Business

US-Iraq rice negotiations stall, China increases palm oil import

World prices were lower last week, but US prices remain as cheap or cheaper than other origins in the world market.

Latest news in the commodities market: Demand for ethanol production remains strong, US-Iraq rice negotiations stall, China increases palm oil import.

Wheat

US markets were lower last week as the weather did show some improvement in the central and southern Great Plains. The Hard Red Winter futures market in Chicago suffered the biggest losses due to the weather and forecasts for this week. Rains were reported in eastern sections, but western areas remained mostly dry. It is the western part of the Great Plains where the biggest drought patterns exist. The area of most concern runs from the Texas Panhandle north into western Kansas and eastern Colorado. These areas have chances for some precipitation this week. The rains are needed as the crop is well out of dormancy and trying to grow. It has almost no moisture to work with right now. Demand for US Wheat, and especially higher protein Wheat remains strong. World prices were lower last week, but US prices remain as cheap or cheaper than other origins in the world market. Minneapolis futures held better last week after being the weaker market for a month or so. However, it was also lower and faded from resistance on the weekly charts. The weekly charts show that futures rejected a chance to start a new leg higher. Moving higher now would indicate potential for a move to and perhaps well above $5.00 per bushel basis the nearest Chicago SRW futures contract. Minneapolis could move back to the highs just under $6.00 per bushel for 2017 and also display the chance to move to new highs for the calendar year. Chicago HRW charts show that the market is still working on a potential bull flag formation. HRW futures show the weakest chart patterns right now.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

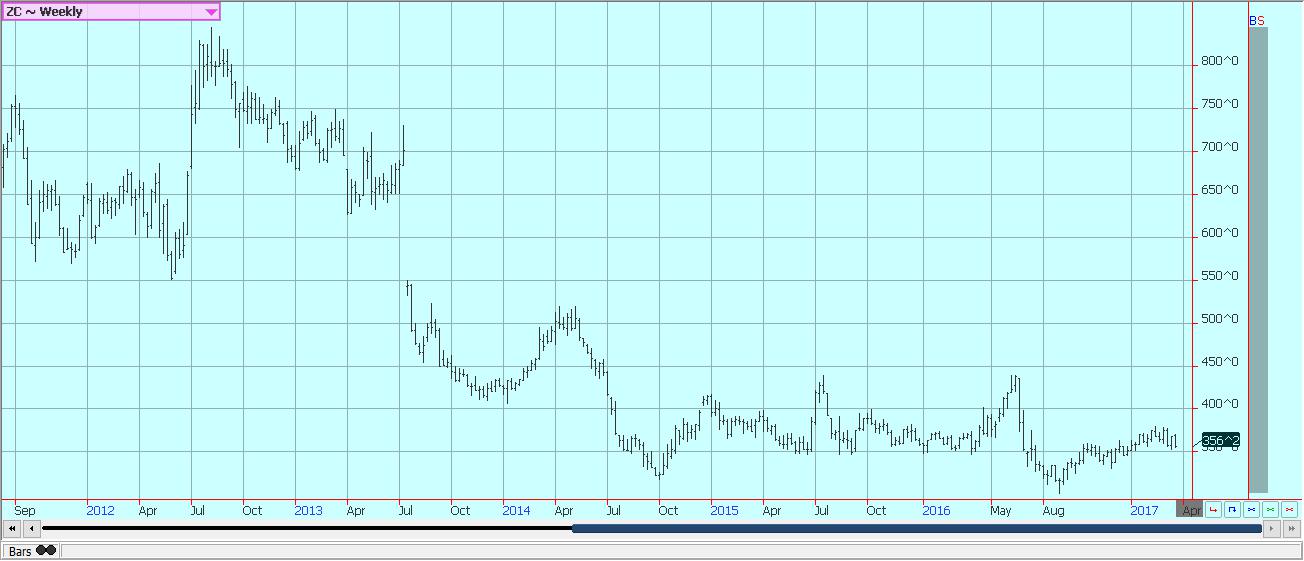

Corn was lower last week as traders remained more concerned about the potential for stronger competition in the world market from South America and the big supplies here. US demand is actually good and the weekly export sales reports have been strong. Production forecasts for South America have been high and have trended higher. Brazil will need to replenish its own supplies first, and that might take a while. There are ideas that Brazil will not be able to offer corn in the world market until late in the Summer. That should keep US sales strong for several more months. Demand for ethanol production remains strong as well. The major weakness in demand for the marketing year has been from the feed side of the market, and the trade will have new indications on the size of the demand from this sector when the quarterly stocks reports are released on Friday. Planting has been reported in areas near the Gulf Coast, and fieldwork remains active in areas to the south of interstate 80. It remains very early in the new crop year, but producers in many areas have been able to get a lot of the preparation done. Forecast indications for the next three months are for generally warmer than normal temperatures and no tendency for precipitation above or below normal for the next three months. USDA will issue its annual plantings intentions reports on Friday and the trade expects Corn planted area to drop by perhaps 4.0 million acres.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

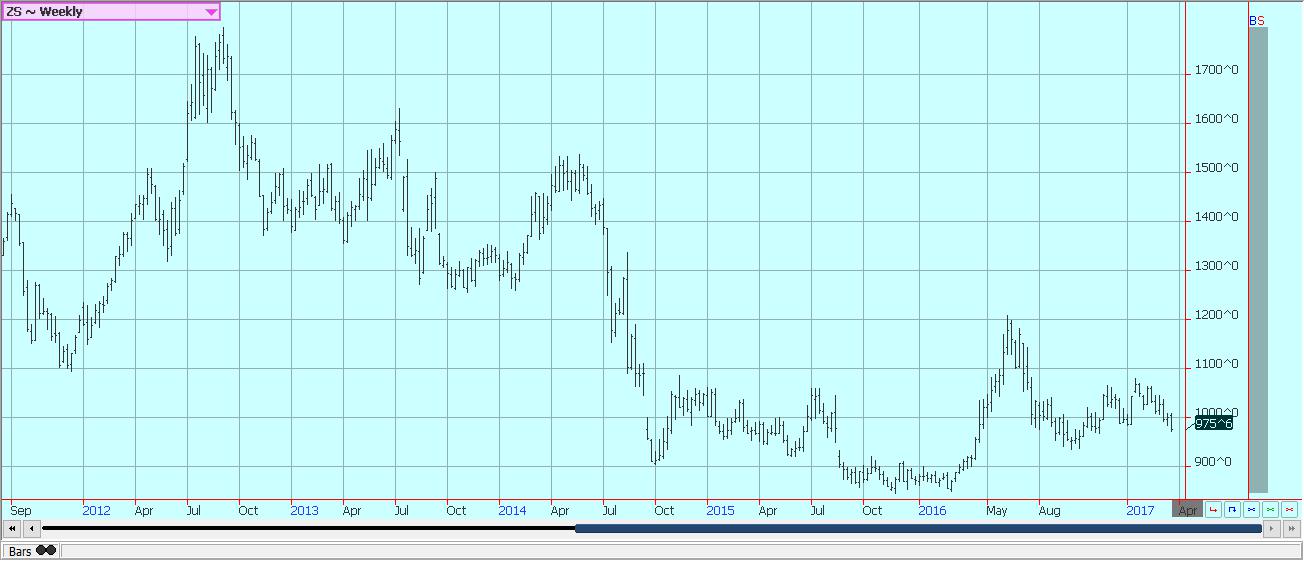

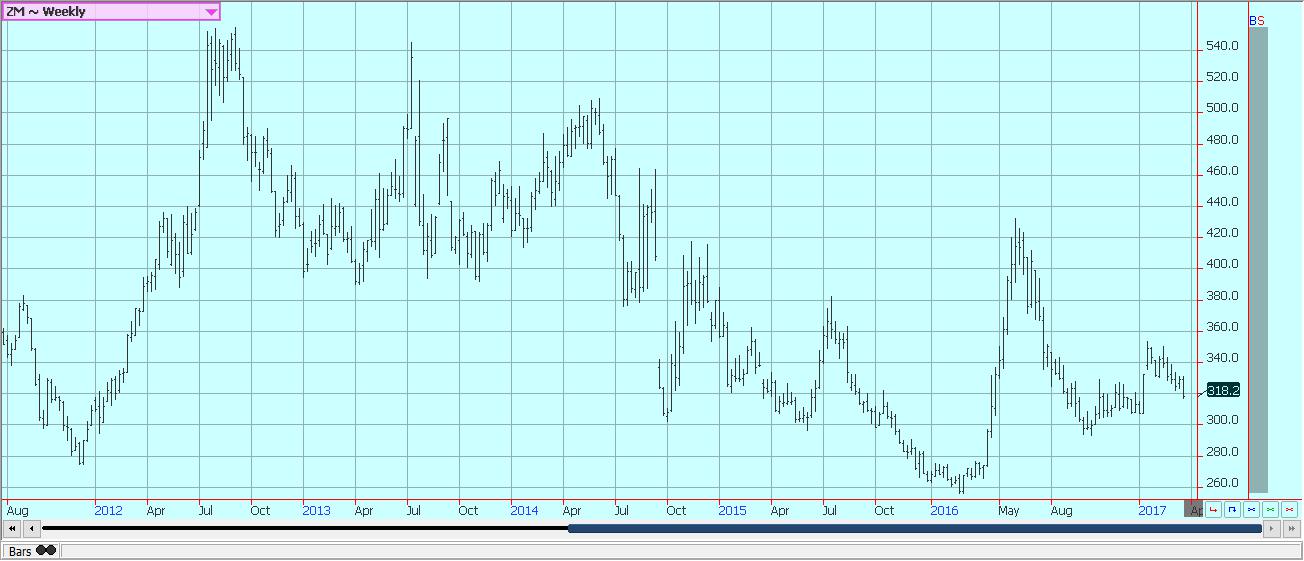

Soybeans and soybean meal

Soybeans and Soybean Meal were lower last week as the potential for sales in the world market from South America increased. South America is in the market, but US prices are still competitive. US sales are less than seen several months ago but have been holding together relatively well. The Real remains relatively strong against the US Dollar, and this has inhibited selling from producers. The harvest is moving ahead with speed. The country is now almost two-thirds harvested and offers will need to increase soon as storage fills up. Production ideas are very high with many in the trade anticipating production up to 109 million tons in Brazil. Argentina is also harvesting, and production ideas there are strong and are getting stronger. The Bolsa de Buenos Aires said last week that it expects production to be close to 56.5 million tons. That is near original expectations for production and means that the flooding did only minimal damage. The weekly charts show that futures are moving through some important support areas and that a downtrend could be underway once again. Weaker markets overall are still anticipated for the Soy complex due to the potential large offer from South America and the potential for very strong production this Summer here in the US. USDA will issue its quarterly stocks report and plantings intentions report on Friday. Planted area could increase by 4.0 million acres this year.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Futures closed lower and faded from resistance areas on the weekly charts. The weekly charts still show a range trade and the charts also suggest that the market is forming a longer term bottom. The US cash market is still reported to be slow, but the trade is awaiting news on negotiations to sell Iraq up to 100,000 tons of US long grain milled Rice. The trade has been waiting for several weeks now and so far there has been no news. However, there are widespread expectations that Iraq needs to buy the Rice. It would be a big shot in the arm for the Rice market if the deal got done. Some paddy Rice continues to move in local cash markets. The most trade appears to be in Louisiana at this time. Farmers, there are planting, and some isolated planting has been reported in Texas. Most of the rest of the US area will not get planted until next month. Lower planted area is still anticipated as more producers look at alternatives such as Cotton or Soybeans. China imported about 209,511 tons of Rice in February, up about 19% from last year. Vietnam, Thailand, Cambodia, Myanmar, and Pakistan were the biggest sellers. Futures trading volumes are still slow, but the market acts prepared to go higher. The current market still has no real strong fundamental to drive prices higher, but the overall situation appears to be changing and prices in futures markets could start to anticipate a different environment as trading moves into the Spring and Summer. If so, good buying support should be seen on any short term moves lower.

Weekly Chicago Rice Futures © Jack Scoville

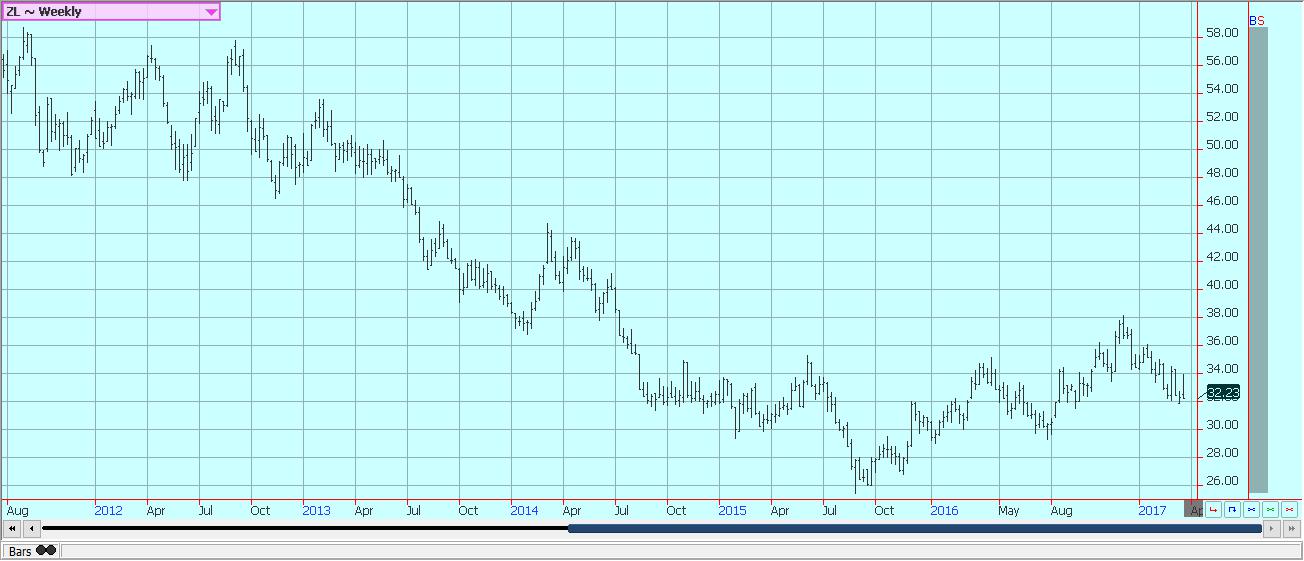

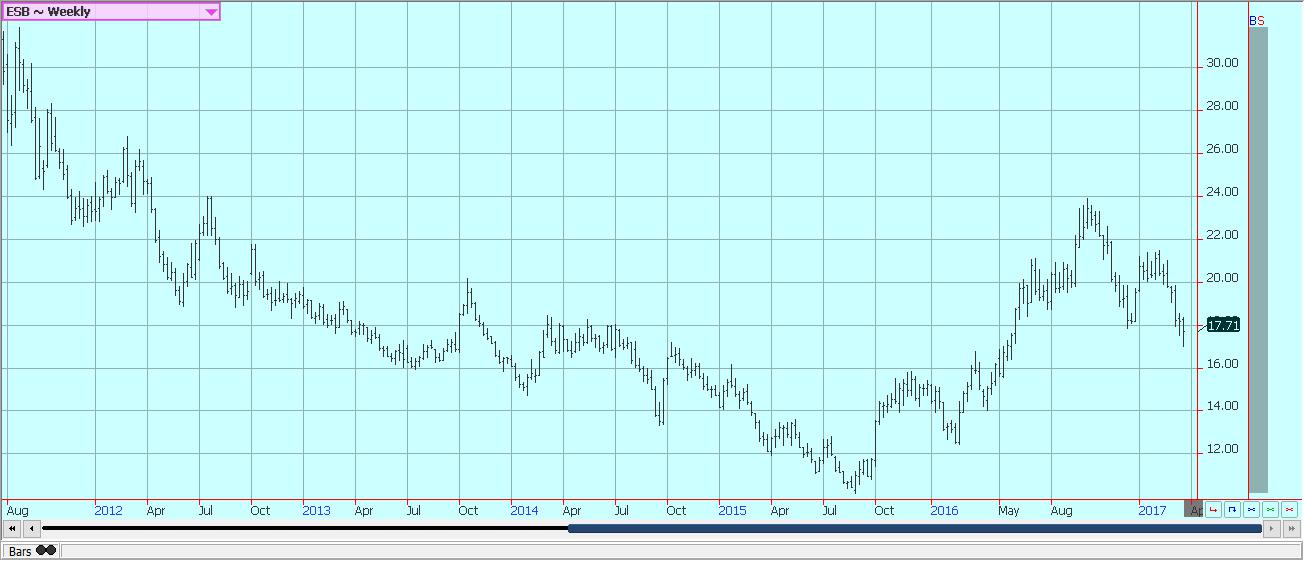

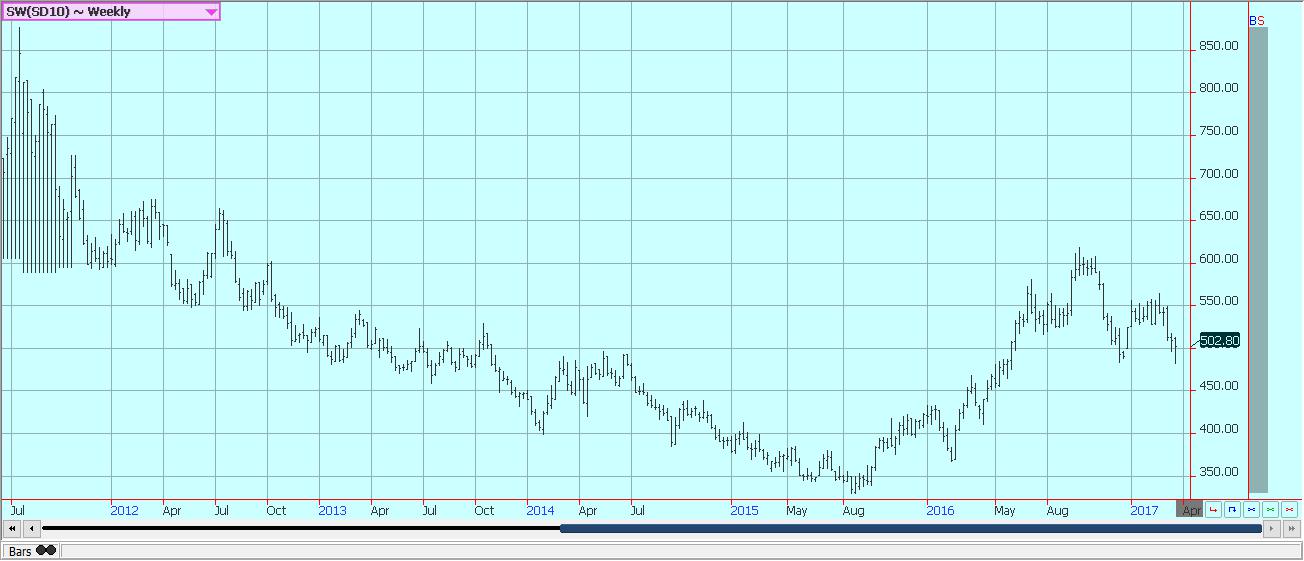

Palm oil and vegetable oils

World vegetable oils markets were lower last week on ideas that world production was about to increase. Palm Oil production is likely to increase in the short term as trees start to produce more as they recover from the El Nino drought of last year. There are some anecdotal reports that the production in Malaysia is not recovering at as fast a rate as the market had anticipated. However, demand has not been real strong, either. Ideas are that inventories are increasing. The Indonesia Palm Oil authority showed bigger stocks in a report it issued last week. the report showed that stocks in Indonesia were about twice as big as expected, and this was a big negative to prices. China imported 339,652 tons of Palm Oil in February, up 26% from last year. Calendar year imports are now 874,683 tons, up 16.5% from last year. Indonesia exported just over 202,000 tons and Malaysia exported 127,000 tons. China imported 39,393 tons of Soybean Oil, down almost 63% from last year. Imports from the US were strong at over 23,000 tons. Year to date imports are now 65,078 tons, down about 30% from last year. South America will soon enter the mix. Argentina is the world’s largest seller of Soybean Oil and will be strong competition in the world market. Brazil is also a big seller. The weekly charts for both Palm Oil and Soybean Oil show that prices are holding at some important support areas. These areas could be tested further this week, and penetration of these support areas could indicate that significant price weakness is coming.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures © Jack Scoville

Cotton

Futures closed lower last week but held inside the trading range seen over the last few weeks. The price action was somewhat disappointing as the week had featured another strong export sales report from USDA. Cotton remains mostly a demand story as US export demand has been stronger than any trade expectations so far this year. USDA has been forced in its recent monthly updates to increase export demand estimates at the expense of ending stocks and might be forced to do it again next month. Ideas that US buyers have a large amount of Cotton bought remain the other reason for futures to trend higher. These buyers will need to buy futures sooner or later to fix prices. The key time for them to get covered will be near the start of the delivery periods for the May and July Contracts. Prices can hold strong until then, with many now looking for a push to perhaps 8300 May. USDA will issue its plantings intentions reports on Friday, and many analysts look for USDA to show planting intentions above the 11.5 million acres estimated by the agency at its annual Outlook Conference. Ideas are that planted area could be as high as 12 million acres this year. Cotton is paying much better than Rice and is also paying better and is more reliable to grow in parts of Texas than Sorghum or Corn. Wheat is also cheap compared to Cotton.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ tried to surge higher but failed to hold and closed the week slightly lower. It was a disappointing week for bullish traders due to the failed breakout attempt on the charts. The market remains in a bullish supply market mode, with less and less domestic demand hurting any upside potential. Domestic production remains very low due to the greening disease and drought. Florida remains very dry. Trees are in bloom in all areas of the state, and petals are starting to drop in some areas as fruit is forming. Good rains are needed for the bloom and initial fruit development. Irrigation is being heavily used to prevent loss. The harvest has been very active. Early and Mid Oranges are moving mostly to processors. The Valencia harvest is moving to processors and into the fresh market. Major freezes in southern Europe this Winter have damaged the citrus production. Ideas are that losses are extensive, but no one has quatified total losses yet. Brazil crops remain in mostly good condition.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower last week. New York is getting a downtrend established again. London is trying to start a downtrend on the daily charts but remains in a trading range on the weekly charts. New York has featured buying support from commercials as they fix prices for differentials purchases. Speculators have been the best sellers. Offers remain in the cash market, and differentials are stable to weak. Buyers have turned quiet and appear ready to use already contracted supplies. There is business in specific qualities at specific times. London is trading sideways as supplies available to the market remain tight. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Indonesia is also very low on supplies. The ICO reported another month of strong world exports, and supplies in importing countries appear adequate to surplus at this time.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures closed lower for the week, but in the middle of the weekly range. It appears to have been a short-term recovery for a market that has seen a lot of selling pressure on prices in the last couple of months. The fundamentals appear to be changing from a tight situation to one with more available to the market. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months. However, the situation remains one of less production in Brazil at this time. UNICA said that Brazil mills crushed 3.3 million tons of Sugarcane in the latest two-week period, a decrease of 38% from the previous year. They produced 73,000 tons of Sugar, down 48% from last year, and 161million liters of ethanol, down 28% from last year. The year to date crush is now 599.2 million tons of Sugarcane, down 0.7% from last year, with Sugar production at 35.4 million tons, up 15%, and ethanol production at 25.3 million tons, down 8% from last year. India is determined not to import Sugar this year even though domestic production is short and internal prices are very high. India had lower production last year due to the uneven monsoon rains. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remain too dry. Center South areas have had plenty of rain. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

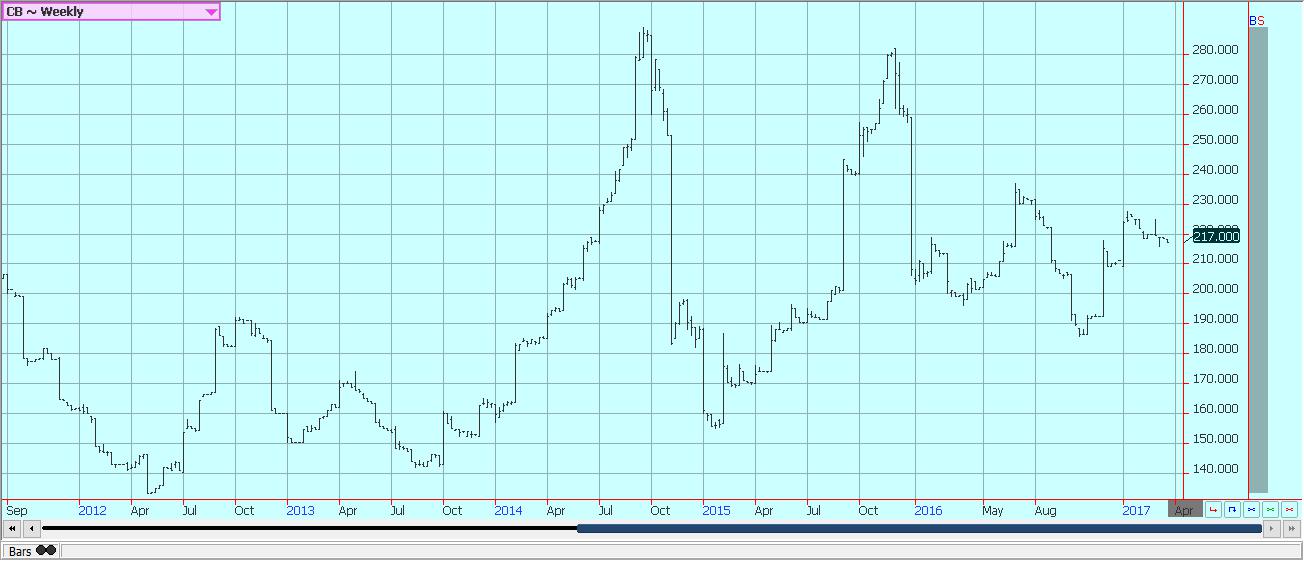

Cocoa

Futures markets were higher again last week but spent the second half of the week consolidating gains. It remains possible that the worst of the bearish price news has now been absorbed. The weekly charts imply that a low has been found but that an uptrend has not yet started. The mid crop harvest continues in West Africa under good weather conditions. However, there are reports that suggest that the quality of the remaining main crop is not good and that much of the Cocoa delivered recently is not of exportable quality. Exporters are rejecting loads and hoping for a better mid crop arrival. Overall world production is expected by the ICCO to be strong and above demand. In fact, the ICCO now anticipates that production could be above demand for several years and that prices could remain generally weak for an extended period. The demand from Europe is reported weak overall, and the North American demand has been weaker than anticipated. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Traders will watch now to see if Harmattan winds develop that could decimate the mid-crop. So far the winds have not developed and growing conditions are called good. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia. Even so, Indonesia will harvest less this year as producers look for more profitable crops to grow.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

Dairy markets were mixed as big and stable supplies of milk are available to the market. Supplies are strong seasonally in all areas as the annual flush is active in the US. Demand is good for cream, and cheese makers are displaying increasing demand. Cream demand for Butter has been very good as orders for print butter have increased. However, butter inventories in cold storage are increasing in some areas. Demand for Ice Cream has been mixed depending on the region. Cheese demand appears to be getting stronger due to promotions on the retail level. Exports are reported to be stronger. Dried products prices are generally weaker. Bottled milk demand has been steady to lower due to school holidays.

US cattle and beef prices were firm last week amid on strong prices. News of a bribery scandal in Brazil brought speculative buying. Meat inspectors were reportedly bribed to let substandard beef pass into the food chain. The beef was consumed internally and sold for export. Many nations are temporarily banning imports from Brazil or at least subjecting the imports to further inspections. China closed its market late last week but opened it again over the weekend. Packers paid higher prices in the auction market last week and volumes traded were strong. Beef prices have also been strong and have led Cattle futures higher. Ideas are that prices can hold at higher levels for now, but that weaker prices will be seen once feedlot offers start to increase. Overall beef exports have been very strong this marketing year. The Cattle on Feed report was released Friday by USDA and was considered neutral to prices. On Feed as of March 1 was 100% of last year. Placements for February were 99% of last year, while marketings were strong at 104% of last year. Another disappearance was 97% of last year. The report shows that feedlots are remaining current with sales.

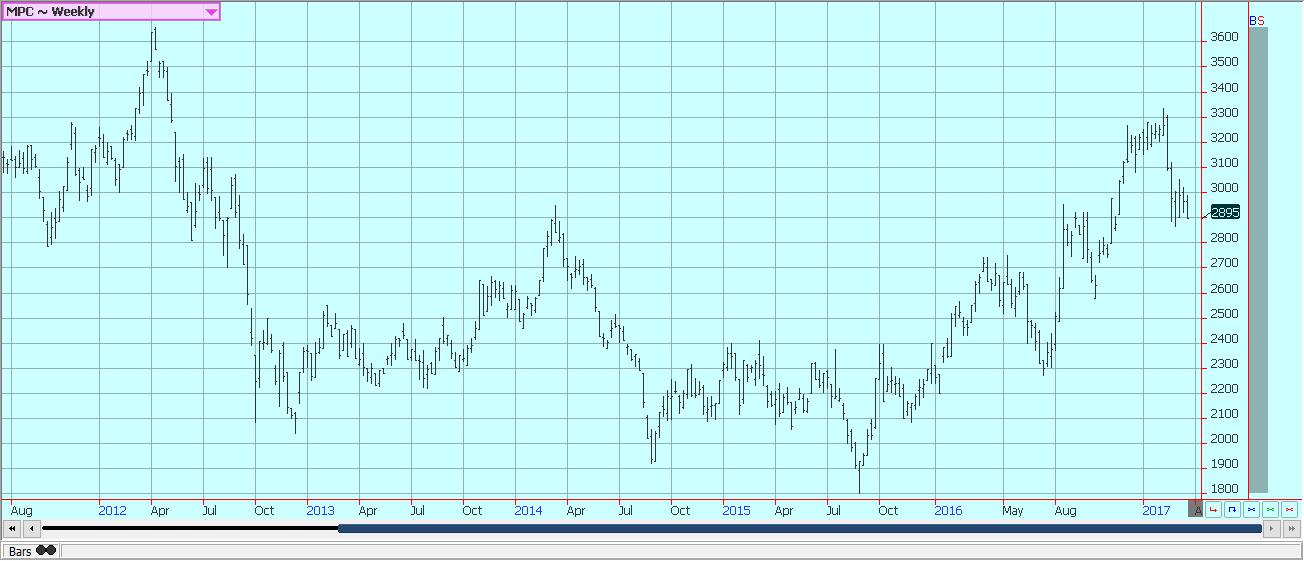

Pork markets and Lean Hogs futures were weaker last week, but the market held the recent trading range overall. Pork demand remains stronger than expected and ham prices have been strong. The Cold Storage report showed fewer supplies of pork than had been expected, implying that demand can stay strong for the time being. The demand should help keep supplies available to the market under control at a time when hogs production remains very strong. The big supply of hogs expected to be in the market remains the big problem for higher prices. Packer demand has been very good as packers move to meet the strong domestic and world demand, but was reported to be less last week. There are big supplies out there for any demand. The charts show that the market could remain in a trading range at good levels for both processors and producers.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

You must be logged in to post a comment Login