Markets

Global Sugar Market Sees Mixed Trends Amid Weather Shifts and Price Pressures

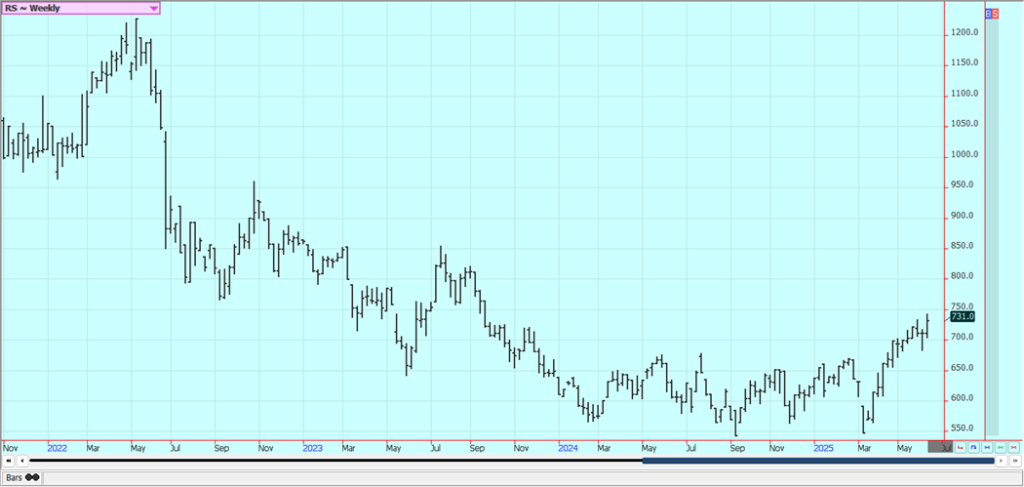

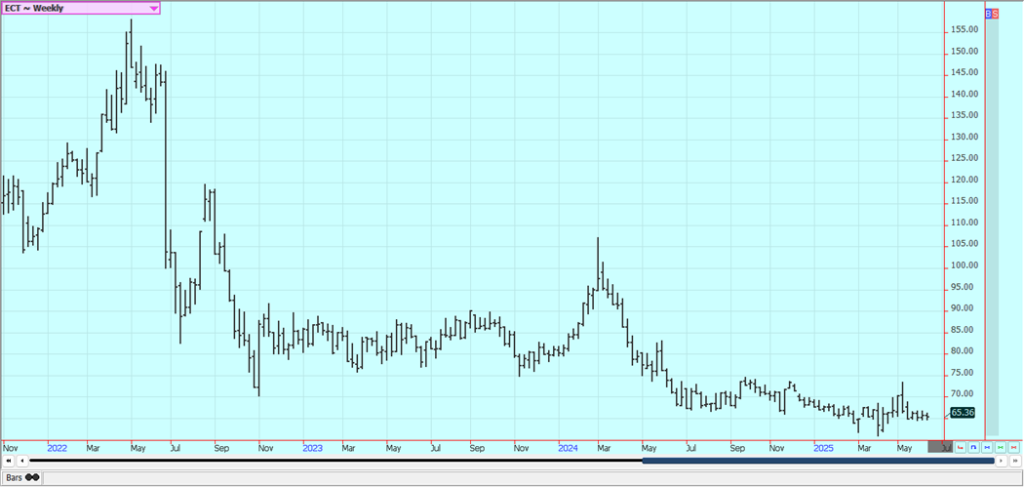

Sugar prices dipped in New York and held steady in London. China remained an active buyer. Drier weather in Brazil accelerated the cane harvest. India and Thailand reported strong sugar cane growth due to a robust Monsoon. Lower sugar prices in Brazil may prompt refiners to shift from sugar to ethanol production.

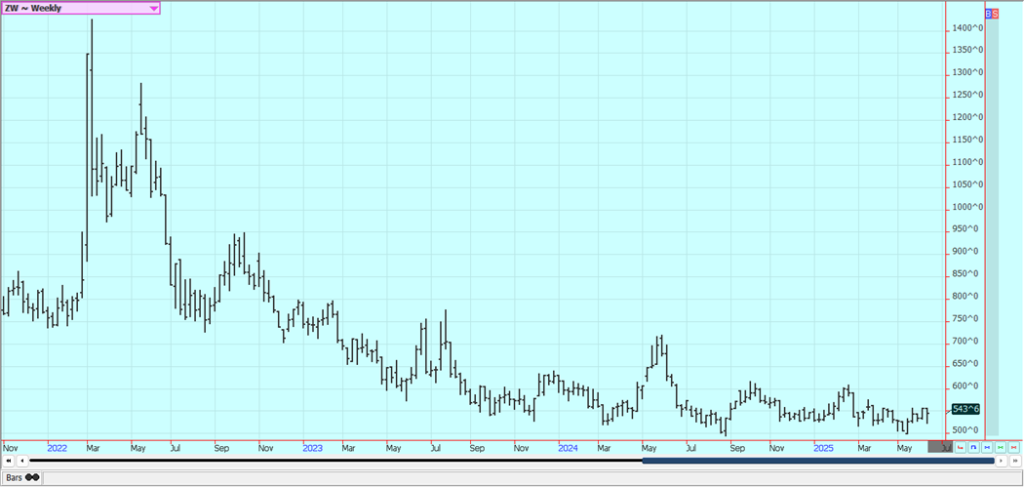

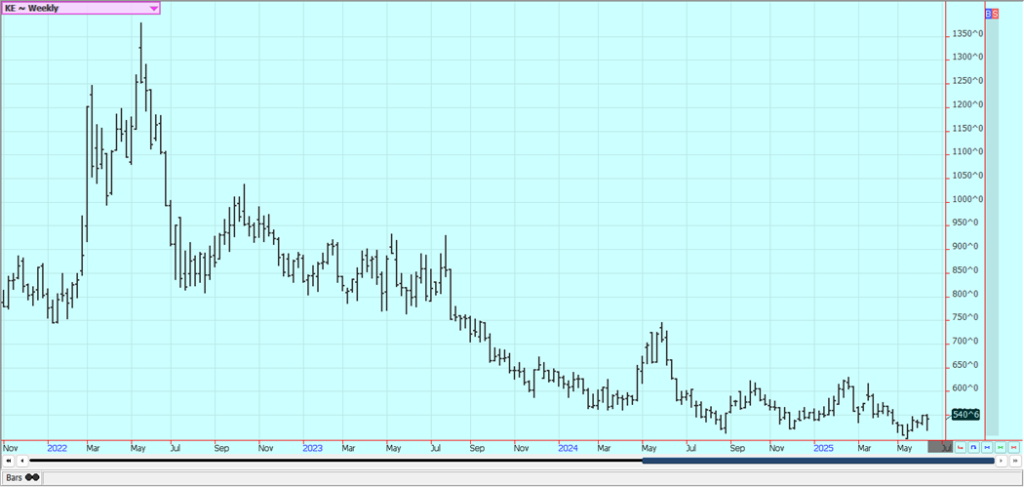

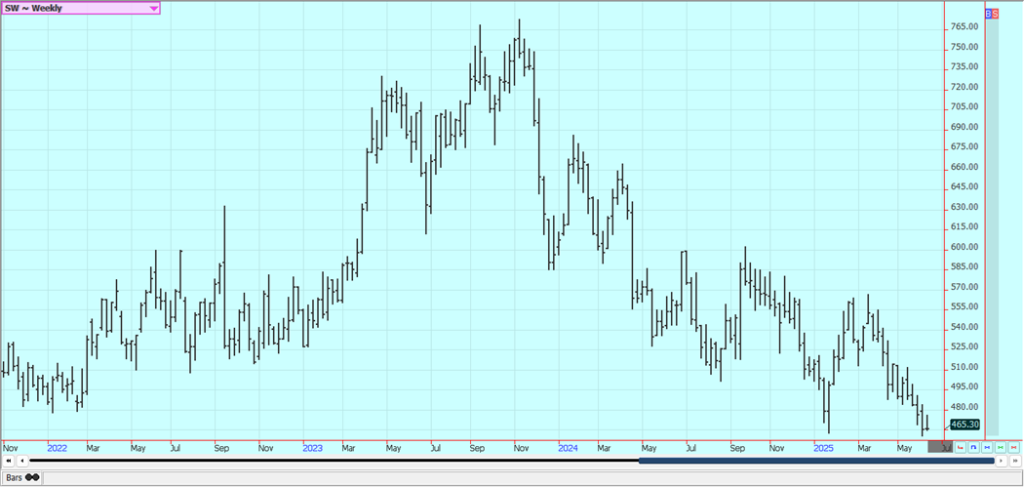

Wheat: All three Wheat markets closed lower last week as growing conditions at home and abroad have improved. USDA released its monthly supply and demand reports and made no real changes for the US data, but did cut ending stocks estimates in its world data. There are still reports that the weather has reduced production potential in Ukraine and Russia and reports of dry weather in some parts of the EU and China.

Russia is forecasting a large reduction in Wheat production for the coming year. Winter crops in the Great Plains are reported to be in good condition, but Spring Wheat crops in the northern Great Plains and into Canada have been dry. Some rain is in the forecast for the northern Great Plains this week and wetter and warmer conditions are now forecast for the southern Plains as well. It is too wet in the Delta and Southeast. Overall demand for world Wheat has been weak.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Kansas City Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

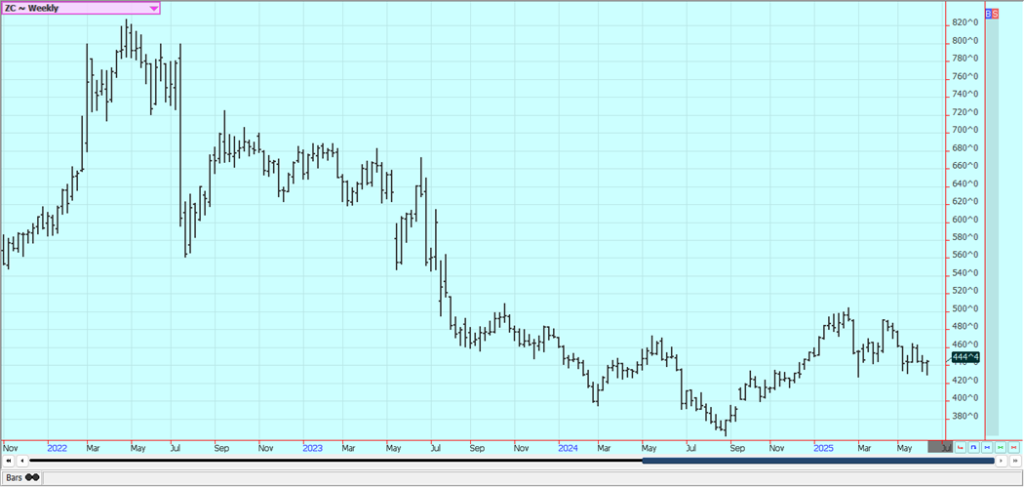

Corn: Corn was a little higher last week after trading lower earlier in the week on ideas of better demand and despite forecasts for good weather. July gained slightly on December on the spreads but remained near even money. EPA on Friday released its proposed renewable fuels blending requirements that were considered supportive for Corn. EPA wants increased use of biofuels, and the government wants the new demand filled by US farmers. USDA left its US production ideas unchanged but increased export demand and cut ending stocks as anticipated by many traders. World ending stocks ideas were also trimmed by USDA.

Forecasts for improved growing conditions in the Midwest through this weekend were a reason to sell. Warmer and drier weather is in the forecast for this week, but temperatures should turn a little cooler over the weekend. Warm weather returns in the forecasts for next week. A severe drought is seen in central Nebraska and moderate drought extends east in a corridor into the Chicago area. Most of the Midwest has seen adequate or greater precipitation and it is still too wet in the eastern and southern parts. Demand for Corn in world markets remains strong. Oats were higher.

Weekly Corn Futures

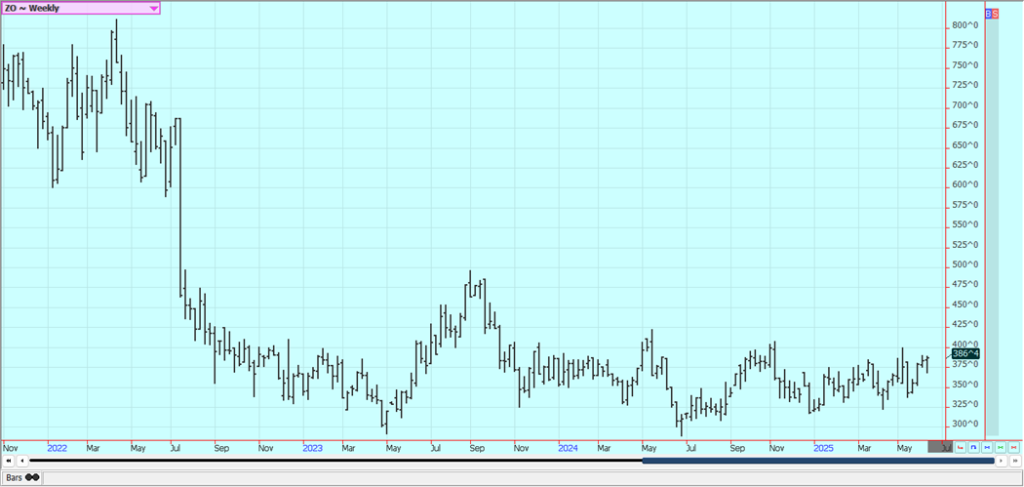

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans were higher and Soybean Oil was limit up on Friday, but Soybean Meal was a little lower after the release of the new EPA biofuels blending requirements were released. The proposals increase the demand for Corn and Soybeans for blending requirements, although not as much as the industry wanted. Even so, it was a win for US agriculture and caught the market by surprise as the president has been against clean energy in the past. USDA made no significant changes to the US supply and demand estimates b ut increased ending stocks estimates for the world despite unchanged Brazil and Argentine production ideas.

China and the US announced a couple of days ago that they had made a trade agreement that will allow Chinese students to attend US universities in exchange for rare earth metals. No mention of agriculture was made. Forecasts for good growing conditions in the Midwest and as cheaper prices reported from Brazil are still being heard. The market could remain under pressure as Brazil basis levels have been under pressure the last few weeks and prices in world markets for Brazil Soybeans are now less than those from the US.

Export demand is in its seasonal doldrums. Export demand remains less for US Soybeans as China has been taking almost all the export from South America. Warmer temperatures and drier conditions are expected this week after a cold and wet week last week. A severe drought is seen in central Nebraska and moderate drought extends east in a corridor into the Chicago area. Most of the Midwest has seen adequate or greater precipitation and it is still too wet in southern and eastern areas.

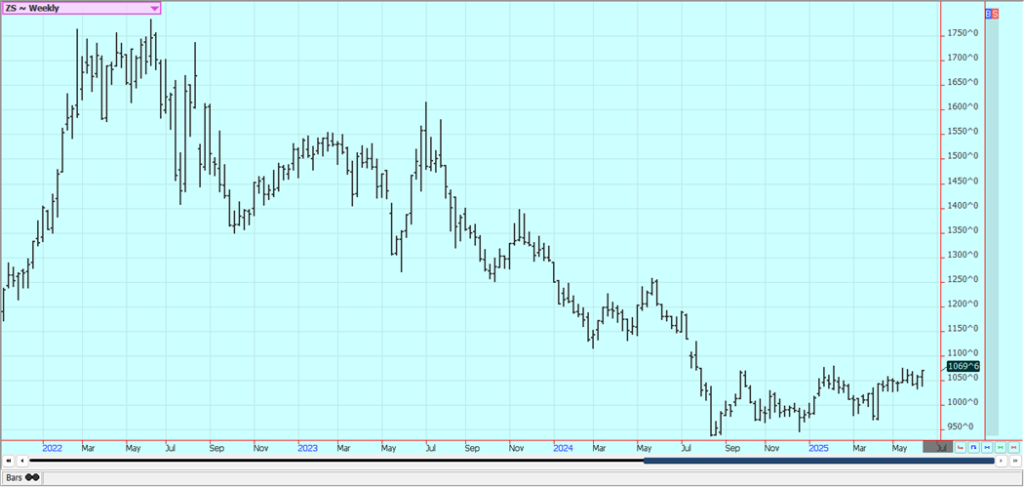

Weekly Chicago Soybeans Futures

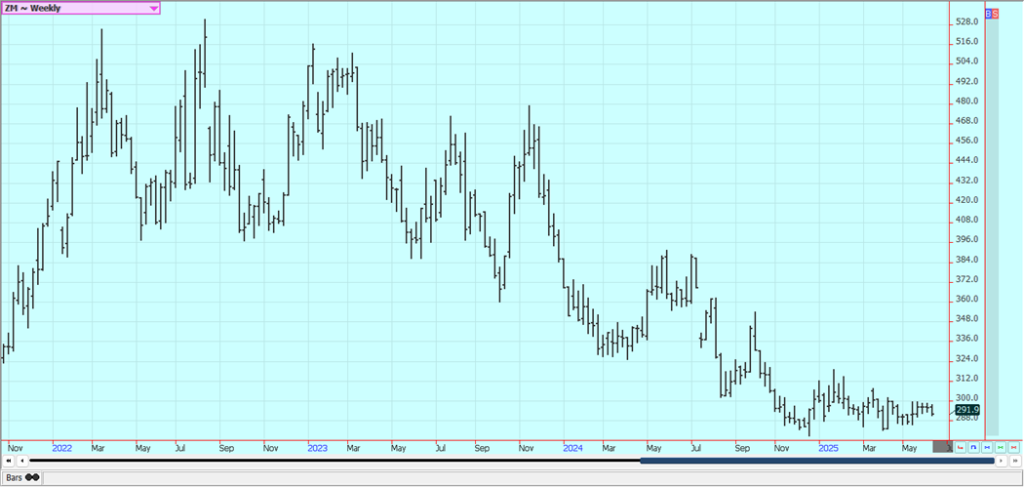

Weekly Chicago Soybean Meal Futures

Rice: Rice was a little higher last week in part in response to the USDA supply and demand reports. USDA cut production by reducing planted area and yields due to the wet weather seen in the Delta. Demand was also cut back but not as much as supply so ending stocks were a little lower. World data showed the potential for higher ending stocks. Chart trends are up on the daily charts.

There is still a lot of speculative buying seen in the market that is thought to be mostly short covering, but commercial buying has been very strong as well. The cash market has been slow with mostly quiet domestic markets and average export demand. Milling quality of the Rice remains below industry standards and it takes more Rough Rice to create the grain for sale to stores and exporters. Rice has emerged in most growing areas now. Condition has been rated as good but too much rain has been reported in southern areas.

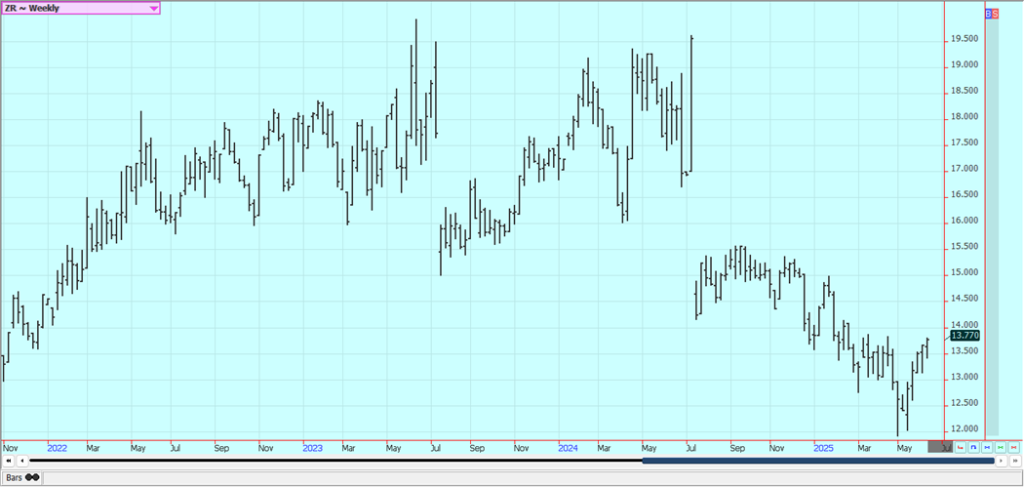

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil futures were higher last week with the price action in Chicago and hopes for improved Indian demand. Ideas that current increased production levels mean higher inventories in MPOB monthly data are still around. Ideas of increasing production and reduced demand are also heard. Canola was higher. Trends are up on the daily charts and are turning up on the weekly charts. The weather has generally been dry for planting and crop development in the Prairies with warm and dry weather around lately.

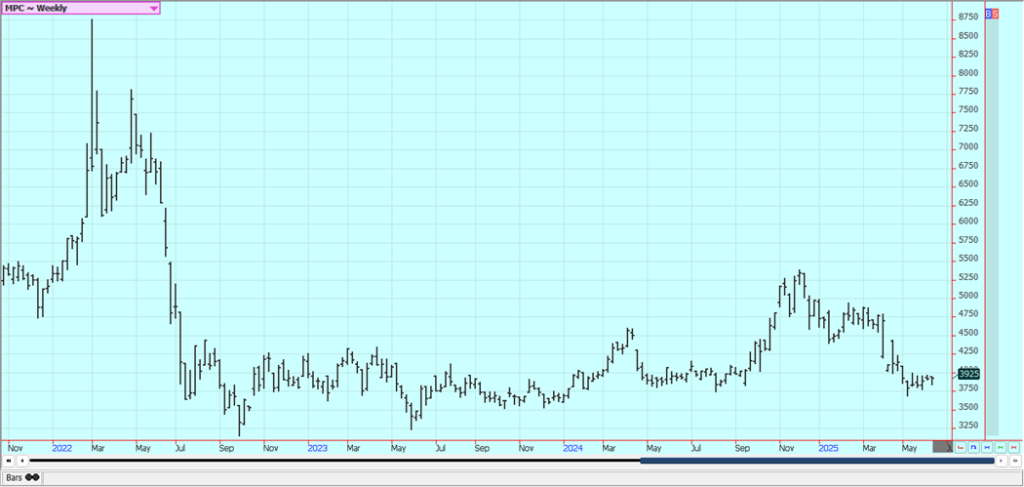

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was a little lower last week. USDA cut significantly the production potential for the crop still being planted and this filtered down to the ending stocks estimates. It also cut production estimates for South Asia. The market recovered the biggest losses of the day but still closed lower on the news. China and the US reached a trade agreement a couple of days ago that gives the US more rare earth metals in exchange for Chinese students being allowed to study in the US again No mention was made of agriculture and agricultural trade between the countries.

There are still reports of better weather for planting in Texas and on demand concerns caused by the tariff wars and after USDA reported moderate to poor weekly export sales. However, Gap stores reported strong earnings and said it would greatly increase its use of US Cotton in its clothing. Planting conditions remain good in Texas, but it is still too wet in the Delta and Southeast. Planting progress is still a little behind the five year average and condition is rated behind last year. The monsoon in India is off to a good start and a good production there is possible. The Monsoon is paused right now but has featured early and above average rains so far.

Weekly US Cotton Futures

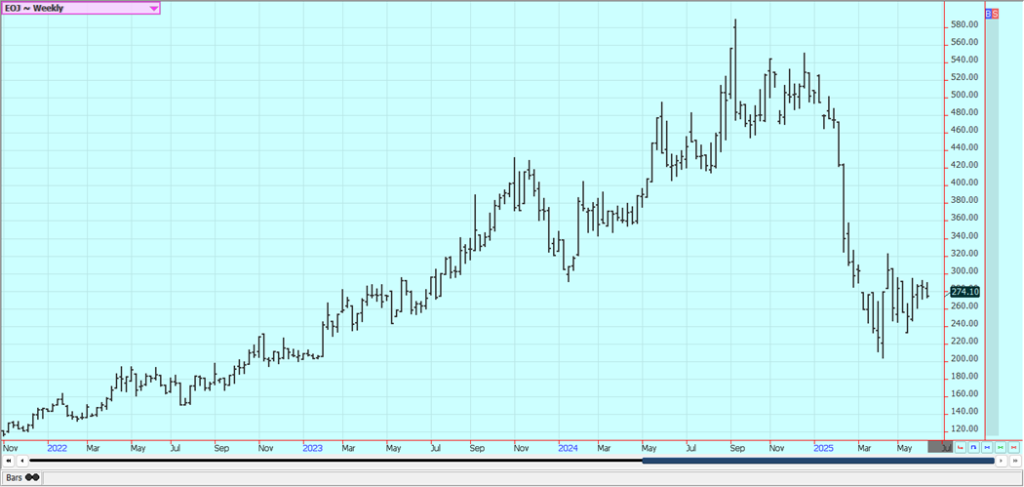

Frozen Concentrated Orange Juice and Citrus: Futures were lower in narrow range trading last week and trends are still mixed in the market. Trading has been choppy this week. Production estimates from USDA and private sources remain well below those from a year ago. USDA estimated Florida production up slightly from the previous estimate at 12.0 million boxes, but that is still down 34% from last year.

All US production was also a little higher from the previous report, but still down 37% for the year. The futures market caress much more about Florida conditions. The poor production potential for the crops comes from weather but also the greening disease that has caused many Florida producers to lose trees. A tight market and higher prices should remain a feature for futures traders.

Weekly FCOJ Futures

Coffee: New York and London closed lower last week on an uptick in supply available to the market. Prices have now been dropping for several weeks and are much more moderate than before as supplies available to the market have ticked up. The Brazil Robusta harvest continues, and Indonesia continues to harvest. Vietnam is done with its harvest. The Brazil Arabica harvest is starting and is expected to be less this year, although maybe not as bad a originally feared.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

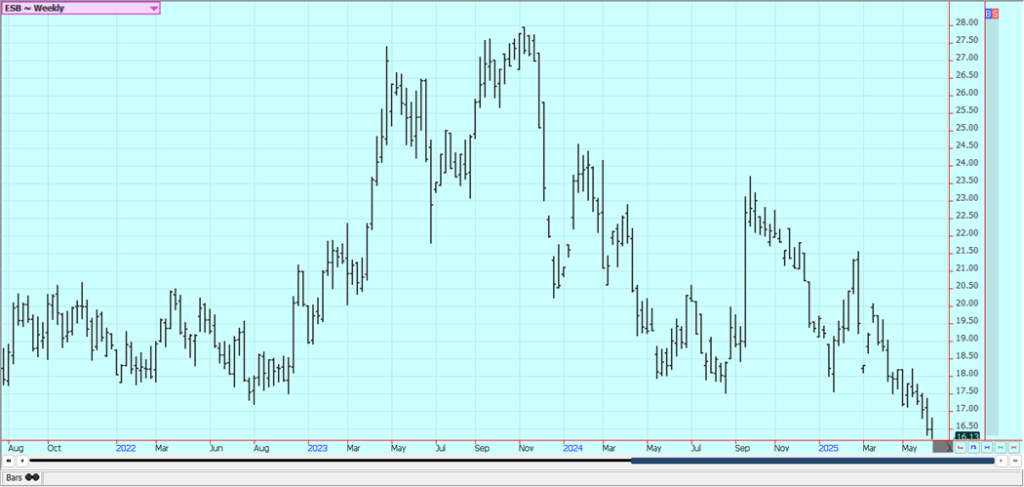

Sugar: New York was lower last week and London closed about unchanged. Ideas of good supplies for the sugar market continue to be heard. China has been a sugar buyer. There were reports of drier weather in center south Brazil and the sugar cane harvest is faster now amid drier conditions.

Good growing sugar cane conditions are reported in India and Thailand after a fast start to the Monsoon season. The Monsoon has featured above average rains. Sugar prices in Brazil are now cheap enough that at least some refiners could increase ethanol production and cut back on Sugar production.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

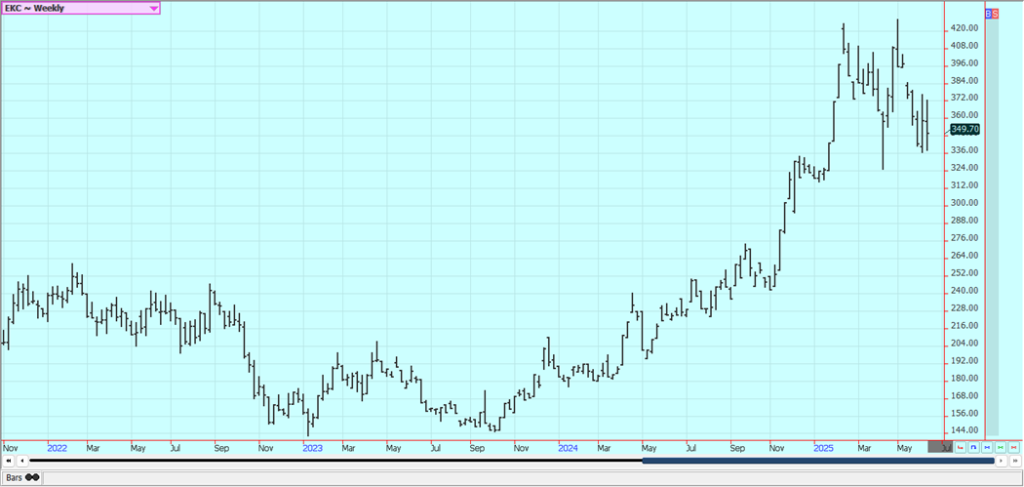

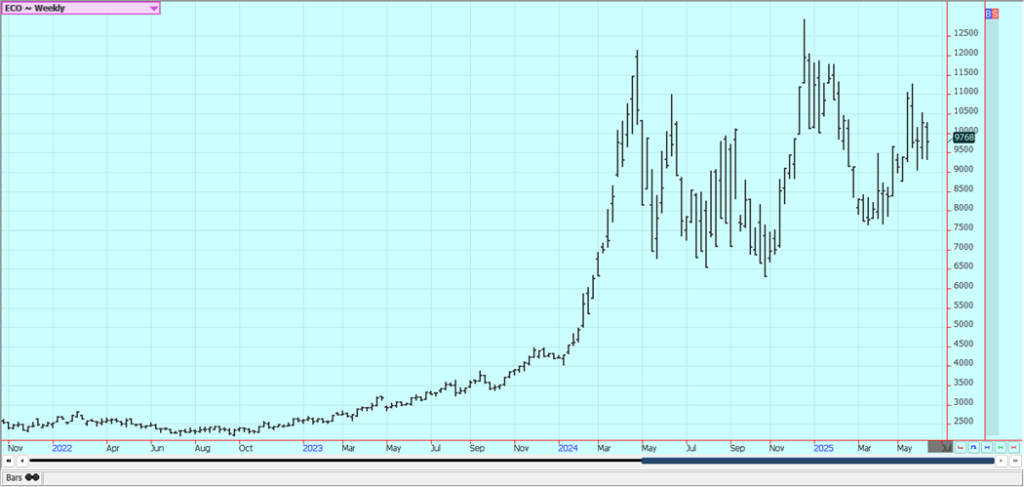

Cocoa: Both markets were lower last week in speculative trading. There are still reports of increased flows of Cocoa from Nigeria and reports of increased production potential in other countries outside of West Africa, including Asia and Central America. The market anticipates good demand and less produc-tion from Ivory Coast and Ghana. Early pod counts for the 2025/26 main crop suggested there is unlike-ly to be a significant recovery in production next season, and current weather is dry for the crops. Trends are turning down again in London and in New York.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Daniel Kraus via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEU Backs 90% Emissions Cut by 2040 and Delays ETS2 Rollout

-

Markets6 days ago

Markets6 days agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Biotech2 weeks ago

Biotech2 weeks agoDNA Origami Breakthrough in HIV Vaccine Research

-

Cannabis3 days ago

Cannabis3 days agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns