Business

What’s new in the agriculture market this week (November 21-27)

US markets were a little higher last week as demand for US Wheat held strong in the world markets.

Here’s everything you need to know about the latest changes in the agricultural market in the US.

This week’s commentary and analysis are from market analyst Jack Scoville.

Wheat

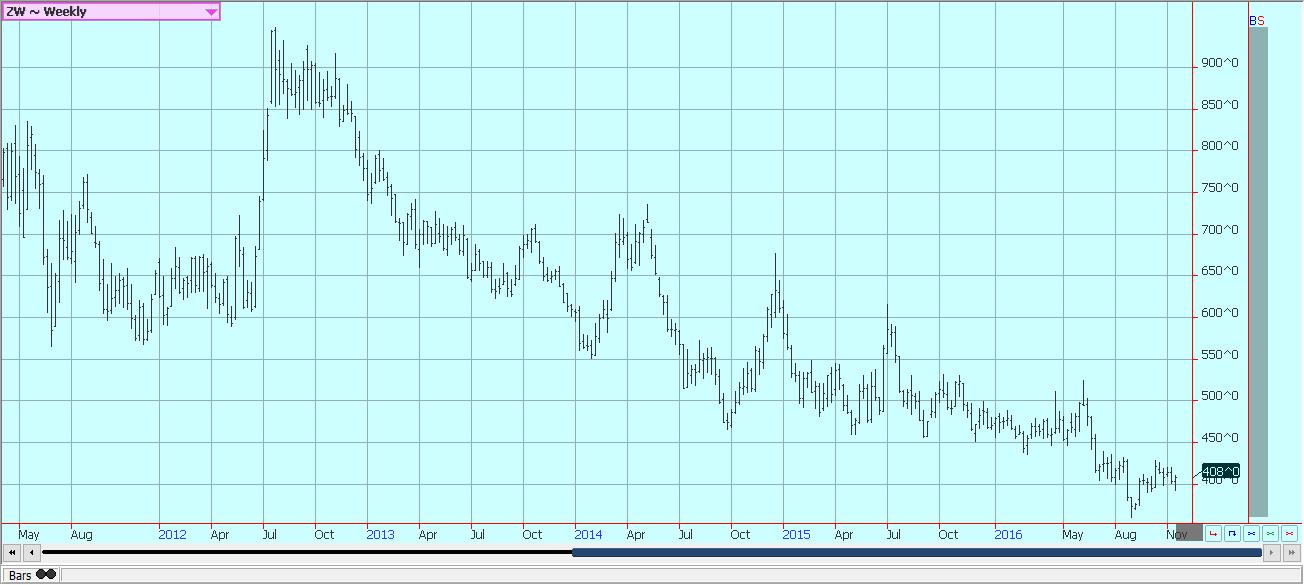

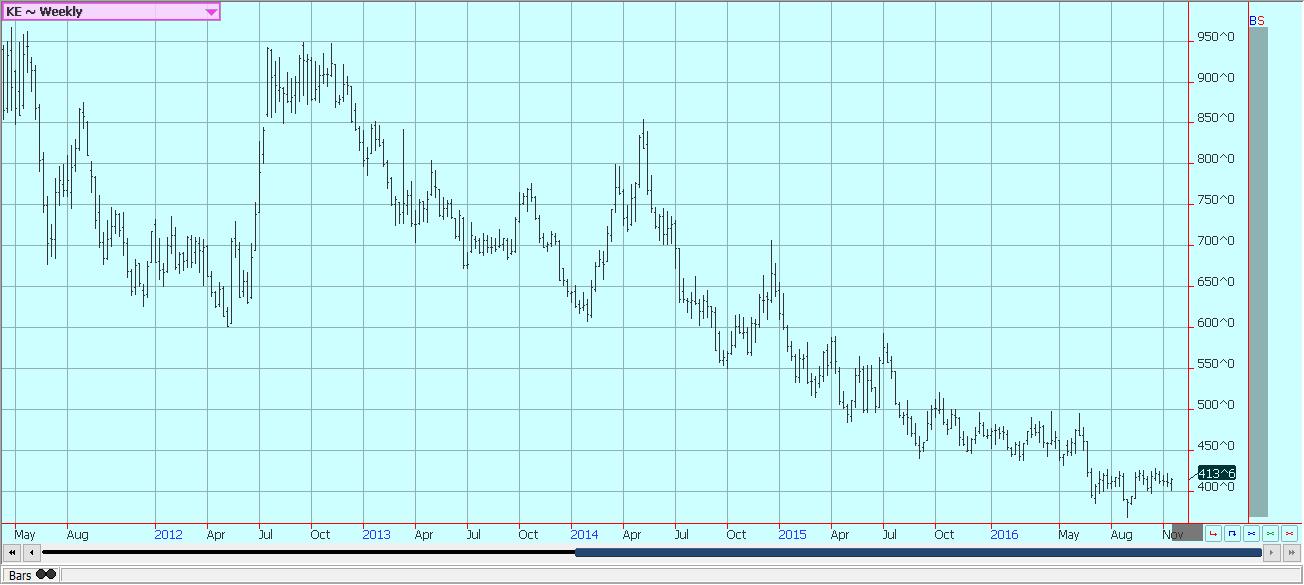

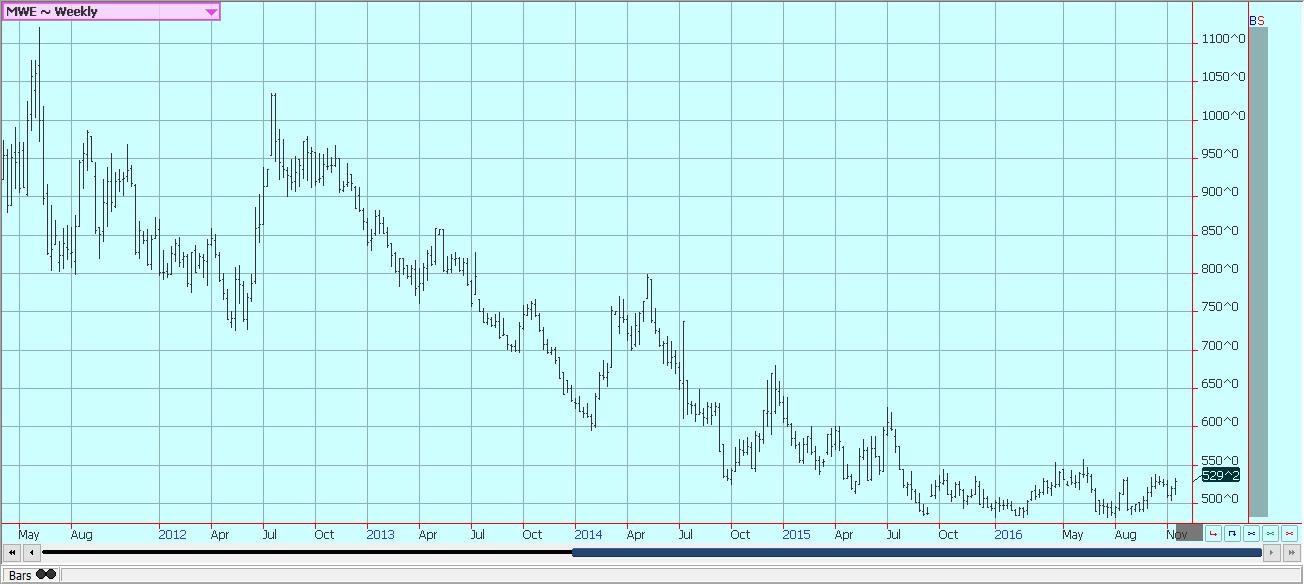

US markets were a little higher last week as demand for US Wheat held strong in the world markets. The demand is holding best for the higher protein wheats here and around the world as supplies for the higher end Wheat is less than normal. The bad weather in Europe and also in places like Canada and Australia has made the higher protein Wheat a more valuable commodity. Lower quality wheats are available in abundance in the world market. The US crop was a good one and the quality of the HRW and HRS was very good. Unfortunately for US producers, the US Dollar rallied to 13-year highs on the index and that news, when combined with the current improvement in futures prices, has made US Wheat much less competitive in the world market. Prices for US Wheat had been lower than the competition until last week, but now are equal to or above other world market offers. Prices from Argentina and Australia are reported to be well below US prices.

The trade will now wait and see how well demand for US Wheat holds together in the wake of the world currency changes. It is most likely that the US will start to lose some demand if the currency trends continue. The trade is also looking ahead and expected less US production for the coming year. The US Winter Wheat crop is still being planted and is emerging under mixed conditions. Parts of the southwestern Great Plains remain too dry. But, the big problem for producers is the price. Futures are too cheap and producers lose money at current levels. In fact, they have lost money on Wheat for the past few years. Some US producers are not planting Wheat and will plant other crops like Soybeans and Corn or Sorghum instead. That could cause higher prices next year, at least in the US market. In the meantime, the currency problems should keep futures from rallying much, but the speculators have been short and are coming out of these positions. So, the speculative buying could keep futures prices supported despite the world market conditions.

Weekly Chicago Wheat Futures © Jack Scoville

Weekly Kansas City Wheat Futures © Jack Scoville

Weekly Minneapolis Wheat Futures © Jack Scoville

Corn

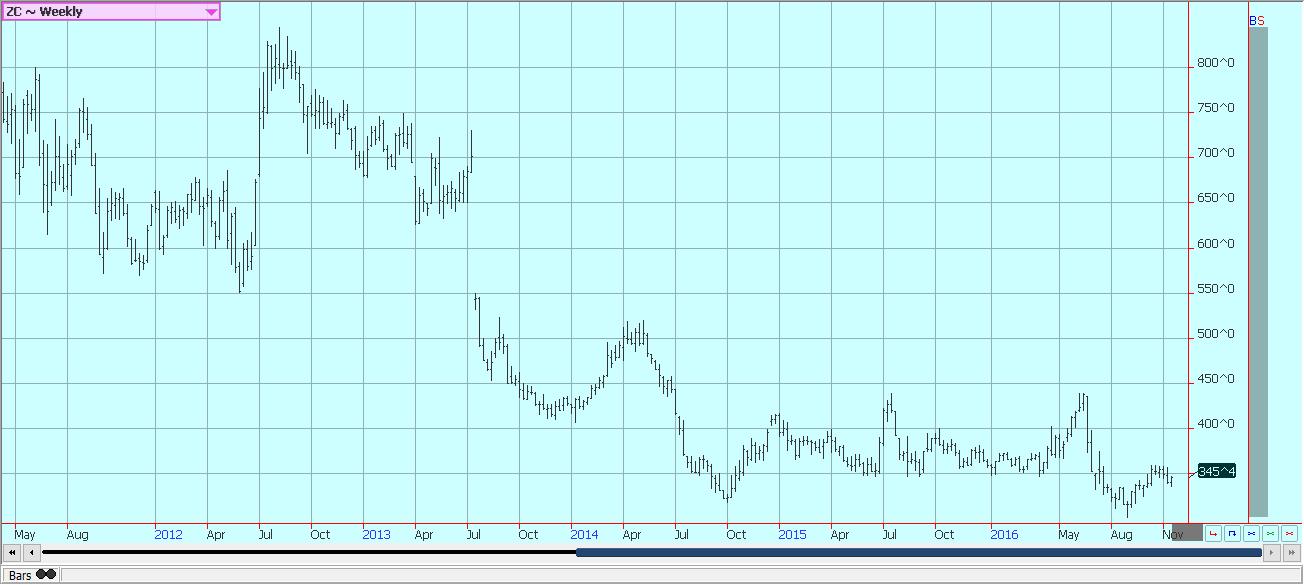

Corn closed higher for the week on what appeared to be improved demand in the domestic and world market and on speculative short covering. The US harvest is just about over and the producer has sold about all he wants to sell at this point. Domestic prices in the country are below the cost of production for many, so almost all producers are indicating they will hold Corn and hope for some price improvement in the coming weeks and months. Supplies are big, so price improvement will likely be relatively minor unless some supply problems in other countries appear. The US export sales report last week was strong and helped support prices. However, many are expecting export sales to crop off as the US Dollar has surged higher and is now at 13-year highs against the basket of currencies. Futures market speculators hold short positions and are leaving at least part of these positions and are providing some buying support in futures. Everything indicates that futures prices should probably hold to a trading range for now. Thanksgiving Day in the US is on Thursday, and volumes are expected to tail off as the week progresses. CBOT will open on Friday for the US day session only.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

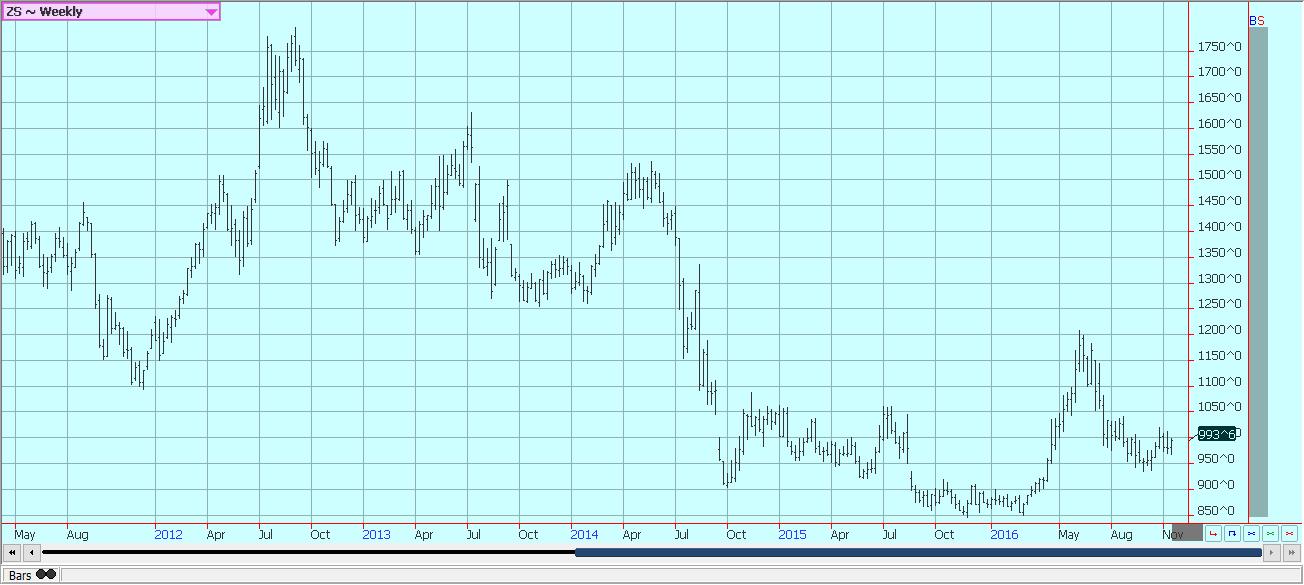

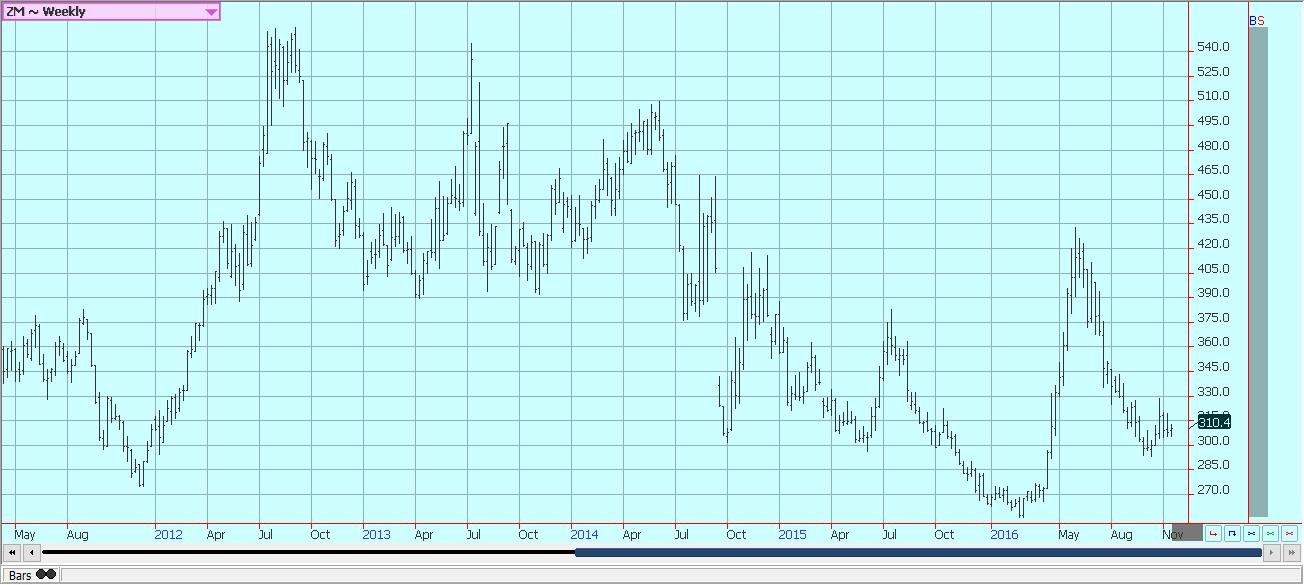

Soybeans and Soybean Meal

Soybeans and Soybean Meal were higher last week. Speculators and commercial interests were the best buyers amid strong demand reports. In particular, China continues to be a strong buyer of US Soybeans. There is some talk that these sales could start to decline and that some of the previous sales could be cancelled. The US Dollar is at 13-year highs on the index, and prices from Brazil and Argentina are now reported to be competitive in the world market. The US harvest is mostly over now and yield reports from many producers have been outstanding. US producers have been selling Soybeans this year as current prices are returning better than profits Corn. However, sales should tail off once the harvest finishes up and a post-harvest rally becomes possible due to the great demand. Planting is finishing up now in the northern half of Brazil. Planting got off to a slow start, but has been rapid lately and overall progress is now ahead of normal. Strong planting progress is reported in southern Brazil and northern Argentina under drier conditions. The US Thanksgiving Day holiday is Thursday and the markets will only open for the US day session on Friday. Volumes traded will be less as the week progresses.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

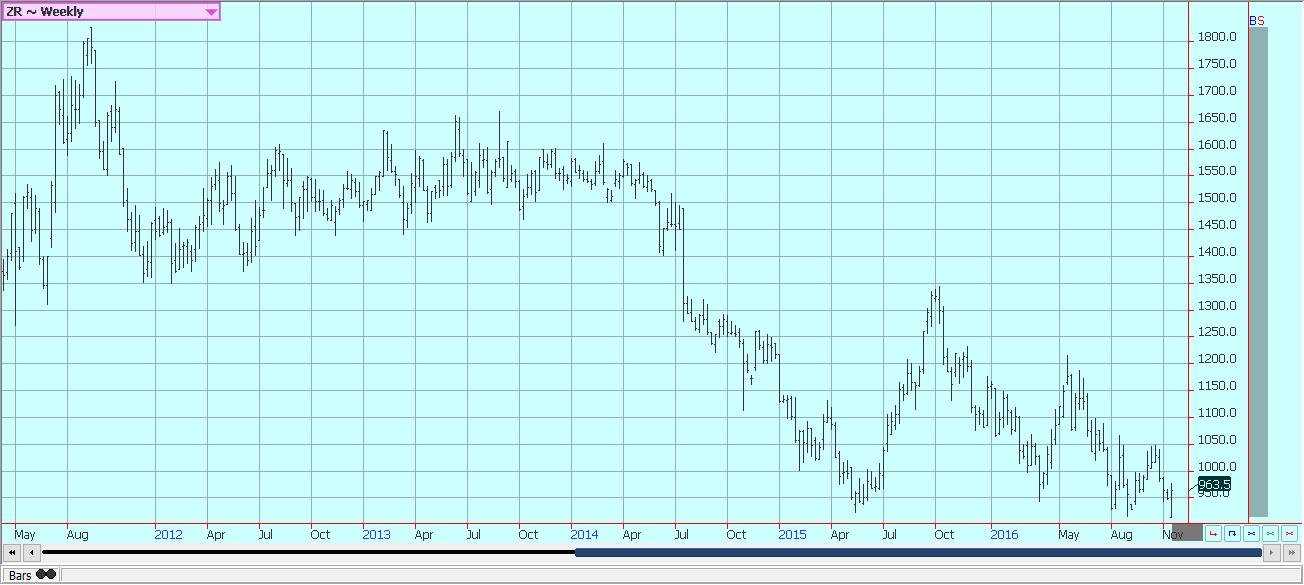

Rice

World markets were mostly soft last week. Southeast Asian prices were sideways to weaker, and southern Asian markets were also unchanged to lower. The Philippines said that production for the current harvest might be just 17.91 million tons, down 1.3% from 2015, due to reduced planted area. The country expects an uptick in yields and expects higher planted area and yields in 2017. The country has been quiet in the world market after being a big buyer earlier in the year. US markets were higher as prices fell early in the week, then recovered all of the losses and more. The US cash market remains soft as demand from the mills has been steady at low levels. The mills have not been able to find any big export business and report that domestic demand is steady. The mills hope for export business from the Middle East, especially Iraq and Iran, but there has been no demonstrated interest in buying from either destination. Export demand overall has been good from Latin America, but they buy Rough Rice and mill it at home. The price action and the volumes traded have not been real strong in the futures market. US producers are not really selling as the harvest is about over and prices are well below the cost of production for many.

Weekly Chicago Rice Futures © Jack Scoville

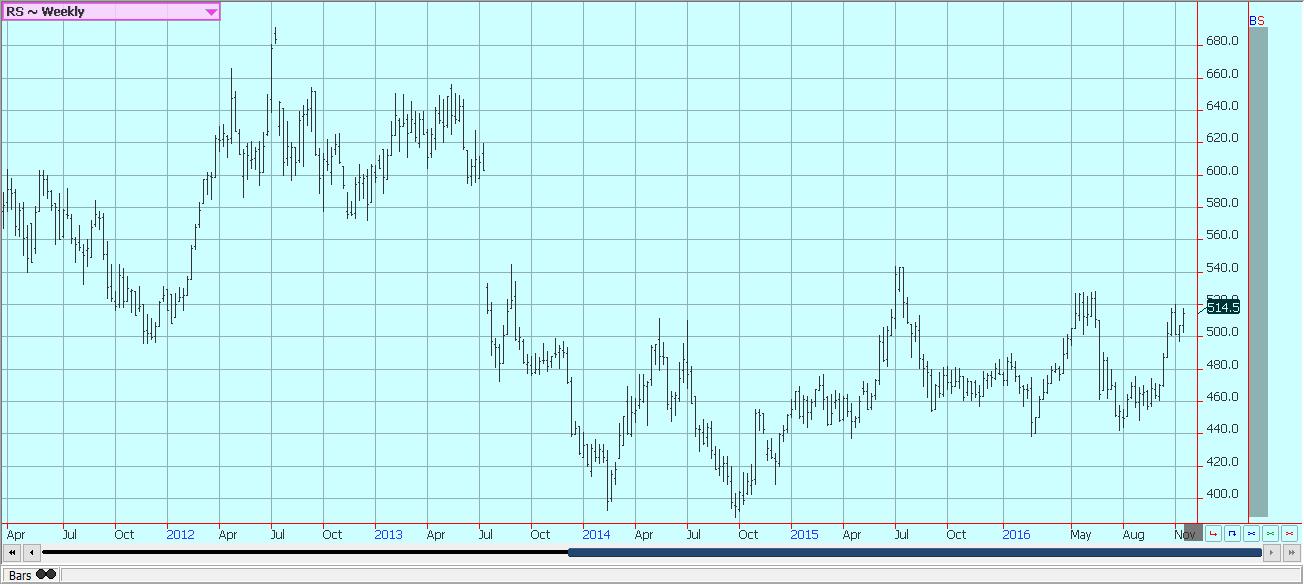

Palm Oil and Vegetable Oils

Palm Oil gave back a large part of the gains seen the previous week, but held the short term up trend. The battle between the supply side bulls and the demand side bears continues. The supply side issues have been real. Production in Malaysia especially has been less as the trees have been slow to recover from the drought effects from El Nino. The monthly production data from MPOB has been consistently below trade expectations and in turn has supported futures values. The rains have been a lot better over the last couple of months, and ideas are that production will eventually get better. However, the ideas of when the production can improve have been pushed back until next Spring at the earliest. On the other hand, demand has been dropping the last few months. The data from the private surveyors has shown consistently less export demand for each month as Palm Oil prices are very high in the world market. World buyers generally see better value in competing vegetable oils, especially Soybean Oil. The lost demand has helped maintain monthly ending stocks levels at comfortable levels. The chart trends are still up for Palm Oil, but are weaker for Soybean Oil, so the battle looks likely to continue this week.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

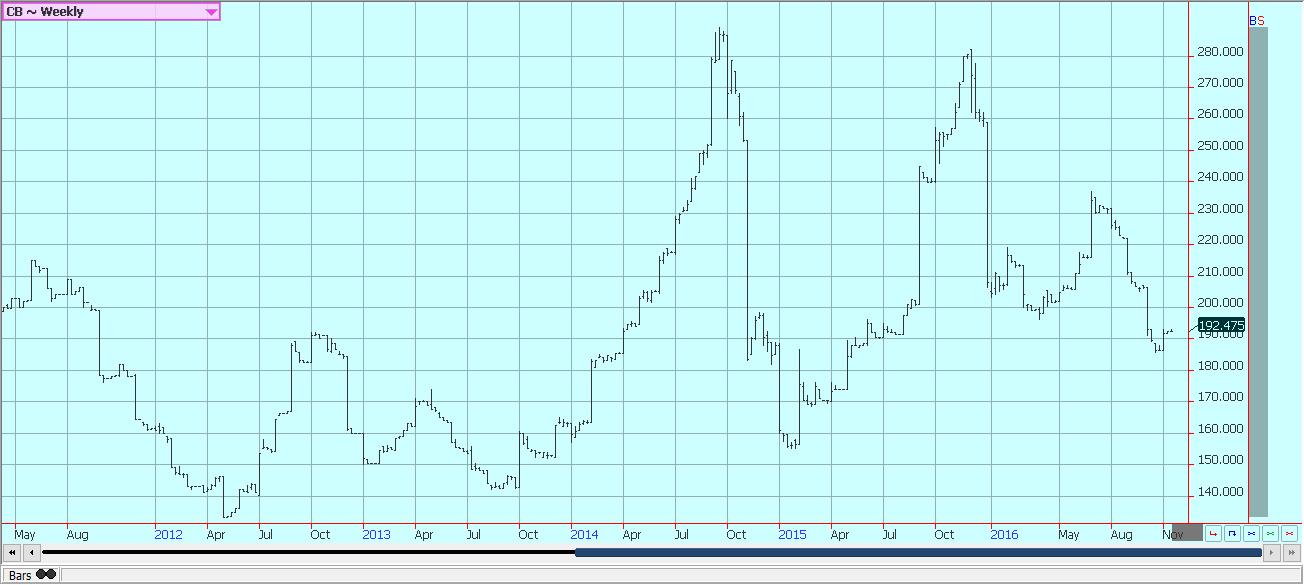

Cotton

Futures in the US were higher last week and trends turned up on the weekly charts. The price strength was based primarily on world market conditions. China has seen excessive rains in Cotton areas and the harvest has been delayed. There are questions now on the quality of the remaining harvest and some expectations that yields will be reduced. Ideas are that the country might have to import more than had been anticipated. India has made some currency changes as it has outlawed large bills and the market has become frozen. Everyone is waiting to see how the economy handles the changes. In the meantime, producers have partially withdrawn from the market and prices have held strong. It could take another month for the market to start to relax and for supplies to move in a big way. The US harvest is continuing throughout the southern parts of the US, and reports have been good. Current weather forecasts call for warm and dry conditions in production areas that should be good for crop maturation and harvest activities. The classing data provided by USDA shows that the quality of the crop harvested so far is mostly good. The quality should continue to improve as the harvest expands as conditions in most areas have been very good. Demand for US Cotton should remain relatively strong as the US has Cotton available.

Weekly US Cotton Futures © Jack Scoville

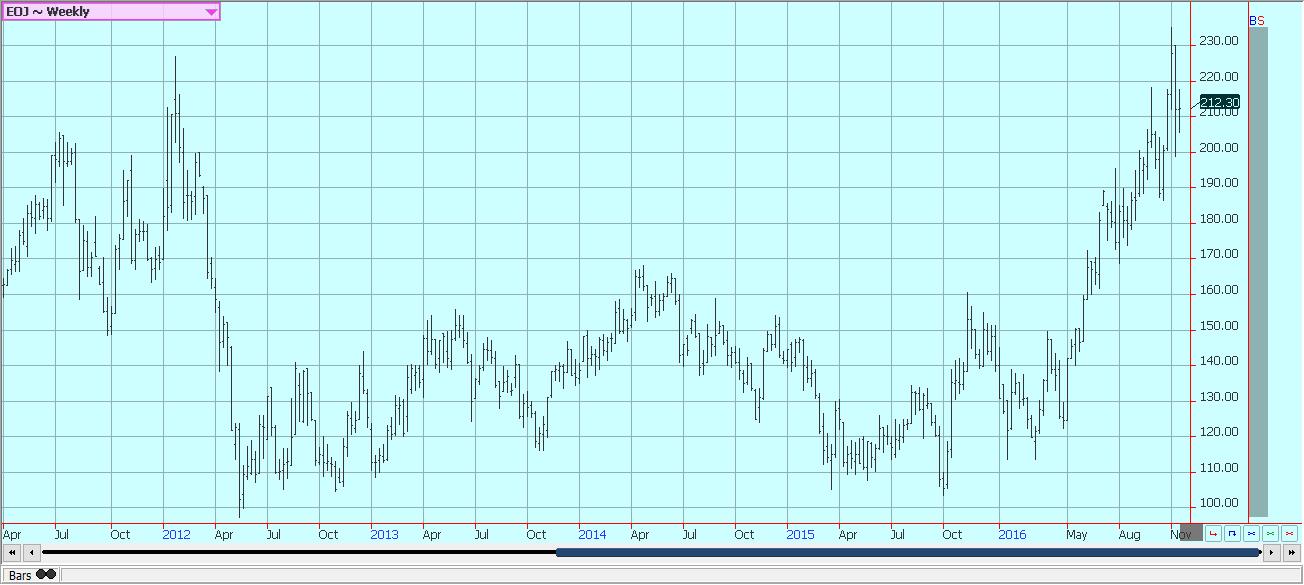

Frozen Concentrated Orange Juice and Citrus

Futures were mixed. The weather in Florida looks calm and mostly dry, which will be good for crop maturation and initial harvesting. The harvest continues for the fresh market with the holidays not all that far away. Fruit is turning color in some groves, so the fruit is getting mature. Fruit size is reported to be uneven from multiple flowerings this year. Acid content is expected to be strong as the dry weather should keep water in the fruit to a minimum. The harvest progress is said to be behind normal for the date. Brazil saw drier weather in Sao Paulo last week, and flowering and fruit development should be continuing under good conditions. The overall tone of the market remains very strong as the theme of reduced production and supplies due to crop losses caused by the greening disease continues to be the overriding factor in the market.

Weekly FCOJ Futures © Jack Scoville

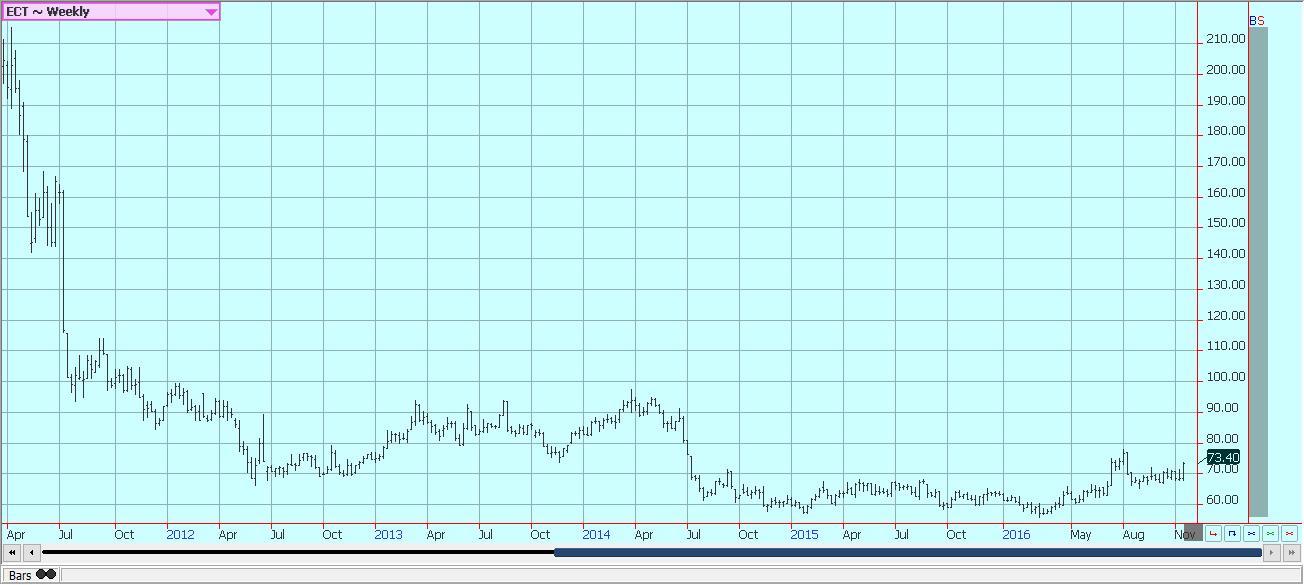

Coffee

Prices were slightly lower in New York, but stronger again in London. New York saw some selling pressure develop as December futures go into delivery on Monday. Producers were fixing contracts in the cash market and were selling futures. The stronger US Dollar worked against all commodities, including Coffee last week. The US Dollar is now at 13-year highs against the basket of currencies, and demand could be curtailed. Differentials paid in Central America have weakened over the last few weeks with the harvest. But now appear stable. Differentials are also stable in Colombia. Brazilian producers are said to be more active sellers as the Real has weakened significantly against the US Dollar. However, this selling is not really being felt in the international market in a big way. The market remains strong, but prices have hit some targets to the upside in the last couple of weeks nad have since been in a consolidation mode. The holidays are coming and that could mean that the market remains a quiet and sideways trading affair. New York is close to important support areas on the weekly charts.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

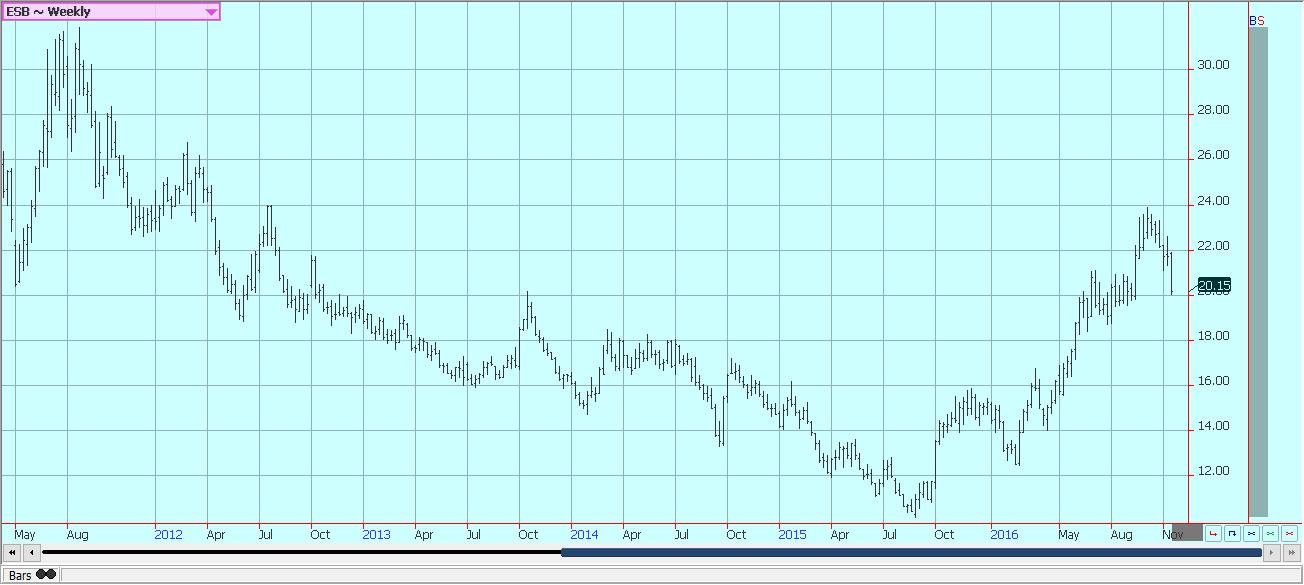

Sugar

Futures closed lower again last week on questions about demand and on strength in the US Dollar. The Dollar moved to 13-year highs and hurt the prices in all commodities markets. Funds and other speculators were the best sellers as the down trend continues. The speculative side of the market still holds significant long positions and should be consistent sellers for the near term as they work to reduce market exposure. Demand news over the last few weeks has been bearish for futures prices. China is the world’s largest importer of Sugar, but could import significantly less for the future as it starts to liquidate massive supplies in government storage by selling them into the local cash market. A smaller crop than expected for Brazil is possible as rains in the center-south region have been uneven so far this year. Current rainfall amounts have been high in many areas recently. However, the Brazilian Real has moved sharply lower in the past few sessions and kept mills in a selling mode. There could be smaller crops coming from India and Thailand due to uneven monsoon rainfall in Sugar areas in both countries. The monsoon has now withdrawn and dry conditions will help crop maturity and harvesting. The weather in other Latin American countries appears to be mostly good as rains remain sufficient.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were lower and made new lows for the move. Trends are down in both New York and London. Overall price action remains weak and it is possible that prices will fall more in the next couple of months. However, some buying did appear last week as prices have moved to levels not seen in a long time. Speculators are mostly done liquidating and some commercial buying has been noted. The next production cycle still appears to be bigger as the growing conditions around the world are generally improved. West Africa has seen much better rains this year and alternating warm and dry weather with the rains. There have been some reports of disease to crops in the wetter areas, but so far there is not a lot of market concern. Bigger production is expected this year in all countries. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

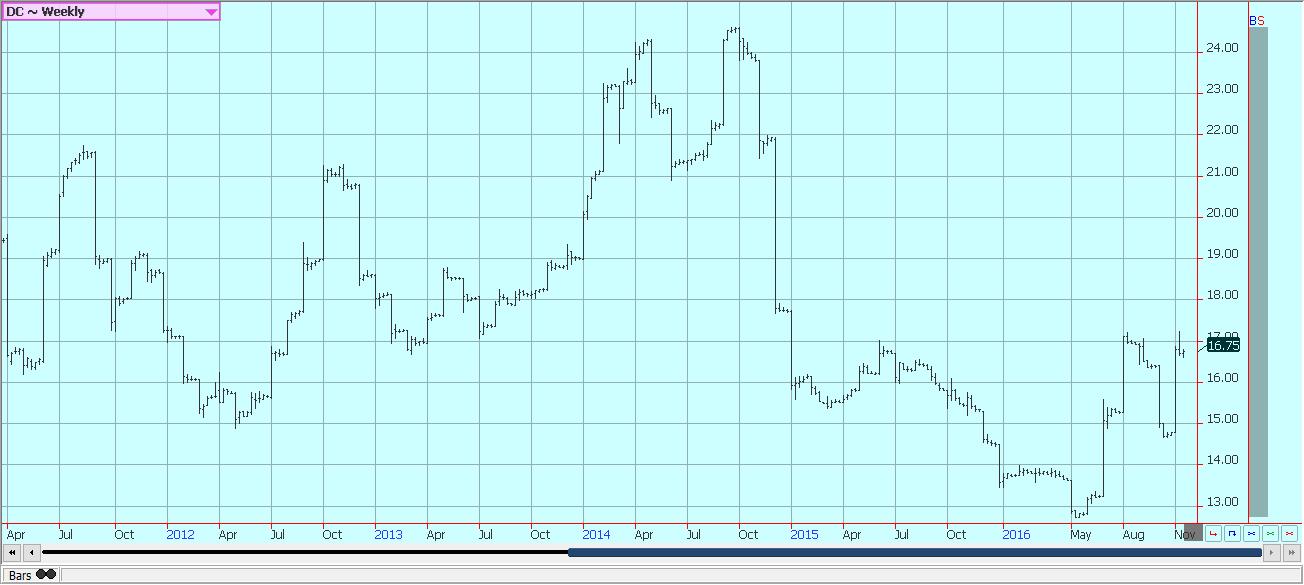

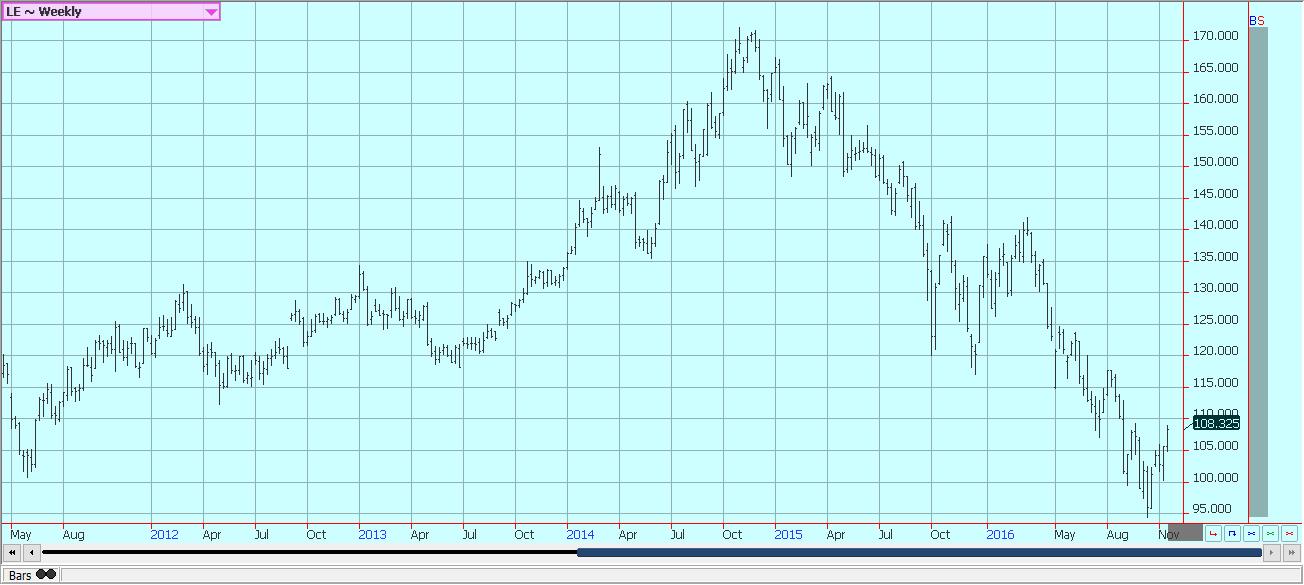

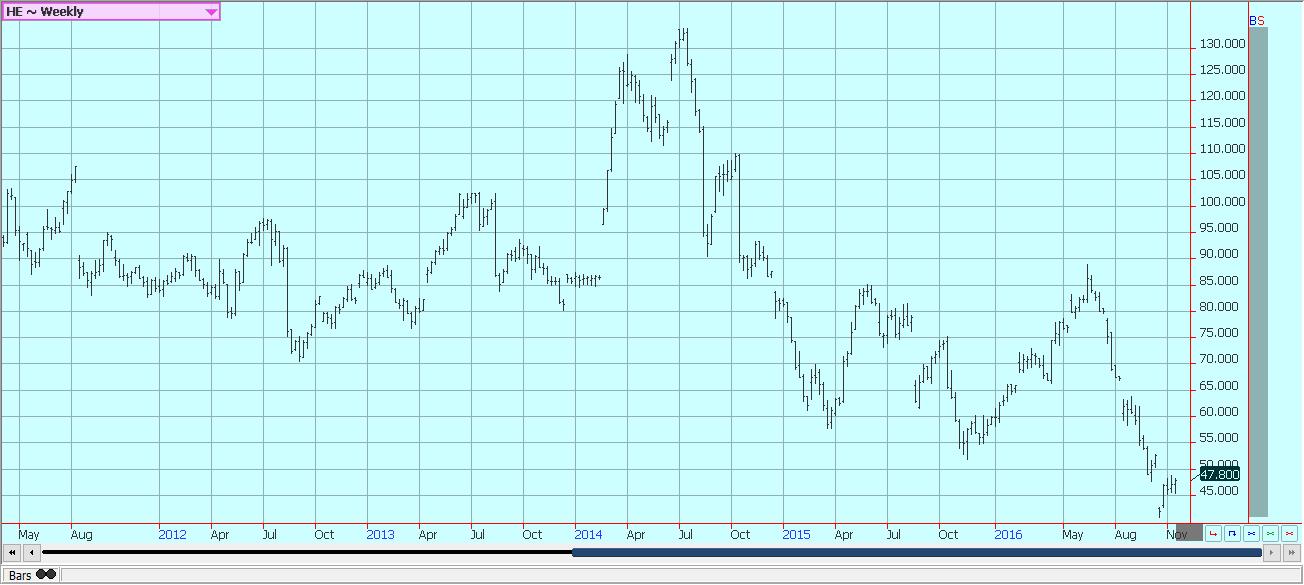

Dairy and Meat

Dairy markets were higher last week. The Global Dairy Auction once again showed that world cash markets have been firming due to reduced production in Oceana and Europe. Production in the US remains strong, but US domestic demand has kept the market strong and exports have been less. US prices are holding higher on the good domestic demand. Butter and cheese demand is strong from wholesalers and retailers as both start to prepare for the holiday season. Raw milk demand has also been stronger. Inventories appear mostly good for butter, but are getting tight for cheese. Some manufacturers are having trouble sourcing milk, but milk production is generally strong due to the mild temperatures seen in much of the US. Dried products prices are mixed. Whey prices are strongest, and whole milk prices are good. NDM prices are weak.

US cattle and beef prices were higher last week in reaction to reports of higher beef prices and in response to higher prices paid in cattle markets the previous week. Cash cattle markets traded at higher prices at the end of last week and in good volumes. The charts show that market could move higher. The Cattle on Feed report released on Friday showed that potential, and also showed that producers are willing to keep cattle on grass due to the weak overall price structure as placements and on feed data were below a year ago. Demand is starting to improve overall as the wholesale market starts to look past Thanksgiving. Australia has less to offer and very high prices. Herd culling has slackened in both Australia and New Zealand. Pasture conditions in both countries are better than a year ago.

Pork markets have been stable to firm. Pork demand has been relatively weak as consumers and ex- porters have looked to buy other meats and have been content to watch pork prices fall. There has been a lot of featuring in supermarkets in the US in an effort to stimulate demand, and it is starting to work as the pork cash market has improved in volume and somewhat in price. Pork demand should increase in the next couple of weeks as hams and other cuts will be featured for holiday buying. US export demand should start to improve on the lower prices. The charts show that the market could develop a sideways trend for the short term or turn higher.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech4 days ago

Biotech4 days agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Impact Investing1 day ago

Impact Investing1 day agoEU Industrial Accelerator Act: Boosting Clean Industry and Resilient Supply Chains

-

Cannabis1 week ago

Cannabis1 week agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

You must be logged in to post a comment Login