Business

Australia set to harvest wheat soon, droughts in Brazil increase coffee prices

There is less production in Brazil this year due to the drought in northeast Brazil. Production ideas range from 45 to 50 million bags.

Weekly agriculture market report: Less production of coffee in Brazil because of droughts, US cotton demand from the Middle East and the Far East remains strong and consistent.

Wheat

US markets closed a little higher for the week but saw some selling pressure on Friday. The USDA Outlook Conference supply and demand estimates were generally in line with trade ideas. Production this year is estimated at 1.8 billion bushels due to the significant cut in planted area reported by producers this year. Domestic and export demand were also cut back, but ending stocks are projected to fall and be about 905 million bushels next year. The average farm price was raised to $4.30 per bushels from $3.85 per bushel this year. US weather conditions turned colder over the weekend after some very warm temperatures the last couple of weeks. There could be some burn to crops that have emerged from dormancy. Temperatures should moderate this week and some growth could resume. Egypt bought again from Russia and East Europe and have been a big buyer in the last couple of weeks. Ideas are that world Wheat prices could be near a short-term high given the good buying and ideas that Russian producers are about to increase offers into the domestic and export market. Australia will harvest a big crop and will be strong competition in the world market as well. The weekly charts show that Chicago SRW and HRW held trend line support as it corrects from a new high for the move made two weeks ago. Minneapolis is acting weak but is entering longer term support areas.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

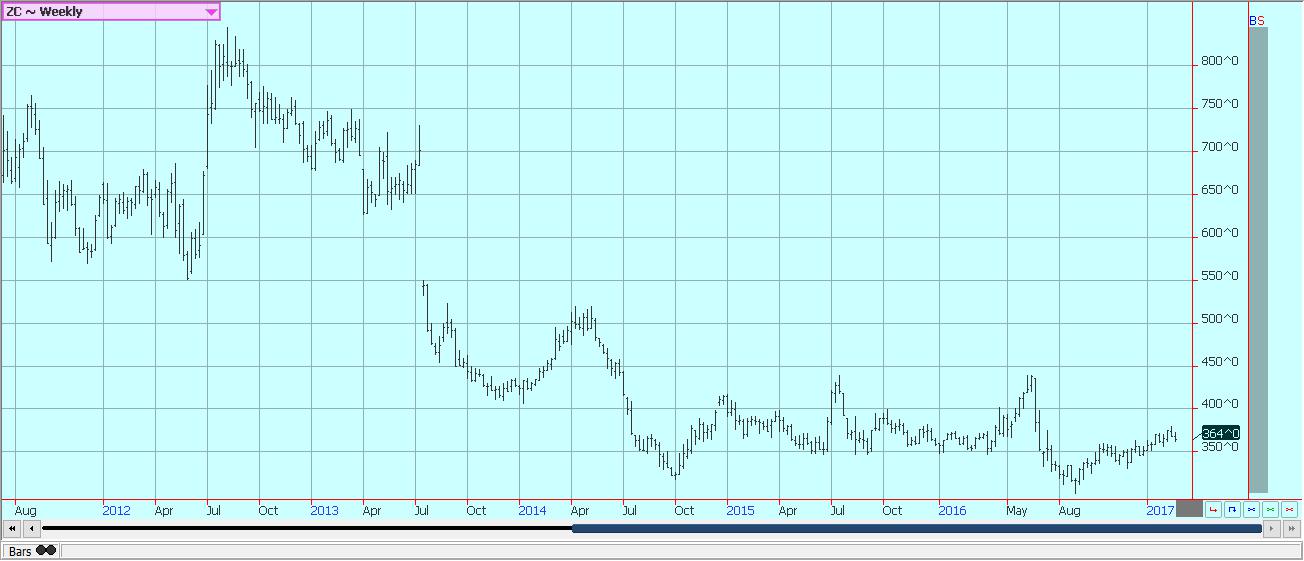

Corn

Corn closed slightly lower but is holding trend line support on the weekly charts. The USDA Outlook Conference showed reduced production potential for the coming year at just over 14 billion bushels. The reduced year on year production ideas come from reduced planted area expectations at 90 million acres and reduced yield estimates for the coming year. Many parts of the US enjoyed a very late growing season last year and this added greatly to yield potential. USDA is using a normal weather model for its yield projections for the coming year and that would imply less overall yield. Demand was also trimmed and ending stocks projections were above 2.0 billion bushels. That is below last year but still a very comfortable number for the trade. The weekly export sales report was strong but below trade expectations. Demand continues strong as South America remains out of the market. The report should show strong demand this week in the wake of daily sales announcements last week totaling over half a million tons. Producers in the southern half of the Midwest have been active in the fields for the last week doing initial field preparation in response to much above normal temperatures seen for an extended period. It turned cold over the weekend, but above normal temperatures are likely again this week and preparations could continue.

Weekly Corn Futures

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans and Soybean Meal were lower last week as the potential for sales in the world market from South America started to increase. Much of the feat of increased sales has to do as much with the calendar as anything else. The harvest progress in Brazil remains very rapid, but producers there are not really selling anything. The Real remains very strong against the US Dollar. The harvest in Brazil has been active. Production ideas currently appear to be near or above 106 million tons. Argentina has seen improved crop conditions. Production estimates for Argentina now range from 54 to 55 million tons. USDA estimated US production for the coming year at about 4.1 billion bushels in its Outlook Conference last week. Planted area potential was increased to 88 million acres, from 83.4 million last year. However, yield potential was less as USDA is expecting a normal growing season instead of a very long growing season as seen last year. Demand was increased to meet the additional supply, with the biggest increase seen on the export side. Ending stocks levels were left unchanged on a year to year basis. The weekly charts suggest that some additional price weakness is possible this week.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

It was another sideways to lower week for US Rice futures last week. The export sales report was positive and showed strong long grain demand, but the trade was much more interested in what was said in Washington DC at the annual USDA outlook conference. USDA expects Rice planted area this year to be around 2.6 million acres, down more than 17% from 2016. The lower area is all due to price as cash and futures prices remain well below the cost of production for many producers. The main cuts will come in long grain in the south, with the loss of about 500,000 acres possible in this area. Medium and short grain will also see less planted area, but the cuts here will be much more limited and maybe no more than about 100,000 acres. Production could be 200 million hundredweight or less, and ending stocks should be cut to perhaps 37 million hundredweight, from a projected 52 million this year. However, USDA expects weak price action to continue despite the reduced production as demand should be slightly less as well. It showed a marginal increase in the average farm price to $10.70/cwt, from $10.50/cwt for the current year. The USDA estimates tend to be close to the ideas of the market and should have little overall effect on prices. Prices should stay weak until demand improves or some weather event arrives to change the scenario. Ideas are that futures price action can remain relatively weak for now, but the projected drop in year to year ending stocks estimates implies that downside price potential is probably limited.

Weekly Chicago Rice Futures © Jack Scoville

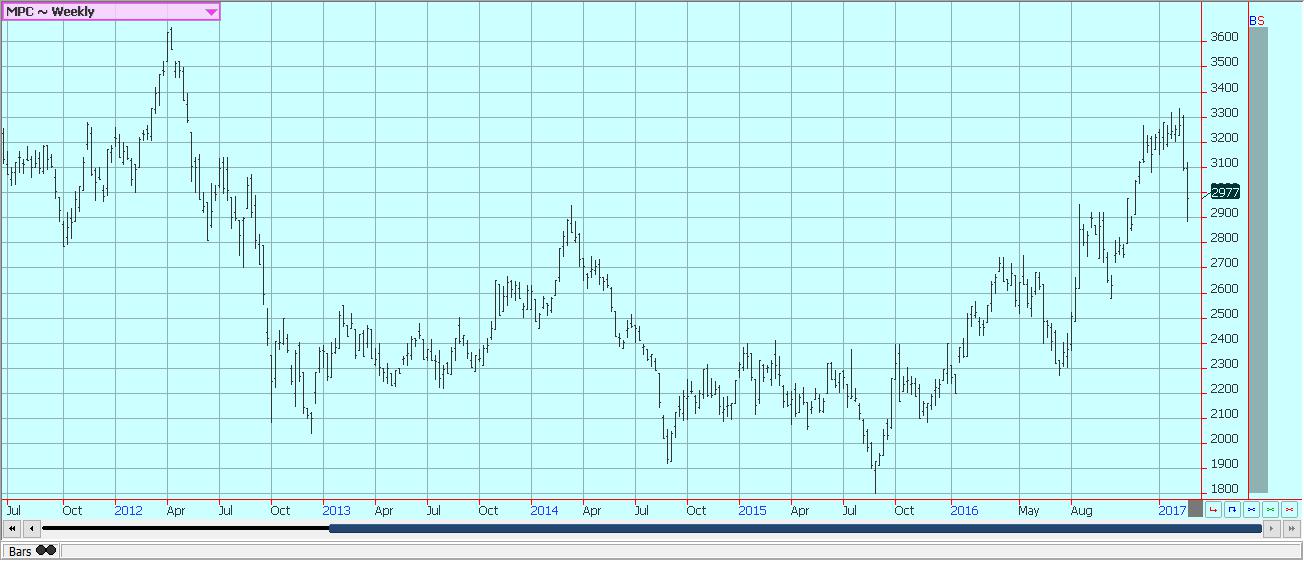

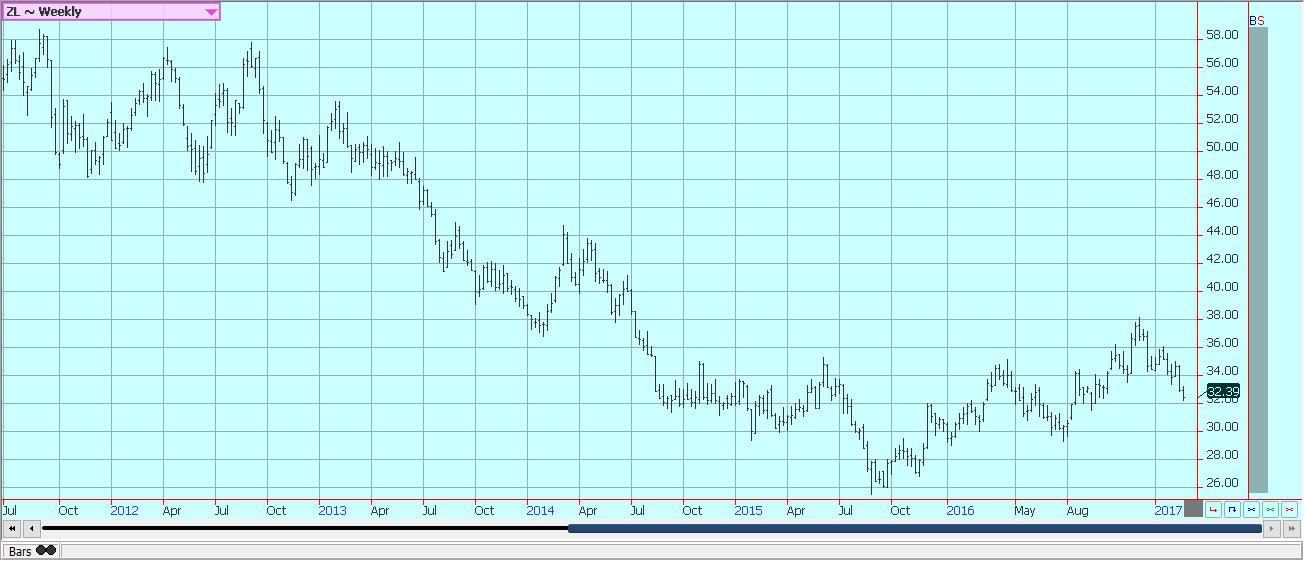

Palm oil and vegetable oils

World vegetable oils markets were lower last week and trends remain down on both the daily and weekly charts. It was an ugly week for Palm Oil prices as those moved sharply lower. It moved to targets for the move and could trade sideways to higher this week. The move is coming in response to ideas of increasing production amid weaker demand potential. Palm Oil production starts to seasonally increase about now, and trade comments suggest that reports from production areas show increased production. Demand has remained on the weak side of expectations, with the latest reports from the private sources showing less month on month exports. Prices have also been weaker for Soybean Oil as production starts to increase. South America is harvesting a big crop and is providing more competition for sales. The competition should start to increase once Argentina becomes a bigger seller. Argentina is usually the biggest exporter of Soybean Oil in the world market and will look to compete for the title again this year. The potential for weaker Soybean Oil prices will keep selling pressure on Palm Oil prices so that market can compete for business.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures

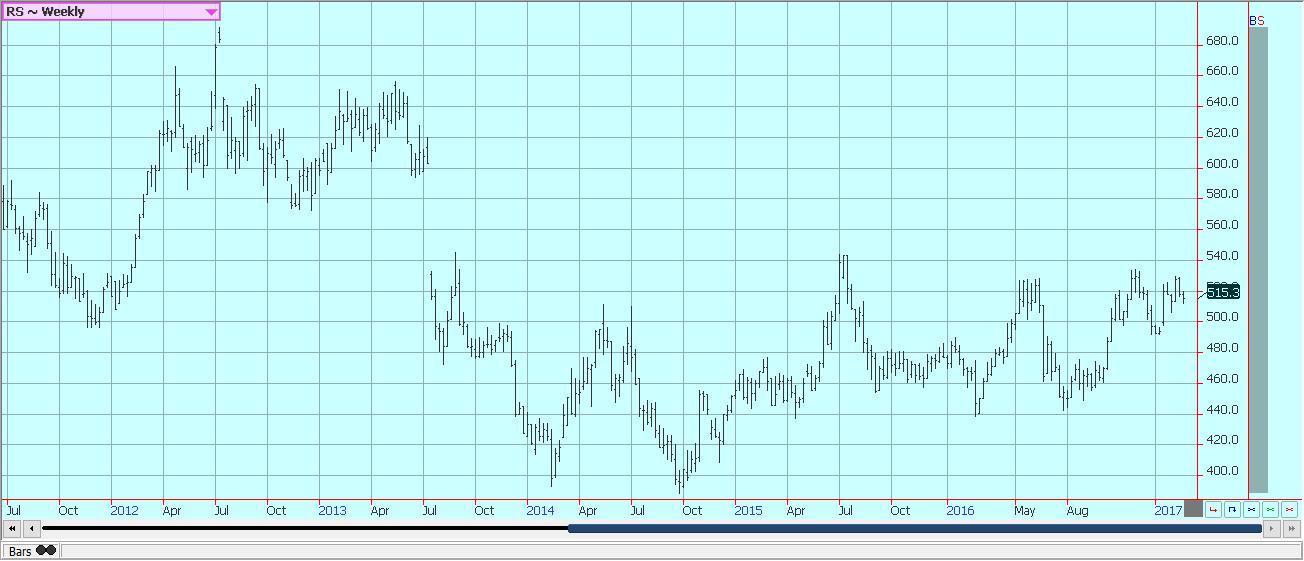

Weekly Canola Futures © Jack Scoville

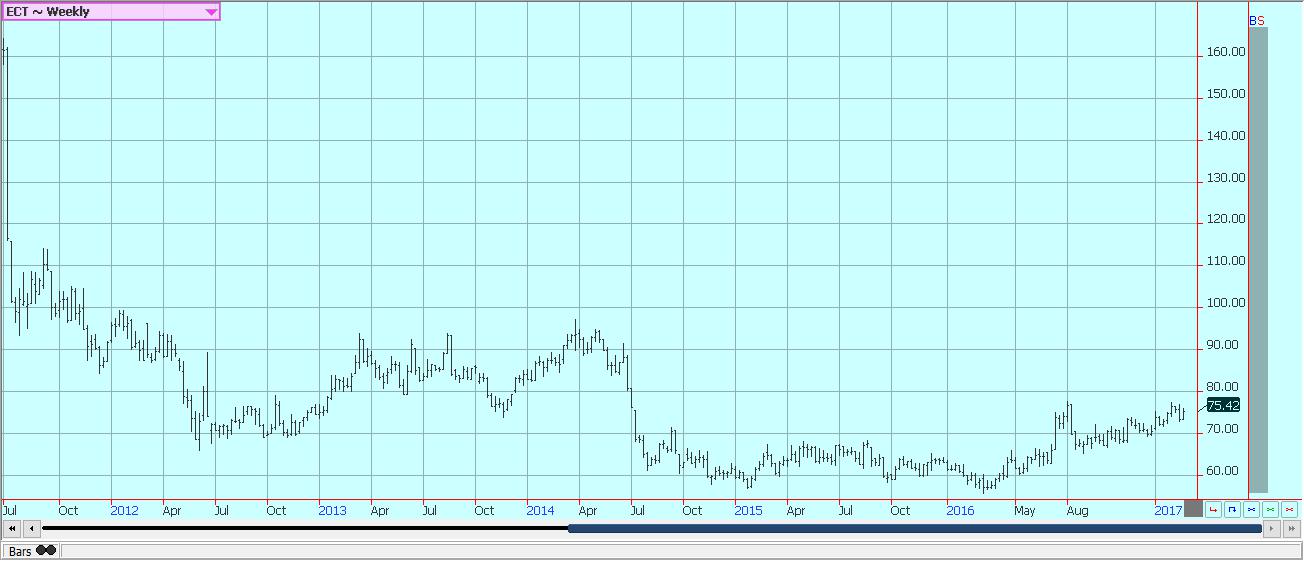

Cotton

Futures were higher for the week in recovery trading. It was a strong week of price action for the bulls. The USDA Outlook Conference showed deteriorating market conditions for US producers as the average farm price projection was cut from 69 ct/lb for the current marketing year to 65 ct/lb for the coming marketing year. Planted area potential showed an increase to 12.5 million acres, but yields were cut as USDA factored in normal growing conditions instead of the extra long growing season seen last year. Export demand was increased, but ending stocks ideas were increased from about 4.8 million bales this year to about 5.2 million bales next year. These are not price-positive ideas, but the market keeps pushing higher. The main buying has come from strong export demand in the cash market and fund buying in the futures market. Funds and other speculators hold extreme long positions and many expect the rally to collapse at any time. However, the speculators have been able to stay with positions due to the stronger than expected export demand for the US Cotton. The US demand should stay strong as the US has a lot to offer and is only starting to see some competition from Australia. US demand from the Middle East and the Far East remains strong and consistent.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ closed lower last week and failed at strong resistance areas near about 180.00 basis the nearby futures on the weekly charts. It is turning into a weather market as Florida has been very dry. Some showers were reported last week, but now it is dry again. This is great for harvesting, but not good for the development of the next crop. Trees are in bloom in all areas of the state, and petals are starting to drop in some areas as the fruit is starting to form. Good rains are needed for the bloom and initial fruit development. Irrigation is being heavily used to prevent loss. The market is still caught between low production and low demand. USDA now estimates Florida Oranges production at 70 million boxes, a very low amount. The Greening Disease remains the overriding factor for reduced production. The Florida harvest remains active. Early and Mid oranges are being harvested for processing. The Valencia harvest is moving forward. Demand for Orange Juice inside the US is still a big problem. It is currently at its lowest level since records started being kept in 2002, and there are no real prospects for improvement right now as consumers have plenty of alternatives. Sao Paulo state is getting good weather and crop conditions are called good.

Weekly FCOJ Futures © Jack Scoville

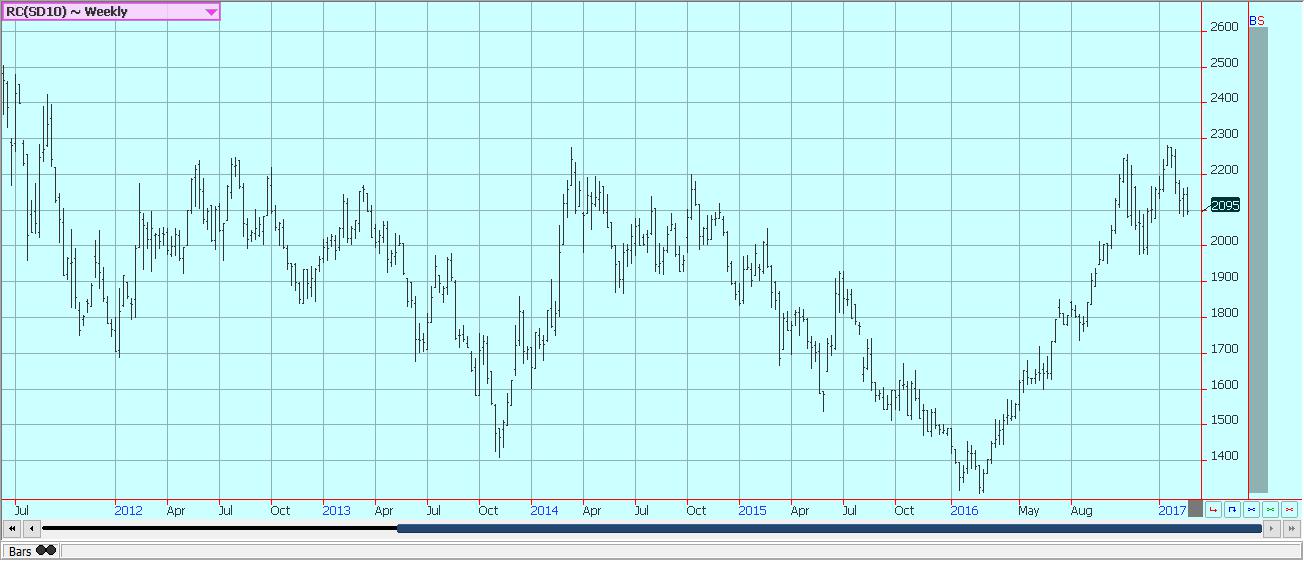

Coffee

Futures moved lower, with much of the price weakness seen on Friday. The selling was prompted by news that Brazil will not allow imports for now. The producers had argued against imports and won. The government will now do a census of the Coffee supplies in the country and then decide if imports are needed. The census will not doubt take quite some time to be completed and that means that imports will be restricted. Meanwhile, internal prices remain higher and lower qualities are very hard to find inside Brazil. There is less production in Brazil this year due to the drought in northeast Brazil. Production ideas range from 45 to 50 million bags. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Vietnamese prices have started to drop a little bit as demand has shifted to other countries. The demand has been great for inferior qualities of Coffee from the rest of Latin America, although prices paid remain low and differentials paid to remain weak. Differentials for better qualities are stable. The charts show that the price action has been choppy and that choppy price action can continue.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures closed lower, and more moves lower are possible this week. New York closed below the range seen for the last month and a half and could find follow through selling in the next few days. Part of the selling is coming as the March contract will go into delivery in New York later this week. Long speculators are closing out positions or rolling forward, and for now, the commercial is only providing partial buying interest. The bullish supply side news seems to be getting a little stale at this time and the market needs some fresh reasons for buying to emerge. News of less than expected production in Brazil combined with less on offer from India and Thailand provide the best reasons for strong prices. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remains too dry. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures © Jack Scoville

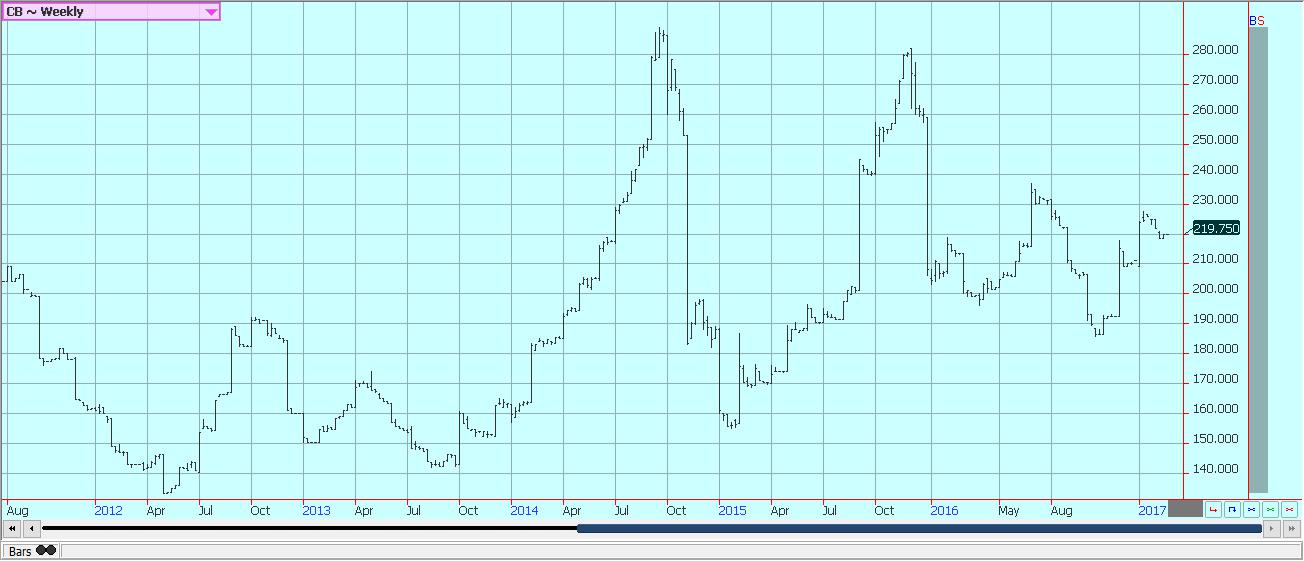

Cocoa

Futures markets were lower last week but traded inside the trading ranges of the last few weeks. Ivory Coast sold 350,000 tons of Cocoa into the world market after taking the Cocoa from local industry defaults. The move was an effort to clear room in the domestic market for more trading. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. However, the price action over the last couple of weeks could start the beginning of a low. The demand from Europe is reported improved, but still weak over all, and the North American demand has been weaker than anticipated. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Traders will watch now to see if Harmattan winds develop that could decimate the mid-crop. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

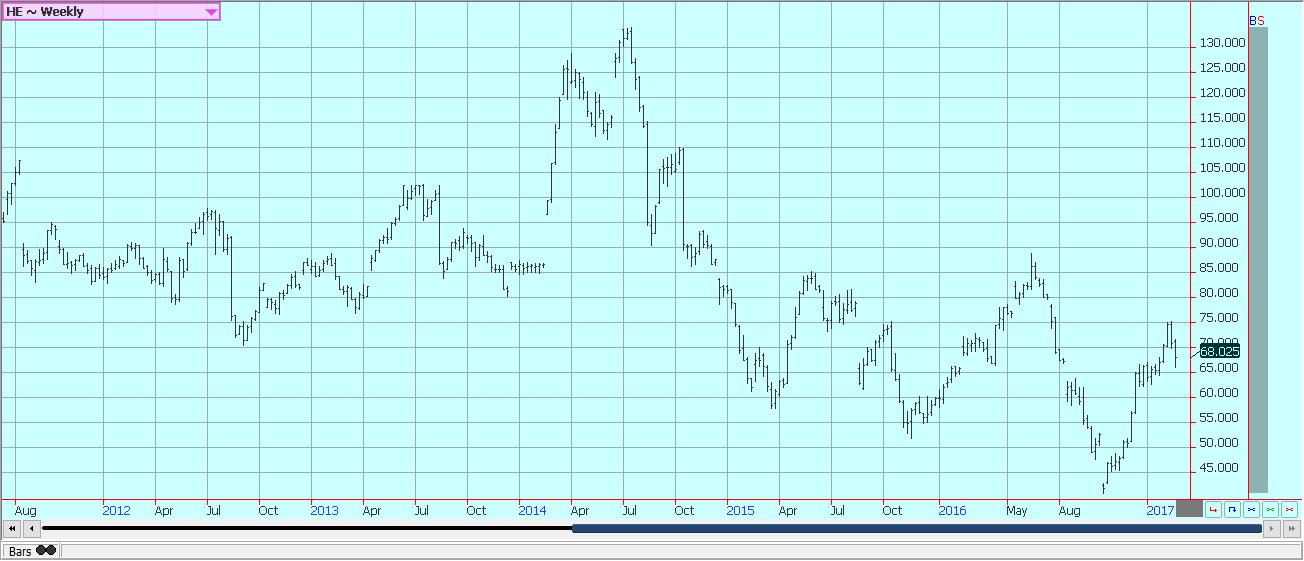

Dairy and meat

Dairy markets were mostly lower as good supplies of milk remain available to the market. Supplies are increasing as the weather has been unusually warm in the central parts of the country. However, supplies in the west have suffered somewhat due to some extreme weather. Northeast areas have seen more stressful weather as well. Demand is good for cream, but cheese makers have started to back away from the market. Bottled milk demand has been mostly strong, but the Midwest is reporting less demand. Butter and cheese manufacturers report that inventories are starting to increase as there is a lot of milk available. This is especially true for Butter, where bulk supplies are going to storage. Cheese supplies are increasing and much of the production is going into aging coolers. Midwest cheese makers are pulling back on taking new milk. Butter manufacturers are mostly producing bulk butter for inventories. Dried products prices are mixed.

US cattle and beef prices were firm last week amid firm beef prices. Packers paid higher prices in the auction market last week. Feedlot offers were good, but weights are down, and there is talk that Cattle supplies might be light for the next several weeks. The Cattle on Feed report on Friday showed that there is plenty of cattle out there. However, it appears that a lot of the cattle is not yet ready for market. Packers appear short bought. Ideas are that prices can hold at higher levels for now, but that weaker prices will be seen once feedlot offers start to increase in a few months. The weekly export sales report was not strong, but overall beef exports have been very strong this marketing year.

Pork markets were weaker and Lean Hog futures were weaker. Pork demand remains stronger than expected and ham prices have been contra-seasonally strong. The monthly supply and demand updates from USDA showed that strong pork demand can continue on the domestic and export fronts. The demand should help keep supplies available to the market under control at a time when hogs production remains very strong. Pork prices have trended higher in retail and wholesale markets. Export prices have been strong as well. Packer demand has been very good as packers move to meet the strong domestic and world demand. There are big supplies out there for any demand. The charts show that the market could remain higher, and strong demand ideas should continue to support the market overall.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business1 week ago

Business1 week agoLegal Process for Dividing Real Estate Inheritance

-

Fintech5 days ago

Fintech5 days agoPUMP ICO Raises Eyebrows: Cash Grab or Meme Coin Meltdown?

-

Africa2 weeks ago

Africa2 weeks agoMorocco Charts a Citizen-Centered Path for Ethical and Inclusive AI

-

Africa9 hours ago

Africa9 hours agoSurging Expenditures Widen Morocco’s Budget Deficit Despite Revenue Growth

You must be logged in to post a comment Login