through the implementation of policies that support security and technological innovation.

Regulation and tax incentives designed to promote research and development in key sectors such as fintech and cybersecurity have been decisive. This regulatory framework not only protects but also encourages investment by Spanish companies, ensuring a favorable business environment for the growth and expansion of these critical technologies in Spain.

__

(Featured image by Tima Miroshnichenko via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PERIODICO de IBIZA. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us

-

Cannabis5 days ago

Cannabis5 days agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

-

Cannabis2 weeks ago

Cannabis2 weeks agoWhen a Cutting Becomes a Cannabis Plant: Court Clarifies Germany’s Three-Plant Rule

-

Crowdfunding1 day ago

Crowdfunding1 day agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Africa1 week ago

Africa1 week agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks