Markets

A high-yielding dividend formula for all stock traders

The method introduced in this article could be used by investors to get a superior return by investing in a portfolio of large cap stocks.

In this article, I will present a formula that can be used by investors to create a winning large-cap high-yielding dividend growth portfolio. The following screen shows such a promise. I have searched for Russell 1000 companies that pay very rich dividends with a low payout ratio. Those stocks also would have to show a dividend growth in the last five years. The Russell 1000 index is composed of about 1,000 stocks of the largest companies in the U.S. stock markets. This index contains over ninety percent of the total market capitalization of all stocks listed in the United States. 18 years back-test of the formula has given an average annual return of 11.56%, while the average annual return of the Russell 1000 index during the same period was only 3.86%.

The screen’s method that I use to build this portfolio requires all stocks to comply with all following demands:

1. The stock should be included in the Russell 1000 index.

2. Market cap is greater than $500 million.

3. The dividend yield is greater than 3.5%.

4. The payout ratio is less than 100%.

5. Positive dividend growth in the last three years.

6. Positive dividend growth in the last five years.

7. The twenty stocks with the highest ranks according to the Dividend Factors ranking system among all the stocks that complied with the first six demands.

The Dividend Factors ranking system is taking into account high dividend yield-35%, low payout ratio-35%, and high dividend growth-30%.

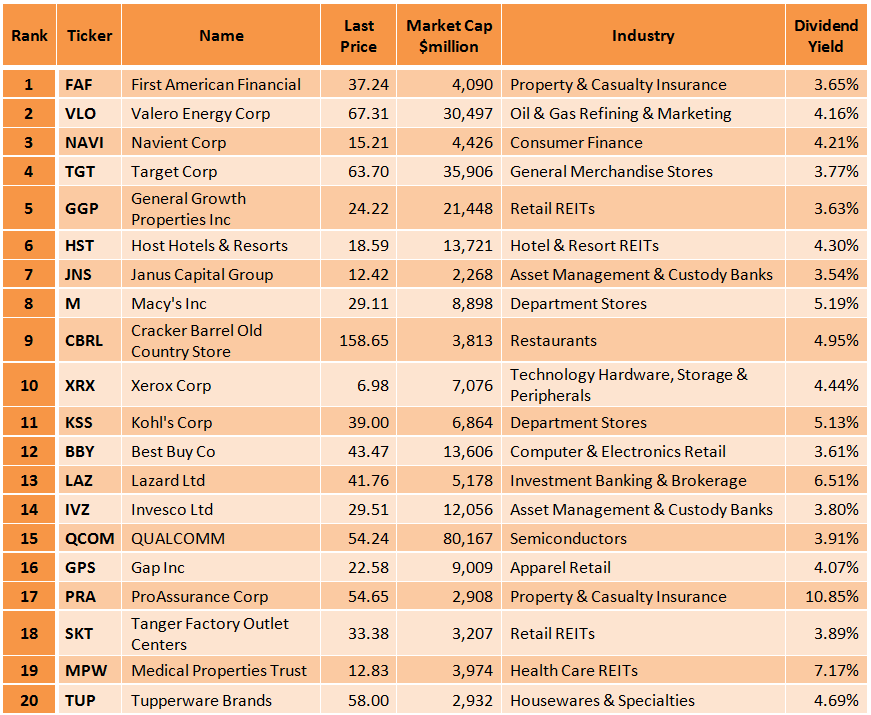

I used the Portfolio123’s screener to perform the search and to run back-tests according to these conditions. After running this screen on January 28, 2017, I discovered the following twenty stocks, which are shown in the table below.

(© Arie Goren)

Back-testing

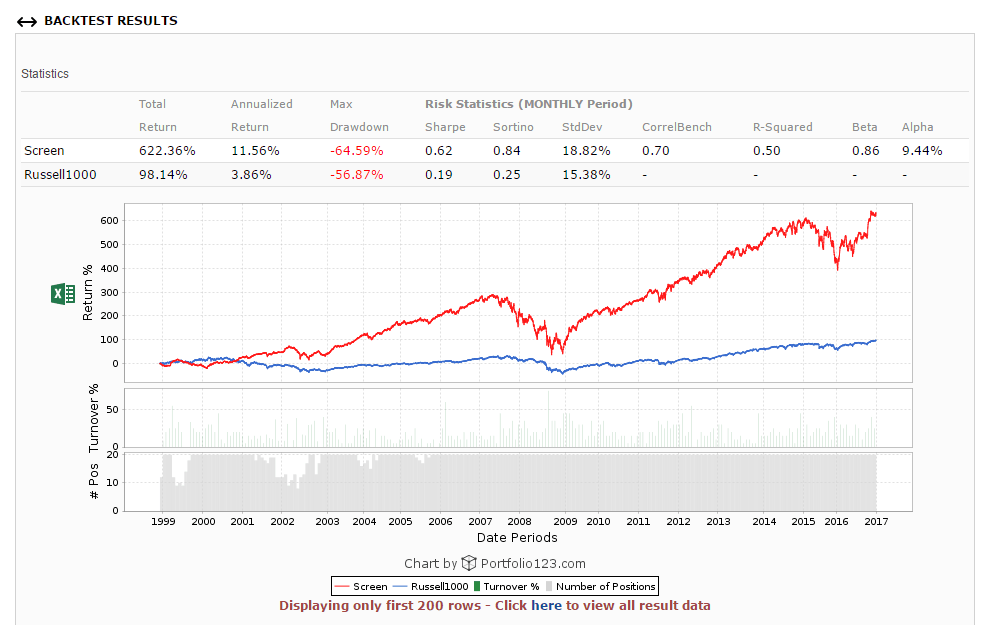

In order to find out how such a screening formula would have performed during the last eighteen years, I ran the back-tests, which are available by the Portfolio123’s screener.

The back-test takes into account running the screen each four weeks and replacing the stocks that no longer comply with the screening requirement with other stocks that comply with the requirement. The theoretical return is calculated in comparison to the benchmark (Russell 1000 index), considering 0.25% slippage for each trade and 1.5% annual carry cost (broker cost).

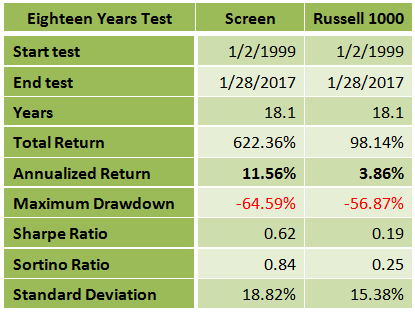

Eighteen years back-test Results

The high-yielding dividend growth stocks screen has given much better return during the last eighteen years than the Russell 1000 benchmark. The Sharpe ratio, which measures the ratio of reward to risk, was also much better for the screen. The 18-year average annual return of the screen was at 11.56%, while the average annual return of the Russell 1000 index during the same period was only 3.86%, as shown in the chart and the table below.

(© Arie Goren)

(© Arie Goren)

Conclusion

The method introduced in this article could be used by investors to get a superior return by investing in a portfolio of large cap stocks.

The back-test results shown in this article refer to a practice of rebalancing the portfolio each four months. However, rebalancing every larger period would also give superior results. Running the back-test while rebalancing each three months has given an average annual return of 11.66%, rebalancing each six months has given a return of 10.09%, and rebalancing once a year has shown an average annual return of 10.79%.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech2 weeks ago

Fintech2 weeks agoDruo Doubles Processed Volume and Targets Global Expansion by 2026

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Health Trader Affiliate Program Review]

-

Africa4 days ago

Africa4 days agoAir Algérie Expands African Partnerships

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum Pushes AI Integration With ERC-8004 and Vision for Autonomous Agents

You must be logged in to post a comment Login