Featured

Why Were Cotton Futures Lower for the Week

Cotton futures were lower last week on demand concerns as ideas of strong demand continue. The weekly export sales report was called positive for prices. Analysts say the demand is still very strong and likely to hold at high levels for the future. Production ideas are being impacted in just about all areas due to the weather extremes.

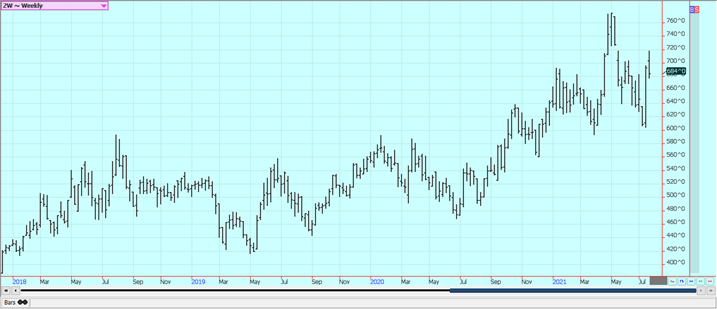

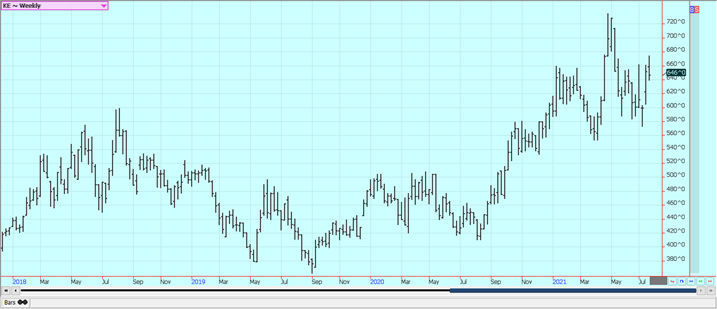

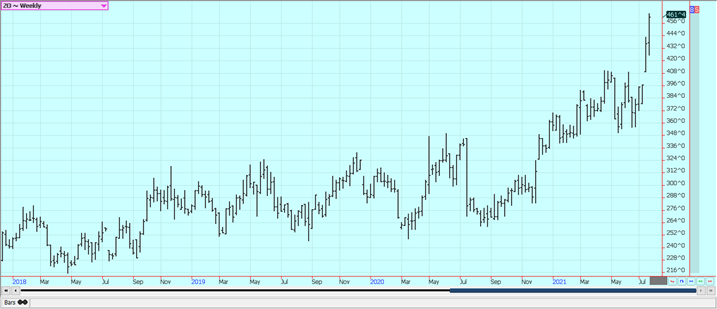

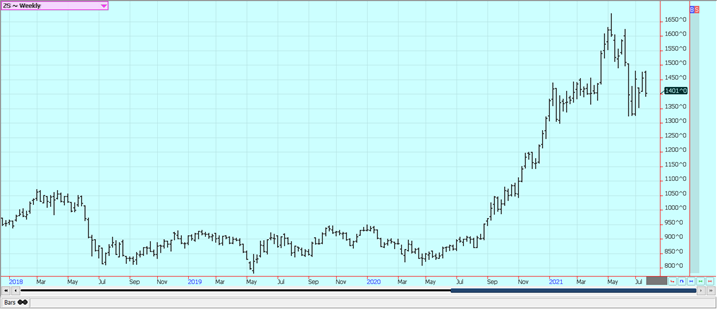

Wheat: Winter Wheat markets were lower last week and Minneapolis Spring Wheat was a little lower as the Winter Wheat harvest continues. Yield reports have generally been good in Winter Wheat areas but there have been mixed results reported in some Great Plains states. Quality has been generally average. Minneapolis was lower on forecasts of rainfall for the Dakotas. The rains will not be enough to change the overall drought situation but will help in the short term. Trends are mixed on the daily charts for the Winter Wheat markets. The harvest should help keep the pressure on futures for a little while longer. However, the Spring Wheat situation is different and a short crop is increasingly likely. There are ideas that the coming rains will not help much as they are late. It will turn cooler but will heat up again after a week. The dry and hot weather seen to date have produced very low crop condition ratings and conditions are not expected to improve much if at all in the coming weeks.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn was lower after a sharply lower day on Friday as the forecasts for 11 to 16 days out changed. The European model has added cooler temperatures and rain to the forecasts for the Northern Plains and western Midwest. All forecasts and models call for hot and dry conditions for the next 10 days and the American model continues the hot and dry weather for the following days. The growing conditions in the US are highly variable and not likely to produce trend line yields. Traders are reducing yield estimates from the USDA report of 179.5 bushels per acre to more like 174 bushels per acre and ideas are that more adverse weather could drive yields lower. No one is talking much about increasing yield estimates right now. Ideas are that Brazil Corn production will be less than 90 million tons so reduced production estimates are expected in coming reports. Demand has been poor for UDS Corn with net cancellations showing in the weekly sales report last week. Net sales have been bad for the past several weeks and this has gained the notice of traders. Oats were higher last week as the weather market continues. Hot and dry weather is forecast for the Dakotas and into the Canadian Prairies for the next ten days. Canadian Oats areas look to get some rain after that in the next couple of weeks, but US areas showed mixed conditions in the weekly USDA updates. Longer range forecasts released by NWS call for warmer and drier weather for many important US growing areas this Summer.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and the products were generally lower last week as the outlook for the weather in 11 to 15 days changed. The European model has added cooler temperatures and rain to the forecasts for the Northern Plains and western Midwest. All forecasts and models call for hot and dry conditions for the next 10 days and the American model continues the hot and dry weather for the following days . There are many areas that do not have good Soybeans in the US. Soybeans conditions in central production area are often too wet and have suffered. The weather forecasts changed to wetter and cooler and the crop needs dry conditions and some heat . Minnesota and northern Iowa and the Dakotas have been very hot and dry but Iowa got very beneficial rain last week. \The longer range forecasts from NWS call for warmer and drier than normal conditions for most Soybeans areas of the US. The forecast is open to change but there is also a lack of demand showing right now. The monthly crush data and weekly export sales reports have been less than expected, so demand is becoming a problem for those traders looking for more upside price action.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice closed higher Friday and closed very strong for the week on increasing demand ideas and as the weather has been variable for Rice. The weekly export sales report was stronger than expected. The market expects smaller production this year due to reduced planted area and some weather extremes seen through the growing season to date. Growing conditions have been mixed at best with many areas getting too much rain. Rice areas have generally been wet. Louisiana and parts of Mississippi were saturated and are still reported to be wetter than desired for strong production and good quality. Warm temperatures are reported in Arkansas and Missouri and the crop progress is improving. However, it is still very wet in Arkansas. Texas has also been wet. Export demand has been disappointing and Asian prices are trending lower.

Weekly Chicago Rice Futures

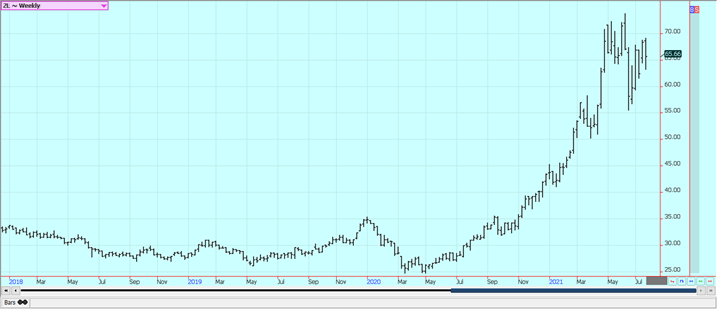

Palm Oil and Vegetable Oils: Palm Oil futures were sharply higher last week on ideas of tight supplies. Trends are up on the daily and weekly charts. The private surveyors showed less demand for the current month in reports issued last week and futures did dip a bit on the news. The tight supply scenario is keeping the market afloat. Canola closed lower on weather concerns as forecasts call for some shoers in a couple of weeks. It remains generally hot and dry but some relief is in sight at least according to one computer model. The showers have a chance to be very beneficial as the Prairies crops are in big trouble now due to previous and coming hot and dry weather. It will be hot and dry for the next week or two before any relief comes. Demand is not real strong right now. Soybean Oil was also lower. Ideas are that demand for biofuels will hold strong due to the stronger Crude Oil futures.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Futures were lower last week on demand concerns as ideas of strong demand continue. The weekly export sales report was called positive for prices. Analysts say the demand is still very strong and likely to hold at high levels for the future. Production ideas are being impacted in just about all areas due to the weather extremes. Demand was increased in the weekly export sales report and is expected to stay strong as the world economy rebounds from the Covid times.

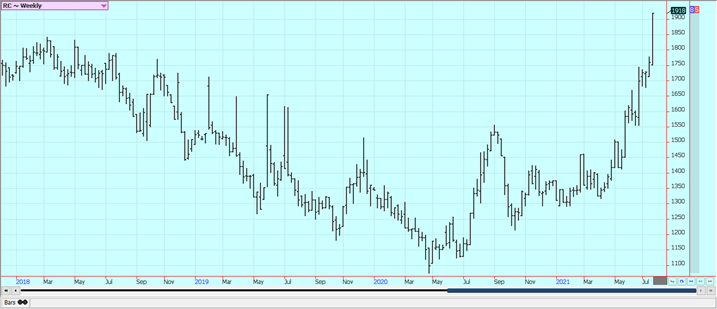

Weekly US Cotton Futures

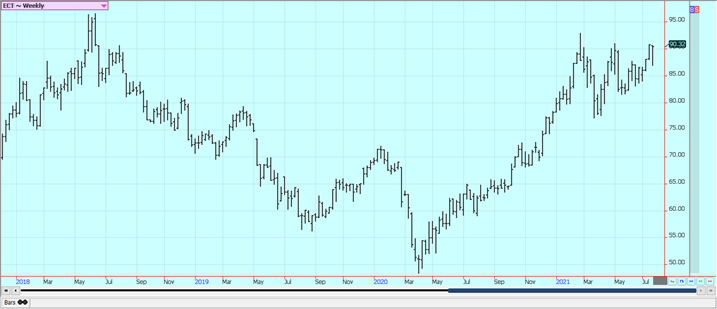

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher and made new highs for the move on news of freezing temperatures last week in Sao Paulo Brazil that could have affected the production of Oranges in the state. Weather conditions in Florida are rated mostly good for the crops. The Atlantic is turning more active although nothing has formed to threaten the state of Florida yet. A big storm could threaten trees and fruit. Brazil is reported to be cold and dry. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. Northeastern Mexico areas are too dry, but the rest of northern and western Mexico are rated in good condition.

Weekly FCOJ Futures

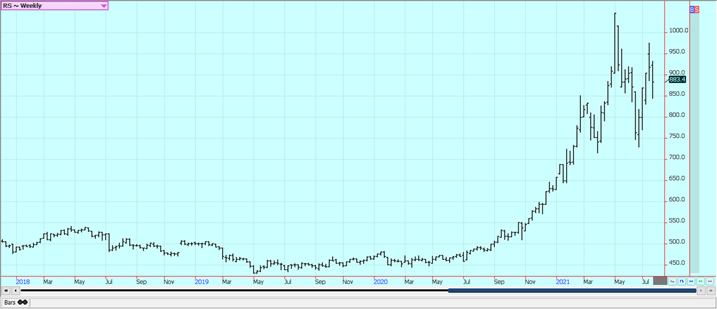

Coffee: New York and London closed much higher last week on freezing temperatures in Brazil growing areas earlier in the week. The freeze caught traders by surprise as forecasts had been for cold, but not threatening, temperatures in Coffee areas. Freezing temperatures were reported in much of Minas Gerais and Parana and also in Sao Paulo. It is not yet known how extensive the damage was but ideas are that a significant part of the cop got hurt. It is flowering time for the next crop and the flowers were frozen and will drop off the trees. London remains firm overall on some speculative and commercial buying tied to dry weather in Southeast Asia and on reports that Vietnamese producers were not selling or delivering. Some of the buying late last week was tied to the big rally in New York as well. Temperatures are now turning warmer in Brazil. There were some losses created by a hot and dry start to the growing season that impacted flowering and initial cherry development and a little Coffee was lost during the freeze event several weeks ago. Increasing showers are coming this week to Southeast Asia and tree condition should be improved. Good conditions are reported in northern South America and good conditions reported in Central America. Colombia is having trouble exporting Coffee due to protests inside the country. Conditions are reported to be generally good in parts of Asia and parts of Africa.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

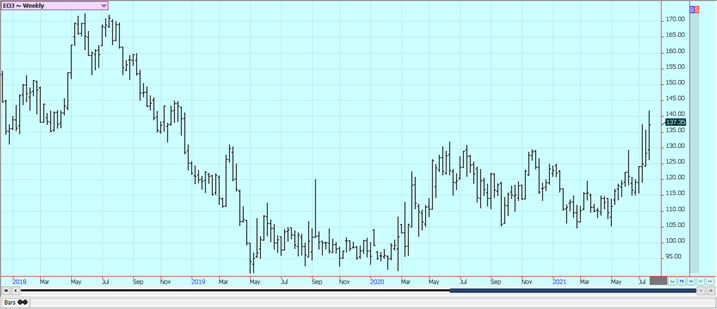

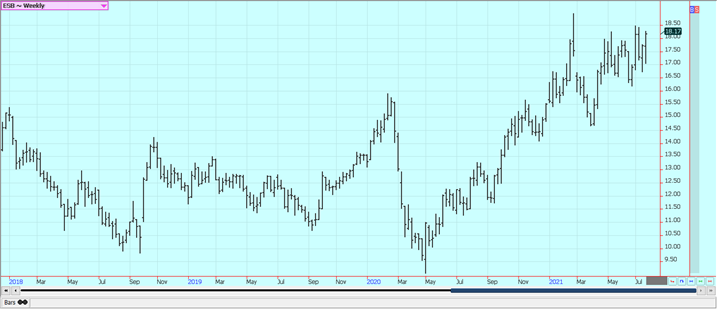

Sugar: New York and London closed on a strong note on Friday and were higher for the week as freezing temperatures hit Sugarcane areas of Brazil and probably caused some significant damage. Reports of damaged cane in Brazil and pictures of the damage were tweeted, but there has not been any real information sent out since the event. The pictures are showing the potential for significant damage to crops. Brazil temperatures are now moderating. Mills were also processing for more Ethanol and less for Sugar than expected and this trend should continue even with weaker world petroleum prices. London has been the weaker market on ample supplies of White Sugar available to the market and as demand for White Sugar is less. There is plenty of White Sugar available in India for the market and monsoon rains are promoting good conditions for the next crop. The Indians are selling with or without a subsidy from the government. Thailand is expecting improved production. Sugar demand is said to be weak. Ethanol demand is returning to the market as more world economies open up after the pandemic.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

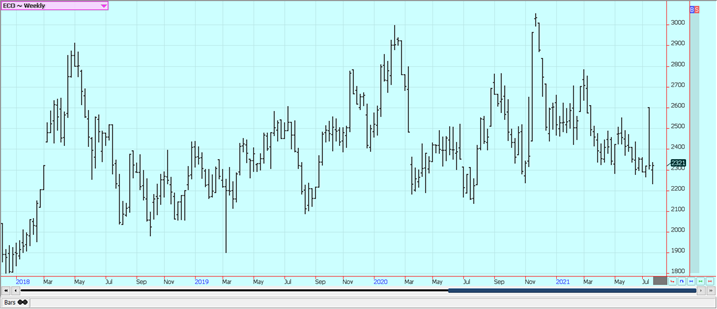

Cocoa: New York and London closed higher on Friday but near unchanged for the week. Futures remain in a trading range on the daily and weekly charts. It appears that the supply fundamentals are now part of the price structure for Cocoa. The European grind data was released last week and showed a strong recovery from the Covid times. Asian data was released a week ago and also showed increased demand, although not as much of an increase than showed for Europe. Ports in West Africa are filled with Cocoa right now. The weather has had above average rains in West Africa and crop conditions are rated good.

Weekly New York Cocoa Futures

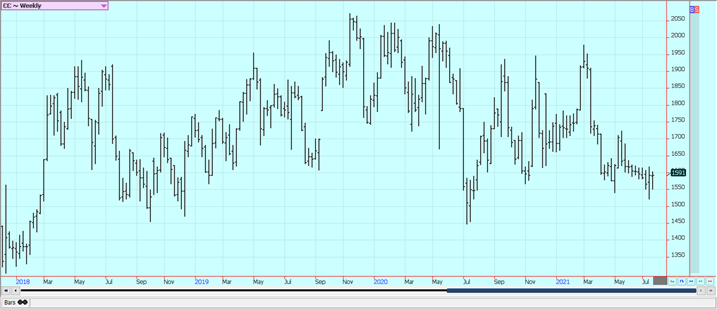

Weekly London Cocoa Futures

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

—

(Featured image by Amber Martin via Unsplash)

DISCLAIMER: This article was written by a third-party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa3 days ago

Africa3 days agoSurging Expenditures Widen Morocco’s Budget Deficit Despite Revenue Growth

-

Markets2 weeks ago

Markets2 weeks agoSoybean Market Reacts to Trade Hopes, High Stocks, and Global Price Pressure

-

Cannabis11 hours ago

Cannabis11 hours agoGermany Moves to Curb Medical Cannabis Abuse, Sparking Access Concerns

-

Cannabis1 week ago

Cannabis1 week agoSwitzerland Advances Cannabis Legalization with Public Health Focus