Featured

The Current Bond Markets Crash Could Bring Investors Unpleasant Surprises

Stock markets crash. But do bond markets crash? Well, yes they do. We look at one of the more famous bond market crashes and then we look at today’s bond market crash. Bond market crashes have in the past taken down funds. Will we get a surprise out of the blue with this one? Yes, we could. Bond yields hit their highest levels seen since 2019 this past week.

Hands up: who remembers the great bond massacre of 1994? Bond crashes are usually not at the top of the list for famous crashes. Stock market crashes, yes—1929, 1938, 1974, 1987, 2008, 2020—those are the dates that resonate with investors. But a bond market crash? Yet it has happened. Could it happen again?

So, what was the great bond massacre of 1994? Coming out of the 1990 recession, long-term interest rates had fallen, nearing 30-year lows. Predictions were that rates could go even lower. But in Q4 1993 GDP growth was stronger than many expected. Inflation also picked up. That started talk of the Fed hiking interest rates. Since mid-1992, Fed funds rates had fallen into the 3% range, the lowest level seen since the early 1960s. Some pressure began to build in the bond market as rates began to creep higher. Then came the Fed meeting of February 3 and 4, 1994 and the Fed hiked interest rates from 3% to 3.25%. The Fed also started a move to slow monetary growth through the money supply. Nonetheless, it set off a series of moves in the bond markets and when the dust cleared, some $1.5 trillion had been wiped off bond funds globally, $1 trillion in the U.S.

The Fed funds rate rose from 3% in February 1994 to over 6% by March 1995. The 10-year U.S. treasury note that was at 5.19% in October 1993 rose to 8.04% in October 1994, a rise of about 55%. In some respects, that doesn’t seem like much. The 10-year today has moved from a low of 0.55% in July 2020 to 2.37% today or, to be fair, a move from 1.74% in March 2021. That’s a 330% move from July 2020 and a 36% from March 2021. That March 2021 rate was actually a peak at the time and by July 2021 the yield was down to 1.24%. Since then, it is a 91% rise.

The 1994 bond debacle was exacerbated by the use of derivatives. There was a long list of collapses that in some instances almost completely wiped out a number of bond funds. The most famous was the collapse of

Orange County, California that was forced into bankruptcy because of huge losses on their bond portfolio and a derivatives position gone totally askew.

Yes, there have been other bond collapses. The worst have seen the collapse of high-yield bond funds. Collapses that come to mind are the savings and loan crisis of the late 1980s, the dot.com collapse of 2000–2002, the financial crisis of 2007–2009, and, somewhat more recently, a severe bond market correction in 2013.

Back in 1994 it was Fed Chair Alan Greenspan hiking interest rates. They hiked it 25 basis points (BP) in February, 25 BP in March and April, 50 BP in May and August, and 75 BP in November. From 3% to 5.50% in nine months. Today we have bonds headed for record losses, according to Bloomberg.

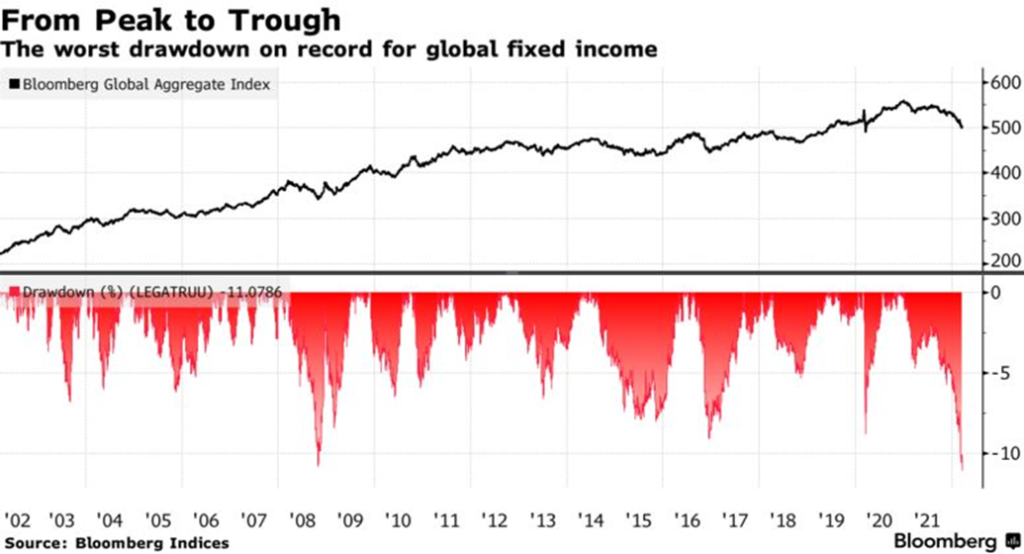

The Bloomberg Global Aggregate Bond Fund, a benchmark for government and corporate debt, has fallen 11% from its high in early 2021. That apparently surpasses the 10.8% drawdown during the financial crisis of 2008. What that translates into is some $2.6 trillion in losses. That pales the losses seen during the 1994 bond crash. During the 2008 financial crisis, bond losses were in the range of $2 trillion. Grant you, the times are different and global debt in 1994 wasn’t $300 trillion. We are reminded that in 2008 at the time of the financial crisis global debt was only around $140 trillion. Since then, it has more than doubled in 12–14 years. It is also revealing that effectively five countries hold an estimated 66% of the world’s public debt: U.S., Japan, China, Italy, and France.

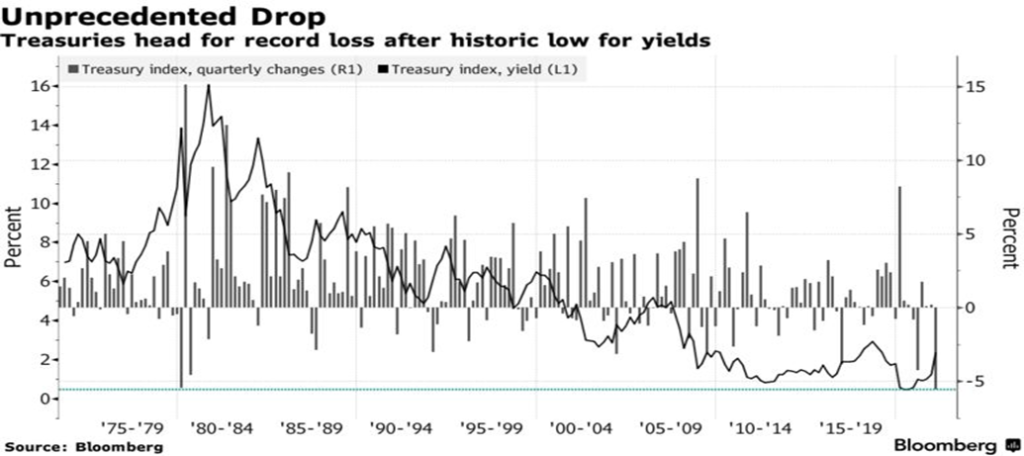

Below we show two charts. One shows the historic drop following record low yields. The second shows the huge drawdown related to the Bloomberg Global Bond Aggregate Index.

Bond yields have broken the long down trend line from the 1981 top in the past. But now bond yields are threatening to break that downtrend line again. It would be the third time that the downtrend has broken to the upside. This in turn could set in motion a period of persistently higher interest rates. We are coming out of a historical period of the lowest interest rates ever seen. Interest rates more recently were lower than were seen during the Great Depression. It has been an unprecedented period.

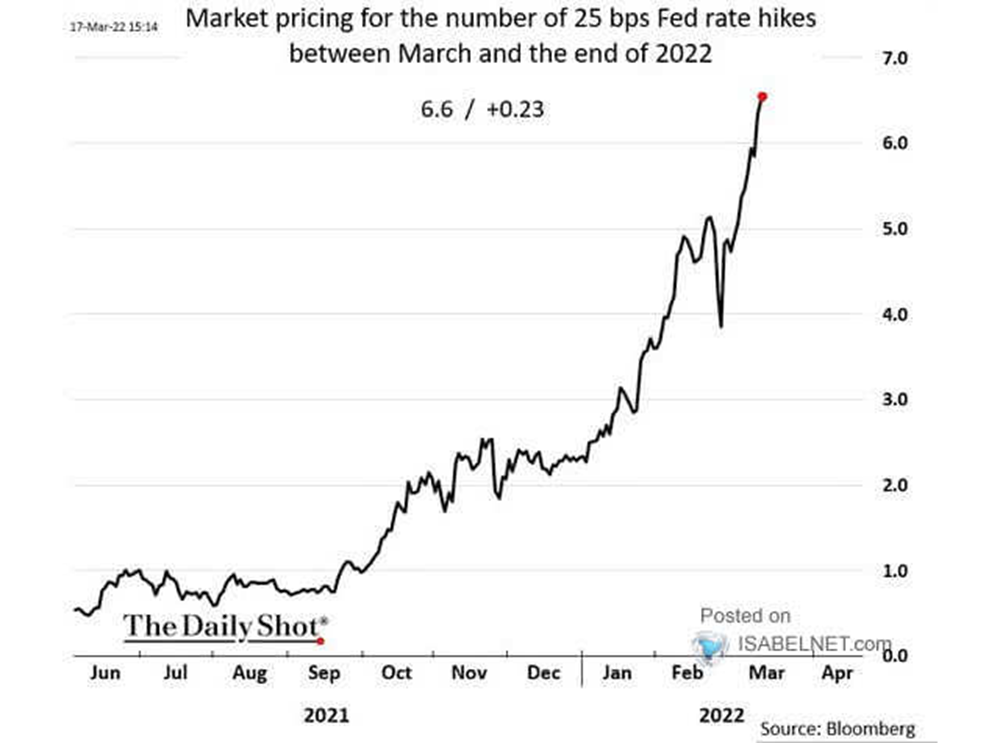

But rates are now rising. The Fed hiked 25 bp in March and Fed Chair Jerome Powell has hinted that could accelerate. Some are now talking a 50 bp hike in May. Fed funds rates have been consistently below the rate of GDP growth for the past decade or more. It has been an unprecedented period. When Fed funds exceed the real rate of growth for GDP, a recession has normally followed. We have two more charts below. The first chart suggests a rapid pace of Fed rate hikes between now and the end of the year. Effectively, the market is pricing in seven more hikes between now and year end. That could bring the Fed rate to 2.25% by year end. We wouldn’t be surprised that, at that point, the yield curve will have fully inverted with Fed funds above the U.S. 10-year treasury note rate. Right now, we are not even close with a negative spread at roughly 2.22% with the Fed rate at 0.25% and the 10-year at 2.47%. The closely watched 2–10 spread is closest to turning negative, currently at around 20 bp. But the 3-month—10-year spread is 1.93%. Many put more importance in the 3m–10 spread rather than the 2–10 spread as an indicator for an impending recession. We monitor both but, in the past, we have seen the 2–10 spread turn negative before the 3m–10 spread.

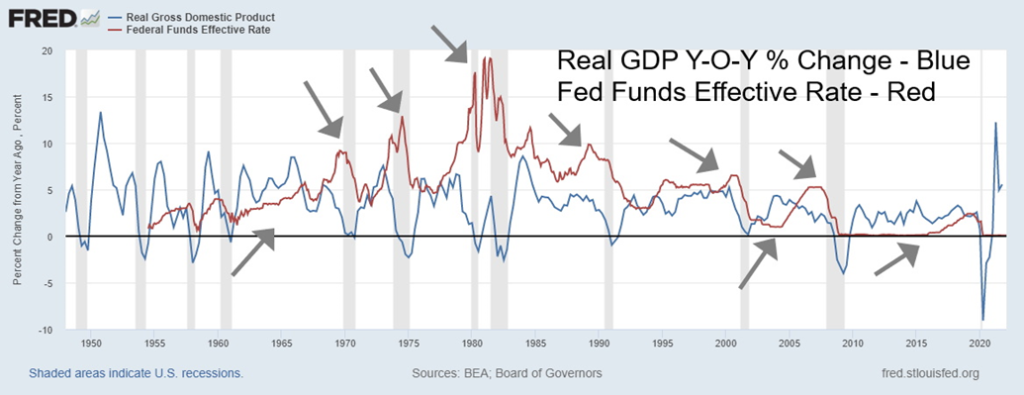

Our final chart below shows the long-term relationship between the real GDP growth rate and the Fed funds rate. Note how, during periods when the Fed funds rate is below the rate of real GDP growth, we do have strong periods of economic growth, or at least we have economic growth. That was the case during the 1960s and the early part of the 2000s, and more recently the period of the 2010s. But periods of Fed funds exceeding the rate of real GDP growth have, with lags, resulted in recessions: 1970, 1973–1974, 1980–1982, 1990, 2000–2002, 2007–2009. The two were about equal before the pandemic crash of March 2020 and the short-lived recession that followed. Real GDP growth is slowing, but still more than exceeds the Fed funds rate. So, while it is easy for us to say a recession is coming, we are definitely not there yet.

Many say the Fed is behind the curve, meaning they leave rates too low for too long, then hike too late and then start to cut rates again only when it is clear the economy is falling into a recession. Others argue the opposite. The bond market is the signal. The evidence is in the sharply rising bond yields with the 10-year U.S. treasury note already rising from 1.35% in December 2021 to the current 2.48%. Inflation was last at 7.9% in February 2022 and 7% in December 2021. But sharp rises in bond yields have in the past resulted in trouble in

the bond markets. So far, we haven’t heard of anybody in trouble but would we be surprised if we were suddenly confronted by a bond fund collapse? No.

January and February have seen net withdrawals from bond funds. But they haven’t reached crisis proportions yet. Bond funds can and do use derivatives to manage their positions and they can just hold them to maturity. Problems arise only when the withdrawals become a flood and they are forced to either stop withdrawals or sell more positions to raise cash. Then somebody goes under. How big that somebody is could then negatively impact the entire market and even the financial system, requiring bail-outs. Then we have a debacle like 1994 and even 1998 when the collapse of the Russian ruble and a Russian debt default sparked the collapse of Long-Term Capital Management (LTCM) and shook the entire financial system. Could today’s financial markets withstand another one? Or worse, another Lehman Brothers? We wonder.

Chart of the Week

In a world agog with sharply rising energy prices, it is easy to overlook the metals. But, as we have noted, sanctions have wide negative effects on a host of things, particularly metals. Russia is a commodities powerhouse. Russia is a significant producer and has large reserves of palladium, aluminum, nickel, platinum, gold, diamonds, phosphates, coal, and more. Nickel, for example, is vital for stainless steel production. As well, it is used in batteries—nickel-hydrogen, chromium-nickel, and nickel manganese. Although sanctions target only Russia, they have disrupted things worldwide. Nickel got caught in a huge short squeeze, shutting down the LME market and setting up huge losses for China’s Tsingshan Holding Company. Surprisingly, sanctions have not been placed on Norilsk Nickel, Russia’s largest nickel producing company and the second largest in the world.

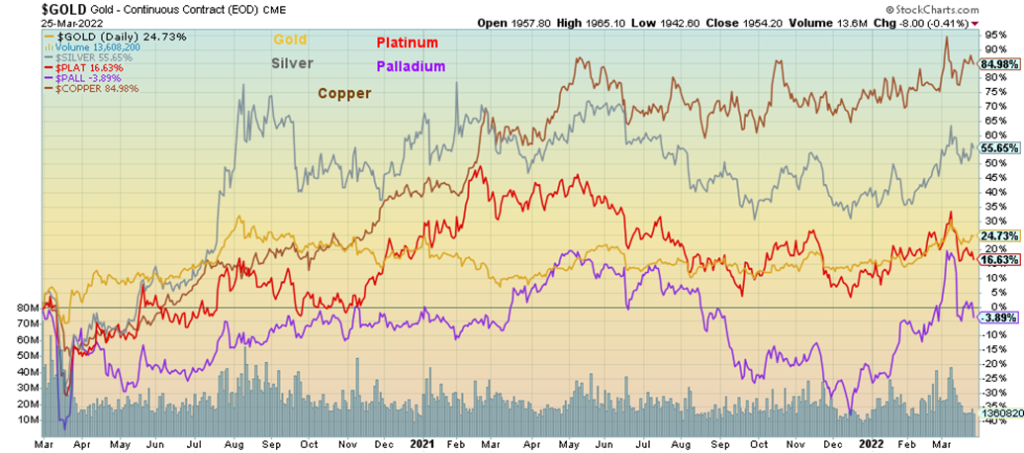

The CRB Index metals components include the precious metals: gold and silver, along with the metals aluminum, nickel, and copper. Our first chart shows the relative performance of gold, silver, platinum, palladium, and copper. Gains since March 2020 have been considerable. Gold +24.7%, silver +55.7%, platinum +16.6%, palladium -3.9% (palladium was at all-time highs on March 1, 2020 before a 50% collapse during the March 2020 pandemic panic, hence the low return), and copper +85.0%. From the pandemic lows the gains would be even higher.

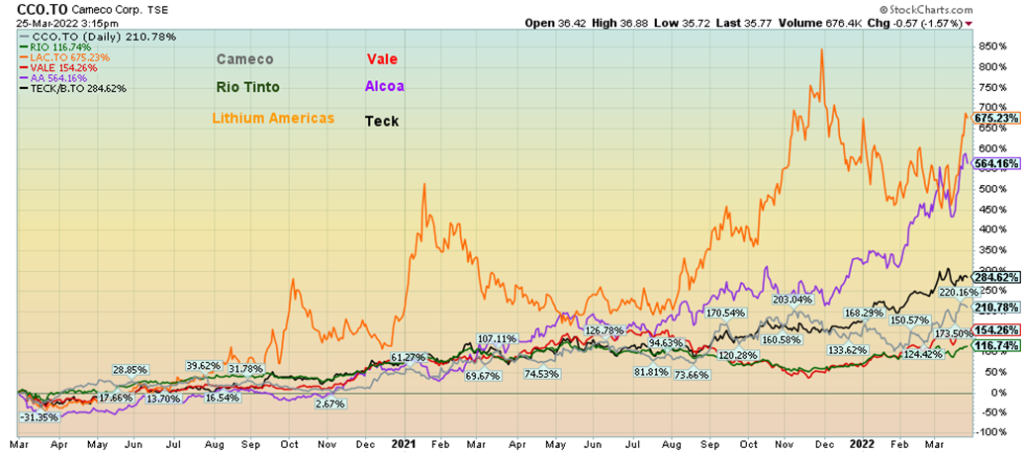

StockCharts does not have symbols for the other metals we’d like to show—aluminum, nickel, cobalt, lithium, diamonds, iron ore, and uranium. Our second chart below, instead, uses large stock-listed companies as proxies for the metals. Companies can either outperform or underperform the metal, depending on a host of circumstances. Usually, they are outperforming as they are leveraged to the price of the commodity.

The six companies represented here are: uranium – Cameco Corp (CCO) +210.8% market cap $14.0 billion; diamonds – Rio Tinto Diamonds (part of the Rio Tinto PLC Group) +116.7% market cap $99 billion; aluminum – Alcoa Corp. +564.2% market cap $17.0 billion; iron ore and nickel – Vale SA (VALE) +154.3% market cap $97.0 billion; lithium – Lithium Americas +675.2% market cap $6.0 billion; coal – Teck Resources Ltd. (TECK.B) +284.6% market cap $27.0 billion. Note: this is not an endorsement of any of the noted companies.

The war in Ukraine and the subsequent sanctions on one of the world’s largest commodity producers have had a profound effect on metal prices everywhere in addition to energy. Energy may be the most noticeable for most people but metals are equally important to the global economy. Taking a large supply out of the market has had what would be expected—sharply higher prices.

MARKETS AND TRENDS

| % Gains (Losses) Trends | ||||||||

| Close Dec 31/21 | Close Mar 25/22 | Week | YTD | Daily (Short Term) | Weekly (Intermediate) | Monthly (Long Term) | ||

| Stock Market Indices | ||||||||

| S&P 500 | 4,766.18 | 4,543.06 | 1.8% | (4.7)% | up | neutral | up | |

| Dow Jones Industrials | 36,333.30 | 34,861.24 | 0.3% | (4.1)% | up (weak) | down (weak) | up | |

| Dow Jones Transports | 16,478.26 | 16,386.12 | (0.7)% | (0.6)% | up | up | up | |

| NASDAQ | 15,644.97 | 14,169.30 | 2.0% | (9.4)% | up | down | up | |

| S&P/TSX Composite | 21,222.84 | 22,005.94 (new highs) | 0.9% | 3.7% | up | up | up | |

| S&P/TSX Venture (CDNX) | 939.18 | 886.32 | 3.8% | (5.6)% | up | down | up | |

| S&P 600 | 1,401.71 | 1,331.02 | (0.6)% | (5.0)% | up | down | up | |

| MSCI World Index | 2,354.17 | 2,210.90 | 0.7% | (6.1)% | neutral | down | up (weak) | |

| NYSE Bitcoin Index | 47,907.71 | 44,313.54 | 8.6% | (7.5)% | up | neutral | up | |

| Gold Mining Stock Indices | ||||||||

| Gold Bugs Index (HUI) | 258.87 | 314.80 | 3.5% | 21.6% | up | up | up | |

| TSX Gold Index (TGD) | 292.16 | 349.70 | 2.2% | 19.7% | up | up | up | |

| Fixed Income Yields/Spreads | ||||||||

| U.S. 10-Year Treasury Bond yield | 1.52% | 2.48% (new highs) | 15.4% | 63.2% | ||||

| Cdn. 10-Year Bond CGB yield | 1.43% | 2.55% (new highs) | 16.4% | 78.3% | ||||

| Recession Watch Spreads | ||||||||

| U.S. 2-year 10-year Treasury spread | 0.79% | 0.20% (new lows) | 5.9% | (77.2)% | ||||

| Cdn 2-year 10-year CGB spread | 0.48% | 0.20% (new lows) | (33.3)% | (58.3)% | ||||

| Currencies | ||||||||

| US$ Index | 95.59 | 98.82 | 0.6% | 3.4% | up | up | up | |

| Canadian $ | .7905 | 0.8017 | 1.0% | 1.4% | up | up | up | |

| Euro | 113.74 | 109.83 | (0.6)% | (3.4)% | down | down | down | |

| Swiss Franc | 109.77 | 107.44 | 0.2% | (2.1)% | down (weak) | down | up (weak) | |

| British Pound | 135.45 | 131.86 | flat | (2.7)% | down | down | neutral | |

| Japanese Yen | 86.85 | 81.84 (new lows) | (2.5)% | (5.8)% | down | down | down | |

| Precious Metals | ||||||||

| Gold | 1,828.60 | 1,954.20 | 1.3% | 6.9% | up | up | up | |

| Silver | 23.35 | 25.61 | 2.1% | 9.7% | up | up | up | |

| Platinum | 966.20 | 1,008.50 | (2.7)% | 4.4% | down | neutral | up | |

| Base Metals | ||||||||

| Palladium | 1,912.10 | 2,394.30 | (4.0)% | 25.2% | neutral | up (weak) | up | |

| Copper | 4.46 | 4.70 | (0.8)% | 5.3% | up | up | up | |

| Energy | ||||||||

| % | 75.21 | 113.90 | 10.5% | 51.4% | up | up | up | |

| Natural Gas | 3.73 | 5.61 | 15.4% | 50.4% | up | up | up | |

New highs/lows refer to new 52-week highs/lows and, in some cases, all-time highs.

Despite the war in Ukraine, a hawkish Fed, inflation, stagflation, supply chain disruptions, the stock markets rallied for the second consecutive week. The markets appear to be headed for a gain in March against the backdrop of the war in Ukraine. The S&P 500 gained 1.8% this past week, the Dow Jones Industrials (DJI) was up 0.3%, but the Dow Jones Transportations (DJT) proved to be a loser, off 0.7%. Maybe rebounding oil prices are weighing on the DJT. The NASDAQ gained 2.0%, the small cap S&P 600 fell 0.6%, but the mid-cap S&P 400 gained 0.2%. In Canada, the steaming TSX Composite once again made new all-time highs, up 0.9%. The TSX Venture Exchange (CDNX) was up 3.8%. Bitcoin had a strong up week, gaining 8.6% to over 44,000.

In the EU, the London FTSE gained about 1.0% but the war weighed on the European indices as the Paris CAC 40 fell 1.0% and the German DAX was down 0.7%. In Asia, China’s Shanghai Index fell 1.2% but the Tokyo Nikkei Dow (TKN) continued its rebound from deeply oversold levels, up 4.9%. The MSCI World Index was up 0.7%.

The stock market is rallying because, as one pundit put it, “equities are rallying despite a hawkish Fed and stagflation concerns, as many believe there is no alternative to stocks.” Maybe so. Yes, the war is over there and the U.S. isn’t involved in any military fashion, but talk of war is great for defense stocks. And the COVID is at bay as the numbers have collapsed, despite the death toll now officially passing one million. COVID has now killed more Americans than were lost in the U.S. Civil War and has far surpassed the death toll of the Spanish Flu of 1918–1920. The restaurants are packed, the arenas are packed, baseball spring training is underway,

everything is returning to normal. Well, mostly normal. Despite that, consumer sentiment remains weak as the final Michigan Sentiment Index for March came in at 59.4, the lowest level seen since 2011. We’ll see how the jobs report pans out this coming Friday with the release of the monthly nonfarm payroll and employment numbers.

So, what we appear to be seeing is that expectations of growth remain strong as indications are the employment situation is good, so inflation and Fed rate hikes be damned. Many are now indicating at least six more rate hikes in 2022, including at least one or more 50 bp rate hikes. The next FOMC is May 3–4 and then the June meeting on the 14–15.

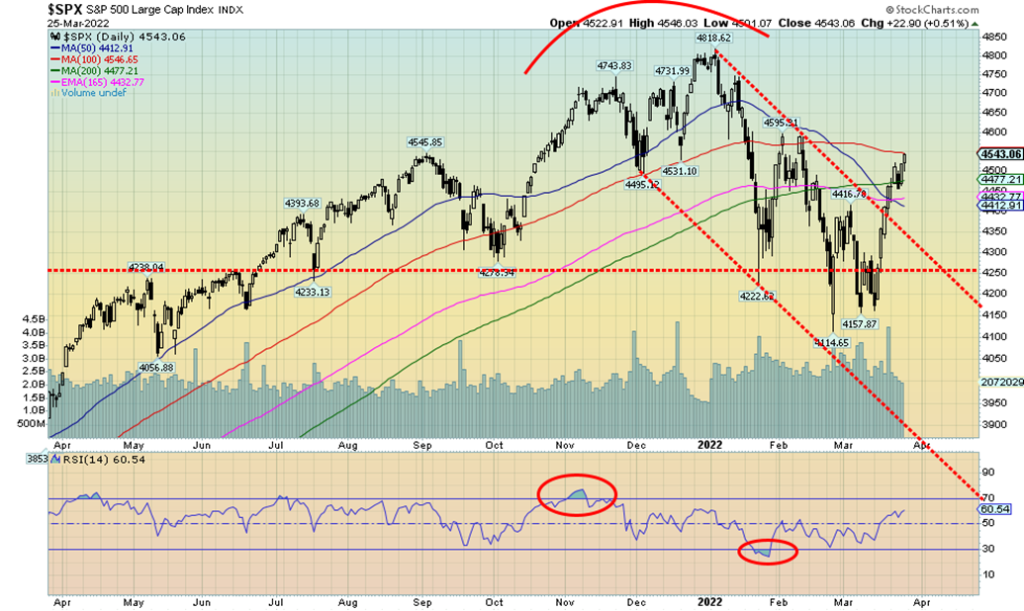

The S&P 500 has broken the downtrend from the early January high. It has cleared the 200-day MA and is now testing the 100-day MA. Note how the 50-day has crossed below, giving the classic golden cross MA signal. The Fed is now at roughly the Fibonacci 61.8% retracement level of the entire down move. A move back above 4,650 could suggest that new highs could be coming. Elliott Wave International (www.elliottwave.com) believes this is nothing more than a bear market rally. The rally so far is unfolding quickly, typical of bear market rallies. But it is one that could carry further and even see new highs. A classic sucker rally? Could this run into May? Quite possibly. But sucker rallies are what bear market rallies are all about.

We note that the market sentiment has quickly become quite bullish once again. The advance/decline line is rising but other internals are suggesting the rally is weak. The S&P 500 Bullish Percent Index is up to 69.2. It becomes overbought over 80. Some 60% of S&P 500 stocks are trading over their 50-day MA but only 24% are over their 200-day MA. That suggests that the rally is being led by a few. Note under our NASDAQ comment that the FAANGs appear to be once again leading the way. Buy those stocks and up goes the market. Value stocks are still in demand as Berkshire Hathaway, the penultimate value stock, was up 4.8% this past week to new all-time highs. Financial stocks have also been strong, but then rising interest rates are usually good for banks. The energy sector has been strong and this past week the U.S. announced a deal to send more gas to the EU.

All in all, that is helping push the markets higher. But, as we note, the key level to watch is 4,650, as above that level we could see new all-time highs. Or the zone could act as major resistance. Despite the strong rally, the S&P 500 RSI is only just over 60 so it has room to move higher. Most indicators are high but still have room to move higher. Our expectation is that this rebound should continue into April and possibly as well into May. But beyond that we wonder if the bear returns.

The NASDAQ had a good week, gaining almost 2.0% as many of the FAANGs also recorded a strong week. Meta (Facebook) gained 2.5%, Apple +6.5%, Amazon +2.2%, Google +3.5%, Microsoft +1.1%, Tesla +11.6%, Twitter +2.2%, Alibaba +4.4%, and Nvidia +4.8%. But there were a couple of losers as Netflix fell 1.8% and Baidu was down 1.7%. The NASDAQ has crawled over the down-sloping 50-day MA and appears headed for the 200-day MA near 14,700. More important as resistance and a potential target is that downtrend line from the highs currently near 15,100. If this is truly a B wave as we suspect, that zone could be a target before the NASDAQ runs into stiffer resistance.

The DJI gained 0.3% this past week but is now running into the 200-day MA resistance. We did draw a parallel line off the early January high to the lower channel line. That suggests we could see the DJI rise to around 35,250 before running into resistance. Note that the 50-day MA has crossed under the 100 and 200-day MAs— the classic golden cross, suggesting here that the trend of the market has turned down. Can the rally pull the 50-day MA back up? It will take much more of a rally and a longer one to fully turn the 50-day MA around. So, watch that one closely. Of course, the golden cross has also occurred for the S&P 500 and the NASDAQ but it will take a lot more to turn to the NASDAQ around. So, the DJI and as well the S&P 500 would be the ones to watch to see if the downtrend of the 50-day can be reversed with this rally.

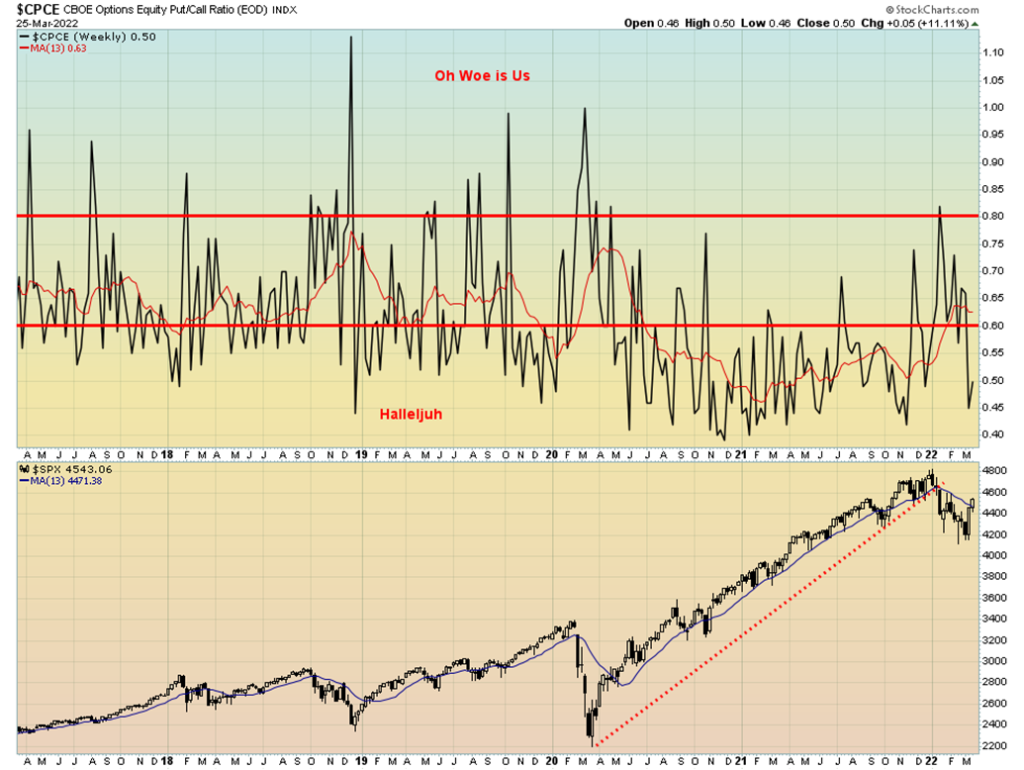

The All-Bears Index and the All-Bulls Index have fallen from their highs or are up from their lows as the stock markets continued to rally this past week. But the put/call ratio remains at 0.50, still well entrenched in bull territory. The put/call ratio as a measurement of sentiment is usually pretty good. We were concerned that at the recent lows the ratio could barely muster over 0.80 before falling once again into bull territory. The reality was that sentiment never became super bearish. A strong persistent reading over 0.80 is usually needed for the put/call ratio to suggest that a low might be seen in the stock market. Instead, here we are super bullish once again. Seems that rate hikes, wars, sanctions, and more do not impact the stock market.

The TSX Composite once again hit new all-time highs with a gain of 0.9%. The TSX is the only major North American index to do so. The small cap TSX Venture Exchange (CDNX) also enjoyed a good week, up 3.8%. The TSX is actually in the green for 2022, up 3.7%. All other major indices remain in the red. While the TSX Composite made new all-time highs, only one sub-index made a new high and that was Income Trusts (TCM), but in the end it was actually down on the week losing 1.1%. A reversal? Of the 14 sub-indices, half or seven were down on the week. Leading the way down was Information Technology (TKK), down 2.5%. Real Estate (TRE) lost 2.0%. But it was the winners that helped take the TSX to new highs. Health Care (THC) was the big winner, up 13.8%. More important because of its weight in the TSX was Energy (TEN), up 8.1%, just shy of new highs. Metals & Mining (TGM) gained 4.6%, Golds (TGD) were up 2.2%, and Materials jumped 2.3%. All of this was enough to help the TSX to a record high. In the end the TSX closed off that high as the high of the week touched the top of a possible top channel that could be forming an ascending wedge triangle. Ascending wedge triangles are bearish. The break point is not until under 21,600 so there is some room for the TSX to move higher in the wedge. Resistance can be seen up to 22,200. We’ll have to monitor this one going forward as the pattern now appears bearish despite the nice gains recorded. The breakout to new highs has ended all thoughts of a double or triple top.

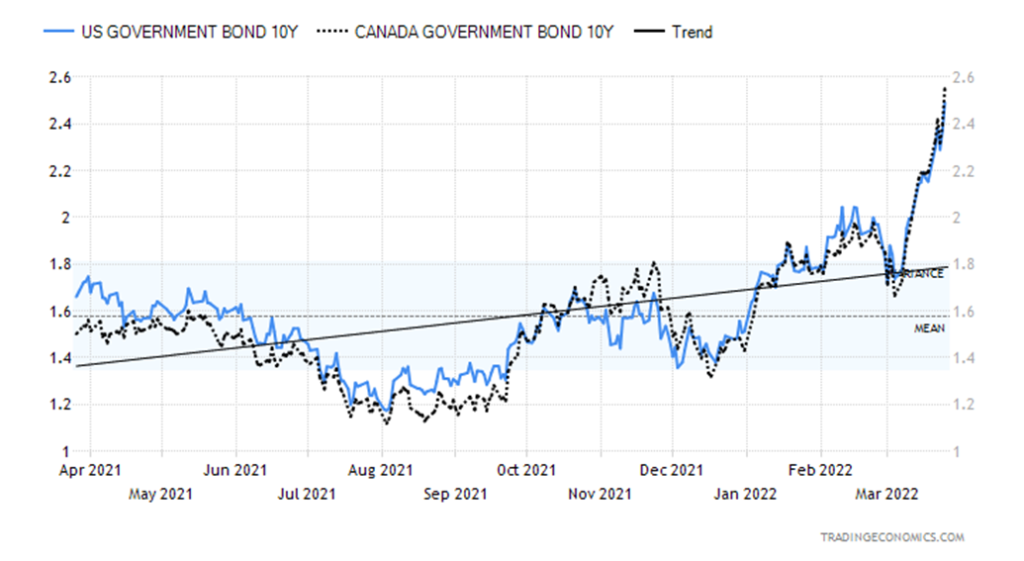

U.S. 10-year Treasury Bond/Canadian 10-year Government Bond (CGB)

With fears of the Fed hiking interest rates faster than expected and some economic data continuing to be stronger than expected, bond yields leaped this past week. The 10-year U.S. treasury note jumped to 2.48% from 2.15% the previous week. We outlined earlier how this is having a negative impact on bond funds with losses mounting as prices fall (prices move inversely to yields). Canada’s rates followed as the 10-year Government of Canada bond (CGB) jumped to 2.55% from 2.19%.

Some economic numbers came in stronger than expected. The Richmond Fed reported its manufacturing index was +13 vs. an expected negative 1 and the previous one recorded at 1. Initial jobless claims this past week were 187,000 vs. an expected 210,000 and the previous week’s 215,000. The Markit Composite Purchasing Managers Index (PMI) was 58.5 vs. an expected 55.4 and finally the Kansas Fed Manufacturing Index was 46 vs. an expected 25 and last month’s 31.

Not all numbers were rosy. The Michigan Consumer Sentiment Index final for March was 59.4 vs. 62.8 the previous month. Pending home sales fell 4.1% in February and down 5.4% y-o-y. New home sales were 772,000 vs. an expected 810,000 as they fell 2% in February after the market expected a 1.1% gain. Durable goods for February fell 2.2% below the expected decline of 0.5% and January’s gain of 1.6%. But the real catalyst for rising yields was the hawkish Fed and expectations that there were another six rate hikes in 2022, taking the Fed rate to 2.25%.

It is now hard to say how high rates will get as we are breaking downtrends that have been in place for years. A rise to 3% or higher now does not seem impossible. And that translates back to everything else—mortgages, car loans, etc. Could rising rates in the U.S. and Canada tip the housing market over? Quite possibly. But the stock market seems oblivious, at least for the moment, as it was rising this past week. There has been considerable outflow of funds from bond and money market funds and, oddly, it is winding up in the stock market as the buy the dip mentality takes hold. But the mentality also seems to be spooked by the Fed’s hawkish statements and the stronger than expected labour market. Next Friday, April 1 we will get the March jobs report. This is unusual as, while April 1 is the first Friday of the month, usually when it falls on the first, we would expect the report to be out on April 8. Nonetheless, the market is looking for a gain of 460,000–475,000 nonfarm jobs and an unemployment rate of 3.7%. The February nonfarm was 678,000 jobs and an unemployment rate of 3.8%. Canada won’t be reporting its job numbers until April 8.

With rates rising fast now, will some fear set into the market creating the bond debacle we outlined earlier?

Many bond followers cite the U.S. 10-year treasury note spread to the U.S. 2-year treasury note (aka the 2–10 spread) as the one to follow as a recession indicator. But others point to the U.S. 10-year treasury note spread to the U.S. 3-month treasury bill as being more important (aka the 3m–10 spread). So, which is it? We follow the 2–10 initially as it has had a tendency to turn negative ahead of the 3m–10. We find the 3m–10 tends to lag. Given that the Fed is just starting to hike interest rates, that hasn’t shown up yet with a sharply rising 3–month T-bill. Meanwhile, the 2-year has not only kept up with the rise of the 10-year but is rising faster, hence the narrowing of the spread. This chart here shows the 2–10 has fallen rapidly, currently to 18 bp. But the 3m–10 spread has gone up, not down, and is currently at 193 bp. Note how the 2–10 topped in 2003, a good year before the top in 3m–10 spread. The 2–10 spread then turned negative before the 3m–10 spread. Happened again in 2019/2020 although the two did tend to top together but the 2–10 turned negative ahead of the 3m–10. When the 3m–10 starts following, the decline could be rapid. We’ll continue to monitor both spreads.

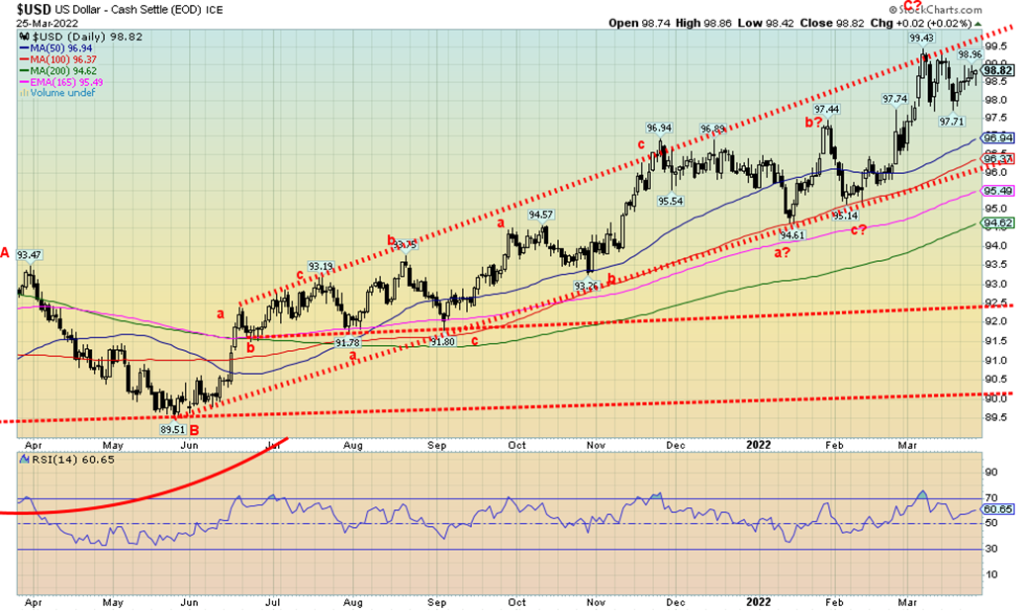

The US$ Index rose 0.6% this past week as the funds continued to flee the EU for the safety of either gold or the U.S. dollar. While bond yields are rising, the stock market has suddenly become the go-to place to park cash again. Gold is also rising. The euro fell 0.6% but the Swiss franc, which some also view as a safe haven, rose about 0.2%. The pound sterling was flat and the Japanese yen continued its recent down move, off 2.5% to fresh 52-week lows. Japan, being highly dependent on imported oil, is showing signs of falling into a recession. Is Japan a leading indicator for a recession? Canada with oil and probably about to sell more saw the Canadian dollar rise about 1.0%, closing over 80 cents for the first time since January 2022. The last good high was in June 2021 at 83.28.

The US$ Index continues to climb up the upper channel so we cannot rule out a run once again to new highs and even to 100. The top of the channel is now up around 100. Only a breakdown under the recent low at 97.71 could at least put on hold any thoughts of 100. Then we could see the US$ Index fall to around 97 or even down to 96.50. Below 96 the US$ Index could enter a down phase. While the U.S. dollar is benefitting from the conflict in Ukraine, it is facing challenges. Saudi Arabia could start selling its oil in yuan to China. Russia is demanding that unfriendly countries pay for their energy (oil and NG) in rubles rather than U.S. dollars. That would have the effect of increasing demand for rubles and help prop up the ruble. The trouble is how to buy them as they’d have to go to the Central Bank of Russia (CBR). And that could cross U.S. sanctions.

China’s currency is not fully convertible, so the reality is it is not a major challenge at this time to the U.S. dollar supremacy. They also have strict controls on money in and out of the country. The yuan is the world’s fifth most used currency for global transactions in the past year, behind the U.S. dollar, the euro, the pound sterling, and the Japanese yen.

We acknowledge the US$ Index could go higher from here but the moves continue to be corrective in nature. So we know when this ends we’ll start another down leg.

Despite the threat of not only higher interest rates but also the threat of interest rates rising faster than expected, gold managed to eke out a 1.3% gain this past week or about $25 to $1,954. So far, gold has made new highs in both euros and Japanese yen but no other major currency. Gold continues to have concern over the war in Ukraine. Gold acts as a safe haven in times of geopolitical and financial uncertainty. It also acts as a hedge against both inflation and deflation. Higher interest rates do spook gold as we saw when gold softened following hawkish comments from Fed Chair Jerome Powell over how quickly he might hike interest rates in 2022. Higher interest rates increase the cost of holding bullion. Besides gold rising this past week, silver was also up 2.1% but platinum softened, losing 2.7% and palladium continued its recent correction, off almost 4.0%. Copper prices also slipped by 0.8%.

Despite the gain this past week, gold did correct down from the recent spike high by about 9%. That shouldn’t be a concern as during the 2009–2011 run to new all-time highs gold had a few pullbacks of around 10% or more. Gold appears to be holding an uptrend line. The recent low of $1,895 acts as support as does the entire $1,900/$1920 zone. It is difficult to say as to whether this correction is over or whether there could be more downside first. Gold’s long-term support is around $1,820. A breakdown under that level would set up a test of the August low near $1,675. But $1,920 is the first line in the sand and below that $1,885. Under $1,885 a test of $1,820 could occur.

The most interesting story of the week was the West’s announced attempts to prevent Russia from utilizing its gold reserves. Russia’s foreign reserves have been effectively frozen to the extent that they are held with the Fed, the ECB, etc., but Russia’s gold is held in Russia and Russia also has substantial yuan reserves held with PBOC. China has shown no propensity to go along with Western sanctions. However, freezing foreign reserves puts all countries on notice as to whether your reserves are really yours. With the sanctions on gold, many countries that hold gold with the Fed and other central banks could get nervous and demand that their gold be repatriated. But does the Fed have the gold? When Germany asked for its gold back, the Fed said it would take seven years. Ultimately, it took four. But would the Fed even adhere to requests to repatriate other countries’ gold? That, given the current climate, is questionable.

While the West can put sanctions on Russian gold, Russia could easily have its gold sold in markets in Asia in small amounts. That gold can then be melted down and refined under the stamp of another country. China, who has been accumulating gold, would be a natural source for sales. As well, Russia can easily replenish its gold supply, given they are the world’s third largest producer behind China and Australia and hold the world’s second largest reserves of gold behind Australia. The CBR could purchase all gold produced in Russia and that would not be subject to sanctions. But the fact that they are attempting to sanction Russia’s gold could spark turmoil in the gold market. And that would be bullish for gold. Finally, as we noted Russia could demanding payment from unfriendly countries for Russia’s oil and gas. But if that didn’t work, could Russia demand payment in gold and silver? It could happen. The gold market would descend into chaos. There is simply not enough gold and silver.

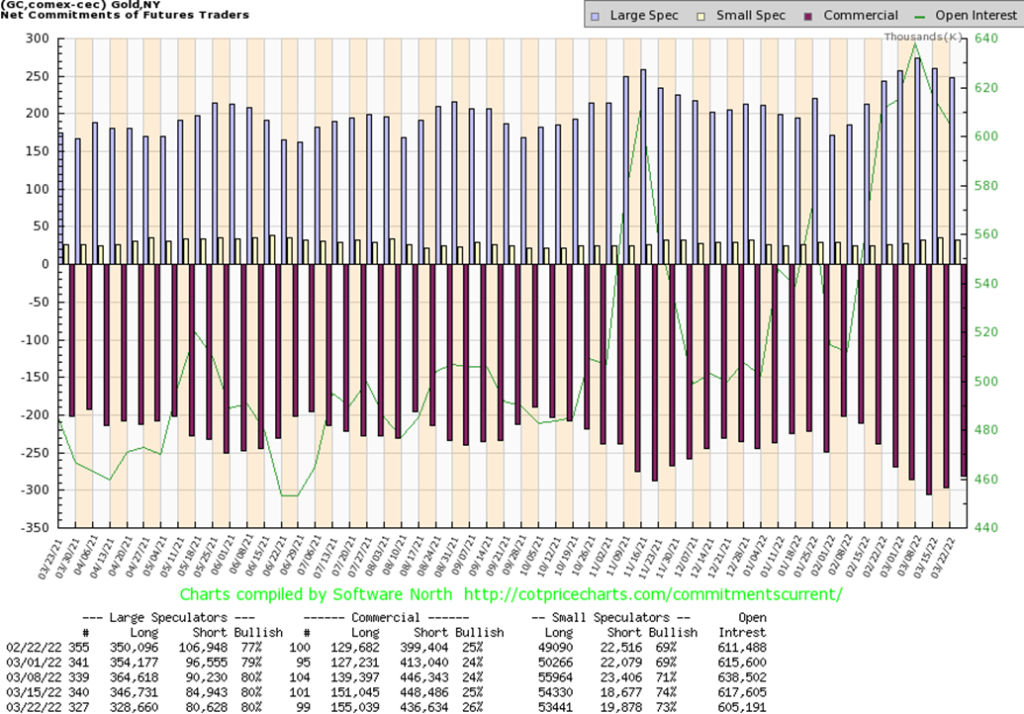

The gold commercial COT (bullion companies and banks) rose to 26% this past week from 25%. The improvement is welcomed. Long open interest rose about 4,000 contracts while short open interest fell about 12,000 contracts—the best combination. As to the large speculators (hedge funds, managed futures, etc.), their COT was steady at 80% but longs fell about 18,000 contracts even as shorts also fell down just over 4,000 contracts. Overall open interest fell by over 12,000 contracts. We are encouraged by the rise in the gold commercial COT but, overall, the week saw basically short covering as opposed to new longs.

Silver prices rose about 50 cents this past week or 2.1%. Silver is now up 9.7% on the year. Silver held its uptrend line with the low this week at $24.70. Silver’s recent spike took it to $27.50, so that level remains a target to be taken out. Silver broke out of a wedge triangle back in February. That breakout projects up to at least $31/$32. Many believe that over $30 silver has even higher potential. The high last February 2021 was $30.35. The top of the channel right now is up around $29. A move over $28.25 would suggest that new highs are probable. Meanwhile, silver needs to hold above $25 support and the uptrend line. The moving averages are turning up and MA followers can note the golden cross of the 50-day moving above both the 100 and 200-day MAs. The 100-day MA still lags behind the 200-day MA but is rising nicely now. The trend is up across all time frames. While $25 is important support, the drop-dead zone is a breakdown under $23.75. Under $22.85 new lows are probable. One thing we can’t help but notice is the huge premiums for silver coins. One-ounce Maple Leafs at SilverGoldBull (www.silvergoldbull.ca) are trading at a 38% premium to spot silver in Cdn$, although that drops if you were purchasing more in bulk. That tells us the demand is there and continues to support potentially higher prices for silver.

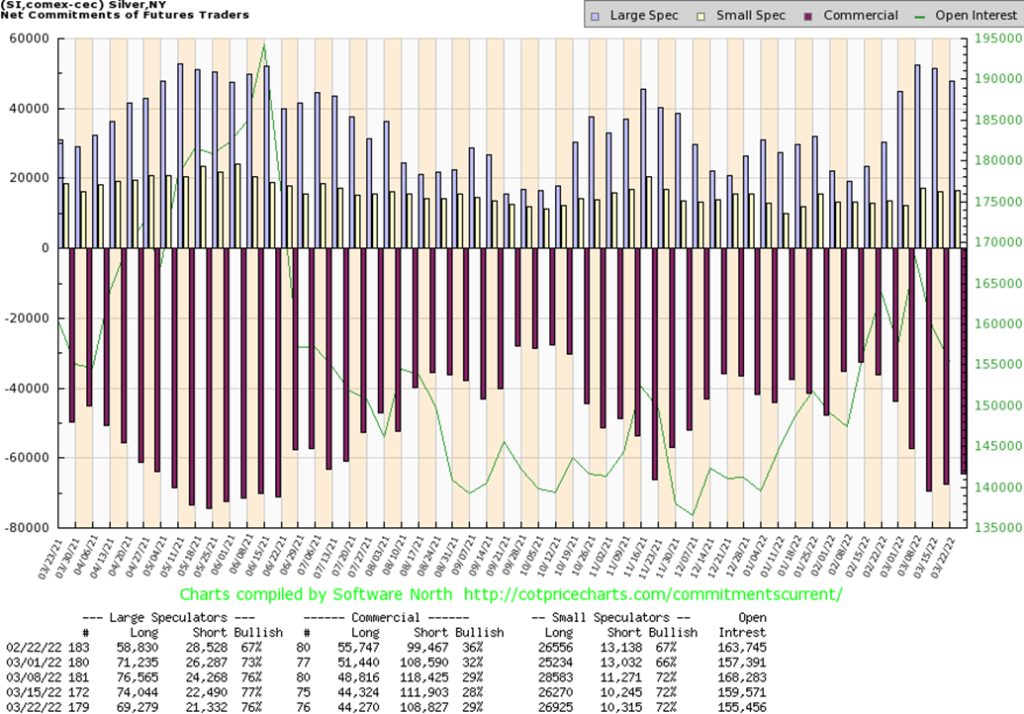

The silver commercial COT improved to 29% this past week from 28%. Long open interest was largely unchanged but short open interest fell about 3,000 contracts. Overall open interest contracted around 4,000 contracts, suggesting that much of the action again this past week was short covering. The large speculators COT slipped to 76% from 77% as they lost almost 5,000 longs but also 1,000 or so shorts. The improvement is welcome but, overall, this week’s silver was underwhelming, given that there were no new longs.

Both gold stock indices gained this past week with the TSX Gold Index (TGD) up 2.2% and the Gold Bugs Index (HUI) up 3.5%. However, for the TGD the recent 374 spike remains in place. The correction took the TGD down 10.7% from the spike high. So far, a fairly normal correction that fell in an abc corrective fashion. The question is, this just an upward correction to the recent decline or the start of a new up leg? A rise above 365 would suggest new highs ahead. But a decline now back through 340 could suggest new lows ahead. The uptrend line currently near 330 could be a draw. Whenever markets get too far from their 200-day MA a correction usually follows. At the recent high the TGD was almost 28% above its 200-day MA. Now it is only 18% above the key 200-day MA. The 200-day MA is just starting to turn up. The other key MAs have all crossed over to the upside, suggesting that we are embarked on a bull move to the upside. Targets should be at least 362 (recent high 358) or even up to 390. We have further potential targets up to 455 which would equal the 2011 high. The uptrend line appears to be around 330, so on any further pullback we’d prefer we hold that level. A drop under 330 would question the uptrend and minimum we’d look for a test of the 200-day MA near 295. The Gold Miners Bullish Percent Index (BPGDM) is still at 72.40 so there is plenty of room for that indicator to move higher. In 2016 the BPGDM hit 100 and more recently at the August 2020 high it also hit 100. Those are normally signals to at least take profits. The uptrend for the gold stock indices appears to be in place. Gold stocks remain cheap relative to gold. However, what we can’t say for sure yet is whether this recent pullback is over. As noted, a move above 365 would suggest new highs ahead. The trend is up, but the recent correction may not be over just yet.

Following a sharp pullback, oil prices resumed their upward trek this past week. With Russia threatening to end oil exports to Europe (or, as it states, unfriendly countries pay in rubles), a storm knocking out an important oil export facility in Kazakhstan, a Saudi oil terminal on fire following an attack suspected from the Yemeni Houthis, and the Iranian nuclear deal seemingly further away, oil prices had only one way to go and that was up. By the end of the week, WTI oil had jumped 10.5% to about $114, Brent was up 11.7% over $117, while natural gas (NG) had a big jump, up 15.4% to $5.61. The energy indices also had a good up week with the ARCA Oil & Gas Index (XOI) hitting fresh 52-week highs, up 7.7% and the TSX Energy Index (TEN) just missing 52-week highs, up 8.1%.

The question now is, will oil prices now hit new highs above $130? Many expect that to happen. Oh yes, deals are being cut to expand Canada’s oil exports to the U.S. and a new LNG deal between the U.S. and Europe will help, but they are not immediate and Europe still lacks LNG facilities as new ones have to be built. Finding new supplies is not something that happens overnight. Russia’s demands that Gazprom’s long-term gas contracts be converted to rubles are also sparking concern. As we noted under the U.S. dollar commentary, that can only be accomplished by the EU purchasing rubles and selling U.S. dollars. Meanwhile, countries not really caring about Western sanctions continue to buy Russian oil, often at a discount.

The oil market is becoming somewhat unpredictable. It is difficult to say from this chart whether we’ll see new highs above $130 or not. Certainly, if we do, then in theory we could project up to around $165. If that happens, if you think gas at the pump is expensive now, wait until oil prices reach those levels. Meanwhile, NG has broken out of what appears as a large symmetrical triangle and now projects up to $8/$8.50. That would still, however, only be about half of the price NG reached in late 2005.

If WTI oil were to break down under $97 and under the recent low of $93.53, a fall back to around $80 would be in sight. A reminder, however, that even if the war in Ukraine ended tomorrow, the sanctions would remain in place. Once sanctions are put on, they never seem to come off. And that in turn would help keep oil prices high for an extended period of time.

__

(Featured image by Elchinator via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.

-

Impact Investing4 days ago

Impact Investing4 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech2 weeks ago

Biotech2 weeks agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business1 day ago

Business1 day agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech1 week ago

Fintech1 week agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich