Markets

Weekly Agricultural Futures Update – Commodities Face Covid Realities

You know what they say about living in interesting times. Well, there is no doubt that the futures markets are full of interesting tidbits that reflect the larger realities of both global and local economies. From weather to whether covid variants outpace the vaccine, all factors must be analyzed if we want to have a hope of understanding the global fluctuations in agricultural futures.

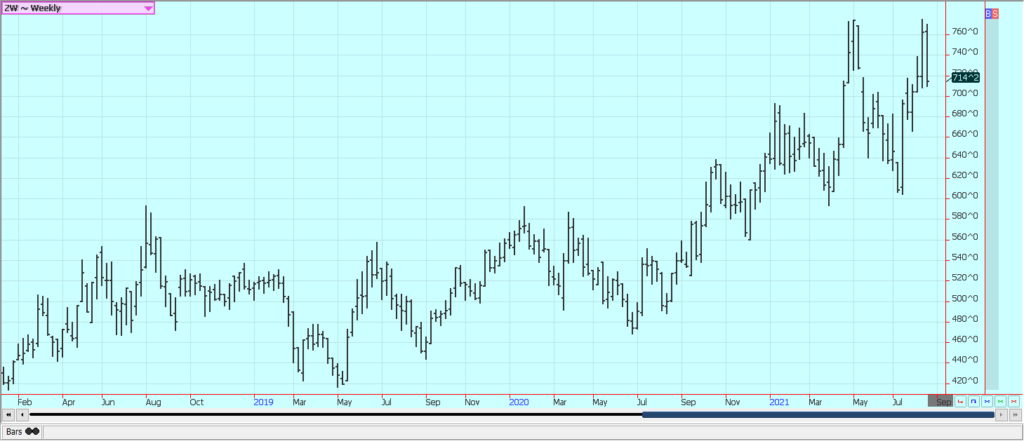

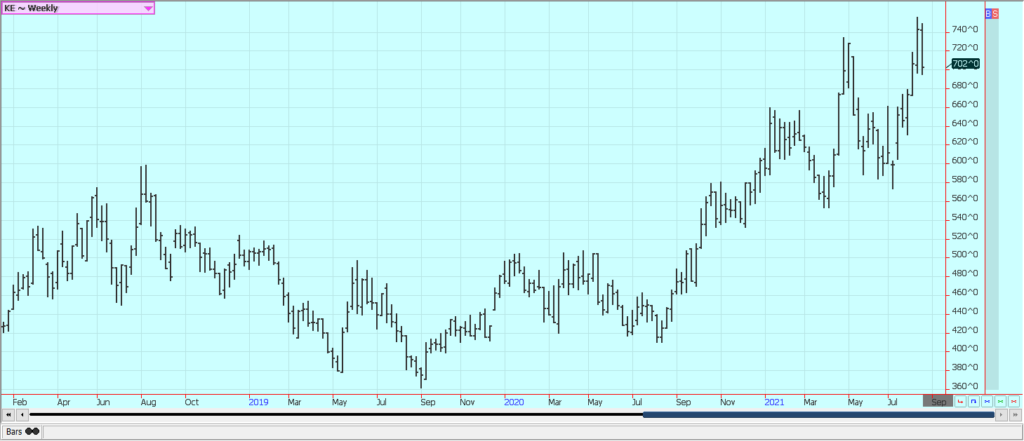

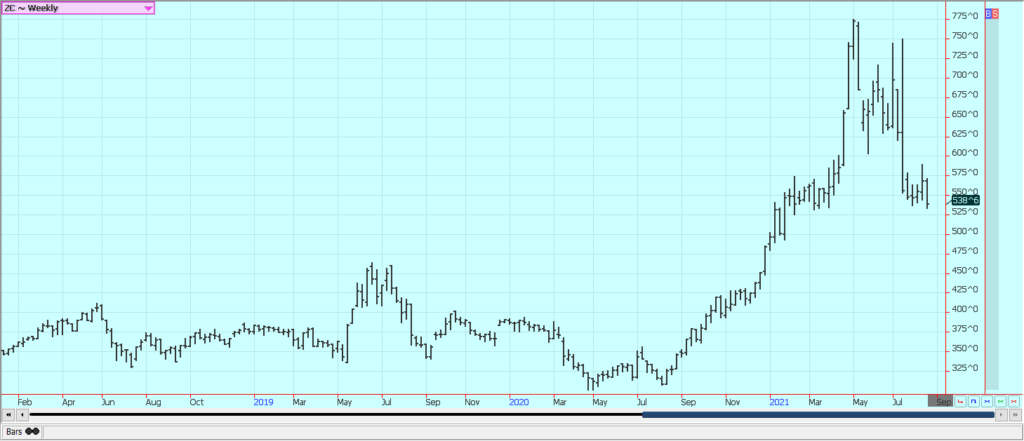

Wheat Futures Show Hesitancy:

Wheat was lower on demand concerns. Covid is back and Chicago has introduced a new mask mandate for public spaces. There are fears of new lockdowns and what that could mean to world economies and demand potential. Funds were the best sellers ad the US Dollar got stronger. Dry weather in southern Russia as well as the northern US Great Plains and Canadian Prairies remains a supportive feature in the market. Trends in Winter Wheat markets are still mixed. Crop size estimates in Russia have been reduced. The Russian weather has been good for production in northern and western areas but is still trending dry in southern areas and into Kazakhstan. Some showers are no in the forecast for the drier areas but are not expected to help much. The weather in China and Europe is wet and there is potential for reduced quality in Europe. Europe is expecting top yields in some areas but less yield in others and parts of eastern Europe and northern Russia are expecting strong yields. US White Winter Wheat production is also being hurt by hot and dry weather, but a cold front could bring some relief in several days.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

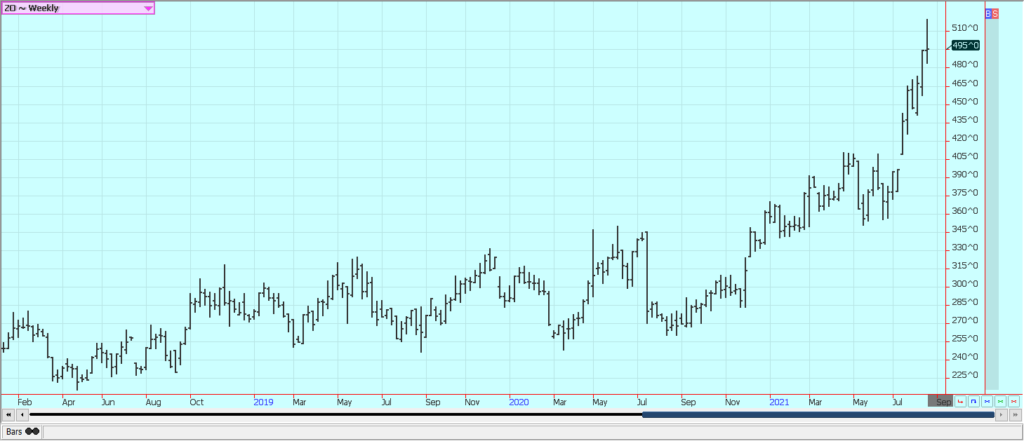

Corn Futures Cave to Global Concerns:

Corn was lower on fund selling tied to news from the Pro Farmer tour and world economic worries. News that EPA could reduce demand for bio fuels through new mandates hurt prices on Friday. Covid is back and Chicago has introduced a new mask mandate for public spaces. There are fears of new lockdowns and what that could mean to world economies and demand potential. Funds were the best sellers ad the US Dollar got stronger. The Pro Farmer crop tour has estimated US Corn production at 15.116 billion bushels with yields of 177 bushels per acre.. The weather remains a feature of the trade. Some forecasts call for improved weather, especially in the eastern belt. The growing conditions in the US are highly variable and not likely to produce trend line or record yields. It is still too dry in many areas of the west and drier weather is expected in the east. It should stay hot in the west and cool in the east. Ideas are that Brazil’s Corn production could be less than 85 million tons so reduced production estimates are expected in coming reports. Oats were lower on what appeared to be speculative selling. The uncertain weather in the northern Great Plains and Canadian Prairies remains the best support for the market. Canadian Oats areas and those in the northern Great Plains remain too hot and dry. Some rain is now in the forecast but is too little and too late to materially help crops.

Weekly Corn Futures

Weekly Oats Futures

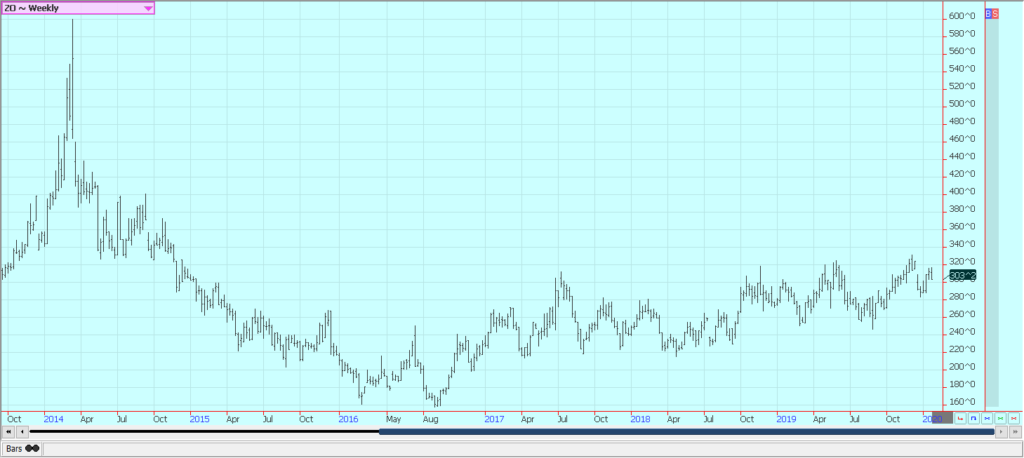

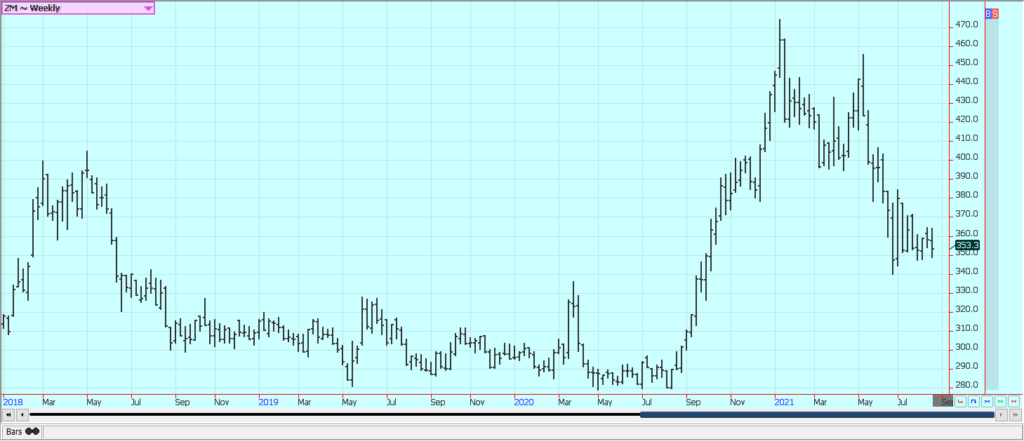

Soybeans and Soybean Meal:

Soybeans and both products were lower last week in response to the Pro Farmer tour and on demand worries. The demand threats mostly surfaced late in the week and were caused by talk that the Fed would soon begin to taper bond purchases and therefore increase interest rates and keep the Dollar supported and on reports that the EPA was about to submit to the White House new bio fuels blending requirements that could call for less bio fuels demand. Covid is back and Chicago has introduced a new mask mandate for public spaces. There are fears of new lockdowns and what that could mean to world economies and demand potential. Funds were the best sellers as the US Dollar got stronger. US weather is still a feature in the market as it remains hot in the west and is dry in just about all areas now. Eastern Midwest areas should be cooler and parts of central Illinois turned too wet again after some big rains on Thursday night. Soybeans conditions in central production area started the year too wet and have suffered some production losses. Pro Farmer estimated US Soybeans production at 4.436 billion bushels with a yield of 51.2 bushels per acre.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice Futures Shed by Speculators:

Rice closed lower last week due to harvest pressure. Speculators appeared to be the best sellers. The harvest is now expanding through southern growing areas. Initial yield reports and quality reports have not been real good. Smut has been reported in Texas but the smut is coming off the grain in the cleaning process. The smut problem appears to be worse around Houston. The harvest pace is expected to be slow due to ongoing showers in both regions. Ideas of average yields at best are also heard in Arkansas and Mississippi. Big rains are reported now in Arkansas. Growing conditions have been mixed at best with many areas getting too much rain. Chart trends are sideways but the price action has not been strong. Asian prices were a little higher last week.

Weekly Chicago Rice Futures

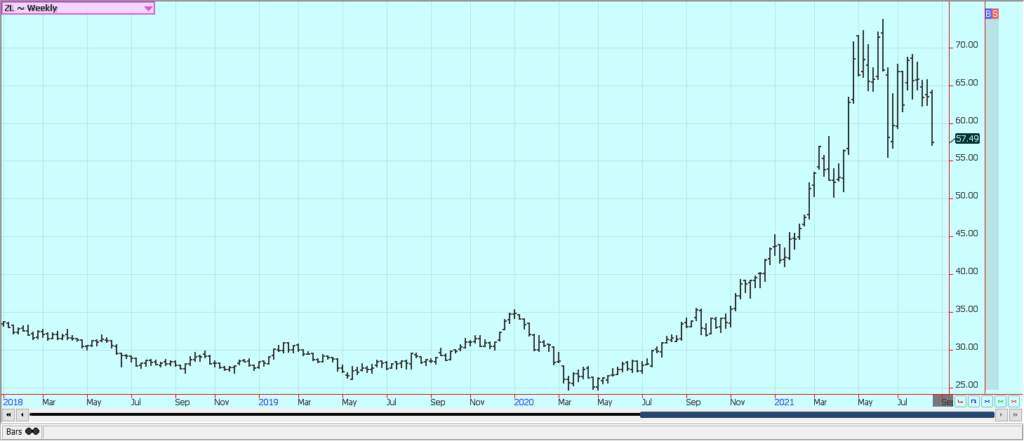

Palm Oil and Vegetable Oils:

Palm Oil closed lower last week on demand concerns. Exports so far this month have not been strong. Futures are still a trading range market on ideas of tight supplies due to labor problems. There are just not enough workers in the fields due to Coronavirus restrictions. Production has also been down to more than offset the export losses so prices have trended higher. Canola closed lower on weakness in Chicago and Malaysia. Damaging weather continues in the Canadian Prairies and northern Great Plains. Production ideas are down due to the extreme weather seen in these areas. It remains generally dry and warm in the Prairies. The Prairies crops are in big trouble now due to previous hot and dry weather and the rains are coming too late. Chicago was lower on wire reports that EPA was ready to give the White House ideas of new bio fuels mandates. Ideas are that the mandates will be less than what is currently required for blending.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

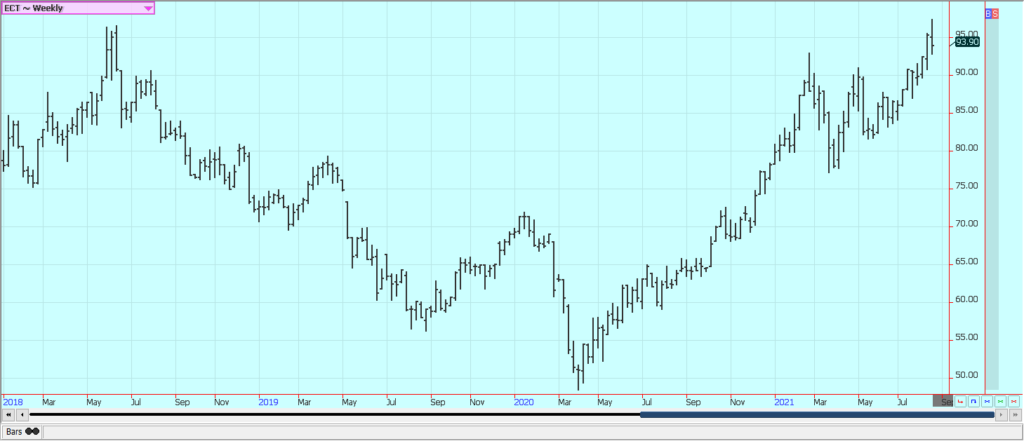

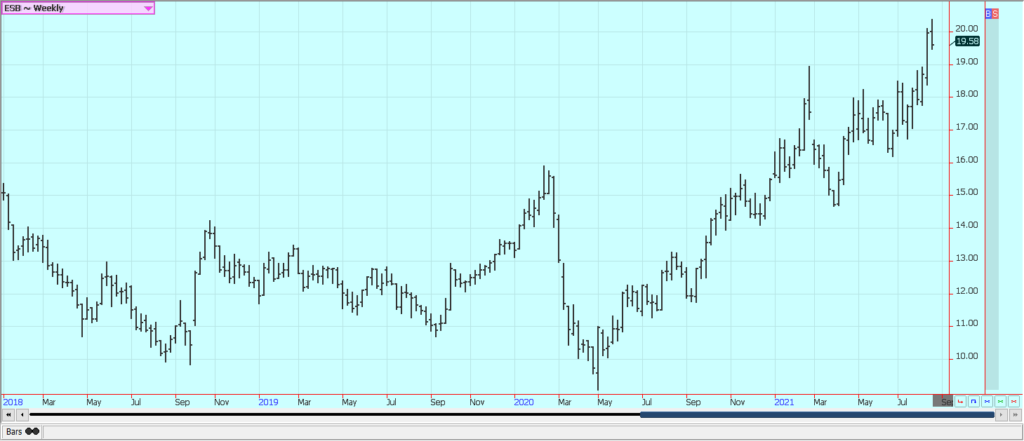

Cotton Futures Close Low on Covid Fears

Futures were lower last week despite a strong weekly export sales report as concern surfaced about Covid and the Delta Variant that could disrupt economic activies here and around the world. The US Dollar was higher to hurt the futures of many commodities including Cotton. The Dollar rallied on news that the Fed was considering tapering its bond purchases in the future. Showers are falling in Texas and throughout the major growing areas of the south. The Southeast is turned drier now as Fred has passed through the region. Ideas of strong demand continue but the weekly reports have shown more like an average demand. The demand is expected to be strong from Asian countries as world economies recover from Covid lockdowns. Analysts say the demand is still very strong and likely to hold at high levels for the future. However, the expansion of the Delta variant has given pause to the better demand ideas due to fears of economies here and around the world starting to partially lockdown again. Production ideas are being impacted in just about all areas due to the weather extremes. It has been very hot in parts of Texas and the Delta and Southeast have had drenching rains at various times in the last couple of months. Overall growing conditions are much better now in just about all areas.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little higher last week in range trading. The market is waiting for some news to trigger a move in one direction or the other. Freezing temperatures have been reported in Sao Paulo in the last couple of weeks but temperatures are now at or above seasonal averages. Weather conditions in Florida are rated mostly good for the crops. A new system could hit the state in the next couple of days and be more threatening than Fred, but the market appears unconcerned. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. Northeastern Mexico areas are too dry, but the rest of northern and western Mexico are rated in good condition.

Weekly FCOJ Futures

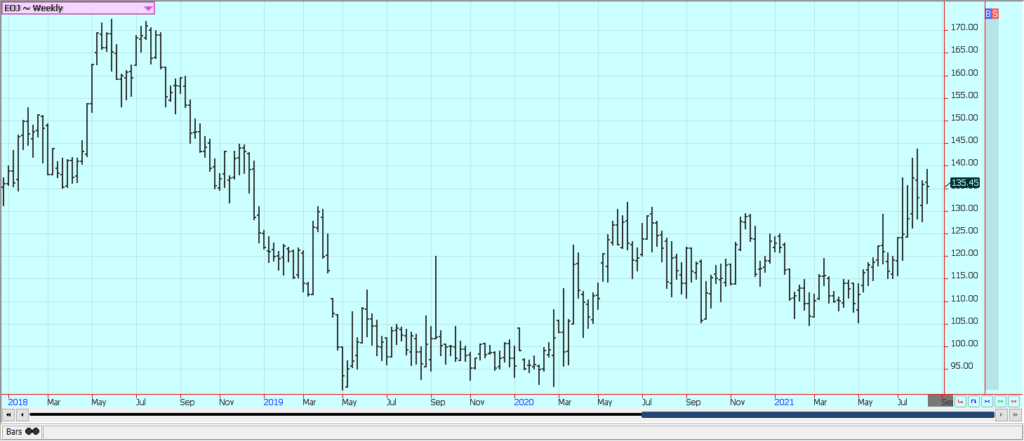

Coffee Divides Markets with Uncertain Future:

New York and London closed mixed last week and held to recent trading ranges. The US Dollar was firmer after Fed governors talked more about tapering of bond purchases and fears of the return of Covid with the spread of the Delta variant were noted. Prices have stayed firm as the current Brazil harvest starts to wind down. Brazil temperatures are warmer with near to above normal readings expected. It is flowering time for the next crop and the flowers were frozen and will drop off the trees. It is also harvesting time and the crop is now more than 89% harvested. The current outlook calls for 10 days of dry weather which will not support the flowering but will keep the harvest active. Improved showers are now in the forecast for Southeast Asia. Little demand is showing for Vietnamese Coffee as containers to ship the Coffee are hard to find. Good conditions are reported in northern South America and good conditions are reported in Central America. Colombia is having trouble exporting Coffee due to protests inside the country. Conditions are reported to be generally good in parts of Africa, but Ivory Coast and Ghana have been a little dry.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

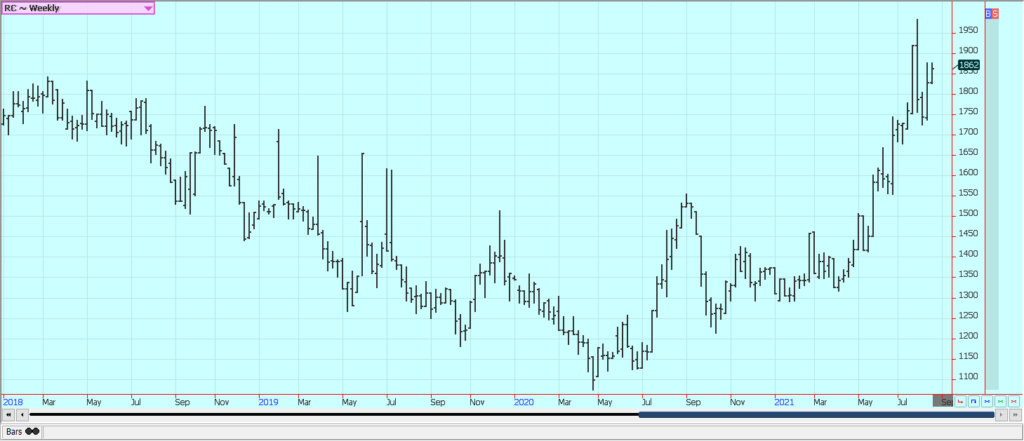

Sugar Futures Sabotaged by Strong Dollar:

New York and London were lower again on Friday on follow-through selling and worries about consumption. Reduced production estimates from Conab in Brazil released on Thursday did not really support the market much. Traders were reacting more to the stronger US Dollar and lower Crude Oil futures. Fears that the Covid is returning and could reduce economic activity and demand held sway. The market is still realizing a short supply situation. The freeze and drought damage is there as industry sources have said to expect a short season for processing. London has firmed a bit lately with the problems in Brazil and trends in this market are up. There is little White Sugar left in India for the export market but monsoon rains are promoting good conditions for the next crop. Thailand is expecting improved production. Ethanol demand is returning to the market as more world economies open up after the pandemic, but renewed Ethanol demand is now in doubt with weaker Crude Oil futures and covid pandemic fears as the Delta variant spreads.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

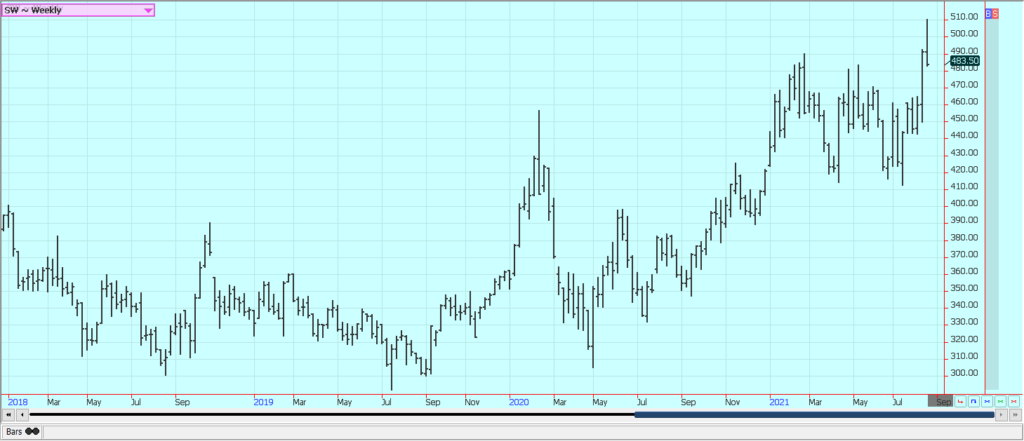

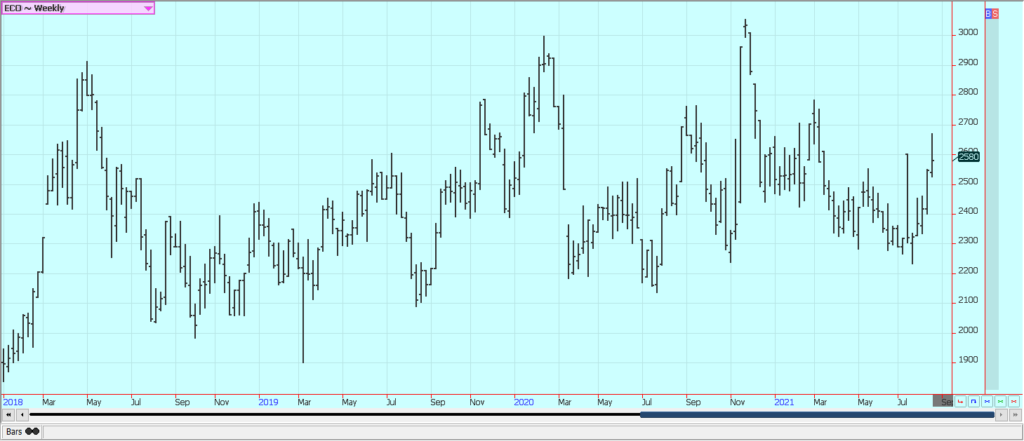

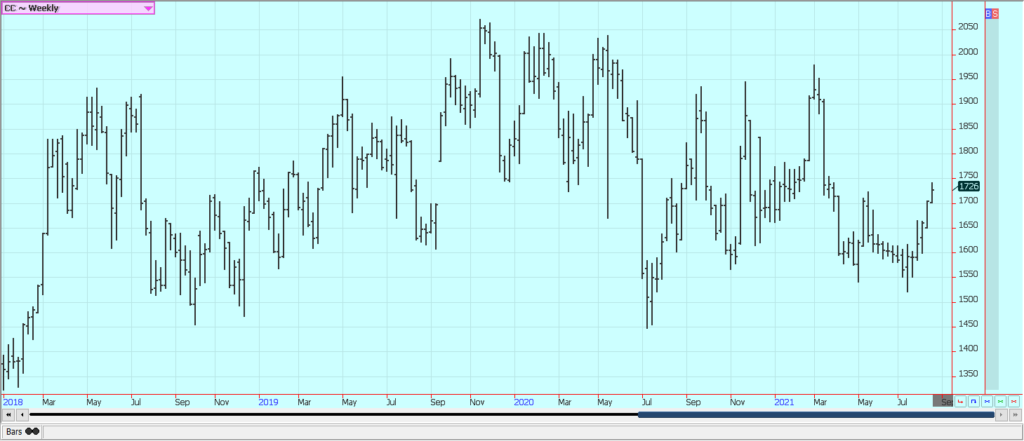

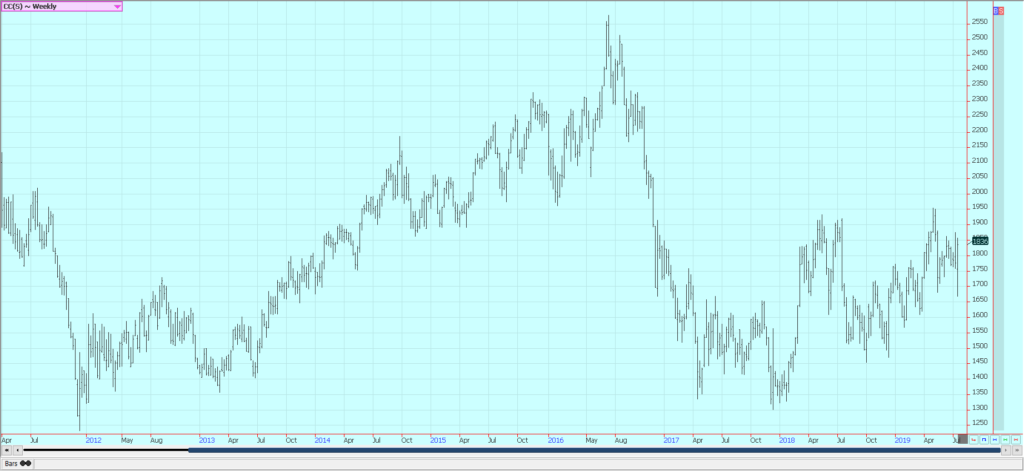

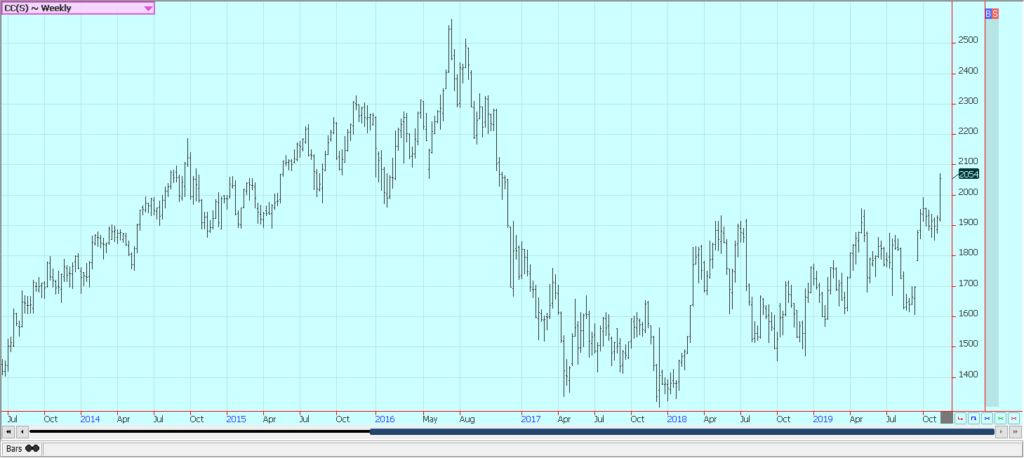

Cocoa Futures Climb, far Short of Week Record:

New York and London closed a little higher last week, but well off the highs of the week with currency considerations the major factor as the US Dollar rallied. The Fed mentioned that it could begin tapering of bond purchasers soon and this caused the macro changes and affected demand ideas for Cocoa. Ivory Coast has stopped selling for the next crop on fears of less supplies. The grind data was released recently and showed a strong recovery from the Covid times. World economies are starting to reopen after Covid and the open economies are giving demand the boost. The weather has had below-normal rains in West Africa and crop conditions are rated good for now but there is concern about the lack of rain.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

Futures and options trading involves a substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever? Past performance is not indicative of future results. Information provided on this report is intended solely for informative purposes and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

—

Featured Image by Jdblack via pixabay

DISCLAIMER: This article was written by a third-party contributor and does not reflect the opinion of Born2Invest, its management, staff, or its associates. Please review our disclaimer for more information.

A majority of the source material for this article was obtained via BBC. In the case of any discrepancies, inaccuracies, or misrepresentations, the source material will prevail.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Fintech1 week ago

Fintech1 week agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Cannabis5 days ago

Cannabis5 days agoColombia Moves to Finalize Medicinal Cannabis Regulations by March

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality

-

Markets12 hours ago

Markets12 hours agoMiddle East Escalation Sparks Market Uncertainty as Oil and Gold Poised to Rise