Crypto

Here’s your best investment opportunity outside of stocks

Bitcoin and other cryptocurrencies may be declining, but blockchain seems to be the next revolution since the internet.

I just gave my second keynote for a major, top-secret crypto conference. It was SO secret, the organizer didn’t disclose the location on the website and only let us know where to travel to at the last minute.

These techno visionaries want a bottoms-up world like me, but with total transparency and total privacy! And that’s what blockchain technologies are all about. In fact, I see that as the next revolution to follow the internet.

And it’s bubbling as the internet did initially as well!

What to remember

That’s why it’s important that we remember that the internet, in the very late 1990s started with an extreme bubble that exploded into February 2000 and then collapsed 93 percent before beginning a real bull market that’s only peaking now.

Breakthrough new technologies always start with a “hype” phase during which their potential is dramatically overstated in the short term.

Then, when that bubble collapses, the technologies are underestimated until the “real” bull market becomes evident after a few decades.

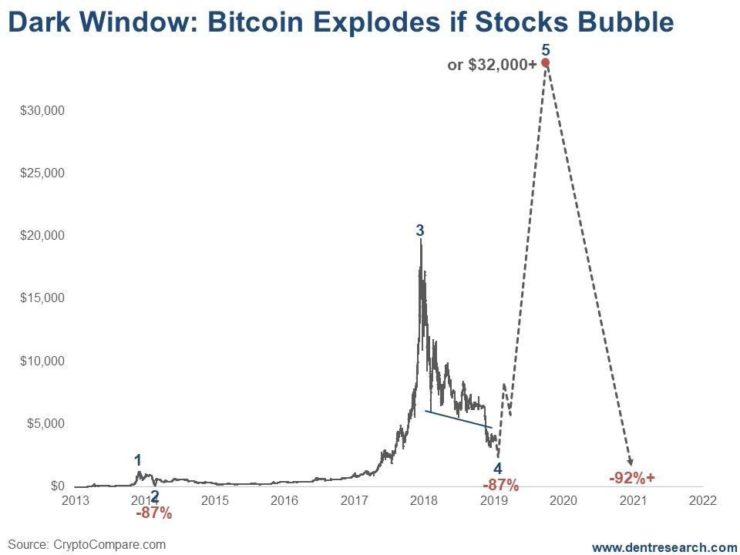

I am clear about one thing. If stocks have this “Dark Window” final blow-off rally that looks increasingly likely to me, bitcoin and cryptocurrencies will almost certainly have their own dramatic blow-off rally as well.

Recall that bitcoin exploded from $1,350 in May 2017 to $19,780 in just seven months! That makes it the most dramatic bubble in history, greater than even the infamous tulip bubble into 1637.

Bitcoin projection

Here’s my projection for Bitcoin if stocks see a final blow-off rally and top:

I can look at the entire bitcoin bull market since 2011 through the Elliott Wave filter. When I do that, it looks like the classic 5-wave rally.

The first wave peaked in late 2013 and crashed 87 percent into early 2015. The next wave peaked in December 2017 and crashed, thus far, 84 percent into its recent low around $3,200. If it repeats the 87 percent crash previously, that would be put it as low as $2,600 just ahead.

Then, if stocks take off soon, as I expect they will, bitcoin could easily rally to new highs.

The target

My best estimate, and it could be higher, would be $32,000.

That target would be proportionate to the internet final wave up into February 2000 after the late 1998 mini-crash — the internet and Nasdaq Dark Window final rally back then. But this would occur ONLY if stocks see that final bubble into late 2019/early 2020.

And like last time, bitcoin is likely to peak about a month before stocks, just like it did in late 2017 and as the internet did in early 2000 before the Nasdaq and stocks peaked.

Stay tuned for a very interesting and very bubbly 2019.

(Featured image by Aleksandar Grozdanovski via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech7 days ago

Fintech7 days agoFirst Regulated Blockchain Stock Trade Launches in the United States

-

Africa2 weeks ago

Africa2 weeks agoAir Algérie Expands African Partnerships

-

Cannabis3 days ago

Cannabis3 days agoAurora’s Electric Honeydew Debuts in Poland, But Shared Registry Raises Patient Caution

-

Markets1 week ago

Markets1 week agoRising U.S. Debt and Growing Financial Risks