Featured

Why the Continued Chinese Lockdowns will Continue to Hurt Demand for Imported Cotton

Cotton was a little higher last week but spent most of the week trading in a small range. The trade is still worried about demand moving forward due to recession fears and Chinese lockdowns. The Chinese had been reopening the economy and country lately as Covid faded, but some reports of a new variant found there could shut the country down again in the near term.

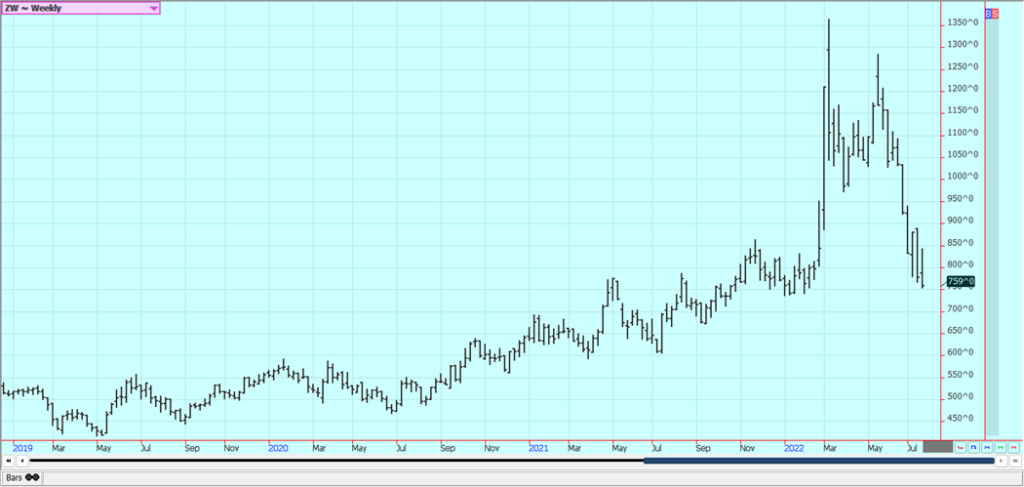

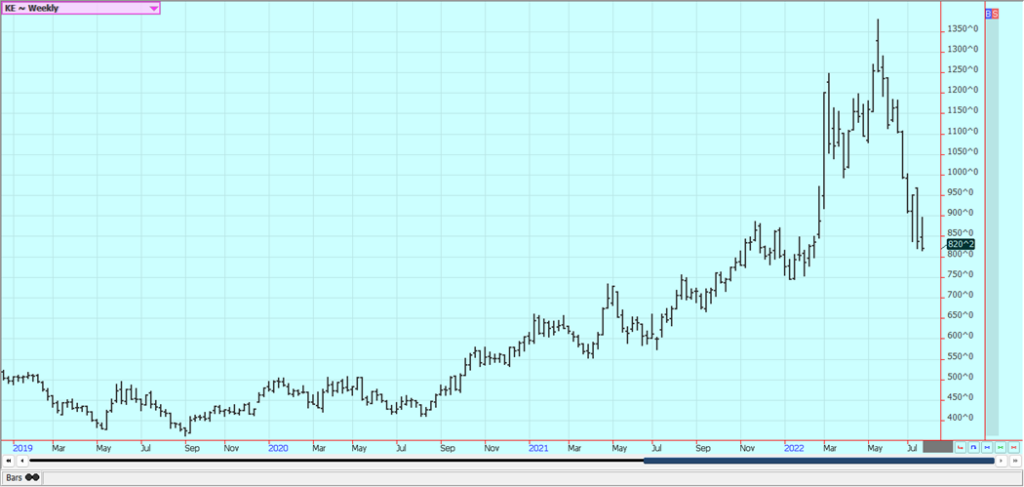

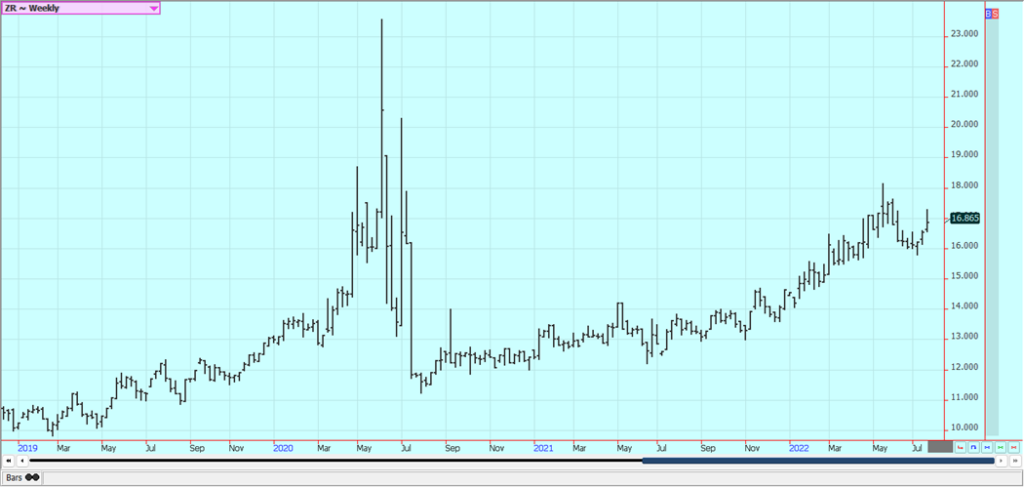

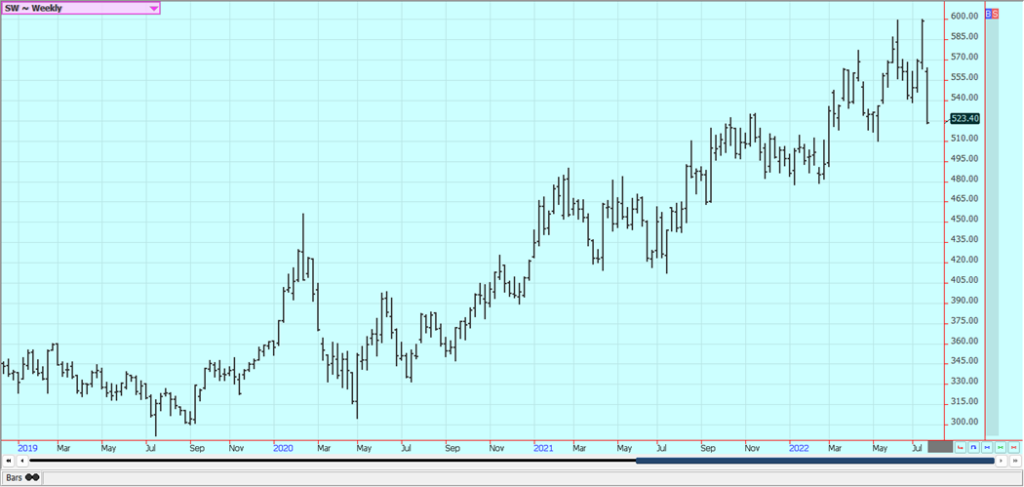

Wheat: Wheat markets were lower on news that Ukraine, Russia, and the UN would come to an agreement to allow for Ukrainian grain exports from the Black Sea. The deal gives Ukraine 120 days to export grain including Wheat and then must be renewed. It is thought to be unlikely that much will move from Ukraine right away as the infrastructure internally and at the ports needs to be rebuilt. It is also unknown how much Wheat and Corn could be available for export even with no infrastructure problems as many areas have been bombed by the Russians. Egypt negotiated directly with sellers instead of via tender and US prices are thought to be competitive. The country appears to have bought over 800,000 tons of world Wheat. Trends are turning down again in all three markets. Export demand is thought to be improving as US prices are now competitive in the world market and many are still scared to send boats into the Black Sea to pick up Russian or Ukrainian Wheat. The Winter Wheat harvest is now more than 70% complete through the Great Plains and Midwest. Hot and dry weather is back for this week in central and southern areas. Northern Plains and Canadian Prairies weather has been improved with showers and storms but is still variable. Europe is too hot and dry.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

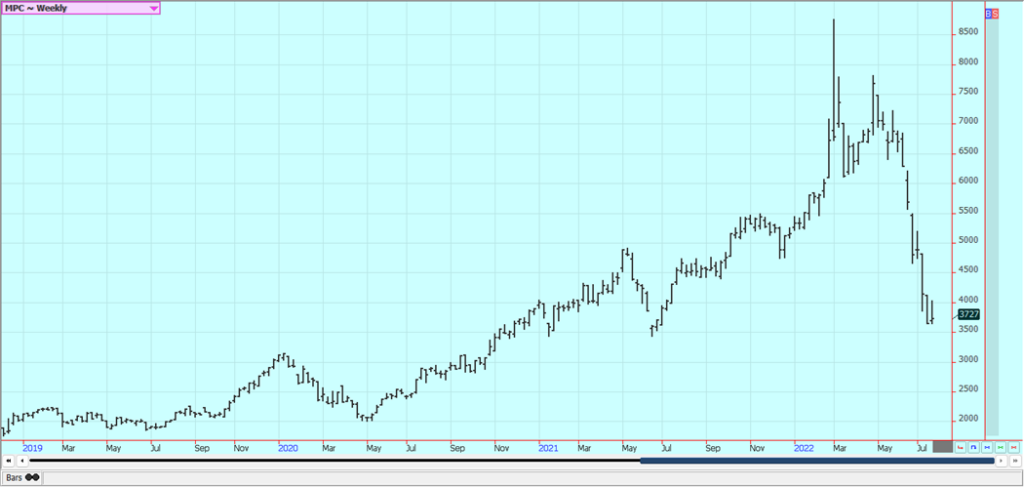

Corn: Corn closed lower last week on the weather forecasts that moderated overnight on temperatures and introduced the possibility of some rain to the Midwest this weekend. Some selling was seen and was tied to worries about the world economic health and Corn demand moving forward and on news that Ukraine and Russia has made a deal to permit Ukraine grain exports for the next 120 days. Corn is a weather market again as hot and dry forecasts were moderated as forecast temperatures are now a little cooler and there is some potential for some showers this weekend. Basis levels in the Midwest are strong amid light farm selling and good demand.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans were lower last week but both products were a little higher on improved weather forecasts. Many Midwest areas got rain in the last week or two and could be in line for more showers this weekend. Basis levels are still strong in the Midwest. The US cash market is still running low on Soybeans but there are still renewed Chinese lockdowns and China has been importing less as a result. There is less Chinese demand for Soy products due to the lockdowns there. The lockdowns are now for one week instead of one month as they were before. Ideas are that purchases could increase as the lockdowns and port closures are finally eased by the government there. China has been a major buyer of US Soybeans this year after a very slow start due to the problems in South America. They have been buying for this year and already have booked a large amount of new crop Soybeans to cover future needs.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher last week and trends on the weekly charts are up. The market acts as if the downside has been exhausted for now but traders need to find a reason to send prices much higher. It remains very hot and dry in Texas and the other growing areas are likely to see hot and dry conditions over the next couple of weeks. Crop conditions are mostly good to excellent for now in Arkansas but the weather could turn hot and dry and that could hurt overall production potential. Mississippi and Louisiana are called in good condition. Texas Rice is developing in what are called stressful conditions. Water availability from the lakes will be very limited this year and maybe next year.

Weekly Chicago Rice Futures

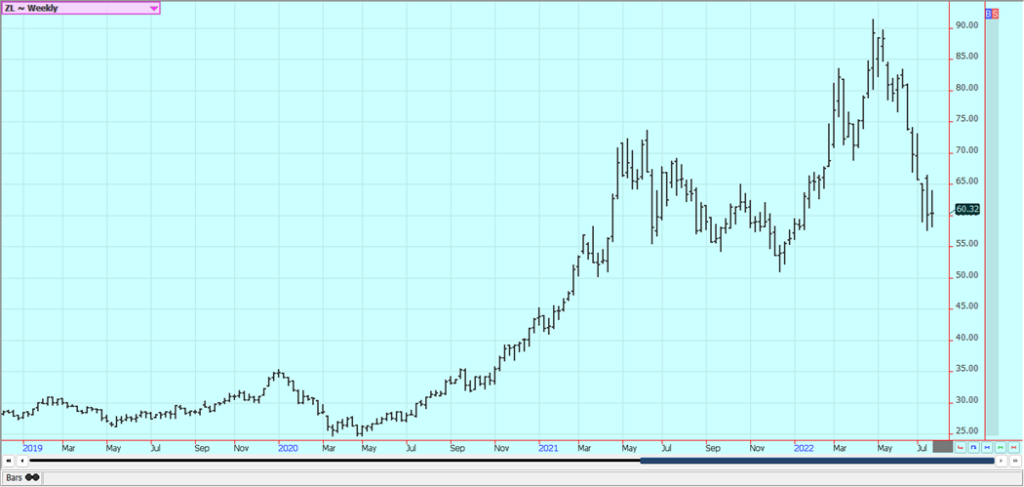

Palm Oil and Vegetable Oils: Palm Oil was a little higher last week in consolidation trading. Malaysia and Indonesia are making moves to expand demand in the face of increasing supply. Refiners in Malaysia have pledged to lower the price of cooking oil for internal consumption in an effort to help control inflation. Indonesia is offering incentives to move the product into domestic and export channels. Export reports from private sources are showing weaker demand this month and this has been the trend for the last few months. Production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Canola was lower along with Soybean Oil and on a stronger Canadian Dollar. The growing conditions are much improved with rans being reported in recent days.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

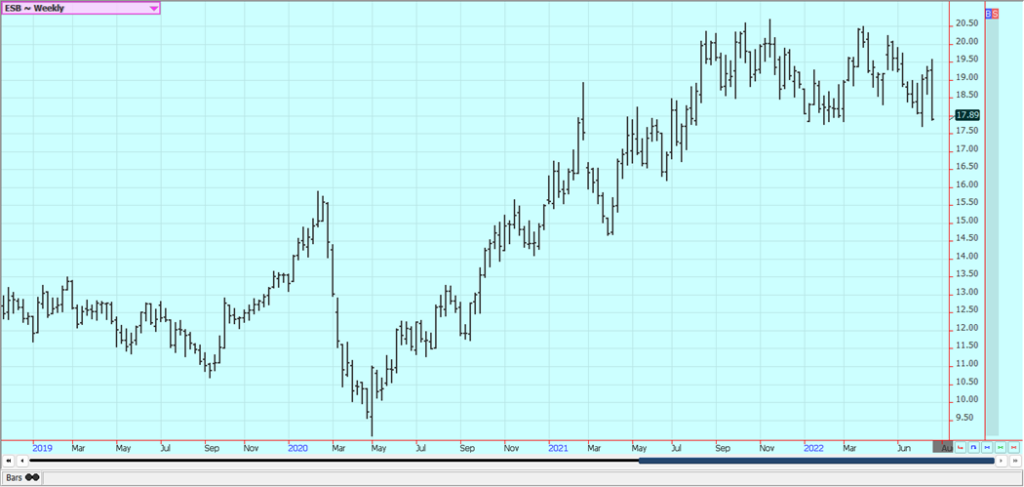

Cotton: Cotton was a little higher last week but spent most of the week trading in a small range. The trade is still worried about demand moving forward due to recession fears and Chinese lockdowns. The Chinese had been reopening the economy and country lately as Covid faded, but some reports of a new variant found there could shut the country down again in the near term. The quarantine is one week now instead of one month as before. Current weather forecasts call for hot and dry conditions for much of the Great Plains including the west Texas Cotton area. It is possible that the continued Chinese lockdowns will continue to hurt demand for imported Cotton for that country and that a weaker economy in the west will hurt demand from the rest of the world.

Weekly US Cotton Futures

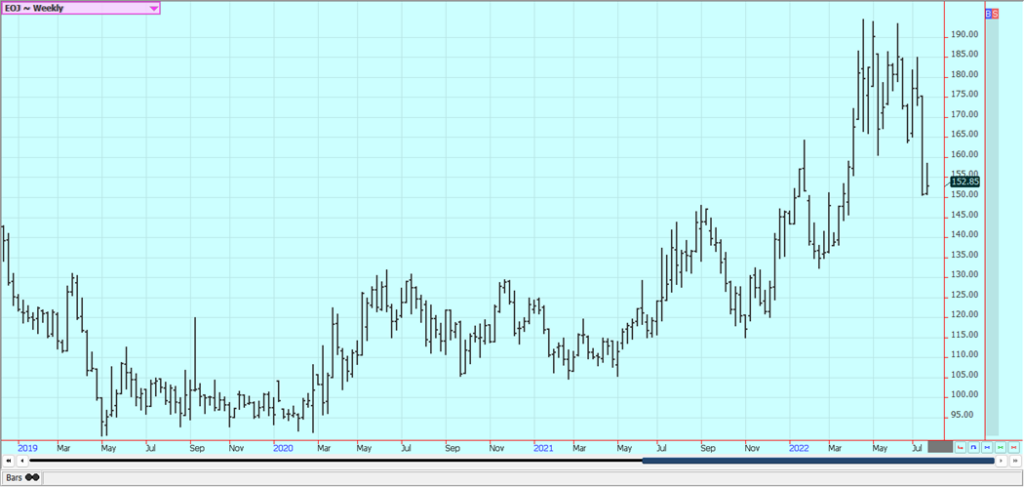

Frozen Concentrated Orange Juice and Citrus: FCOJ was a little higher last week but spent much of the week in a narrow trading range. Trends are mixed on the daily and weekly charts. The recent market weakness has been dramatic since the market made new contract highs earlier this month. The weather remains generally good for production around the world for the next crop. Brazil has some rain and conditions are rated good. Weather conditions in Florida are rated mostly good for the crops with some showers and warm temperatures.

Weekly FCOJ Futures

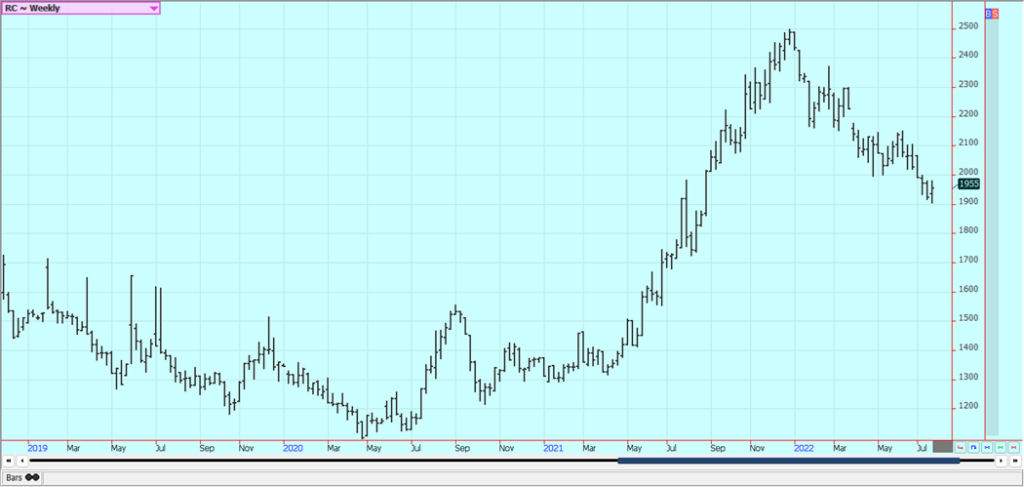

Coffee: New York and London were sharply lower on Friday but still higher for the week. Trends are mixed on the daily charts in London but down in New York. Futures remain rather cheap when compared to the cash market and certified stocks keep dropping. Demand for Coffee overall is thought to be less as the world economic situation is not strong but the strong cash market means that even less Coffee is on offer. There is less Coffee on offer from origin, with Brazil offering less and Central America and Vietnam offering less as well. The weather in Brazil is good for Coffee production and any harvest activities. Temperatures are above normal in Brazil and conditions are mostly dry.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

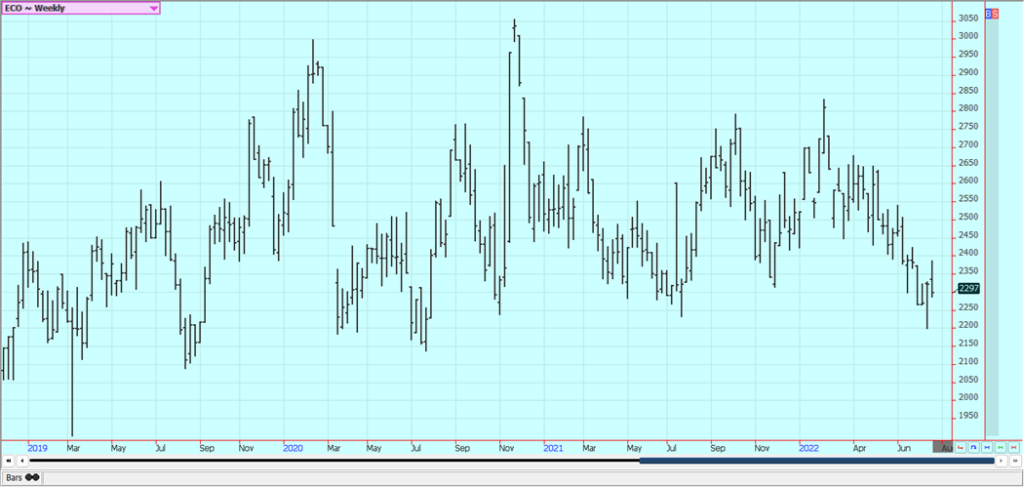

Sugar: New York and London closed lower last week on what appeared to be speculative selling that was seen in many ag markets. Futures have now given back most or all of the recent up move and could work lower. The London market had been looking for increased supplies from origin and now is more worried about demand after recent price strength. Trends are still mixed in New York and in London. is reported to have a big crop of Sugarcane coming and as Brazil is harvesting its crop of Sugarcane and turning much of it into Ethanol but is still making some Sugar and some of that Sugar is making it into export channels. Reports from India indicated that conditions are generally good for Sugar production. Monsoon rains have been good in India this year.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

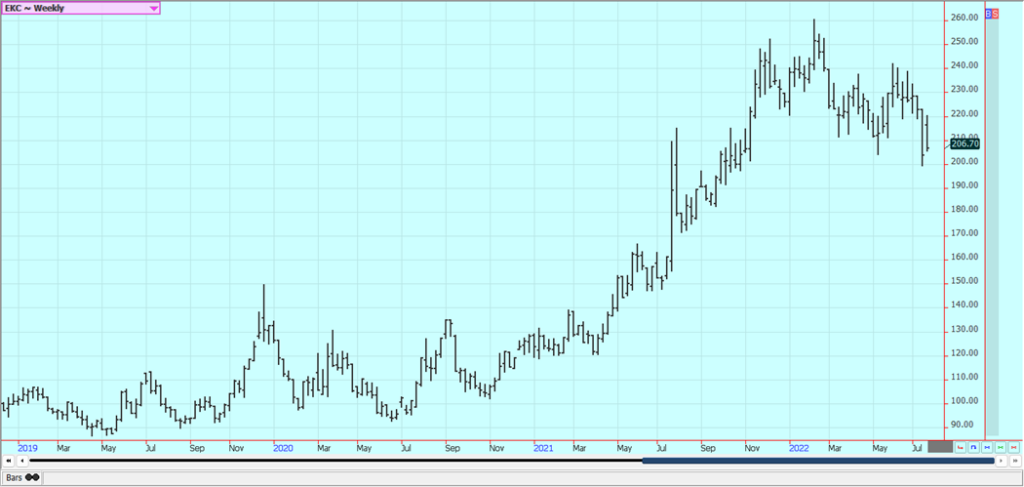

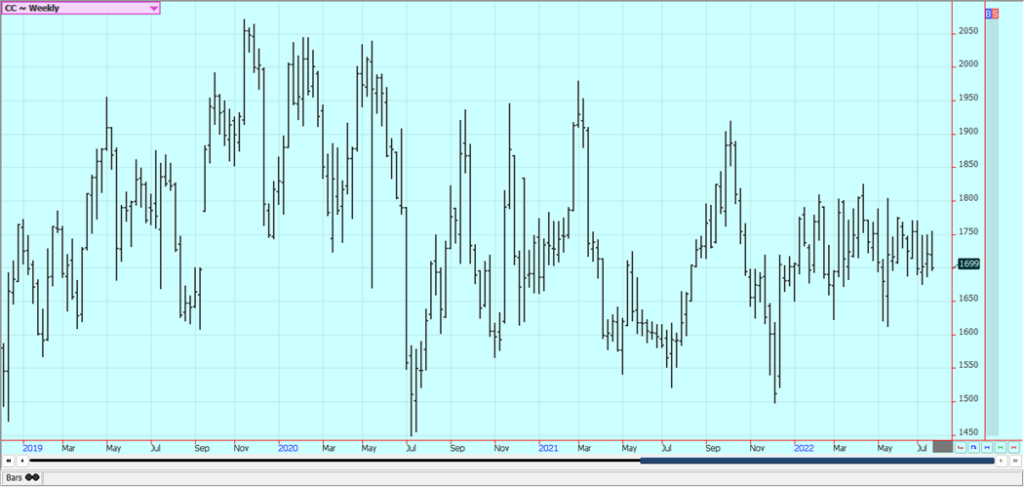

Cocoa: New York and London were lower last week on what appeared to be selling interest from speculators amid signs that supplies of Cocoa are as large as they will be now for the rest of the marketing year. Trends are mixed. Reports of sun and dry weather along with very good soil moisture from showers keep big production ideas alive in Ivory Coast. Ideas are still that good production is expected from West Africa for the year. The weather is good for harvest activities in West Africa but the harvest should be winding down now. Current reports from Ivory Coast indicate that the weather is a good mix of sun and rain. The weather is good in Southeast Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by bobbycrim via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Africa5 days ago

Africa5 days agoMorocco’s Wheat Dependency Persists Despite Improved Harvest

-

Crypto2 weeks ago

Crypto2 weeks agoBrazil’s Crypto Boom Threatened by Surprise Tax Proposal

-

Biotech11 hours ago

Biotech11 hours agoEcnoglutide Shows Promise as Next-Generation Obesity Treatment

-

Markets1 week ago

Markets1 week agoCocoa Prices Drop Amid Speculative Selling and West African Supply Concerns