Markets

Tech stock portfolio spotlight: potential top performers for 2016

There are underdog stocks starting to gain the interest of more investors that can boost your tech stock portfolio this year.

If you’re looking to boost your tech stock portfolio, consider these companies driving innovation in the market right now.

Tech investors always root for category performers in the stock market. This practice tends to leave startups with no room for development sometimes. However, this year has seen advancements to new financial strategies. More tech investors are taking notice of underdog stocks which displays huge potential for growth.

Follow your head, not your heart

Indeed, some long-time investors believe in logic over emotions. While a popular investment strategy is to stay with crowd favorites, taking chances with underdog stocks might be a good idea. That is, buy stocks at a low price, and sell them later on for a higher price.

Motley Fool also goes by this principle. They look for companies which have the odds stacked against them. Then they cite some compelling investment opportunities. In fact, one of the least favorite stocks in the first half of 2016 included Fitbit (NYSE:FIT).

Fitbit started out big in the previous years. However, technical advancements such as smart watches have slowly dominated the wearables industry. The fitness tracker market has enjoyed a 30 percent market share in 2015. Now, its long-term potential is threatened by other entrants. This is why Fitbit continues to add new features and functionalities in order to stay in the competition. And this is also why it remains one of the tech stocks to watch out for.

Staging a comeback

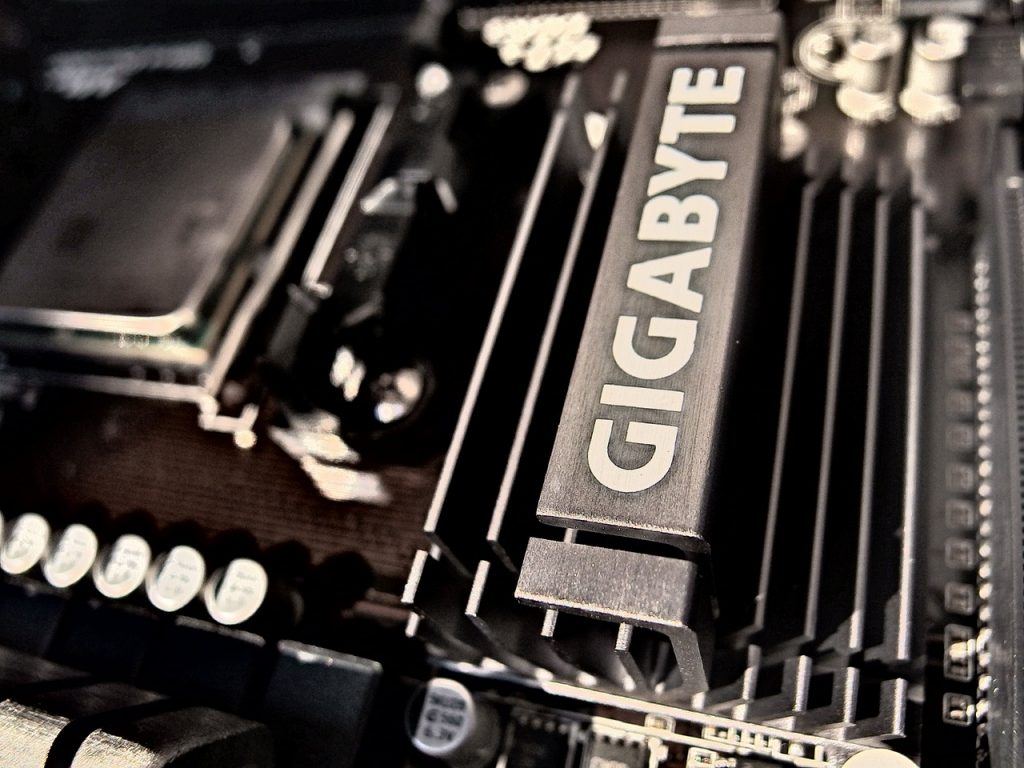

GAM Holdings AG, on the other hand, also included Intel in its list of tech stock underdogs to watch. According to the GAM source, 2016 is the best time to look at Intel (NASDAQ:INTC) again. The company has suffered a decline in PC sales over the last couple of years. But since then, the growth of its Data Center Group has compensated for slow revenue.

They may have always been underdogs, or they might be making a comeback. Either way, these potential movers and shakers can be a great addition to your tech stock portfolio. (Source)

Intel’s developing cloud technology seems to be its saving grace. Add to that the company’s relatively cheap valuation and 3 percent dividend yield. These three factors can become the propeller for investors to consider adding this to their stock portfolio.

The future looks good

Mobile tech innovator 5BARz International, Inc. (OTC: BARZ) also joins the list. Industry insiders are on the lookout for this firm’s potential for growth and expansion.

The Wall Street Journal follows the company’s key stock data, which has shown positive movement so far. It has also been accelerating on raising its capital. Moreover, it has developed a critical piece of carrier grade technology that enhances weak indoor mobile signal. According to one of its releases, 5BARz recently topped a private placement. The equity investment was worth $1.1 million.

“Following the recent series of orders received by the Company from Tier 1 cellular network operators in India, these funds provide a critical element for the expansion of our business and production capability in a market with 981 million cellular phone subscribers. Our management team in India is focused on achieving rapid penetration into this marketplace,” said 5BARz International CEO, Daniel Bland.

Late last year, TheStreet took note as well of Western Digital (NASDAQ: WDC). The hard drive manufacturer announced the acquisition of SanDisk (BMV:SNDK). The March acquisition saw WDC shareholders approve a $16 billion deal. The move likely lifted off investor fears on WD’s 43 percent year-to-date price drop. The SanDisk deal has made WD a broad supplier of data-storage components, according to the Street source.

Truth be told, stock investment has very unpredictable ups and downs. It is evident by the history of the companies in this list. But investors should remember that exciting developments can add value to a plummeting tech stock. Wise firms duly take note of this, especially those aiming to be part of your tech stock portfolio. They continue to bring their game by leveraging on performance and product innovations.

—

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

You must be logged in to post a comment Login