Business

The demand for US soybeans still remains strong

The weekly charts still show overall downtrends, but daily charts are showing the potential for a short-term rally from current levels.

American farmers have been able to get soybeans planting done under relatively better conditions than those seen for corn.

Wheat

US markets were higher last week, and trends are up on the weekly charts. The harvest is moving to completion in Texas and Oklahoma, and reports continue to be mixed. Results indicate that the protein levels are not strong in these areas. Yields are lower as well. The Kansas crop harvest is very active. Yield reports were mixed, but protein levels were considered satisfactory. Minneapolis has been supported by bad growing conditions in Spring Wheat areas of the northern Great Plains and the Canadian Prairies. Provincial reports from Canada suggest improving conditions there, although it remains dry in western growing areas. It is dry in the Dakotas and the southern Prairies, while other parts of the northern Prairies have seen too much rain. The Spring Wheat conditions and ratings are creating concern about the potential for a smaller crop even as demand expectations increase due to the lower Winter Wheat quality and yields. The Midwest has seen plenty of rain, so a lower quality crop is expected, although yields, in general, could be strong. Lower supply expectations will help support Winter Wheat futures but the lower quality will hurt the overall demand profile. The export market will remain difficult as there is still a lot of Wheat around. Russia is cutting back production expectations a bit and there are questions about Ukraine and Europe Wheat production, but Australia has a very good crop and Argentina is talking about a very good crop as well. Overall, though, the theme is that world production will be less than previous expectations. The weekly charts show the potential for Winter Wheat prices to move significantly higher.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

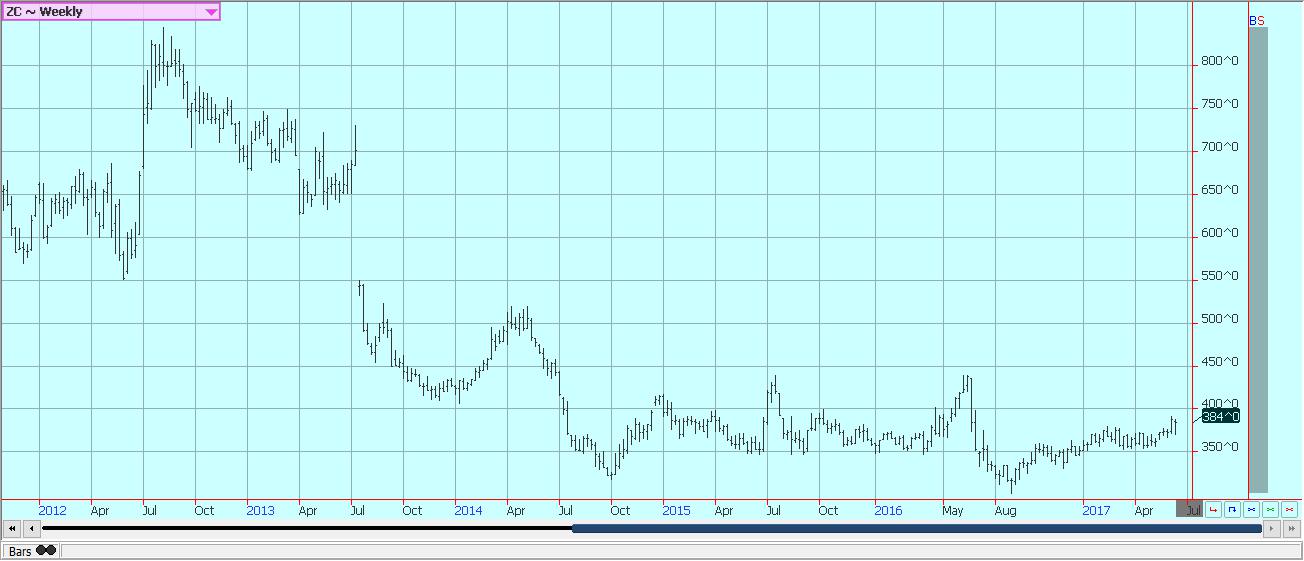

Corn

Corn was lower and Oats were higher last week. Oats moved to new highs on the daily charts. Weekly charts suggest that this particular market has some major rally potential. Trends are up on the daily and weekly charts for Corn, and the weekly charts imply that rallies to 403 and 430 basis the nearby contract are possible. The Corn Belt saw some very hot temperatures over the first part of last week, then some very timely rains. Crops in some areas are still showing signs of stress. There are already reports of leaves rolling in many parts of the Midwest as the roots have not developed enough to tap into subsoil moisture. The areas that got rain in the last week now have better conditions and the stress should be less. Crop progress remains generally good, as emergence is reported everywhere. Ideas are already that the top edge of yield potential is gone, although the potential for very good production is still very much there. But, the weather must stay good and so far the weather has been variable at best. Variable and potentially stressful conditions are expected to return with hotter temperatures by the end of this month and into July. The trade is concerned about the potential for more hot and dry weather later this Summer due to the much above normal temperatures seen this early in the season, and these fears will help keep buying interest in the market for a while or until July when reproduction will be done. Most analysts have cut yield projections already and now estimate yields at about 157 to 168 bushels per acre. Initial projects had been above 170 bushels per acre in line with USDA trend line yield calculations.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

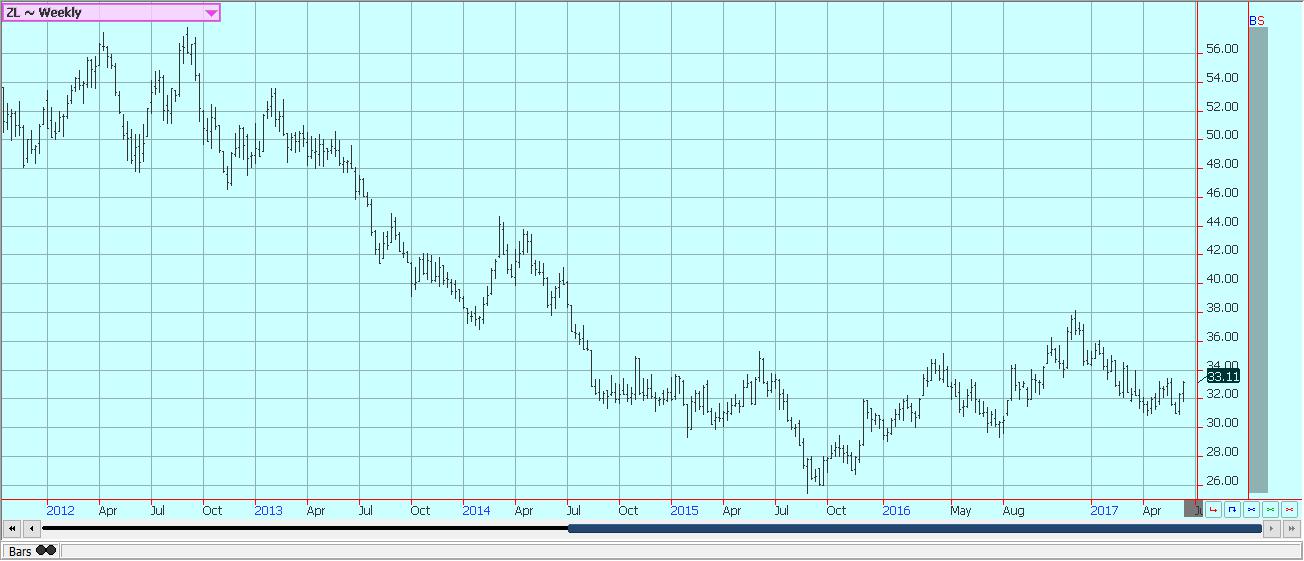

Soybeans and soybean meal

Soybeans were higher and soybean meal was lower last week. These markets remain the most negative markets at CBOT due to very high production expectations here couple with high production in South America. South American producers remain reluctant sellers at current prices, and American farmers have been able to get planting done under relatively better conditions than those seen for Corn. Soybeans are in the ground now and most have emerged. The weather has been very warm, but showers were seen late last week and over the weekend and cooler temperatures are expected this week. Crop ratings are not as high as expected but should show some improvement in the data that will be released on Monday afternoon. Speculators appear are still the best sellers right now as they add to short positions. Overall the trade remains bearish on the price potential for the entire complex but is keeping a close eye on the US Dollar that acts weak and the Midwest weather that might turn hot and dry again by the end of the month. Demand for US soybeans remains strong, with solid export sales on a weekly basis that run above trade and USDA expectations and a stronger than expected crush rate in the domestic market as reported by NOPA last week. The weekly charts still show overall downtrends, but daily charts are showing the potential for a short-term rally from current levels.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice closed higher again last week after holding support areas on the charts. The Price action on Thursday was very strong after the collapse on Wednesday and implied that much higher prices are coming soon. The potential for smaller US crops this year continues to support the move higher. The weather in most growing areas has improved as it remains warmer and drier, but many parts of the Delta and along the Gulf Coast remain too wet and this weather has affected production potential. Only Texas is in good to very good condition. California has good looking crops, but the crops were planted late so top yields are not likely. The Delta from Louisiana to Arkansas and Missouri remains the big problem area, and this is where the big production normally is. The emergence remains slightly behind the average pace. Crops are in flood in the south and going into the flood in the north. The crop condition improved on a week to week basis but remains slightly behind the conditions of last year. The weekly charts show that the rally could move higher over time, with final targets near 1275 basis the nearest futures contract possible.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils markets were mostly lower last week and price trends are down on the weekly charts. The weekly charts for the various vegetable oils markets remain the weakest of all agricultural futures markets. Only Soybean Oil has managed to trade higher on indications of strong domestic demand, especially for biofuels, and on better than expected exports. Palm Oil is seeing weaker demand so far this month when compared to last month. Both of the private surveyors estimated Malaysian Palm Oil exports at 15% lower than the first half of last month. Reports from the interiors of Indonesia and Malaysia indicate that production conditions are mostly very good. Canola remains relatively strong amid tight Canadian market conditions, but trends remain down. The crops are emerging and growing. Western areas of the Prairies remain too dry. Eastern areas have seen good rains. Demand from both the processor side and the export side has been strong enough to generally support the market.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was lower and trends are down on the charts. The daily charts show that futures could be oversold and in need of a short covering rally, but it is possible now that the market is in an extended trend lower that could last at least through the rest of the year. The growing weather in the US is generally good and crop conditions are reported to be good by producers and observers. Warmer temperatures have arrived to support the development and there has been enough rain. Warmer and drier weather is expected this week in most production areas, and growing conditions should remain good. The US and maybe the world will produce much bigger crops this year. Monsoon rains are appearing in India and Pakistan and ideas of bigger production in that part of the world. On the other hand, China has been too dry. Central Asia has been dry, but conditions are rated as good. Overall, the market expects more production in the world against stagnant demand, but demand has been stronger than expected this year and cheaper prices could keep demand next year stronger than expected and cause a bigger drawdown in stocks levels than anticipated.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ closed higher last week and could be trying to find a short term bottom. Both the daily and weekly charts show that a bottom could have been completed. Selling has abated with the Valencia harvest coming to a close. It is hurricane season, and an above average year is expected in the Atlantic. Some systems have been forming in the Gulf of Mexico and the Caribbean and one even formed off the coast of Africa, a rare occurrence for so early in the season. Florida weather has shown improvement as rains continue in the state. These rains have been very beneficial as the state had been in a drought. There are no systems in the Atlantic to cause concern about tropical storm development that could be detrimental to trees and fruit. The demand side remains weak and there are plenty of supplies in the US. Brazil has been exporting FCOJ to the US to cover the short Florida crop. Domestic production remains very low due to the greening disease and drought. Trees now are showing fruit of varying sizes and overall conditions are called good because of the irrigation. The Valencia harvest is moving to processors and into the fresh market and is almost over. Brazil crops remain in mostly good condition.

Weekly FCOJ Futures © Jack Scoville

Coffee

It was a tale of two markets last week, with London moving sharply higher and New York moving a little lower into new lows for the move. The New York market action remains weaker overall due to ideas of good supplies and reports of weak demand. These ideas were reinforced last week as the ICO projected adequate supplies for the coming year and the GCA showed record supply levels in the US. The cash market remains very slow with almost no interest seen from roasters as they see the big US supplies and think that prices will remain cheap. Offers remain in the cash market, and differentials are stable. New York has featured some buying support from speculators as they have become more two-sided in trading the market as the Winter season is approaching in Brazil. However, speculators and commercials are still mostly bearish. London had been strong as news surfaced that supplies in the cash market are tight due to reduced Vietnamese selling and tight supplies in the country. Offers are less and seen at high prices from Robusta countries such as Vietnam. Indonesia and Brazil are also very low on supplies. The Robusta market is still relatively strong compared to Arabica and due to the short supplies available to the market as it works to curb demand through the higher prices.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures in both London and New York were lower last week, and both markets made new lows for the move before trading sideways for the second half of the week. London weakened on spreads against New York. It remains the frequent reports of increased supplies to the market that has pressured prices in the last few weeks. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months as the Sugarcane harvest moves to its peak. Production in India and Thailand is expected to improve in the coming year as both countries anticipate better monsoons than the failed monsoons of last year. It is raining in parts of India now as the monsoon arrived a few weeks ago. The Indian weather service estimates that the monsoon will be within the normal range. Thailand also hopes for an improved monsoon season this year and is getting rains now. China is still importing significantly less Sugar so far this year. The weather in Latin American countries away from Brazil appears to be mostly good. Most of Southeast Asia has had good rains and rains continue.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

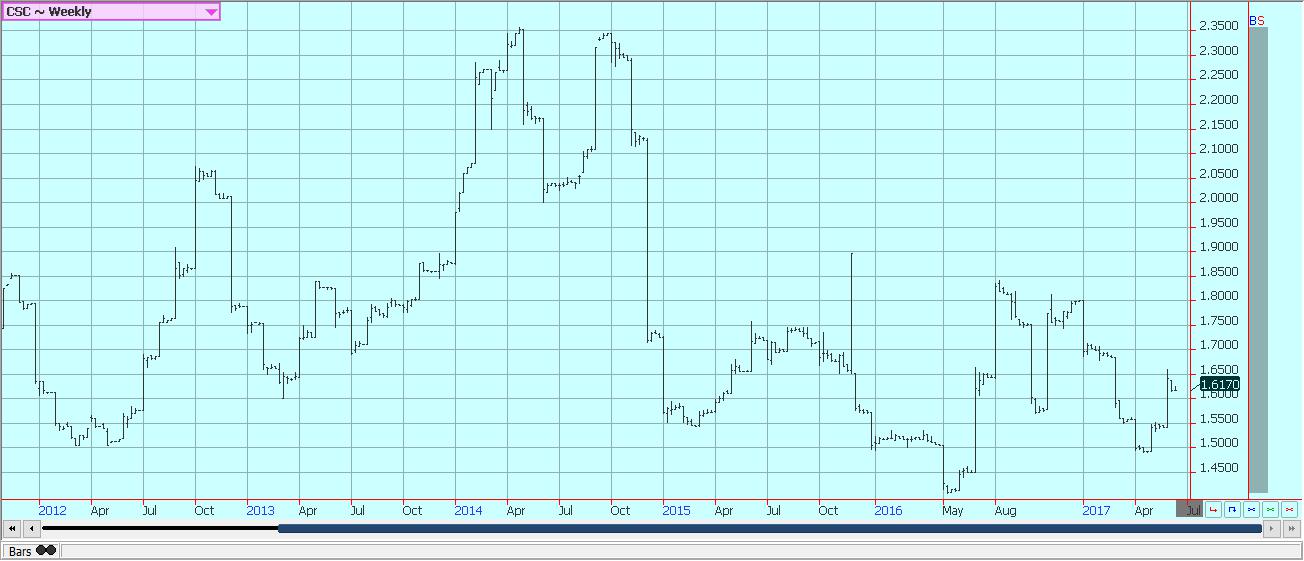

Cocoa

Futures markets were lower last week and both markets faded from important nearby resistance areas on the weekly charts. However, the tone of the market has changed and this could be more of a corrective move than one to new lows. The overall market situation remains generally bearish, although fundamentals could change in the longer term. Harvest activities in West Africa are completed. That means that there is less offer in the cash market as much of this Cocoa has already been sold. The demand from Europe is reported weak overall, and the North American demand has been weaker. However, chocolate prices are falling in Germany and should be falling in other parts of the world now to help move product and to get the market flowing again as input costs are much lower now. The next production cycle still appears to be big on the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

Dairy markets were higher last week, and longer term trends remain up. Gutter prices have been the strength of the market on reports of very good demand for the next six months and tightening supplies due to hotter weather. Cheese prices have been relatively weak. Demand is good for cream, but the cream has been available to meet the demand. Cream demand for Butter has been very good as orders for print butter have increased. Demand for Ice Cream has been mixed depending on the region. Cheese demand appears to be getting weaker especially in western areas and for Italian varieties. Dried products prices are generally weaker. World prices have been firming in the last month, with European prices leading the way, especially for Butter.

US cattle and beef prices were lower and trends in cattle futures turned down. The beef market has been strong, but could be near a seasonal top as much of the holiday buying gets done. Feedlots are very current with supplies and are pulling cattle ahead in order to take advantage of the high prices. The trade is worried about a trend change to down given that the market has been very strong, but the cash market keeps holding and demand is also holding.

Pork markets and Lean Hogs futures were weaker. Cash markets have had a firm tone inside the US despite strong hog availability. Pork demand remains stronger than expected, but packers have been pulling back from the market as they sense increasing supplies are coming. Packer demand has been very good until now. There are big supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech2 weeks ago

Fintech2 weeks agoFintech Alliances and AI Expand Small-Business Lending Worldwide

-

Crypto1 week ago

Crypto1 week agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Fintech2 weeks ago

Fintech2 weeks agoDruo Doubles Processed Volume and Targets Global Expansion by 2026

-

Business2 days ago

Business2 days agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

You must be logged in to post a comment Login