Business

New announcements at the agriculture market in the past week

World markets were mostly stable again last week. US futures markets moved lower and are showing the potential to move even lower into the new year.

Weekly report with detailed analysis and commentary on the state of agriculture markets in the U.S.

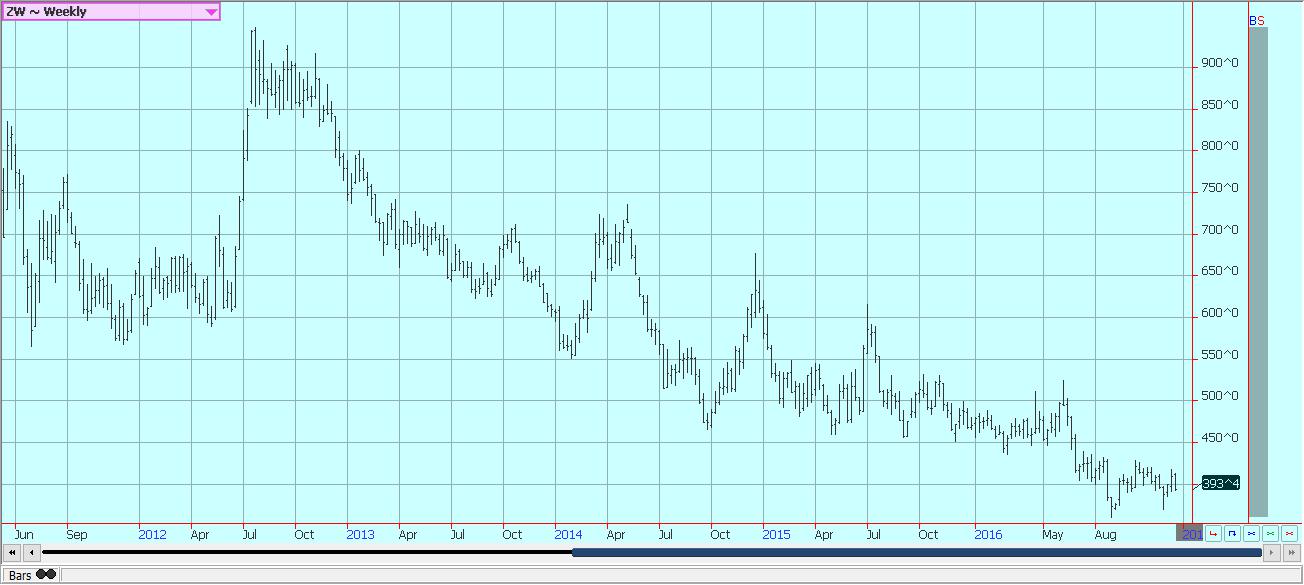

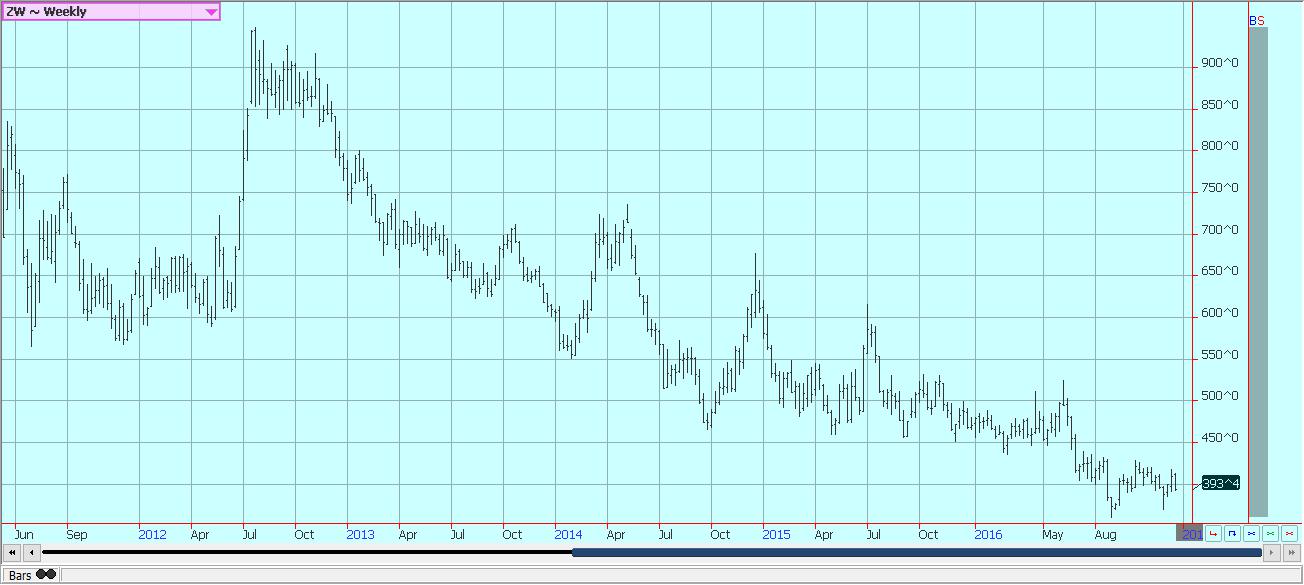

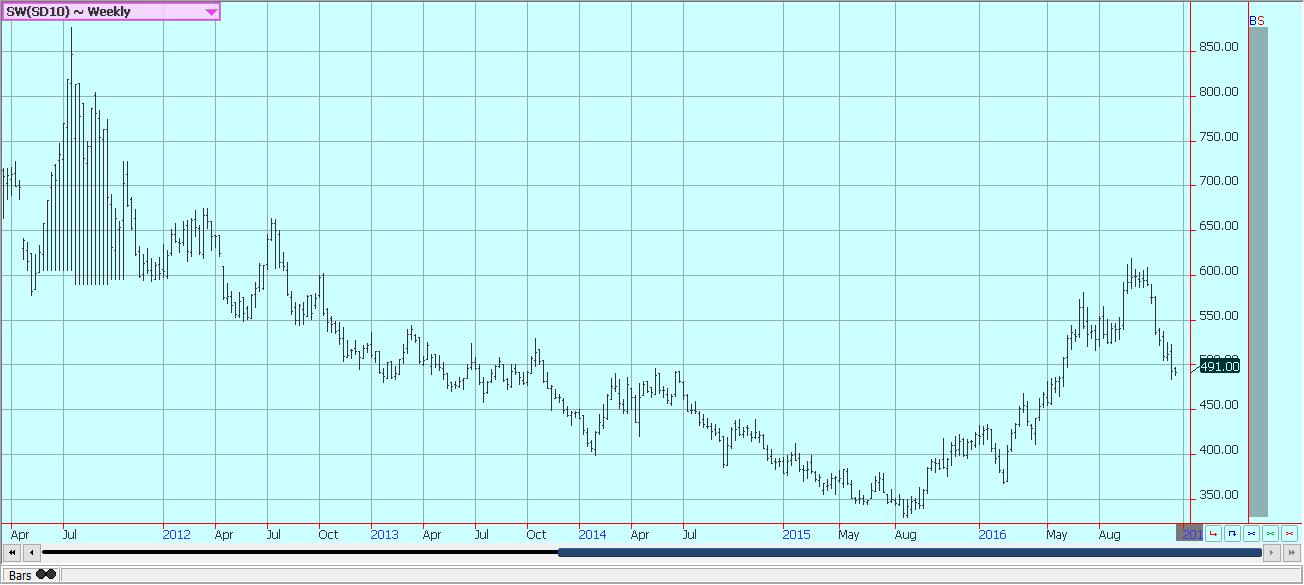

Wheat

US markets were lower last week as temperatures in the US moderated after the freeze event of the weekend before. There was some loss to Winter Wheat production in western parts of the US Great Plains as well as in the southern Midwest. How big the losses are will not be known until the crop comes out of dormancy in the Spring. In the meantime, attention has shifted back to demand. The weekly export sales report was down from the last few weeks, and the demand news for the week highlighted the potential demand problems for US Wheat. Egypt bought more Wheat in the world market and did not buy from the US. That on its own is not that unusual as Egypt for some reason does not really like US Wheat. But, they bought part of the load from Argentina, and that was a surprise for the market. It seems a little early for Argentina to be a force in the world market, so Argentina is starting its selling program early. They have Wheat and they have a weak Peso against the US Dollar, so they can offer at very favorable terms. In fact, the Argentine offers were the lowest at the Egyptian tender. Futures are now at support areas on the weekly charts and need to try to hold at current levels. Another round of selling will be possible this week if the macro-economic conditions and the demand news continue to point things away from the US.

Weekly Chicago Wheat Futures © Jack Scoville

Weekly Chicago Wheat Futures © Jack Scoville

Weekly Minneapolis Wheat Futures © Jack Scoville

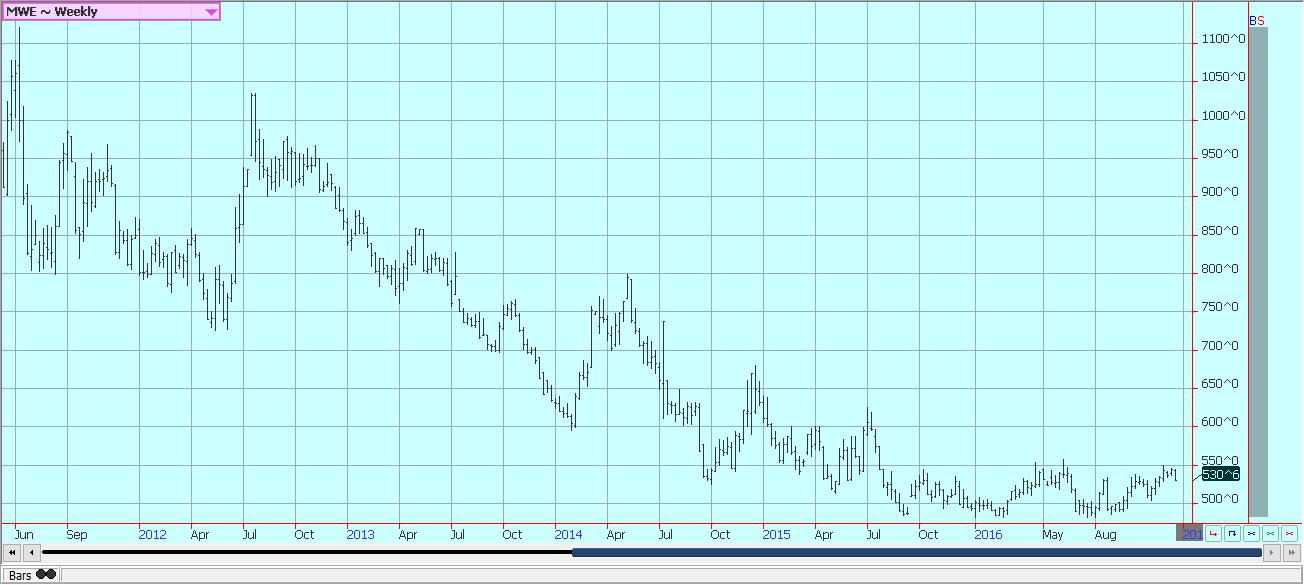

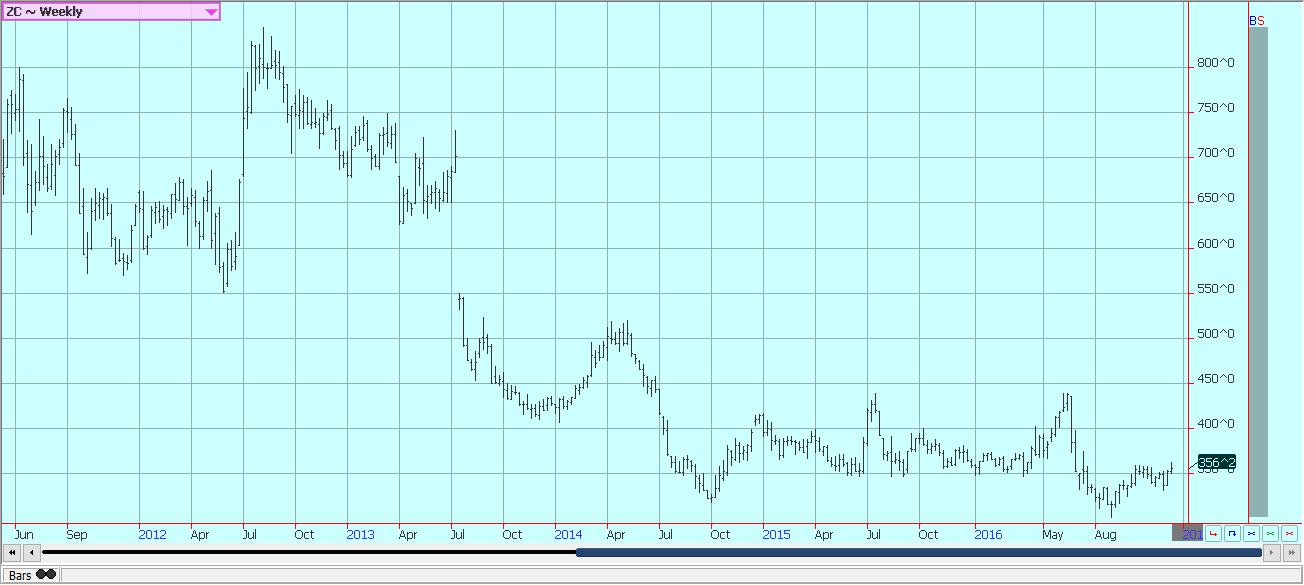

Corn

Corn closed lower for the week, but it seems like most of the selling was in response to weaker prices in Soybeans and Wheat. Corn had little reason to move lower on its own. Demand remains very good for US Corn and sales are ahead of the projected pace of USDA at this time. US farmers are not really offering in the cash market, and basis levels in the country have held firm. Gulf of Mexico basis levels have been stable in the past week. There is some talk that Brazil and Argentina will now start to offer Corn in competition with the US into the world market. We wonder when this can begin. Brazil was very short Corn in its domestic cash market for most of last year as the exporters oversold. Brazil had to import most of the Argentine Corn surplus and prices in its domestic markets remain high. It seems most likely that the first part of the Corn harvest in both countries will go to fill internal pipelines and exports will become possible once the local pipelines are filled. That could take until the middle of next Summer. The US has a chance to dominate Corn exports until that time. The lack of farm selling in the US will help support prices, but will also limit the upside potential. The market knows that US farmers have been storing Corn in hopes of stronger prices, and it knows that sooner or later some of the crop will need to get sold. Buyers will only try to bid the market higher to the point that demand gets covered, then prices will drop again. All that implies that Corn can trade in a choppy to perhaps higher pattern as the market moves into the new year. There seems to be no reason to work lower given the lack of competition in the world market.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

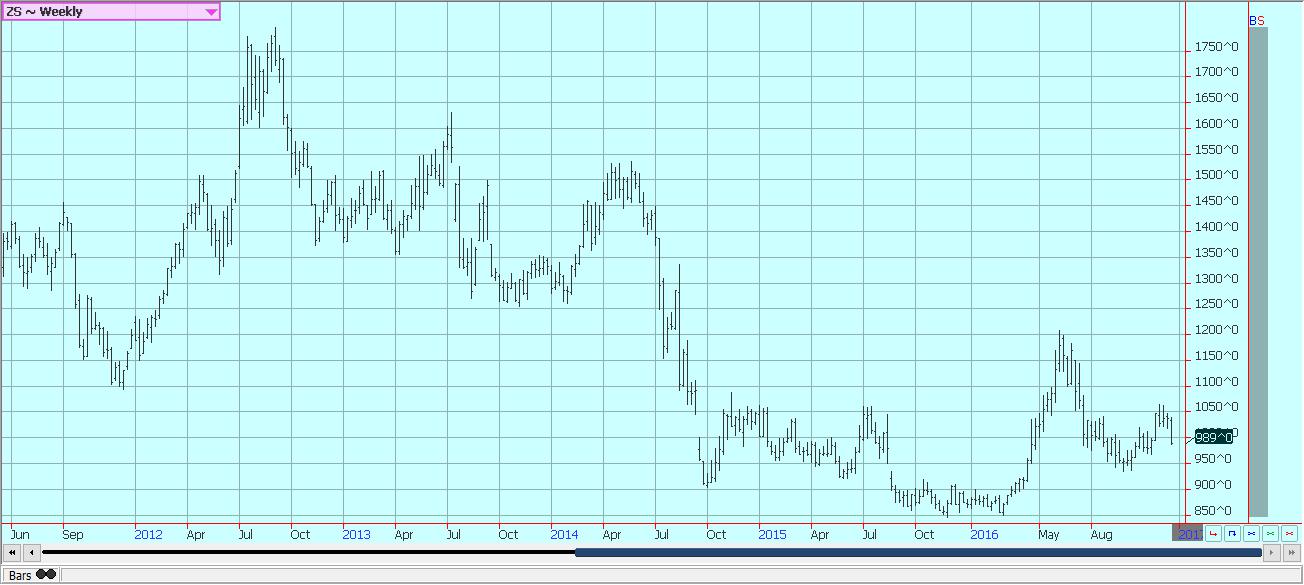

Soybeans and soybean meal

Soybeans and Soybean Meal were lower for the week as the weather in South America improved. Rains began to appear in Argentina a week ago and were reported again late last week and over the holidays. The crops in Argentina should be in much better condition due to the increased rainfall as some areas of the country had seen next to nothing. Southern Brazil had also been drier than normal and has now been getting some beneficial rains. It should turn drier and warmer this week. The area to watch will be northern Brazil as northeast areas especially turn hot and dry. The market is also hearing about some initial harvest activity in the far north of Mato Grosso. This is a very early start to the harvest. Most northern Mato Grosso areas will not start until later next month and Soybeans could be available for export by late February or early March. The trade fears lost business for the US once Brazil starts selling. However, the uncertain economy and currency in Brazil are making farmers take a wait and see attitude. The farmers fear Real weakness and want to wait and see if they are right before selling as Soybeans become a bank for them. Farmers in southern Brazil are about done with planting now, but Argentina still has more to go. Some areas of Argentina have been too dry, but most of the country got some very beneficial precipitation last week. US farmers have been selling Soybeans and reports indicate that at least two-thirds of the crop have been sold. US farmers are starting to look at futures price indications for next year and Soybeans right now are presenting the better return. A sharp increase in Soybeans planted area is possible in 2017. Soybeans seem to be pushing for an interim low right now and might find a reason to rally sooner rather than later, especially if farmers here and in South America turn quiet.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

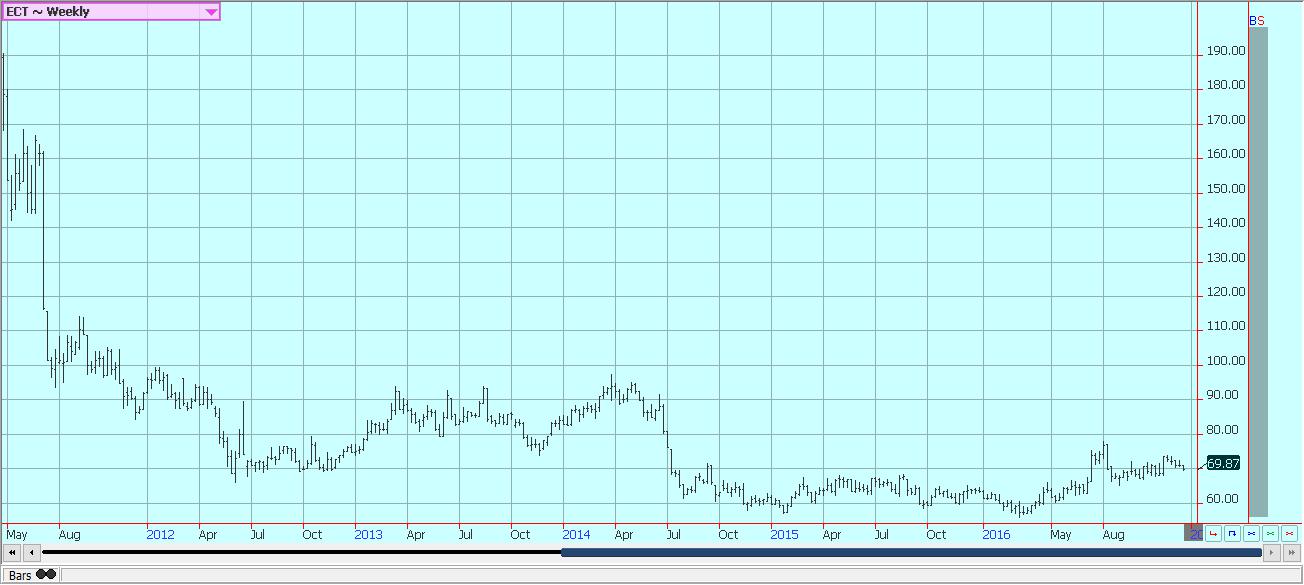

Rice

World markets were mostly stable again last week. US futures markets moved lower and are showing the potential to move even lower into the new year. Speculators remain the primary sellers in Chicago. The US market has turned very quiet for the holiday period, and most farming operations are now shut down for the holidays. Most producers will not look at the market until early next year now. There is not much reason for them to consider prices at this time as cash market bids remain well below the cost of production for most sellers. Domestic mills appear to have enough Rice on hand to meet projected demand into next year. Export sales last week were solid once again but featured big sales of medium grain to Japan. Actual long grain demand was much improved for paddy and milled. Southeast Asian markets keep feeling demand from China. The country imported 335,482 tons of Rice in November, up 5/61% from last year. Cale3ndar year imports are now 4.72% ahead of last year at 3.093 million tons. Almost all of the demand is getting filled by Southeast Asian countries, but some is also getting done by Pakistan. The US is facing a big cut in planted area next year unless prices improve this Winter. Planting mix decisions will start being made next month, and most are now expecting a drop of 15% to 25% in planted area due to price. It just is not profitable to grow Rice in the US at current prices. Rice producers do have significant support from the farm programs, but even these are not enough to overcome the loss potential. We expect quiet markets the next couple of weeks, then a chance to try to rally prices again in January to encourage some farm selling.

Weekly Chicago Rice Futures © Jack Scoville

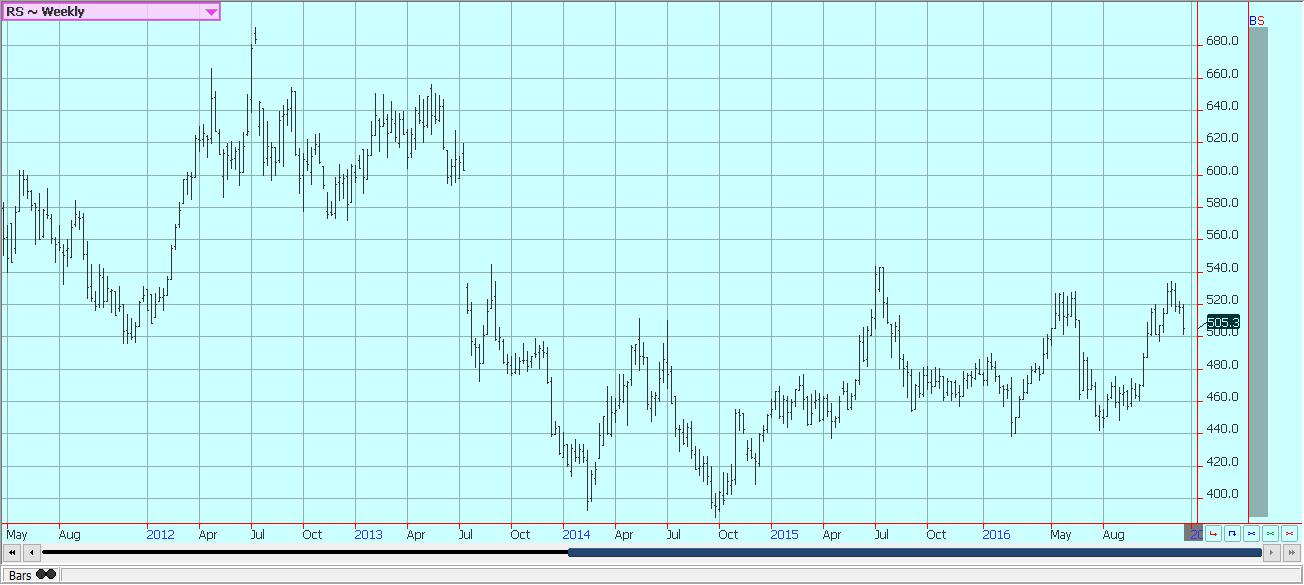

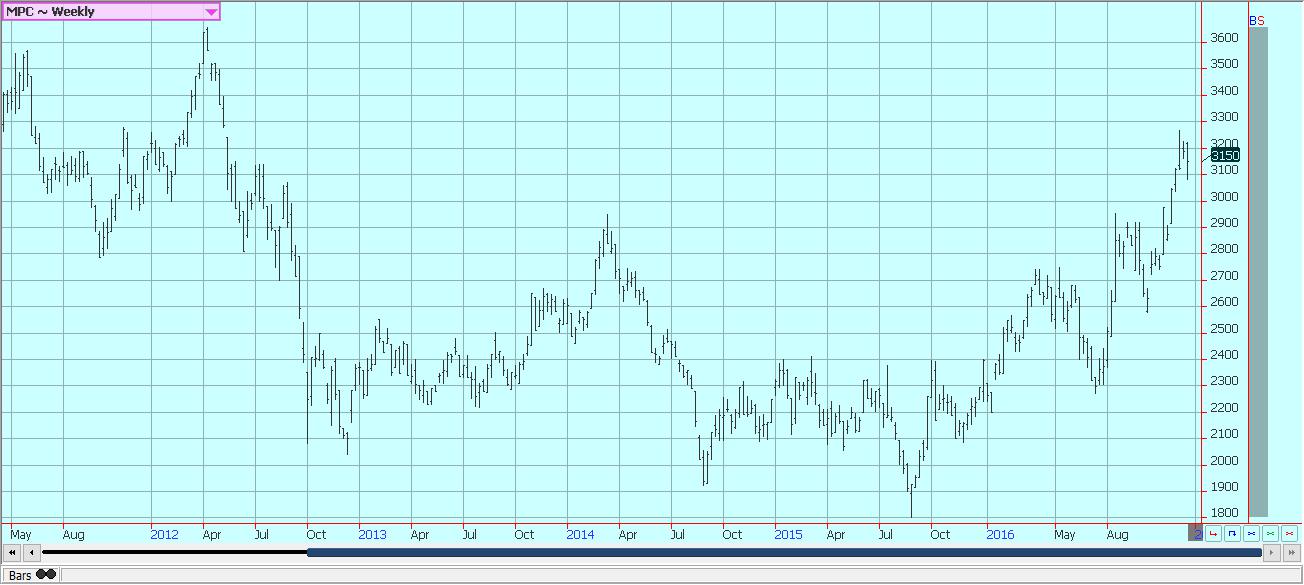

Palm oil and vegetable oils

It was a lower week for world vegetable oils markets. Production of Palm Oil might be down, but the market seems to be shifting attention once again to the demand side. Demand for vegetable oils has been good, but not great. Palm Oil sales have suffered to traditional customers like China and India. For example, China imported 446,218 tons of Palm Oil in November, but this was down 3.5% from last year. The sales all came from Indonesia and Malaysia. Calendar year to date imports are now 3.798 million tons, down 27.5% from 2015. Indonesian sales are down 24.75% from last year and Malaysian sales are down 30.88% from last year. The reduced sales pace partially reflects the smaller crops produced in the last six months due to the drought losses from El Nino. The smaller Palm Oil production has pushed Palm Oil prices to points where it makes sense for buyers to consider Soybean Oil. However, Chinese Soybean Oil imports are also less. For example, China imported 79,168 tons of Soybean Oil in November, down 13% from last year. About 80% of the imports came from the US, and that was very good news for the US as last year it imported no Soybean Oil in November from the US. Calendar year to date imports of Soybean Oil are now 523,513 tons, down 34.75% from 2015. The US sold 81,767 tons to China, a big number for the US and welcome demand. The new US government is indicating that it will not renew bio fuels credits next year. Ideas are that this could hurt vegetable oils demand in the coming year. Chart patterns have turned weaker in the last couple of weeks, and moves lower are possible in the coming year.

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Weekly Malaysian Palm Oil Futures

Cotton

Futures were lower. The weekly charts show that the market held support and that the longer term uptrend remains intact. The market is testing the up trend line and needs to hold at current levels. Significant long liquidation is possible if the market does not hold. USDA weekly export sales were down on a week to week basis, but were still very strong if one considers the sales for the current and next marketing year combined. The situation in India remains difficult as the market has yet to open much due to the changes in monetization of the country. The government has changed bills and appears to be forcing more electronic transactions to open the economy and increase transparency. Trade in most agricultural markets has ground to a halt for a while and is now slowly starting to get better. The US has been able to sell more Cotton into the world market this year due to these developments, and even Pakistan has become a good buyer as they look to replace purchases normally made from India.

Weekly US Cotton Futures © Jack Scoville

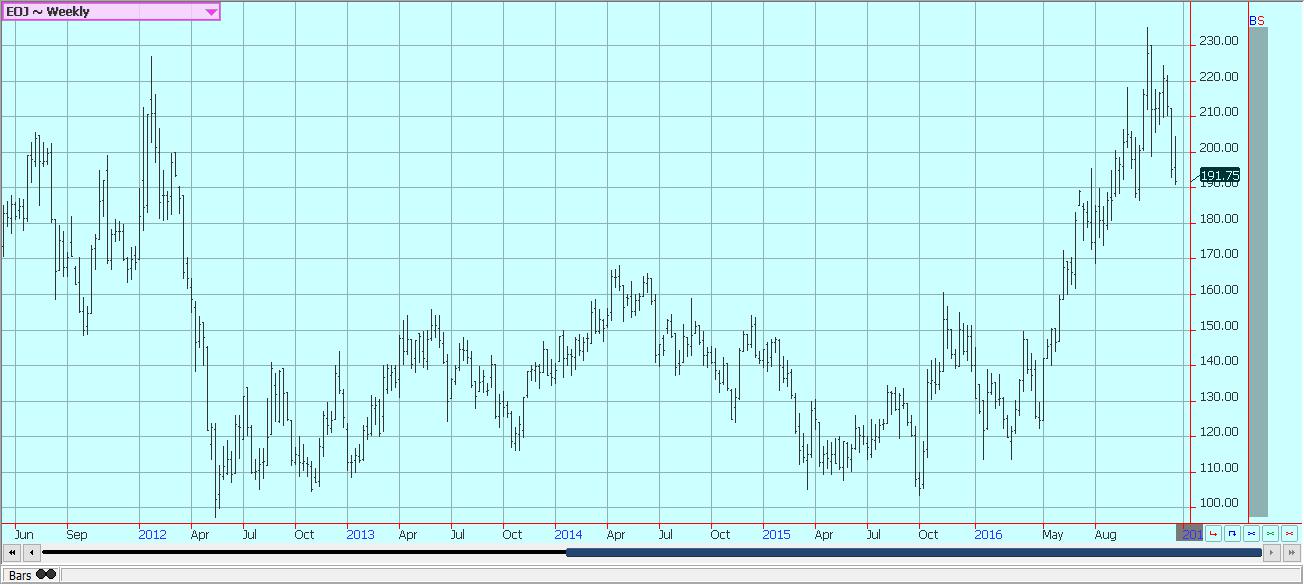

Frozen concentrated orange juice and citrus

FCOJ closed a little lower on Friday and lower for the week. The market is looking at stable production estimates for Florida and the potential for increased competition from Brazil. USDA left production estimates for Florida Oranges unchanged in its monthly reports. There are no frosts or freezes in the forecast for Florida, but it has turned cooler. Less Florida production and also less production in Brazil are the main market support factors. Brazil also suffers from the greening disease. However, the USDA Attache said that improved weather this year should lead to increased production. The Attache is calling for about a 37% increase in Oranges production in Brazil. That would put production near the historical normal and alleviate many concerns about the reduced Florida production as the Brazil production will be availab le for import and blending. The Florida harvest is moving forward, but harvest progress has been slow and progress is called behind normal. Irrigation has been used in Florida and is being used frequently at this time due to dry conditions. Fruit is moving to packing houses for the fresh trade and is also now moving to processors. In Brazil, Sao Paulo state is getting good weather and crop conditions are called good.

Weekly FCOJ Futures © Jack Scoville

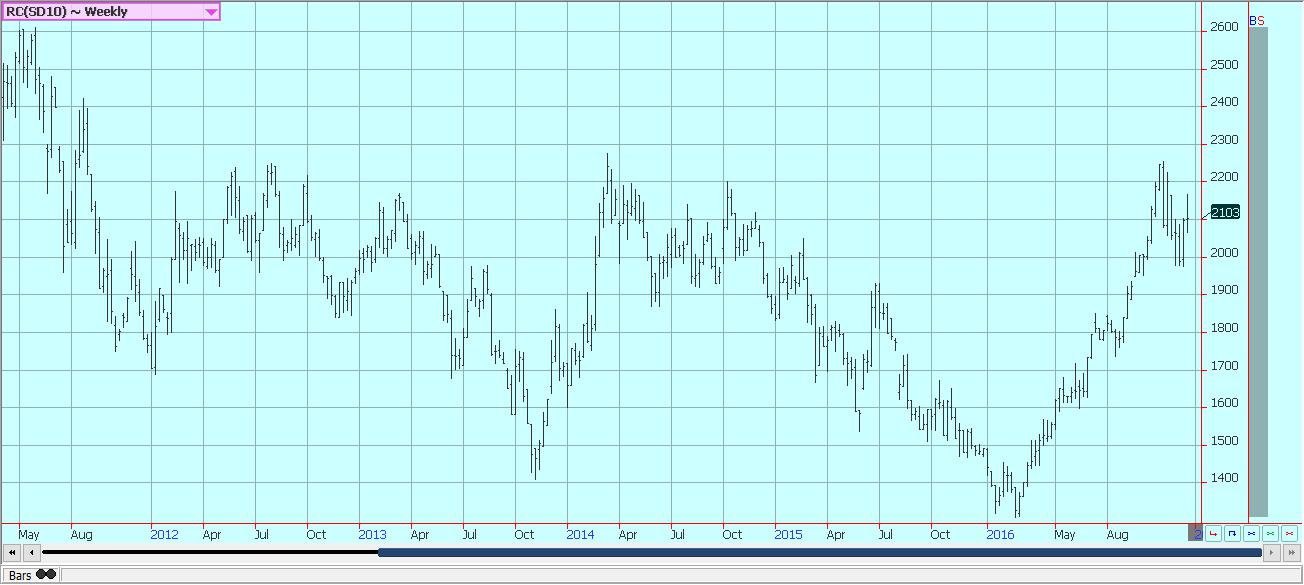

Coffee

Futures moved in different directions last week, with New York a little lower and London a little higher. Much of the price action came late in the week and was in reaction to new Brazil production estimates released by CONAB. The government agency estimated production at 51.4 million bags due to much better than expected Arabica production. It had previously estimated total production at just 49.6 million bags. Production last year was just 43.2 million bags. Arabica production was estimated at 43.4 million bags, from 41.3 million in September and 32 million last year. Robusta production was estimated at 8 million bags, from 8.4 million in September and 11.2 million last year. The estimates cause the market to adjust the spread between New York and London and made it hard for one to imagine a big rally in New York this year. However, prices are getting close to support areas on the weekly charts, so down side potential might also be limited. This could be especially true if London can stay strong and trade higher. The offer side of the market is quiet. Differentials paid in Central America appear stable at weak levels. Little selling is being reported, but offers are available as the harvest starts to increase. Differentials are also stable in Colombia. Brazilian producers have become quiet as the fear further weakness in the Real against the US Dollar. Coffee becomes a bank account when these fears get big enough. Roasters have become more withdrawn in the marketplace due to the recent surge in prices, and now due to the price weakness. They will probably start to buy again if a more stable price outlook appears.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

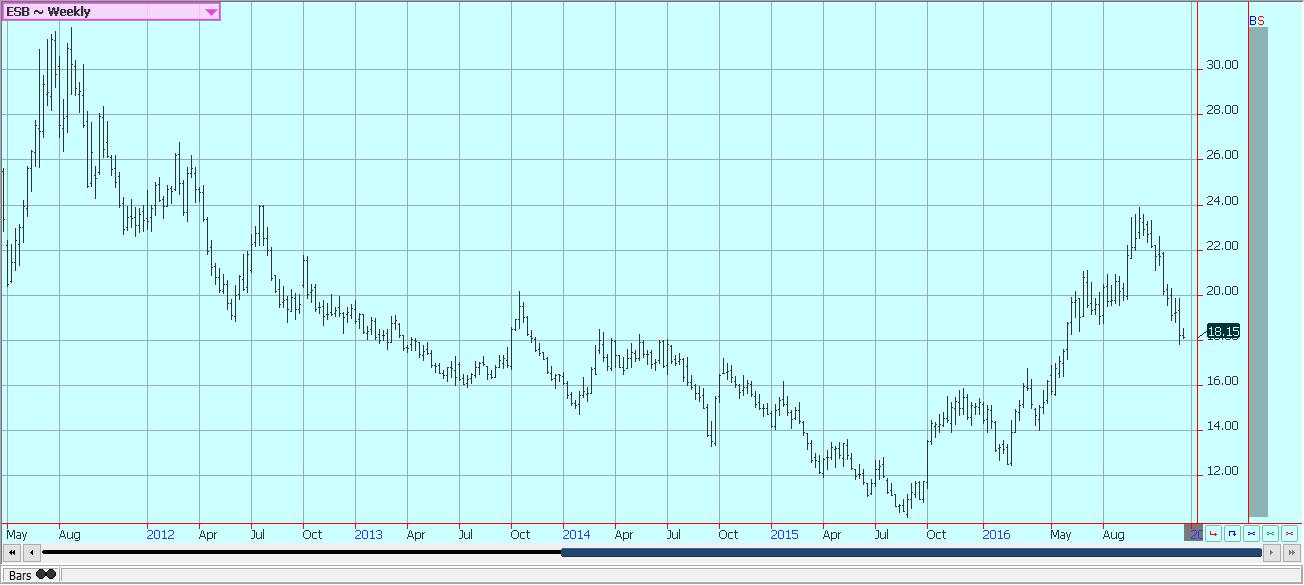

Sugar

Futures closed slightly higher last week. It is possible that futures eventually move down to test more support at 1600 and 1500 in New York. Price action overall remains negative on worries about overall demand potential and on bigger than expected exports from Brazil. Demand news remains bearish for futures prices. China has imported significantly less Sugar in the last couple of months as it starts to liquidate massive supplies in government storage by selling them into the local cash market. The Brazilian Real has moved sharply lower in the past couple of weeks. There could be smaller crops coming from India and Thailand due to uneven monsoon rainfall in Sugar areas in both countries. India has said that its production and amounts in storage are sufficient and that there is no need for imports that had been expected earlier. The weather in other Latin American countries appears to be mostly good as rains remain sufficient. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were higher in recovery trading. Trends remain down in both New York and London, but prices have moved sharply lower in the last few weeks and some short traders might decide to book profits for the end of the year. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. Speculators are mostly done liquidating and some commercial buying has been noted. Reports indicate that consumptive demand is increasing at these lower price levels. The demand from Europe is reported improved based on some corporate data released in the last few weeks. However, the Euro remains weak and new demand could be hurt. The next production cycle still appears to be bigger as the growing conditions around the world are generally improved. West Africa has seen much better rains this year and alternating warm and dry weather with the rains. There have been some reports of disease to crops in the wetter areas, but so far there is not a lot of market concern. Bigger production is expected this year in all countries. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

Dairy markets were firm as good supply met very good demand. Butter and cheese manufacturers report strong demand, but expect demand to fall off now as the holiday season is here. Butter manufacturers are shifting from producing print butter to producing bulk butter. Most have good supplies on hand, but inventory has been moving. Even so, inventories are increasing. Cream demand has been strong in the domestic and world market, with Mexico and Canada showing buying interest. Cheese demand is being met with adequate to strong milk supplies and manufacturing is active. Fresh cheese markets are in balance at this time, but aged cheese inventories are said to be high. Raw milk production has also been stronger, with only the Pacific Northwest reporting less production due to weather stress. Dried products prices are mixed to firm. Whey prices are strong, and whole milk prices are firm. NDM prices are mixed to firm. International markets are featuring higher prices due to reduced production. Production is less in Europe and Russia. Production is down in New Zealand due to adverse November weather. The country produced 2.85 million tons of milk, from 3.04 million in October and 2.98 million last year. Milk solids production was 234.77 million kg, from 247.43 million in October and 248.03 million last year. South American prices are firm as raw milk production goes into a seasonal decline. Prices were mixed at the Global Dairy Auction last week.

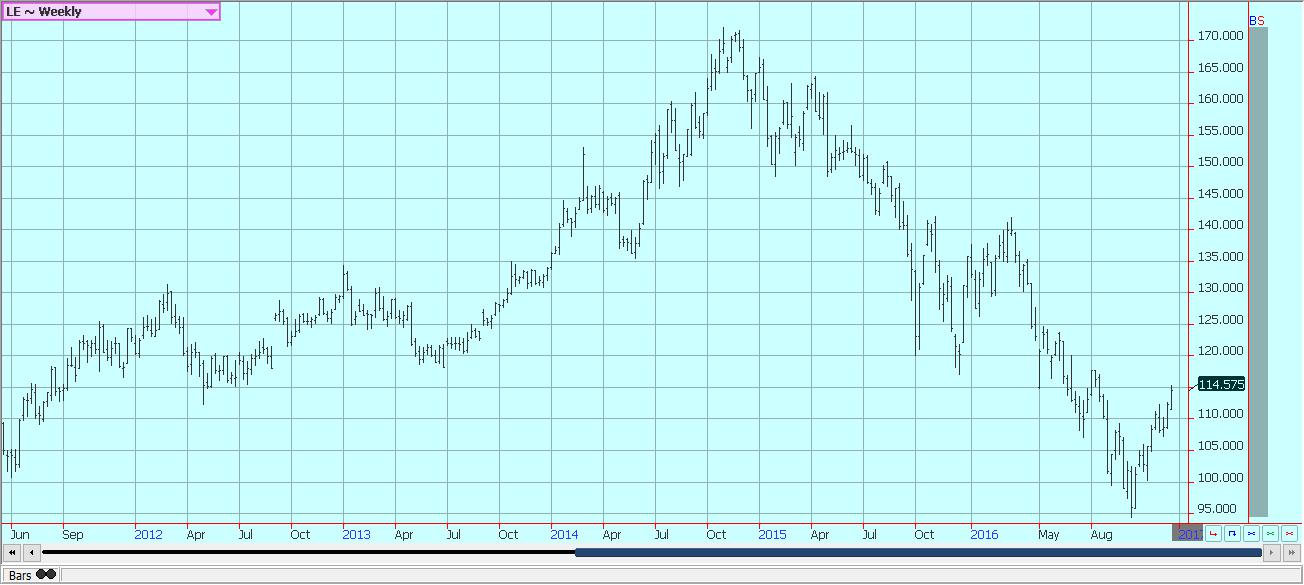

US cattle and beef prices were higher last week in reaction to reports of higher beef prices and on higher prices paid in cattle markets. Cash cattle markets traded at higher prices at the end of last week and in good volumes. Prices paid in the cash markets were in line with futures. The charts show that market could move higher. However, higher prices might be hard to find this week due to the Cattle on Feed report. The report showed that on feed, placements, and marketings were all above expectations. The placements were 15% higher compared to expectations for about 5% higher. Demand is starting to improve overall as the wholesale market anticipates better demand in the new year. Australia has less to offer and very high prices. Herd culling has slackened in both Australia and New Zealand. Pasture conditions in both countries is better than a year ago on colder and wetter weather seen until now.

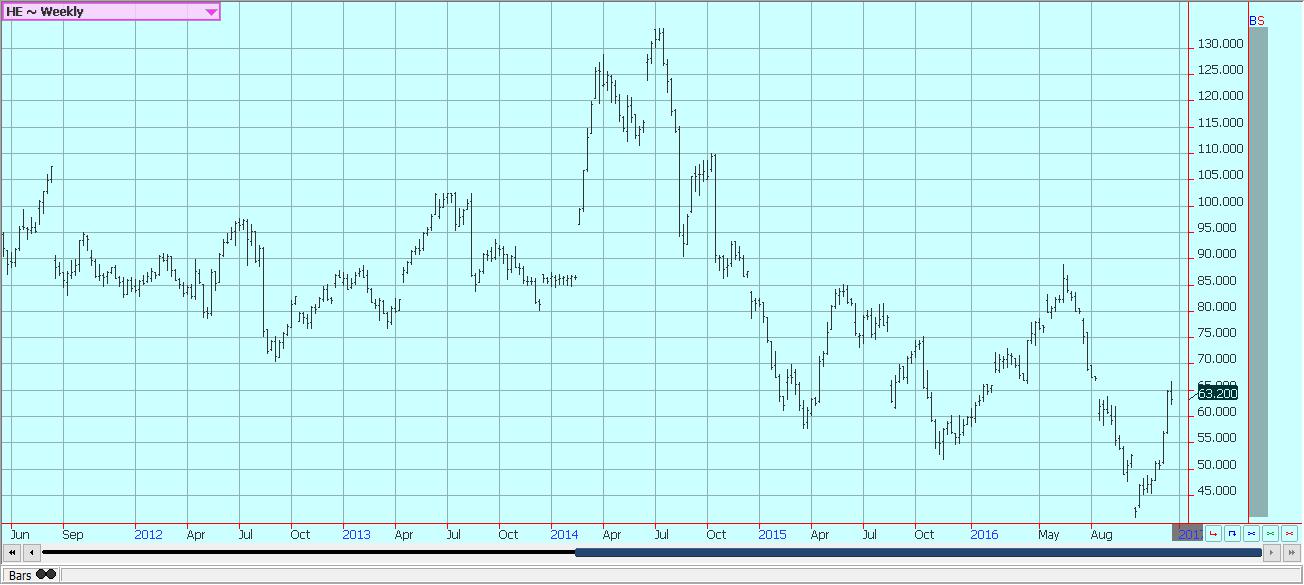

Pork markets have been firm, and live hog futures trends are higher. Pork demand has been stronger than expected and a primary ham consumption period is here with the holidays. Pork prices have trended higher in retail and wholesale markets. Packer demand has been improving as many packers expected reduced supplies of Hogs late in the Winter or in the Spring. However, USDA surprised the market in its hogs inventory report. The report showed that producers were expanding hog production at a faster pace than expected. The herd size was estimated at 71.5 million head, up about 4% from last year. The trade had expected about a 1.5% increase, so the report should be bearish for prices today. The charts show that the market could remain higher.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

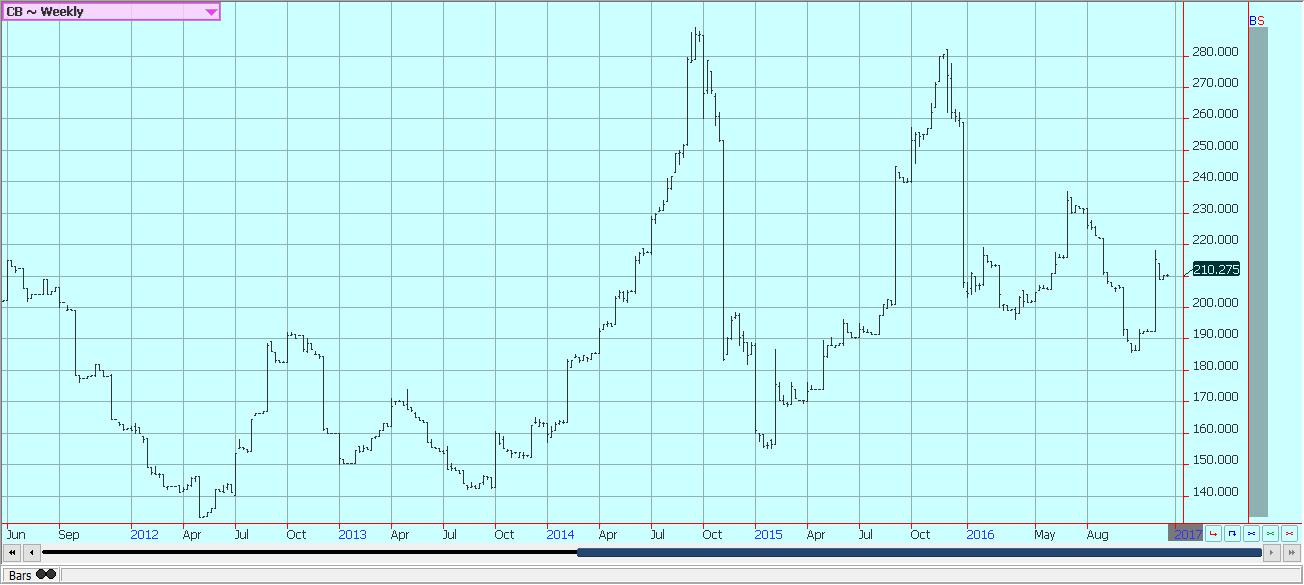

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto3 days ago

Crypto3 days agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Markets1 week ago

Markets1 week agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Crypto6 hours ago

Crypto6 hours agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Cannabis1 week ago

Cannabis1 week agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

You must be logged in to post a comment Login