Crowdfunding

Apis Cor Launches Equity Crowdfunding via StartEngine

Apis Cor’s business model is to rent the printers to builders and sell our 3D printing material exclusively as B2B. The targeted monthly rental for the equipment is $9,000, and the material price is $7 per square meter of the wall, which works out to about $8,400 for a 1,200-square-foot single-family home. As of December 2021, the company has received 183 requests to reserve its 3D houses and 3D printers.

Apis Cor, the construction technology company known for its world-record building in Dubai, announces a key milestone in its crowdfunding campaign on StartEngine: more than $200,000 has been raised in less than a week. The round is still open – click here to support the campaign.

With its vision to build homes that are accessible, affordable, and durable, and thanks to the strength of its founding team and technology, Apis Cor is already backed by At One Ventures and has raised over $1.1 million from retail investors under its Reg A+ through September 1, 2022.

Venture capital funding for 3D printing startups aiming to transform industries such as aerospace, healthcare, and housing reached $1.5 billion in the first six months of 2022 alone. However, those benefiting from these early-stage offerings have been limited to accredited investors and institutions.

Read more about Apis Cor and find the most important business headlines with the Born2Invest mobile app.

Recently, however, several 3D-printed homebuilding companies have opened the door to funding from outside sources through crowdfunding platforms such as StartEngine and Republic

Boxabl, while not specifically in the 3D printing space, saw a great response from interested investors, raising over $3.5 million this summer.

Unlike many of its competitors, Apis Cor is already established in the market, with completed projects in Texas and Missouri and preliminary MOU agreements with two companies to develop and 3D print affordable homes in New Orleans, Louisiana and Wilmington, North Carolina.

In addition, Apis Cor has 117 letters of intent from builders across the country to use the Apis Cor robotic system for construction.

Apis Cor is also one of the only construction companies that has developed 3D-printed walls that meet international building codes, and recently became the first state in Montana to receive comprehensive regulatory approval for its method and materials.

Small investors interested in taking advantage of Apis Cor’s investment opportunities should take note:

Extremely high market demand

The construction industry is facing a massive shortage of labor and materials. Apis Cor’s robotic technology solves this problem by reducing the need for human labor and using concrete versus hard-to-find lumber.

The world will need more than two billion new homes in the next 80 years, and at the current rate, this demand will not be met. The primary market addressed by Apis Cor is low-end residential construction, including affordable housing and new single-family homes in both the high-end and mid-range segments, areas where the need is greatest.

The global residential construction market is estimated to reach $6.8 billion by 2022, with a CAGR of 10.3%. 3D printing in construction is expected to reach $40 billion by 2027.

According to Cemex Ventures, investment in the construction technology ecosystem reached a record $4.5 billion in 2021, triple the amount invested in 2020. According to a McKinsey report, 3D printing, modularization and robotics are among the largest application clusters in the construction industry. The same report shows that growth in construction technology venture capital investment far outpaces that of the overall venture capital sector.

Product Market Fit

Apis Cor creates value for an underserved market – developers who need to build high-quality, durable homes at an affordable price in a short amount of time and with readily available materials.

Thanks to the precision of concrete 3D printing technology, builders can build concrete, durable homes in 2 to 3 months, compared to 7 to 12 months currently required for traditional construction.

Apis Cor’s business model is to rent the printers to builders and sell our 3D printing material exclusively as B2B. The targeted monthly rental for the equipment is $9,000, and the material price is $7 per square meter of the wall, which works out to about $8,400 for a 1,200-square-foot single-family home.

A subcontractor using the technology could 3D print the walls of four homes totaling 1,200 square feet each per month, resulting in a profit of about $13,500/month. As of December 2021, the company has received 183 requests to reserve its 3D houses and 3D printers.

Apis Cor’s mission is to give homebuilders the tools and technology to increase productivity to increase inventory in the market to combat the housing crisis.

Competitors’ 3D equipment is large and bulky, which limits the size of 3D-printed buildings they can produce. Apis Cor robots have compact dimensions that we believe are suitable for any size building and are also easy to transport, making deployment costs almost zero.

Long-term prospects for investors

While the company is primarily focused on the low-rise residential market, other market segments are available due to the ability of Apis Cor technology to erect wall structures for buildings with virtually any footprint and up to three stories.

These include commercial and industrial buildings, warehouses, storage facilities, distribution centers and structures, elements, walls, fences, and retaining walls for large industrial infrastructure construction projects.

__

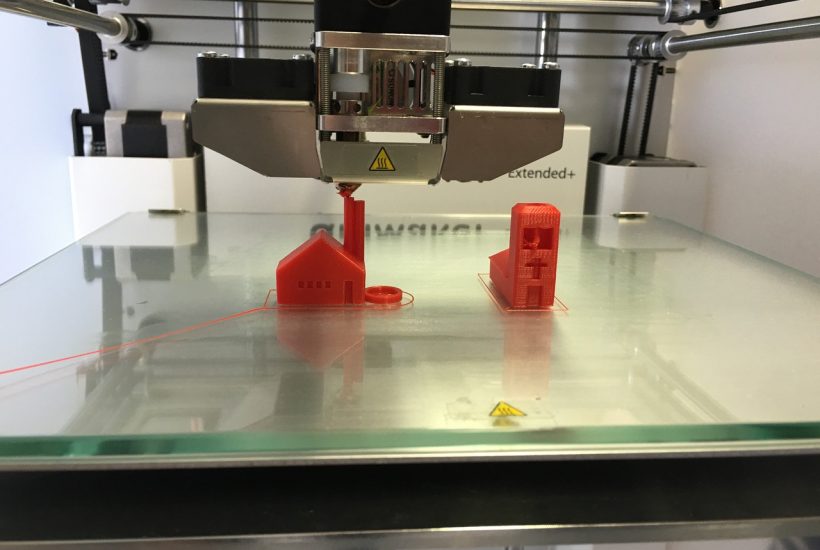

(Featured image by mebner1 via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in 3DRUCK.COM, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crowdfunding1 week ago

Crowdfunding1 week agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter

-

Impact Investing5 days ago

Impact Investing5 days agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoBNP Paribas Delivers Record 2025 Results and Surpasses Sustainable Finance Targets

-

Impact Investing2 days ago

Impact Investing2 days agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development