Markets

Why Sugar Markets Closed Lower This Past Week

Last week, New York and London markets closed lower with downward chart trends. Expectations of a strong Brazil harvest persist. Indian production estimates are increasing but remain lower than previous years. Concerns linger over Thai and Indian production. Brazil offers remain active, while other origins, except Ukraine, show limited activity due to the war. European demand reports are robust.

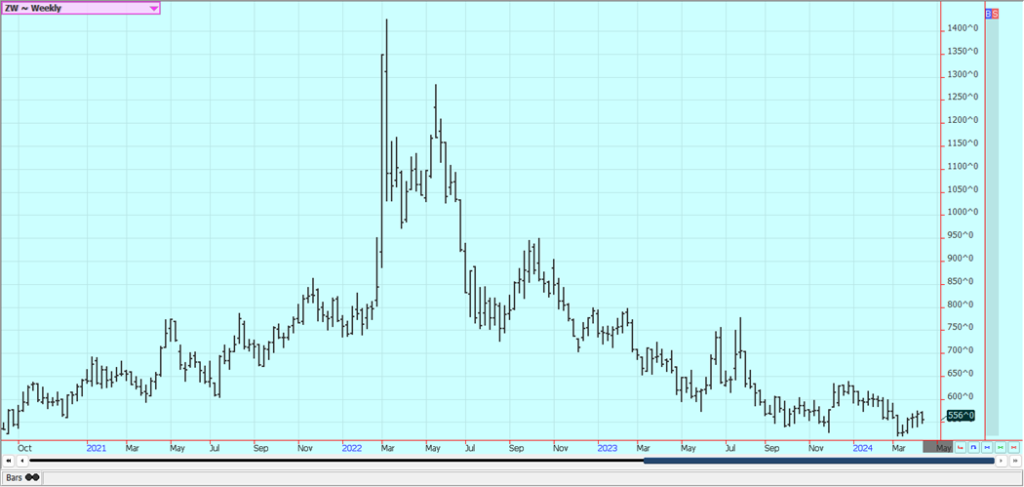

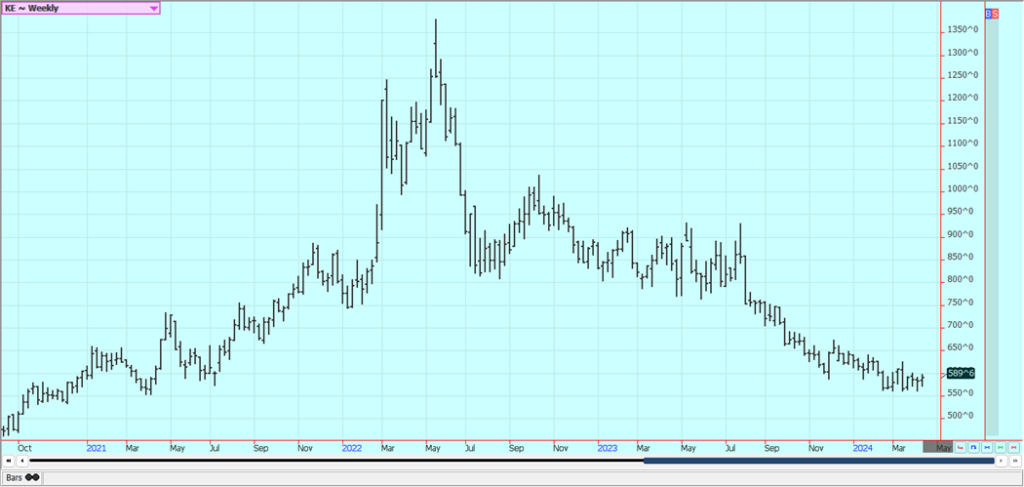

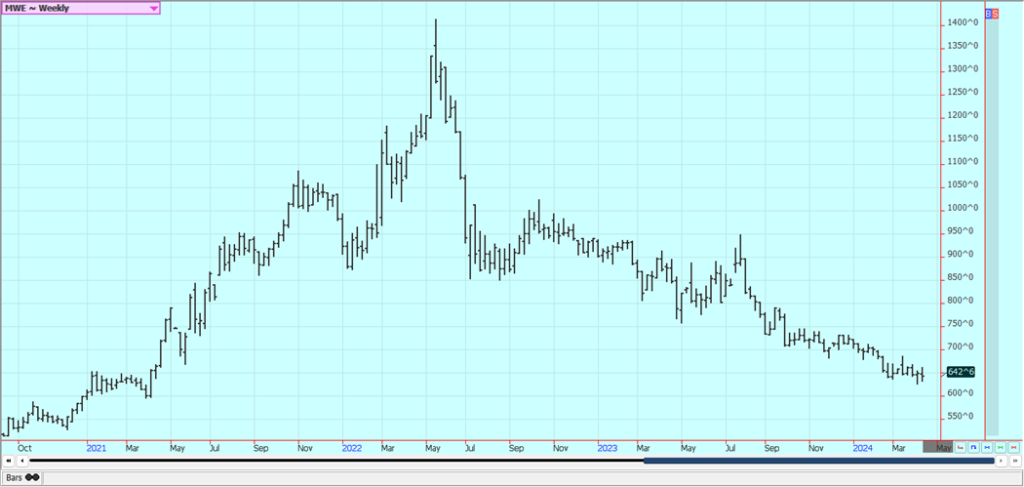

Wheat: Wheat was a little higher last week in response to the supply and demand reports that showed higher than expected ending stocks estimates from USDA and additional fighting between Russia and Ukraine. Trends remain mixed in all three markets. The problems with Russian Wheat exporters continue.

The reports indicate that the government is seeking more control of the exports and has made life very difficult on the private exporters in an effort to extract more sales and powers to the government. Russia is the world’s largest exporter and sets the world price and prices remain low. Big world supplies and low world prices are still around. Export sales remain weak on competition from Russia, Ukraine, and the EU as those countries look to export a lot of Wheat in the coming period. Black Sea offers are still plentiful, but Russia has been bombing Ukraine again and shipments might be hurt from that origin.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

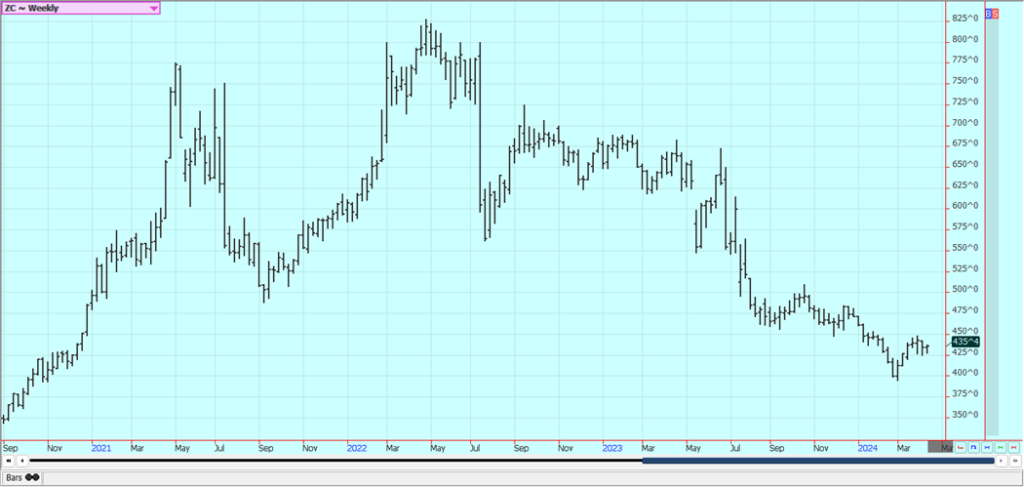

Corn: Corn closed slightly higher and Oats closed higher last week as traders think that good Spring weather here will greatly increase planted Corn area. The USDA supply and demand reports showed reductions in Corn ending stocks in line with trade expectations but still over 20 billion bushels. Increased demand was noted in all domestic categories, but export demand was left unchanged.

South American production estimates were little changed. It is very expensive to plant Corn and Corn is considered unprofitable to plant right now, so planted are might not increase that much if at all. USDA issued its crop progress report for Corn and Corn planting is proceeding slowly. Demand for Corn has been strong at lower prices. Big supplies and reports of limited demand are still around, but futures have been very oversold. Funds remain very large shorts in the market.

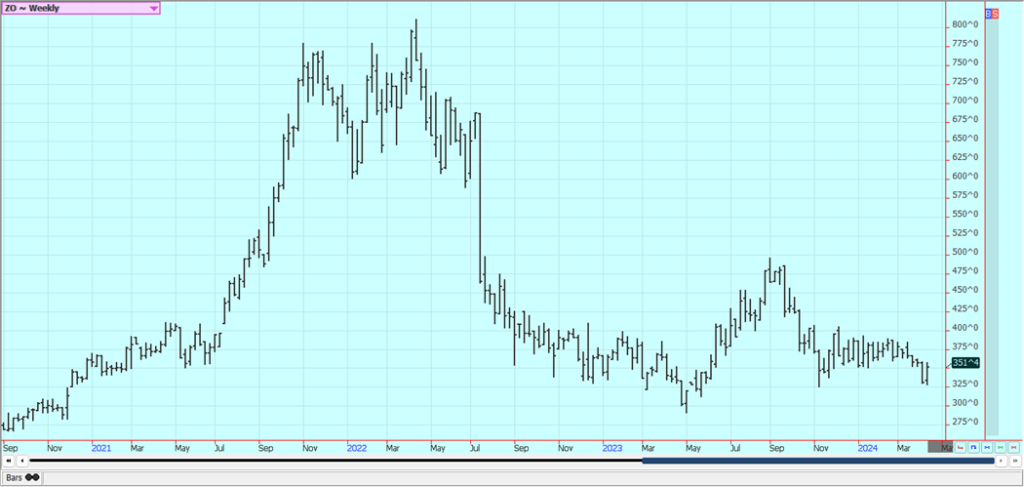

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and Soybean Oil closed lower and Soybean Meal closed higher last week in response to the USDA supply and demand estimates that showed a greater increase in US ending stocks than the market had anticipated. South American production estimates were little changed.

Brazil producers had been taking advantage on higher futures in the US and higher basis levels in Brazil, but the basis has fallen sharply in Brazil this week and sales have been less. Reports of great export demand in Brazil provide some support. Reports indicate that China has been a very active buyer of Brazil Soybeans this season. Ideas that South American production is taking demand from the US have pressured futures lower. Funds remain large shorts in the market. The US reports strong domestic demand.

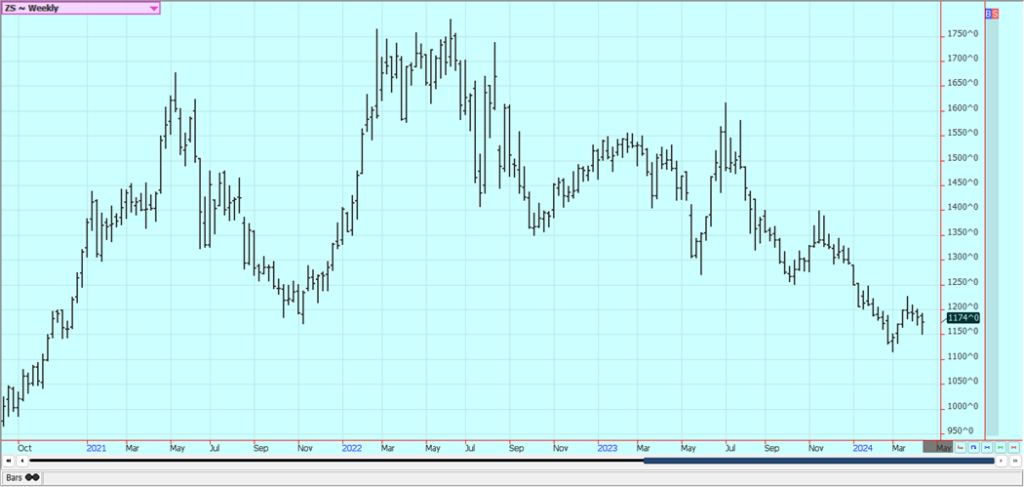

Weekly Chicago Soybeans Futures

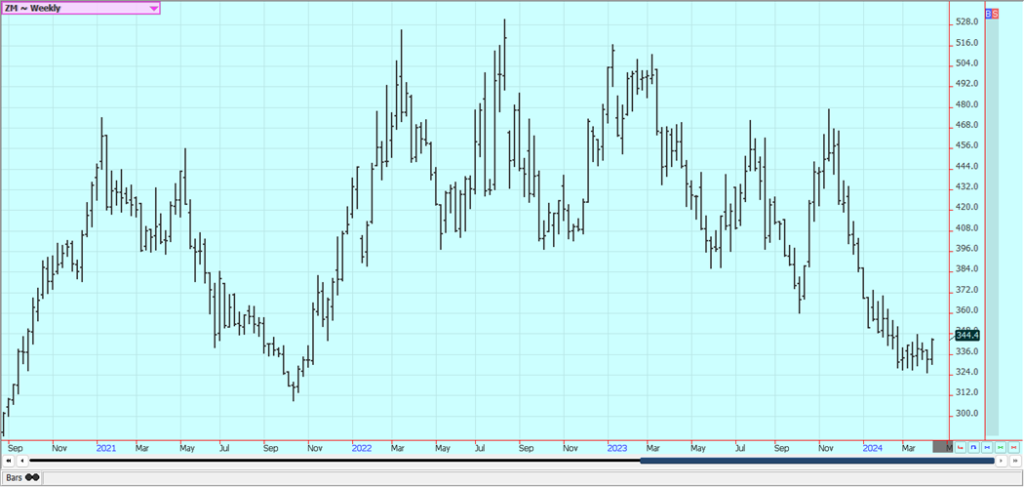

Weekly Chicago Soybean Meal Futures

Rice: Rice closed higher as tzhe long liquidation by the funds is now complete. Futures were a little weaker at points during the week in reaction to the USDA supply and demand reports, but the rebound from the fund selling was more important. USDA cut domestic demand a lot but increased export demand for increased ending stocks levels. USDA also increased world ending stocks estimates for the year. Trends are up in this market on the daily charts. The market noted good planting and emergence progress in the weekly USDA reports released on Monday afternoon. Good demand for exports continues.

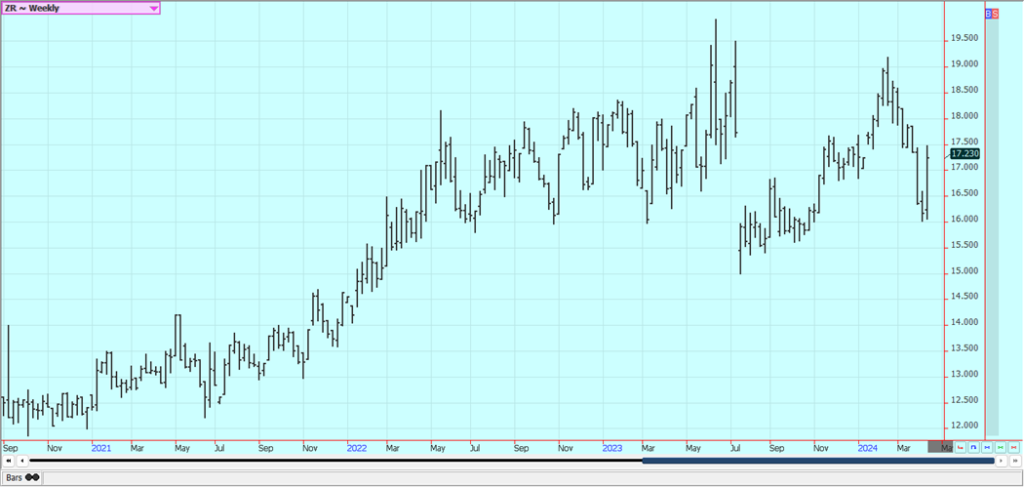

Weekly Chicago Rice Futures

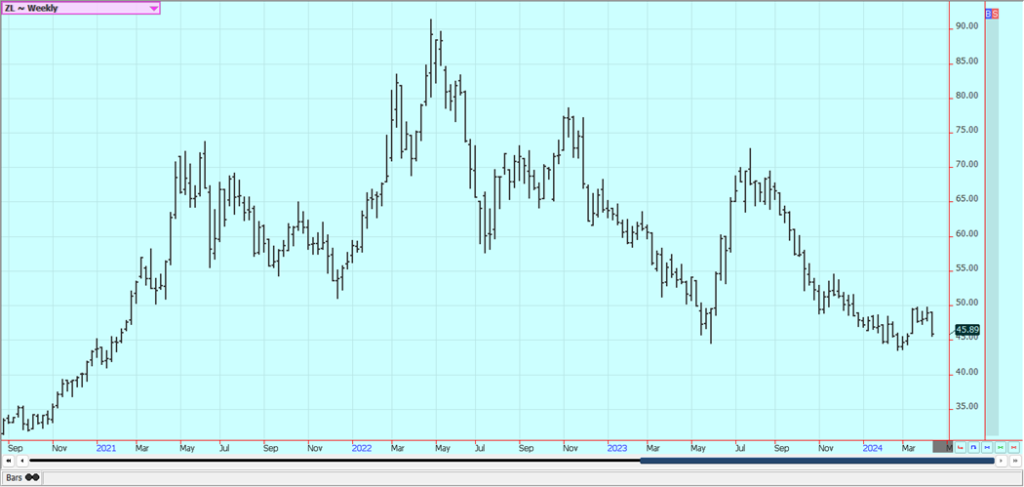

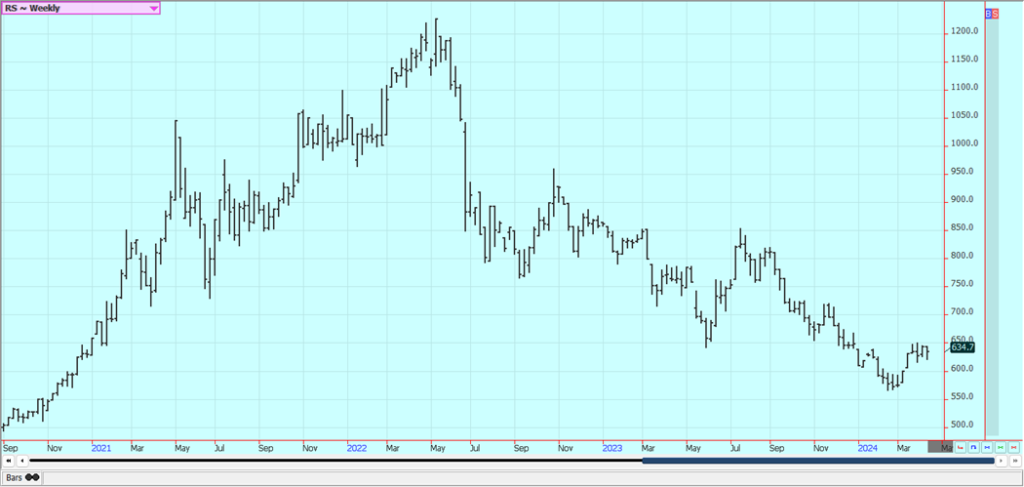

Palm Oil and Vegetable Oils: Palm Oil was lower last week in sympathy with the price action in Chicago and on demand concerns.. The export pace is expected to continue to really improve but this is part of the price already, in part due to stronger world petroleum prices that have affected world vegetable oils prices as well. Domestic biofuels demand is likely to improve. Ideas of weaker production ideas against good demand still support the market overall. Trends are turning up on the daily charts. Canola was lower in response to the USDA reports that showed plenty of oilseeds viable in the US and the world.

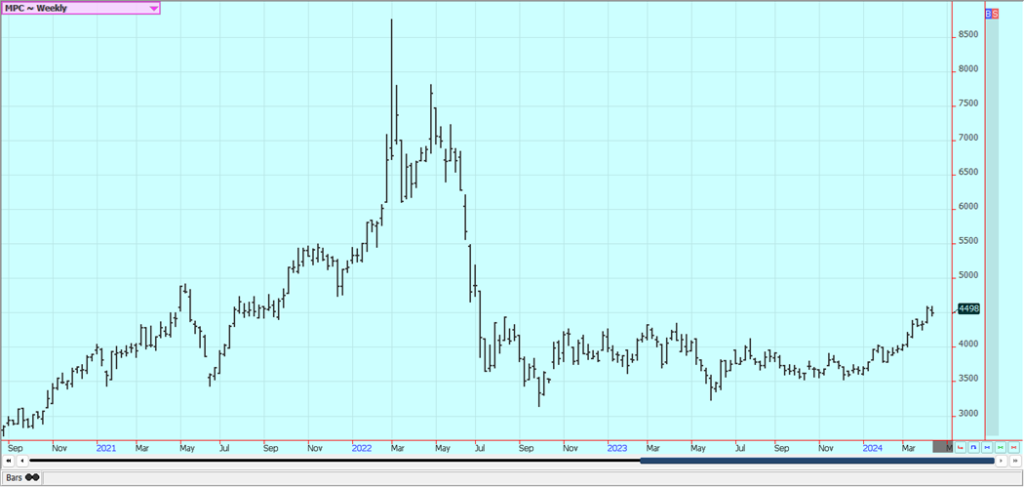

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

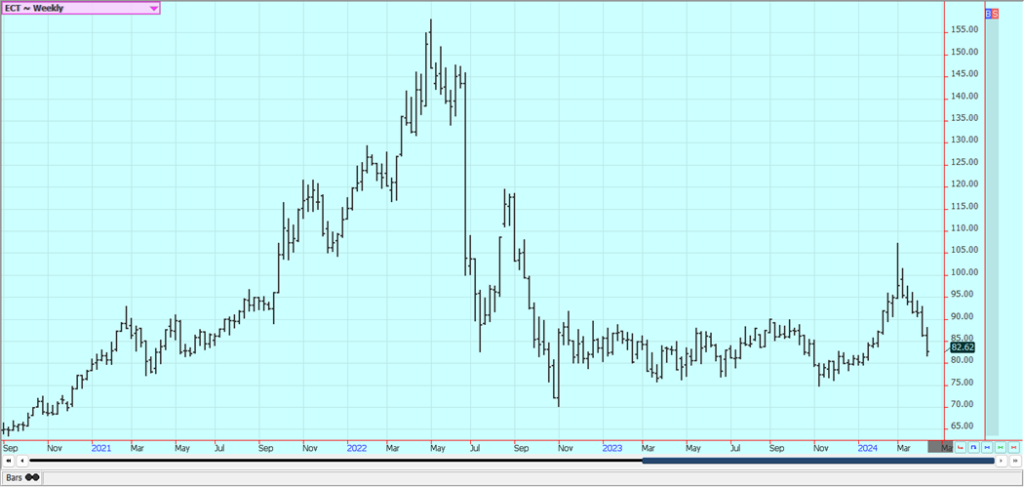

Cotton: Cotton was lower last week in response to the USDA reports and weaker demand ideas. The export sales report showed poor dales once again. USDA made no changes to the domestic supply or demand sides of the balance sheets, but did cut world ending stocks slightly. Trends are still down on the daily and weekly charts.

Demand has been weaker so far this year. The US economic data has been positive, but the Chinese economic data has not been real positive and demand concerns are still around. However, Chinese consumer demand has held together well, leading some to think that demand for Cotton in world markets will increase over time.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher last week and remains in a trading range. The move came in reaction to the latest USDA reports that showed less production. Florida production is now estimated at 18.8 million boxes, from 19.8 million last month. Reports of tight supplies are around. Florida said that Oranges production will be low, but above a year ago. Futures still appear to have topped out even with no real downtrend showing yet, so a range trade has been seen.

Prices had been moving lower on the increased production potential for Florida and the US and in Brazil but is now holding as current supplies remain very tight amid only incremental relief for supplies is forecast for the coming new crop season. There are no weather concerns to speak of for Florida or for Brazil right now. The weather has improved in Brazil with some moderation in temperatures and increased rainfall amid reports of short supplies in Florida and Brazil are around but will start to disappear as the weather improves and the new crop gets harvested.

Weekly FCOJ Futures

Coffee: Both markets closed higher last week and both show up trends on the daily and weekly charts. The lack of Robusta Coffee in the market continues to support futures. Robusta offers from Vietnam remain difficult to find and the lack of offer of Robusta is a bullish force behind the London market action.

There were some indications that Vietnam producers were now offering a little Coffee, but not much and not nearly enough to satisfy demand. Vietnamese producers are reported to have about a quarter of the crop left to sell or less and reports indicate that Brazil producers are reluctant sellers for now after selling a lot earlier in the year. The next Robusta harvest in Brazil is starting now.

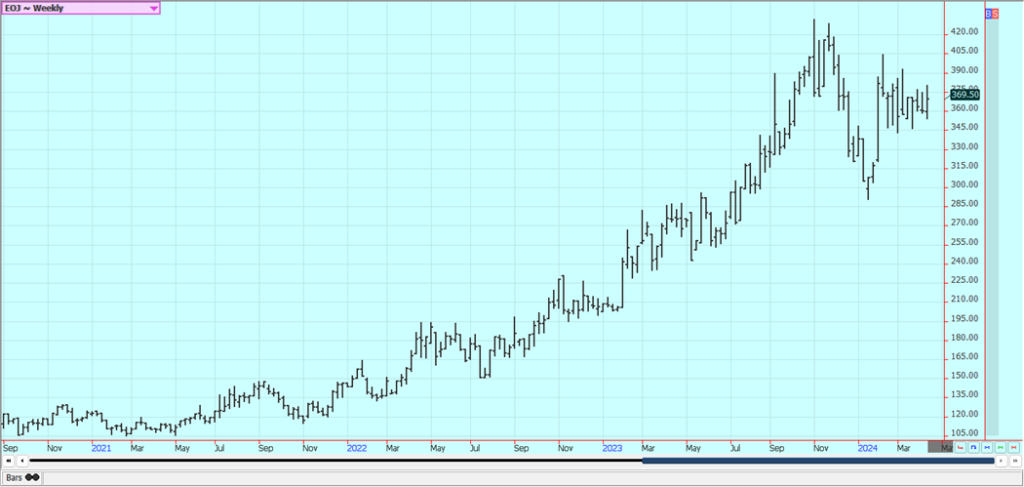

Weekly New York Arabica Coffee Futures

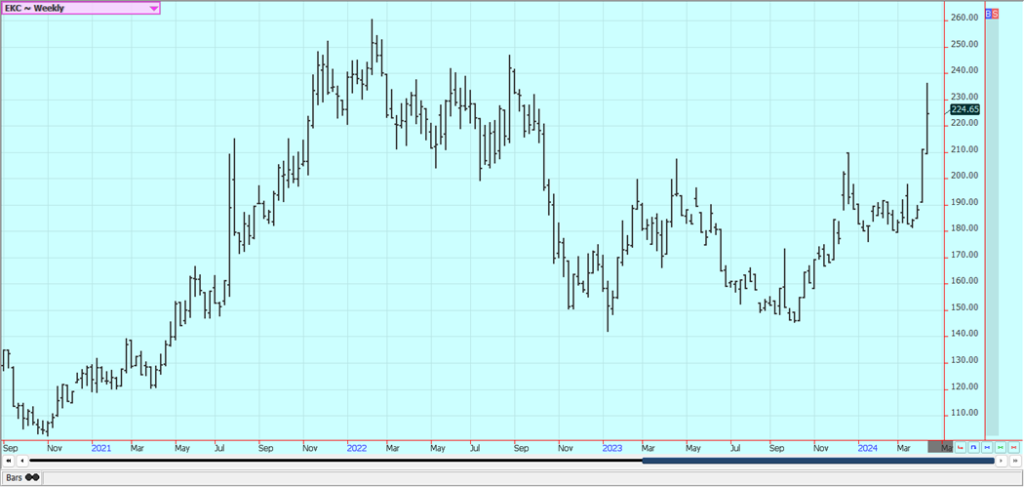

Weekly London Robusta Coffee Futures

Sugar: New York and London closed lower again last week and sugar trends are down on the charts. There are still ideas that the Brazil sugar harvest can be strong for the next few weeks if not longer. Indian production estimates are creeping higher but are still reduced from recent years. There are worries about the Thai and Indian sugar production. Sugar offers from Brazil are still active but other origins. are still not offering in large amounts except for Ukraine. Ukraine sugar offers have suffered lately with the war. Sugar demand reports from Europe have been strong.

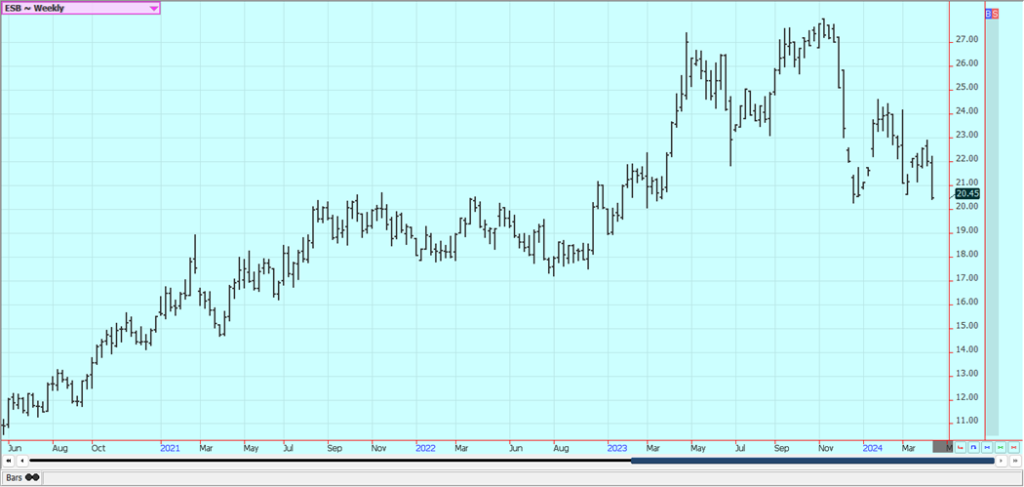

Weekly New York World Raw Sugar Futures

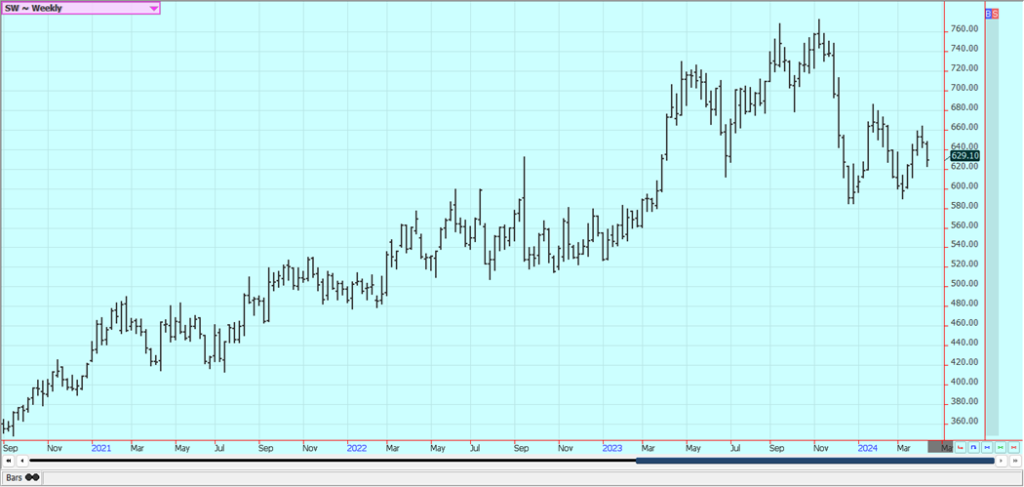

Weekly London White Sugar Futures

Cocoa: New York and London were higher last week and trends are up. Production concerns in West Africa as well as demand from nontraditional sources along with traditional buyers keep supporting fu-tures. Production in West Africa could be reduced this year due to the extreme weather which includ-ed Harmattan conditions.

The availability of Cocoa from West Africa remains very restricted and projections for another production deficit against demand for the coming year are increasing. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue. Ivory Coast arrivals are now 1,301 tons, down 26.7% from the previous year. Mid crop harvest is now underway and here are hopes for additional supplies for the market from the second harvest. Demand continues to be strong, especially from nontraditional buyers of Cocoa

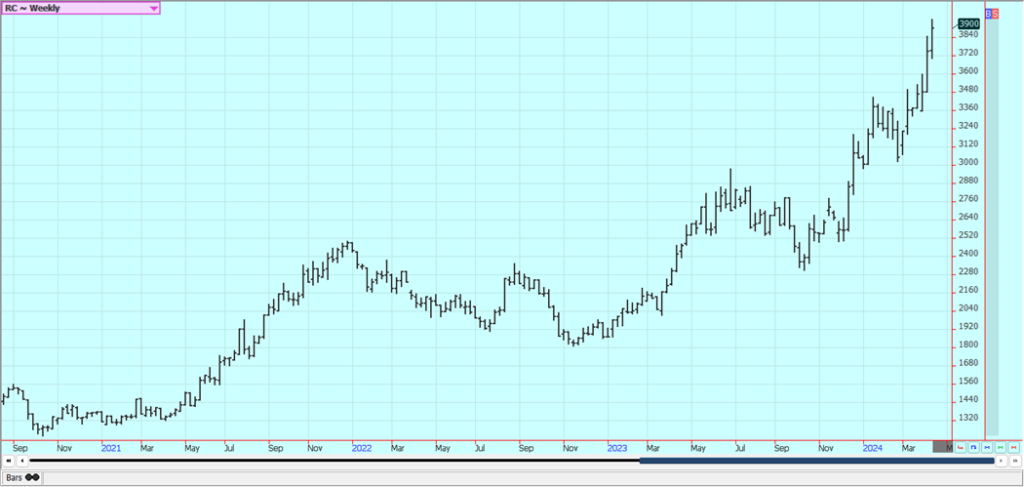

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Tijana Drndarski via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crypto1 week ago

Crypto1 week agoBitcoin Rebounds Above $70K as Crypto Markets Show Fragile Signs of Recovery

-

Biotech7 days ago

Biotech7 days agoEurope Launches Personalized Cancer Medicine Initiative

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEnfinity Launches First Solar Plant in Italy with Microsoft

-

Crypto3 days ago

Crypto3 days agoBitcoin Wavers Below $70K as Crypto Market Struggles for Momentum