Markets

10 ‘S&P 500’ companies with the best dividend growth stocks

The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

Cautious income-seeking investors might look for large-cap dividend stocks in order to avoid significant stock price fluctuation. As such, they might limit their choice to companies that are included in the S&P 500 index.

Description from “S&P Dow Jones Indices” website:

The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

Some investors are looking for high yielding dividend stocks; others prefer dividend growth stocks. In this article, I will show how to build a dividend growth stocks portfolio.

When a company has a long-term track record of consistent and rising dividend payments, it is a clear indicator that the company’s financial position is good. Investing in companies that regularly raise dividends provides security in an uncertain market and means higher returns ahead. I consider that besides dividend yield, the consistency and the rate of raising dividend payments are the most crucial factors for dividend-seeking investors.

Peter Lynch, the legendary manager of the Fidelity Magellan Fund, wrote in his book “Beating the Street”:

The Dividend Achievers Handbook is one of my favorite bedside thrillers. Here’s a simple way to succeed in Wall Street: Buy the stocks on Mergent’s list and stick with them as long as they stay on the list.

Dividend Achievers are stocks with more than ten consecutive years of dividend increases.

In the following, I will show how to find the best large cap dividend growers stocks according to my criteria. Since this article is designated to income-oriented investors, I have considered only stocks that are yielding more than 2.5%. Also, I have put some more requirements:

-Payout ratio less than 100%

-Average annual dividend growth over the last five years higher than 5%

-Average annual dividend growth over the last three years higher than 5%

-Positive dividend growth over the last year

Since 64 stocks have complied with the requirements mentioned above, I have created a particular ranking system to rank the best ten dividend growers stocks.

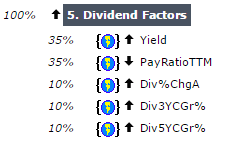

I have used the Portfolio123 ranking system, which allows the user to create complex formulas according to many different criteria and evaluating performance by backtesting, to develop the following ranking system. The ranking system gives a weight of 35% to the yield, and 35% to lower payout ratio. Also, it gives a weight of 10% to dividend growth in the last year, 10% to the average annual dividend growth over the last three years, and 10% to the average annual dividend growth over the last five years, as shown in the chart below.

© Arie Goren

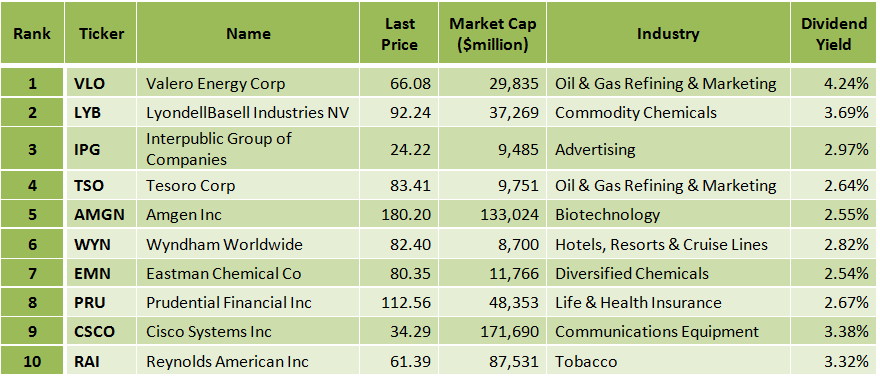

After running the screen on March 5, I discovered the following ten best S&P 500 dividend growers stocks, which are shown in the table below.

© Arie Goren

It is worth mentioning that the best ten dividend growers stocks represent nine different industries. As such, in my opinion, the system, which I have shown in this article, could be used by income-oriented investors to create a superior diversified dividend growth stocks portfolio.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

Featured Image by Katrina Tuliao via Wikimedia Commons / CC BY 2.0

-

Cannabis4 days ago

Cannabis4 days agoSwitzerland Advances Cannabis Legalization with Public Health Focus

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Surges Toward $110K Amid Trade News and Solana ETF Boost

-

Crowdfunding8 hours ago

Crowdfunding8 hours agoEquity Crowdfunding in Europe Surges to €160M in H1 2025 Amid Market Resilience

-

Fintech1 week ago

Fintech1 week agoRipple and Mercado Bitcoin Expand RWA Tokenization on XRPL

You must be logged in to post a comment Login