Markets

Why Both Sugar Markets Closed Lower Last Week

Trends are mixed on the daily sugar charts. End users need Sugar but are not finding too much available in the cash market. There are still ideas that the Brazil sugar harvest can be strong for the next few weeks amid dry harvest weather, but now the cry weather is causing concern about developing Sugarcane in center south areas. Harvest weather is called good in center-south Brazil.

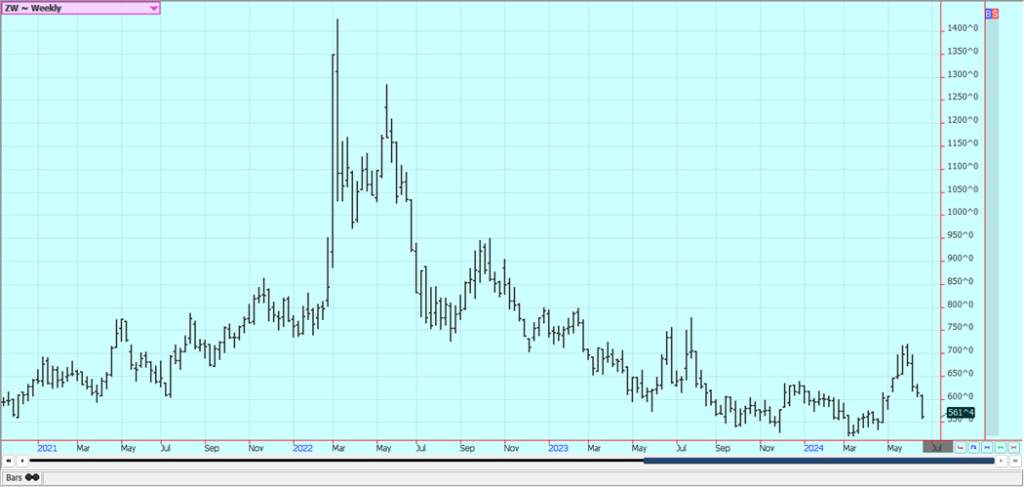

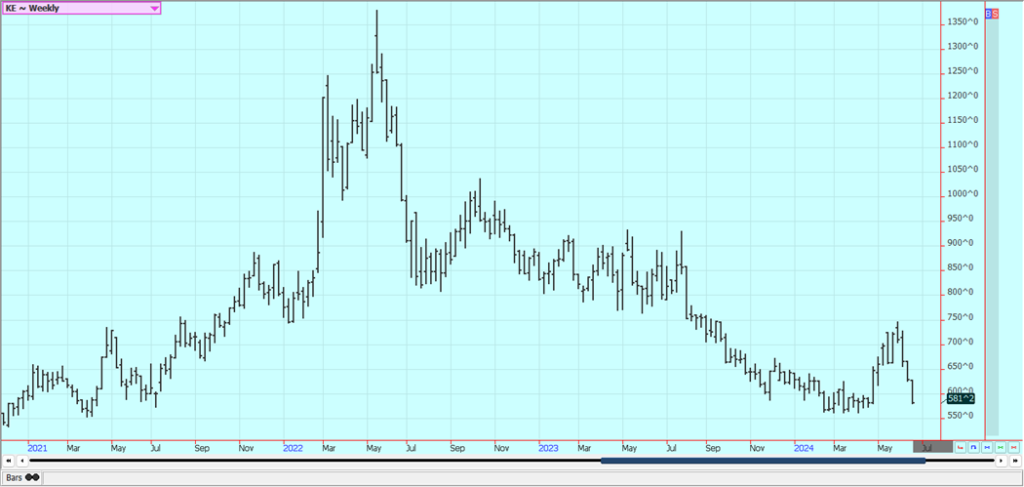

Wheat: Wheat was lower in all three markets last week on reports of cheaper prices offered from Russia and as the US harvest expands and even as adverse world growing conditions are still around. There are more reports of hot temperatures coming this week to Russian growing areas. It has also been very dry there. The weather is still a key, with extreme dryness reported in Russia and parts of the US and too wet conditions reported in Europe. However, US producers are reporting strong yields that exceed expectations so far and very good conditions. Big world supplies and low world prices are still around.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

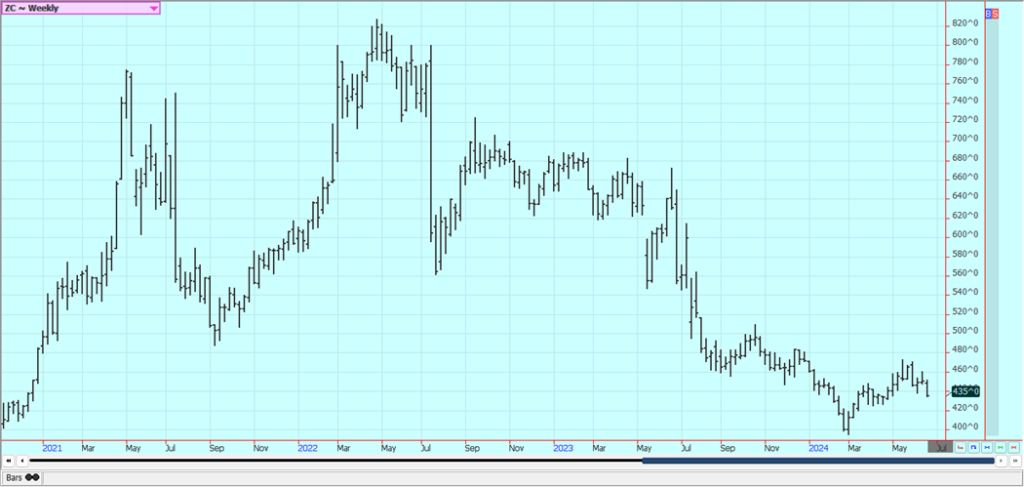

Corn: Corn closed lower last week on US weather that remains hot and mostly dry now, but should turn cooler next week. The US Midwest is still seeing good growing conditions although it has turned hot and dry now. The heat is expected to partially end next week but dry weather remains a concern.

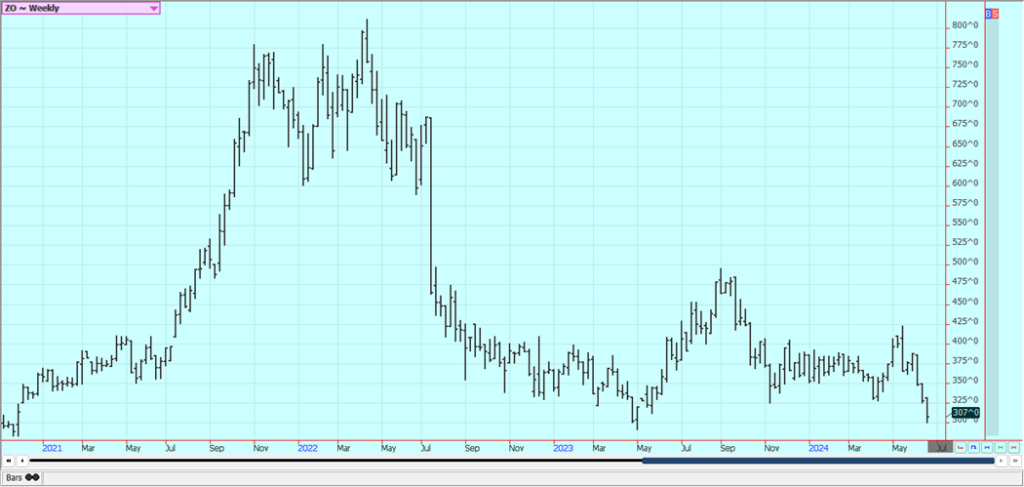

The market anticipated that crop condition ratings would be very high in the USDA reports last week and will anticipate high crop ratings this week. Oats were lower on good growing conditions found in the northern US and into Canada. Demand has been a force behind the rally. Increased demand was noted in most domestic categories along with rising basis levels, and export demand has been strong.

Weekly Corn Futures

Weekly Oats Futures

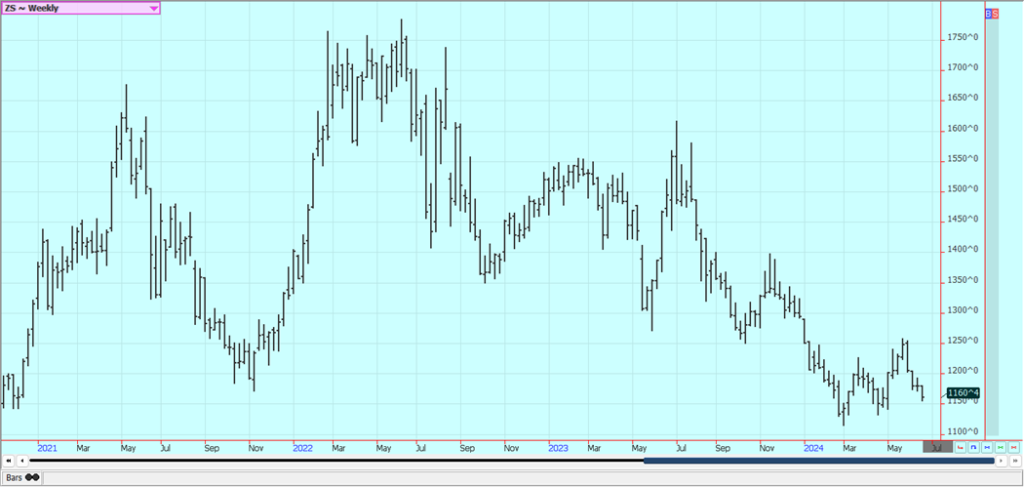

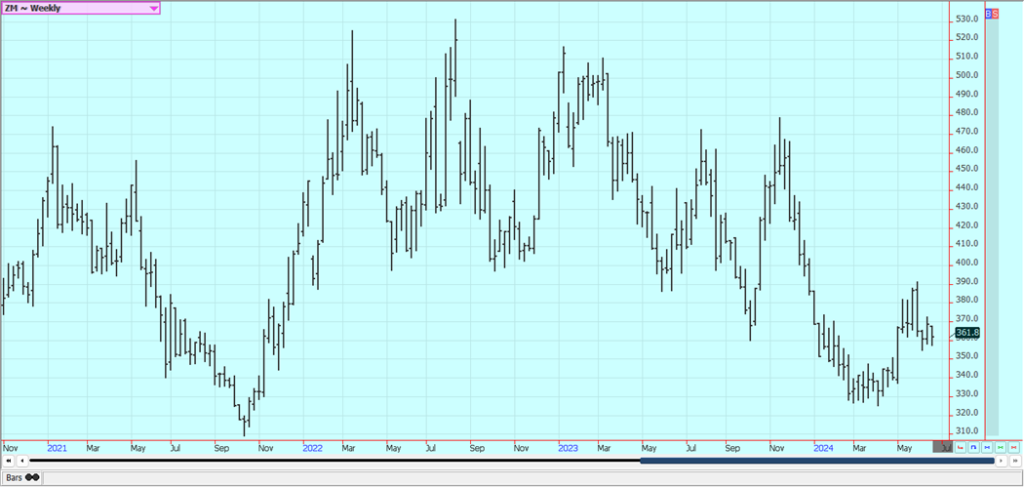

Soybeans and Soybean Meal: Soybeans and Soybean Meal closed lower last week on good but deteriorating growing conditions in the US and on forecasts for less heat in the Midwest this week. Precipitation chances are uncertain but the heat is expected to be less. There were wire reports that China prices are weakening amid veery strong imports from Brazil and from the US.

US exports are more than 150% higher than a year ago due to logistical and production problems this year in Brazil. Reports indicate that China remains an active buyer of Soybeans in Brazil but has cut back on demand if the domestic market does not improve and on ye tax issues in Brazil. Some of that demand has moved to the US. China said that it has increased exports of Soybean Meal due to the weaker internal demand. Domestic demand has been strong in the US but has suffered as crushers were crushing for oil. Oil demand has suffered as cheaper alternatives for feedstocks hit the biofuels market.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

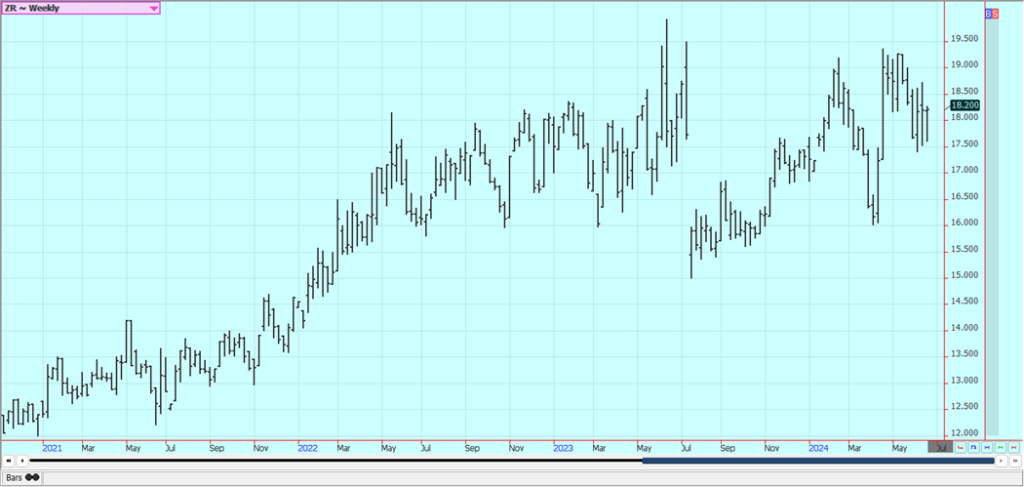

Rice: Rice closed near unchanged last week. The big US crops are now in doubt from reports of extreme rains in southern growing areas and especially near Houston. Supply tightness is expected to give way to increased production this year and greatly increased supplies this Fall. These ideas are reflected in the prices seen in the old crop and the new crop. Big storms have brought significant rains to crops in Texas, but the weather is better now.

Weekly Chicago Rice Futures

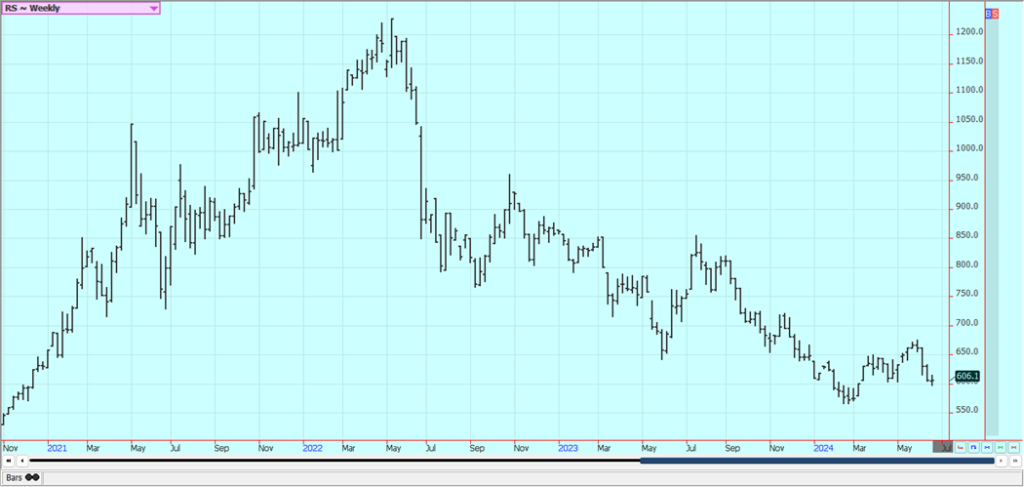

Palm Oil and Vegetable Oils: Palm Oil was a little lower last week in range trading. Export demand has been very strong in recent private reports. There is talk of increased supplies available to the market, but the trends are up on the daily and weekly charts. Canola was a little higher last week despite reports of generally good conditions in Canada and as the Canadian Dollar rallied. The Brazil news was bearish as well.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was a little lower last week as growing conditions are good and demand is not. A stronger US Dollar on Friday kept Cotton in a negative mode. Big storms were reported in southern Texas last week that could damage crops. There are also some big problems with too much rain in the Delta and Southeast in recent weeks. Demand has been weaker so far this year but there are hopes for improved demand with the lower prices. Chinese consumer demand has held together well, and Chinese demand for Cotton has started to increase.

Weekly US Cotton Futures

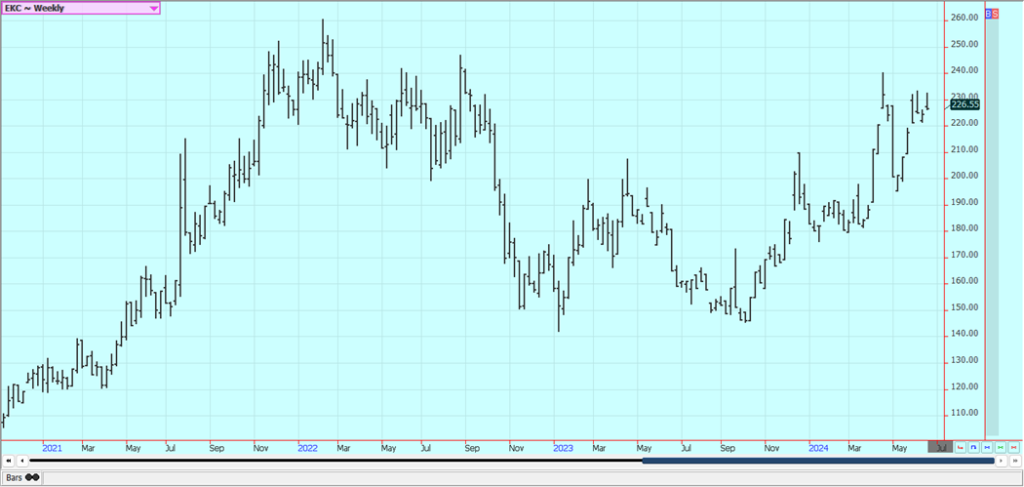

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher in range trading last week. The daily charts show that the market is trying to form a bottom. The market remains well supported in the longer term based on forecasts for tight supplies and very hot weather in Florida. The reduced production appears to be at the expense of the greening disease.

There are no weather concerns to speak of for Florida or for Brazil right now. The weather has improved in Brazil with some moderation in temperatures and increased rainfall amid reports of short supplies in Florida and Brazil are around but will start to disappear as the weather improves and the new crop gets harvested.

Weekly FCOJ Futures

Coffee: New York and London closed lower on Friday but were higher for the week on the strength in the US Dollar but reports of short supplies that could be made worse by ideas of reduced offers of Robusta are still in the market and forecasts for another couple of weeks of dry weather in Vietnam are still heard. There were also reports of poor Robusta yields in Brazil during the harvest. Ideas of less production in Vietnam are driving the rally. There were indications that Brazil and Vietnam producers were now offering Coffee, buts in small amounts,

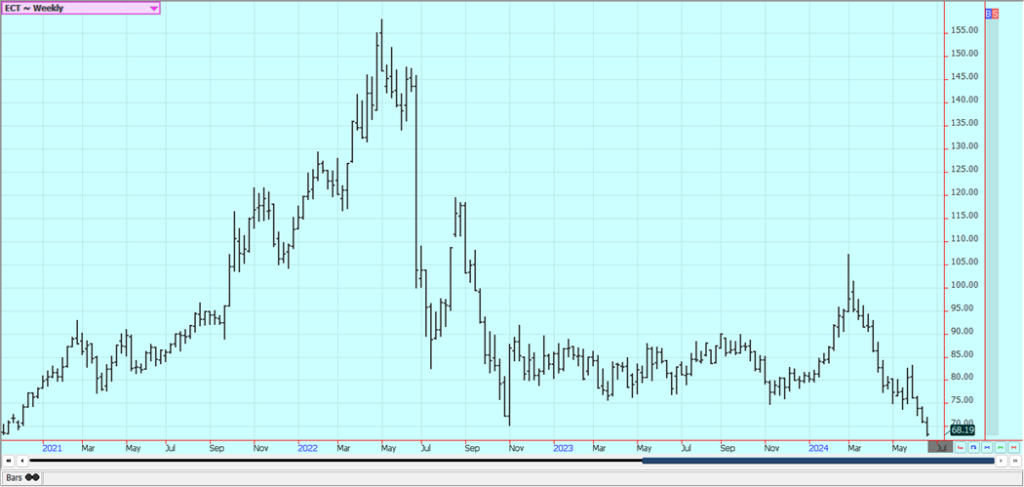

Weekly New York Arabica Coffee Futures

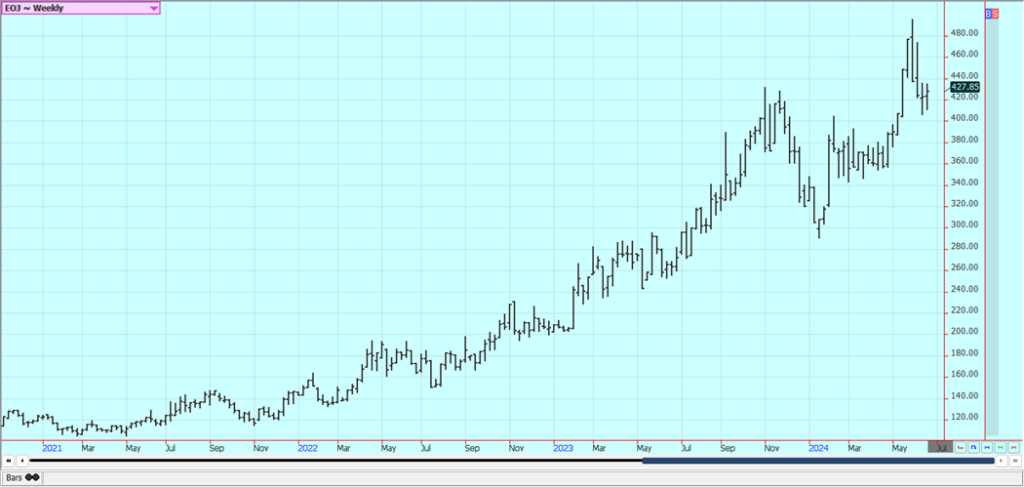

Weekly London Robusta Coffee Futures

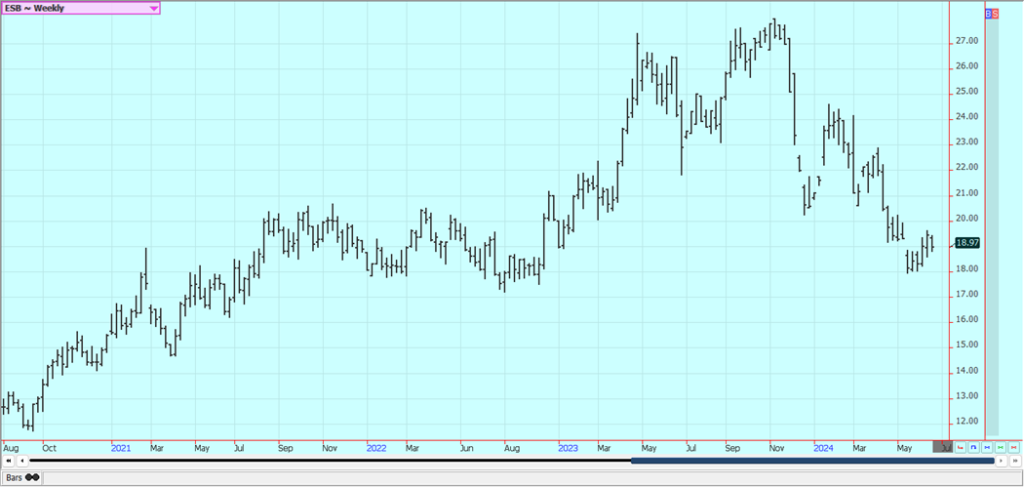

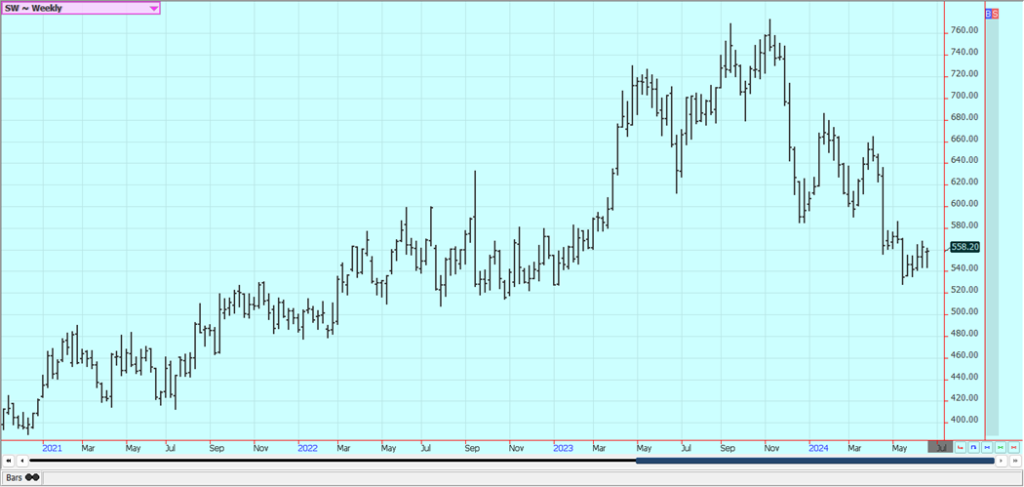

Sugar: Both sugar markets closed lower last week as harvest progress in Brazil was the important fundamental. Trends are mixed on the daily sugar charts. End users need Sugar but are not finding too much available in the cash market.

There are still ideas that the Brazil sugar harvest can be strong for the next few weeks amid dry harvest weather, but now the cry weather is causing concern about developing Sugarcane in center south areas. Harvest weather is called good in center-south Brazil. There are worries about the Thai and Indian sugar production, but data shows better than expected production from both countries.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

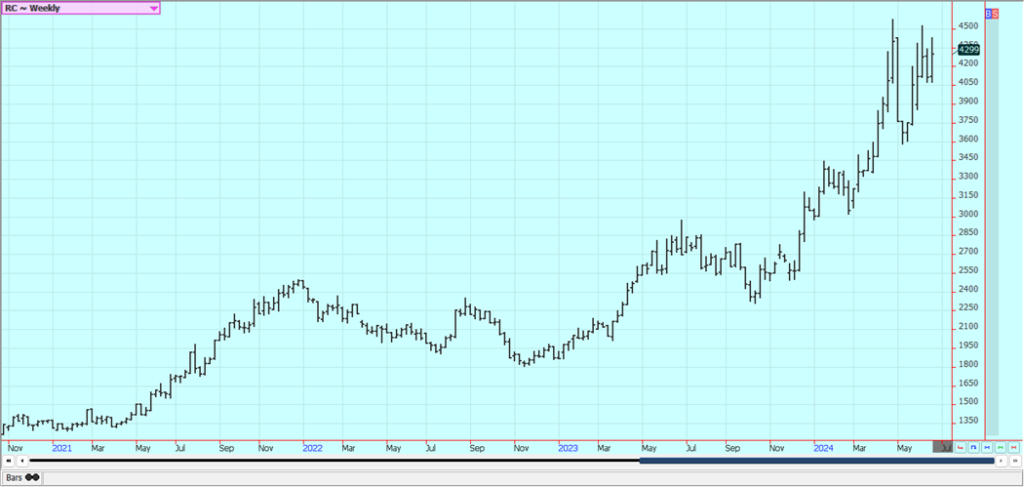

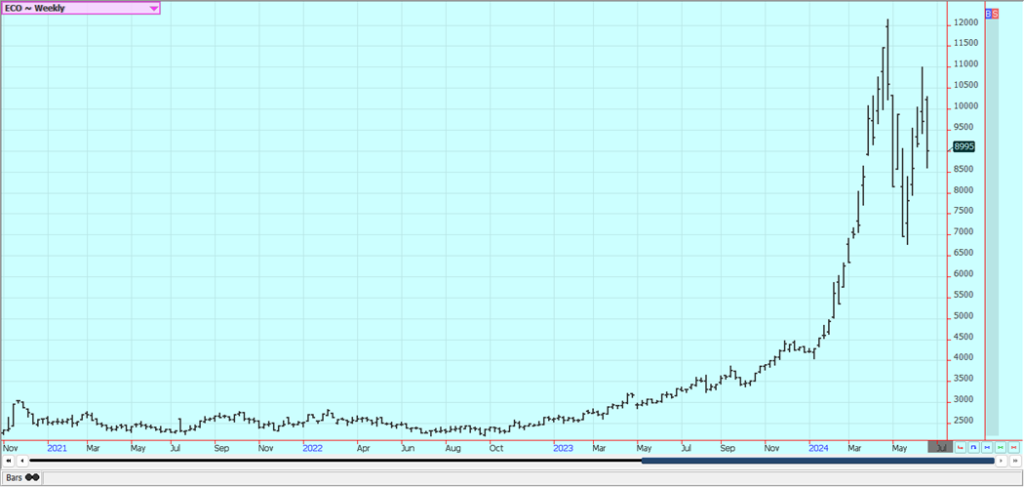

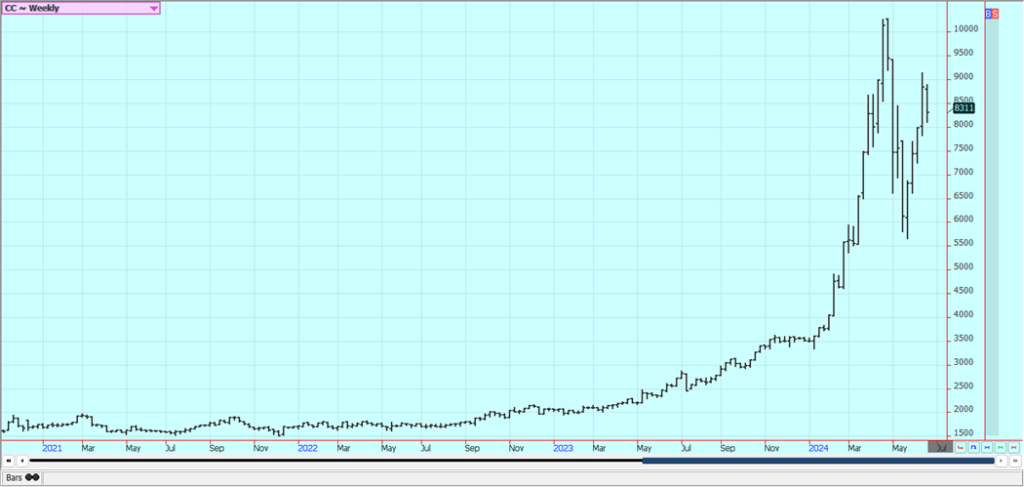

Cocoa: Both markets were lower last week and weekly chart trends are turning down. Production con-cerns in West Africa as well as demand from nontraditional sources along with traditional buyers keep supporting futures. Production in West Africa could be reduced this year due to the extreme weather which included Harmattan conditions. The availability of Cocoa from West Africa remains very restrict-ed and projections for another production deficit against demand for the coming year are increasing. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana con-tinue.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Jason via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Impact Investing5 days ago

Impact Investing5 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech2 weeks ago

Biotech2 weeks agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business3 days ago

Business3 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech1 week ago

Fintech1 week agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich