Markets

Stock markets in 2017 offer investors to retire as millionaires

Though the chance of reaching millionaire status is still relatively small, the number of families reaching this level has been growing strongly for the past eight years.

Stock markets in 2017 offer investors to retire as millionaires at a young age if they invest smart.

Though most Americans will never reach one million dollars, 10.4 million families have managed to do so. This is a breath of fresh air and a reminder that it is indeed possible. A stock like AT&T can help deliver results to get an investor closer to the goal, especially if reliable, steady and growing retirement income is the main concern.

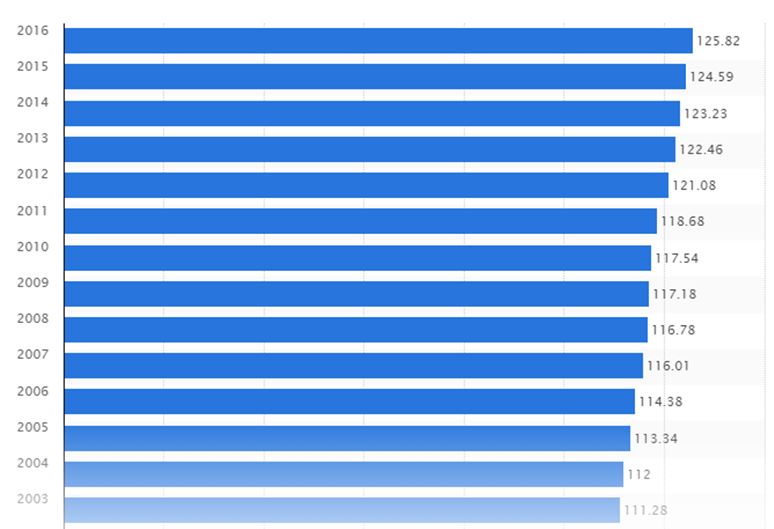

Number of households in the U.S. from 2003 to 2016 (in millions) (Source)

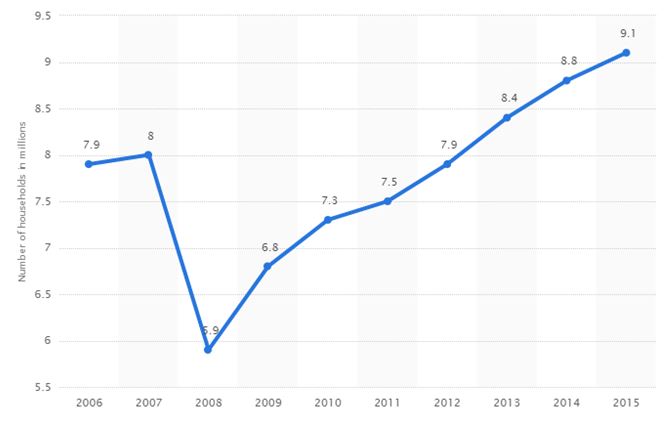

Number of millionaire households in the U.S. from 2006 to 2015 (in millions) (Source)

Percent of families that have reached $1 million in investable assets: 10.4 million Families/ 125.8 million total families = 8.3%

Recent history shows that as of 2007, the country had 8 million millionaire households. The financial industry debacle that brought the 2008 stock market meltdown cut assets considerably and left the country with only 5.9 million such households that year. From that year onward, we were off to the races again as the stock markets began their recovery, jobs grew and overall assets grew in concert. By 2015 the U.S. had reached 9.1 million households and by 2016 we were counting 10.4 million millionaire households.

Based on the math shown above, about one in twelve households today have reached this exclusive club and it continues to grow with every new record set in the stock market, with every new job created (of which there have been many), with every salary increase (which has picked up just recently). If you’re not that one in twelve households, it could be your next door neighbor, the neighbor across the street, the owner of your hair salon, your dentist, doctor, accountant, or any number of acquaintances in your life.

If you structure your life along some of the lines we’re about to discuss and buy some of the stocks with excellent long-term performance, you could be part of this 8.3%. You may not reach the heights of the one-per centers, but hey, if you reach the 8.3% mark, a million is still a million.

Where do millionaire’s come from?

Unlike some fortunate folks born with a silver spoon in their mouths, most experience much more humble beginnings. Most successful people spend the greater part of their lives amassing their fortunes by working hard, spending little, saving a lot and investing wisely. It may sound very simple, but the vast majority of Americans fall short of this lofty goal.

Then again, as we’ve discussed, 10.4 million households in the U.S. have attained $1 million or more in investable assets and their ranks continue to grow. This fact alone is enough to convince us it’s not impossible.

Paths to the millionaire’s club

The right job

Having the right job can make all the difference. Some jobs can get the wealth accumulation machine fired up and going faster than others.

Positions in medicine, like nurse, nurse practitioner and highly specialized lab and x-ray fields are among the highest paying positions. So, too are many technology and finance jobs. A nurse practitioner has a median salary of $97,000. Compare that to a person working in retail, earning $10 per hour or $20,800 per year and you can easily see what a strong head start can be gained from the right job. However, given an early start in their earning career, even a low-wage earner with good saving and spending habits can build a comparative fortune. A higher salary simply makes it an easier task to save more and to save larger amounts, faster.

Remedy:

Find a field that interests you that also promises a lucrative career. Working hard at something that is challenging your whole career is better than slaving away at a boring position and having no financial payoff as well.

Save enough

Even a squirrel collects and buries acorns so that he’ll have food to survive the winter. If you live off of every penny that you make, you’ll have none left over for everyday emergencies, not to mention any to live off in the winter of your life, your retirement.

You need to develop habits of saving money or you’ll never reach that $1 million. It’s a pretty obvious concept but is given little thought by millions of people. Especially vulnerable to this lack of understanding are new, young workers, just starting out. Typically, they’re so excited to finally be on their own that they waste no time indulging themselves in every little fantasy of consumerism they’ve every harbored.

Even if you earn several hundred thousand per year, or a million a year, if you spend it all every year you wind up with none left over. None for an emergency and none for retirement when you can’t or don’t wish to work any longer.

Remedy:

Start to save as soon as practicable. The earlier you begin the saving habit, the faster and the more your money will compound for you. Doing so early means you’ll actually have to save less, now and in the future.

Putting together a budget is the first step to getting a grip on your expenditures and finding areas where you can trim expenses. The more possibilities you find to trim or cut, the larger your savings will be.

If you get a bonus at work or a large gift for a wedding or birthday, funnel it into savings immediately to fence it off from the impulse to spend it.

Fear of investing in the stock market

Millennials today are well aware of how their baby boomer parents saw 50% or more of their hard-earned savings go down with the ship when the stock market collapsed in the 2008-2009 financial debacle.

Dow Industrials October 1, 2007, to March 9, 2009 (Source)

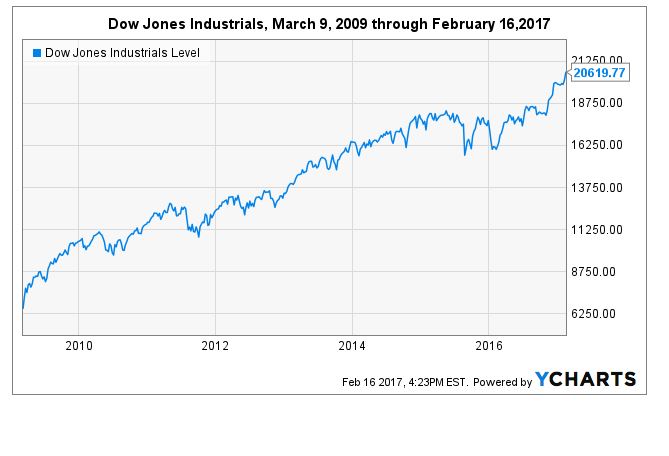

The Dow Index careened for 17 months, from around the 14,000 level, finally bottoming at 6547 on March 9, 2009. It was a stomach-wrenching ride for most investors.

Millennials were witnesses to the daily, intensifying anxiety displayed at the dinner table by their parents who saw much of their wealth evaporate. Some of their parents sold their good quality equities at bargain basement prices. Doing so, they gave in to the panic and utter fear swirling in the markets and converted their paper losses to real losses.

Running out of the market, and staying out of the market these last eight years, deprived them of the opportunity to rebuild their nest eggs. Those investors with longer-term perspective and experience in the markets kept their positions and held their quality stocks. Doing this allowed them to not only recover their capital positions, but grow them to new, higher and higher levels.

Dow Jones Industrials, March 9, 2009, till now (Source)

Remedy:

If this sounds like you, the answer to overcoming this fear of the markets is easier than you might think. It involves a commitment to simply educate yourself about the workings of the economy and the stock markets that fuel the growth of our economy through the sale of shares to investors.

Read as much as you can, or whatever interests you on sites like Seeking Alpha, Yahoo Finance, Google Finance and many others. Read books by and about Benjamin Graham, Warren Buffett and Peter Lynch. Become aware that the stock market in the U.S. goes upward most of the time. Even when it goes into correction mode, or bear market mode, it always, eventually overcomes all obstacles and reaches new highs.

Don’t live above your means

According to financial research firm Value Penguin, among those households that carry credit card debt, the average credit-card debt is $16,048. One in three households carries credit card debt. Does this describe you?

Again, it seems quite obvious that spending more than you earn can put you in a dangerous hole of debt. Some people can’t help themselves. They see consumer ads all day on T.V., in newspapers, magazines and online. The temptation for them is something they just can’t resist. “The devil made me do it.”

Remedy:

One of the biggest obstacles to becoming rich is living like you’re rich before you actually are rich. This is where that budget comes in handy. You need to get a handle on your cash flow to be sure that you have more money coming into the household than what is flowing out.

Instead of viewing a credit card as easy access to cash to buy something you don’t really need but simply would like to have, think of it as a financial management tool. Apply for credit cards that give you the highest cash back in categories that you spend the most. And always pay off your full balance each month so as not to incur any interest charges.

Used in this fashion, a credit card becomes a money maker and adds to your savings, rather than a money-loser that constantly drains your savings. Think of it. If you put all of your major annual spending, say $40,000.00, on a credit card that pays you 2% back on all your purchases, you could actually generate $800.00 per year of income, simply by using the card to manage your ordinary spending.

But remember, you’ll need the discipline to pay off your balance in full each month to make this method an income generator.

Spend smart

Spending money wisely is part of keeping expenses down and cutting and trimming those fees and costs in our lives that detract from our goal of attaining wealth. Not getting the small stuff right means you’ll never get the big stuff right.

We’re talking here about those small everyday expenses that just don’t appear to be a big deal but add up to a very big deal, indeed.

- Some banks charge monthly fees to customers, perhaps $10 per month, or more, if they don’t carry a certain average monthly balance in their account.

Remedy:

Move your funds to a bank that does not charge such a fee, or if minimal, deposit the necessary amount to avoid such fees.

- Late-payment penalties on your bills and out-of-network ATM fees on your cash withdrawals.

Remedy:

Pay your bills on time to avoid such fees, and try to schedule the use of in-network ATMs on your way to or from work or school to avoid those fees.

- Investing fees attached to mutual funds can really take away from your long-term returns

Remedy:

Look for the lowest cost mutual funds which are usually the index funds. Instead of paying 1.5% to 2.0% or more on actively managed funds, passive index funds can be found for .5% or less. Most studies show that passive indexing results in higher performance, long term, than actively managed funds. So going passive is a win-win. You’ll get better performance at a much lower cost.

2017 investing strategies to reach $1 million

Save even more by actively managing your own portfolio with high-quality dividend stocks with long histories of growing their earnings and consistently growing their dividends. The very low commission fees that are available today will result in your saving what could amount to several thousands of dollars each year on mutual fund management fees and expenses.

This has been our approach to the stock market for many years.

AT&T strategy session – a great stock at a better price and yield

If we are willing to exercise patience, instead of having price dictated to us by the market, we can set our own price targets that will fulfill our particular goals for yield and income with AT&T (NYSE:T) with the help of the Real Time Portfolio Tracker.

In order to manage our portfolios in real time and stay on top of all of our positions, I use the Real Time Portfolio Tracker. When dips occur, I’m able to easily monitor the impact on each equity’s dividend yield. This always helps in the process of layering in slowly with gradual share additions to help grow income further going forward.

Real Time Portfolio Tracker

Real Time Portfolio Tracker-T (Source)

Here, I’ve used the tracker to input various target prices. Because the app calculates prices, dividends yields and investment cost all in real time, it is simple to let the app manipulate target prices to quickly arrive at the results we’re seeking.

For comparison purposes, we’ve entered a hypothetical purchase of T with a cost of $33.20 per share, giving a yield of 5.9% and income for the portfolio of $491.96 per year on the 251 share position.

If we’re willing to wait for a price compression of 1.73%, as indicated and circled in red, in column I, we can see that this will result in the yield rising from the current 4.82% to a yield of 4.90%, circled in red in column L, Yield on Cost. However, if we are a bit more patient, and decide to buy shares for $39.20 each, we could obtain a better yield of 5.0%.

For the same 100 share position contemplated, we are able to see the effect on our investment cost with each price contraction, also circled in red in Column G.

In real time, the app also feeds us with important metrics that include the current value of each of our positions, the percentage change in value from our buy price, current dividend yields, yields on cost based on our buy price, the dollar income each constituent contributes to overall portfolio income, the percent of income each represents and our capital gain from each position as well as the total portfolio.

This is one of many ways we monitor our portfolios in real time and make adjustments to holdings as opportunities present themselves. Bulking up an AT&T position at a better price will save us 3.8% in investment cost and give us a more generous yield.

Recent AT&T developments

Though T has risen a bit since we last visited this watch list candidate, we continue to believe that patience may deliver this stock to an investor at a better price point. Fed Chair Janet Yellen, on Wednesday, finished two days of testimony before congress. She made it pretty clear that rate increases would be affected sooner rather than later. After her testimony, odds of a rate increase for March went up to 50%. She focused on the continued growth in the economy and strengthening jobs picture. Ms. Yellen also discussed the danger of getting behind the curve, noting that if inflation begins rising too fast the Fed will have difficulty getting it under control if they wait too long to put the next rate rise into effect.

Retail spending in January came in stronger than analysts had predicted, and consumer and business sentiment continue to be high. Records have been set for seven straight days in the markets, adding to investor confidence and enthusiasm on the back of the president’s talk about major tax cuts, reduction in regulations and infrastructure spending.

President Trump has, several times, tweeted his disapproval for the merger between Time Warner (NYSE:TWX) and AT&T. He and some regulators agree that such a merger would result in too much of a concentration of communications and content in one company and have a negative impact on competition in the marketplace. With his continued negative tweeting about CNN which is owned by Time Warner, there continues to be a lot of uncertainty surrounding this proposed merger.

These factors lead me to believe that AT&T’s stock price may still see a decline on the order of 5% as investors worry about the effect of interest rates on their bottom line and a merger that may fall through the cracks.

Because I believe that anti-trust concerns will be lessened in this new administration and both companies will be able to show that content and delivery of content are two different business models, eventually, this merger has a good chance of reaching completion. If that be the case, the merger of some of the best video and online content from Time Warner with AT&T’s behemoth network for delivering content will be a win-win for the merged company’s bottom line and investors who buy their shares.

Conclusion

Though the chance of reaching millionaire status is still relatively small, the number of families reaching this level has been growing strongly for the past eight years. This should lend some comfort to investors of all ages who wish to attain this asset level in order to provide a level of comfort in retirement.

Spending smart and cutting unnecessary expenses can go a long way toward aiding readers to reach these goals. Some ideas were advanced, but there are literally thousands of ways people can accomplish this.

Just as we wash our faces each morning and brush our teeth, making saving and investing strategies part of our daily routine can ease our fears of the stock market, especially if we educate ourselves in the various methods and strategies that can get us there.

Approaching the markets in an unemotional, rational manner is what is necessary to withstand the anxieties that commonly make an investor’s quality stocks fly out of his hands in inevitable moments of market corrections and investor panic.

Dividend growth investing in high-quality stocks like AT&T is one method that can provide solid, reliable income to investors in retirement.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets6 days ago

Markets6 days agoRising U.S. Debt and Growing Financial Risks

-

Business2 weeks ago

Business2 weeks agoDow Jones Near Record Highs Amid Bullish Momentum and Bearish Long-Term Fears

-

Africa3 days ago

Africa3 days agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances

-

Crowdfunding1 week ago

Crowdfunding1 week agoThe Youth Program at Enzian Shooting Club Is Expanding Thanks to Crowdfunding

You must be logged in to post a comment Login