Featured

Cotton Futures Closed Higher, but Short-Term Trends Are Still Sideways

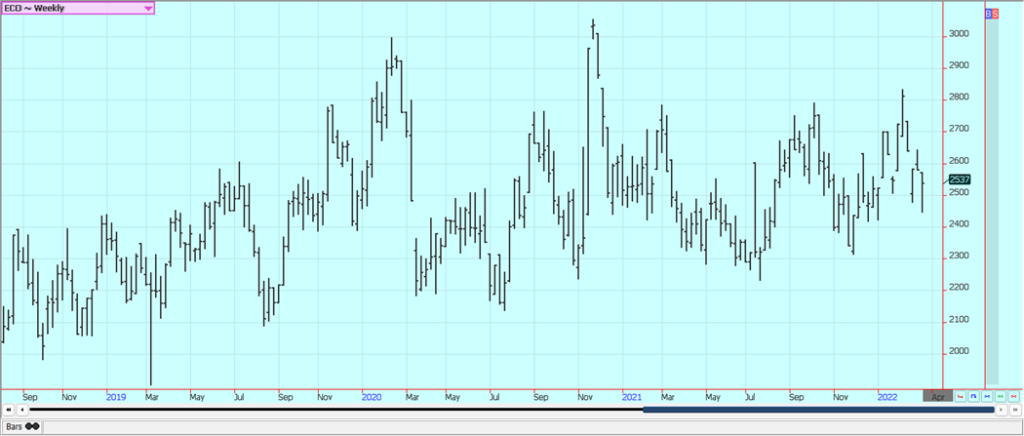

Cotton futures closed higher last week on good demand as seen in the weekly export sales report and despite ideas of Chinese import problems. China has been buying even with the port closures and domestic difficulties. The Russian invasion of Ukraine continued and shipments of Crude Oil and products from Russia are interrupted. That means higher Crude Oil prices and higher polyester prices for the world.

Wheat: Wheat markets were lower last week as the peace talks and the war between Ukraine and Russia have made some progress but look to drag on for a long time. Trends are sideways on the daily charts. Ukraine said that Russia was making more realistic demands and Russia said some parts of an agreement were already agreed to by both sides. Ports are closed in Ukraine and Russian shippers and exporters are not offering in part due to sanctions but mostly due to the war and the chance to lose ships. The US is revoking Most Favored Nation trading status for Russia. Higher prices seem likely down the road. Ukrainians have no interest in living under Russian occupation so the war could be deadly and very costly to both sides. Russia and Ukraine are both major Wheat exporters.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn closed lower last week in sideways trading as Russia remains bogged down in its war with Ukraine. Both sides in the conflict have said that peace talks could resume this week and that some progress and been made in talks already concluded. The potential loss of Ukraine exports of Corn makes the world situation tighter and could be enough to keep Corn prices trending higher for now. Ukraine might not plant much if any Corn this Summer, too. Russia is also a Corn exporter and no product is moving from either country at this time Crop losses in South America are noted. The summer corn crop in South America has been hurt by drought, but some rains are reported now. Corn has been slow to react because the bigger crop is the Winter crop in Brazil and that is expected to be large. However, not all of the Winter crop has been planted and the best weather window for Corn planting is passing by. China has a Covid outbreak again and has closed some cities and some ports in response. The moves are harsh but China has a no-tolerance policy about the pandemic. The closings of cities and ports will hurt the economy as people cant make or spend money and hurt imports as there will be fewer places to unload cargoes. Shanghai has said it will remain open in contrast to much of the country and asked its office workers to work in a hybrid format much like was done in the US.

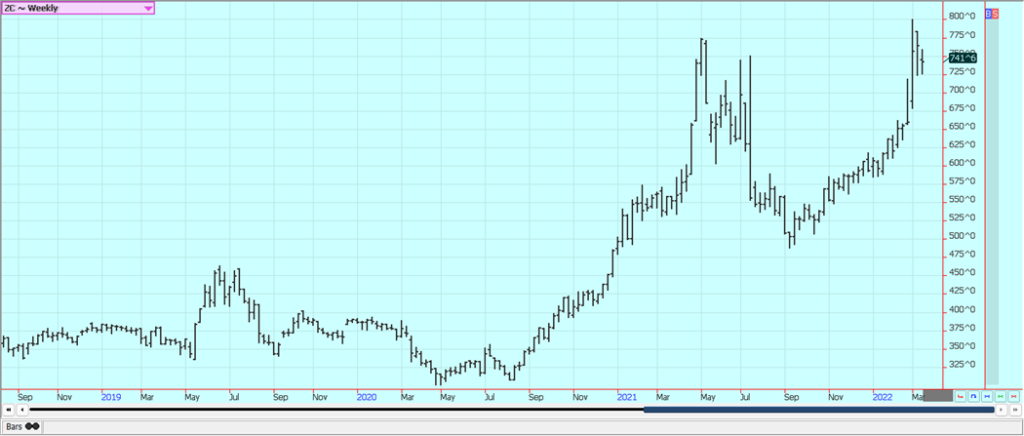

Weekly Corn Futures

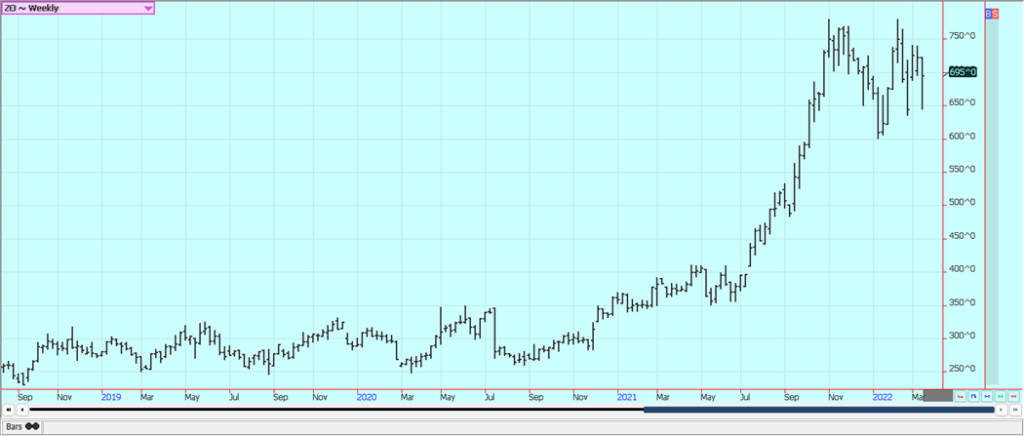

Weekly Oats Futures

Soybeans and Soybean Meal:

Soybeans and both products were lower last week despite another week of strong export sales. Ideas are that the Chinese economy could slow down due to the Covid lockdowns there and cause the country to purchase less Soybeans in the world market. Shanghai has said it will remain open but asked office workers to work from home in a hybrid format. The Ukraine-Russia war has supported Soybeans and world vegetable oils as Russia and Ukraine both export Sunflower Oil. The two countries account for about 80% of all world Sun oil exports. Russia is also a major exporter of Crude Oil. The US is now curbing Russian exports as part of the sanctions but nothing is moving from either country as the companies effectively embargo themselves from doing business in either country. Russia and Ukraine announced that peace talks could continue. Both sides said that some progress has been made in resolving the conflict. The world situation is still tightening as Brazil and Argentina are getting into the harvest of less Soybeans. Paraguay might import Soybeans this year from Argentina. Higher Soybeans prices are still possible due to the war and the overall supply and demand situation. Argentina has suspended export registrations for Soybeans and products as it works to raise taxes on the Soy complex exports. China has a Covid outbreak again and has closed some cities and some ports in response. The moves are harsh but China has a no-tolerance policy about the pandemic. The closings of cities and ports will hurt the economy as people can’t make or spend money and hurt imports as there will be fewer places to unload cargoes.

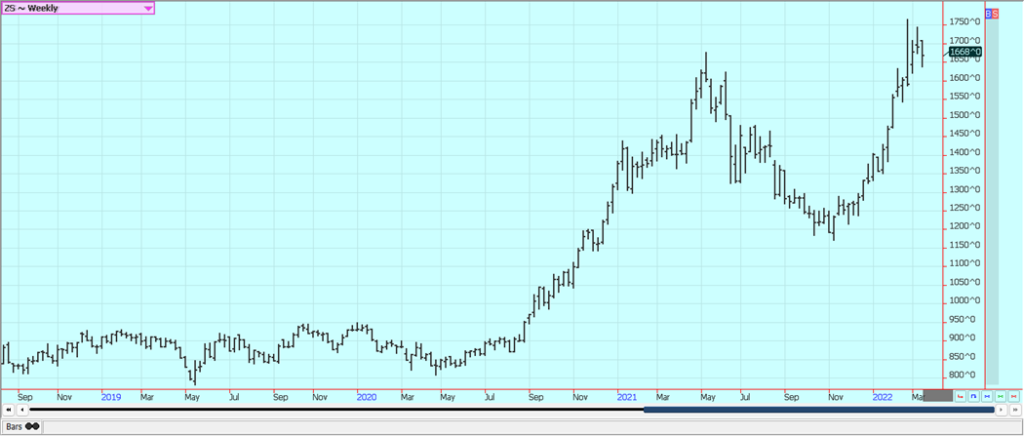

Weekly Chicago Soybeans Futures:

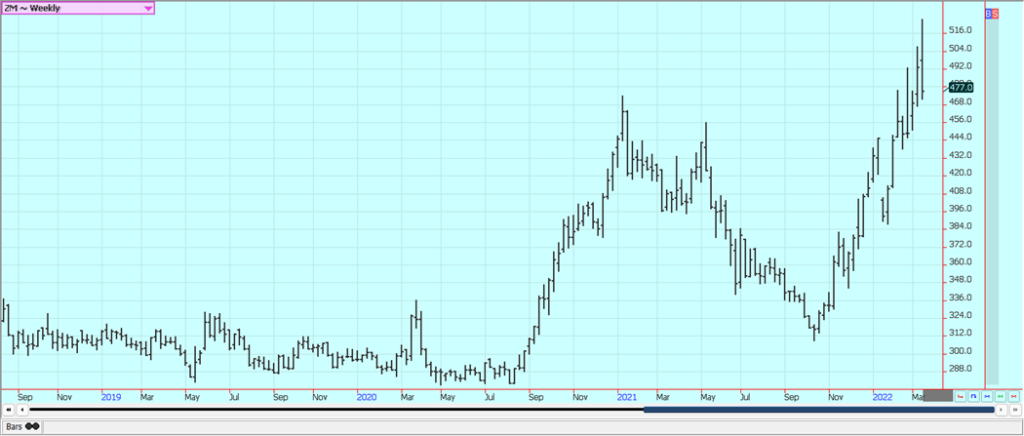

Weekly Chicago Soybean Meal Futures

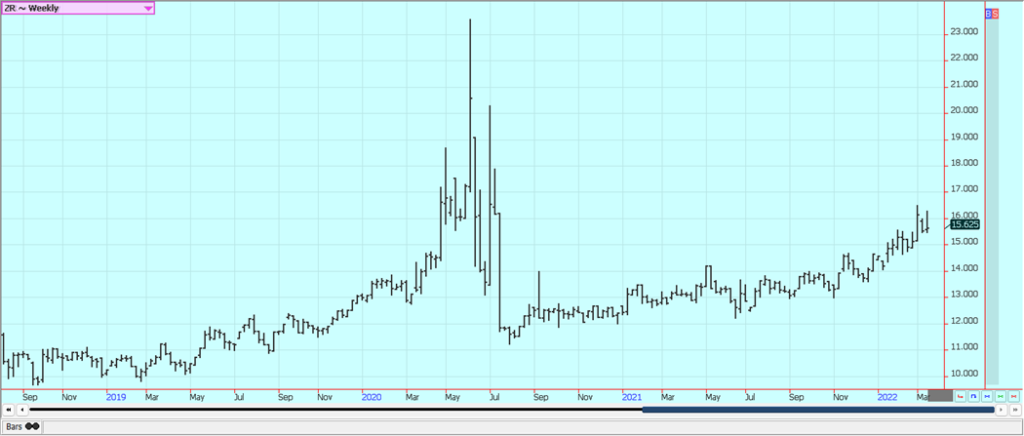

Rice: Rice was lower last week and trends are turning down on the daily charts. The cash market is showing that domestic mill business is around everywhere in good volumes. Producer sales are reported to have been way ahead of average early in the marketing year so stocks on hand in first hands are reported to be lower than normal. Export demand was just average to below-average again last week, but has been stronger overall, especially for Rough Rice. Export sales were improved from a week ago.

Weekly Chicago Rice Futures

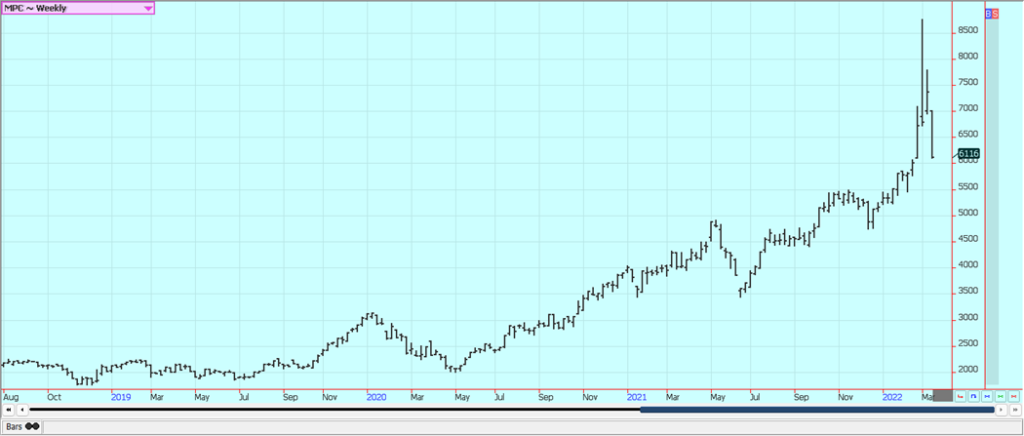

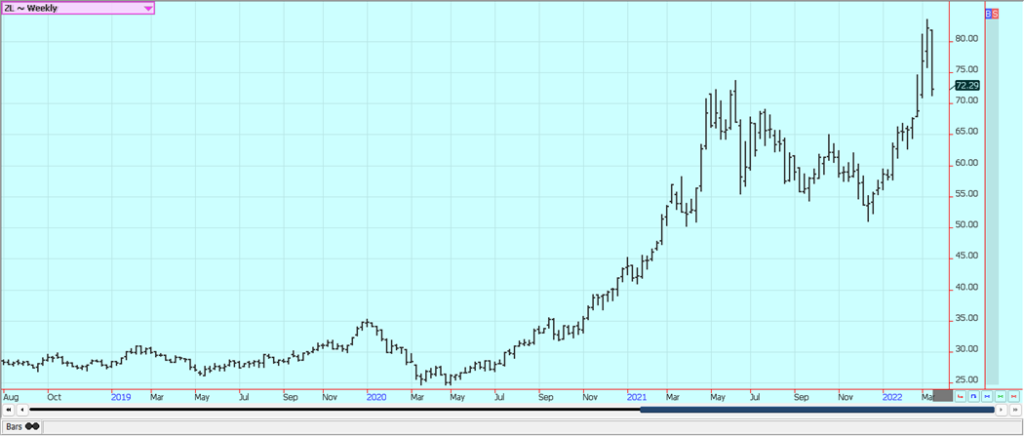

Palm Oil and Vegetable Oils: Palm Oil was lower as Indonesia decided not to force exporters to divert 30% oof the export demand into the domestic market and opted to increase export taxes instead. Demand in Malaysia could improve soon as Indonesia is expected to keep most Palm Oil at home. However, production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Indonesia is once again making moves to cut the availability of Palm Oil for export as it seeks to keep more at home for bio fuels purposes. Traders are mostly worried about demand from India who has been buying Soybean Oil in the US instead of Palm Oil from Malaysia and Indonesia and is also worried about China and its demand for Palm Oil for bio fuels. Canola was a little lower along with Chicago Soybean Oil and Palm Oil and on despite ideas of reduced Sunflower export potential from Russia and Ukraine due to the war The market is worried about South American production as well. Canada produced a very short crop of Canola last year so supplies are tight.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton futures closed higher last week on good demand as seen in the weekly export sales report and despite ideas of Chinese import problems. China has been buying even with the port closures and domestic difficulties. The Russian invasion of Ukraine continued and shipments of Crude Oil and products from Russia are interrupted. That means higher Crude Oil prices and higher polyester prices for the world. The ongoing peace talks between the two sides are making slow progress much to the cheer of the rest of the world. Traders are worried about Chinese demand moving forward. China has closed two ports for imports due to Covid and is also closing down a number of cities as the Covid spreads through the nation. However, Shanghai said it would stay open and asked office workers to follow a hybrid model used here in the US. The US Dollar has been moving higher in the past week due to the war and the stock market has worked lower. Short-term trends are still sideways.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was higher last week on lower US production estimates and less FCOJ in storage. The weather remains generally good for production around the world. Brazil has some rain and conditions are rated very good. Weather conditions in Florida are rated mostly good for the crops with a couple of showers and warm temperatures. Mexican crop conditions in central and southern areas are called good with rains. Northern and western Mexico is rated in good condition. Florida Mutual said that FCOJ inventories are now 30% less than last year in its latest Movement and Pack report.

Weekly FCOJ Futures

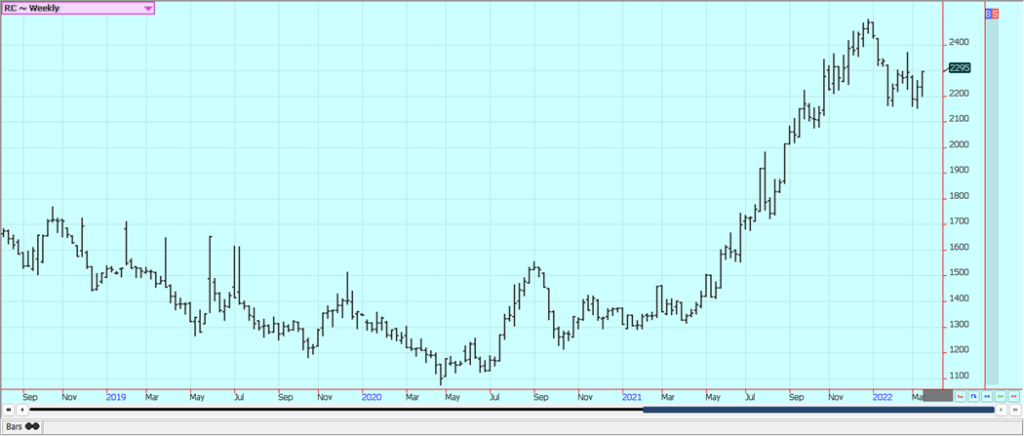

Coffee: New York was lower last week but closed the week on a positive note. London was higher as a lack of deliveries from Indonesia supported the futures market. The Russian invasion of Ukraine continued and caused a lot of concern about demand for Coffee in the world in the future. However, the two sides are talking and are apparently inching to an agreement and the market has relaxed its selling pressure in Coffee. Good growing conditions for the next crop in Brazil were also noted as a reason to sell. Coffee prices have been negatively affected, but most other agricultural futures are higher to sharply higher due to the war. The logistical and production problems in Brazil are still around. The dry weather and then the freeze in Brazil have created a lot of problems for the trees to form cherries this year. Containers are not available in Brazil to ship the Coffee.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London were higher last week in reaction to the Russian invasion of Ukraine and the potential for the west to cut off Crude Oil exports from Russia. Current peace talks between Russia and Ukraine are yielding at least slow progress and that kept Crude Oil supported. Plenty of White Sugar is available from India and Thailand, and India said its export pace is above that of a year ago. Exports are expected to be 7.5 million tons this year, from 7.3 million last year. President Biden indicated last week that Russian energy imports would be curtailed due to the war. The daily charts show that price trends are turning up for both markets. News reports indicate that little export activity is taking place from Ukraine or Russia with the Black Sea and Azov Sea ports basically closed. Some of the oil giants have pulled operations out of Russia in response to the war, but others are still working there.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

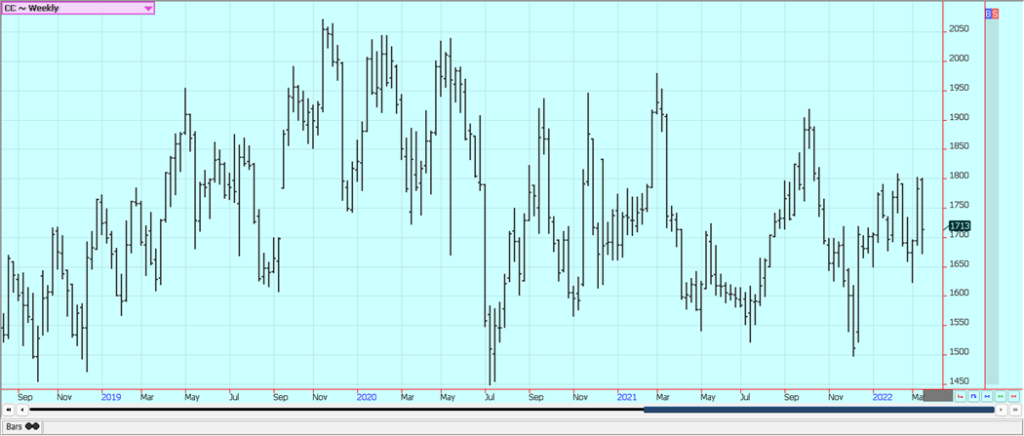

Cocoa: New York and London closed lower for the week as some showers are in the forecast for West Africa. Chart trends remain down on improved crop conditions and in part because of demand fears as Europe is the leading per capita consumer of Chocolate and demand could drop if the war in Ukraine expands or even if it doesn’t. Demand fears have eased a bit as both sides in the conflict report slow progress at peace talks, but progress has been made. The weather is generally too dry for West Africa and good in Southeast Asia. The dry conditions in West Africa are now disappearing due to scattered showers in the region. Ideas are that demand will only improve slightly if at all and production in West Africa appears to be good this year. Cocoa arrivals in Ivory Coast are now 1.618 million tons, up 1.4% from last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by juangondel via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Africa7 days ago

Africa7 days agoCôte d’Ivoire Unveils Ambitious Plan to Triple Oil Output and Double Gas Production by 2030

-

Biotech2 weeks ago

Biotech2 weeks agoGalicia Becomes First in Spain to Approve Gene Therapy for Hemophilia B

-

Business4 days ago

Business4 days agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [NordVPN Affiliate Program Review]

-

Fintech2 weeks ago

Fintech2 weeks agoBitget Secures Operational License in Georgia, Strengthening Its Eastern Expansion