Business

The TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [Everygame Affiliates Review]

Ever seen the billions being bet on Polymarket and its ilk and asked yourself, “How can I tap into that as an affiliate marketer?” Me too! Lucky for us, this week we’ll be looking at how you can take advantage of all the action. But there’s a twist: the affiliate program you’ll need to monetize is none other than the one and only Everygame Affiliates. Curious how? Then read on.

Quick Disclosure: We’re about to tell you how Everygame Affiliates is pretty great. And we really mean it. Just know that if you click on an Everygame Affiliates link, we may earn a small commission. Your choice.

When you think about it, affiliate marketing is a lot like dating.

If you wanna make a conversion, then you’re probably gonna need a few good lines that persuade.

But there is a key difference.

In affiliate marketing, you actually want a third wheel by your side.

And yeah, by third wheel, I actually mean affiliate program.

Let me introduce you to a good one.

TopRanked.io Affiliate Program of the Week — Everygame Affiliates Review

Another week, another top pick from the TopRanked.io affiliate program directory.

This week, it’s Everygame Affiliates.

And with good reason.

Let me explain.

Everygame Affiliates — The Product

Simply put, when you signup with Everygame Affiliates, you’ll be signing up to promote a sportsbook (plus casino and poker).

But there’s one thing that immediately makes Everygame affiliates stand out as “not just another sportsbook” — they’re running the oldest online sportsbook on the market.

Yep, founded in 1996, Everygame is more or less a dinosaur. And that’s a good thing.

How so?

Well, do you think any online business can survive the better part of 30 years if it’s not up to par?

In other words, that’s already one big vote of confidence for the product behind the Everygame Affiliates program.

So what else have Everygame Affiliates got on the product front?

Well, here’s a few highlights you can use to help you promote with Everygame Affiliates:

- Heaps of timely promotions to help push some traffic through your Everygame Affiliates links (right now there are 4 March Madness related promos)

- Heaps of deposit options (including crypto)

- As the Everygame Affiliates name might imply, you get to promote a sportsbook that covers pretty much everything.

- And did we mention how long Everygame has been around and how much that says about the quality of the company?

Anyway, that’s hopefully enough to give you an idea of the product behind Everygame Affiliates. Let’s get onto the good part.

Everygame Affilaites — The Commissions

Like most good sportsbooks and casinos, Everygame Affiliates will set you up on a rev share plan as the default.

As for the rates, here’s why they look like with Everygame Affiliates.

| Revenue Tier | Commissions |

| $1-20,000 | 20% |

| $20,001-30,000 | 25% |

| $30,001-40,000 | 30% |

| $40,001+ | 35% |

All pretty solid if you ask me.

But here’s the kicker — Everygame Affiliates pays rev share for life. So if you manage to nab a few conversions who stick around, then you just earned yourself a solid passive income.

Everygame Affiliates — Next Steps

That should hopefully be enough to give you a quick idea of who Everygame Affiliates are and why you might wanna sign up.

If you want a bit more information, then head on over to TopRanked.io for our full Everygame Affiliates Program Review.

Or, if you know a good thing when you see it, the head here to sign up with Everygame Affiliates today.

Affiliate News Takeaways

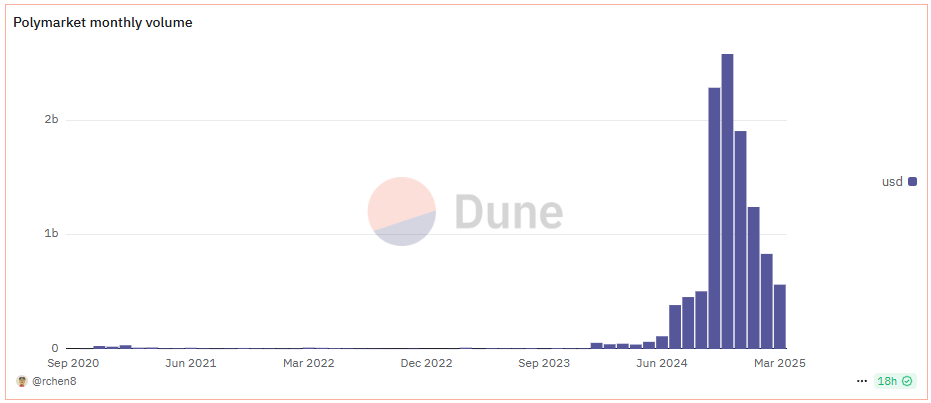

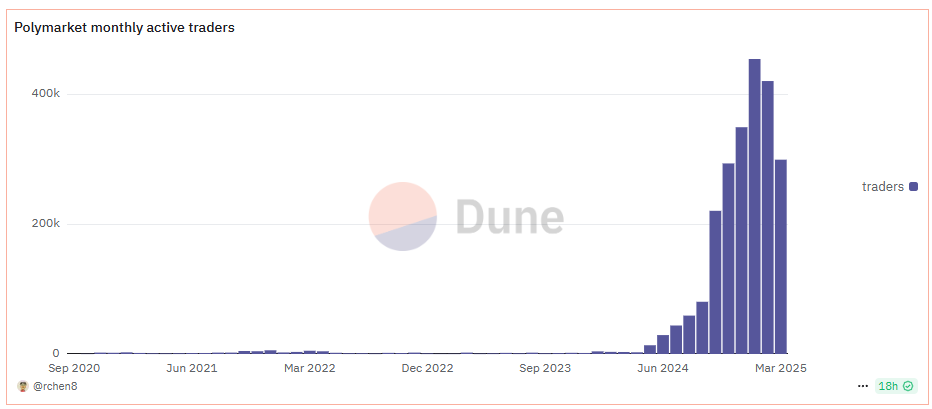

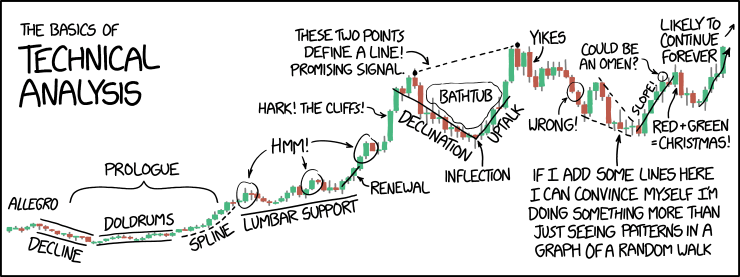

This week, I want to kick off the news with a couple of charts.

So here’s chart #1.

And now for chart #2.

And for our regular readers who are used to me front-loading the news section with memes… well, here ya go.

Anyways, back to the charts, which I stole from here.

For those who can’t read the titles, those are charts of the monthly volume and the number of active traders on Polymarket.

Don’t know what Polymarket is?

tl;dr — it’s a crypto “prediction market” where you can buy YES or NO “shares” on an outcome.

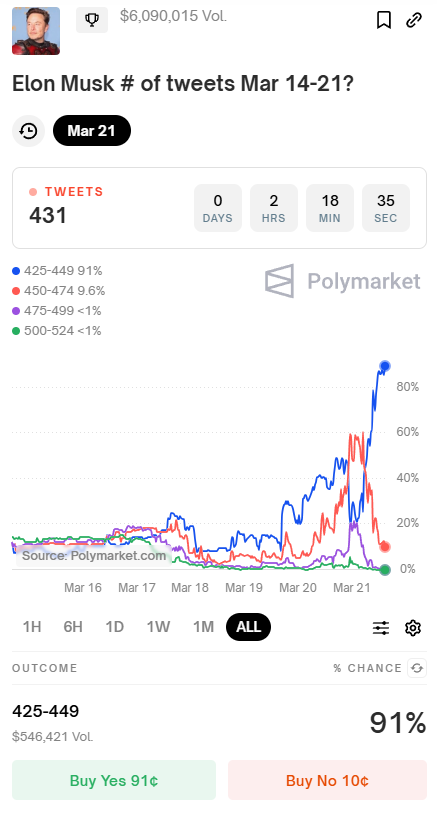

Here’s an example, here’s one where you can bet on the number of times Elon will tweet this week.

So now we all know what Polymarket is — a “prediction market” — let’s turn our focus back to the charts… again.

[PS: Pay attention to this “prediction market” term — you’re gonna be seeing it a bit.]

Notice how there’s been a massive spike in the number of traders, and total volume compared to where things were in early 2024?

A spike that’s sustained itself well beyond the pre-November surge that was brought on by election betting?

Think that spike might mean something?

Good — you’re not alone.

The entire iGaming and sports betting industry seems to think so, too.

Apparently it was all the rage during last week’s Next.io event in New York. (Well, that and a bunch of other stuff… but I’m not covering it here, but you can go read this article if you really want to know.)

And when I say it was all the rage, I mean that kinda literally — if reports are to be believed, there are some “tensions between the big betting companies and disrupters” like Polymarket.

And I guess you can see why. As of today, Polymarket’s pulled in over half a billion big bucks in volume for March… and the month’s still not over.

Oh, and don’t think Polymarket’s the only one getting in on the action. There’s plenty of others, like Kalshi, Manifold Markets… and even Robinhood, which just launched its own Prediction Market Hub this week… just in time for March Madness.

So why aren’t traditional sportsbooks getting in on the action?

Well, they want to… but it’s complicated.

Presumably, a few don’t wanna rub regulators up the wrong way. After all, if they’ve got a licence to operate in a state, do they really wanna risk losing that licence?

Probably not.

And there are more than a few states who’ve been hostile to prediction markets. Just last week, Nevada’s Gaming Control Board sent a cease and desist letter to Kalshi.

So there’s that which probably has a few playing it safe for now.

Oh, and speaking of sage, here’s another unrelated meme.

Anyway, back on topic.

Another problem is the lack of “legal clarity” at the federal level for now.

Fortunately, that may well come — the CFTC announced it was going to hold a roundtable sometime soon. And there, things are looking positive on the prediction markets front.

Or, at least, things are looking positive if Acting Chairman, Caroline D. Pham, is any indication. In the CFTC’s press release, she said:

“Prediction markets are an important new frontier in harnessing the power of markets to assess sentiment to determine probabilities that can bring truth to the Information Age. The CFTC must break with its past hostility to innovation and take a forward-looking approach to the possibilities of the future.”

Tl;dr, she pretty much just said she’s all for prediction markets.

Oh, and also, can we all just take a moment to LOL at the fact she just said “Information Age”!?!?! I mean, is she still living in the 90s?

Anyway, back on topic — prediction markets.

By now, we should all be on the same page about how prediction markets are the next big thing. That’s all pretty clear.

What might be less clear is exactly what any of this has to do with affiliate marketing. After all, it’s not like there’s any affiliate programs out there for any of these predictions markets.

Well, with Robinhood joining the fray, maybe there’s that. But with a $20 CPA commission plan (for a funded account), I’d argue that it’s hardly worth your time.

Especially when Everygame Affiliates will pay you 35% rev share. (PS: In case you hate math, at 35% rev share, your Everygame Affiliates referrals will only need to generate about $57 in revenue to earn you your first $20.)

So where’s the affiliate play come into it then?

Well, I think there might be a few opportunities here to spin the popularity of prediction markets in different ways.

Now, at this point, there isn’t much in the way of ‘concrete’ studies done on what’s made prediction markets so popular.

But, I think we can make a few assumptions that are reasonably safe. So let’s start with a big one — crypto.

Unsurprisingly, all of these young upstart prediction markets are all crypto-based.

Now, this may all just be coincidental, but take a look at the price (and volume) of Bitcoin over the last 12 months.

Notice how those ‘curves’ look eerily similar to those from the Polymarket charts we kicked this whole thing off with? (Remember, the Polymarket charts are since 2020, so you’ll have to ‘adjust’ the way you view the time scales.)

Obviously, like I already said, this could all just be a coincidence. But it’s probably worth paying attention to seeing as there does seem to be a correlation between the two.

So, what else do we have?

Well, there was a reason I used the number of times Elon tweets as an example of a “prediction market” way back at the beginning. Quite simply, there’s way more markets available beyond the usual suspects you’ll see at a regular sportsbook. So maybe that’s something…

And finally, we’ve got another element which I think is hard to ignore — there’s the ‘financialization’ aspect.

Now, here, I suspect, there are two elements.

For one, there’s probably a small handful of people who’re using prediction markets as legitimate financial instruments. You know, like maybe you bet “No” on Trump winning the election as a hedge against the Bitcoin bets you’d made.

But then, and more importantly for us, I think there’s also what I’ll call the ‘degen in disguise’ element.

That is, there are people who like the idea of dressing up regular degen betting with a ‘financy’ element. I mean, what could be more ‘financy’ than buying and selling “shares” in an outcome?

You can even draw pretty lines on the chart to make it look like you know what you’re doing.

And it’s this last element where I think there might be a big opportunity for affiliates.

Takeaway

Now, I might have pointed to technical analysis as an example of adding a ‘financy’ edge to sports betting.

But that’s not where I think the money for affiliates is. Again, you don’t have many affiliate programs in this space yet, so probably better to avoid doing pure prediction markets promos for now.

For now, just understand that when I say ‘financy’, I’m basically just referring to any sort of “analysis” that makes people think they’re beating the odds.

Let me give you an example… but first, there’s one other thing you need to know about prediction markets that I haven’t covered yet.

That thing is the fact that people think they’re some sort of arbiter of truth. That is, people have great faith in the ability of prediction markets to accurately predict uncertain outcomes.

Heck, there’s even some nutter form the Tony Blair Institute for Global Change who thinks prediction markets should be how we make democratic decisions…

…yeah, can’t see how replacing the current system with a market that’s easily manipulated by whoever has the most money changes anything…

But anyway, point is, people have great faith in prediction markets.

And so now we get on with the example.

Because people have faith in prediction markets, you can use these to compare odds and find “sure”/”value”/”arbitrage” bets at sportsbooks.

How so?

Well, let’s imagine there’s a prediction market on Polymarket where one outcome is currently at 70% probability (which is equivalent to decimal odds of 1.43).

Now imagine the Everygame sportsbook is also offering decimal odds of 2.20 on the same outcome.

Guess what!?

You just found an excellent way to encourage people to click on your Everygame Affiliates link. I mean, who doesn’t want to bet on a reasonably “sure” thing that’s got probability-beating odds?

And then, you can also play the ‘arbitrage’ game here.

Let’s go back to our last Polymarket prediction market — the other side of that prediction would be 30% (which is equivalent to decimal odds of 3.33).

Hey, looks like an arbitrage opportunity to me — 3.33 on one side, and 2.20 on the other side — which is another great way to push a few Everygame Affiliates links on people.

Now, so far, this is all simple, tried-and-tested sports betting kinda stuff.

But you can also start doing a few new and creative things here. Like maybe you start using more financy type words like “leading indicator”.

In this instance, the “leading indicator” is the predictions market — “hey look, predictions market just went from 50% to 80% — click my Everygame Affiliates link to bet on this at 2.00 odds… but get in quick before the odds catch up.”

You kinda get the point.

Oh, and one other thing — notice how I’ve used Everygame Affiliates all throughout these examples?

There’s a good reason why — with Everygame Affiliates, you can also promote a “crypto” sportsbook (they accept crypto deposits). And that might be kinda important for anyone interested in prediction markets.

Closing Thought

This week, another closing thought courtesy of James Clear — the author of Atomic Habits.

This time, I’m stealing it from his 3-2-1 newsletter, which is probably tied for first place as one of my favorite newsletters. The other #1 would have to be Kronikl, the smartest history newsletter ever.

Anyway, here’s the quote:

“The way to help someone is not to critique what makes them smaller, but to encourage what makes them larger.”

Now, don’t get me wrong here.

I’m not about to start preaching about how you should do good to your fellow man. I’m way too self-centered for that.

What I want to do instead is flip this quote on its head a little bit. So here goes:

“The way to help yourself is not to focus on your weaknesses, but to work on what will make you stronger.”

Makes sense?

No? You want a concrete example?

Alright, here’s one.

As an affiliate, you’re nothing without an affiliate program. So there’s something that makes you stronger, I guess… so let’s work on that for a minute.

How so?

Well, ask yourself this question — are your current affiliate programs making you as strong as you could be, or is there room for improvement?

Chances are, unless you’ve already signed up for Everygame Affiliates, there’s room for improvement. 😉

__

(Featured image by SevenStorm JUHASZIMRUS via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Business1 week ago

Business1 week ago2.5 Billion People Watch Quiz Shows Every Day. Masters of Trivia (MOT) Is Letting Them Compete

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Crypto3 days ago

Crypto3 days agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip