Biotech

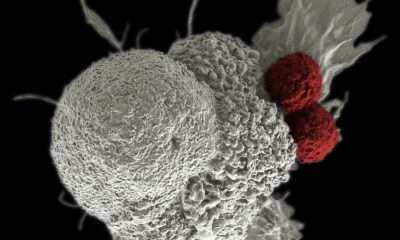

Belgian biotech company specializing in cancer treatment goes public

Celyad Oncology—a biotech startup creating a highly specialized treatment for relapsing multiple myeloma patients—has just had its clinical trial validated by the FDA. A major milestone in their development, the market reaction was overwhelmingly positive. Some analysts are now eyeing a 3-month price target of $25.28, a 119% increase from the post FDA approval price of $11.54.

“This is a decisive moment for our company,” said Filippo Petti, the current director of Celyad Oncology, a Belgian biotech company founded in 2004 and located in the French-speaking commune of Mont-Saint-Guibert in the Walloon Region. This week in the United States, the FDA (Food and Drug Administration) has validated the upcoming launch of the company’s new clinical trials, which are going to conduct a study around a new approach to the treatment of cancer.

The startup—who is just one of several innovative biotech players driving advancement in the sector—notably specializes in the highly specialized and delicate case of patients whose existing drug treatment does not deliver the expected response when treating relapsing multiple myeloma. Celyad Oncology had applied to the US Drug Administration to validate a new phase of testing in which the biotech will test a new process that does not involve genome editing (corresponding to the localized modification of genomic sequences, which is a dangerous process).

To read more about advancements in the biotech sector along with all the daily business news, head to the app store, and download our free companion app, Born2Invest.

Already up by more than 11%

On Tuesday, July 14th, when the FDA announced that the biotech stock price listed on the Brussels Euronext and the Nasdaq had gained 11.7%, a sharp rise that gave it visibility until Thursday, when the share price climbed a further 2.45% to $11.4 (€9.6). For Boursorama analysts, the 3-month price target is $25.28, which demonstrates the company’s potential in cancer research.

“Today’s announcement demonstrates our ability to advance in parallel several ready-to-use allogeneic candidates based on different technologies not involving genome editing into clinical research”, said the company, adding that “for the CYAD-211 program, our team has enabled the project to progress from the proof of concept phase to an effective IND in a very short period of time, less than two years.”

A fast-growing sector

For several months now, Société Générale Bank has grouped 48 of the sector’s best-performing biotech companies under the “Next Biotech” index. In this year 2020, it is currently indicative of strong growth in the biotech market, which has taken advantage of the health crisis to have numerous growth levers at its disposal.

Despite the stock market crash in early March, a fund like Pictet Biotech has risen 16% since the beginning of the year and 37% since its dip in March. In recent days, US biotech Moderna Therapeutics has been in the spotlight, as its research into a vaccine against COVID-19 has taken another major step forward with the validation of a final test phase.

Last month, Lemon Press also gave a comprehensive report on a very similar situation in the health tech market, where those health-care startups that have taken advantage of the current climate to attract more investors. The first quarter of 2020 set a record for fundraising in the sector, with $8.2 billion in new money raised worldwide, a marked increase of 76 percent compared to the first quarter of last year.

__

(Featured image by Bongkarn Thanyakij via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in Presse Citron, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crypto2 weeks ago

Crypto2 weeks agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Cannabis2 hours ago

Cannabis2 hours agoCBD and CBG Show Promise in Reducing Fatty Liver and Improving Metabolism

-

Impact Investing1 week ago

Impact Investing1 week agoGreen vs. Brown Stocks: Climate Policy, Capital Costs, and the Battle for Market Returns

-

Africa4 days ago

Africa4 days agoSouss-Massa Council Approves Budget Surpluses and 417M Dirham Loan for Infrastructure and Water Projects