Biotech

Asabys Wants to Raise €200 Million to Invest in Biotech

Asabys, which counts Alantra as a strategic partner, launched the first fund four years ago with an initial target of €60 million and the support of Banco Sabadell as the main investor. Following the announcement, the fund manager saw increased demand and finally closed the vehicle with €117 million. Asabys Partners invests in healthcare companies in its three verticals: medtech, biotech, and digital therapy solutions.

Asabys, the Spanish private equity manager plans to raise a new €200 million vehicle with the support of Sabadell and Alantra, current investors, to continue investing in the life sciences and healthcare innovation sector.

The fund, called Sabadell Asabys Health Innovation Investments II, already has part of that money committed from investors who participated in the first fund, which raised more than €100 million.

In fact, last July, Asabys reported to the National Securities Market Commission (Cnmv) a prospectus contemplating the launch of a new fund and whose note specifies that “total commitments will at no time exceed a total amount of €250 million.”

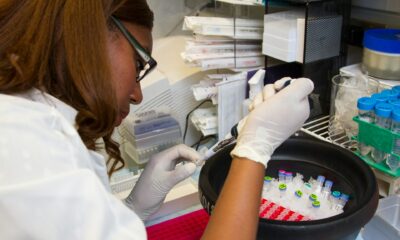

The document goes on to detail that the fund will invest in companies with a significant research and development (R&D) base addressing unmet medical needs and adds that “in particular, the fund’s investments will be oriented towards the early-stage human health innovation space: bio-therapeutic companies, medical device companies, health technologies, disruptive services, and digital health companies.”

Read more on the subject and find the latest business news of the day with the Born2Invest mobile app.

Asabys hopes to continue to invest in companies with a strong research and development base

Asabys, which counts Alantra as a strategic partner, launched the first fund four years ago with an initial target of €60 million and the support of Banco Sabadell as the main investor. Following the announcement, the fund manager saw increased demand and finally closed the vehicle with €117 million. Asabys Partners invests in healthcare companies in its three verticals: medtech, biotech, and digital therapy solutions.

In 2020 Asabys backed projects in different companies. Some of the investments are related to Medlumics, Medasense, or Splice Bio. In the case of Medasense, for example, the management company became a shareholder as part of an $18 million investment round. Medasense, founded in Tel-Aviv (Israel) in 2008 by Galit Zuckerman and with a team in Barcelona, has developed a “nociception” pain assessment and monitoring system for operating rooms and intensive care units, for use in patients under general anesthesia.

In the case of Splice Bio, Asabys Partners co-invested with Ysios Capital. This company specializes in gene therapy. The company’s technology addresses the main limitations of adeno-associated viruses (AAVs), which are the viral vectors used in this type of therapy.

In 2021, the Spanish venture capital manager invested between one and three million euros in the start-up Nuage Therapeutics, which aims to discover drugs aimed at therapeutic targets considered difficult to address until now. In 2022, Asabys invested in the biotech Agomab, dedicated to the development of innovative treatments for fibrosis. These are just some of the manager’s numerous projects.

__

(Featured image by nattanan23 via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce, a third-party contributor translated and adapted the articles from the originals. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEU Backs 90% Emissions Cut by 2040 and Delays ETS2 Rollout

-

Markets6 days ago

Markets6 days agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Biotech2 weeks ago

Biotech2 weeks agoDNA Origami Breakthrough in HIV Vaccine Research

-

Cannabis3 days ago

Cannabis3 days agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns