Biotech

3D-Shaper opens a funding round of half a million euros

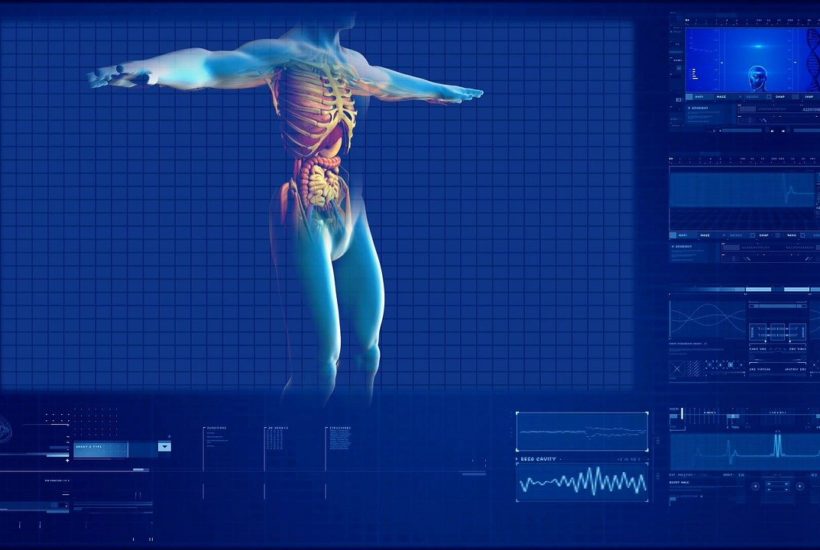

3D-Shaper is looking for new funds to expand its product in the United States and Asia. The company has recently started a crowdfunding campaign on the Crowd Angel Platform. The software developed by the company is an algorithmic model that creates an exact replica of the bone in 3D, which allows a better analysis and understanding of each patient’s situation.

The company 3D-Shaper is currently looking for investors. The Barcelona-based health tech company, specialized in the development of technology for bone diseases, has opened a funding round of $600,000 (€500,000) through the Crowd Angel platform.

This is a second tranche in the raising of funds, according to the company, as 3D-Shaper has recently obtained $365,000 (€300,000) from a family office, whose name has not transcended. Therefore, the total amount collected could rise to $973,000 (€800,000).

The company will use the funds to start the expansion of its product in the United States, Asia, the approval of the American Drug Agency (FDA) and to increase the equipment. The company hopes to reach break even in 2021 and that its gross operating profit Eebitda) will be $10.9 million (€9 million) in 2024.

Read more details about the company 3D-Shaper and its latest crowdfunding campaign and find more business headlines with our companion app, Born2Invest.

3D-Shaper has obtained one million euros of public funding

Beyond private funding, the company has obtained one million euros in subsidies and credits from public administrations to be able to develop its technology. 3D-Shaper has promoted the first software in the world capable of creating a three-dimensional replica of the patient’s bone structure, quickly and at low cost, allowing the precise diagnosis and monitoring of osteoporosis.

The software is an algorithmic model that creates an exact replica of the bone in 3D, which allows a better analysis and understanding of each patient’s situation. The technology is an add-on to current bone densitometry (DXA) machines, thus improving their diagnosis. 3D-Shaper is born within the Galgo Medical Group, a start up specialized in image software that includes three companies in its shareholding, within which is Inveready, one of the most important venture capital managers in Spain. These three companies are Adas 3D, Ankyras and Sylvius.

The company hopes to reach an agreement with Hologic in 2021

The company’s business model is divided into three. 3D-Shaper sells its software to DXA machine manufacturers, markets them to hospitals and performs research and development (R&D) services to pharmaceutical companies. Every year 5,000 DXA machines are sold worldwide and there are 50,000 distributed.

The next goal of the start up is to reach an agreement with Hologic in 2021, an operator that controls 40% of this market. The company is led by Ludovic Humbert, a scientist with experience in computer imaging and also co-founder of Galgo Medical. Antoni Riu is the financial director, who is the CEO of Adas 3D. In Spain alone, $3.53 billion (€2.9 billion) are allocated to this type of fracture and 66% of the cost is associated with surgery that could be prevented by early diagnosis.

__

(Featured image by PublicDomainPictures via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crypto6 days ago

Crypto6 days agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Biotech3 days ago

Biotech3 days agoSpain Invests €126.9M in Groundbreaking EU Health Innovation Project Med4Cure

-

Crypto2 weeks ago

Crypto2 weeks agoRipple Launches EVM Sidechain to Boost XRP in DeFi

-

Impact Investing6 days ago

Impact Investing6 days agoShein Fined €40 Million in France for Misleading Discounts and False Environmental Claims