Business

Ukraine’s rapeseed exports may hit a 4-year high

Known to many as canola oil, rapeseed oil has been found as the new and healthier standard, compared to olive oil, in the annex of gourmet cuisine.

Rapeseed is now becoming once again a topical subject for the oilseed sector of agriculture. Remarkably, this involves not only forecasts for the next season 2018/19, but also expectations about the results of the current marketing year. Seemingly, the most active part of MY 2017/18 for the rapeseed market is already over, and its final results can be stated with high probability. But the current season’s trends make us adjust the supply and demand balance for this oilseed.

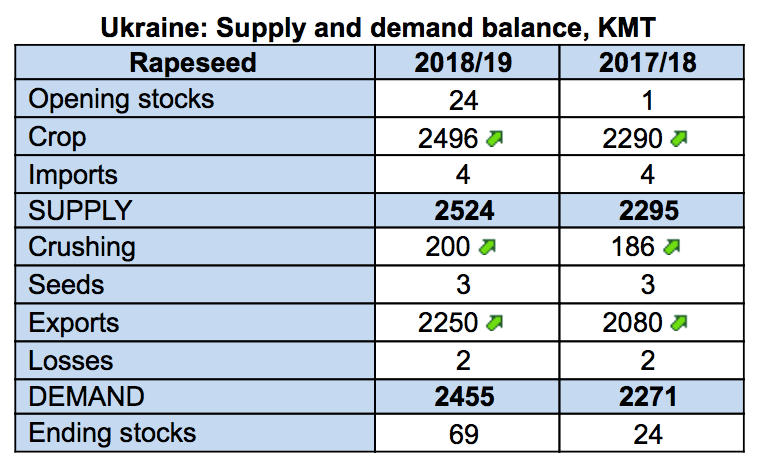

First of all, the changes concern the 2017 rapeseed crop estimate: UkrAgroConsult is raising it to 2290 KMT. This prompts us to increasingly often think of the reliability of official estimates and growers’ withdrawal into the shadows — this time in the rapeseed segment as well.

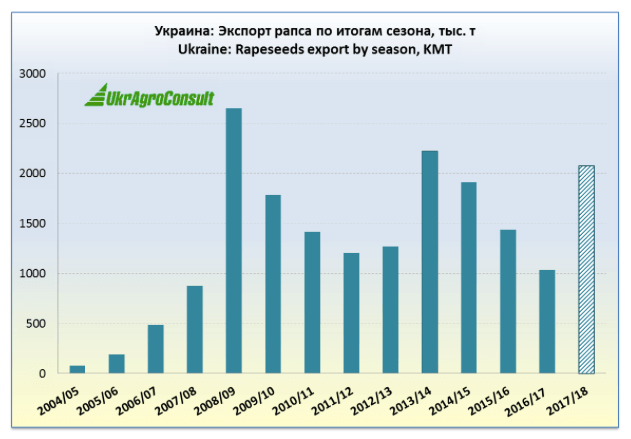

The brisk pace of rapeseed exports seen in the first half of MY 2017/18 (almost 2 MMT in July-December) suggests that Ukraine will ship abroad a total 2080 KMT this season (up 1045 KMT from MY 2016/17). So, it is going to hit a four-year high.

© UkrAgroConsult

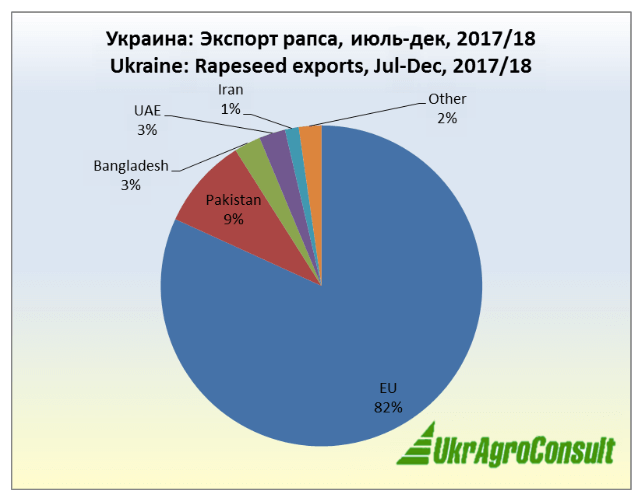

We cannot but dwell on the range of rapeseed export destinations. So, the existing end markets grow in size along with a rising number of trade partners within the EU, which absorbed 82 percent of total exports (1626.6 KMT against 847.5 KMT a year ago).

In addition, Pakistan resumed rapeseed purchases from Ukraine and currently accounts for 9 percent of its total exports with some 183 KMT imported. Bangladesh, a traditional buyer, steps up its purchases (53.2 KMT against 19.8 KMT a year ago). It is worth noting that Ukraine took over the positions of the world’s top rapeseed exporter, Canada, in the EU and Pakistani markets.

© UkrAgroConsult

As a reminder, this year crushers more actively compete with traders for rapeseed in the domestic market than a year ago. They have increased raw material stocks substantially against 2016/17 (up 78 percent as of Nov. 1, 2017) and crushing to 186 KMT against 165 KMT a year ago. At the same time, oil extractors will nevertheless process a smaller portion of the total rapeseed crop than in the previous season (down at 8.1 percent) because of strong demand from global importers and attractive export prices.

At the moment, the prospects for the next season 2018/19 look quite optimistic in view of a large area seeded to winter rape (over 1 Ml ha) and the current meteorological situation (UkrAgroConsult is cutting the winter loss rate to 9.4 percent). The rapeseed crop forecast for 2018 has been increased to 2496 KMT, leading to gains both in exports (to 2250 KMT) and crushing (to 200 KMT).

Although the prospective cancellation of oilseed export VAT refunds from 2020 will allow the 2018/19 season to pass in a “routine mode”, it will force the sector to start adapting and restructuring as soon as the next marketing year.

© UkrAgroConsult

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing6 days ago

Impact Investing6 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech2 weeks ago

Biotech2 weeks agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business4 days ago

Business4 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech2 weeks ago

Fintech2 weeks agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

You must be logged in to post a comment Login