Business

This Kevin Harrington-Endorsed Company’s Set to Soar in a Perfect Storm [RDE, Inc. | RSTN]

Right now, a perfect storm is brewing in the US economy, setting companies like Restaurant.com and CardCash.com [RDE, Inc. | OTC: RSTN] up for a record period of explosive growth. Here, we take a closer look at exactly what’s happening before hearing from Kevin Harrington (of Shark Tank fame) about why he’s so excited to be involved with these brands as a proud RDE, Inc. board member.

![RDE, Inc. [ OTC: RSTN ] is set to soar in a perfect storm](https://born2invest.com/wp-content/uploads/2024/02/pexels-burak-the-weekender-187041.jpg)

Right now, the US economy is in a weird state.

And that’s creating a once-in-a-lifetime opportunity.

What lies ahead will detail this opportunity for you. But first, here’s a quick sneak peek.

- For the last couple of years, we’ve been getting mixed messages. Between predictions of Goldilocks landings, recessions, continued growth, and everything in between, it’s hard to make sense of what’s going on.

- The real-world data is also mixed.

- On the one hand, we’ve got strong growth. GDP, jobs, you name it — business is good.

- On the other hand, we’ve got ongoing inflation, lagging wage growth, and a general sense of pessimism hitting the everyday American population.

- The result is a split-brain scenario. One half of the economy is behaving one way, while the other is behaving exactly the opposite.

The long story short here is that this split-brain economy is setting up a perfect storm of record growth. But only for companies that can play both sides of it perfectly.

And this is precisely what we believe RDE, Inc. [OTC: RSTN] with its flagship brands Restaurant.com and CardCash.com is doing. (PS: Read to the end to hear what Kevin Harrington — an original shark on Shark Tank — has to say.)

Here’s why we believe this to be so.

The US Economy Is Doing Fine — But a Slowdown Is Creating an Opportunity

Despite all the doomsday predictions over the last couple of years, the US economy is doing just fine.

In fact, save for a little bit of a lingering inflation hangover, it’s doing better than fine.

Over the last year, the U.S. economy grew at an “unexpectedly brisk 3.3% annual pace”.

Job growth has been strong, too — so strong that unemployment has now remained under 4% for the last two consecutive years. That hasn’t happened in over 50 years.

And save for the odd blip (such as last week’s selloff following higher-than-expected inflation), the stock market is continuing to soar — 24% growth in 2023, with plenty more to come.

In short, the economy in general is doing just fine. And the general consensus is that it will continue to do fine for the most part.

But, with that said, there will be a bit of a slowdown.

Now, don’t get me wrong here — a slowdown doesn’t imply negative growth. It just means slightly slower growth.

More precisely, in its most recent Economic Forecast for the US Economy, The Conference Board is forecasting GDP growth will “converge toward its potential of near 2 percent in 2025.”

Or, said another way, the economy will keep growing. Just a little bit slower.

But, depending on how you navigate it, that’s fine.

In fact, if you’re in a position like RDE, Inc. [OTC: RSTN], it’s more than fine — this just so happens to be the precise moment when opportunity comes knocking.

Consumer Spending Slowdown to Create Massive Opportunity in 2024

As for what’s driving the forecasted slowdown, the major factor here is consumer spending.

Yes, consumer spending was strong throughout 2023. But it is now showing signs of slowing.

To lift a lengthy quote from The Conference Board that sums it all up nicely, here’s what’s happening:

“Real disposable personal income growth struggled to outpace real consumer spending in H2 2023, pandemic savings are dwindling, and household debt is rising (along with delinquencies). Additionally, the growth in ‘buy now, pay later’ plans may also weigh on future spending as bills come due. Thus, we forecast that overall consumer spending growth will gradually slow to a standstill in Q3 2024 as households struggle to find a new equilibrium between income, debt, savings and spending.”

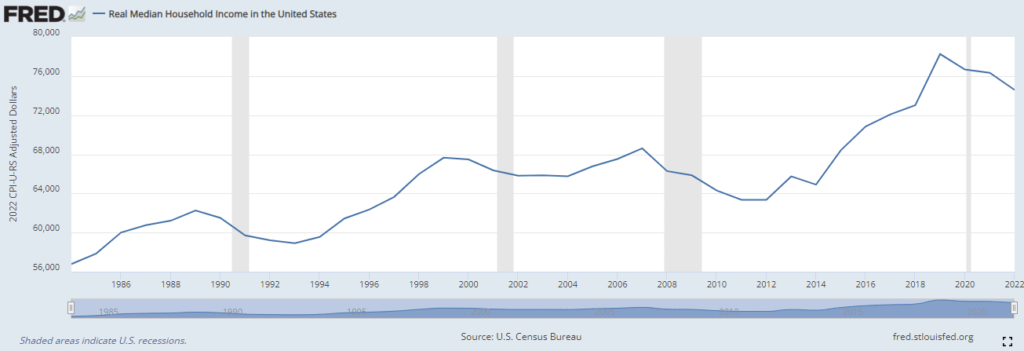

To illustrate exactly what’s going on here, let’s introduce a visual element.

That chart is the Real Median Household Income in the United States.

In other words, it’s income adjusted for inflation. And if you look closely, there are three major dips.

The first started in 1990.

The second started in 2008.

And the third, and current dip, started in 2020.

In other words, the dips line up with the early 90s recession, the 2008 GFC, and then the 2020 Covid pandemic.

Now, immediately, there’s something weird going on here. After all, if real incomes have taken a recession-like hit, why was consumer spending still so strong throughout 2023?

To answer that, we return to our quote above — dwindling savings, rising debts, and reliance on “buy now, pay later” schemes.

Basically, households have delayed the effects by turning to their savings and credit cards. But that party’s about to end.

Savings are running dry.

Credit lines are maxed out.

And real wages only grew by 0.8% in 2023, barely making a dent in the 4.69% tumble that came in the two years after COVID-19.

And that means, for the average household where the economy revolves around their personal finances, 2024 is going to feel like a recession.

Here’s The Opportunity | RDE, Inc [OTC: RSTN]

Now, immediately, you might be tempted to think this is a nightmare scenario for business. After all, there are a bunch of businesses out there that depend on consumer spending for the bulk of their revenues.

And, for some, it is a nightmare.

But shifting changes in consumer spending don’t impact all businesses the same way.

In fact, every time this happens, without fail, there are always a small handful of businesses like RDE, Inc. [OTC: RSTN] that experience record growth.

Essentially, what happens is big ticket items go on hold — new cars, overseas travel, etc. And at the same time, everyday household expenses might get a lookover and find themselves subject to a little rationalization.

But because people still want to treat themselves, demand for “affordable luxuries” goes up. Especially if they can get them at a discount.

The last time that happened was in 2008. And it’s about to happen again.

The Formation of a Perfect Storm

While RDE, Inc. [OTC: RSTN] wasn’t operating during the 2008 GFC, it is all too familiar with the “affordable luxuries” effect it had on one business it has since acquired — Restaurant.com.

For the unfamiliar, Restaurant.com is a restaurant meal deals business where restaurants sell discounted meal certificates directly to consumers.

And, as you would expect, this kind of business is in a prime position when household budgets tighten and affordable luxuries become the name of the game.

In fact, when looking back through past results, Ketan Thakker, CEO of RDE, Inc., notes that “the biggest year in the history of Restaurant.com was during the great recession of 2008. People still want to go out and do things but in recessions they want deals.”

Now, so far, so good. That gives RDE a stiff breeze at the tail.

But where’s the perfect storm? The raging gale of a tailwind?

Well, that’s on the other side of the economy — the business is good side.

Remember, 2023 was much better than expected. Growth is expected to continue, albeit just a little bit slower. And the stock market is ticking along quite nicely.

For investors in a public company like RDE, Inc. [OTC: RSTN], that’s the sort of dream scenario that only comes along once in a lifetime.

On one hand, they get the benefit of a market and economy that’s the polar opposite of a recession.

But at the same time, they get the additional tailwind of a business that’s set to absolutely boom as consumers adopt recession-like consumption patterns.

If that doesn’t sound like a perfect storm, then I don’t know what does.

But wait, it gets better.

2024 Will Be a Breakout Year for RDE, Inc.

With both of its flagship brands — Restaurant.com and CardCash.com — playing to the discounted “affordable luxuries” market perfectly, 2024 is already shaping up to be a bumper year for RDE, Inc. [OTC: RSTN].

But there’s a little bit more going on here than just that.

This year, RDE is also eyeing a Nasdaq Capital Markets uplisting. And, as promised at the beginning, here’s RDE board member, and original shark on Shark Tank, Kevin Harrington to tell you a little more about it.

That’s a lot of good news coming at once.

__

(Featured image by Burak the Weekender via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa1 week ago

Africa1 week agoCôte d’Ivoire Unveils Ambitious Plan to Triple Oil Output and Double Gas Production by 2030

-

Business5 days ago

Business5 days agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [NordVPN Affiliate Program Review]

-

Fintech2 weeks ago

Fintech2 weeks agoBitget Secures Operational License in Georgia, Strengthening Its Eastern Expansion

-

Cannabis15 hours ago

Cannabis15 hours agoCannabis Company Adopts Dogecoin for Treasury Innovation

![RDE, Inc. [NASDAQ: RSTN] hits the Nasdaq](https://born2invest.com/wp-content/uploads/2024/08/rde-inc-hits-the-nasdaq-400x240.jpg)

![RDE, Inc. [NASDAQ: RSTN] hits the Nasdaq](https://born2invest.com/wp-content/uploads/2024/08/rde-inc-hits-the-nasdaq-80x80.jpg)