Featured

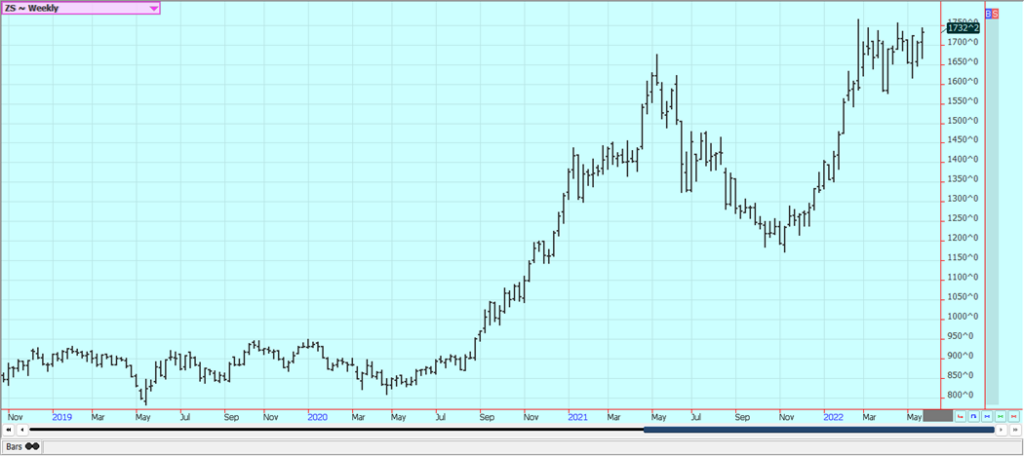

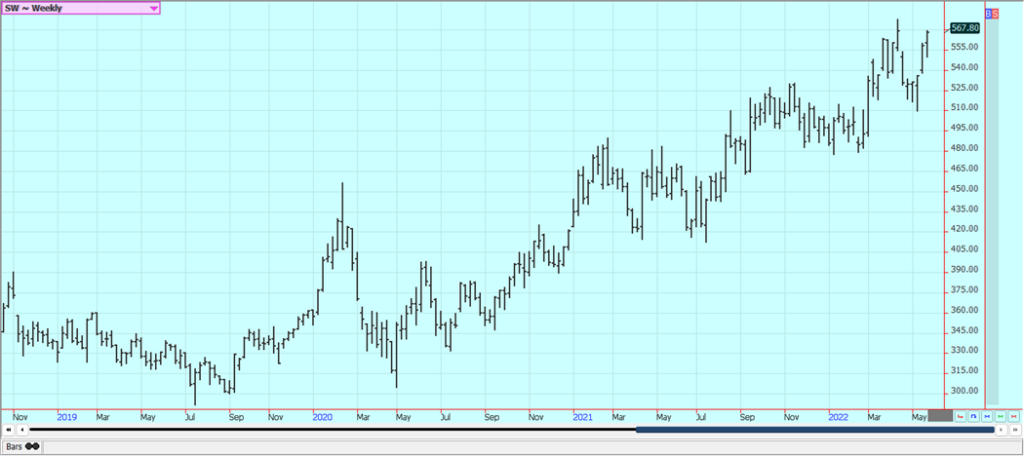

Soybeans Were Higher Last Week and Made New Highs for the Move

No one is sure why Soybeans rallied so much as they moved to new highs. New wires noted less Chinese demand for Soy products due to the lockdowns there. Soybean Oil is not going to restaurants as quickly as in the past due to Covid lockdowns and Meal demand is down as well as less meat is being produced for the same reason

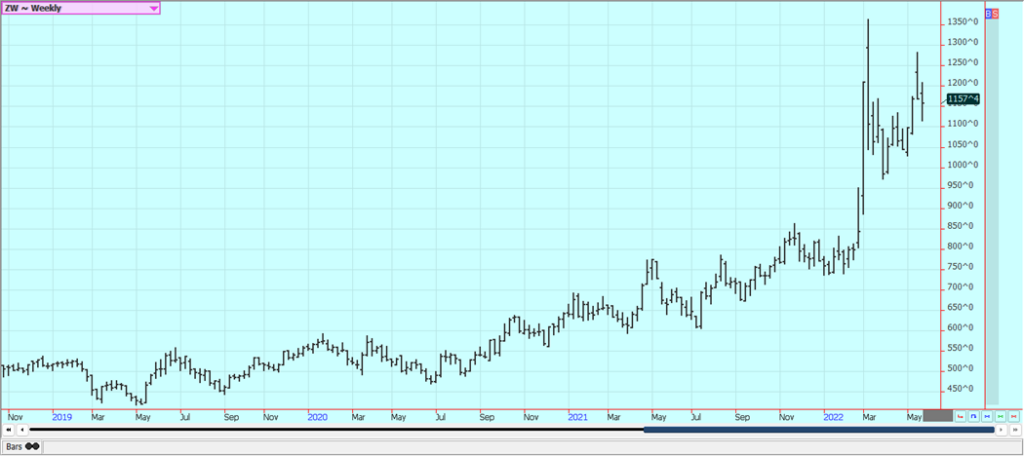

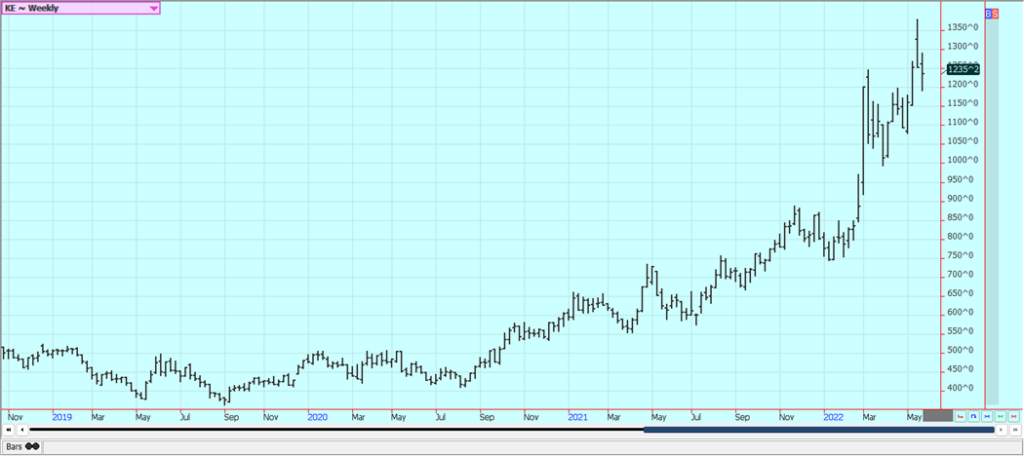

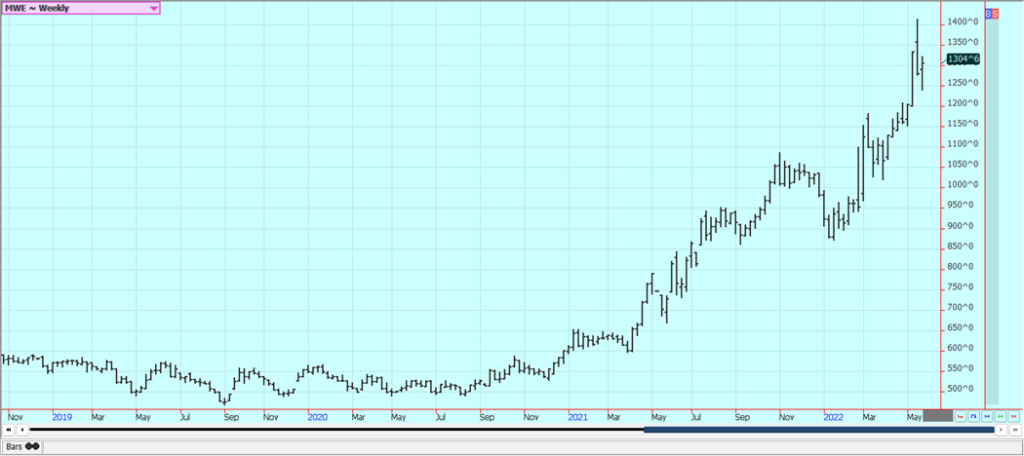

Wheat: Winter Wheat markets were lower last week as the focus turned to Russia. The weekly export sales report showed poor sales once again. The government there said it was willing to discuss terms with the west for shipments of Ukraine grain to get safe passage, but ideas are that the terms Russia will ask for will be so onerous that they will be rejected. There was knee jerk selling seen when the news came out, then doubts surfaced that any deal could be struck so futures closed well off the lows of the day. Those doubts were confirmed as Russia and the US both denied that anything was going to happen. Minneapolis Spring Wheat futures were higher as the weather remained bad for planting in the northern Great Plains and the Canadian Prairies. The US western Great Plains got some rainfall and the rains fell in some of the areas most in need of some precipitation. It is turning warmer and drier farther north to give hope to Spring Wheat farmers that they can plant crops. Europe is too hot and dry and India and Pakistan are both getting major heat waves and dry conditions. India has exempted Egypt from the ban and will honor previous commitments. It had been expected to offer up to 12 million tons to the world market. Ukraine exports were reduced due to the war and the trade is hoping for improved production in the EU to make up the difference. USDA reduced production estimates for Hard Red Winter Wheat in the US recently due to the hot and dry conditions in the western Great Plains and reduced Spring Wheat production estimates due to delayed planting. Only Russia says it has a very big crop coming and many will not buy from there because of the sanctions.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

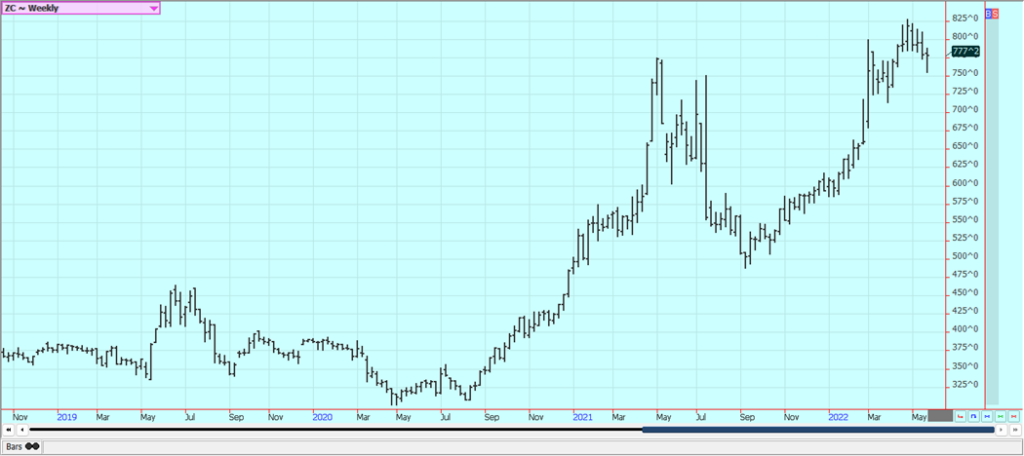

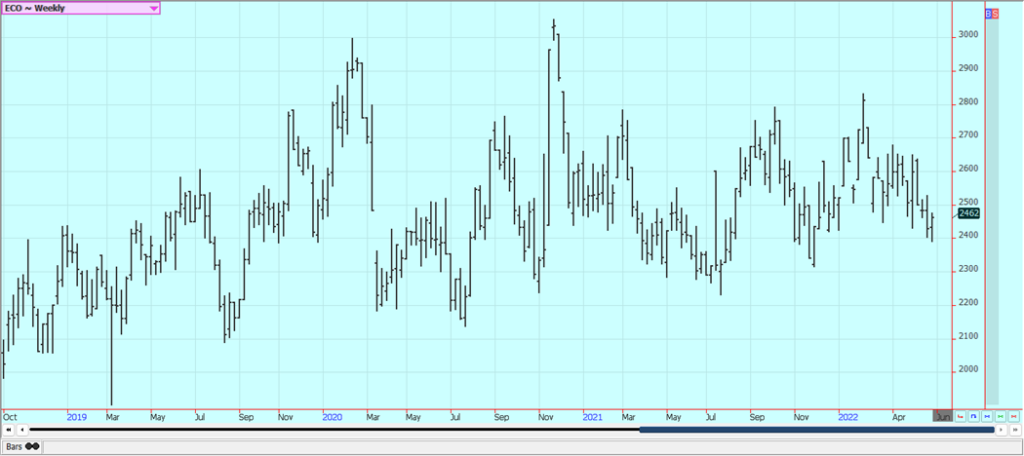

Corn: Corn closed near unchanged on news from Russia and on a bad weekly export sales report. The government there said it was willing to discuss terms with the west for shipments of Ukraine grain to get safe passage, but ideas are that the terms Russia will ask for will be so onerous that they will be rejected. Russia and the US said on Friday that an export corridor was not unlikely to happen anytime soon if at all. There was knee jerk selling seen when the news came out, then doubts surfaced that any deal could be struck so futures closed well off the lows of the day and July futures actually closed slightly higher. The weather was variable last week with periods of rain and very cool temperatures and then warm and dry conditions and more of the same is expected this week. Many think the top end of the yield has been taken off the Corn crop due to the delayed planting. It already thinks there is reduced planted area because of the March planning intentions reports from USDA and the bad planting weather. The potential loss of Ukraine exports of Corn makes the world situation tighter. China has a Covid outbreak and has closed some cities and some ports in response. Brazil and China have reached agreement on phytosanitary rules so that Brazil can now export Corn to China. Oats were sharply higher on bad planting conditions in the northern US and Canada.

Weekly Corn Futures

Weekly Oats Futures

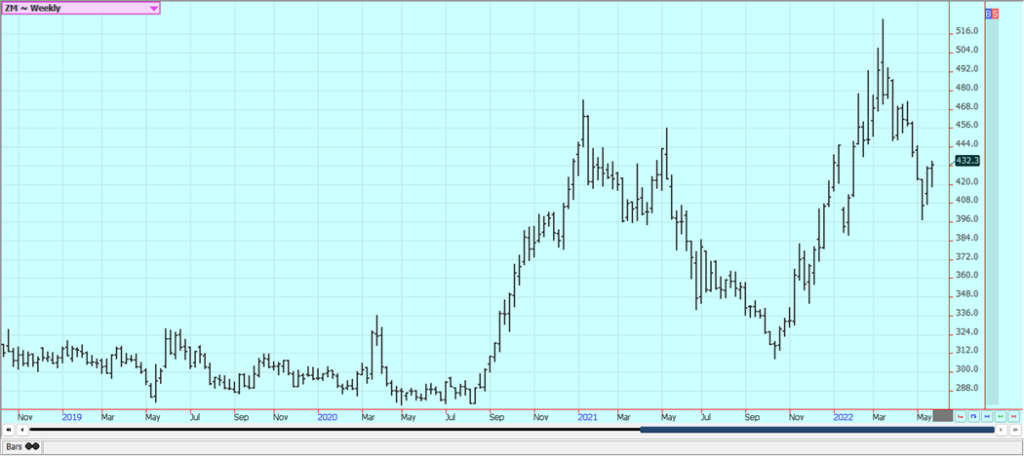

Soybeans and Soybean Meal: Soybeans were higher last week and made new highs for the move and the products traded in sideways patterns. No one is sure why Soybeans rallied so much as they moved to new highs. New wires noted less Chinese demand for Soy products due to the lockdowns there. Soybean Oil is not going to restaurants as quickly as in the past due to Covid lockdowns and Meal demand is down as well as less meat is being produced for the same reason. There are still fears of a cooling economy and forecasts for much improved planting weather this week. China has been a major buyer of US Soybeans this year after a very slow start due to the problems in South America. They are buying for this year and already have booked a large amount of new crop Soybeans to cover future needs. Most of the current buying is for next year. Ideas are that the Chinese economy could slow down due to the Covid lockdowns there and cause the country to purchase less Soybeans in the world market and these ideas got some confirmation last week as the economic numbers from China indicate the potential for a shrinking economy.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

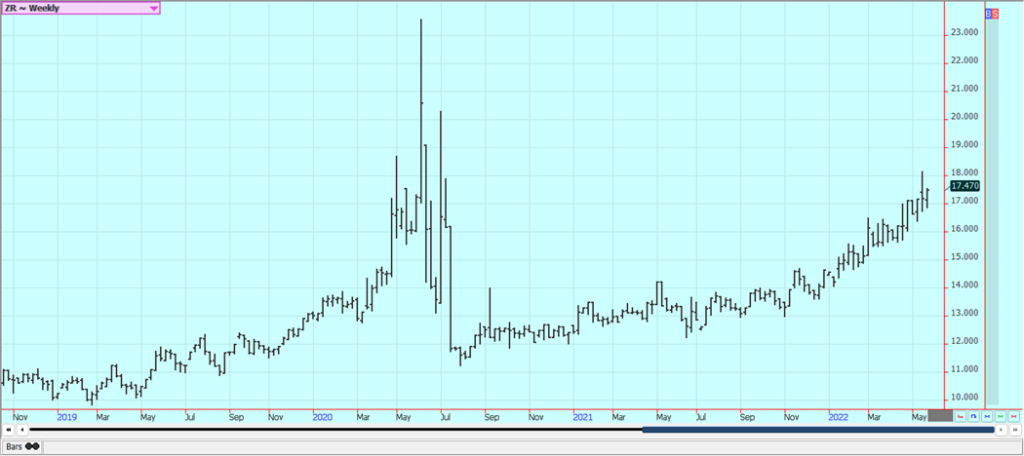

Rice: Rice was higher last week on ideas of less production of US Rice this year. The planting pace is catching up to normal, but acreage estimates are still down for the next crop. Some traders note that it will be difficult to move Rice at current price levels and they are worried about domestic and export demand moving forward. It is hot and dry in India and it is possible that Rice production will be affected. Rice is a highly political grain for India and the government goes out of its way to subsidize the crop production and support Rice farmers.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was higher last week but closed in the middle of the weekly range. Futures are higher overall on ideas of less Malaysian production due to worker shortages from Covid and on the potential for strong exports for the month from Malaysia. The Indonesian government is now imposing a domestic reserve on exporters. Some analysts think Palm Oil is topping out anyway due to reduced demand ideas. Hopes for better demand from India keep the market supported, but Chinese demand could be less. A new Covid outbreak is reported in China and cities and infrastructure has been shut down, including some airports and water ports. The economy could slow down and affect demand. Production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Canola was higher. It is reported to be very dry and has been cold for planting but better planting weather is coming now. StatsCan said that Canadian farmers intend to reduce planted area for Canola this year and use the area to plant Wheat instead. There are ideas of reduced Sunflower export potential from Russia and Ukraine. The market is worried about South American production as well. Canada produced a very short crop of Canola last year so supplies are tight.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was lower last week on poor weekly export sales as hot and dry conditions in the western Great Plains should return after a little rain in the last couple of days. Futures seem to have hit a wall against moves to higher prices and are now correcting lower. It is also hot and dry in India and crops grown there are thought to be under stress as well. There were ideas that production potential is slipping further due to the hot and dry weather in West Texas and the rest of the western Great Plains. Chinese demand could become less due to the Covid lockdowns there be trimming imports due to Covid and has closed a number of cities as the Covid spreads through the nation. China port closures and domestic difficulties caused by renewed Covid lockdowns are causing ideas of less demand.

Weekly US Cotton Futures

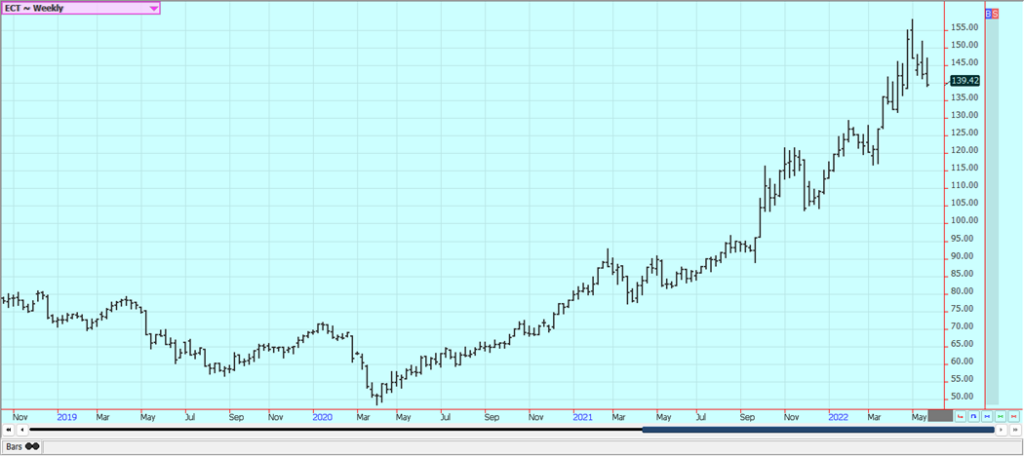

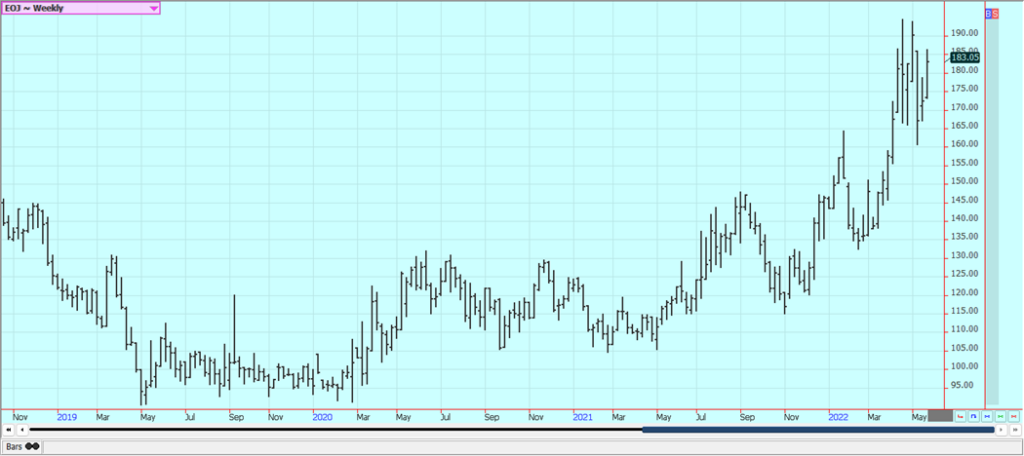

Frozen Concentrated Orange Juice and Citrus: FCOJ was higher last week and made new highs for the move. July was the leader to the upside as the market apparently needs juice. Logistics on imports is once again a problem with a lot of boats stuck off shore in China. Oranges production could have been affected but it is not likely that there was any major damage from freezing temperatures in Brazil. There are concerns that another freeze could develop but there is nothing in the forecast for now. The market is short Oranges and short juice production but is also worried about domestic demand destruction as pills are becoming cheaper again. The greening disease has taken its toll on the US crop and the previous Brazil crop was down significantly due to drought. The weather remains generally good for production around the world for the next crop. Brazil has some rain and conditions are rated good, but it is drier now and some trees are developing stress. Weather conditions in Florida are rated mostly good for the crops with some showers and warm temperatures.

Weekly FCOJ Futures

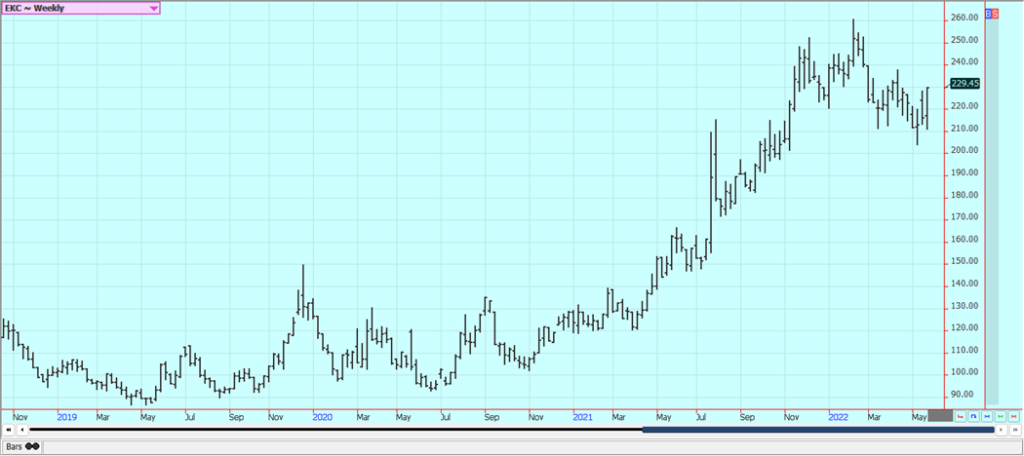

Coffee: New York closed higher and London closed a little lower in consolidation trading, with New York firm on concerns for more freezing temperatures for Brazil. Both markets closed higher for the week and London looks like a bottom is forming on the weekly charts. There is nothing in the forecast yet for any new freeze in Brazil but the Winter season is here. The Ukraine war is supporting ideas of less demand from Europe generally and Ukraine and Russia. Demand from China is thought to be less due to the war against Covid. Deliveries from Vietnam and Brazil Robusta are noted to be decreasing as the harvest is now complete, but selling was active in previous months.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

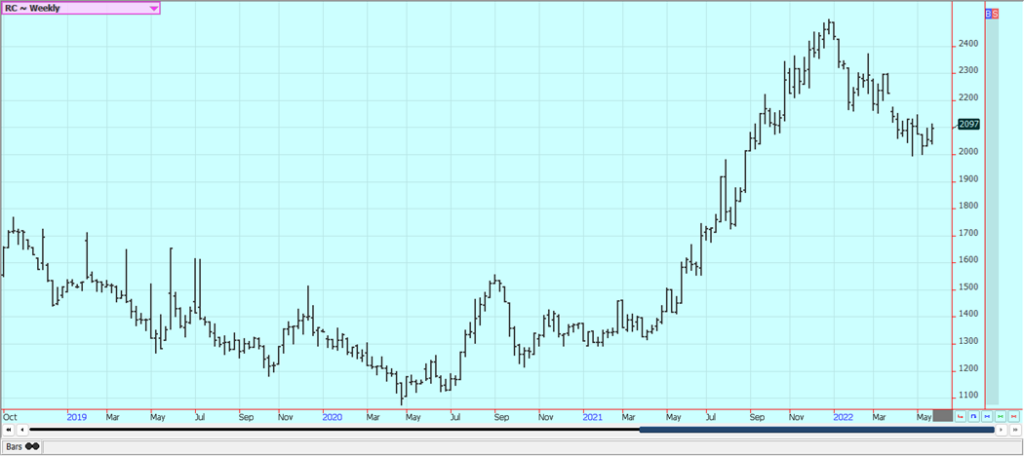

Sugar: New York closed lower last week but London closed higher on reports that the freeze event in Brazil cause only minimal damage and as India has limited exports of White Sugar to 10 million tons for the current marketing year. India said it could have over 6 million tons in ending stocks due to the move but it has been very hot and very dry there so the production for the next crop might be much less. Support for London also came from ideas of little Sugar coming from Brazil as the mills there are processing for Ethanol. Ideas are still that prices for Sugar are relatively cheap in the world market. But the bulls have not been able to sustain a rally attempt.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

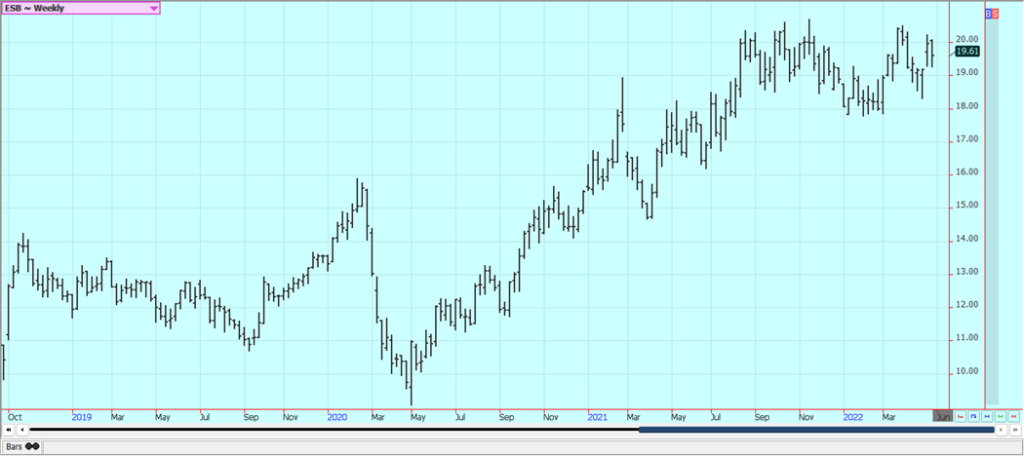

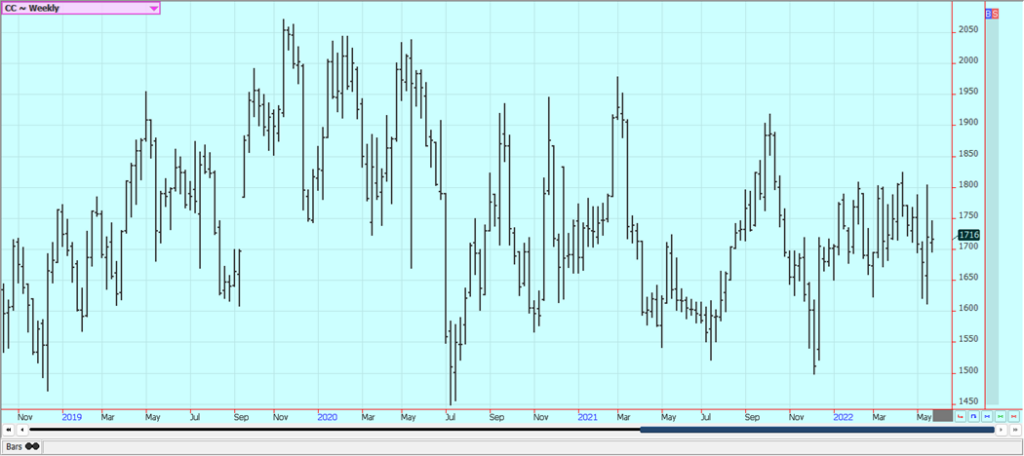

Cocoa: New York and London moved lower again yesterday but then closed higher in consolidation trading and chart patterns are sideways for the weekly charts but still down on the daily charts. Ideas are still that good production is expected from West Africa for the year. The weather is good for harvest activities in West Africa. Current reports from Ivory Coast indicate that the weather is a good mix of sun and rain so a good midcrop production is expected. The weather is good in Southeast Asia. Ghana arrivals have been below year ago levels. Cocoa arrivals in Ivory Coast are now 1.874 million tons, now down 4.5% from last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by James Baltz via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoDolci Palmisano Issues Its First Minibond of the F&P “Rolling Short term” Program

-

Africa2 days ago

Africa2 days agoBLS Secures 500 Million Dirhams to Drive Morocco’s Next-Gen Logistics Expansion

-

Fintech1 week ago

Fintech1 week agoRipple Targets Banking License to Boost RLUSD Stablecoin Amid U.S. Regulatory Shift

-

Biotech5 days ago

Biotech5 days agoBiotech Booster: €196.4M Fund to Accelerate Dutch Innovation