Featured

A Freeze on the Coffee Market Could Develop

New York and London both closed a little lower last week as the US Dollar remains high but very high cash market differentials are supportive of prices. Less demand for Vietnamese coffee was hurting the London price action. Demand for coffee overall is thought to be less as the world economic situation changes for the worse but the strong cash market means that even less coffee is on offer.

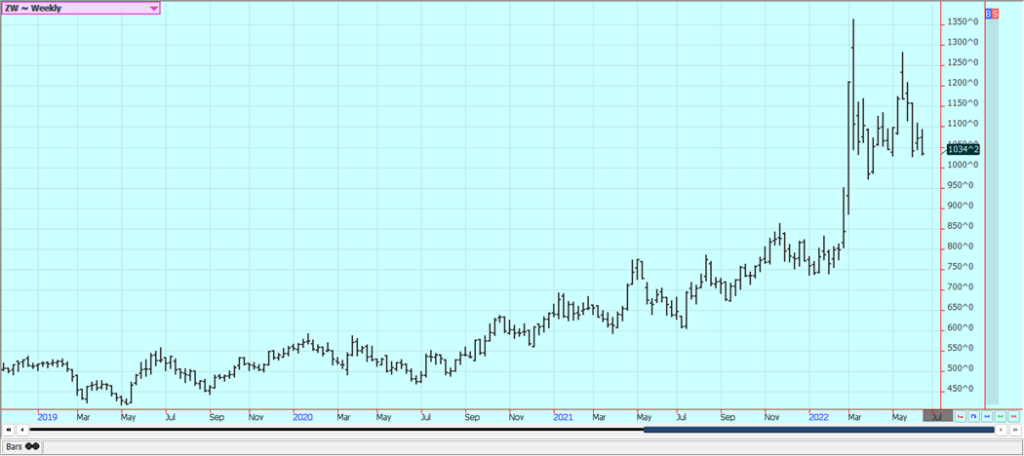

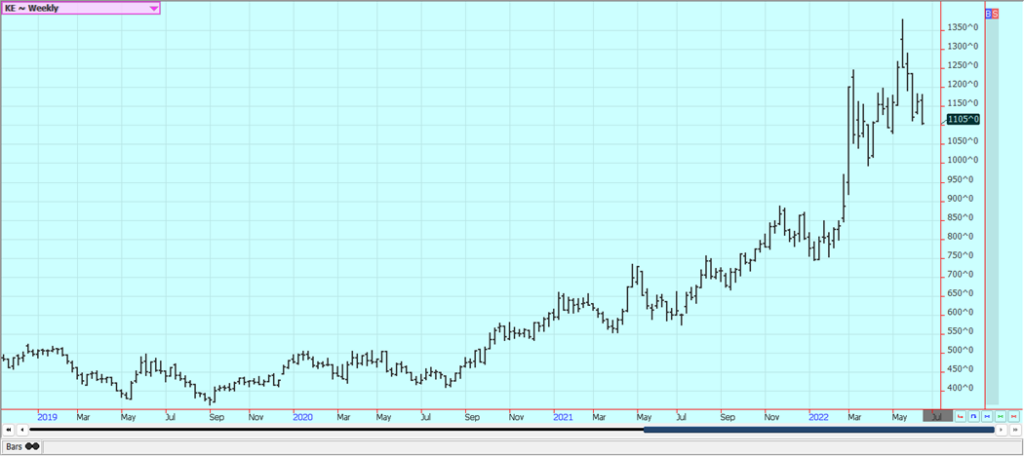

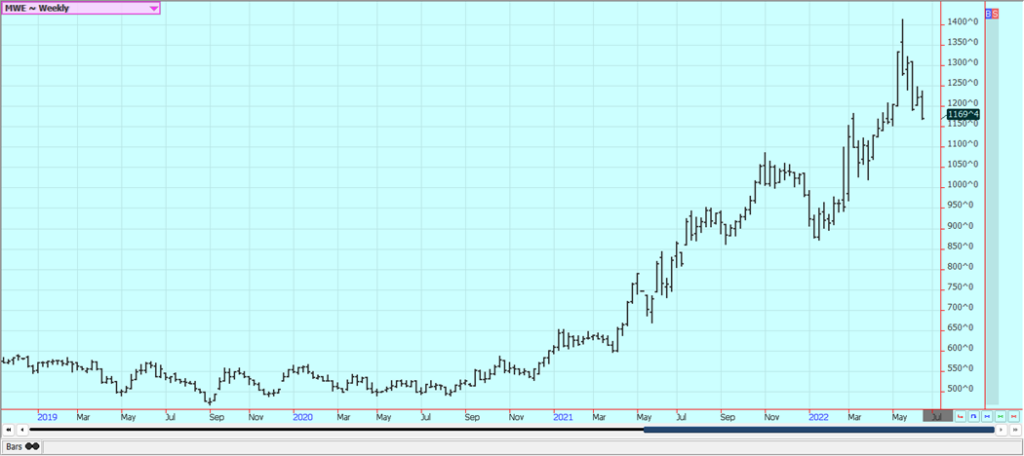

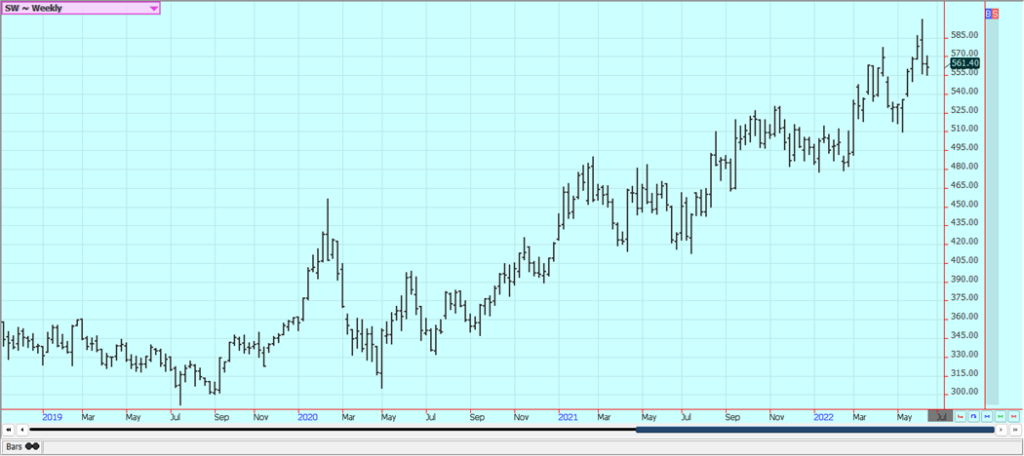

Wheat: Wheat markets were sharply lower on Friday and lower for the week as the Winter Wheat harvest is underway. The harvest was 10% complete in Monday USDA data and futures should form harvest low earlier in the harvest due to the small crop size. Yield reports have been OK in Kansas as recent rains have helped kernel size and test weight. USDA noted mostly stable conditions for the Winter Wheat crops on Monday but noted Spring Wheat planting remained far behind average. The US western Great Plains got some rainfall and the rains fell in some of the areas most in need of some precipitation. Hot and dry weather could return this week. It is turning warmer and drier farther north to give hope to Spring Wheat farmers that they can plant crops. Europe is too hot and dry and India and Pakistan are both past major heat waves and dry conditions.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

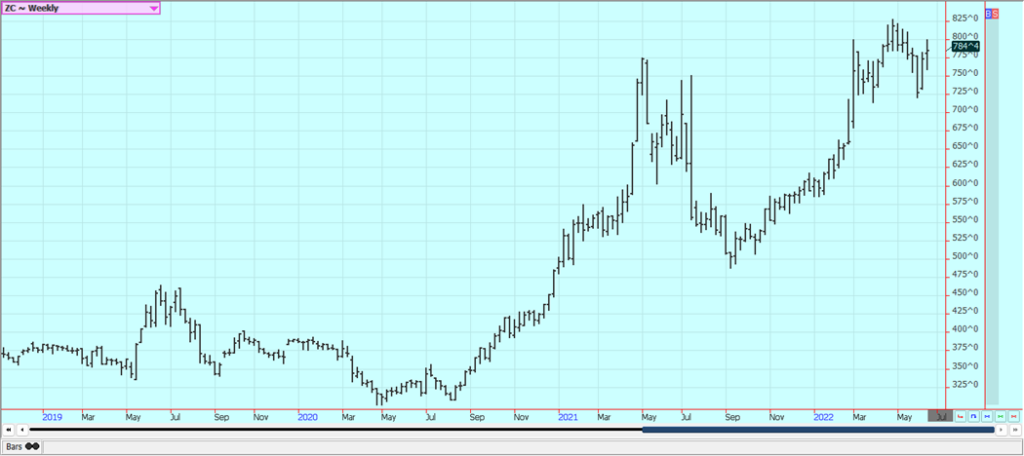

Corn: Corn closed higher in July on reports of a stronger US cash market and higher in new crop months on outlooks for hot and dry weather for the next month and three months. Corn has emerged under what is considered good conditions but it has turned hot in the Midwest. This will be good for a while but continued hot and dry weather could hurt yields down the road. Stress could start to develop next week if the hot and dry weather returns as forecast. The areas left to be planted are primarily in the Dakotas and will not get planted as the insurance planting dates have passed. The risk to plant now would be much higher without the insurance and the high costs of inputs. There are also pockets of area left to be planted in the big production states. The weather was variable last week with periods of rain and very cool temperatures and then warm and dry conditions and hot and dry weather is expected this week after some rains in central areas on Monday. Many think the top end of the yield has been taken off the Corn crop due to the delayed planting but others look at the crop condition rating and expect improved yields. It already thinks there is reduced planted area because of the March planting intentions reports from USDA and the bad planting weather.

Weekly Corn Futures

Weekly Oats Futures

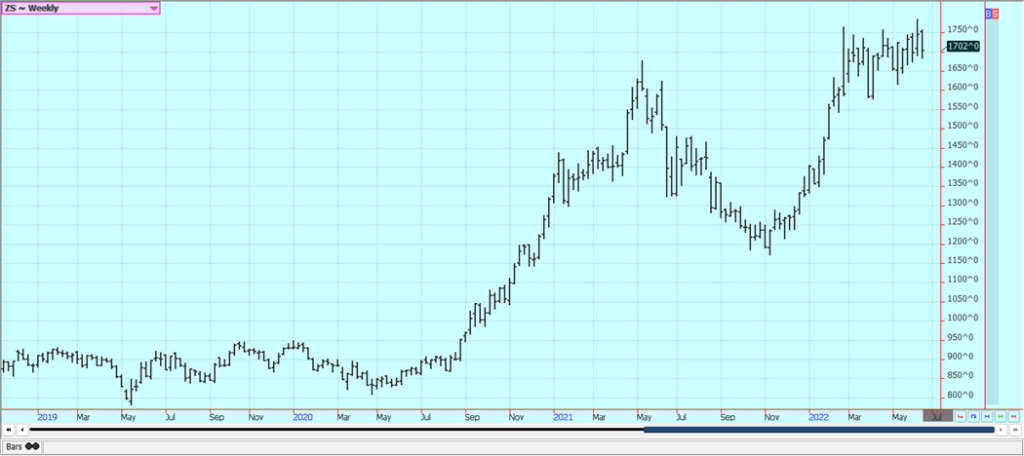

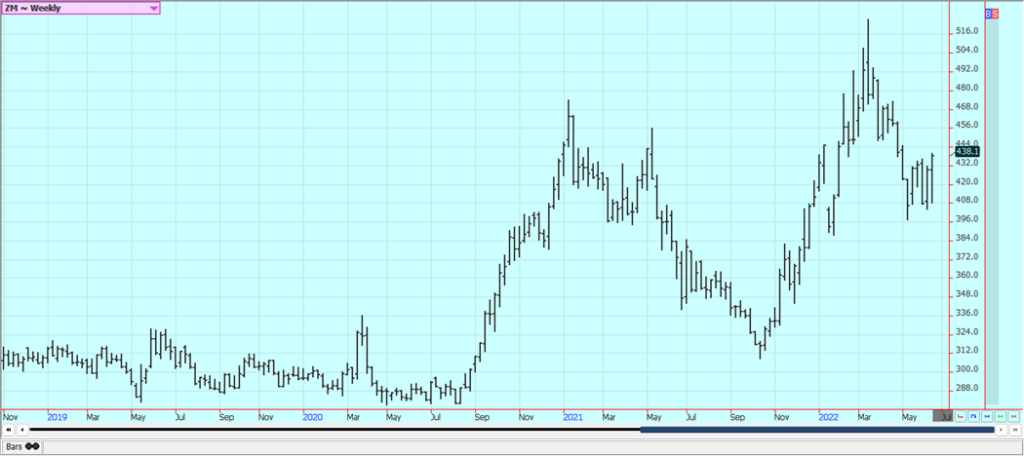

Soybeans and Soybean Meal: Soybeans were lower and Soybean Meal was higher last week as hot and dry weather invades the US but Soybean Oil was lower on weakness in petroleum markets and other vegetable oils markets. US cash market is still running low on Soybeans and there are still renewed Chinese lockdowns. There is less Chinese demand for Soy products due to the lockdowns there and China is starting to renew the lockdowns now as Covid cases have risen in number. China has been a major buyer of US Soybeans this year after a very slow start due to the problems in South America. They are buying for this year and already have booked a large amount of new crop Soybeans to cover future needs. Most of the current buying is for next year.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was lower Friday and near unchanged for the week after failing to take out some resistance areas on the charts earlier in the week. Trends are turning down on the charts. Growing conditions are said to be deteriorating due to hot and dry weather in Texas expanding to include Arkansas. There are still ideas of less production of US Rice this year. The emergence remains behind and acreage estimates are still down for the next crop. Some traders note that it will be difficult to move Rice at current price levels and they are worried about domestic and export demand moving forward.

Weekly Chicago Rice Futures

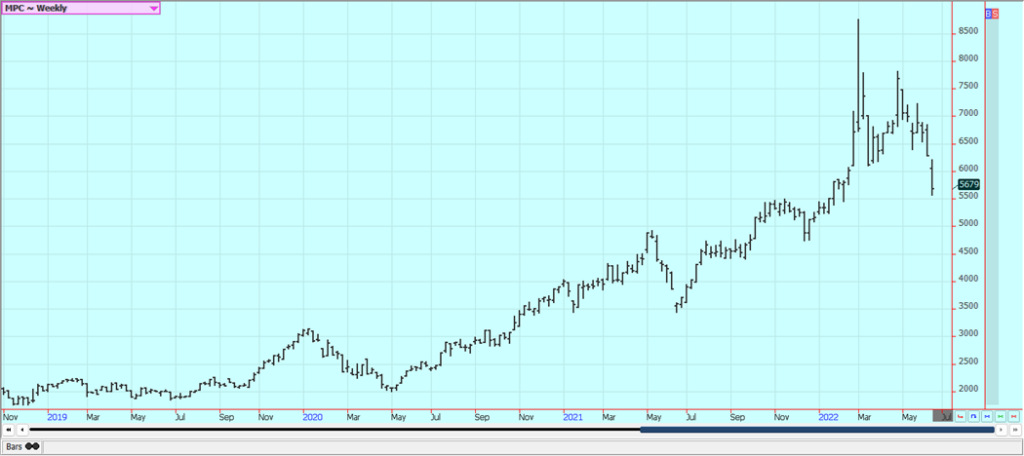

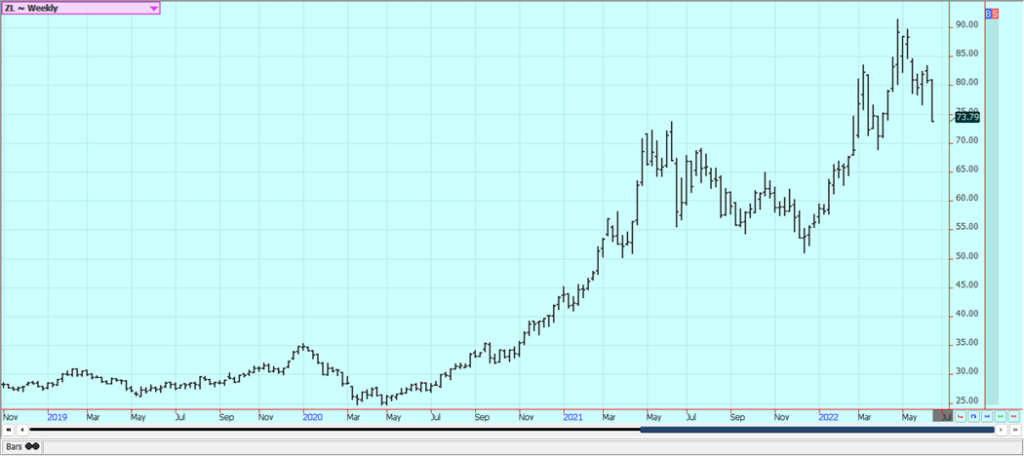

Palm Oil and Vegetable Oils: Palm Oil closed lower last week despite ideas of less Malaysian production due to worker shortages from Covid and on the potential for strong exports for the month from Malaysia. The Indonesian government is now imposing a revised tax scheme on exporters to increase export sales and is allowing more export permits to be issued. Some analysts think Palm Oil is topping out anyway due to reduced demand ideas. Hopes for better demand from India keep the market supported, but Chinese demand could be less. A new Covid outbreak is reported in China and cities and infrastructure has been shut down, including some airports and water ports. The economy could slow down and affect demand. Production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Canola was lower along with other vegetable oilseed markets. The crops are going into the ground and the growing conditions are much improved. It is reported to be very dry and has been cold for planting but better planting weather is coming now as it is now much warmer. There are ideas of reduced Sunflower export potential from Russia and Ukraine. The market is worried about South American production as well. Canada produced a very short crop of Canola last year so supplies are tight.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was a little lower in choppy trading last week. The Fed raised interest rates by 0.75% this week in an effort to control inflation and there has been talk that the Fed will raise them even more and cause some lost economic opportunity and lost Cotton business. There are forecasts for hot and dry weather to return this week after some showers in West Texas and the rest of the Great Plains over the last couple of weeks. The crop conditions are better than expected after a very hot and dry period in West Texas and the rest of the western Great Plains. The Indian weather is cooler and wetter and conditions appear good. There were ideas that production potential is slipping further due to the previous hot and dry weather in West Texas and the rest of the western Great Plains. Chinese demand was shown in the weekly export sales report. Chinese demand could become less due to the Covid lockdowns there be trimming imports due to Covid and has closed a number of cities as the Covid spreads through the nation. The cities and ports are shut down again as Covid returns.

Weekly US Cotton Futures

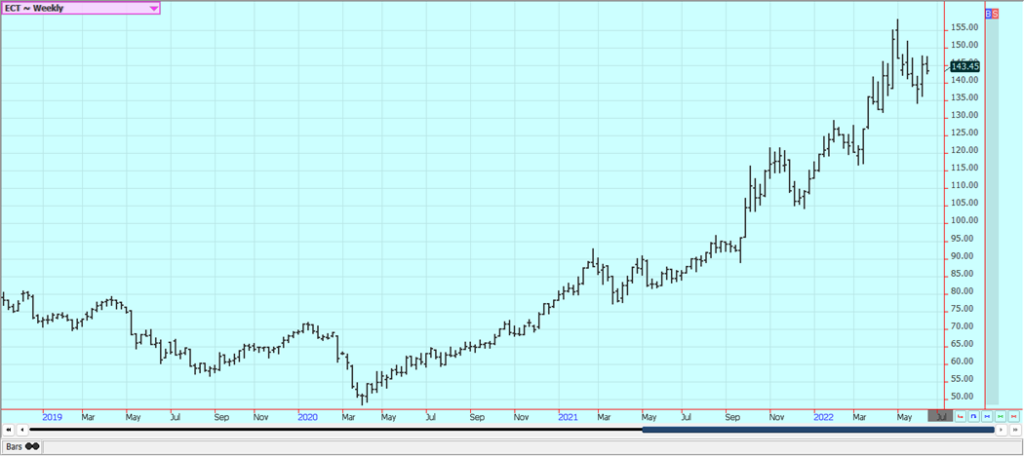

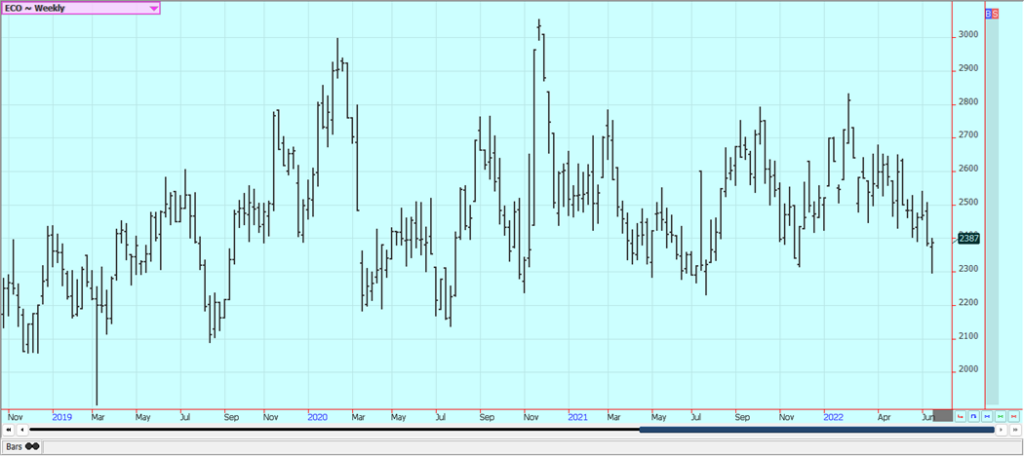

Frozen Concentrated Orange Juice and Citrus: FCOJ was lower last week and trends are down on the charts. The fall has been dramatic since the market made new contract highs in the previous week. There are concerns that another freeze in Brazil could develop but there is nothing in the forecast for now. The market is short Oranges and short juice production but is also worried about domestic demand destruction. US production is 11% below last year but higher than initial USDA projections but the data appears to be part of the price now. The greening disease has taken its toll on the US crop and the previous Brazil crop was down significantly due to drought. The weather remains generally good for production around the world for the next crop. Brazil has some rain and conditions are rated good. Weather conditions in Florida are rated mostly good for the crops with some showers and warm temperatures.

Weekly FCOJ Futures

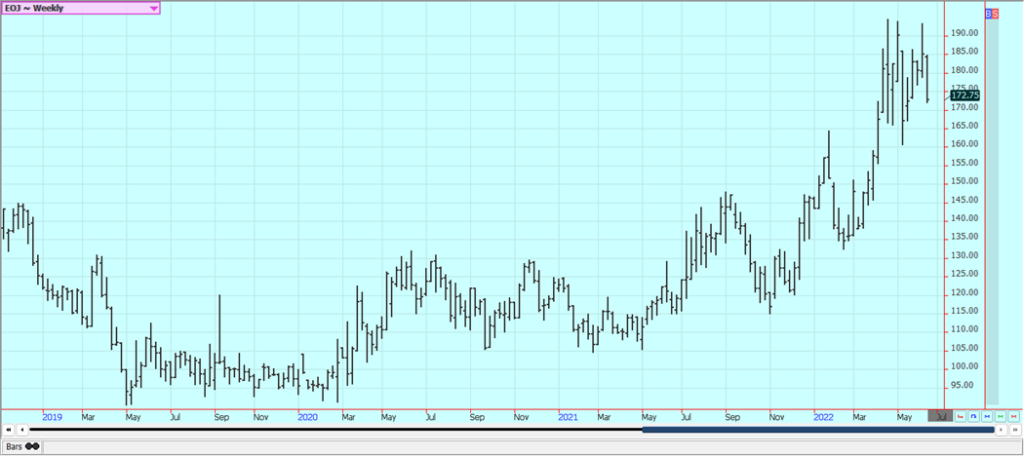

Coffee: New York and London both closed a little lower last week as the US Dollar remains high but very high cash market differentials are supportive of prices. Less demand for Vietnamese Coffee was hurting the London price action. Demand for Coffee overall is thought to be less as the world economic situation changes for the worse but the strong cash market means that even less Coffee is on offer. Temperatures are near to below normal in Brazil and there are no forecasts for frosts or freezes in the short term but the market fears that a freeze could develop.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

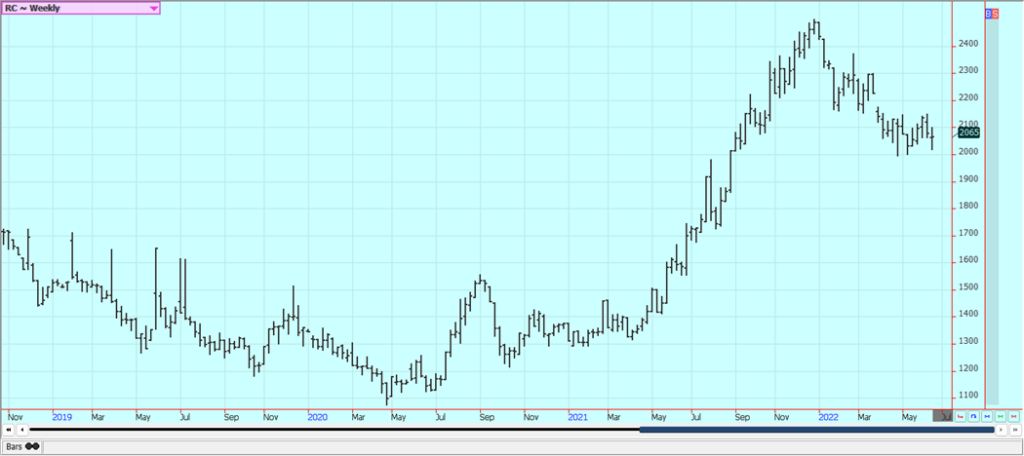

Sugar: New York was a little lower last week on ideas of bigger supplies as Brazil has changed its tax regimen to promote the production of Sugar over Ethanol and London closed lower as White Sugar supplies and production are expected to increase after being short recently. London White Sugar has been better supported but remains in a sideways range as India has limited exports of White Sugar to 10 million tons for the current marketing year and as Brazil is harvesting its crop of Sugarcane and turning most of it into Ethanol but some Sugar is making it into export channels. However, Sugar production from these countries is expected to be surplus or at least in line with demand. Thailand is still offering and exporting. Reports from India indicated that conditions are generally good for Sugar production. The Indian weather service is predicting a normal monsoon season this year.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

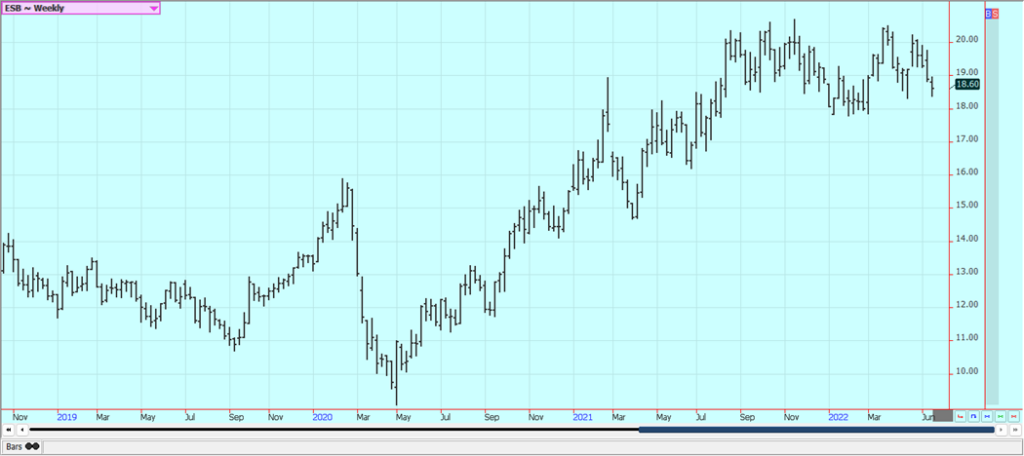

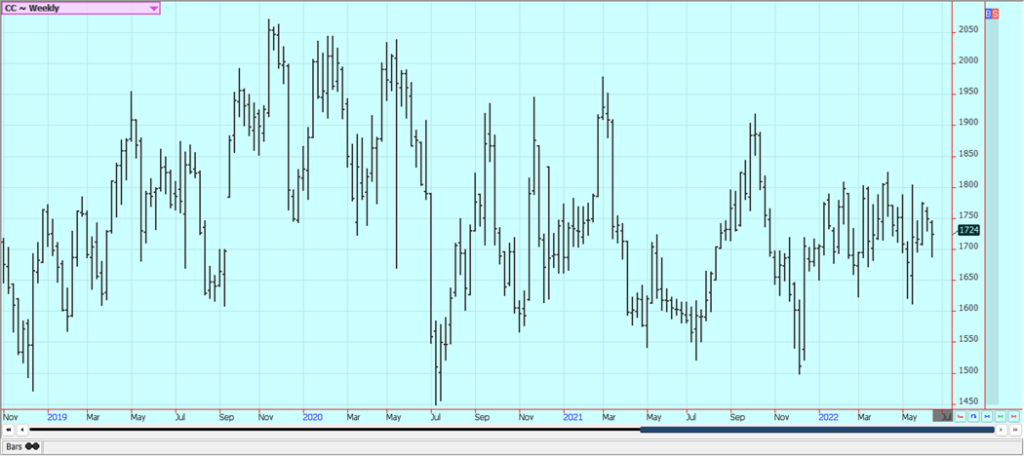

Cocoa: New York was a little higher and London was a little lower last week as currency moves caused most of the movement in Cocoa. The US Dollar was sharply lower and demand ideas are weak, but both cocoa markets are showing signs of a bottom on the daily charts. Reports of sun and dry weather along with very good soil moisture keep big production ideas alive on Ivory Coast. Ideas are still that good production is expected from West Africa for the year. The weather is good for harvest activities in West Africa. Current reports from Ivory Coast indicate that the weather is a good mix of sun and rain so a good midcrop production is expected. The weather is good in Southeast Asia. Ghana arrivals have been below year-ago levels. Ivory Coast arrivals are now 1.913 million tons, down 5.1$ from last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Mike Kenneally via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crypto1 week ago

Crypto1 week agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Biotech4 days ago

Biotech4 days agoSpain Invests €126.9M in Groundbreaking EU Health Innovation Project Med4Cure

-

Crypto2 weeks ago

Crypto2 weeks agoRipple Launches EVM Sidechain to Boost XRP in DeFi

-

Biotech5 hours ago

Biotech5 hours agoAdvancing Sarcoma Treatment: CAR-T Cell Therapy Offers Hope for Rare Tumors