Business

Agriculture weekly: Coffee demand growing

There are ideas of less production in Brazil this year, in part because it is the second year of the biennial cycle and in part due to the drought in northeast Brazil.

What changed in the agriculture market in the previous week? Here is the report that shows how coffee futures moved higher since it was noticed a better demand for Arabica coffee.

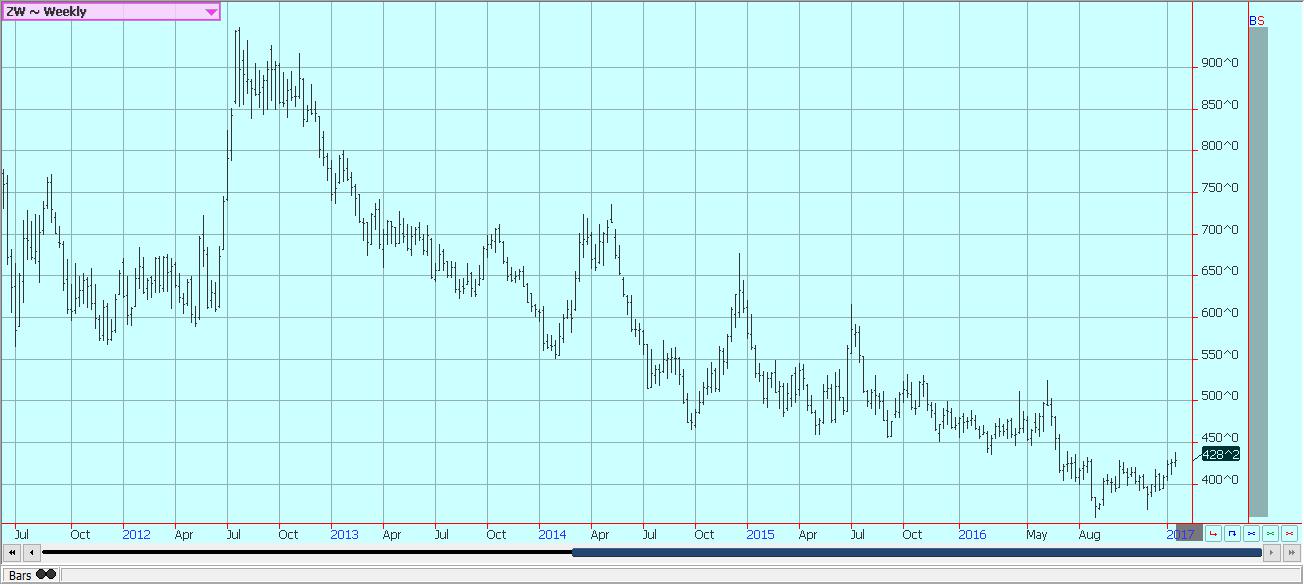

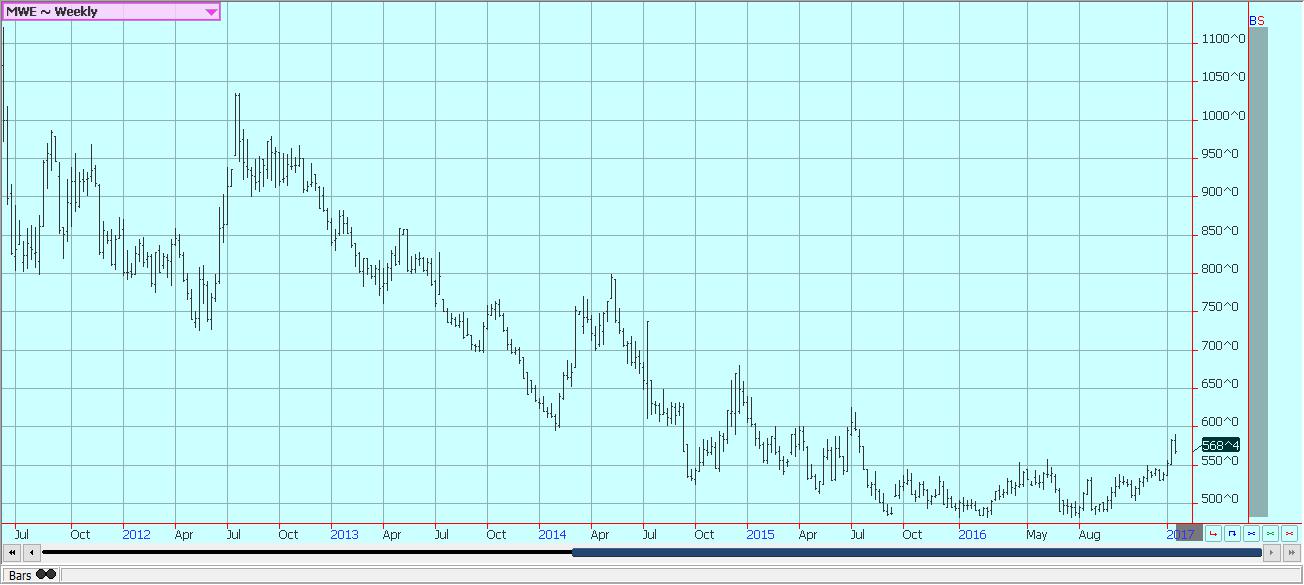

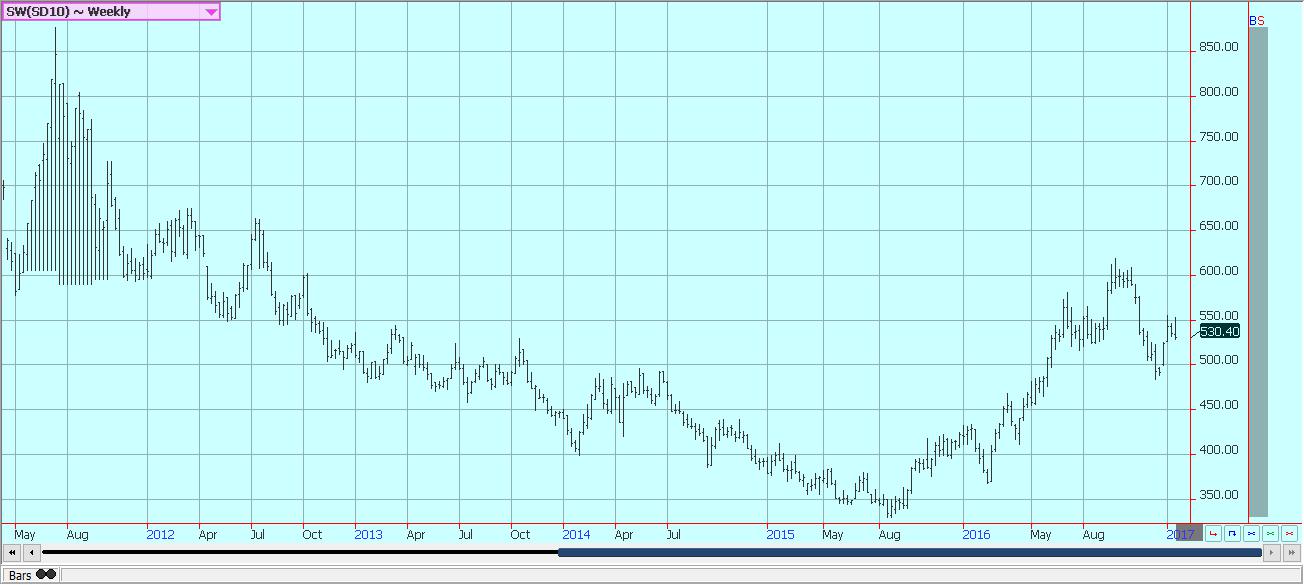

Wheat

US markets were a mixed for the week. Chicago SRW closed slightly higher, but HRW and Minneapolis closed lower. Prices trade both sides of unchanged and overall volumes were on the quiet side. The weekly export sales report released on Friday morning showed lower than expected demand at just over 242,000 tons. Egypt bought one cargo from Ukraine on Friday. World Wheat markets remain in control of the buyers as there is still plenty of Wheat available in export markets all over the world. The market is still feeling a little support from the low planted area report from USDA just over a week ago. The report showed the lowest Winter Wheat planted area in 107 years and created ideas that the long slide in prices might be coming to an end. Minneapolis futures had a very choppy week last week and finished the week on a bad note. The market acts as if a top is at hand for now after rallying on solid demand news and in response to ideas that more Spring Wheat needs to be planted this year. It has been far and away the strongest market for weeks, but the rally might be running out of steam. The Chicago markets at least seem to have bottomed now but have had problems sustaining much of a rally. However, both markets appear ready to work higher over time. Wheat needs a story to move sharply higher, but there is no real story for the market right now.

Weekly Chicago Wheat Futures © Jack Scoville

Weekly Kansas City Wheat Futures © Jack Scoville

Weekly Minneapolis Wheat Futures © Jack Scoville

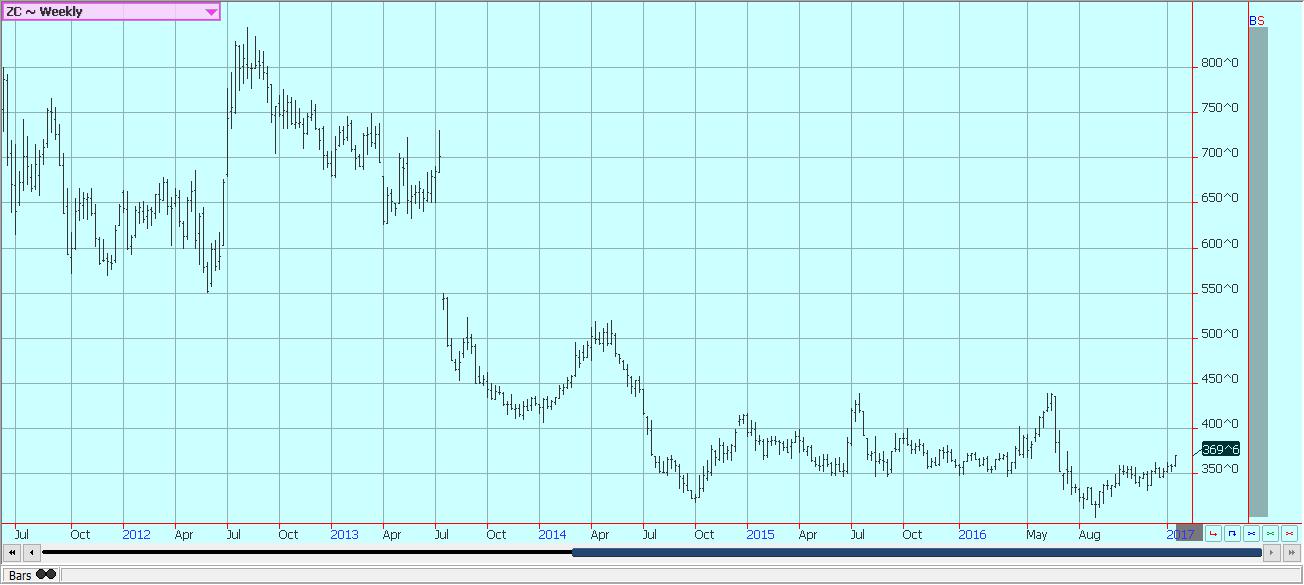

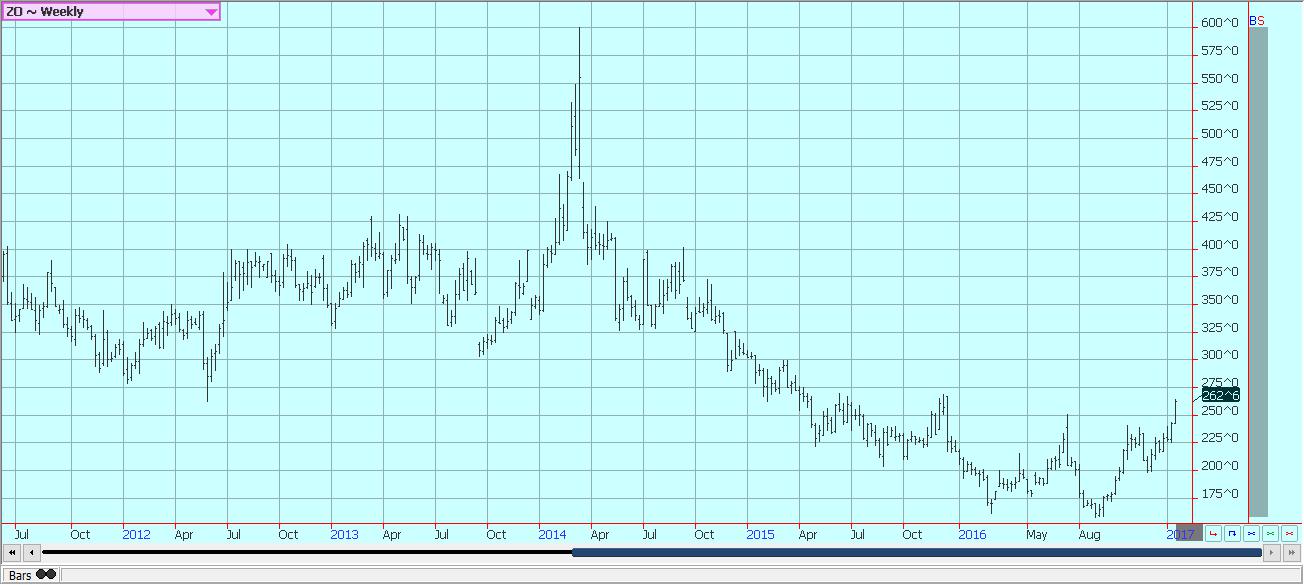

Corn

Corn closed higher last week and had its strongest week of trading in a long time. The March contract traded to $3.70 per bushel, the first time this had happened since last July. The weekly close was the highest on the weekly continuation charts since late last June. Indications of strong demand fed the buying interest last week. The government ethanol data for the week indicated that ethanol production remained at record high levels and implied that strong corn demand from this sector should continue. The weekly export sales report showed the strongest demand since before Christmas and was above trade expectations. The focus is also on the weather in South America, and principally in Argentina. The rains in northern Argentina have given way to hotter and drier weather for the whole country. Southern areas had been experiencing a hot and dry Summer, anyway, and were seeing some crop stress. The hot and dry conditions should stick around for at least the next week and could cause additional stress on crops. Damage and loss estimates from the rains are starting to arrive, and it appears that at least half a million tons have been lost. The weekly charts suggest that a push to just below $4.00 per bushel is possible in the medium term.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

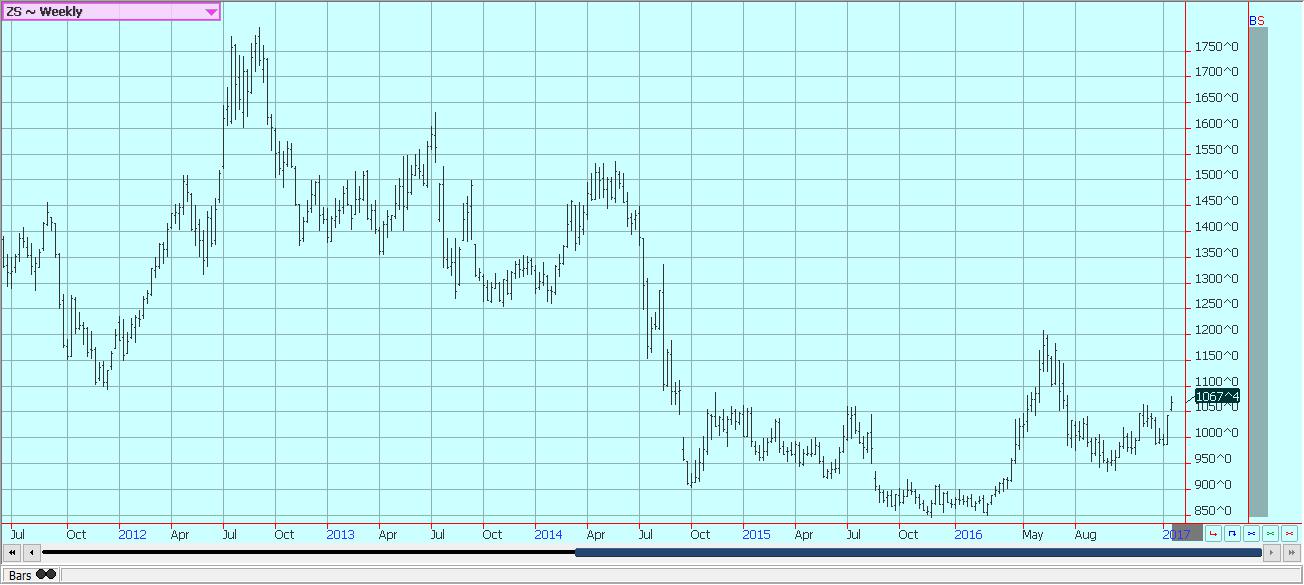

Soybeans and soybean meal

Soybeans and soybean meal were higher for the week but began to lose the buying interest near the end of the week. The South American weather became even more important to the trade. Rains have stopped in northern Argentina and the region has turned hot and dry. Some of the rains have been heavy and some flooding has been reported in central Argentina. The crops in Argentina are also facing stress from drier and hotter than normal conditions to the south. Press reports from Argentina suggest that at losses in the region could be important and that total; production now might not be much more than 50 million tons. The trade had expected the country to produce up to 55 million tons this year. The area to watch will be northern Brazil as northeast areas especially turn hot and dry. Sources in the region tell us that Soybeans look very good right now despite the weather. The market is also hearing about some initial harvest activity in the far north of Mato Grosso. This is a very early start to the harvest and the total harvest to date is not over 5% complete. Most northern Mato Grosso areas will start late this month and Soybeans could be available for export by late February or early March. The trade fears lost business for the US once Brazil starts selling.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

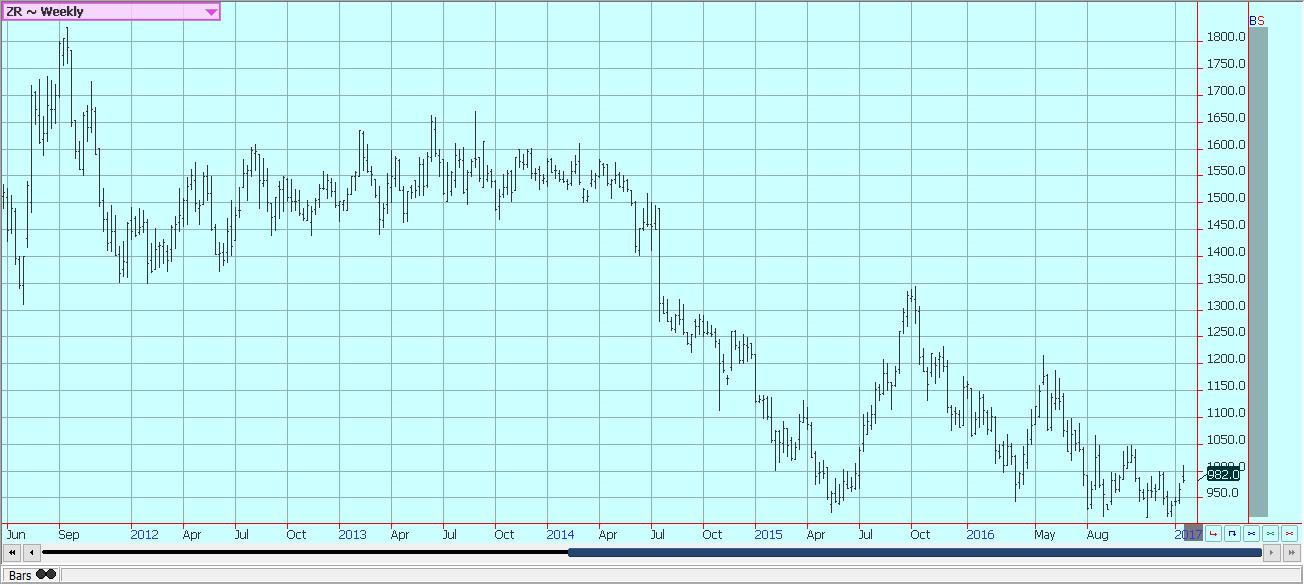

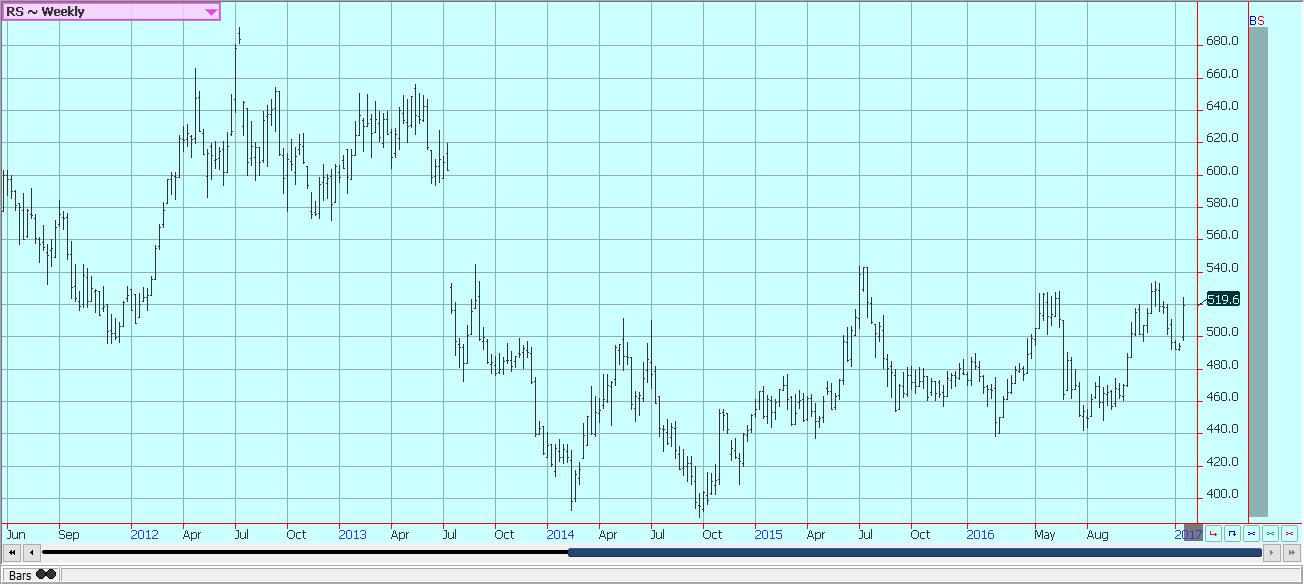

Rice

World markets were firm last week and US futures moved higher. It was a very slow week for Rice futures trading in Chicago last week. The export sales report was very strong and featured sales to unknown destinations and Japan. The price action was not that strong as futures could not hold above #10.00 per hundredweight in the middle of the week, then closed in the lower end of the range. More slow trading is likely until the US cash market starts to get more active. The market has been slow to come out of the holiday mode, but might now that January is well into its second half. Planting decisions are being made right now and right now the talk in the South is that more Soybeans and less Rice will be planted. Less Rice is possible in parts of Texas as well, but those producers will most likely plant Sorghum. Ideas are that 15% or more of the area planted to Rice in 2016 could be planted to something else in 2017. The market is in a wait and see on that matter and just about everything else at the moment and is looking for a reason to move much higher or much lower right now.

Weekly Chicago Rice Futures © Jack Scoville

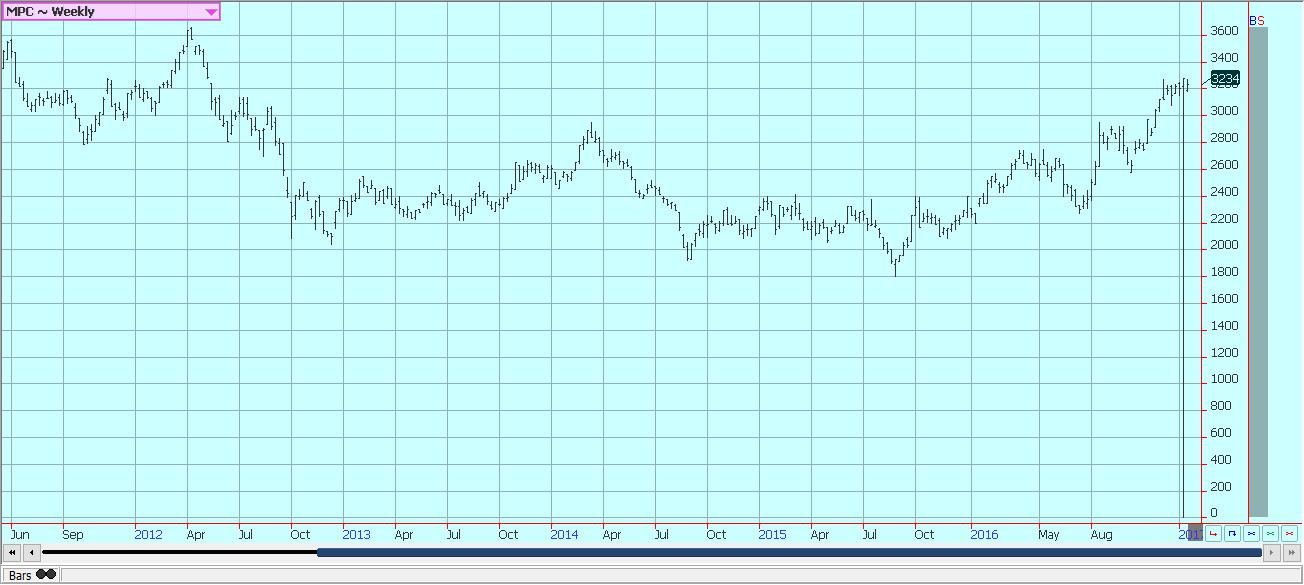

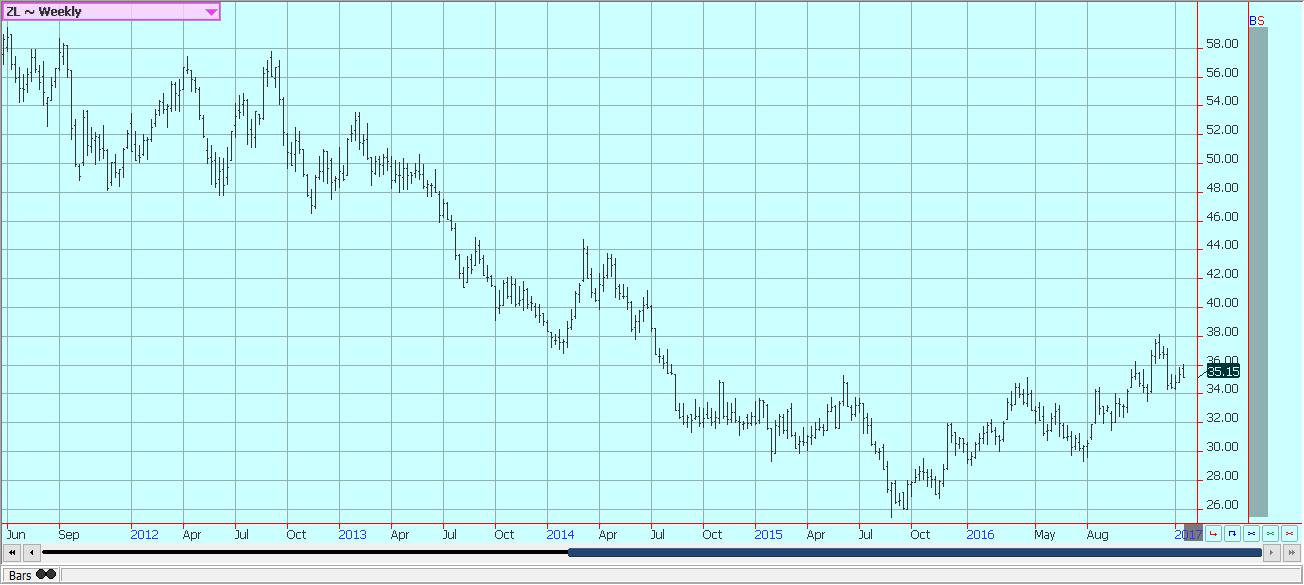

Palm oil and vegetable oils

World vegetable oils markets were mixed last week. Soybean Oil turned weaker, but Canola was able to rally on strong demand and positive domestic crush margins. Palm Oil was mixed and caught between competing fundamentals. Ideas are that production will start to increase in the next few months for seasonal reasons. The rains have greatly improved this year after the El Nino-induced droughts of last year and these better rains are expected to result in improved production. Production normally starts to increase in the Spring due to the effects of the rainy season. Just about all major analysts are calling for significantly increased production this year, with many looking for at least a 10% jump in production. Demand has also improved as export volumes are 20% above last month at this time. So, the increased production will be welcomed for now. Palm Oil markets have run a long way since the middle of 2015 when prices were as low as 1800 Ringgit per ton. The weekly charts still show up trends but futures made initial swing objectives for the entire move and then some. Final targets for the move are at about 3500 Ringgit per ton.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures were higher and held the nearest support at 7200 March. The weekly charts show that the longer-term uptrend remains intact. The market found buying interest as export demand remained very strong at over 300,000 bales. The sales pace remains strong despite the strong US Dollar as Asian countries from Turkey to China and Southeast Asia continue to buy. The market will now be actively interested in the policies of the new president and how those policies will affect demand potential. The conflicting ideas could put some demand at risk down the road. The weekly USDA classings report suggests that the harvest is about over now as classings are getting closer to USDA production expectations. The reports have shown that about 71% of the Cotton has been tenderable this year. Speculators are the major longs, but appear justified as demand remains strong. The charts suggest further rallies are coming. However, the market has already been in an extended uptrend that could run out of gas at any time.

Weekly US Cotton Futures © Jack Scoville

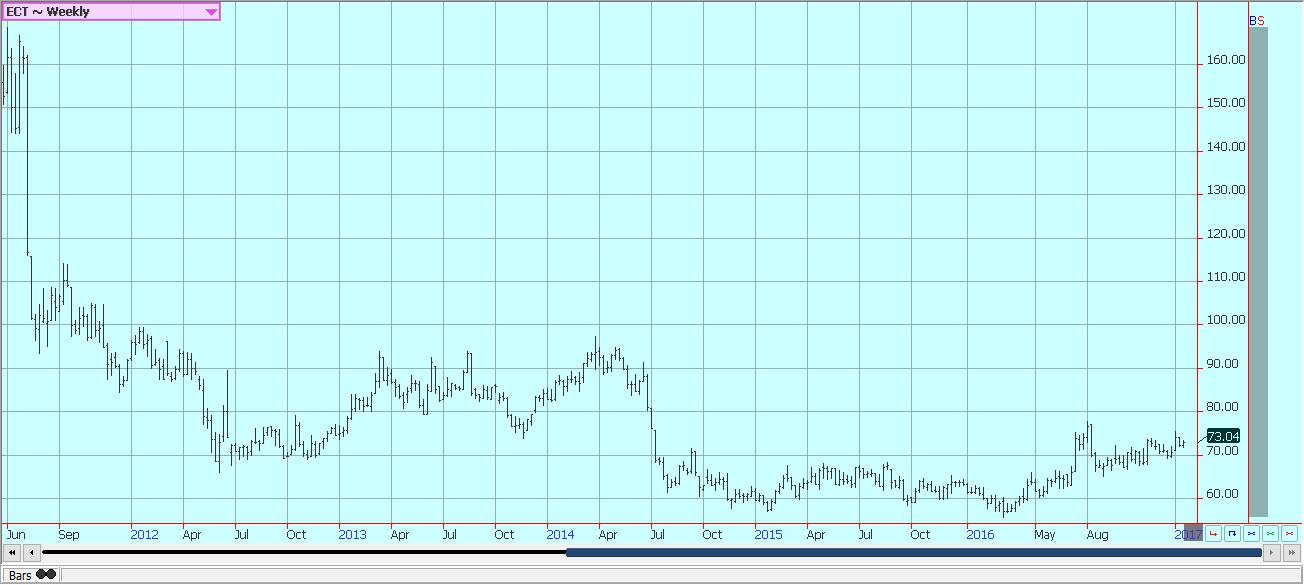

Frozen concentrated orange juice and citrus

FCOJ closed lower again last week as the Florida harvest was active amid good weather conditions. Early and Mid oranges are being harvested for processing. Harvest c conditions are good amid dry and warm weather. However, it is too dry for the trees and irrigation is being used frequently. Demand for Orange Juice inside the US is still a big problem. It is currently at its lowest level since records started being kept in 2002, and there are no real prospects for improvement right now as consumers have plenty of alternatives. Sao Paulo state is getting good weather and crop conditions are called good. It remains too cold in Europe and some damage to citrus trees is expected. A downside might be limited as the market has already fallen a long way. However, there does not seem to be a weather or demand event coming to trigger any kind of a significant rally.

Weekly FCOJ Futures © Jack Scoville

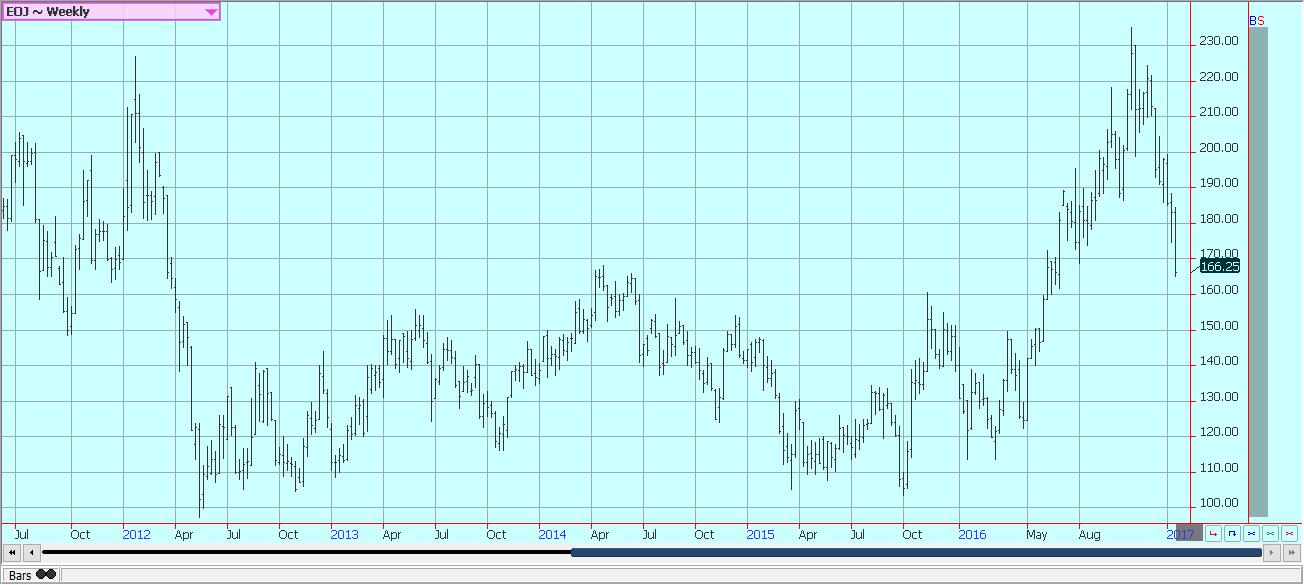

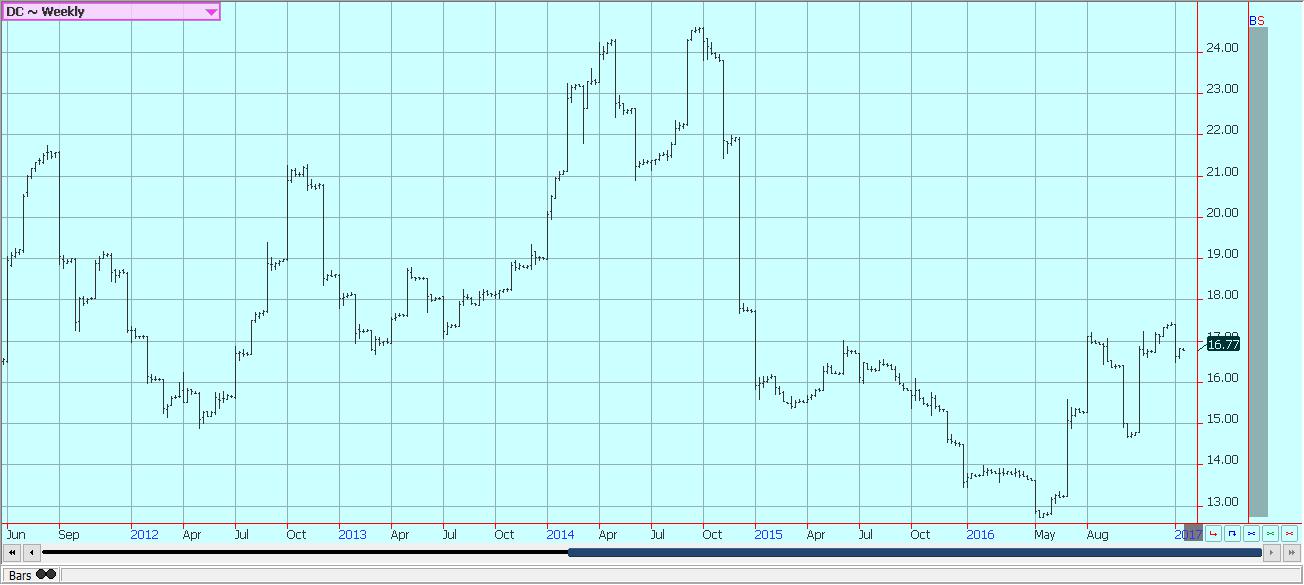

Coffee

Futures moved higher last week as reports of better demand for Arabica coffee were heard. There are ideas of less production in Brazil this year, in part because it is the second year of the biennial cycle and in part due to the drought in northeast Brazil. Offers are less and at high prices from Robusta countries such as Vietnam, and that has been a short crop as well. That has created the best demand in years for inferior qualities of Coffee from the rest of Latin America, and business volumes being traded are starting to increase. Prices paid for these coffees are low but could start to firm in the short term. Differentials for better qualities are stable to the firm. The charts show that both New York and London have been rallying and that these rallies can continue in the short term. The ICO said that stocks levels should be a little lower at the end of the marketing year due to stable world production against increasing demand, and the demand is in the market.

Weekly New York Arabica-Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

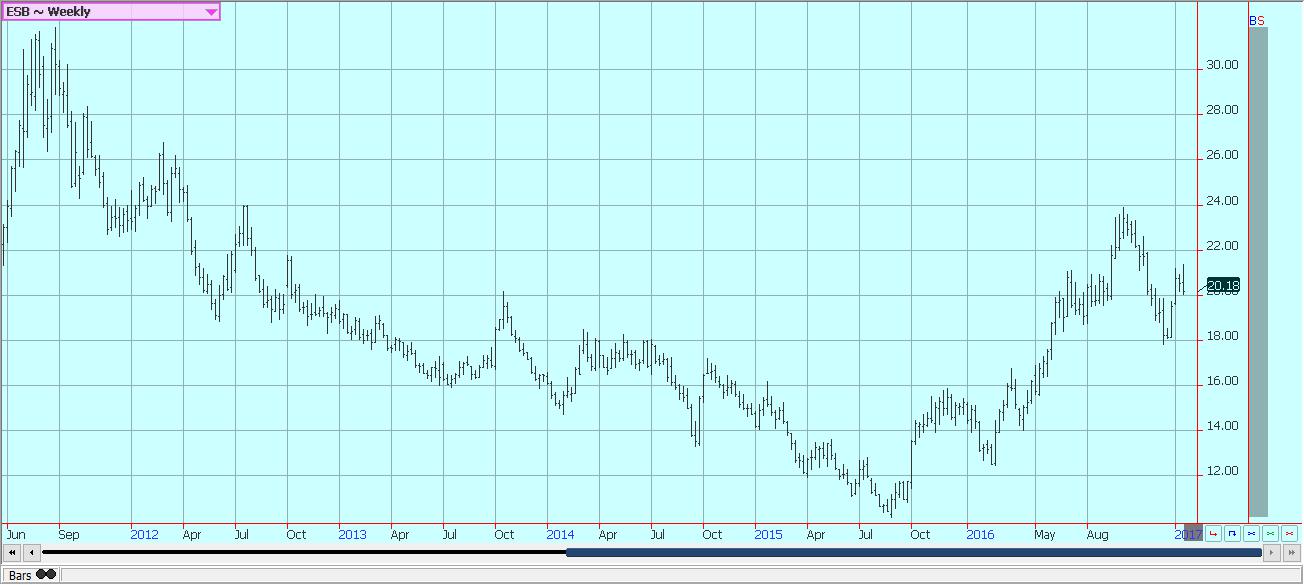

Sugar

Futures closed lower last week in choppy trading. Futures had attempted to rally in the first part of the week, but collapsed on Thursday and could only hold the lower levels on Friday. The price action was bad, but prices could still try to recover early this week. A more significant correction could unfold if prices are unable to hold the lows from last week. It seems like a lot of the supply side news is in the market. News of less than expected production in Brazil combined with less on offer from India and Thailand provide the best reasons for higher prices. Demand news remains bearish for futures prices. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. India has said that its production and amounts in storage are sufficient and that there is no need for imports that had been expected earlier. Demand from North Africa and the Middle East is consistent but normal. The weather in other Latin American countries appears to be mostly good, although parts of Brazil remain too dry. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

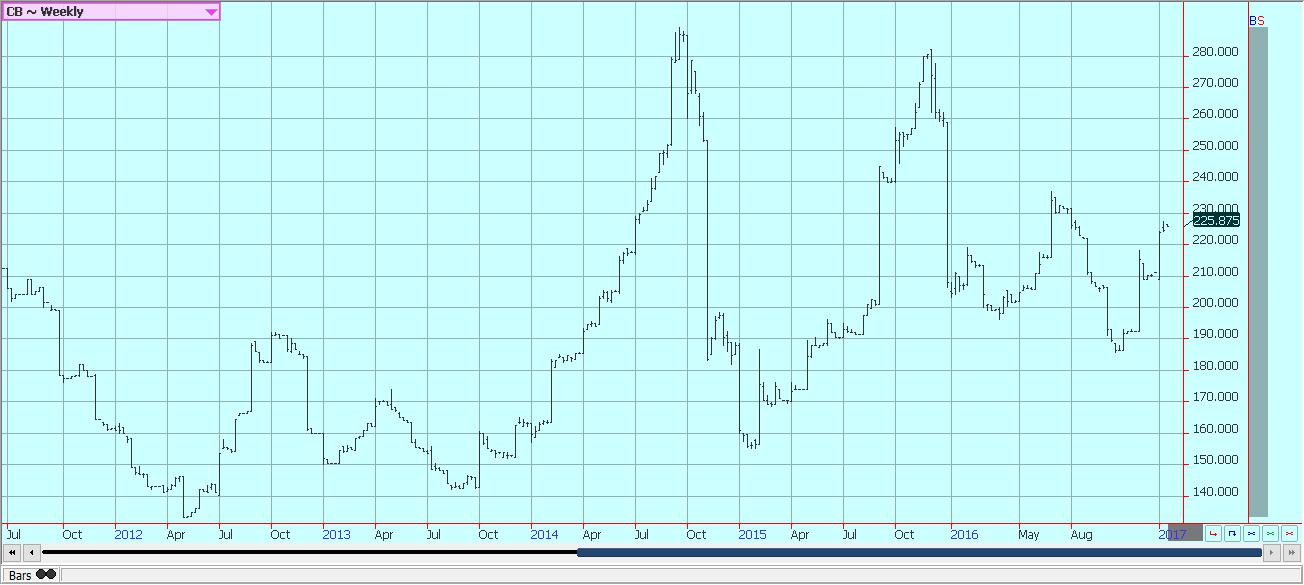

Cocoa

Futures markets were lower but held to a trading range on the weekly charts. It is possible that both markets are making some intermediate lows. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. Reports exporters have bought a lot and have plenty of product to sell. Many can no longer buy as storage in West Africa has been filling up and as demand in consuming countries has not been all that strong. The demand from Europe is reported improved, but still weak overall. The Asian Cocoa grind data for the quarter was strong and stronger than expected, but the North American data was weaker than expected and overrode the positive news from Asia. The next production cycle still appears to be bigger as the growing conditions around the world are generally improved. West Africa has seen much better rains this year and alternating warm and dry weather with the rains. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

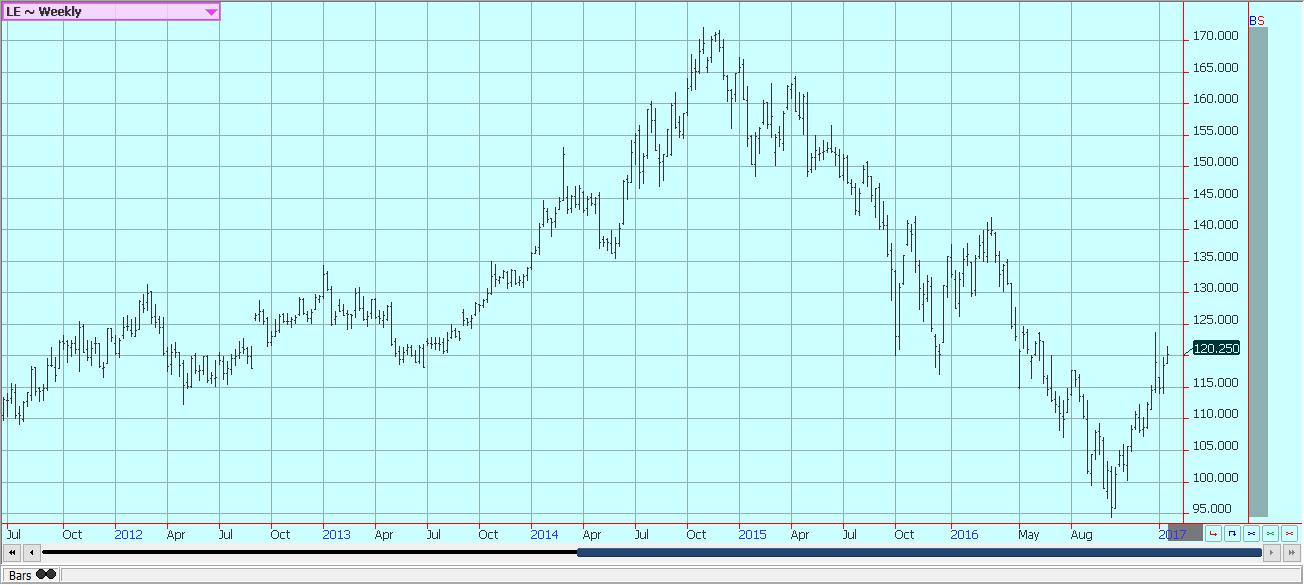

Dairy and meat

Dairy markets were mixed and mostly stable last week. Milk prices were little changed as demand is good enough to meet current production. Production has been seasonally strong. Butter and cheese manufacturers report strong demand, but inventories are starting to increase as there is a lot of milk available. This is especially true for Butter, where bulk supplies are going to storage. Demand has been at least as good as expected for butter and especially cheese as many retailers buy ahead of the Super Bowl. Butter manufacturers are mostly producing bulk butter for inventories, but there is increasing print butter production ahead of the game. Cheese demand is being met with adequate to strong milk supplies and manufacturing is active. This is especially true for Mozzarella before the game. Raw milk production has been stable to higher in all areas. Dried products prices are mixed to firm. Whey prices are mixed to strong, and whole milk prices are stable. NDM prices are stable. International markets are featuring higher prices due to reduced production. Production is less in Europe and Russia. Export demand for New Zealand has increased due to stronger demand from China. Production is in a short-term decline due to poor pasture conditions. On the other hand, hay supplies in Australia are excellent to surplus and milk production is strong. The Global Dairy Auction featured lower prices. South American prices are firm as raw milk production goes into a seasonal decline. Argentina is seeing weaker production due to big storms in central and northern areas that have also affected production in parts of Uruguay.

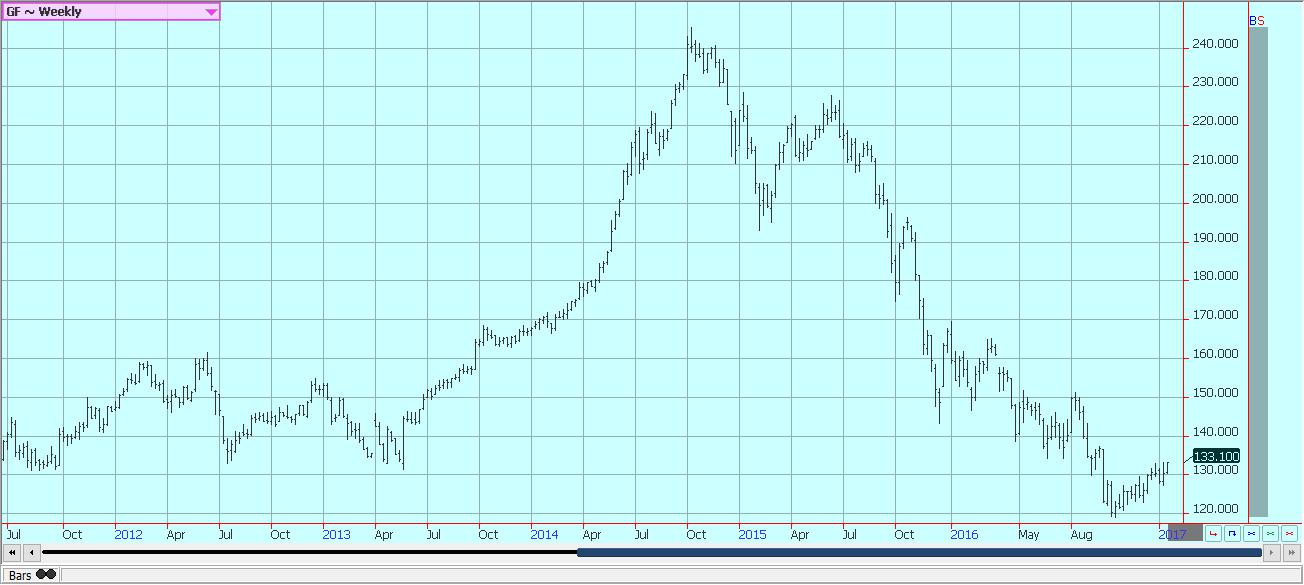

US cattle and beef prices were stable to higher much of last week, then moved lower on Friday. The price action on Friday could represent a short-term top for the market. Auction markets in the Great Plains were higher on Friday and big volumes were traded. The combined price action implies that the market might have blown off and that a period of price weakness is coming. Beef prices were weaker. Demand is expected to become more stable this week and more stable pricing is expected in cash markets. Australia has less to offer and very high prices. Herd culling has slackened in both Australia and New Zealand. Pasture conditions in both countries are better than a year ago in colder and wetter weather seen until now. Conditions in Australia are very good and surplus hay is reported in many areas. New Zealand now needs drier weather to promote growth.

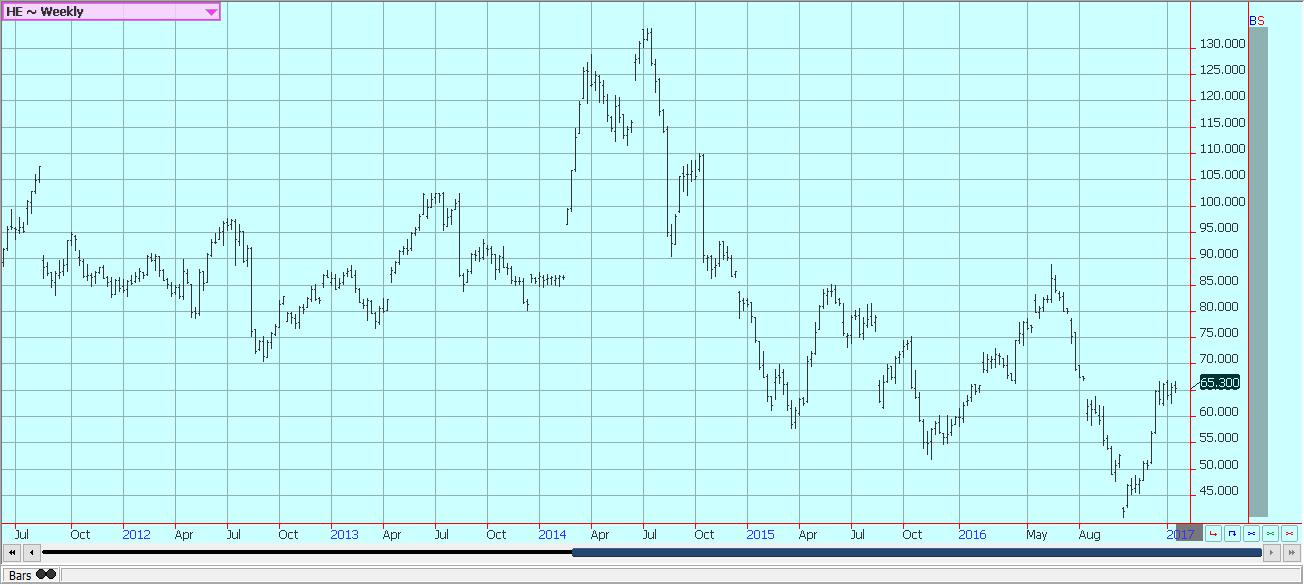

Pork markets have been firm, and live hog futures trends are sideways for the short term, but still higher for the longer term. Pork demand remains stronger than expected and ham prices have been contra-seasonally strong. Pork prices have trended higher in retail and wholesale markets. Packer demand has been stable as many packers expected reduced supplies of Hogs for the next several weeks. This is a seasonal tendency. The charts show that the market could remain higher, but seasonal studies indicate that futures could make an intermediate high soon.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto3 days ago

Crypto3 days agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Markets1 week ago

Markets1 week agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Crypto4 hours ago

Crypto4 hours agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Cannabis1 week ago

Cannabis1 week agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

You must be logged in to post a comment Login