Business

US palm oil production on the rise, China continually liquidates sugar supply

Palm oil could be a relatively weak performer for the next couple of months as spreads between this market and the competing vegetable oils return to more normal levels.

Latest news in the commodities market: China continually liquidates sugar supply, US palm oil production is on the rise and much more.

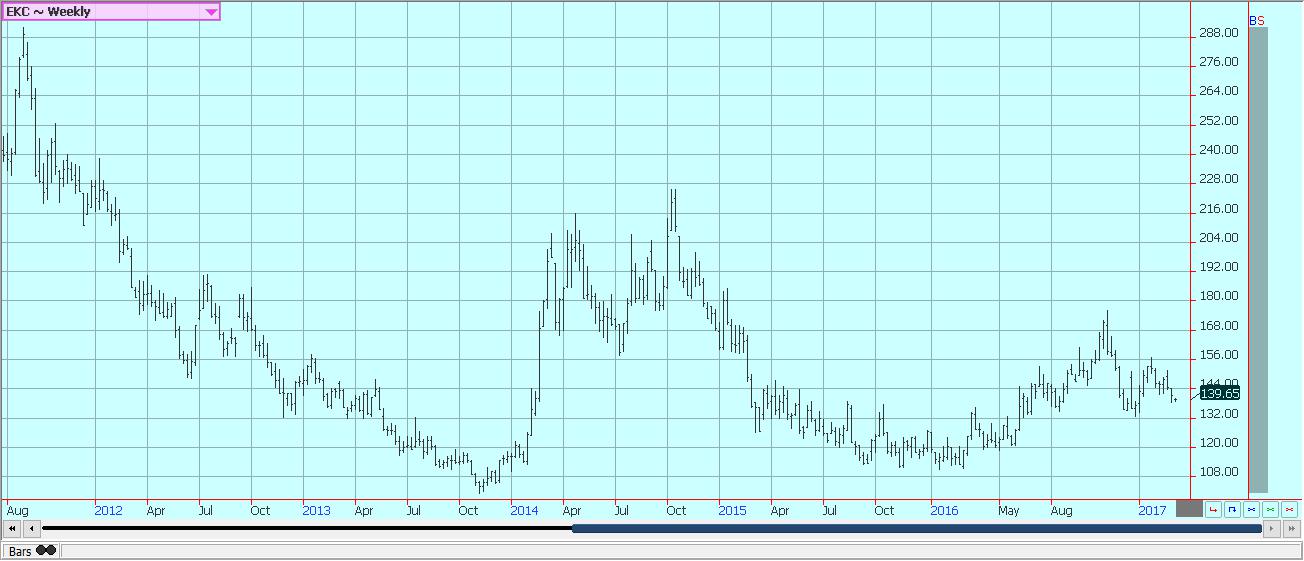

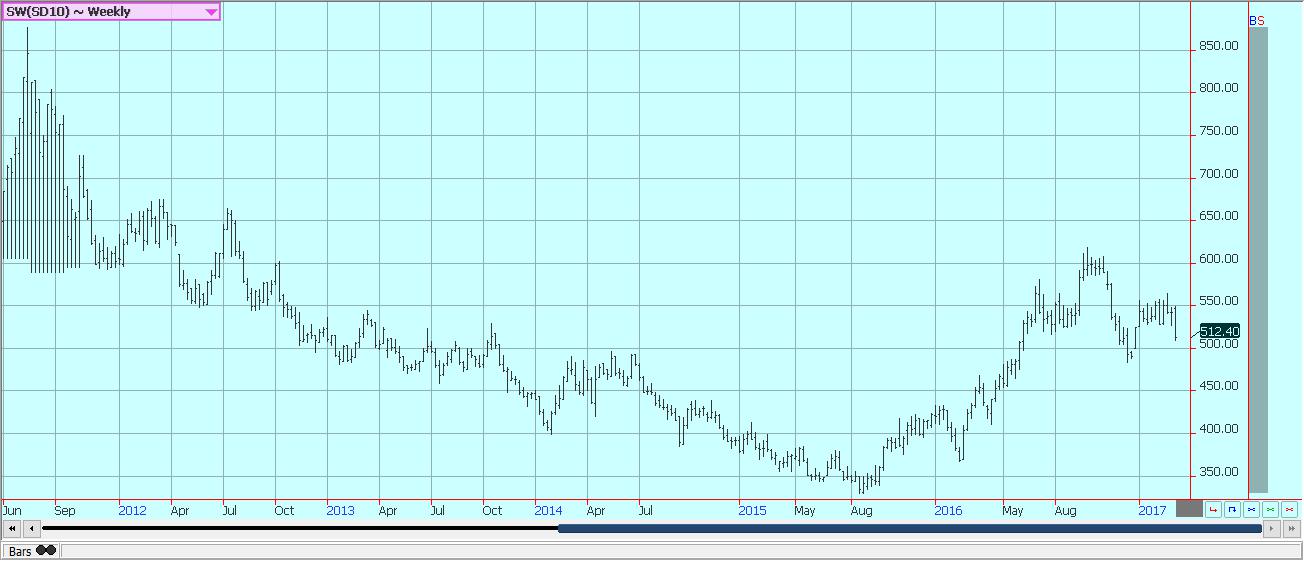

Wheat

US markets were lower last week. USDA issued its latest round of supply and demand estimates, and cut US imports and ending stocks slightly. World data showed increased stocks levels and was considered negative to US prices. The weekly export sales report was not all that strong, and the trade overall remains concerned about demand for US Wheat. The sales report did show that the demand remains good for the higher protein Wheat. Better demand ideas along with some very cold weather in the northern Great Plains and a snow storm in the Canadian Prairies kept Minneapolis futures stronger last week. The trade is also keeping an eye on US Winter Wheat crop conditions. Midwest Wheat areas in the southern and eastern areas are in the beginnings of a drought. These crops have had some moisture and should still be able to produce well. It remains drier than normal in the Great Plains and longer range forecasts call for the dry weather to last well into the Spring and early Summer. These crops need some moisture now as the unusually warm Winter has caused dormancy to break and for the crops to start growing. Light moisture was seen over the weekend and more light precipitation is possible this week.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

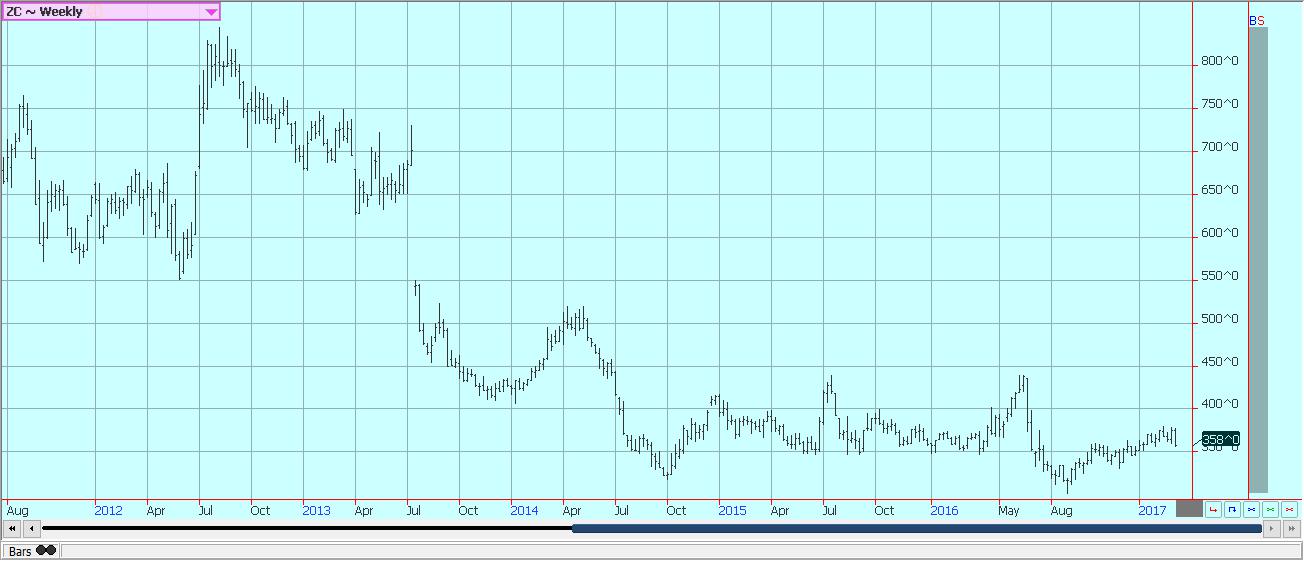

Corn

Corn was lower in part in reaction to the USDA monthly supply and demand updates. USDA made no changes to domestic ending stocks levels, but did modify some of the demand by increasing ethanol use and cutting feed demand. It increased production potential for Brazil to 91.5 million tons and for Argentina to 37.6 million tons. It also increased world ending stocks levels due to the increased South American production. Demand for Corn has held well, especially on the ethanol front. Corn demand for ethanol has been at record or near record levels for the past few months and shows no sign of abating. However, ethanol demand could be threatened as Brazil has reportedly cancelled purchase contracts from the US and has started to offer Sugar based ethanol into the US in a reversal. That is a sign that the next Brazil Sugar crop is looking good and could be big. There are still plenty of supplies of Corn in the US to be used up, and the big supplies have kept the Corn market pinned for this year. Supplies look to remain ample through the next marketing year, unless some kind of weather shock or increased demand surfaces. The increased demand should hold together into the Summer as offers remain scarce from South America and Ukraine. South America mostly ran out of Corn last year due to the drought in the second half of the growing year in northern sections of Brazil. South America needs to fill its pipelines again and that will take time. Winter Corn production in Brazil could be big this year as the Soybeans harvest has been fast and planting of the Winter crop is ahead of normal. The Safrinha harvest in Brazil will start late this Summer and that is when the big competition for business is likely to begin.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans and Soybean Meal were lower last week as the potential for sales in the world market from South America increased. US export sales have been lower in the last few weeks, and the trade expects generally weak sales for the next several months. USDA highlighted the possibility when it cut export demand and increased domestic crush levels to show a slight increase in ending stocks levels for the US last week in its monthly supply and demand updates. The world data featured unchanged production estimates for Argentina at 55 million tons, but a sharp increase in Brazil production potential to 108 million tons. The Brazil harvest has been very active, but farmers have not been real big sellers due to the exchange rates for the currencies. The harvest is over half done now and has been steadily moving south. Producers in central and southern Brazil started to increase offers once the holiday came to an end. The offers dropped off late in the week in response to the move lower in Chicago, but there are still Soybeans to be sold and priced from South America and these sales and offers could serve to limit the upside potential for Soybeans. USDA estimated that US production could be over 4.1 billion bushels this year, which would be more than 11.5 million tons. That is a lot of Soybeans to sell, so the amount of Soybeans available to the world market could remain large well into the next marketing year and beyond. Demand is becoming a problem as China appears to be buying less. The Bird Flu has returned and that means a lot of birds will be killed in order to keep the overall health of the population there intact. They appear to be importing a little less as feed demand might be cut back if the outbreak is serious enough. Crush margins there have already faded and processing Soybeans has become much less profitable in the last couple of weeks.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

It was a sideways week for US Rice futures again last week. The weekly charts show that the market is attempting to find another bottom in this area/ The charts are showing a retest of the lows made a couple of months ago. Higher prices this week could mark the end of this phase and the potential that a major low has been found. USDA made no changes at all to its domestic supply and demand estimates in the up[dates last week, but it did cut world ending stocks estimates slightly. The domestic cash market remains mostly quiet and bid at prices well below those shown in the futures market. The weak domestic cash market has kept the futures market pinned at current price levels, but the trade shows no real interest in driving the market lower to meet the cash. Ideas are that futures price action can remain relatively weak for now, but the projected drop in year to year ending stocks estimates implies that down side price potential is probably limited. The trade will remain interested in the total planted area for Rice this year, and especially for long grain Rice as the area will be significantly less this year. The prospective plantings report will be released at the end of the month. Farmers are very discouraged with the prices as low as they are, and many are going to add area planted to Soybeans or Cotton this year. It will take a long time for many producers to get interested in planting Rice. Some producers, such as those in Southwest Louisiana and in parts of Texas, have no real alternative, but if the producer has a choice then the choice has been to plant less Rice and plant more of something else.

Weekly Chicago Rice Futures © Jack Scoville

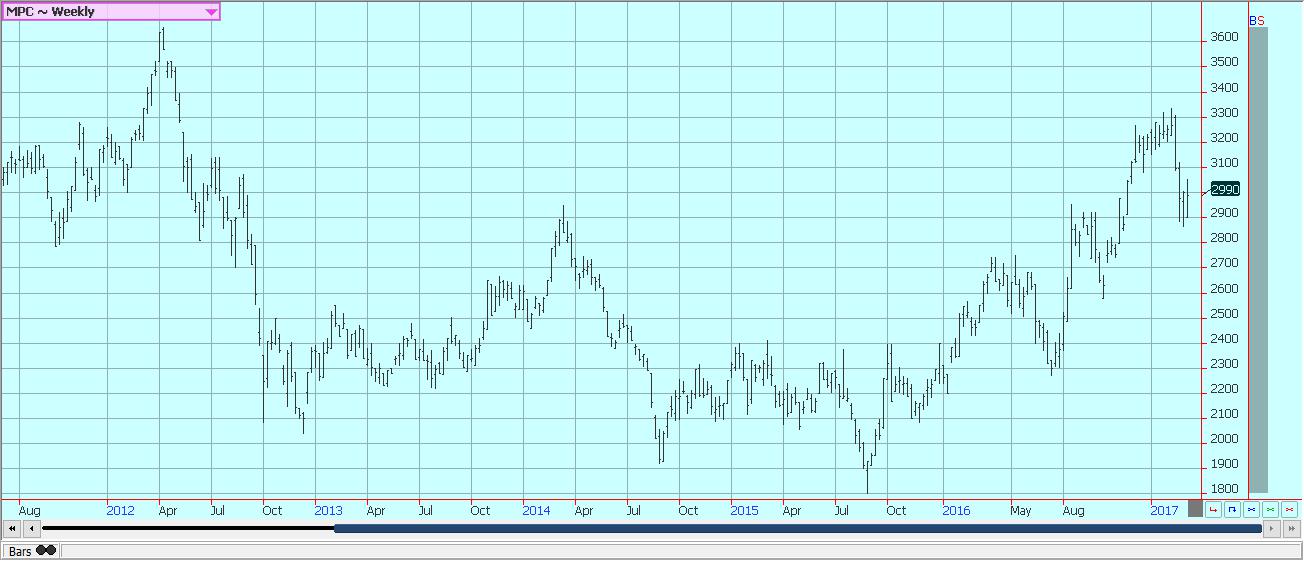

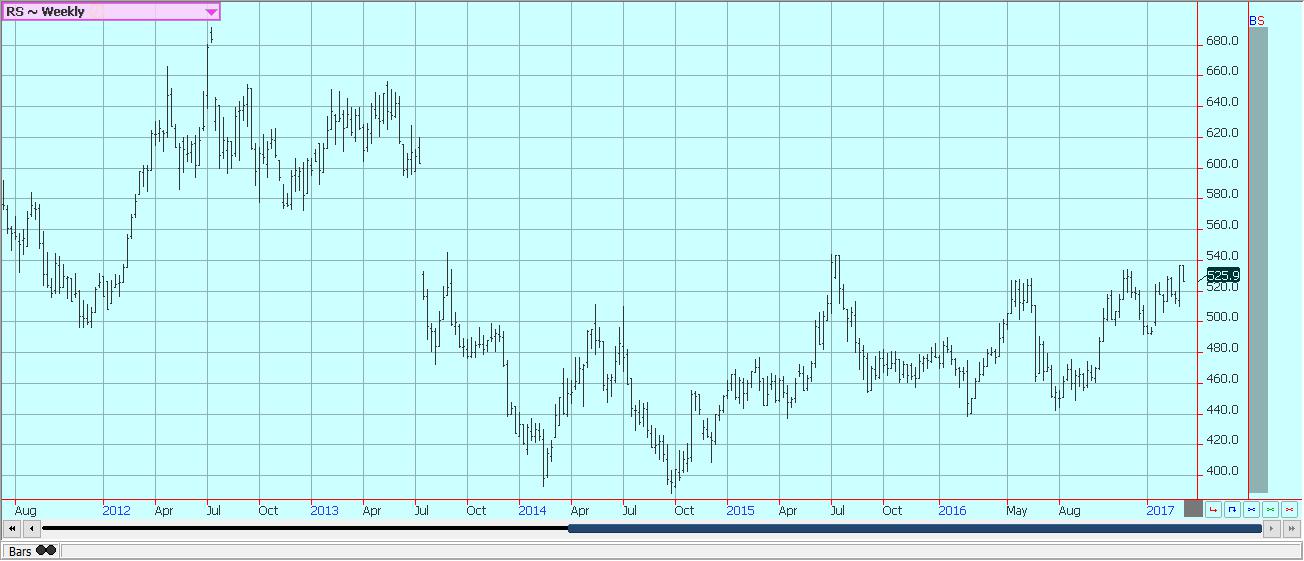

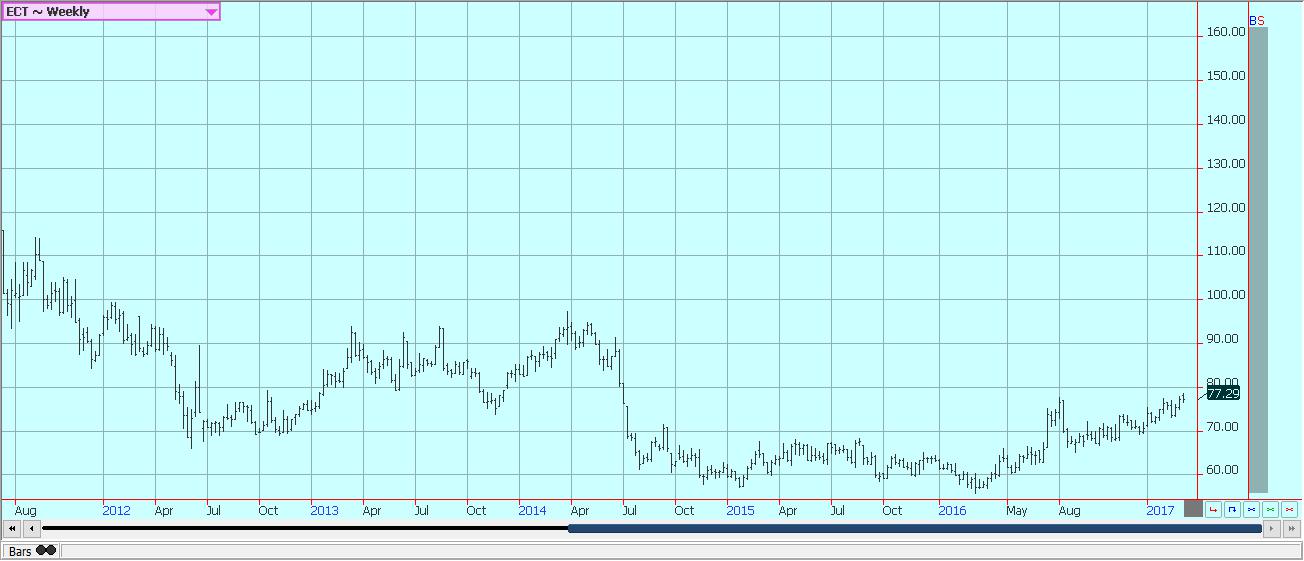

Palm oil and vegetable oils

World vegetable oils markets were lower last week on ideas that world production was about to increase. Palm Oil production is likely to increase in the short term as trees start to produce more as they recover from the El Nino drought of last year. Some of the recovery could be getting underway now as MPOB showed production of 1.26 million tons, a little above trade estimates and just below production from the longer month of January. Exports were only 1.11 million tons, and export demand could remain less as Palm Oil remains relatively high priced in the world market. February ending stocks were 1 46 million tons, in line with trade estimates. Big Soybean crops are being harvested in Brazil and will be harvested in the short term in Argentina. The US is also expected to get a big crop this year. That means that Soybean Oil will be easy to find, especially if Argentina increases offers as it is the largest exporter of Soybean Oil in the world. Palm Oil production is also expected to increase more in the next couple of months as the trees in Malaysia and Indonesia. Demand has fallen off for Palm Oil in the last couple of months as Palm Oil is pretty high priced when compared to the competition such as Soybean Oil. Palm Oil could be a relatively weak performer for the next couple of months as spreads between this market and the competing vegetable oils return to more normal levels.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures closed lower on Friday on some long liquidation from speculators. Futures closed about unchanged for the week. USDA raised export demand and cut US ending stocks more than most trade expectations in its supply and demand updates on Thursday. However, it narrowed the top end of the farm price range, and that news negated the bullishness of the estimates. However, Cotton remains mostly a demand story as US export demand has been stronger than any trade expectations so far this year. The demand for US Cotton remains solid despite the fact that the Chinese government is once again offering Cotton into the domestic market. China appears ready to sell about 30,000 tons of Cotton per day into the internal market as it reduces its government supplies. These supplies are up to seven years old and Chinese industry will need to keep buying imported Cotton to blend with the old government supplies. Ideas that US buyers have a large amount of Cotton bought but unpriced also supported futures. These buyers will need to buy futures sooner or later to fix prices. The key time for them to get covered will be near the start of the delivery periods for the May and July Contracts. Prices can hold strong until then, with many now looking for a push to perhaps 8300 May. The US demand should stay strong as the US has a lot to offer and is only starting to see some competition from Australia. US demand from the Middle East and Far East remains strong and consistent. Farmers in the US are starting to make final planting decisions now and there are widespread ideas that Cotton area will be higher than last year. Cotton is paying much better than Rice, and is also paying better and is more reliable to grow in parts of Texas than Sorghum or Corn. Wheat is also cheap compared to Cotton. USDA will issue its next round of supply and demand updates this week. No changes are expected, but USDA could increase demand and cut ending stocks again. The export sales report was the strongest of the year, and year to date export sales have been much stronger than expected by USDA and the trade.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ closed a little lowr after resistance near 180.00 held on the weekly charts. The market remains in a bullish supply market mode, with less and less domestic demand hurting any upside potential. USDA reduced Florida Oranges production estimates to 67 million boxes in its reports last week, and this is very low production. However, other industry data has shown that imports of FCOJ from Brazil have increased and are enough to meet any short US production, so the effects of the report were not so strong. A lot of the loss is due to the greening disease that will remain a long term problem for Florida producers as it has for producers in Brazil. Florida remains very dry. This is great for harvesting, but not good for development of the next crop. Trees are in bloom in all areas of the state, and petals are starting to drop in some areas as fruit is starting to form. Good rains are needed for the bloom and initial fruit development. Irrigation is being heavily used to prevent loss. The harvest has been very active. Early and Mid Oranges are moving mostly to processors. The Valencia harvest is also active, with fruit moving to processors and into the fresh market. Demand for Orange Juice inside the US is still a big problem. It is currently at its lowest level since records started being kept in 2002, and there are no real prospects for improvement right now as consumers have plenty of alternatives. Sao Paulo state is getting good weather and crop conditions are called good.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were a little lower for the week, but really did not move much in the end. Brazil will allow imports of 1.0 million tons of Robustas to enter the country with a much reduced 2% tariff in an effort to boost internal supplies. Domestic prices remain large and the export of lower end Arabica coffees has been cut in order to feed the domestic industry. Exports for February were just below 3.5 million bags, and this is the second month in a row with exports below that level. There is less production in Brazil this year due to the drought in northeast Brazil. Production ideas range from 45 to 50 million bags. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Vietnamese prices have started to drop a little bit as demand has shifted to other countries. Indonesia is also very low on supplies. The demand has been great for inferior qualities of Coffee from the rest of Latin America, although prices paid remain low and differentials paid remain weak. Differentials for better qualities are stable, but demand is not real strong. Roasters have been busy fixing prices for coffees bought previously and are showing less interest in adding to positions. The charts show that the price action has been choppy and that choppy price action can continue.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures © Jack Scoville

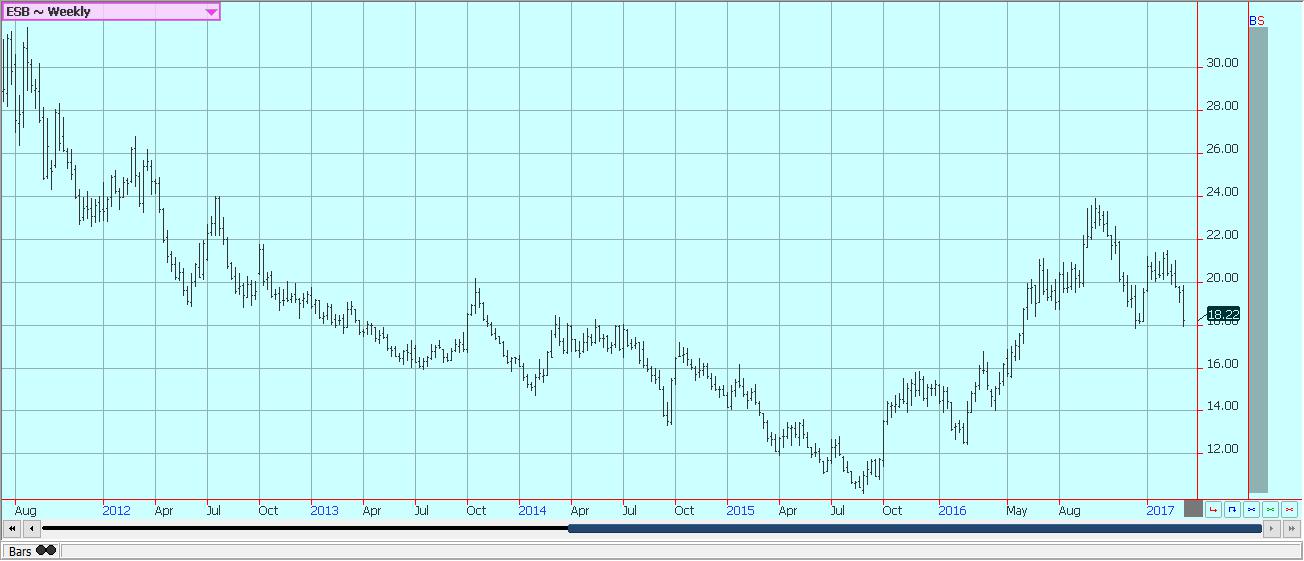

Sugar

Futures closed lower for the week on what appeared to be fund and other speculator selling. It was mostly long liquidation as traders sold in response to the lack of buying from India in the world market. India had lower production last year due to the uneven monsoon rains. Analysts had expected the country to import about 2.5 million tons of White Sugar, but the government has resisted even as some mills have closed early and internal prices have gone higher. The Sugar Association there recently announced that domestic demand has dropped, not doubt in response to the high internal prices. It looks like India might not import now after all unless the next monsoon does not perform well. News of less than expected production in Brazil combined with less on offer from India and Thailand provide the best reasons for strong prices. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remain too dry. This dry area got some very beneficial rains last week. Center South areas have had plenty of rain and good production is expected. Brazil cancelled ethanol import contracts from the US and started to offer ethanol into the world market, a sign that it probably has a big Sugarcane crop coming in the short term. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were lower last week, but recovered on Friday to show the potential for a short term recovery rally on the daily charts. The daily charts show that some significant resistance lies at about 2000 May New York futures. Weekly chart trends remain down. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. Ivory Coast could produce 1.9 to 2.0 million tons, and a record production is possible. Ghana could produce about 800,000 tons, a good crop for them. Overall world production is expected by the ICCO to be strong and above demand. The demand from Europe is reported weak over all, and the North American demand has been weaker than anticipated. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Traders will watch now to see if Harmattan winds develop that could decimate the mid crop. So far the winds have not developed. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia, but it remains too dry in Bahia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

Dairy markets were mostly lower as big and increasing supplies of milk are available to the market. Supplies are increasing seasonally in all areas. Milk and Cheese futures made new lows for the move, and Butter futures remain in a trading range. All producing less than last year. Demand is good for cream, but cheese makers are displaying moderate demand. Cream demand for Butter has been very good as orders for print butter have increased. However, butter inventories in cold storage are increasing. Bottled milk demand has been steady to lower. Cheese supplies are increasing and much of the production is going into aging coolers. Butter manufacturers are mostly producing bulk butter for inventories even with increasing sales for print butter needs for the coming holidays. Dried products prices are steady to lower.

US cattle and beef prices were firm last week amid firm beef prices. However, futures markets once again had a tough time responding. Packers paid steady to higher prices in the auction market last week. There is talk that Cattle supplies might be light for the next couple of weeks, but that is expected to change soon and that is why April futures are not really responding to the current stronger prices. However, it appears that a lot of the cattle is not yet ready for market. Ideas are that prices can hold at higher levels for now, but that weaker prices will be seen once feedlot offers start to increase. Overall beef exports have been very strong this marketing year.

Pork markets and Lean Hogs futures were stable last week. Pork demand remains stronger than expected and ham prices have been contra seasonally strong. The demand should help keep supplies available to the market under control at a time when hogs production remains very strong. Pork prices have trended higher in retail and wholesale markets. Export prices have been strong as well. Packer demand has been very good as packers move to meet the strong domestic and world demand. There are big supplies out there for any demand. The charts show that the market could remain in a trading range at good levels for both processors and producers.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoBNP Paribas Delivers Record 2025 Results and Surpasses Sustainable Finance Targets

-

Impact Investing2 days ago

Impact Investing2 days agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Crypto1 week ago

Crypto1 week agoUniswap and BlackRock Partner to Launch BUIDL in DeFi

-

Biotech5 days ago

Biotech5 days agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

You must be logged in to post a comment Login