Markets

Sugar Prices Edge Up as China Buys and India Eases Supply Fears

Sugar markets edged higher last week as daily chart trends turned upward. Ample supply and weak demand persist, though cheaper prices spurred Chinese buying, especially of Thai sugar. Scattered rains hit Brazil’s center-south, and India is expected to start the season with sufficient stocks, easing concerns over lower projected production this coming year.

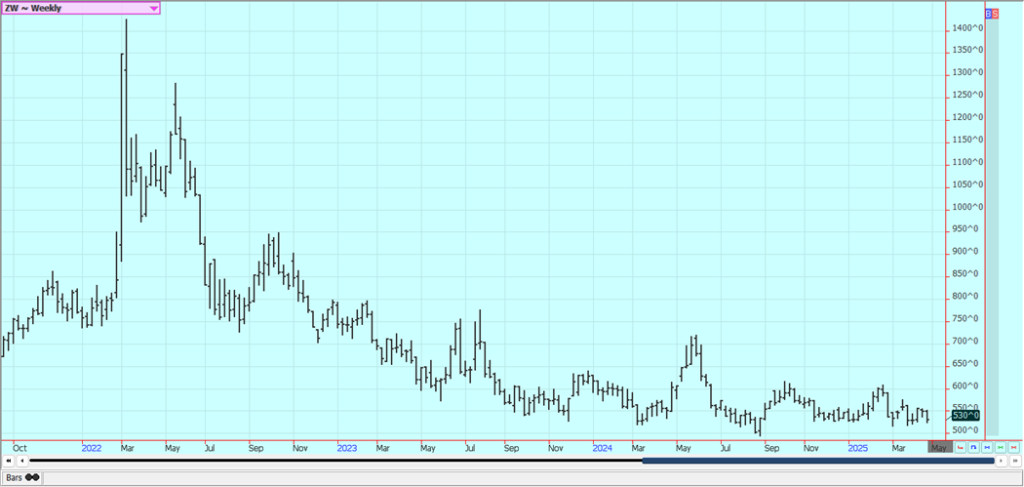

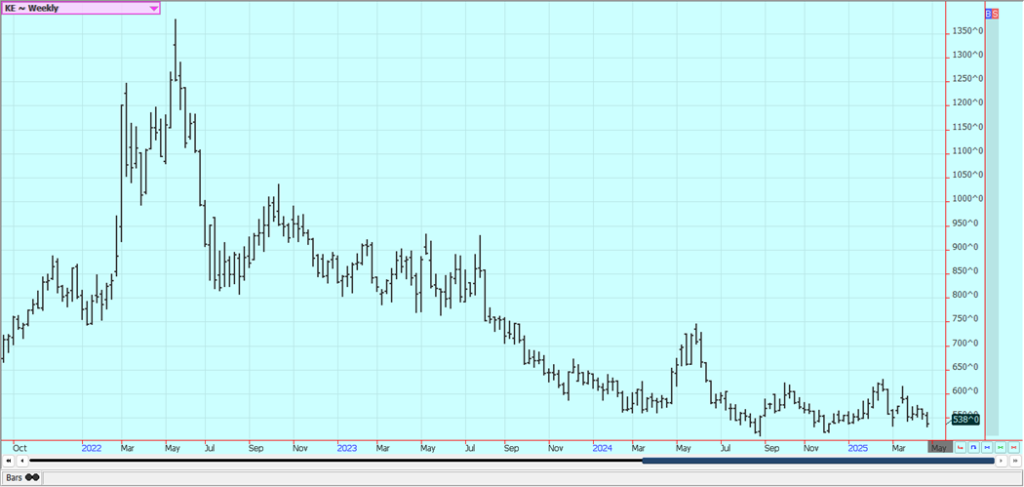

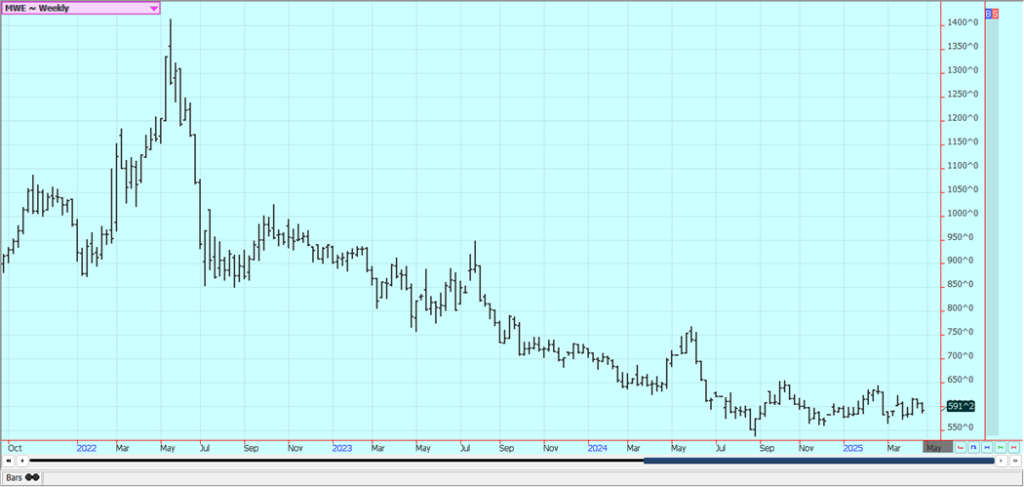

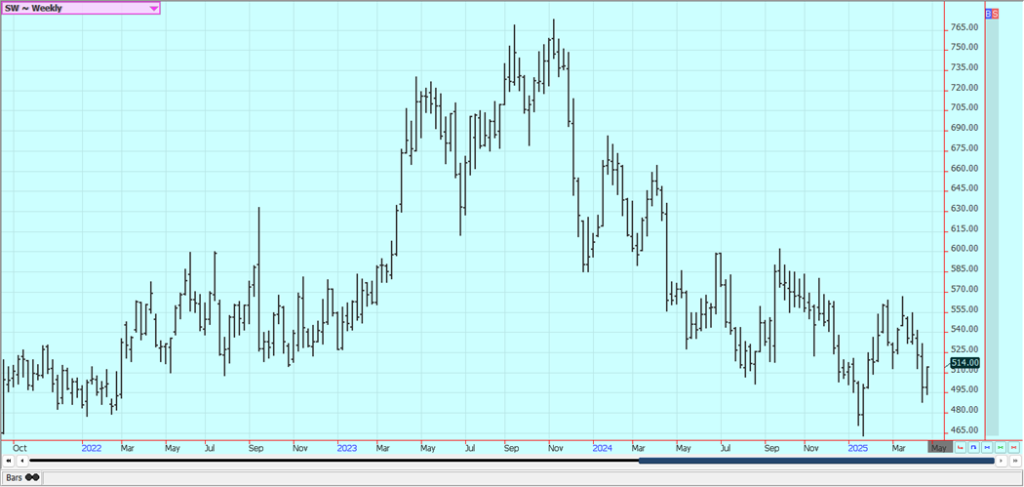

Wheat: All three markets closed lower last week on weekly export sales cancellations and as the weather for growing crops improved with more reports of and forecasts for showers in western growing areas. Crops in the Great Plains are reported to be in good condition. Rain has become much less in the southern Midwest and Mid South.

Chart trends are mixed in Winter Wheat markets and in Minneapolis. Traders keep talking about a tight market as a reason to support prices, but enough Wheat has always been available to the market and demand for US Wheat in export markets has been poor. Dry outlooks for the Black Sea regions are still a main feature. Overall demand for world Wheat has been weak.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

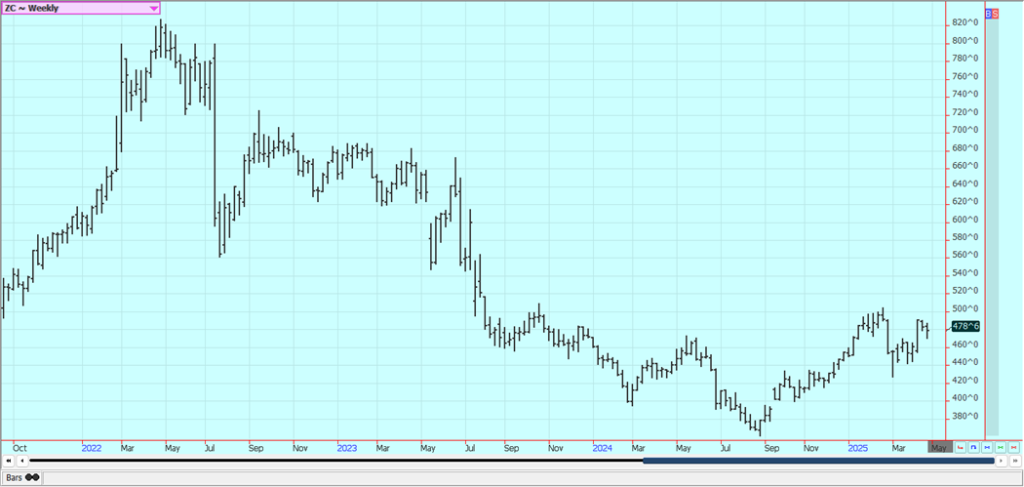

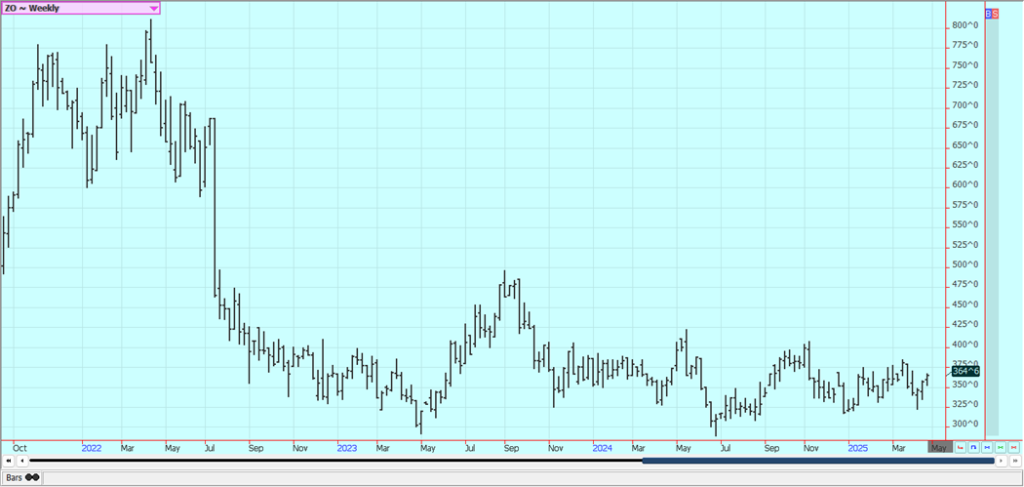

Corn: Corn closed a little lower last week, and the weekly export sales report was strong once again as demand for US Corn mains strong. The market also reacted to better planting weather in the Midwest and the latest in the economic wars and as Trump tried to bring down the temperature on the tariffs and the Fed.

Demand for Corn in domestic and world markets remains strong with sales of above 1.0 million tons in the latest reporting week. It is dry in growing areas in western US, but most of the Midwest has had precipitation lately and eastern and southern areas are too wet. It has become warmer in much of the Midwest and planting progress is expected to be much improved this week, but rain remains in the forecast. Oats were higher, and the trends are mixed in this market.

Weekly Corn Futures

Weekly Oats Futures

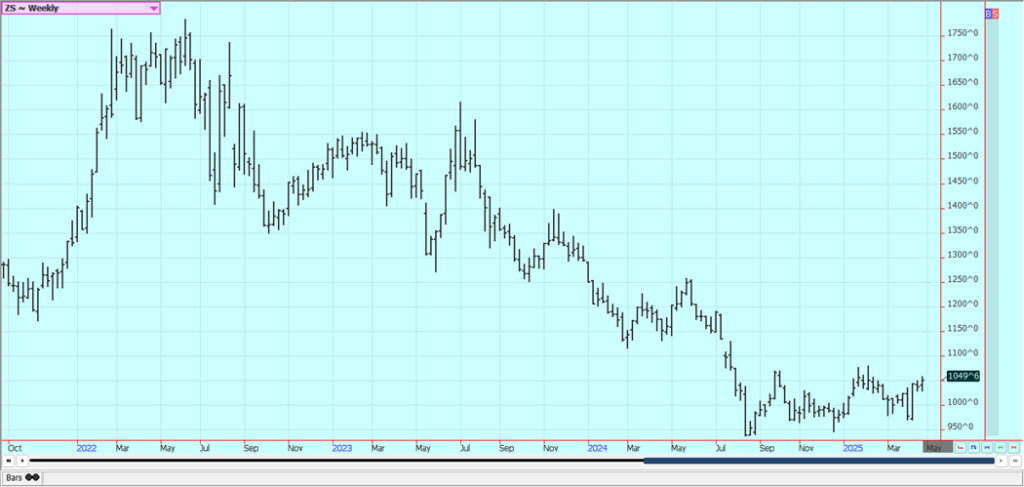

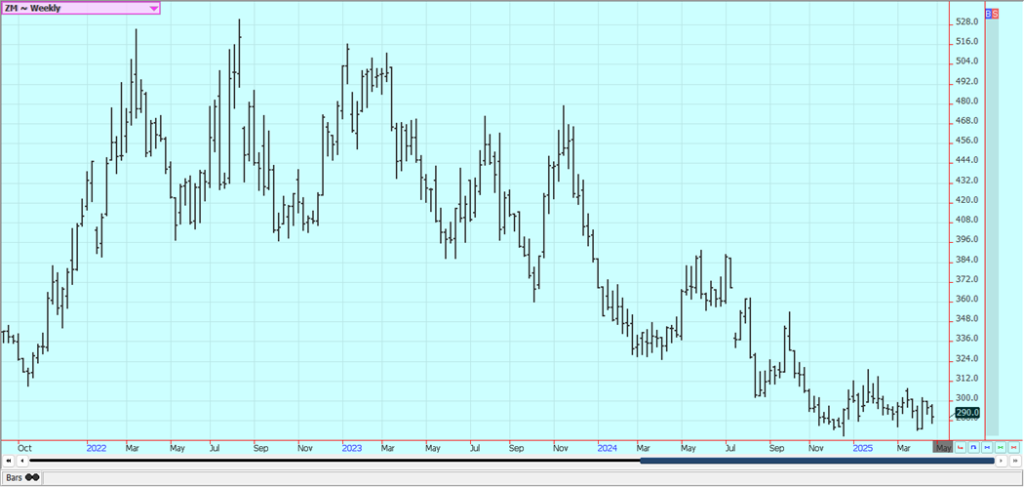

Soybeans and Soybean Meal: Soybeans and Soybean Oil were higher last week, and Soybean Meal closed lower as the market reacted to news of better demand due to high Brazil FOB premiums as well as the news from the president that the US could potentially greatly reduce tariffs on China.

The reports of demand have remained solid for US Soybeans as China has been taking almost all the export from South America. Deferred months were higher as the weather remains too wet to the east and south and too dry to the west. Warmer temperatures are expected through this weekend.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

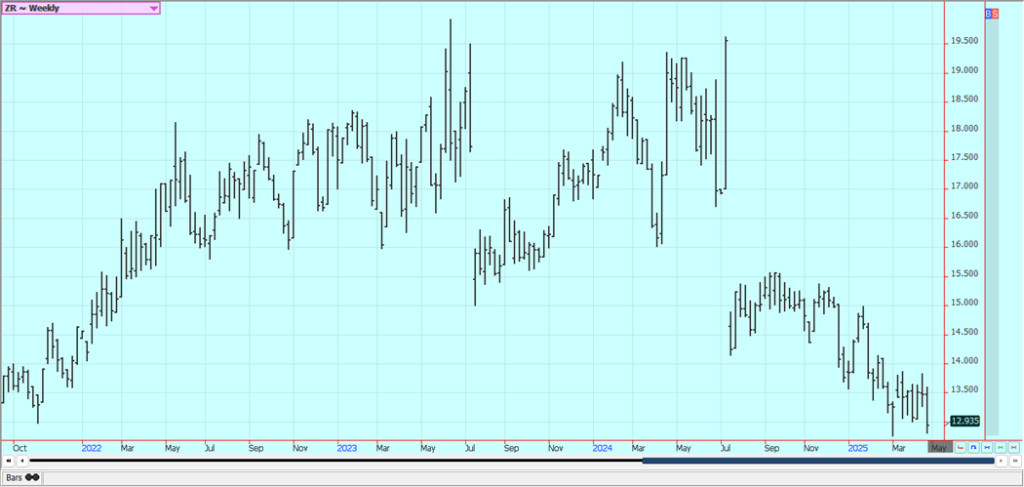

Rice: Rice closed lower last week on speculative selling. The cash market has been slow with mostly quiet domestic markets and average export demand. Export sales have not been strong, and domestic demand is not strong enough right now to bid prices any higher.

Milling quality of the Rice remains below industry standards and it takes more Rough Rice to create the grain for sale to stores and exporters. Rice is planted in southern growing areas now and is about half done farther to the north.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil futures were higher last week as demand ideas improved. There is talk of reduced supplies in the market. Chart trends are mixed. Canola was higher last week and traded at new highs for the move.

Trends are still up on the daily charts and weekly charts. Canadian goods were exempted from the new round of tariffs but still must deal with the tariffs previously imposed by the US.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was a little higher last week as demand ideas got help when Mr. Trump dialed back on his tariff threats and threats on the independence of the Fed.

Macroeconomic markets turned higher with the news and the buying spilled into Cotton. There are still hopes for improved growing weather. Some rain was reported in west Texas last week, and farmers are in the fields. More showers are in the forecast for the Great Plains.

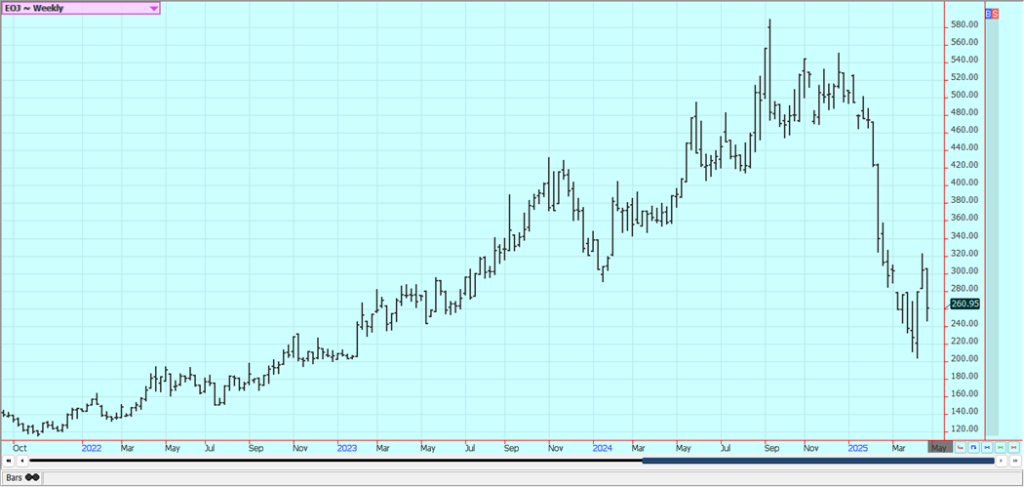

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week and the trends are now down in the market. USDA has reduced Florida production mostly at the expense of the greening disease and some extreme weather seen in the last couple of years. There are no weather concerns to speak of for Brazil or Florida right now although Brazil could turn hot and dry.

Weekly FCOJ Futures

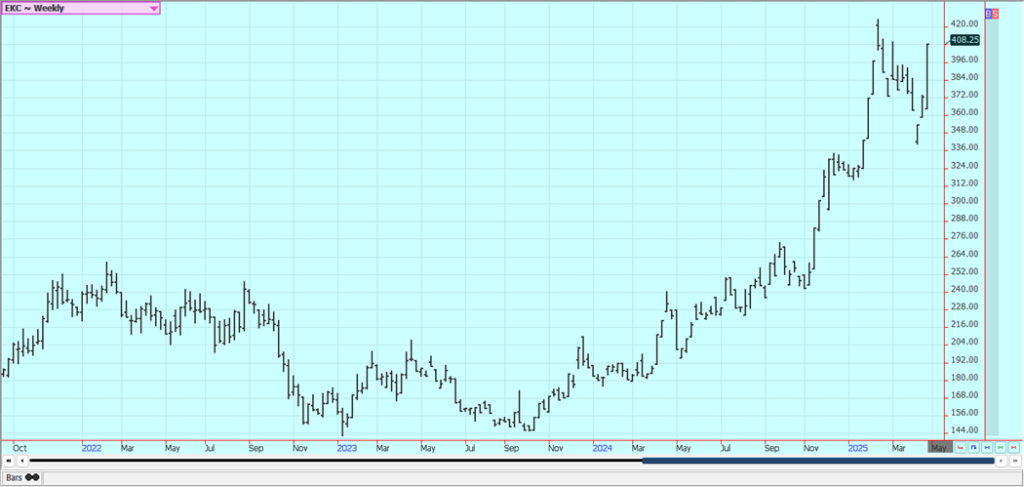

Coffee: New York and London were higher last week. There are still ideas of good demand against ideas of less supplies available to the market.

The lack of offers from Brazil continues even with the Robusta harvest started. Vietnam is done with its harvest. Hot and dry weather is in the forecast for Brazil longer term. Trends are up on the daily charts.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

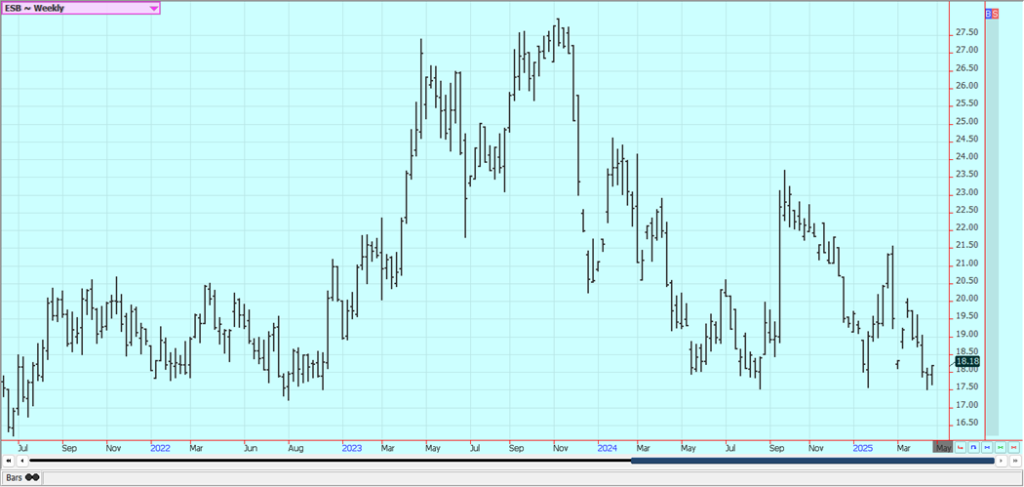

Sugar: Both sugar markets were a little higher last week and trends started to turn up on the daily sugar charts. Ideas of good sugar supplies and less demand continue. China has been a buyer with cheaper sugar prices to help provide some support. Thai Sugar has moved to China lately and in volume.

There were reports of some scattered showers in center south Brazil and reports that India will have comfortable beginning sugar stocks to help cushion the blow from reduced sugar production for the coming year.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

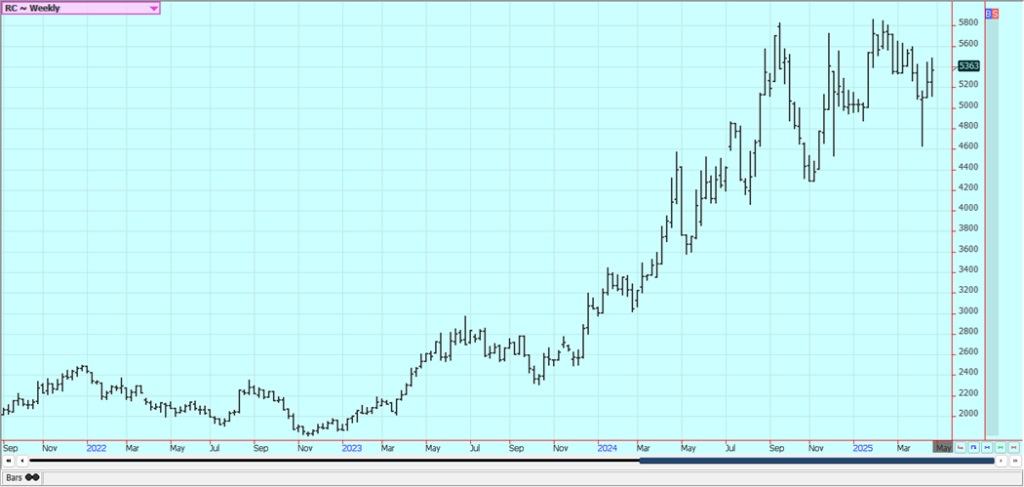

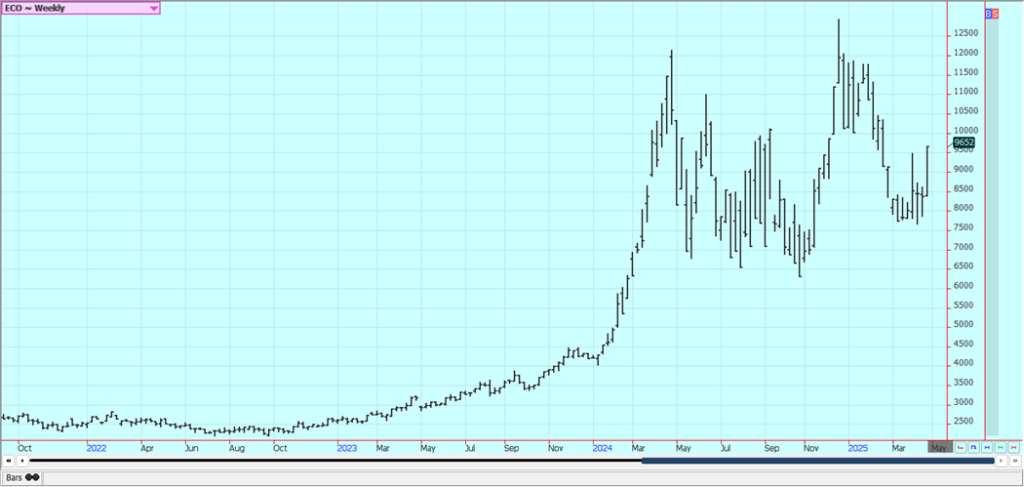

Cocoa: New York and London were higher in recovery trading after weakness on Wednesday. Trends are mixed in London and in New York, and demand ideas got hurt as the tariffs will increase costs to US buyers of chocolates. Demand ideas have been under pressure on the high prices currently seen for Cocoa due to bad production in West Africa. Cocoa imports are now subject to a 10% tariff at mini-mum.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Faran Raufi via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Fintech2 weeks ago

Fintech2 weeks agoDruo Doubles Processed Volume and Targets Global Expansion by 2026

-

Business3 days ago

Business3 days agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Health Trader Affiliate Program Review]

-

Africa1 week ago

Africa1 week agoAir Algérie Expands African Partnerships