Crypto

Is the Bitcoin crash over yet?

With the recent price of Bitcoin in the market, a crash is not far from over yet. What follows may just be detrimental to the stock market as well.

There is a similarity between the internet bubble and crash and the Bitcoin bubble today.

At the time, I saw two possible scenarios. Both are still viable today, but the degree of the 60 percent crash in Bitcoin tells me that we’re most likely experiencing scenario two, where the cryptocurrency hit its top near $20,000.

That doesn’t take scenario one out of the running. There’s still a remote chance that Bitcoin could surge back and break above $20,000, after which it would be curtains.

Neither scenario is good news for stocks.

Here are some updated charts:

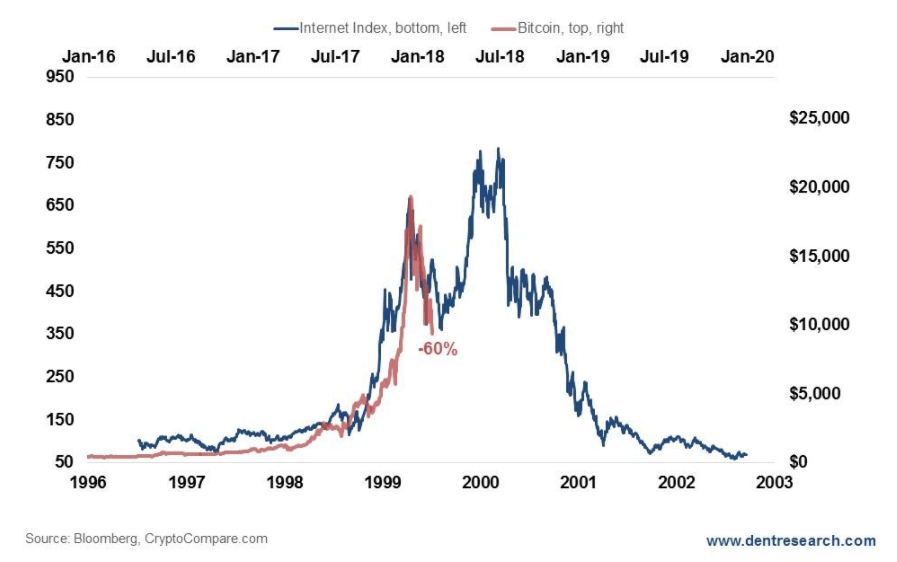

Bitcoin Bubble vs. Internet Bubble, Scenario 1

The internet bubble saw a 46 percent crash in 1999 before rocketing to a new high in early 2000. The Bitcoin bubble has already seen a 60 percent crash, which makes a new high or scenario one less likely. But it is still possible if we can hold the recent 8,800 lows at 60 percent down from the top.

That said, this recent crash makes scenario two look more likely, especially if it goes down further.

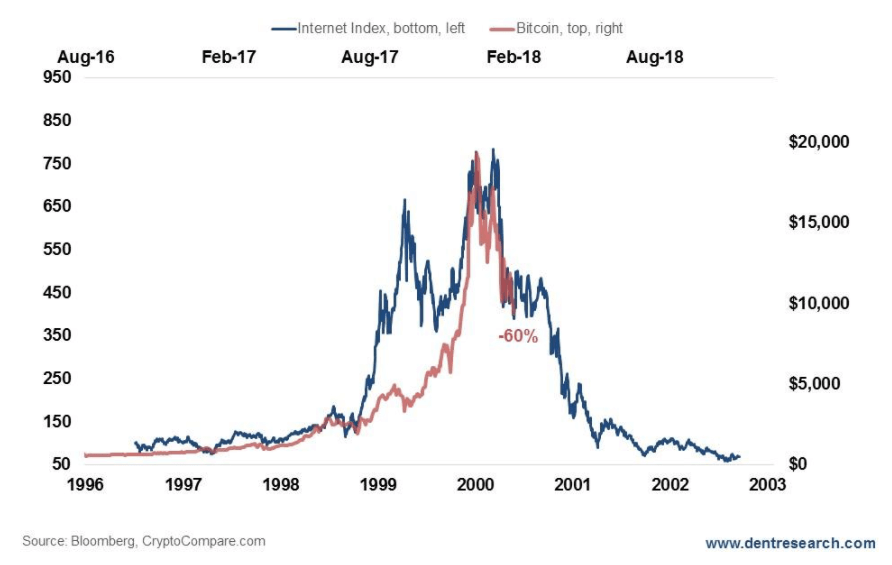

Bitcoin Bubble vs. Internet Bubble, Scenario 2

That scenario would see a crash down to as low as $800 to $1,000 on Bitcoin, which would be down more than 95 percent from the top.

That would be a signal of bubble worry for the stock market. The coming weeks are critical.

Any new lows in Bitcoin would strengthen the likelihood of scenario two unfolding — that Bitcoin and cryptocurrencies peaked around $20,000 and the stock market will follow on about an eight- to nine-week lag.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Crypto1 day ago

Crypto1 day agoCrypto Markets Surge on Inflation Optimism and Rate Cut Hopes

-

Biotech1 week ago

Biotech1 week agoSpain Invests €126.9M in Groundbreaking EU Health Innovation Project Med4Cure

-

Biotech4 days ago

Biotech4 days agoAdvancing Sarcoma Treatment: CAR-T Cell Therapy Offers Hope for Rare Tumors

You must be logged in to post a comment Login