Markets

Investing in assets: Early-stage advice for beginners from Maxim Bederov

When in doubt, follow these seven main investment principles.

When one invests in assets, it’s crucial to take into account the specifications of the project and the system in general. Together with a successful investor and financial advisor, Maxim Bederov, we identified the main factors to be considered when investing in assets.

Getting ready

The first thing required for investment is available funds. In order to have these, proper financial records must be in place. Maxim recommends to control expenses and try to cut the costs whenever it’s possible. This principle applies to transport, food, and entertainment. The faster one starts saving money, the sooner one can take the investor’s path.

Another good idea would be to buy shares in small, but promising companies instead of purchasing a new smartphone or expensive jewelry. In this situation, one may find Warren Buffet’s example very illustrative. The third richest person in the world lives in a small mansion he bought for $31,500 back in 1958, while he can afford to purchase a real palace.

For a better understanding, Maxim Bederov shared this money-saving case study. The whole point is to give up drinking tea. According to YouGov, an average person spends $250 a year on this product in the UK. For the same amount, one could have purchased, during April 2018, 5 Cisco shares ($44 each) and one Yandex ($30 each). This would have created today a return of investment of $60 ($55 on Cisco and $5 on Yandex). Instead of losing $250 on drinking tea, increase personal capital by 24%.

When saving a certain amount of money, a decision needs to be conducted regarding the budget. This should be an amount which won’t be a catastrophe to lose. Decide as well on how much to invest in shares or any other assets. The legend of the finance world, Napoleon Hill, wrote that one should allocate the maximum possible amount of funds for investments which wouldn’t hit the own personal well-being. Maxim suggests avoiding unplanned investments if the budget is not available and additionally avoiding relying on feelings, as this is what could end in bankruptcy.

Analysis

Available saved capital should be handled carefully by assessing the prospects and viability of the company before placing an investment. This stage is called fundamental analysis: here, it’s important to elaborate whether the company will grow and bear a benefit for the investor.

A similar approach is used for real estate investments. Especially when buying a piece of land for commercial construction. It is vital to determine how effective the chosen place would be, and whether it can be interesting for medium and big businesses.

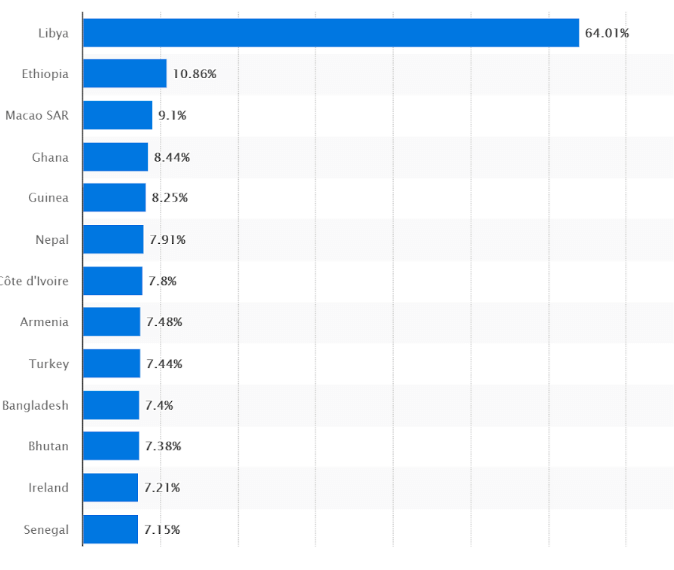

Before making any investment, research all available news on the company and/or the country where the asset is located. Purchase of securities in rapidly growing economies can be particularly advantageous. Buying real estate in a country with an unstable political environment requires to keep in mind that assets can immediately lose its former value at any moment.

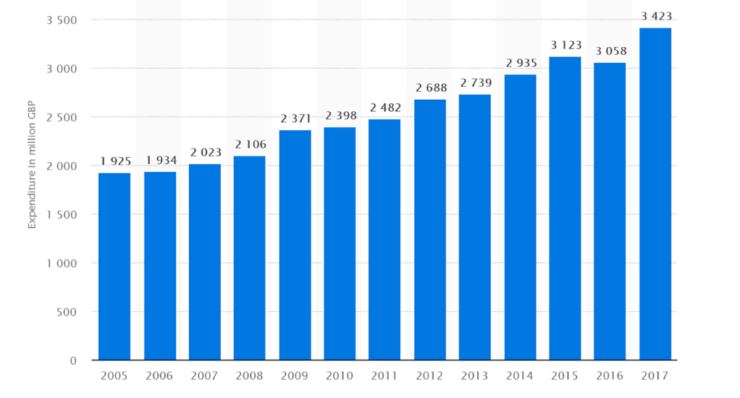

The 20 countries with the highest growth of the gross domestic product (GDP) (Source)

It is more advisable to invest in industries one have been dealing with in the past and bear knowledge on. With existing experience and knowledge in technology, it is rather unadvisable to invest suddenly in the oil or food industry. The world’s wealthiest investor, Warren Buffett, was following this principle and never invested in tech projects. However, the conservative approach is not always the best one. Additionally, always gather knowledge and views from trustworthy resources.

Making an investment

Maxim gives special attention to risky investments. Even if full confidence in a company is existing, a colossal sum of investment in an unstable asset is inadvisable. There is no such corporation that would be immune to crash, and loans are due to payment. For example, in 2008, the world’s largest bank. Lehman Brothers, with a history of a century and a half, went bankrupt to everyone’s surprise. It lost an enormous amount of money due to the CEO’s policy, which involved the acquisition of risky assets. Many people expected the US government to help a well-known entity to stay afloat, but it still went bankrupt eventually.

Investment shouldn’t be a one-time thing. Regularity is the only way to feel the market and control own assets. Never spend the entire budget at once, because securities could lose value at any given time.

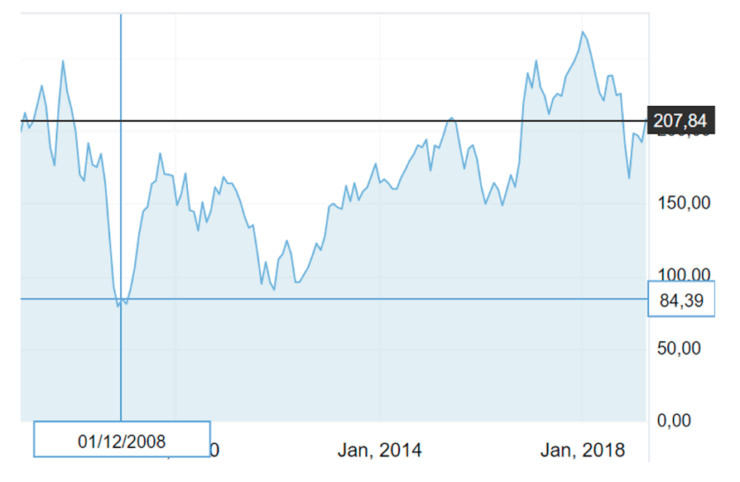

If the value of security does fall, this is the time to take a chance. Purchase shares at a price below market rate during crises and other financial threats. Warren Buffett said that he loves to buy securities when the market is freaking out. During the global economic crisis, the Goldman Sachs shares cost $84 and reached their peak of $267 in January 2018. It exceeded hence the value more than 3 times. Maxim Bederov points out, the main thing is to hold it together and try not to make poor decisions. If a proper fundamental analysis has been conducted, there’s nothing to worry about, because a company’s shares can get cheaper only when the market is unstable.

In order to secure funds during financial collapses, the investment portfolio needs to be kept diversified. The basis of this approach is to acquire the securities which do not depend on each other. This way, when there’s a food market crisis, the lights for the account of investments in technology are kept on. This does not require to purchase tons of different shares. It’s better to discuss it with trusted people who have knowledge in the scope of the company’s activities. Investors most often diversify their portfolios by investing in precious metals, government bonds, and real estate. All major companies are buying various assets too, even Google (Alphabet) and The Walt Disney. Google ads is not the only source of income Alphabet has. It also benefits from managing Android OS. Also, Alphabet was amongst the first Uber investors and has its own assets in the self-driving industry.

Don’t forget to withdraw the deposit amount as soon as possible. Maxim stresses that such a decision will help to minimize the risks and provide a guaranteed income. When the price for securities goes up, many investors keep waiting for further growth and taking their time to withdraw the funds. Usually, they end up losing the money and the chance to make profits.

Additional things to consider before investing

The challenge of choosing a broker should be addressed very seriously: it can be an individual or a company, like a bank. All brokers have different fees regarding their services. Choose the ones with small interests and who have access to several international exchanges. Remember, buying shares of international companies is the best way to protect funds.

Maxim recommends not to disregard paid consulting. This way little money can be spent on discussing investment portfolios with professionals, identifying problems and possible ways to minimize the risks and start getting a stable income. Also, try to attend special events where well-known experts give lectures. Here useful contacts can be made which will help to access useful information about markets in the future.

Conclusion

Investment is a very complex process that takes restraint and concentration. Before investing in securities, don’t forget to conduct a careful analysis and decide on a strategy. It’s important to approach the analysis in a measured fashion: consult with friends who have expertise in the industry and maybe a few paid consultants. When deciding on a plan, follow the seven main investment principles:

- Save your money.

- Don’t put borrowed funds in.

- Invest in industries based on personal experience or which friends have knowledge about.

- Take advantage of the market’s downfalls.

- Diversify investment portfolios.

- Invest in securities on a regular basis.

- Withdraw returns at the right time.

Follow the rules, and your are most likely to achieve success. Just make sure to consider each factor, as the financial market doesn’t tolerate mistakes.

(Featured image c/o Maxim Bederov)

-

Crypto7 days ago

Crypto7 days agoRipple Launches EVM Sidechain to Boost XRP in DeFi

-

Africa2 weeks ago

Africa2 weeks agoCôte d’Ivoire Unveils Ambitious Plan to Triple Oil Output and Double Gas Production by 2030

-

Impact Investing2 days ago

Impact Investing2 days agoShein Fined €40 Million in France for Misleading Discounts and False Environmental Claims

-

Business2 weeks ago

Business2 weeks agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [NordVPN Affiliate Program Review]

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-400x240.jpg)

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-80x80.jpg)

![RDE, Inc. [ OTC: RSTN ] is set to soar in a perfect storm](https://born2invest.com/wp-content/uploads/2024/02/pexels-burak-the-weekender-187041-400x240.jpg)

![RDE, Inc. [ OTC: RSTN ] is set to soar in a perfect storm](https://born2invest.com/wp-content/uploads/2024/02/pexels-burak-the-weekender-187041-80x80.jpg)