Featured

Argentina and Russia continues to dominate global wheat markets

The wheat market went down last week in the US, as Australia, Argentina and Russia continued to dominate the world market. On the other hand, the coffee market in New York went down and reports indicate speculative sales linked to forecasts of better rainfall. Finally, cocoa trends are mixed and trading has been as much about currency relationships than about supply and demands.

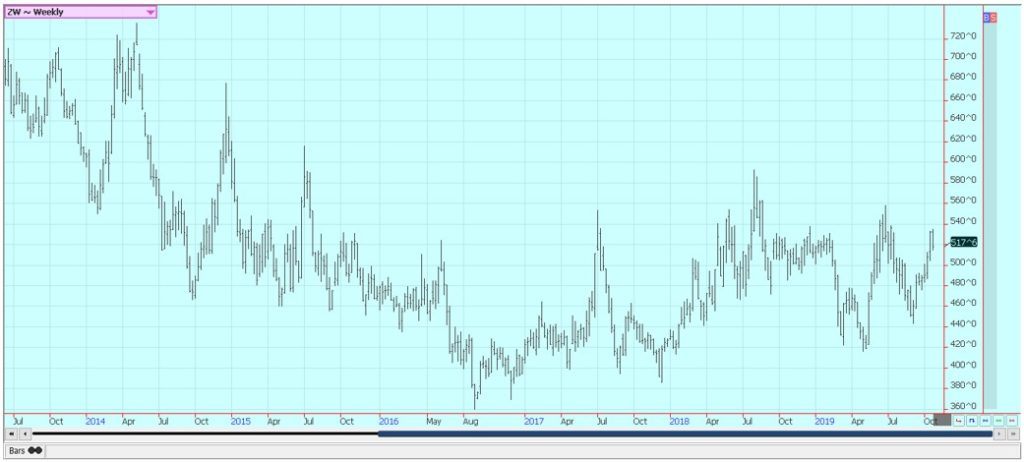

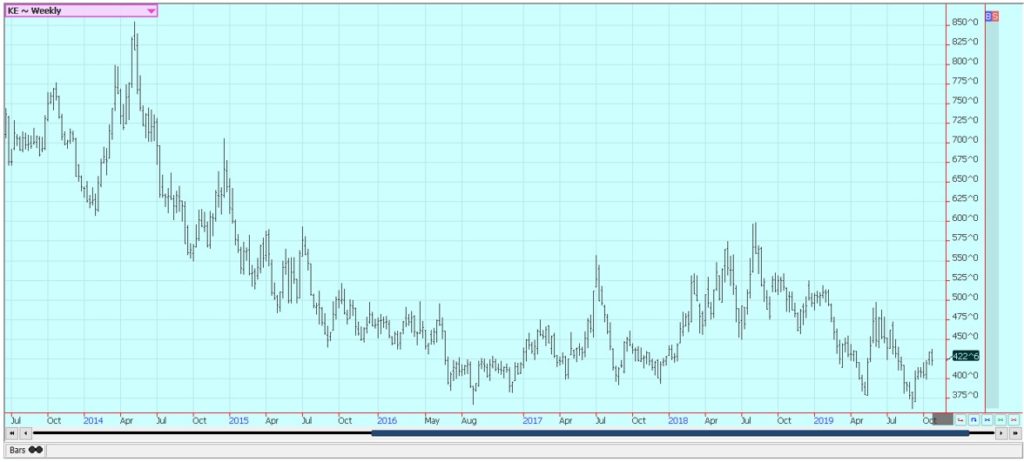

Wheat markets

Wheat markets were lower last week as the potentially bullish news for US Wheat futures seemed to get old and stale. There were no new reports of losses in southern countries such as Australia and Argentina and Russia continued to dominate the world market even with higher prices. US export sales were on the weaker side once again last week.

The weekly charts for Chicago Winter Wheat futures suggest the market is in a short term correction but Minneapolis Spring Wheat futures could be forming a top. US Winter crops are being planted now under generally good conditions. It has been cold but not cold enough to stop fieldwork. There was some significant snow in panhandle areas of Texas and Oklahoma last week, but this snow will melt and add to soil moisture.

Australia and Argentina have both been very dry and these conditions are expected to continue. Australia is once again seeing significant yield losses as a drought in the country extends into the third year. It has been dry in parts of Argentina, especially southern areas, and Wheat production potential has started to suffer.

The weaker crops in the south have supported better demand ideas for US Wheat but the demand has yet to show. Russia and Europe continue to compete for sales and have captured most of the export volume until now.

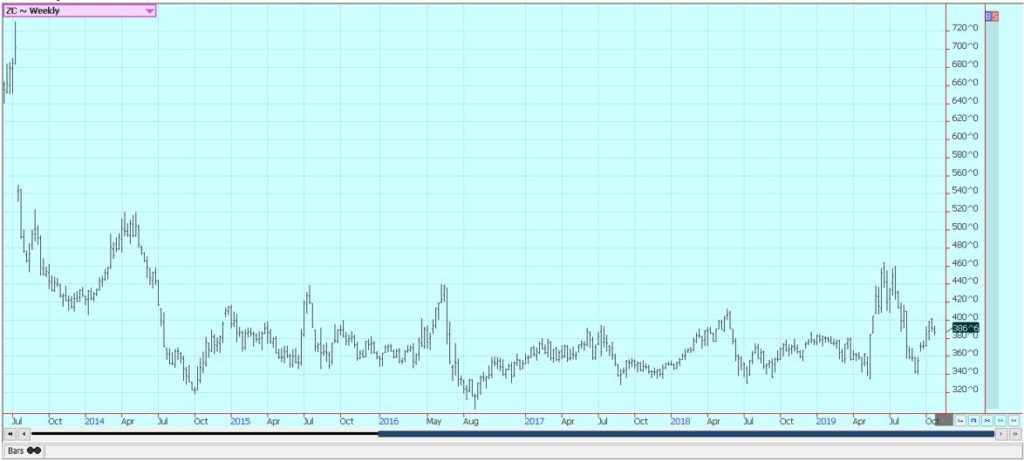

Corn and oats markets

Corn closed lower and Oats closed higher last week. Corn is still feeling harvest pressure. Producers have been concentrating on Soybeans but some producers are also harvesting Corn. Yield data shows mixed crops but some very good results. A few farmers have reported yield potential above a year ago.

These reports are mostly in western areas. Yield reports in other states have been more varied. Some farmers are waiting for crops to dry down more before beginning the harvest. Harvest conditions were variable last week with some rain around and some very significant rains reported in the Midwest over the weekend.

It is cool and the grounds will be slow to dry enough for further harvesting as some rain and snow showers are expected later this week. Export demand remains bad but ethanol demand should continue to improve as petroleum prices have been firming. The Oats harvest is over in the US and is winding down in Canada.

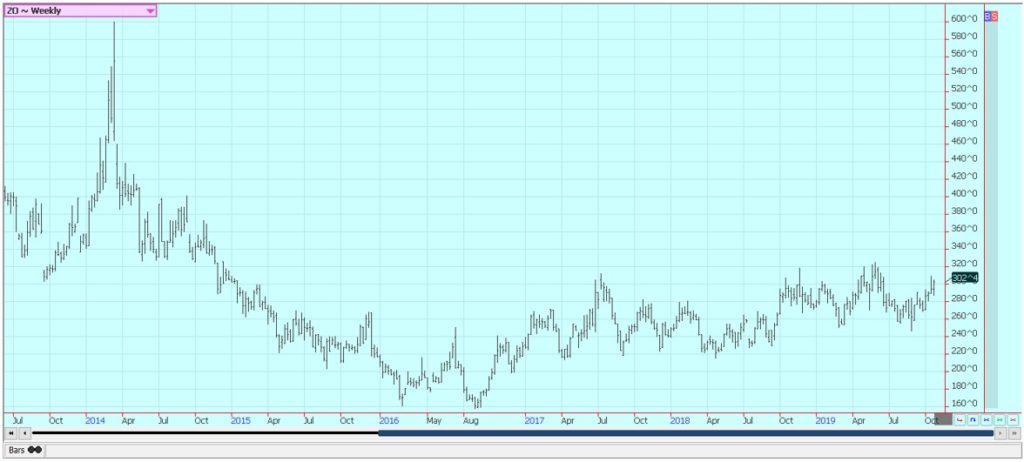

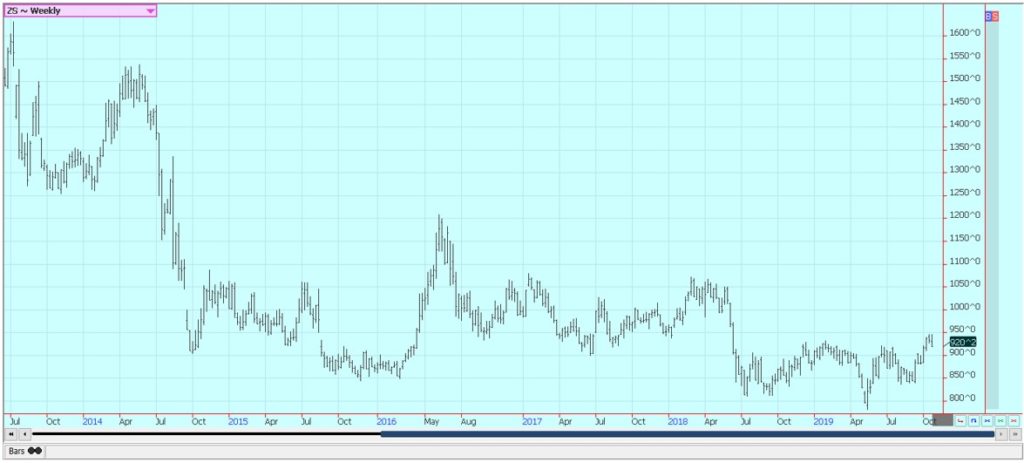

Soybeans and soybean meal markets

Soybeans and Soybean Meal were slightly lower for the week but Soybean Oil was higher. Soybeans ere hurt by ideas of expanding harvest activity and less Chinese buying of US Soybeans. The weekly USDA data showed that farmers were more focused on the Soybeans harvest than Corn last week and data released on Monday should show this trend as well.

Yield reports show that yields are generally better in western areas than to the east with some very good yields reported in the west. China continued to buy US agricultural products including pork and Soybeans and tariff increases from the US were held in check. The two sides hope to have a Phase One deal ready in November for signing at the APEC meetings and comments made on both sides suggest that some agreement will be made by then.

Rice markets

Rice was lower and continued to hold its ground as the US harvest is almost completed. It held some important support areas on the weekly charts at $11.62/cwt last week and might be able to hold this area again this week. The harvest is mostly over in all areas except California and field yields appear to be generally below last year but still stronger than some analysts had expected.

There are a few main crop fields left to harvest in the south along with some second crop Rice in Gulf coastal areas. Milling quality is said to be lower on later harvested Rice but was good for the early harvested Rice. Basis levels are reported to be firmer as the harvest comes to an end and the Rice gets put in on farm storage. There are ideas that not much Rice is available to the cash market right now as much of the new Rice has been put into storage.

Producers will hold out for higher prices as they feel that prices overall are too cheap. Export demand has been holding well and this gives hope for higher prices down the road. The best buyer has been Mexico but Central America has been buying in greater volumes as well. The charts maintain a bullish longer term outlook.

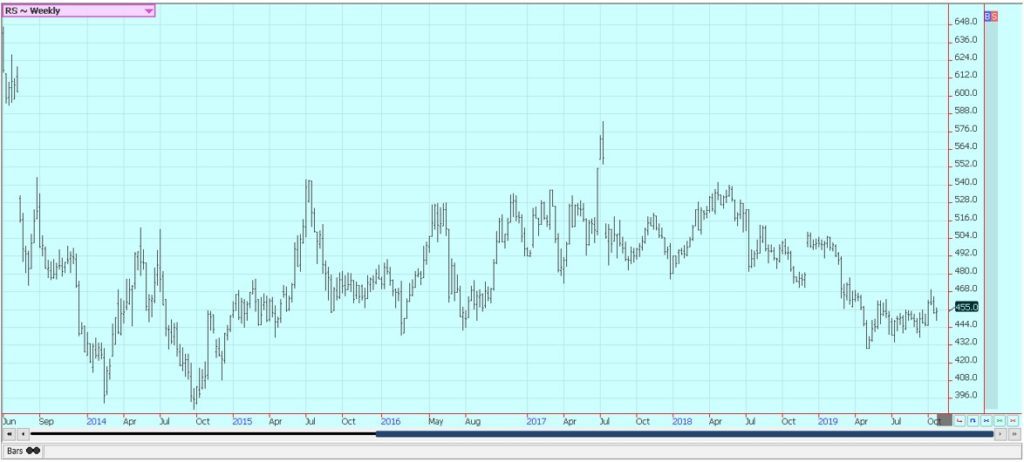

Palm oil and vegetable oils markets

World vegetable oils markets were higher with Palm Oil and Soybean Oil much higher and Canola a little higher. Palm Oil got stronger export news last week as the private surveyors showed that the export pace for the first two thirds of the month is now above from the pace of the previous month. Traders expect stronger demand to continue for both markets on improved bio fuels demand and the potential for more demand from China.

Trends are up in both markets but both could be a little over bought now for the short term. Canola was higher last week with Chicago and Malaysia as the harvest remained active. Progress has been slow but producers have been active and have been delivering into the commercial system. The weather has improved and farmers have been active sellers. Canola charts are keeping a firm longer term outlook.

Cotton

Cotton was slightly lower in narrow range trading. Support came from follow through buying tied to talk that the US and China were close to a partial deal that would allow agricultural exports to flow to China in exchange for a truce in the tariff increases. Cotton producers hope that China will buy some Cotton from the US but China has not been doing this. In fact, China reported that imports from all sources was down 38% from last year in September.

It has concentrated on Soybeans and Pork purchases instead. Export demand has not been real strong as a result. The harvest is active around storms that have hit most growing areas in the last week. Snow was reported in Texas and there are concerns that quality could have been affected.

Quality reports have been high until now and the crop yields appear to be in line with the USDA estimates. Western areas are also reporting good quality and yields. Good quality and yields are being reported in the Delta and Southeast. There is some concern that quality could be lost as the result of big rains in the last week.

Frozen concentrated orange juice and citrus

FCOJ was slightly lower in range trading. Futures have held the same rang for months now and show no signs of going higher or lower. Good growing conditions and increased oranges production estimates by USDA are bearish, but the market seems to have found a minimum area for now. USDA estimated Florida production at 74 million boxes.

The weather has been great for the trees as there have been frequent periods of showers and no hurricanes or other severe storms so far this year. Some areas have been dry lately and some irrigation has been used. A storm moved through central and northern areas of the state over the weekend but mostly brought rain.

Crop yields and quality should be high for Florida this year. Inventories of FCOJ in the state are high and are more than 30% above last year. Rains are falling in Brazil and trees are flowering now.

Coffee

Futures were higher on Friday and for the week in New York. London was slightly higher for the week after a stronger day on Friday. New York was lower on more reports of good flowering in Brazil and speculative selling tied to forecasts for better rains in Coffee areas this week. London has been the weaker market as the Asian harvest is underway but producers do not seem to be selling on ideas that prices are too low to provide profits.

Vietnam exports remain behind a year ago, but the market anticipates bigger offers as producers and traders will need to create new storage space and are expected to do this by selling old crop Coffee. The Arabica growing areas got needed rains to start the flowering last week and reports indicate that flowering is off to a very good start. Rains are expected to start again in Coffee areas on Monday.

Overall the Coffee areas remain in a rain deficit but have had some timely rains to start the flowering. Many now anticipate a big crop from Brazil next year. However, there was some extreme cold and drought conditions earlier in the year that might have stressed trees and could hurt production potential for this year despite the good weather now. Vietnam crops are thought to be big despite some uneven growing conditions this year.

Sugar

Futures closed a little higher in New York and in London on Friday and both markets closed with slight gains for the week. Overall charts trends remain down but the market seems to have discovered some support at current levels. The move higher came despite news from UNICA that production increased in the first half of the month and that mills produced more Sugar and less Ethanol.

Reports indicate that little is on offer from India. Thailand might also have less this year due to reduced planted area. However, most think there is still more than enough Sugar for any demand and that India will have to sell sooner or later. Reports from India indicate that the country is seeing relatively good growing conditions and still holds large inventories from last year.

However, these supplies are apparently not moving and this could be due to less government subsidy for mills and exporters. Europe and Russia are probably buying in the world market after poor growing seasons. Reports of improving weather in Brazil imply good crops there. There is some talk that dry weather could hit Brazil growing areas, but this is helping the harvest and is keeping sucrose levels higher.

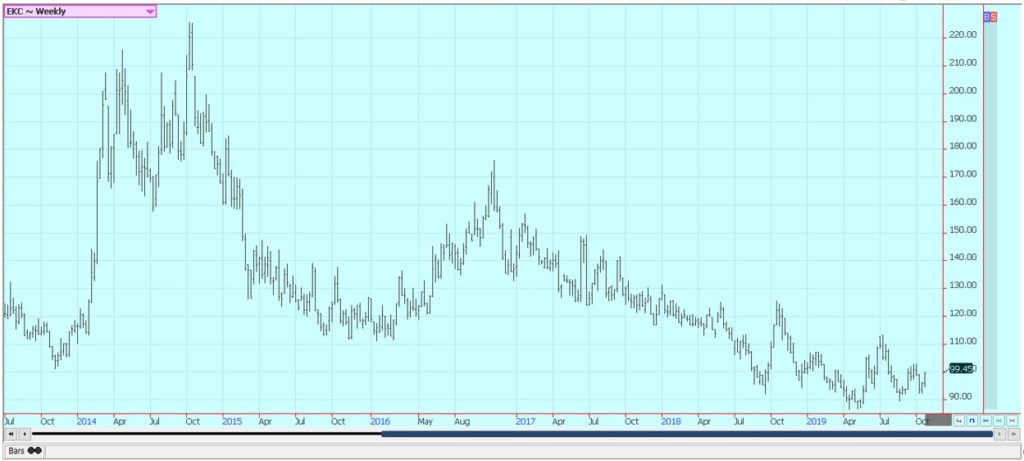

Cocoa

Futures closed lower in both markets on Friday and were lower for the week. Cocoa trading has been as much about currency relationships than about supply and demand. Harvest is now active in West Africa and reports are that good volumes and quality are expected. The quarterly grind data was mixed and left people wondering how good the demand for chocolate will be. Chart trends are mixed.

The reports from West Africa imply that a big harvest is possible in the region. Ivory Coast arrivals are off to a fast start and are above year ago levels three weeks into the season. The weather in Ivory Coast has improved due to reports of frequent showers. The precipitation is a little less now so there are no real concerns about disease. Ideas are that the next crop will be very good.

Both Ivory Coast and Ghana are doing what they can do boost Cocoa prices and maintain good earnings for producers by paying a living wage differential and are looking to regulate the flow of Cocoa into the world market. The moves could force the big Cocoa processors and grinders to pay more as they contract for Cocoa well in advance to ensure adequate supplies.

—

(Featured picture by Melissa Askew via Unsplash)

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech2 weeks ago

Fintech2 weeks agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Impact Investing3 days ago

Impact Investing3 days agoOceanEye: EU Launches €50 Million Initiative to Strengthen Global Ocean Monitoring

-

Cannabis1 week ago

Cannabis1 week agoColombia Moves to Finalize Medicinal Cannabis Regulations by March