Featured

Avoiding hype-burn amidst IPO mania

Given that we’re in the greatest global bubble in history, almost everything is overvalued.

We’re expecting central banks to keep printing money, interest rates to stay near zero, growth to continue “into a plateau of prosperity.” Just like 1929.

Dare us to say: it’s hard to find good value investments out there.

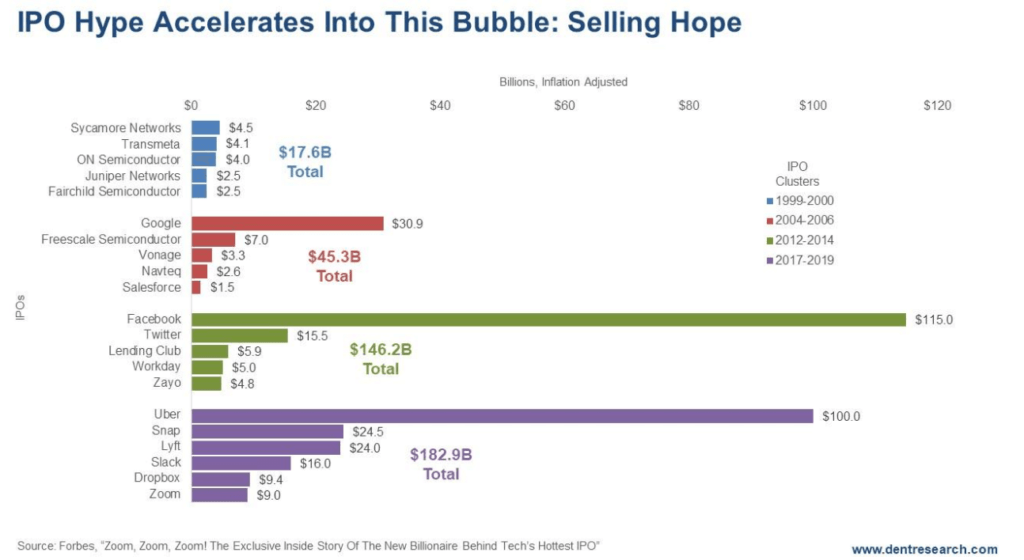

Look at this chart of accelerating IPOs at higher and higher prices, most often from companies that have no or little profits. People are buying into the bubble at prices that companies could not possibly fulfill even in many years, if ever. They don’t call these companies “unicorns” for nothing.

©Harry Dent

At the top of the massive tech and internet bubble in 1999 and 2000, the key IPOs only totaled $17.6 billion.

Look at the progression as the greatest stock bubble in history keeps hitting new higher levels…

Bigger and bigger…

Google and the high-profile IPOs of 2004 to 2006 raked in $45.3 billion. Between 2012 and 2014, Facebook & Co. cumulatively valued at $143.2 billion.

Now it’s Uber and its peers, collectively valuing at $182.9 billion. And this bubble isn’t over yet.

Yet Uber has $16 billion in cumulative losses, no chance of profits anytime soon, if ever. Its drivers are overworked and underpaid. They likely won’t stay with the company for long. And its IPO is backing off that $100-billion initial valuation. (That may be a sign that this bubble is getting close to peaking, but more on that another time.)

So, how do you make money on companies like these that have no profits and are valued 10 to 20 years out, on the assumption of success?

How do you find the Amazons of this world without the wild roller coaster ride – up and down — at the beginning?

Amazon IPO’d in May 1997 with a value of only $438 million. A year later it was smacked down 88%. In the tech wreck of 2000 to 2002, it was whacked down again, 93% from its highs.

After hitting $6 per share, it began its ascension and recently got as high as $2,039 per share. PER SHARE!

How do we get on the train at THAT point?

I guess those are the questions every investor asks and one of the reasons you follow our work. You hope we have the answers.

We do.

Finding the next Amazon

There’s a new twist on our four-season and S-curve model of business that Rodney, our Boom & Bust Portfolio Manager, has identified. It’s called “The Second Wave,” and it’s giving investors like you the opportunity to board the profit train AFTER the hype has done its damage.

I spent years consulting to, running, and investing in new ventures. Being an entrepreneur myself and having a natural attraction to risk, I tended to invest in that brutal first wave… the one that crushes you when the wave breaks. My thinking would be something along these lines: “Here’s a new product/technology. It’s radically better than the existing ones.” Why not get in early on? The problem is that it is just getting off the ground, has to raise money with no track record, get initial customers for credibility and cash flow, and if successful, has to manage rapid growth. There are a million things that can go wrong at that vulnerable stage.

Inevitably they face a crisis, even if successful. Too many competitors will enter the market and over-expand. The creative entrepreneur will find he has no skills at managing the growth he created, funding will dry up in stock crashes like 2000-2002, or 2008-2009… and on and on.

Beating the shakeout

Every new growth industry faces a shakeout. Actually, there’s a series of shakeouts. It’s especially during that first shakeout, when the tide recedes, that you first see who’s swimming naked. The weak are weeded out and the strong survive.

That’s where I should have invested when the new industry or company was still young – at the beginning of that second wave. It’s where the winning candidates come into their own and the direction of the industry comes into clearer focus.

(Featured image by DepositPhotos)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business2 weeks ago

Business2 weeks agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Cannabis2 days ago

Cannabis2 days agoCanopy Growth Launches Cheaper 15g Medical Cannabis in Poland

-

Fintech1 week ago

Fintech1 week agoFirst Regulated Blockchain Stock Trade Launches in the United States

-

Cannabis5 days ago

Cannabis5 days agoAurora’s Electric Honeydew Debuts in Poland, But Shared Registry Raises Patient Caution