Business

A Look at Banking Stocks: 1938 to 2023

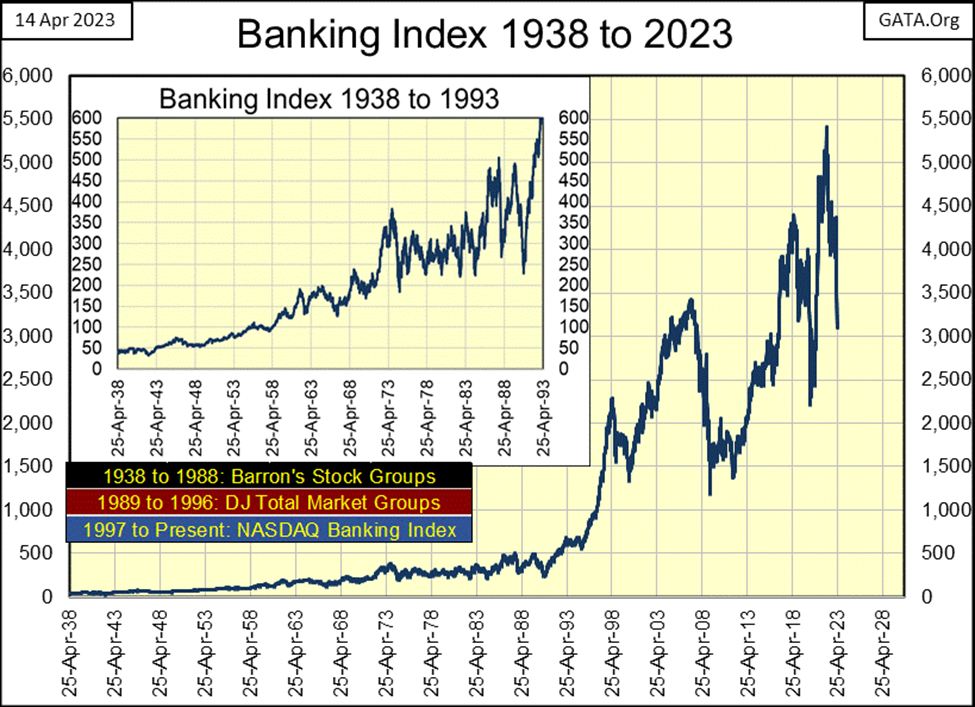

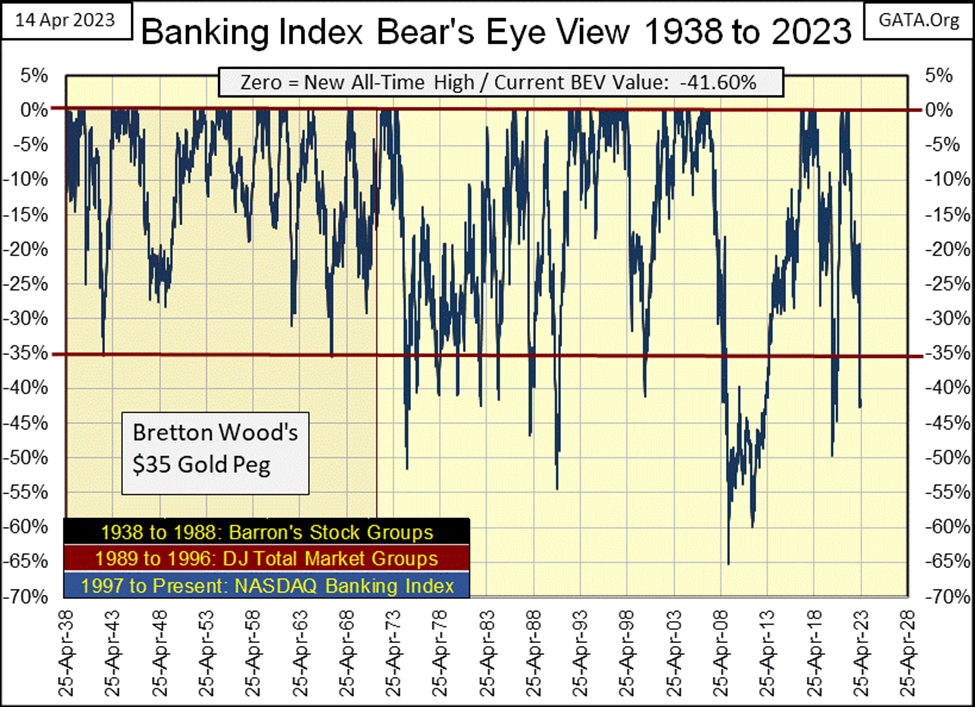

Following August 1971, volatility in banking stocks increased greatly. This banking index found itself below its BEV -40% line frequently. At the bottom of the sub-prime mortgage crisis, the valuation for this banking index was deflated by 65% from its last all-time high. At the bottom of the March 2020 Flash Crash, the banks’ valuation was deflated by 50%.

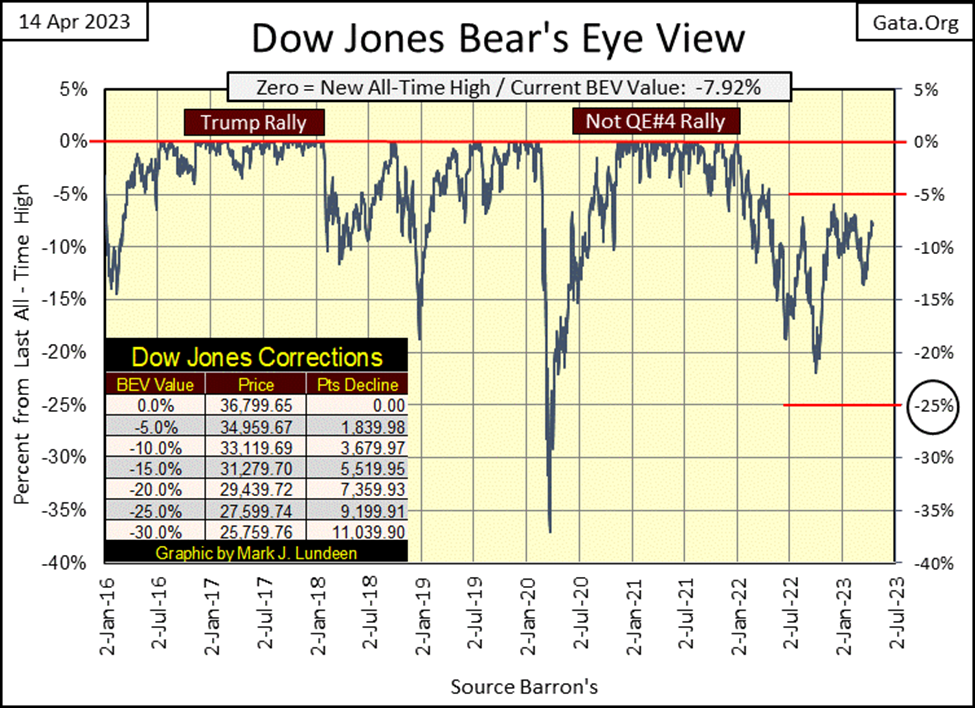

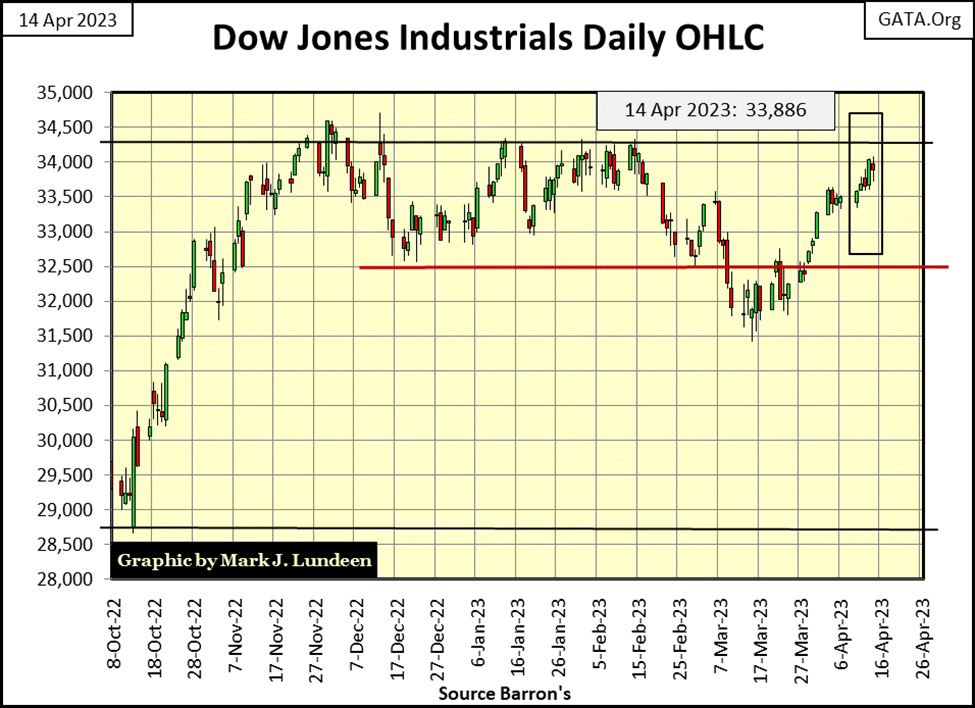

Like the little chu-chu train that knew it could, the Dow Jones continues chugging on up the hill towards a new all-time high. Of course, with a BEV of -7.92% at week’s close, it still has a way to go; 2,913 points if we’re looking at the Dow Jones in dollars. But why not just recognize what the Dow Jones is doing; it’s going up, which is better than when it’s going down.

So, am I recommending a buy on the stock market? Sorry, but I have to pass on that one, as I believe we are still very near to a major market top. And what is it about market tops that turns me off? They offer investors nothing but downside risk. Unlike market bottoms, market tops offer little potential for any reward for assuming those risks. In times like this, it’s best taking a seat in the market’s peanut gallery and just enjoy watching the bulls and bears have at each other far below.

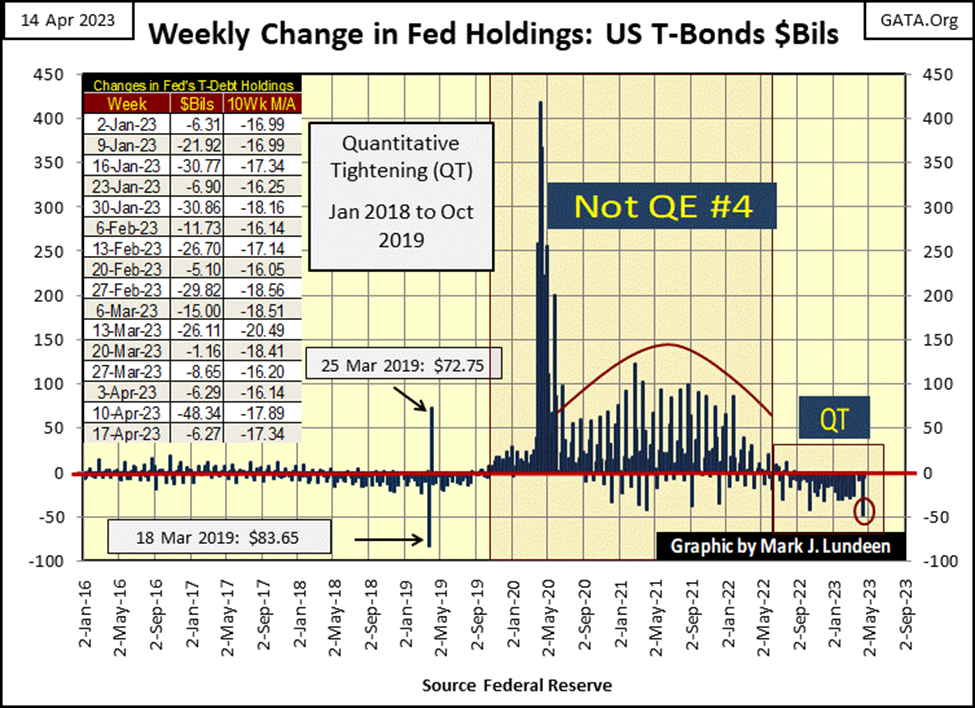

In week’s past, I’ve covered the idiot savants at the FOMC draining “liquidity” from the market with their QT.

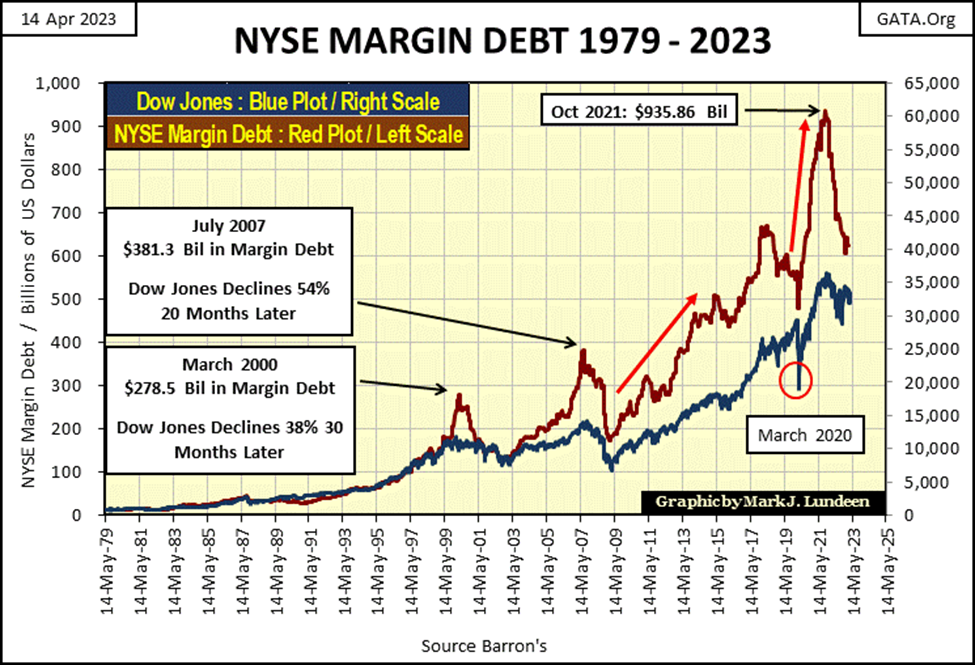

But the public has been withdrawing “liquidity” from the market too, by reducing their margin debt, as seen below.

In the 21st century, this has happened three times before, with never a positive development in the market. The;

- 2000-02 NASDAQ Tech Wreck;

- 2007-09 Sub-Prime Market Crash;

- March 2020 Flash Crash;

were all preceded by a reduction in NYSE margin debt. Now, for the fourth time in the 21st century, NYSE margin debt has again seen a steep reduction. Can that be good? I’m thinking it’s not.

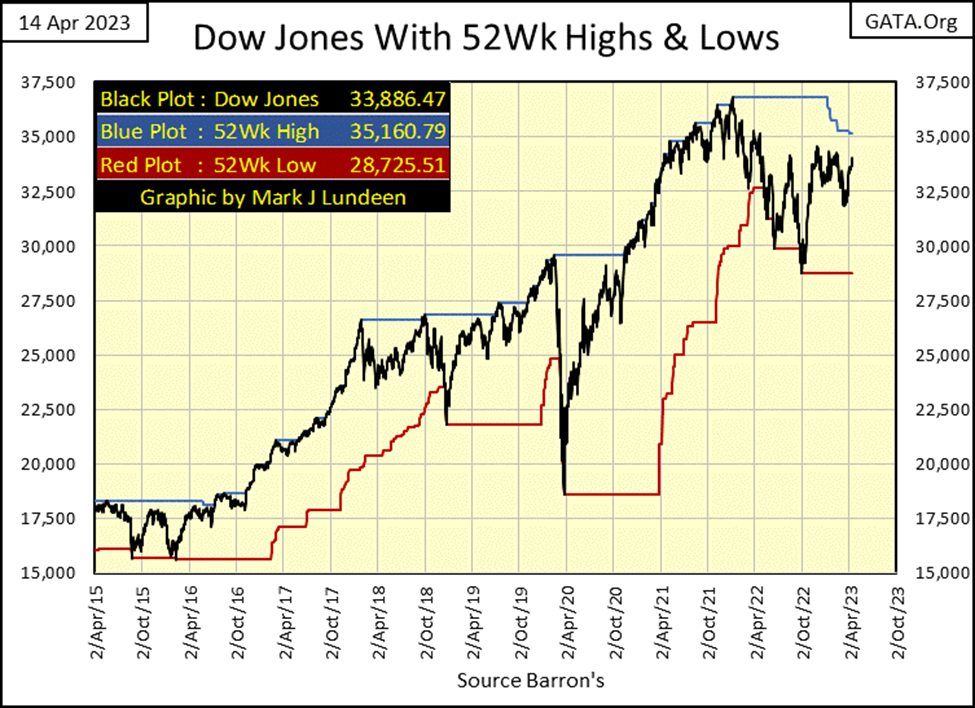

The Dow Jones is headed towards making a new 52Wk high, as seen in the chart below, but in a bear market sort of way. How is that? It’s been over 52Weeks since the Dow Jones has made its last all-time high (52Wk high), and now its blue 52Wk line in the chart below is trending down towards the Dow Jones.

For the Dow Jones to make a new 52Wk high this way, isn’t an omen of pending doom. But it does suggest the Dow Jones is currently advancing more like a geriatric patient in a walker, than an athletic youth charging up the hill.

Here is the Dow Jones in daily bars. If the Dow Jones can break above 34,400 with authority, or better yet 35,000, that would be good. But not good enough to make me care about the stock market. What could make me care about the stock market? Seeing the Dow Jones yield above 6% for the first time since the 1980s would be a good start. Then seeing the Dow Jones yield above 7%, as it closes something like 70% below its last all-time high of January 2022 (36,799) would be even better.

That’s about 11,000 on the Dow Jones. Hey, I’m a big bear. That so few “market experts” are now thinking this way, encourages me that maybe I’m on to something.

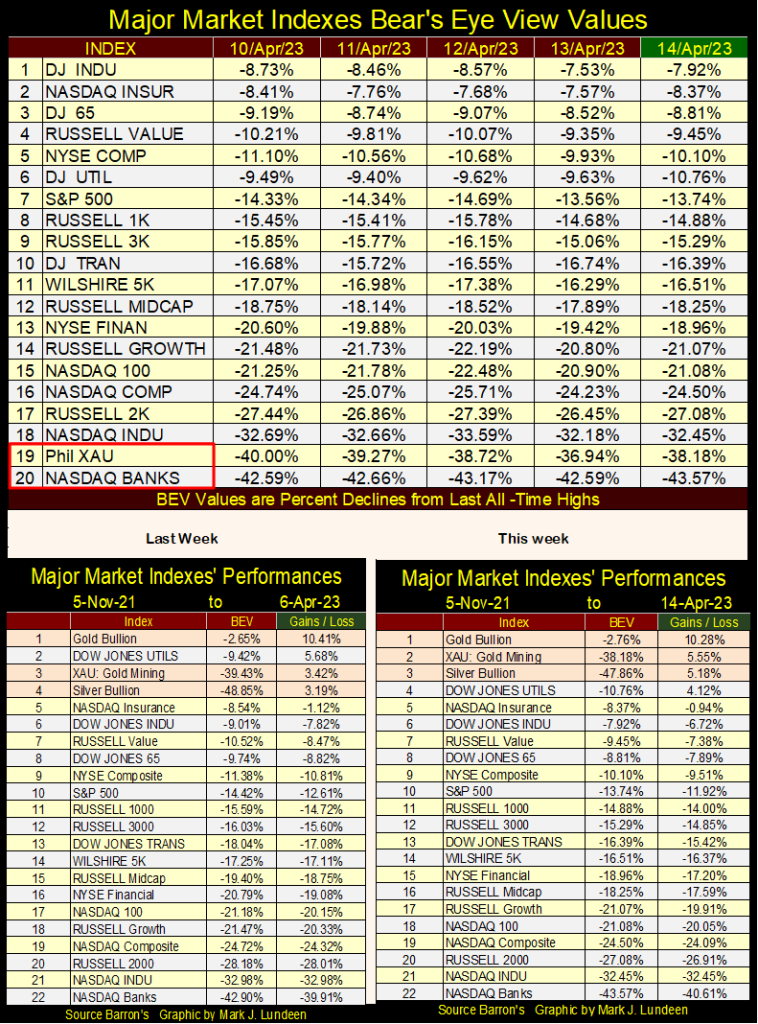

Moving on to my table of major market indexes’ BEV values, it’s been awhile since any of them closed in scoring position (less than 5% away from an all-time high), and a lot longer since any of them closed at a new all-time high (0.0% / BEV Zero).

The Dow Jones is the best of them, leading the pack at #1. And one doesn’t have to go far before seeing indexes 10%, and more from their last all-time highs. It’s been like this for a while, with these indexes hanging around where we see them at this week’s close; not going down, but not going up either. Everyone is waiting for someone to do something, or for something to happen.

The list of positive market events that could drive the market higher seems awfully limited, while those things that could take the market down are much more abundant. The Ukraine / Russian war, and the USofA’s increasing involvement in it poses many hazards to this market.

Why is the US and NATO pledging their treasure and blood for that corrupt regime? The fact that Ukraine’s current government was installed by Obama and Hillary, and then managed by Joe Biden & Son, after they ran a coup on the elected government is enough for me not to favor sending those crooks a single bullet in military aid.

And then fifty-two years after the US Government took the dollar off the gold standard, the world now seems ready to abandon the dollar as an international reserve currency. This is a big deal! Something that isn’t good for the stock, or bond market. Especially the bond market. All over the world, nations and wealthy individuals have billions of dollars of wealth, but not in bags of dimes and quarters laying around somewhere, but in US Treasury bills, notes and bonds.

If the world is going to dump the dollar, they’ll first sell their Treasury debt, then dump the dollars they receive from the sale in the international currency markets, begin buying commodities, and most likely both. The net effect for American citizens; is they’ll see CPI inflation begin to soar, as Wall Street’s banks crash, and as bond yields and interest rates soar to double digits.

No wonder the Federal Reserve, and the Bank of International Settlements are coming out with their own cyber currencies. After these central bankers have trashed the American dollar and Europe’s euro, do they have a choice? In their minds, they don’t.

There is lots of stuff for the bulls to be worried about. The banking system could begin a wave of failures. Joe Biden’s many failures in personal and professional integrity are going to come into the light of day. Let’s face it, Joe and his family have been selling out the United States for decades.

Among the power brokers, the Bidens mingle within Washington, they aren’t alone. Remember the Uranium One scandal, where Hillary Clinton, as Secretary of State, authorized selling something like 25% of America’s uranium to Russia, in return for something like a $130 million donation to the Clinton Foundation? Why isn’t the Department of Justice going after the Clintons? Sorry, I forgot they are too busy prosecuting Trump for no good reason.

One day, all this dirty laundry will come out, and be recognized as the truth. People worldwide will wonder what good are America’s “regulated markets,” when people like this are in control of them?

Did you notice it? For the second week the XAU in the table below was at #19, above the NASDAQ Banks, the new Tail-End Charlie at #20. Since April 2011, it seemed the XAU was bolted down at #20 below, but not anymore. Is it possible the gold miners are finally making their move upward to #1?

Looking at the performance table above for this week, precious metal assets took the top three positions, and all of them were above their levels of 05 November 2021. This is no time to sell, or so it seems to me that now is the time to let profits in gold and silver ride.

A few years ago, I pointed out a fact fully appreciated by me, that without Barron’s and the Dow Jones financial publishing company, I’d have nothing to write about every week. Way back then, I wrote it would be nice if my readers sent a short letter Barron’s statistical department and Dow Jones’ management, which continues providing funding for this vital public service, to say thank you for all you do. Over the entire world, for over a century, no other market is as well documented as are the American markets, and most of that is due to the efforts of Dow Jones Inc.

To the shock of Barron’s statistical department and Dow Jones’ management, some of my readers did send them e-mails thanking them. Apparently, no one has ever done this before. We are talking about people, and everyone likes a nice pat on the back for a job well done. Especially those who work in the dismal and mundane field of publishing market statistics, oppressed people, who most likely are forced to work in a damp, dark basement, next to a steaming boiler.

If any of my current readers would like to thank Barron’s statistics, giving them the recognition they so richly deserve with a quick e-mail, here are three e-mail addresses for contacting them. If you do, it will make for a very happy day for someone not expecting it, and God bless you for it.

I have readers in all of Earth’s 24 time zones. If you are inclined to do so, let them know what city and country you are writing from. Let them know there are people who appreciate them for all they do!

Send your e-mail to

And CC your e-mail to

Phil.Roosevelt@Barrons.com and mike.kokoszka@dowjones.com

It’s not appreciated by the general investment population as much as it should be, but the banking system has once again bungled themselves into a situation where everyone is at risk of significant personal loss. I thought it would be appropriate exploring the history of banking, focusing on some specific issues of what has been, and continues to be the problem with banking.

As always, the data is from Dow Jones inc, because for well over 100 years, Dow Jones, via the Wall Street Journal, and Barron’s has made available to the public hard market and financial data not found anywhere else. If you like my charts, charts that frequently span back before the Great Depression, keep in mind none of them would be possible had Dow Jones not long ago published this data in the public domain.

Currently, I’m only keeping track of the NASDAQ Banking Index. Unfortunately, my files containing the NASDAQ Banking Index data only goes back to December 1996. But in the past, I did keep weekly data for the Dow Jones Total Market Groups (DJTMG), which had a banking index in it. Barron’s still published this data, but in March 2019 they reconfigured their DJTMG, and other data sets. I dropped the DJTMG, as to continue maintaining this data set would have taken more work than I was prepared to do.

But the DJTMG only went back to October 1988, when Barron’s discontinued publishing their Barron’s Stock Averages (BSA), a data set that goes back to the late 1930s, which contained a Banking Average. It also contained an Average for Gold Mining, which is the only stock average from the BSA that survives to this day, as the Barron’s Gold Mining Index.

Using devisors to stitch these three data sets together, I can now plot eighty-five years of banking in the chart below, from 1938 to the close of this week. This chart is interesting, but its usefulness is limited as over the past eighty-five years, valuations in the banking shares have been inflated by the “monetary policy” of a bunch of idiots at the FOMC. In the chart below, how can one relate data from 2023 to data from 1938? You can’t.

To generate a view of this data that provides a deeper insight, I’ve taken the data seen above, and converted it into my Bear’s Eye View (BEV) format below, where each new all-time high is converted into a 0.0% (aka BEV Zero). All other data points not a new all-time high, register as a percentage claw back from its last all-time high.

In effect, the BEV format takes data in dollars, and compresses it within a range of 100%, with 0.0% being new all-time highs, and -100% being a total wipeout in valuation, and you can’t go below that.

I call this format The Bear’s Eye View, as it is how Mr Bear sees these banking stocks, with every new all-time high being no more than a big fat zero, and everything else as a negative percentage clawback from its previous all-time high.

Whether the new all-time happened in July 1938 (41.94), or January 2022 (5,408.36), they are all big fat zeros (0.0%) to Mr Bear. That plus, a 30% clawback from the 41.94 seen in July 1938, or from the 5,408.36 seen in January 2022, impacts the owners of these shares equally hard; a 30% reduction in valuation.

So, in terms of all-time highs, and clawbacks from them, the Bear’s Eye View below provides us with a superior insight of the dollar data for the banking stock seen above.

Below, I enclosed the era where the US dollar was pegged to $35 for an ounce of gold, from April 1938 to August 1971, to highlight the differences in volatility prior to, and after the US government “temporarily” suspended the dollar’s $35 gold peg. Then US Secretary of the Treasury, John Connally made the following comment on this occasion to a disbelieving financial media.

That is how a real “policymaker” goes about making monetary policy! Though in 2023, the dollar has become a problem even for Washington. It’s interesting noting as Governor of Texas in November 1963, John Connally sat with President Kennedy in the presidential limousine, when JFK was assassinated in Dallas Texas.

Returning to the BEV chart below, during the era when the dollar was pegged at $35 gold, the banks never saw a market decline of over 40%, which suggests the banking system was conservatively managed, and bankers shunned risks where they could.

Following August 1971, volatility in banking stocks increased greatly. This banking index found itself below its BEV -40% line frequently. At the bottom of the sub-prime mortgage crisis, the valuation for this banking index was deflated by 65% from its last all-time high. At the bottom of the March 2020 Flash Crash, the banks’ valuation was deflated by 50%. Now three years later, this week these banks closed below their BEV -40% line.

Is this a bottom? Or is more deflation in the banking shares to come?

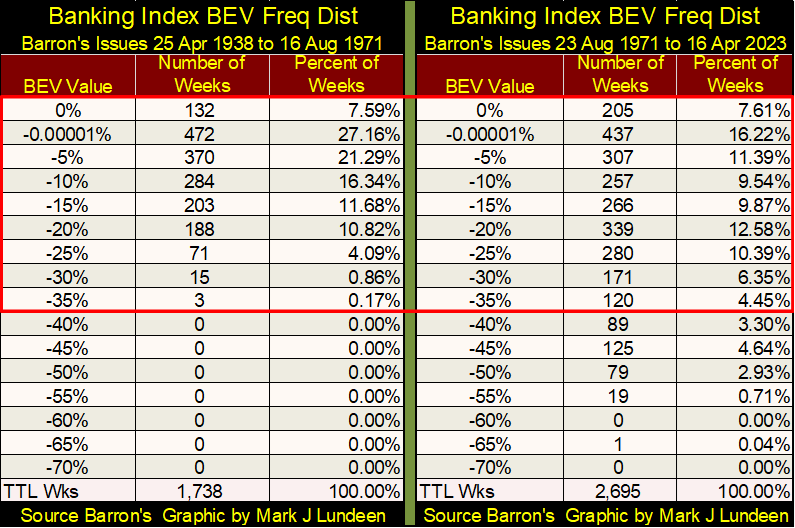

A nice thing about BEV data, we can compare one era with another by seeing the frequency the data is at BEV Zeros, and the claw backs from them, as in the two tables below.

In the left table for the pre-August 1971 data, this banking index never saw a decline of over 40%. After August 1971, the banks saw 313 weekly closes below its BEV -40% line, that is six years in the penalty box below the BEV -40% line. I think this is an important point to be aware of; the elimination of the Bretton Woods $35 gold peg did not stabilize the banking system, as was promised at the time. But in fact, did quite the opposite.

What changed after August 1971? Bankers who had personal memory of the Great Depression retired and were replaced by those who did not. Post-August 1971 bankers were very willing to accept great risks, in derivatives, mortgages, and anything else that promised above-average profits, and were fearless in using the public’s deposits towards their personal gains. When they lost, they were bailed out by the government.

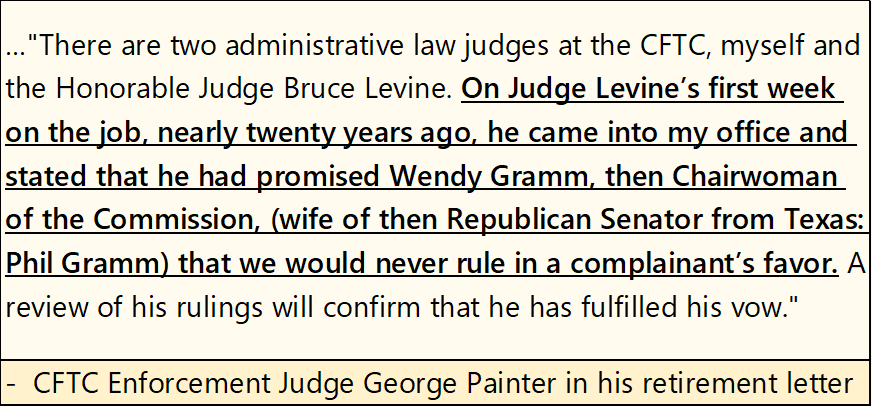

That America’s financial system was “regulated” was all the better, as Washington always allowed the bankers to choose those personnel who would “regulate them.”

Following a successful career at the SEC or CFTC, too many of our “regulators” find themselves employed by the same Wall Street firms they once “regulated.”

Is it just me, or do others also feel the magma shifting beneath Wall Street?

Let’s look at gold’s BEV chart. Jeeze Louise, gold is getting ever closer to making a new all-time high. It closed on Friday with a BEV of -2.76%, but on Thursday it closed with a BEV of -1.01% ($2,040.58), less than $21 from its last all-time high of August 2020.

Yes I know, on Friday the COMEX goons came in to keep gold from closing at a new all-time high. But it is what it is. And what it is, is good market action. Should it continue, we’ll see gold at a new all-time high before May, or next week.

Over at King World News, Eric King interviewed Alasdair Macleod, head of research at Goldmoney, who has some important insights into the reduction of gold inventories in London and at the COMEX. If true, and I don’t doubt it, this is signaling the termination of the “policy makers” manipulation in the gold and silver markets, with much higher prices for the old monetary metals to come.

I’m feeling better. I stopped looking at gold’s BEV -10% line below as a possibility, before gold makes a new all-time high.

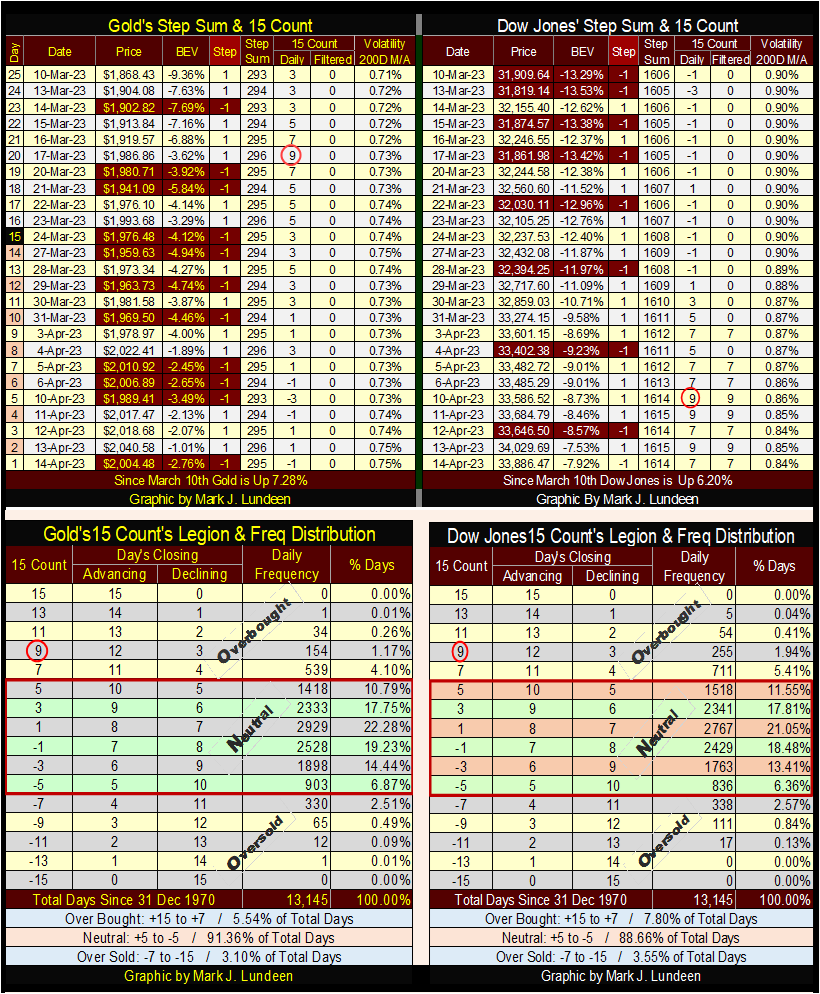

The step sum tables for gold and the Dow Jones continues to be points of interest, specifically their 15-counts. Gold saw a 15-count of +9 on March 17th. A +9 is a very overbought market, and markets don’t like being very overbought. So, as expected, gold began seeing an increase in daily declines in trading, closing this week with a 15-count of -1.

As seen in gold’s 15-count legion & freq distribution table (lower table / left side), gold’s 15-count saw a healthy correction, closing the week with a -1, more daily declines (8) than advances (7) in a running fifteen-day sample. Still, for the second week in a row, gold closed above $2000 an ounce – most unusual, seeing valuations rise as a 15-count decline.

I also note gold’s daily volatility’s 200D M/A continues increasing, closing the week at 0.75%. This is good, as bull markets in gold and silver are volatile markets, as flight capital flees the stock and bond markets, seeking safety in precious metal assets. Should gold’s daily volatility break above its 1.00% line, expect some wild times on the floor of the NYSE and in the NASDAQ markets. That plus seeing the bond market seeing rising selling pressure – rising yields.

So, why is daily volatility increasing in gold, as it is approaching a new all-time high? It seems that I’m not the only one who feels the magma beneath Wall Street begin to shift.

The Dow Jones has been overbought since April 3rd, when it first saw a 15-count of +7, and has remained overbought since then, seeing a +9 this week. This indicates the stock market is seeing many more daily advances than declines, and has since mid-March, as seen in the Dow Jones step sum table above.

For all that, the Dow Jones is up over 1000 points, and that is pretty good. Let’s see what it does when its 15-count declines to a -1, as gold did. Unlike gold, I doubt the Dow Jones will see its valuation rise as its 15-count declines.

__

(Featured image by sergeitokmakov via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto5 days ago

Crypto5 days agoUniswap and BlackRock Partner to Launch BUIDL in DeFi

-

Cannabis2 weeks ago

Cannabis2 weeks agoScientifically Verified F1 Hybrids Set New Benchmark for Indoor Cannabis Yield and Consistency

-

Biotech1 day ago

Biotech1 day agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Fintech1 week ago

Fintech1 week agoImpacta VC Backs Quipu to Expand AI-Driven Credit Access in Latin America