Featured

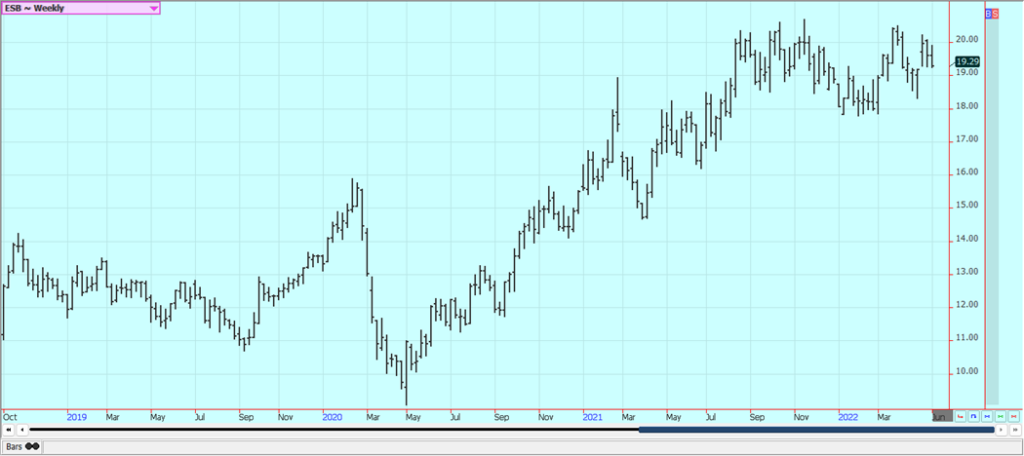

Reports from India Indicated Good Conditions for Sugar Production

New York sugar futures was lower and London was closed in consolidation trading on Friday and New York closed lower for the week. London White Sugar has been the upside leader as India has limited exports of White Sugar to 10 million tons for the current marketing year and as Brazil is harvesting its crop of Sugarcane and turning most of it into Ethanol. Thailand is still offering and exporting.

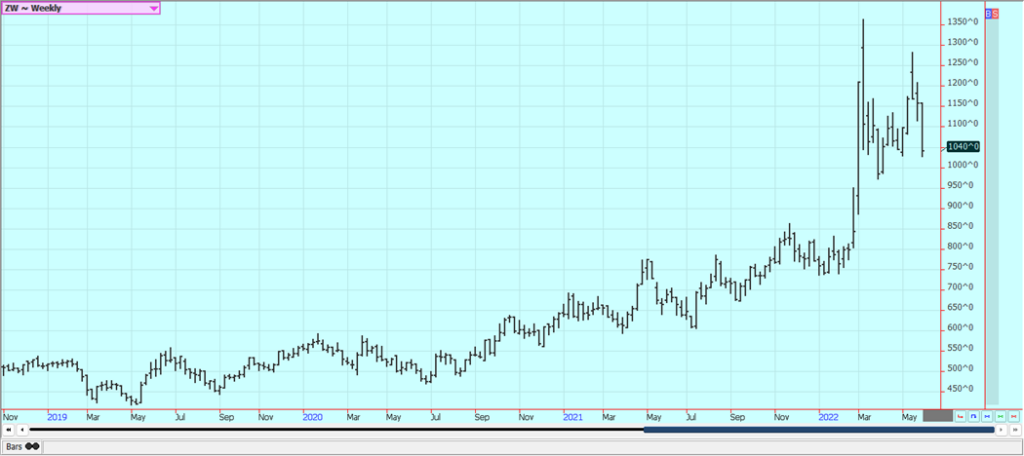

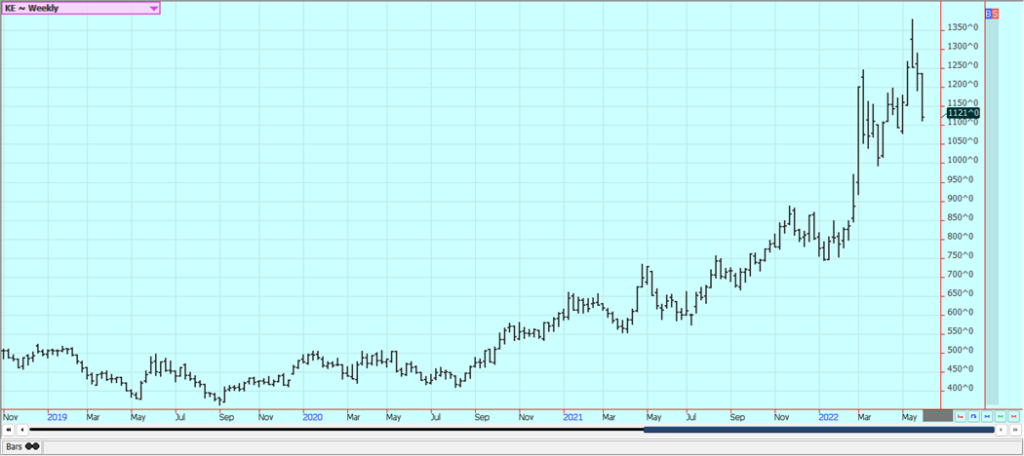

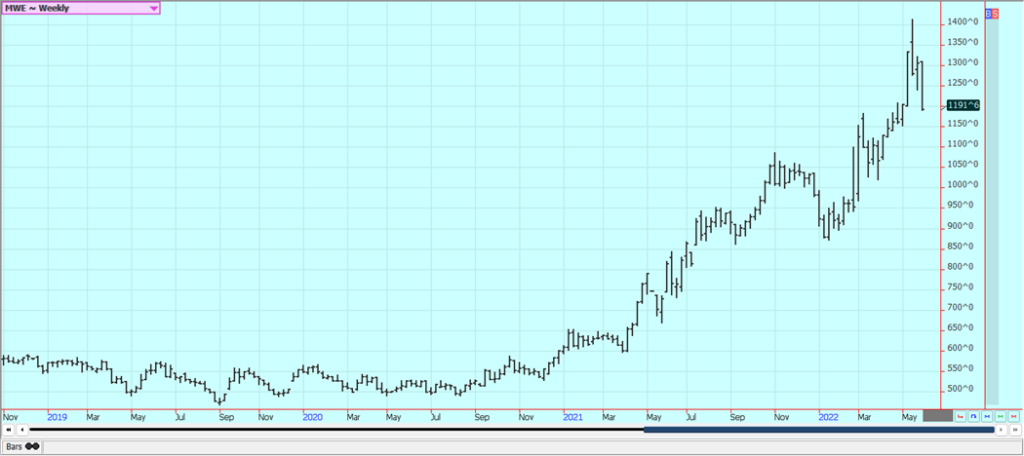

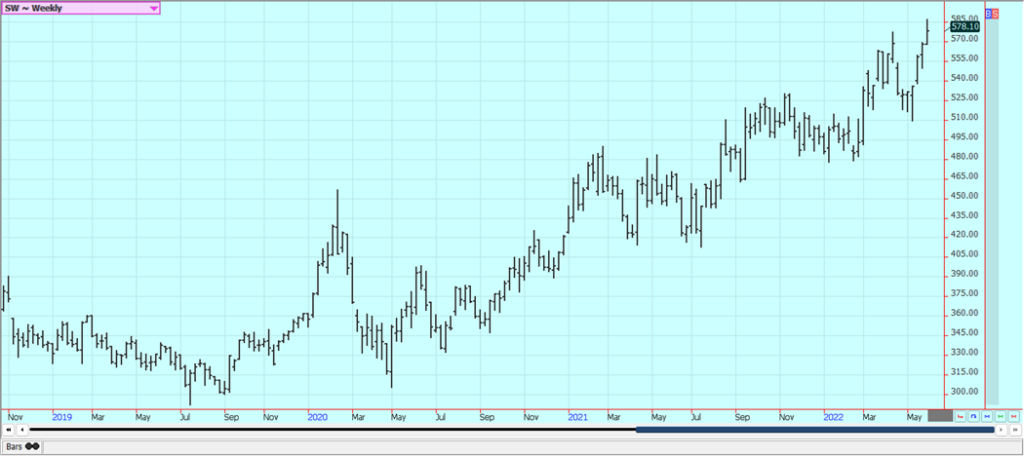

Wheat: Winter Wheat markets were lower last week as the focus remained on Russia and its offer to allow ships into Ukrainian ports to take grain. USDA noted mostly stable conditions for the Winter Wheat crops yesterday but noted Spring Wheat planting remained far behind average. The Winter Wheat harvest is underway in the US. The government in Russia said again that it was willing to discuss terms with the west for shipments of Ukraine grain to get safe passage, but ideas are that the terms Russia will ask for will be so onerous that they will be rejected. The UN said negotiations are making progress but there was still a long way to go before any deal could be concluded. Minneapolis Spring Wheat futures were lower in sympathy with the Winter Wheat markets but the weather remained bad for planting in the northern Great Plains and the Canadian Prairies. It is dry today but there have been several days of rain in both states this week. The US western Great Plains got some rainfall and the rains fell in some of the areas most in need of some precipitation. It is turning warmer and drier farther north to give hope to Spring Wheat farmers that they can plant crops. Europe is too hot and dry and India and Pakistan are both getting major heat waves and dry conditions. India has exempted Egypt from the ban and will honor previous commitments. It had been expected to offer up to 12 million tons to the world market. Ukraine exports were reduced due to the war and the trade is hoping for improved production in the EU to make up the difference.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

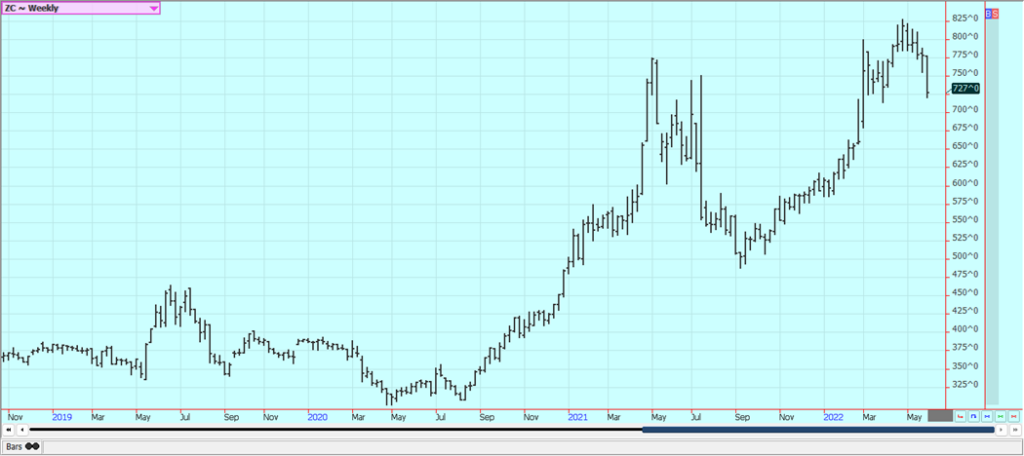

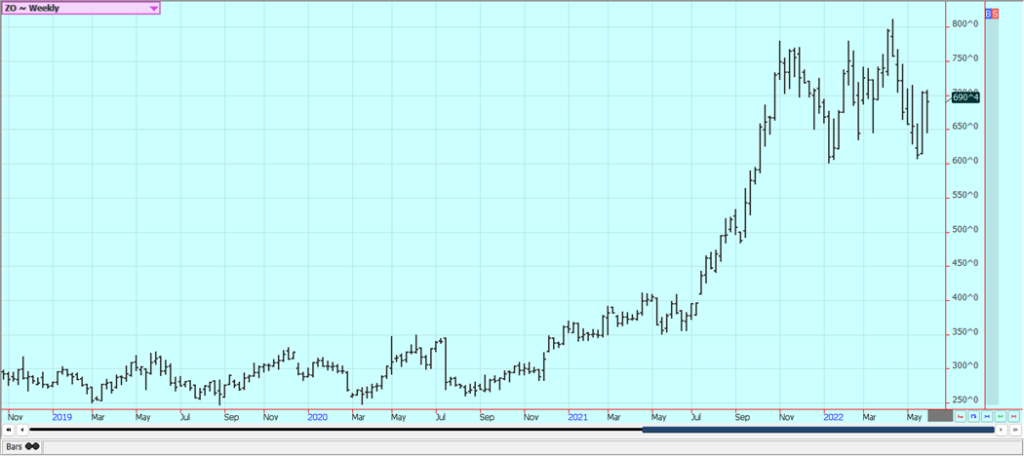

Corn: Corn and Oats were both lower last week as the US crops got into the ground and emerged under what was considered good conditions . The government in Russia said again that it was willing to discuss terms with the west for shipments of Ukraine grain to get safe passage, but ideas are that the terms Russia will ask for will be so onerous that they will be rejected. The UN said it is negotiating with Russia and progress is being made but that any deal was still far away. USDA noted that planting progress for US crops is almost average. The areas left to be planted are primarily in the Dakotas and might not get planted as the insurance planting dates have passed. The risk to plant now would be much higher without the insurance and the high costs of inputs. There are also pockets of area left to be planted in the big production states. The weather was variable last week with periods of rain and very cool temperatures and then warm and dry conditions and more of the same is expected this week. Many think the top end of the yield has been taken off the Corn crop due to the delayed planting. It already thinks there is reduced planted area because of the March planning intentions reports from USDA and the bad planting weather. The potential loss of Ukraine exports of Corn makes the world situation tighter. China has a Covid outbreak and has closed some cities and some ports in response.

Weekly Corn Futures

Weekly Oats Futures

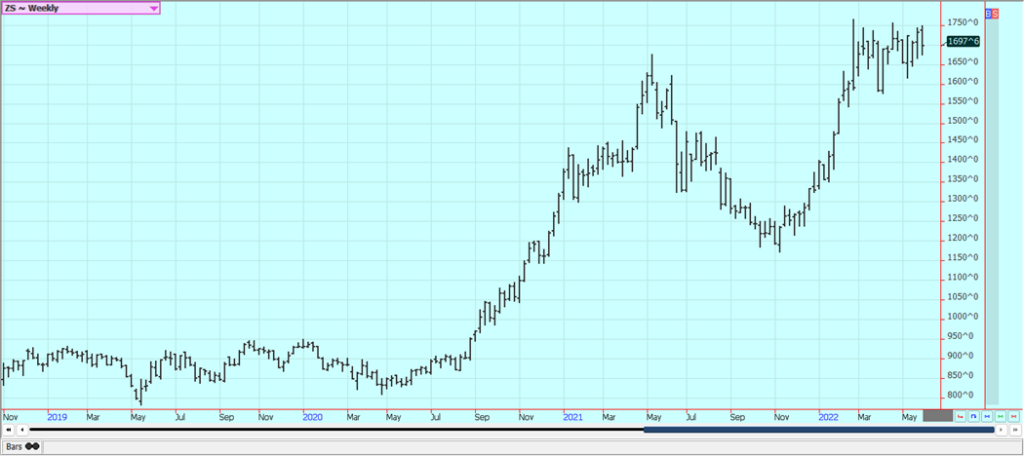

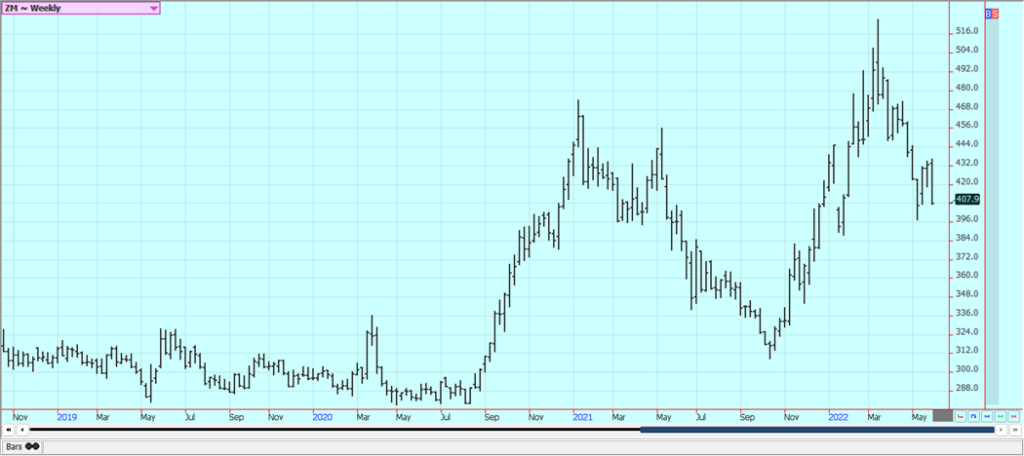

Soybeans and Soybean Meal: Soybeans and Soybean Meal were lower last week but Soybeans are holding overall as the US cash market runs low on Soybeans and farmers are reluctant sellers. Soybean Oil found support in part from talk that President Biden plans to retroactively increase bio fuels use to help bring down the prices of Crude Oil and petroleum products. There is less Chinese demand for Soy products due to the lockdowns there although China did buy US Soybeans yesterday. Soybean Oil is not going to restaurants as quickly as in the past due to Covid lockdowns and Meal demand is down as well as less meat is being produced for the same reason. There are still fears of a cooling economy and forecasts for much improved planting weather this week as the weather will be warm and dry, then rainy and cooler. The export sales report was not strong. China has been a major buyer of US Soybeans this year after a very slow start due to the problems in South America. They are buying for this year and already have booked a large amount of new crop Soybeans to cover future needs. Most of the current buying is for next year. Ideas are that the Chinese economy could slow down due to the Covid lockdowns there and cause the country to purchase less Soybeans in the world market and these ideas got some confirmation last week as the economic numbers from China indicate the potential for a shrinking economy.

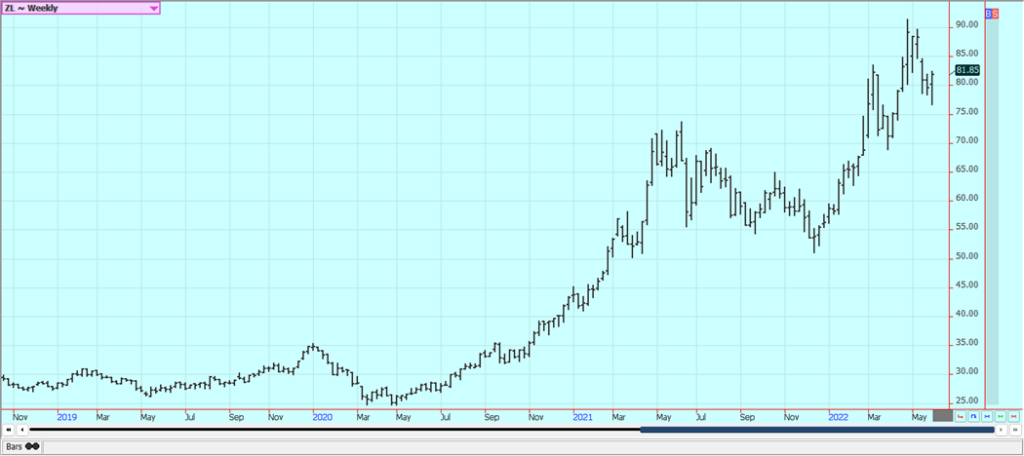

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

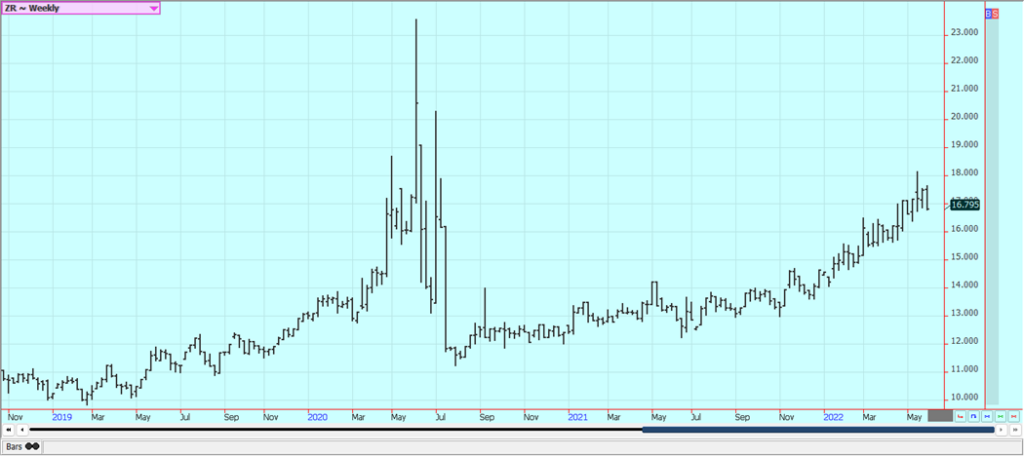

Rice: Rice was lower again Friday and lower for the week on follow through selling from the good progress and condition of the crops shown by USDA in the Tuesday reports. Growing conditions are said to be good. There are still ideas of less production of US Rice this year but the good conditions are starting to limit loss ideas. Trends are trying to turn up on the daily charts but are still mixed overall. The planting pace is catching up to normal, but acreage estimates are still down for the next crop. Some traders note that it will be difficult to move Rice at current price levels and they are worried about domestic and export demand moving forward. The export sales reports in recent weeks have shown less demand. It was hot and dry in India and it is possible that Rice production will be affected. Isolated showers and cooler temperatures are now reported. Rice is a highly political grain for India and the government goes out of its way to subsidize the crop production and support Rice farmers.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was a little lower last week despite ideas of less Malaysian production due to worker shortages from Covid and on the potential for strong exports for the month from Malaysia. The Indonesian government is now imposing a domestic reserve on exporters to limit export sales. Some analysts think Palm Oil is topping out anyway due to reduced demand ideas. Hopes for better demand from India keep the market supported, but Chinese demand could be less. A new Covid outbreak is reported in China and cities and infrastructure has been shut down, including some airports and water ports. The economy could slow down and affect demand. Production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Canola was sharply lower last week despite the strength in Chicago. The crops are going in the ground and the growing conditions are much improved. It is reported to be very dry and has been cold for planting but better planting weather is coming now as it is now much warmer. StatsCan said that Canadian farmers intend to reduce planted area for Canola this year and use the area to plant Wheat instead. There are ideas of reduced Sunflower export potential from Russia and Ukraine. The market is worried about South American production as well. Canada produced a very short crop of Canola last year so supplies are tight. Demand remains a problem as Canola is high priced but the diplomatic spat with China over the arrested Huawei executive seems to be in the past now.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was lower last week on forecasts for some showers in West Texas and the rest of the Great Plains and amid better than expected crop conditions after a very hot and dry period in West Texas and the rest of the western Great Plains. It has also been hot and dry in India and crops grown there are thought to be under stress as well. The Indian weather is cooler now. There were ideas that production potential is slipping further due to the hot and dry weather in West Texas and the rest of the western Great Plains. The export sales report was strong when it was released on Friday morning. Chinese demand could become less due to the Covid lockdowns there be trimming imports due to Covid and has closed a number of cities as the Covid spreads through the nation. China port closures and domestic difficulties caused by renewed Covid lockdowns are causing ideas of less demand as is a stronger US Dollar.

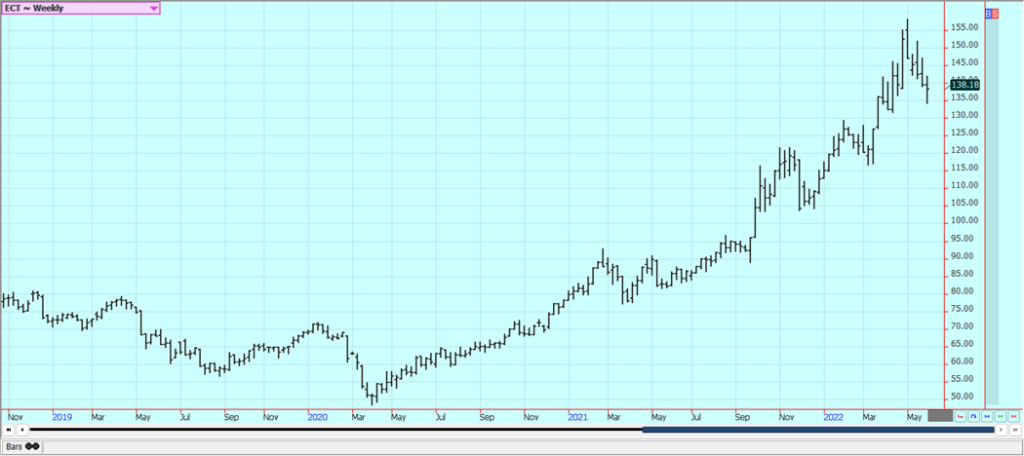

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was slightly lower last week but continued to hold the weekly trend higher. Logistics on imports is once again a problem with a lot of boats stuck off shore in China. There are concerns that another freeze in Brazil could develop but there is nothing in the forecast for now. The market is short Oranges and short juice production but is also worried about domestic demand destruction as pills are becoming cheaper again. The greening disease has taken its toll on the US crop and the previous Brazil crop was down significantly due to drought. The weather remains generally good for production around the world for the next crop. Brazil has some rain and conditions are rated good, but it is drier now and some trees are developing stress. Weather conditions in Florida are rated mostly good for the crops with some showers and warm temperatures.

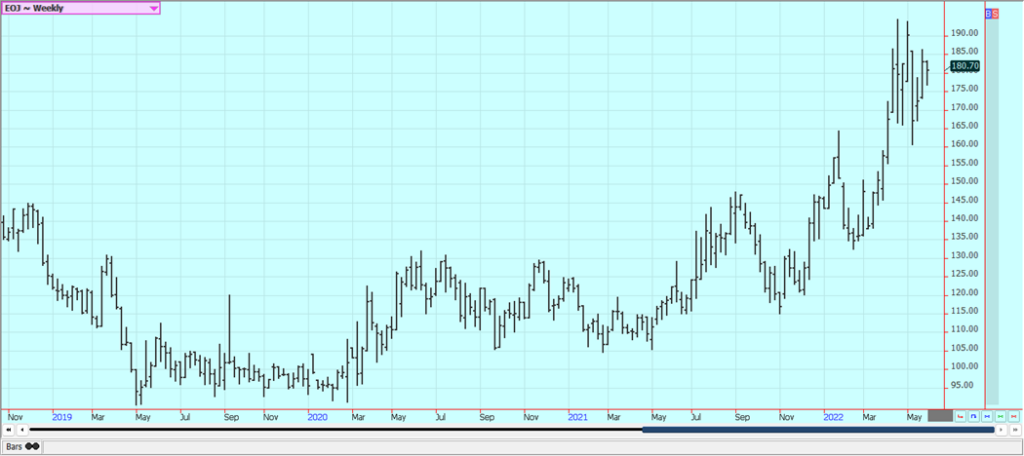

Weekly FCOJ Futures

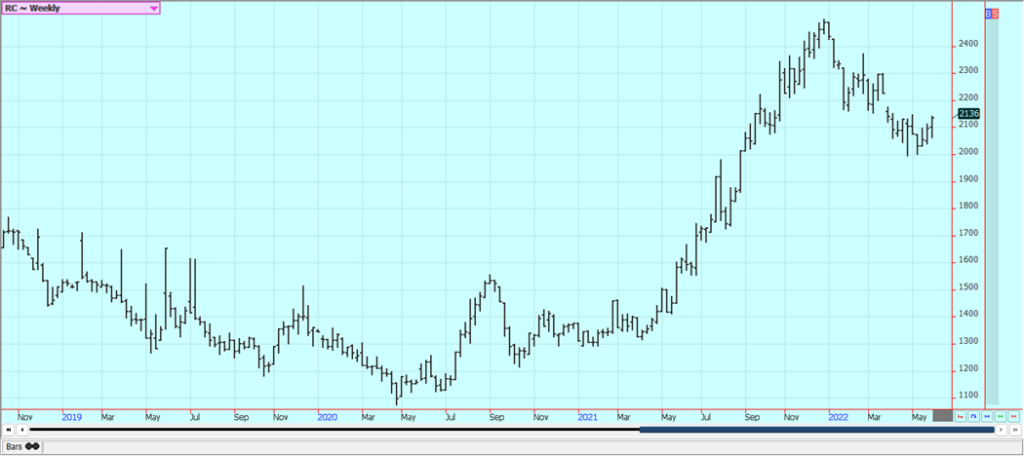

Coffee: New York was lower and London was closed on a stronger Brazilian Real and reports of less farm selling from Brazil. It was a consolidation day yesterday as there was little in the way of news to support prices. Temperatures right now are near to above normal in Brazil and there are no forecasts for frosts or freezes in the short term. The Ukraine war is supporting ideas of less demand from Europe generally and Ukraine and Russia. Demand from China is thought to be less due to the war against Covid. Deliveries from Vietnam and Brazil Robusta are noted to be decreasing as the harvest in Vietnam is now complete and the Brazilian Real is stronger.

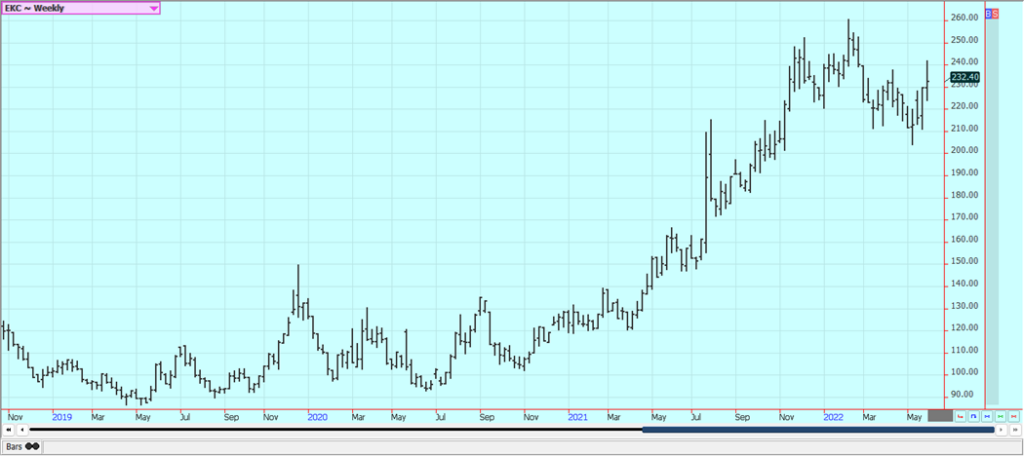

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York was lower and London was closed in consolidation trading on Friday and New York closed lower for the week. London White Sugar has been the upside leader as India has limited exports of White Sugar to 10 million tons for the current marketing year and as Brazil is harvesting its crop of Sugarcane and turning most of it into Ethanol. Thailand is still offering and exporting. India said it could have over 6 million tons in ending stocks due to the move but it has been very hot and very dry there so the production for the next crop might be much less. However, reports from India indicated that conditions are generally good for Sugar production. The Indian weather service is predicting a normal monsoon season this year. Support for London also came from ideas of little Sugar coming from Brazil as the mills there are processing for Ethanol.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

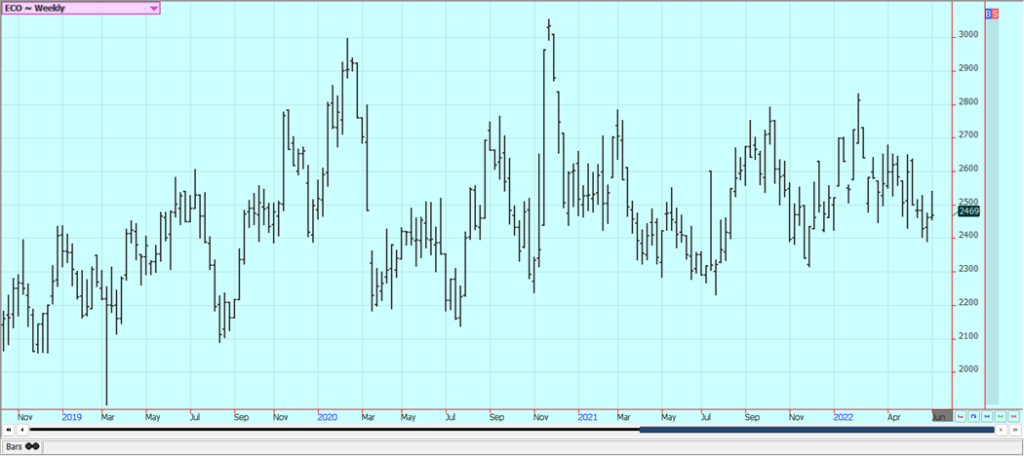

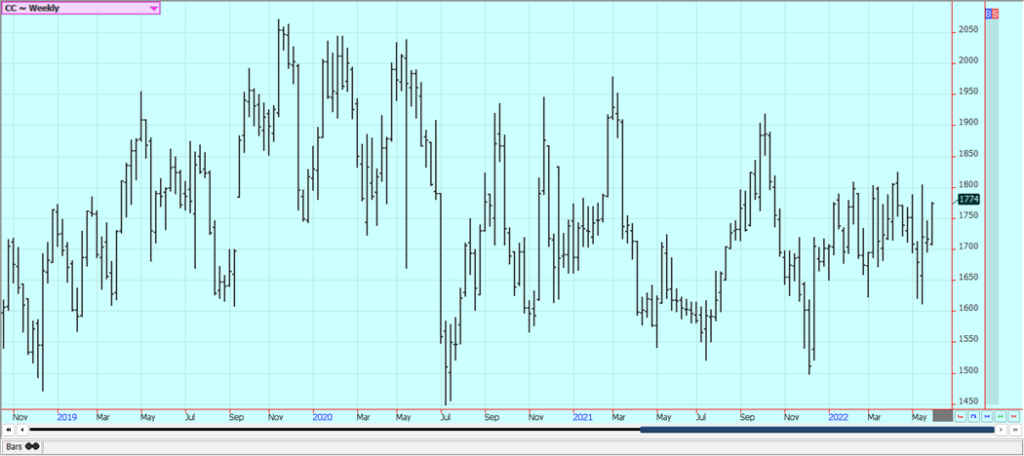

Cocoa: New York as lower on Friday and London was closed but both markets closed higher for the week. Reports of big rains in Ivory Coast supported ideas of a big mid crop production but also brought ideas of moldy deliveries to ports. Ideas are still that good production is expected from West Africa for the year. The weather is good for harvest activities in West Africa. Current reports from Ivory Coast indicate that the weather is a good mix of sun and rain so a good midcrop production is expected. The weather is good in Southeast Asia. Ghana arrivals have been below year ago levels.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by pasja1000 via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding4 days ago

Crowdfunding4 days agoPMG Empowers Italian SMEs with Performance Marketing and Investor-Friendly Crowdfunding

-

Fintech2 weeks ago

Fintech2 weeks agoRobinhood Expands to Europe with Tokenized Stocks and Perpetual Futures

-

Markets6 days ago

Markets6 days agoThe Big Beautiful Bill: Market Highs Mask Debt and Divergence

-

Markets4 days ago

Markets4 days agoA Chaotic, But Good Stock Market Halfway Through 2025