Business

Vivid Seats Acquires Vegas.com in $240M Transaction — Is Restaurant.com [RDE, Inc. | OTCQB: RSTN] Next in Line?

A recent deal saw Vivid Seats acquire Vegas.com at a $240 valuation, representing a massive 6x increase over the $38 million the online Vegas portal was valued at just a few years prior. The valuation highlights a tectonic shift taking place in consumer habits, helping to highlight how fundamentally similar platforms like Restaurant.com (RDE, Inc.) are next in line for similar valuation shifts.

A couple of weeks ago, news crossed the wire that Vivid Seats Inc. [NASDAQ: SEAT] acquired Vegas.com in a deal worth around $240 million, valuing Vegas.com at approximately 5x its 2022 revenues of $48.2 million. The move, according to Vivid CEO, Stan Chia, is a strategic move to enhance Vivid’s scale and reach in the U.S. entertainment capital.

More importantly, however, the Vegas.com acquisition signals some fundamental shifts occurring in consumer spending habits and online marketplaces. We’ll take a closer look at what these are, and what they mean for similar online marketplaces like the RDE, Inc. [OTCQB: RSTN] owned CardCash.com and Restaurant.com.

But first, to illustrate the magnitude of these shifts, the last time Vegas.com changed hands in 2015, the ‘high’ estimate for the total transaction value was $38 million (once various stock options and performance-based cash bonuses are accounted for).

Taking that ‘high’ estimate means the Vivid Seats deal represents a 6x increase in Vegas.com’s valuation (or about +25-30% per year) over the last few years. And this growth isn’t off the back of revenue growth alone.

Taking a look at its 2015 revenues of $24 million vs the $38 million acquisition deal, it had a revenue-to-valuation ratio of 1.58x at the time. That means its current revenue-to-valuation ratio has more than tripled.

As for the driving forces behind all of this, there are a number of factors at play here. These include broader macroeconomic trends and shifting consumer spending habits combining to create some serious tailwinds for the particular breed of online marketplace that Vegas.com represents.

So let’s take a closer look at what’s going on here, what it means for other platforms, and, more importantly, which platforms could be next in line.

The Vegas.com Acquisition Is About a Whole Lot More Than Vegas, Tickets, and Hotels

While the short version of why Vivid acquired Vegas.com is that it wanted a strategic foothold in the nation’s entertainment capital, there’s a bit more going on here than that.

Yes, the Vegas.com domain is valuable, representing the best online foothold one could possibly get for Las Vegas.

And yes, Vegas.com is a prominent online booking platform for tickets and hotels in Vegas.

But neither of these explains the valuation.

To illustrate, let’s start with the domain name. For perspective, the number of domains that have sold for 8 figures can be counted on your fingers. So don’t even imagine the Vegas.com domain had that big of an impact on the valuation.

And as for its prominence as an online hotel and ticketing platform, let’s just get one thing straight — prominence doesn’t mean much on its own.

To illustrate that point, take a look at ticketing giant Live Nation (NASDAQ: LYV), for instance. It has a market cap of about $20 billion vs TTM revenues of about $19 billion. That represents a 1.05x multiple.

And as for hotels, the leader here is Hotels.com parent company, Expedia Group, Inc. (NASDAQ: EXPE). It has TTM revenues of about 12 billion vs a market cap of about $18 billion. That’s a paltry 0.66x multiple.

As for Vivid Seats itself, its TTM revenues are $680 million vs a market cap of about $1.6 billion, giving it a more generous multiple of about 2.4x.

But even with Vivid’s relatively high value-to-revenue ratio for its industry, it still doesn’t touch the 5x valuation it gave Vegas.com.

So let’s take a look at what else is going on besides Vegas, hotels, and tickets.

Vegas.com Was Always About More Than Vegas, Tickets, and Hotels

On the tin, Vegas.com is about event tickets and hotels in the nation’s entertainment capital. But scratch just a little, and you’ll soon see there’s one extra ingredient that gives us a clue to its valuation.

Vegas.com is all about DISCOUNTED tickets and hotels.

It’s impossible to emphasize just how important this aspect is, as it goes a long way (most of the way) toward explaining why Vivid Seats valued Vegas.com at $240 million. In fact, from the outside, it would seem that this is the real foothold Vivid was trying to secure with its Vegas.com acquisition.

To understand why, however, we need to take three additional factors into account — the growing importance of discounts in discretionary spending, the brand equity Vegas.com brings to the table, and its vendor network.

Let’s start by addressing why discounts are becoming so important.

Here’s Why Discounts Are Becoming King in Discretionary Spending

It’s no secret that consumers are facing a considerable crunch on their spending power as they face inflation, wage stagnation, an affordable housing crisis, and dwindling savings (the last time personal savings rates were this low was 2008 — we’ll let you put two and two together).

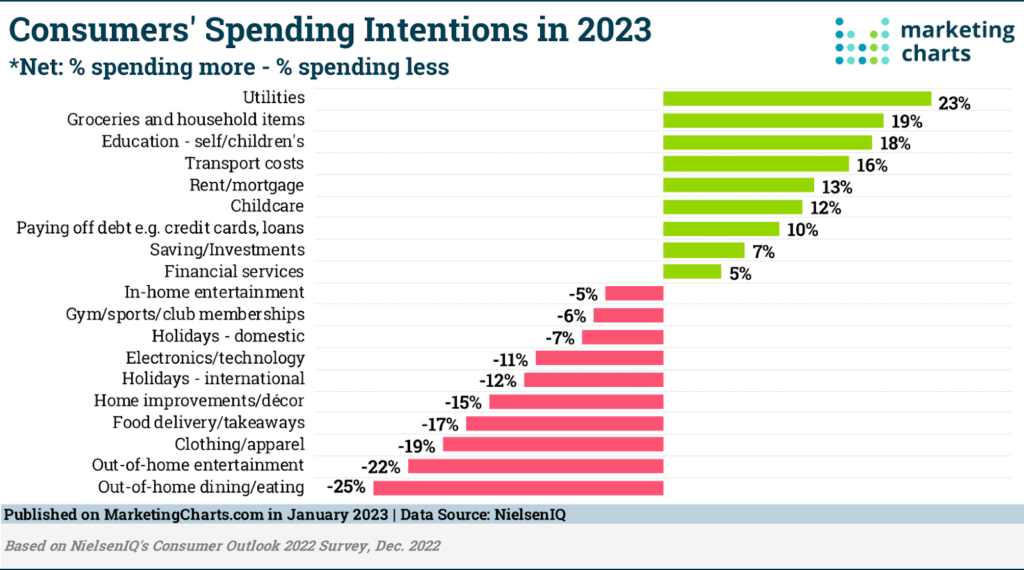

The net effect of this as far as we’re concerned is a shift in spending priorities. The quickest way to illustrate this is with a chart (source).

Essentially, as more and more consumers start to feel the crunch, spending intentions shift away from discretionary spending on items like entertainment, travel, and dining out.

And while you’d think this is bad news for a platform like Vegas.com — which is about as discretionary as it gets — spending intentions are just one side of the story.

To illustrate, take restaurants, for example — the industry that would have been hardest hit if spending intentions alone were the determining factor.

In a recent Deloitte study titled The Future of Restaurants: Creating Dynamic Value in the New Normal, Deloitte found that most consumers had either resumed pre-pandemic levels of dining out, or increased their frequency.

This seemingly flies in the face of their “spending priorities”, which should have indicated a -25% drop in dining out.

What Deloitte found here, however, was that while many diners were hitting restaurants more frequently than their pre-pandemic rates, their habits had shifted. Here, two key insights stand out:

- 37% of dine-in guests and 40% of takeout customers were looking for less expensive options along with promotions and discounts.

- Yet 60% of consumers said they are unlikely to accept lesser quality when ordering takeout food.

Here, we have two conflicting consumer priorities. On one hand, a growing number are prioritizing “less expensive options” above all else. Yet on the other, a majority of those consumers aren’t prepared to accept a drop in quality.

Those sorts of expectations naturally create major tailwinds for anyone who can offer ‘the same product for less’. Especially in an environment where consumers only want to cut back on their spending, not their frequency of consumption.

This is also a story that’s now playing out in multiple sectors, including dining, entertainment, and travel. (And thus we now have a major component in the Vegas.com valuation.)

Now Let’s Talk About Brand Equity and Vendor Networks

While it’s hard to dispute the Vegas.com domain brings some value to the table, the real value in its brand lies in the reputation it has built up among consumers.

For context, Vegas.com launched in 1998 as a general-purpose travel/entertainment booking platform for Las Vegas. But as companies like Expedia and Airbnb grew, they started eating away at Vegas.com’s business.

This forced a change in direction, and over the years, Vegas.com has started to claw back some of its original market share by building itself up as the go-to destination for discounted Las Vegas experiences. This has resulted in it building some serious brand equity that far outweighs its (admittedly) valuable domain name alone.

Fast forward to today, and the strategy is paying major dividends, as the recent Vivid Seats acquisition highlights. As a reminder, its current revenue-to-valuation multiple (6x) has tripled from the last time the company changed hands in 2015.

And this finally brings us to the last piece in the puzzle as to why Vegas.com achieved a $240 million valuation off the back of $48.2 million in annual revenue — its vendor network.

The fact of the matter is that the vendor relationships Vegas.com has built take years. Not only that, but they are also core to the entire business model.

Effectively, these supplier relationships form a considerable moat for the brand. Basically, the only hope any would-be competitor has for acquiring a similar cut-price inventory in the short term would be to do what Uber and the likes did — provide subsidies out of its VCs’ pockets.

And Here’s Why RDE, Inc. Is Next in Line if Any of This is Correct

If any of the above is halfway correct, then now’s the time for investors to start seeking out similar companies to Vegas.com.

Here, the most obvious choice is RDE, Inc. [OTCQB: RSTN] (okay, this is only obvious if you’re already aware it’s the company behind Restaurant.com and CardCash.com) To illustrate why, let’s recap all of the above quickly.

- Vegas.com gets acquired at a revenue-to-valuation multiple of 5x.

- This valuation was primarily driven by the growing importance discounting will have in discretionary consumer spending in the coming years.

- As the go-to hub for discounted Las Vegas experiences, this has driven Vegas.com’s brand equity to new highs.

- Adding to Vegas.com’s value is its existing vendor network (this is 100% necessary if a platform is going to play the discount game without VC money subsidizing the whole show).

Now let’s take a look at RDE.

- RDE, Inc. owns two major online platforms — CardCash.com and Restaurant.com.

- CardCash.com is an online buy-sell gift card exchange (C2C, B2C, and C2C), with the most important facet for this discussion being its main value proposition for buyers — discounted gift cards.

- Restaurant.com is a rapidly growing platform offering consumers discounted dining experiences (to understand why this is huge, cast your mind back to the Deloitte survey we looked at before)

- Both platforms have considerable existing brand equity, and the company is actively growing brand awareness for both.

- Both platforms have a well-established supply of discounted inventory, allowing RDE, Inc. to operate both without putting in a single subsidy dollar.

- The aggregate revenues for both platforms in 2022 were $101.7 million*.

Now, admittedly, the Vegas.com revenue-to-valuation multiple of 6x might be too generous to apply here. Presumably, RDE, Inc. is operating on tighter margins here with CardCash.com being effectively a cash-equivalent exchange.

However, there is a very strong case to be made here that RDE warrants at least half of that multiple. Conservatively, that would value the company at somewhere around 2.5x its revenues. Or, based on 2022 revenues, somewhere around the $250 million mark.

That leaves RDE, Inc. [OTCQB: RSTN] considerably undervalued at its current market cap of around $36 million, creating a major buy opportunity for investors looking to catch the growing wave of discount-driven discretionary spending.

*Reported, unaudited revenues.

__

(Featured image by Julian Paefgen via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Biotech4 days ago

Biotech4 days agoAdvancing Sarcoma Treatment: CAR-T Cell Therapy Offers Hope for Rare Tumors

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoShein Fined €40 Million in France for Misleading Discounts and False Environmental Claims

-

Impact Investing1 day ago

Impact Investing1 day agoNidec Conversion Unveils 2025–2028 ESG Plan to Drive Sustainable Transformation

-

Impact Investing1 week ago

Impact Investing1 week agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport

![RDE, Inc. [NASDAQ: RSTN] hits the Nasdaq](https://born2invest.com/wp-content/uploads/2024/08/rde-inc-hits-the-nasdaq-400x240.jpg)

![RDE, Inc. [NASDAQ: RSTN] hits the Nasdaq](https://born2invest.com/wp-content/uploads/2024/08/rde-inc-hits-the-nasdaq-80x80.jpg)