Markets

More Sugar Is Now Available to the World Market

Both markets closed higher again as traders are more worried about the lack of Sugar exports from India than they are about actual exports from Brazil. India has not cut exports yet but could easily do so in response to dry weather in Sugarcane growing areas. Reports of increased offers from Brazil are still around but other origins are still not offering and demand is still strong.

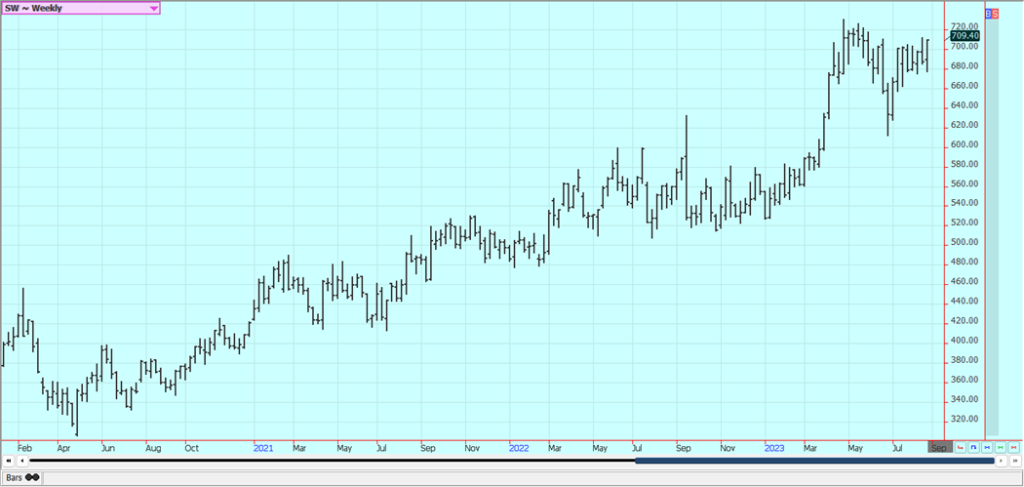

Wheat: Wheat markets held to a trading range last week, Renewed bombing of Ukraine ports by Russia and the unexpected drop in crop condition reported by USDA on Monday night provided the best support. Demand for US Wheat needs to improve. Demand has been poor for US Wheat and should remain bad as Russia production looks strong and exports from Russia have not abated. It is certain that there will be no grain deal soon for Ukraine exports through the Black Sea and any export from the Danube will be difficult if not impossible. Ukraine will still be able to ship via land through the EU. It is unlikely that any ship owner or ship insurer will take the chance on any passage of Ukrainian grain through the Black Sea, and maybe not for Russia, either. The world access to Wheat from at least one and perhaps both countries is a lot more restricted. Weather forecasts call for drier weather for the northern Great Plains and Canadian Prairies and some areas will be real hot. Canada is now suffering potential crop losses due to dry weather.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

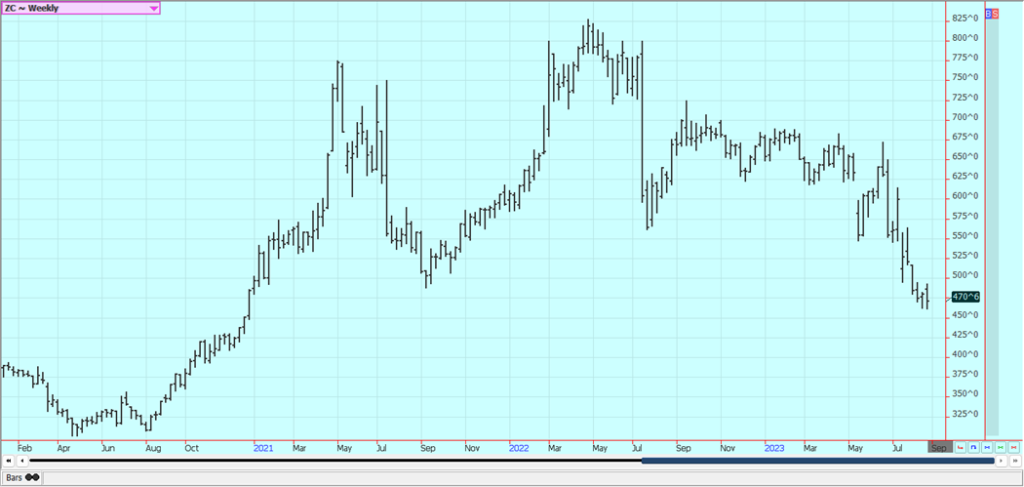

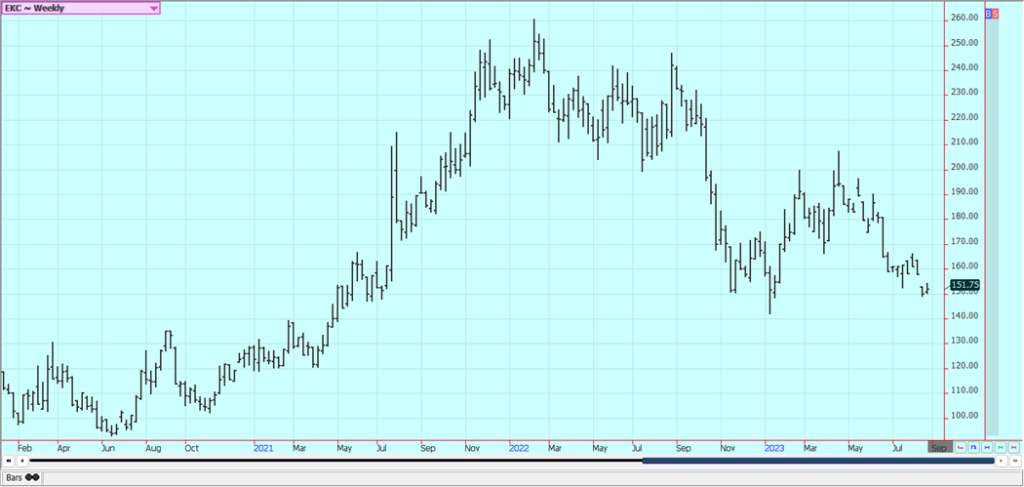

Corn: Corn was higher on a drop in crop condition ratings reported by USDA and as the Pro Farmer crop tour found less than good crops on the complete tour. Highly variable conditions were noted especially in western areas. Pro Farmer estimated production at 14.96 billion bushels with a yield of 172 bu/acre Weather forecasts remain mostly dry and warm for the Midwest for this week and the next couple of weeks. The crops are reported to be in mostly good condition now but will need rain constantly to maintain the condition due to the lack of soil moisture from three months of drought that ended at the end of June. A return to hot and dry weather now could impact yields in a bad way, but ideas are that much of the yield has been already made. Cooler temperatures after this week will help, but the Corn still needs rain and the lack of rain is more important. Demand for US Corn in the world market has been very low and domestic demand has been weak due to reduced Cattle and other livestock production. The Brazil Corn harvest is underway and so export prices for Corn from Brazil are getting relatively cheap and Brazil is getting the business.

Weekly Corn Futures

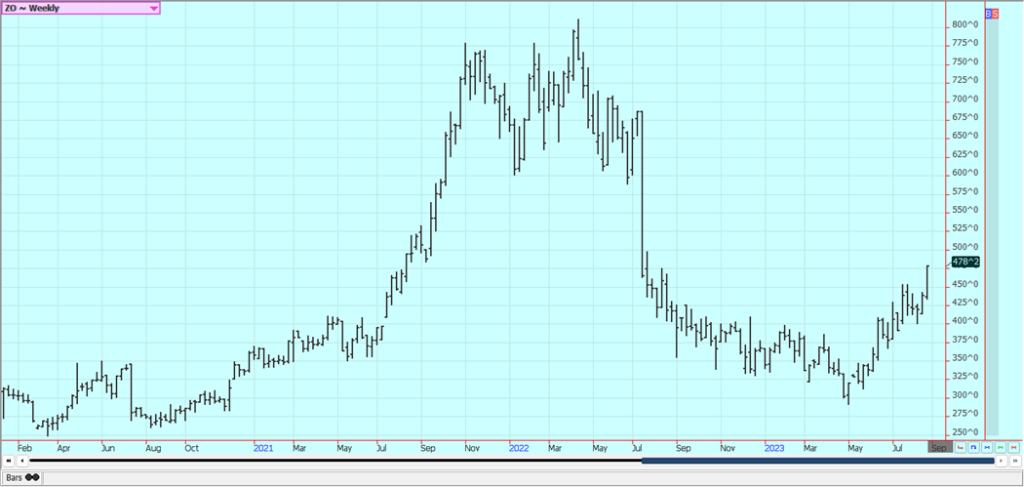

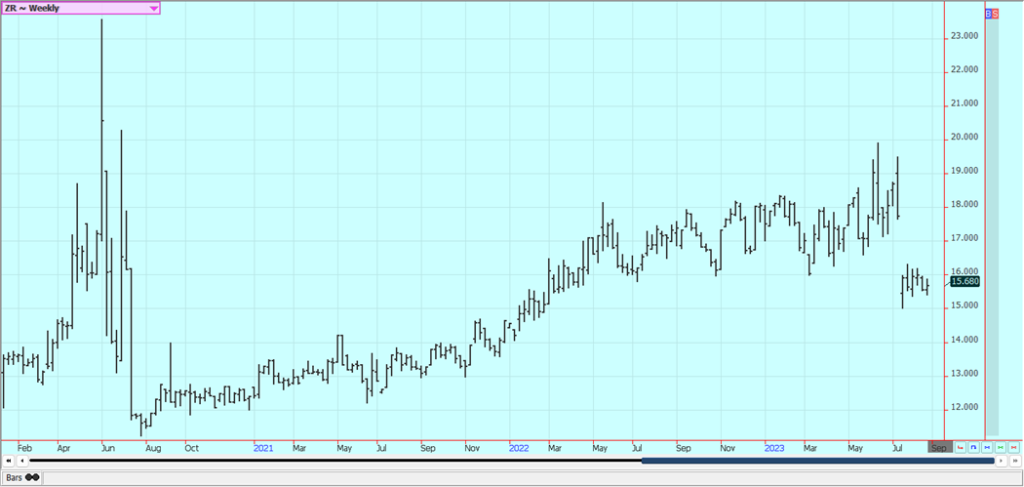

Weekly Oats Futures

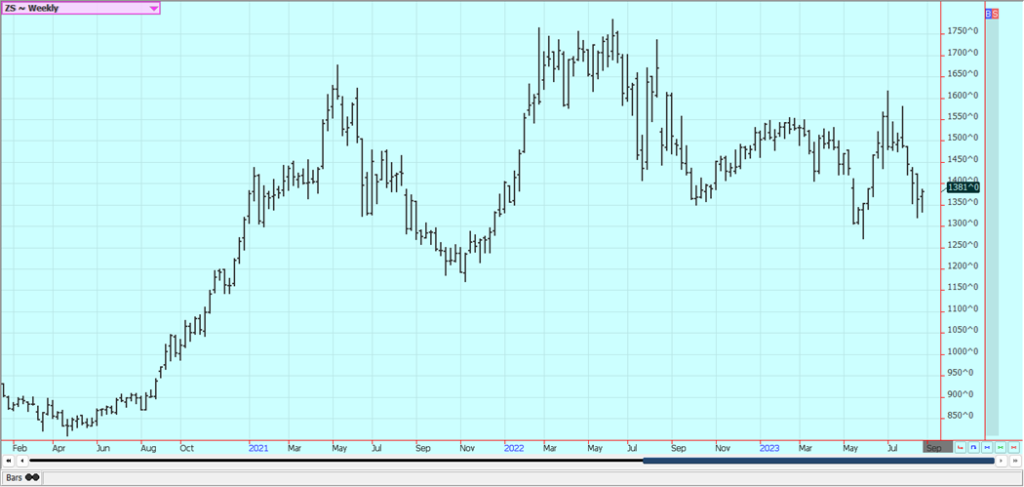

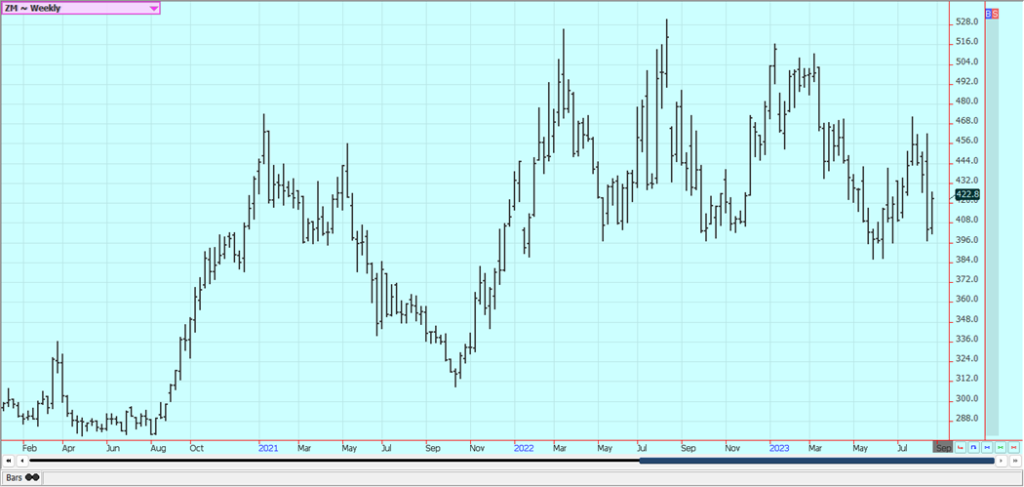

Soybeans and Soybean Meal: Soybeans and the products were higher on less than good crops seen by the Pro Farmer tour last week. Highly variable conditions were noted especially in western areas. Demand forced the soy complex lower early in the week. Pro Farmer estimated production at 4.11 billion bushels with a yield of 49.7 bu/acre Weather forecasts calling for very warm and dry conditions for the Midwest for this week and the next few weeks supported Soybeans futures. Most longer-range maps indicate the potential for dry weather. Temperatures are expected to be above normal. Ideas are that the top end of the yield potential is gone but severe damage has not been reported yet but is becoming possible in some areas. Brazil basis levels are still low, and the US is being shut out of the market for most importers, but the US is price competitive now. Brazil is still selling a lot of Soybeans to China and other countries. Brazil has a very good crop, but the additional Soybeans grown in Brazil will be partially wiped out by the losses in Argentina.

Weekly Chicago Soybeans Futures

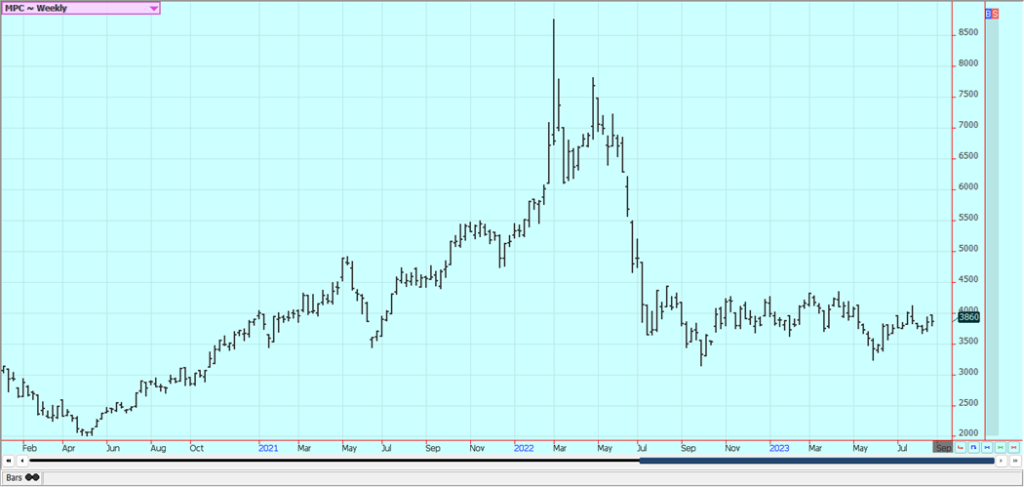

Weekly Chicago Soybean Meal Futures

Rice: Rice closed slightly lower again Friday in consolidation trading as the US harvest expands and good yields are reported. Yields are called average to well above average in the southern US and average to above average so far in Arkansas. The quality has been a little uneven with some crops affected by the extreme heat in southern areas that has hurt field yields in some areas. India will not allow Rice exports except for Basmati for now because of too much rain on some crops and not enough for other areas. Northern areas are too wet and southern areas are too dry. India is the largest exporter of Rice in the world, so it was big news and one that implies that a sharp increase in world price is now possible.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was higher last week on price action in Chicago Soybean Oil. Ideas are that export demand has improved as the private sources reported at 10.8% increase in exports for the month to date last week. But, production ideas are a[so strong and are keeping rallies in check. Canola was higher on Chicago price action. Drier weather is generally forecast for the Prairies and the crop has been stressed. Ideas are that StatsCan will show a reduction in production potential in its updates later this week.

Weekly Malaysian Palm Oil Futures

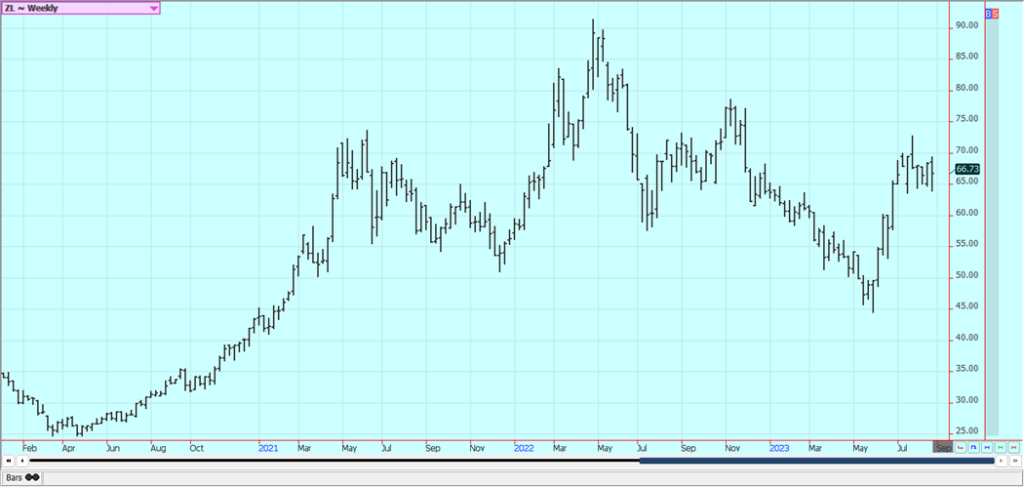

Weekly Chicago Soybean Oil Futures

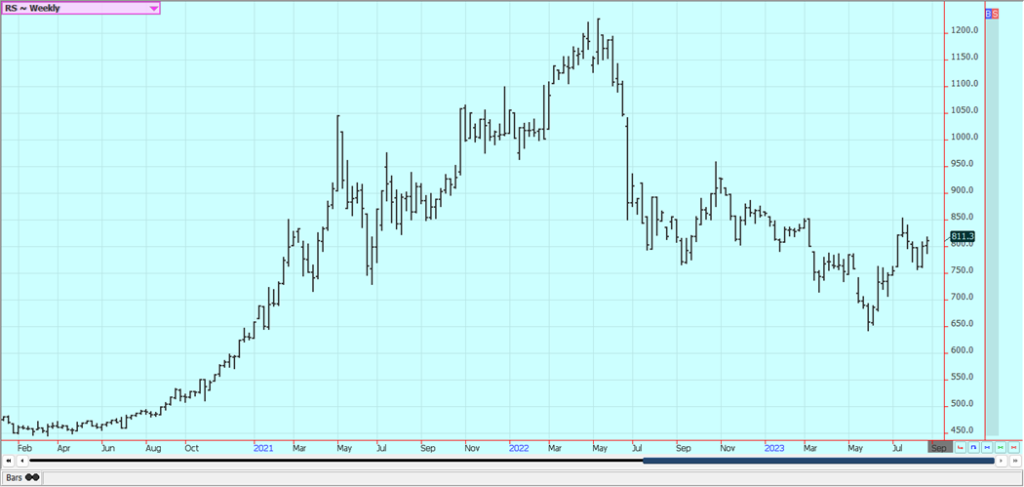

Weekly Canola Futures:

Cotton: Cotton closed higher last week on reports of stressful conditions for US Cotton production. Ideas are around that Chinese economic data implies less US cotton demand for the coming year but demand from other buyers has been good. There is more talk of a contraction that could develop in China and Cotton demand could be hurt if people have less money to spend on clothes. The heat is still extreme in the southern US and has yet to moderate. Ideas of weaker demand due to economic problems in Asia and improved production prospects here at home continue and Chinese economic data continues to show weakness. There are still many concerns about demand from China and the rest of Asia due to the slow economic return of China in the world market and as China is trying not to buy from the US. There are also worries developing that the US could be moving into a mild recession after many months of superlative growth.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little lower last week in consolidation trading. Futures remain supported by very short Oranges production estimates for Florida. Futures are also being supported in forecasts for an above average hurricane season that could bring a storm to damage the trees once again. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for products around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and conditions are rated good. Florida Mutual said that inventories of FCOJ are 44% less than last year.

Weekly FCOJ Futures

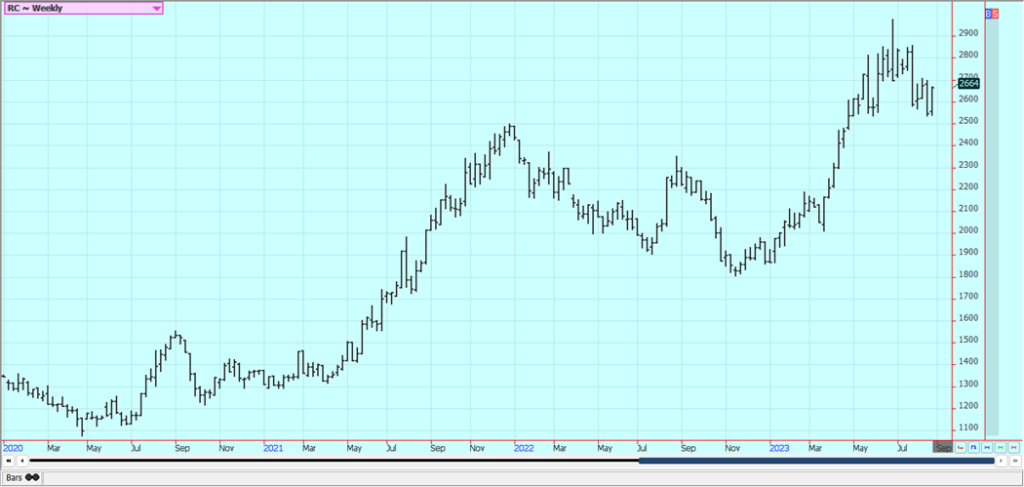

Coffee: New York and London closed higher last week in mostly consolidation trading. Trends are trying to turn up on the charts. Offers from Brazil and other countries in Latin America could be increasing but prices are considered a little cheap to create much selling interest from producers. The Brazil harvest moving quickly along and offers should be increasing. Vietnam is not offering at all into the world market as domestic cash prices are very high. Ideas are that roaster demand is relaxing with more Coffee seen in the market now. There are reports of dry weather for the harvest in Arabica production in Brazil with high production expectations. There are still tight Robusta supplies for the market amid strong demand for Robusta with no offers from Vietnam in the world market due to very high domestic prices. Producers in Indonesia are said to have almost nothing left to sell. Central America is featuring Coffee offered with very high differentials. The market really needs big offers from Brazil to sustain any downside movement and big offers are not coming with the lower prices.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

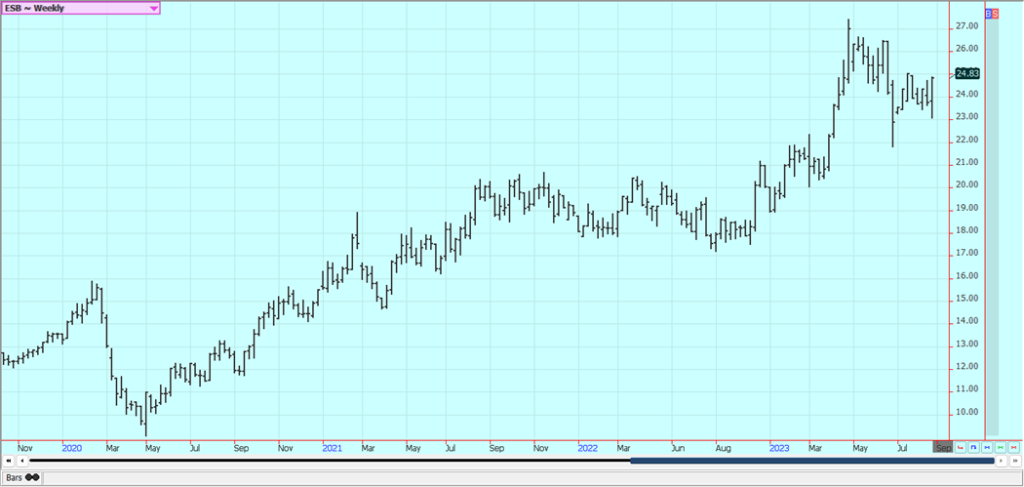

Sugar: Both markets closed higher again as traders are more worried about the lack of Sugar exports from India than they are about actual exports from Brazil. India has not cut exports yet but could easily do so in response to dry weather in Sugarcane growing areas. Reports of increased offers from Brazil are still around but other origins are still not offering and demand is still strong. Brazil production increasing on reports of very good harvest conditions and the weather in Southeast Asia is currently good for the next crop production prospects so relief could be coming soon. More Sugar is now available to the world market. India still has problems with current and future production potential. The current year export quota is already gone and the government has no plans to allow for additional exports at this time. Indian production is less this year and Pakistan also has reduced production and the monsoon has been uneven so far in both countries. Some areas have remained dry while others have seen too much rain. India announced a higher base price for Sugar paid to farmers to help promote additional planted area. Thailand production is also down a lot this year and many Asian countries are worried about El Nino impacting future production.

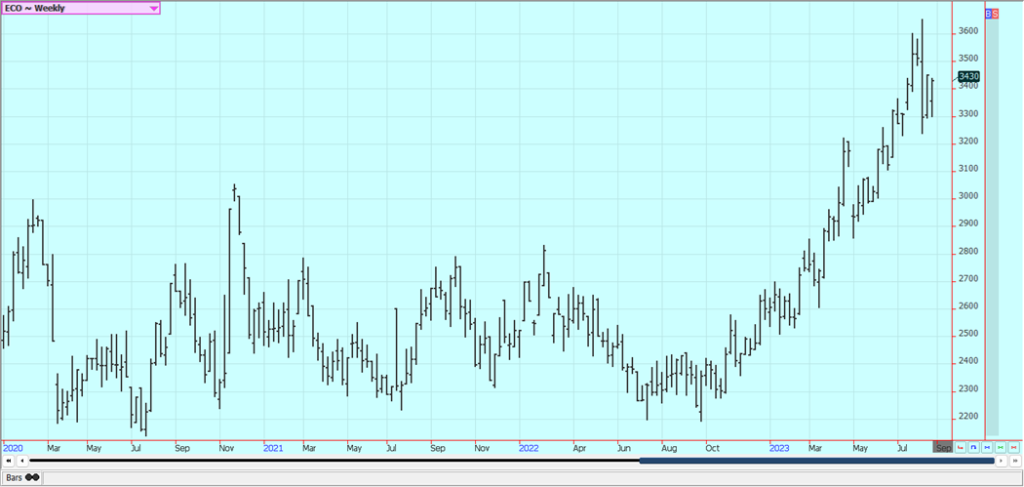

Weekly New York World Raw Sugar Futures

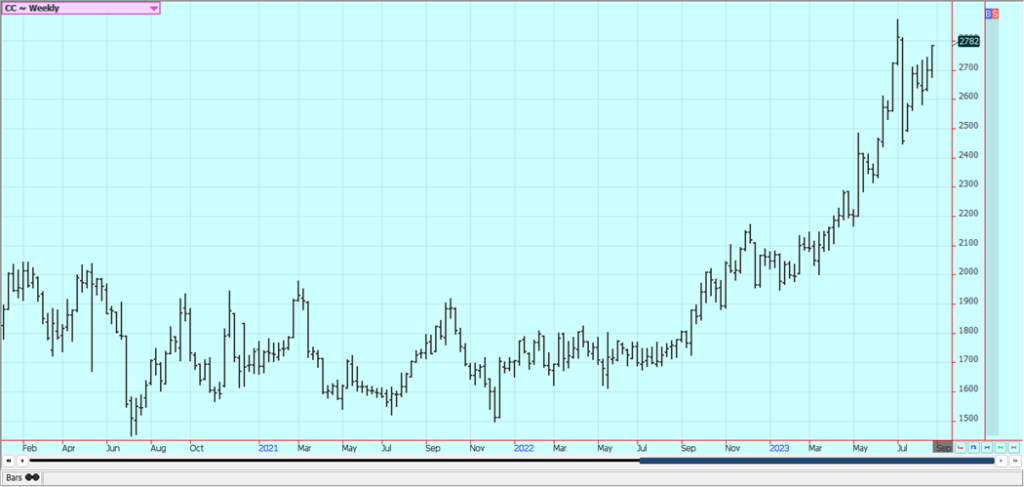

Weekly London White Sugar Futures

Cocoa: New York closed slightly lower as deliveries are getting underway for September contracts, but London closed a little higher and trends turned up again on the charts. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue, Talk is that hot and dry conditions reported earlier in Ivory Coast could curtail main crop production, and main crop production ideas are not strong. Midcrop production ideas are lower now with diseases reported in the trees due to too much rain that could also affect the main crop production.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by FRANK MERIÑO via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information. This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding1 week ago

Crowdfunding1 week agoSavwa Wins Global Design Awards and Launches Water-Saving Carafe on Kickstarter

-

Biotech2 weeks ago

Biotech2 weeks agoAsebio 2024: Driving Biotechnology as a Pillar of Spain and Europe’s Strategic Future

-

Business3 days ago

Business3 days agoDow Jones Nears New High as Historic Signals Flash Caution

-

Business2 weeks ago

Business2 weeks agoFed Holds Interest Rates Steady Amid Solid Economic Indicators