Business

Brazil dominates the coffee market

Crop exports are affected as Canada and China continue to have weaker trade relations. This is due to the political struggle over the Huawei executive who could be deported by Canada to the US to face fraud charges.

Wheat

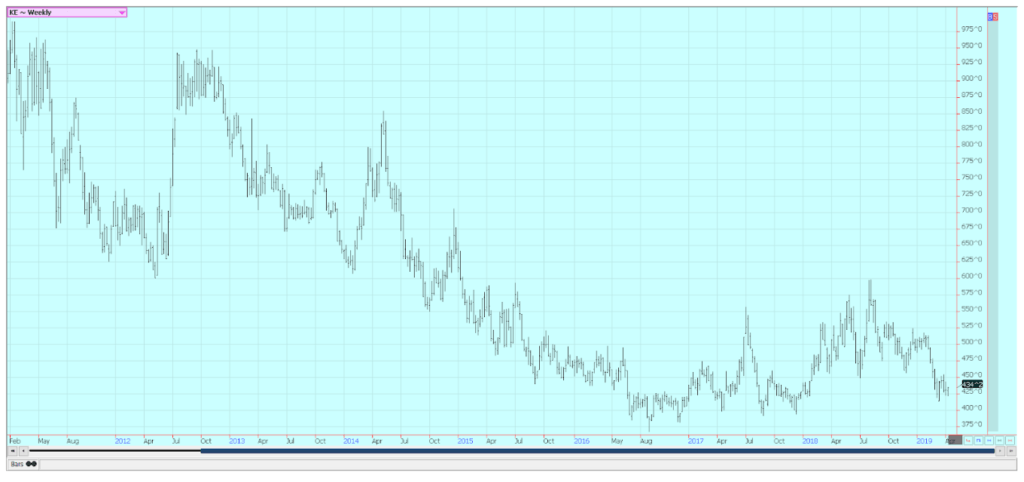

Winter wheat markets were mixed last week, with Chicago SRW a little lower and HRW and Minneapolis spring wheat trading a little higher. Chicago SRW remains in a trading range developed over the last few weeks, but HRW acts weak while holding a support point on the weekly charts. Trends in Minneapolis remain down. Minneapolis remained just above the recent lows on fears of a dramatic increase in planted area to spring wheat in Canada. Spring wheat prices have lost a lot and could go lower in the short term to price in the potential increase in planted area.

On the other hand, some reports from Canada indicate that producers there would rather stick with the normal rotation rather than make any big changes in order to maximize yield potential now and over time. That implies that any switching of crops planted area might be minor. The US spring wheat planted area was projected to be significantly down in the coming year, but not enough to offset the potential increased area in Canada. The US spring wheat area saw a major storm move through late last week and many areas go over one foot of snow. Heaviest snow came in eastern planting areas, but almost all areas got some significant precipitation.

Planting progress will be slow now as producers wait for the snow to melt and for the ground to dry enough to permit work and equipment to be used. It is cold in the region now and snow will be slow to melt. Any major planting delays now could mean that some US spring wheat area lies fallow or is planted to Soybeans, especially with the current weaker prices. The monthly WASDE reports showed an increase in US ending stocks due to the somewhat higher current supplies seen in the quarterly stocks report. The changes were mostly as expected.

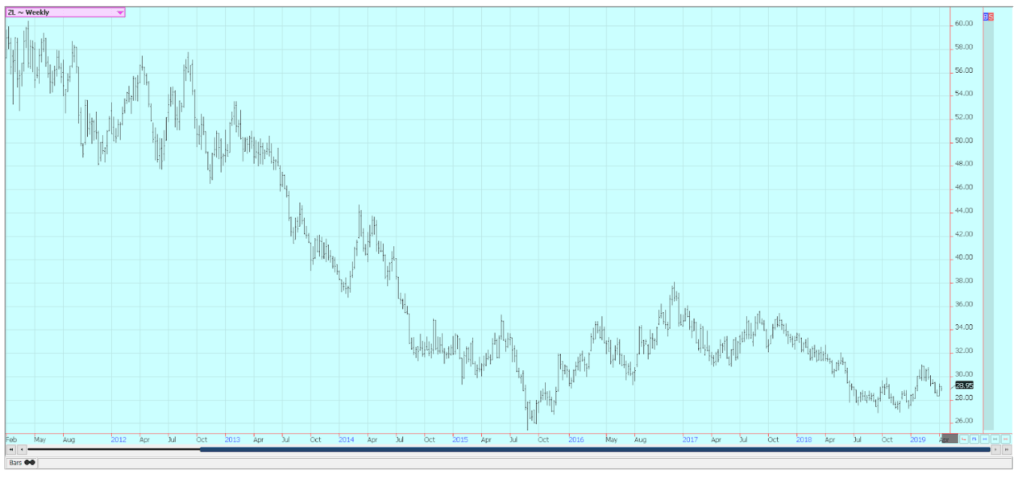

Weekly Chicago Soft Red Winter Wheat Futures ©Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures ©Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures ©Jack Scoville

Corn

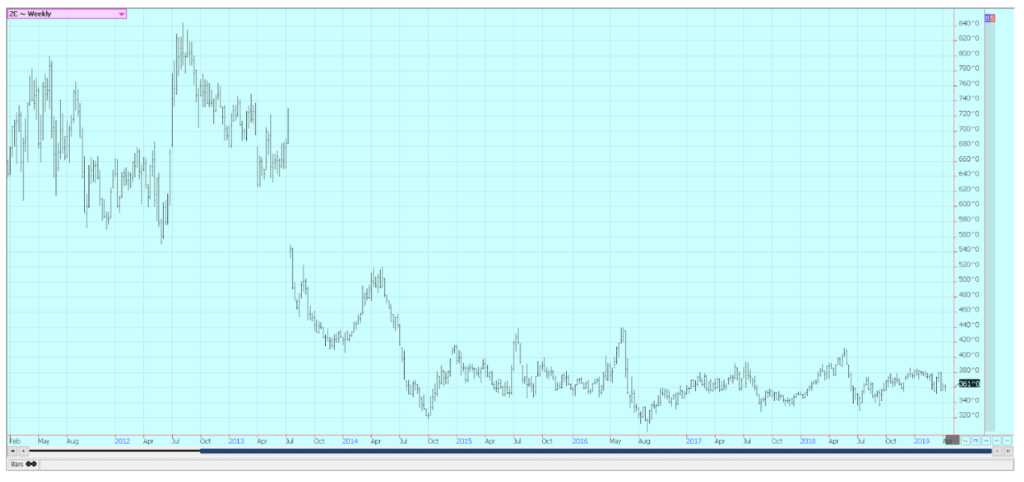

Corn was a little lower last week and remains in a trading range overall. The market is holding support on ideas that prices are cheap enough for this time of year. USDA released its monthly supply and demand updates in the first part of the week and showed reduced feed and export demand to put ending stocks estimates higher in line with the data released in the quarterly stocks report. The report was considered neutral to prices. The weekly export sales report showed poor export demand. Argentina has been offering at equal or cheaper prices than the US and the Brazil winter corn crop is being planted under mostly good conditions. Some parts of the Brazil growing area is turning too dry and it could be that the dry season is starting early. Yield potential could be reduced if the dry season comes before pollination, which is still several weeks away. The crop is getting planted early in many areas in an effort to beat the dry season, so it is a wait and see situation for now. Planting conditions in the US are not real good at this time.

The Midwest and Great Plains saw a major winter storm last week and many areas north and west of Chicago saw between one and two feet of snow. Another big storm moved through the Delta and Southeast over the weekend. Both areas will need time to dry out before fieldwork can get started again. It remains cold in the Great Plains and Midwest so the snow will be slow to melt and the grounds will not get warm enough to allow for any planting. Most producers did little or no fall preparation so many still need to apply fertilizers and other chemicals before starting to plant. The crop could be planted late unless the weather improves soon, but forecasts call for more systems to develop over the next couple of weeks and for temperatures to remain cool. Warmer and drier weather is in the long term outlook after the next couple of weeks.

Weekly Corn Futures ©Jack Scoville

Weekly Oats Futures ©Jack Scoville

Soybeans and soybean meal

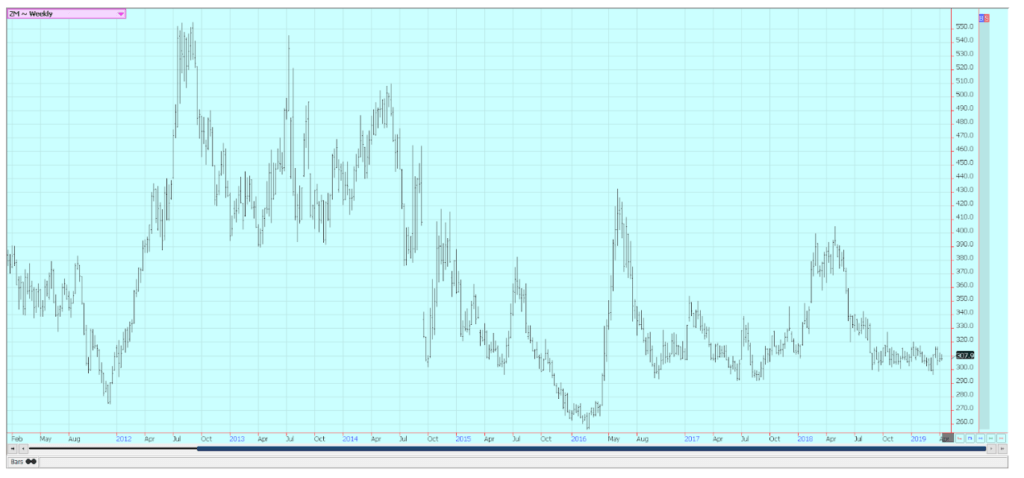

Soybeans were a little lower and soybean meal was a little higher last week. The major news item came on Thursday when USDA released its weekly export sales report. The report showed poor sales of soybeans and huge sales of pork to China. The big purchase of US pork by China despite very high tariffs on US goods showed to many just how big the Asian Swine Flu epidemic is in China. The government reports that a couple of million hogs have been lost but private estimates show much higher loss potential. Some suggest that the total losses of hogs are equal to or greater than the combined production in North and South America combined. It is an indication of the very strong demand potential from China for hogs and pork and products and also an indication that soybeans and meal demand could be significantly less in the coming year as China works to eradicate the disease and then re-populate its herds. The soybeans demand could take several years to recover as it will take time to rebuild the herds.

Export differentials from the US and South America have been under pressure for this reason and also as the South American crop is now available. Prices are a little lower now in Brazil than in the US despite a lack of farmer selling in Brazil. They are unhappy with the price and nervous over economic changes going on in Brazil as the new president works to overhaul the public pension system and finds strong resistance from the Brazilian legislature. Some shifting of business back to the US could happen if the Brazil farmer holding patterns are strong enough and soybeans become more scarce in Brazil ports, but basis levels right now do not indicate any shortages there. US futures prices are usually under pressure at this time of year due to the arrival of the South American harvest, but should soon find a seasonal low and attempt to rally. The magnitude of any rally will depend on the US weather, which is less than favorable right now.

Weekly Chicago Soybeans Futures ©Jack Scoville

Weekly Chicago Soybean Meal Futures ©Jack Scoville

Rice

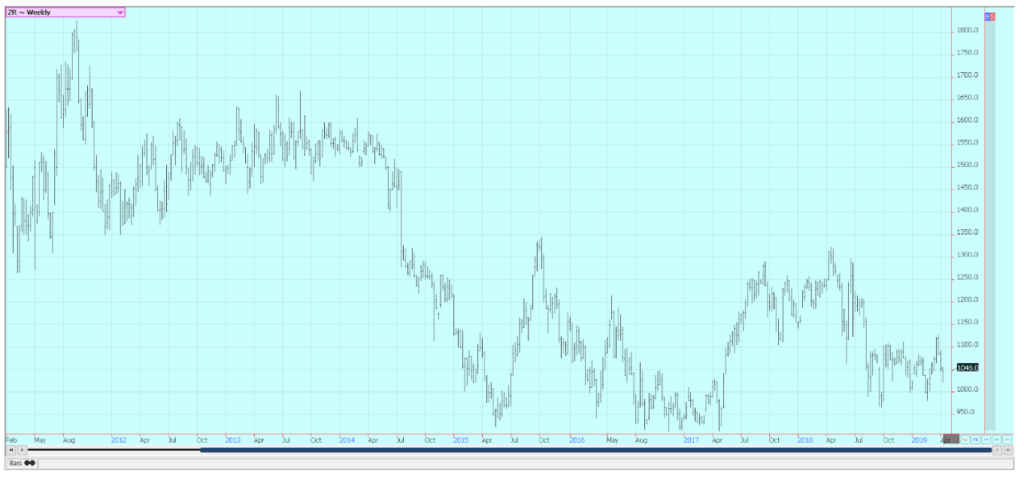

Rice was lower for the week but closed close to the highs of the week after a push into some longer-term support areas seen in the first few days. It is possible that another short term low has been found. USDA showed increased ending stocks for All rice in its monthly supply and demand updates, but the big changes were made in medium to short grain categories. Long Grain ending stocks were unchanged on lower milled rice export demand but higher domestic demand. The average farm price was unchanged. Planting has been active near the Gulf Coast and in Texas. Planting progress has been more sporadic to the north due to cool and wet conditions, but some planting has been done. Producers in Texas and Louisiana reported some impressive rains over the weekend that will help flush the crop and aid in germination. The crop in these areas seems to be off to a good start.

USDA has shown average progress in its reports. The weekly export sales report was poor last week. The market seems content to trade in a wide trading range for now and this implies that somewhat higher prices are possible over the next few weeks. The domestic market is using price breaks to extend forward coverage as the mills push to own rice into the next harvest. Prices have been firming in Texas due to good demand for limited supplies.

Much of the rice is moving to Mexico. Prices have been firm in Arkansas due to a lack of producer selling as they wait to get the next crop planted. Some in the trade are disputing the planted area estimates from USDA. They think the planted area will be less in part due to the weather but mostly due to the prices. Some producers will switch to competing crops such as soybeans, cotton, or Sorghum due to costs of production and relative return potential. Current supplies are high and bearish traders point to this fact as a reason to keep prices relatively cheap or at least in a trading range.

Weekly Chicago Rice Futures ©Jack Scoville

Palm oil and vegetable oils

It was a lower week for world vegetable oils markets. Palm oil was lower despite positive data from MPOB. March palm oil production was 1.671 million tons, from 1.544 million in February. The production was strong at a time when production normally starts to decrease. Demand was much improved on the month at 1.617 million tons, from 1.321 million in February as many buyers started to buy ahead for the spring festival season. Ending stocks were down at 2.917 million tons, from 3.059 million in February. The positive data was not enough to keep the short term uptrend going and prices fell to support areas on the weekly charts by the end of the week.

This week will be an important week for determining the short to medium term direction of the market, canola was slightly lower last week and is in a trading range as supplies in the country remain high and demand has softened. The court case in which a Chinese national could be deported to the US on industrial espionage charges remains a major issue between Canada and China, and China has basically cut off purchases of Canadian canola due to the trial. The market has tried to become more stable in recent weeks but faces strong headwinds in getting demand flowing again and avoiding big ending stocks.

Worries that low production and low planted area this growing season have started to support new crop prices. Soybean oil was lower along with palm oil. It was an inside week as traders showed limited interest in buying or selling. US soybean oil faces increased competition in world markets from Argentina as its soybeans are harvested and processed. Argentina will look to reclaim its position as the largest exporter of soybean oil in the world.

Weekly Malaysian Palm Oil Futures ©Jack Scoville

Weekly Chicago Soybean Oil Futures ©Jack Scoville

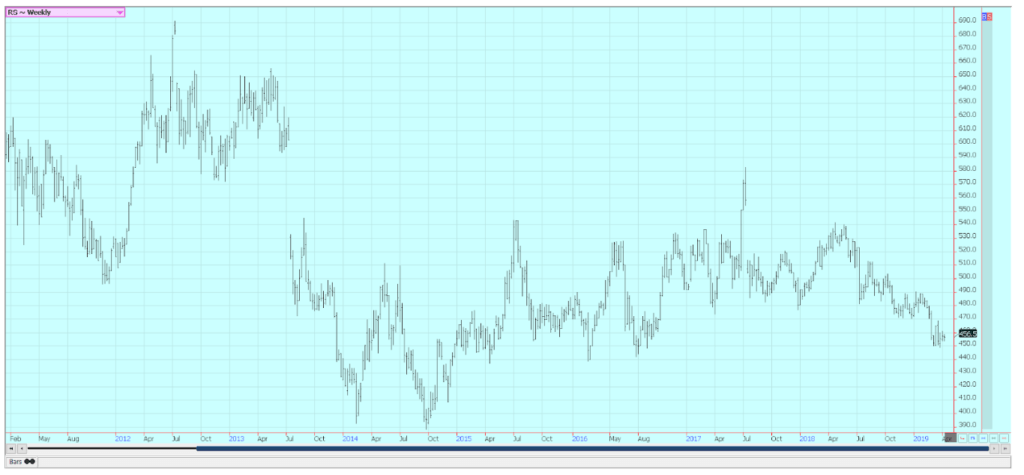

Weekly Canola Futures ©Jack Scoville

Cotton

Cotton was a little lower after making new highs for the move. A strong rally on Friday pushed prices from the lows of the week back to the middle of the range for the week. The daily and weekly charts show that an uptrend is still intact. USDA trimmed domestic demand and showed a slight increase in ending stocks estimates in its monthly supply and demand updates. The market had expected about unchanged ending stocks. The weekly export sales report showed good demand for US cotton and there is talk that the US can have strong sales with other major exporters starting to run low on supplies. The sales report was a little less than the previous week, but overall sales of old crop and new crop cotton remained positive.

USDA showed that planting progress was good. Most of the progress this week will be in Texas after some big rains were reported over the weekend in the Delta. The Southeast also got some big rains. The daily charts still imply that the market can move to or above 82.00 cents per pound. US sales have suffered so far this year in world markets, but have started to improve as other sellers run out of supplies. There are expectations that cotton planted area can increase this season as farmers could be attracted to cotton instead of grains such as corn or rice due to relative pricing. Anecdotal reports imply that the industry is preparing for more production as new facilities such as gins are being opened. Cotton production is poised to make a comeback in the Delta and Southeast.

Weekly US Cotton Futures ©Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was lower again last week and futures moved to new contract lows. Trends are down as the market looks at a big oranges crop and little demand for FCOJ. USDA estimated the production of oranges in Florida at 76.5 million boxes, slightly less than its previous estimate but still a huge recovery from the small crop of the previous year. News that the EU and the US are moving slowly in trade negotiations hurt futures as did the news of good production potential for oranges and FCOJ in Brazil. Brazil will most likely remain the major and almost exclusive supplier of FCOJ to the EU.

Speculators turned sellers after the recent short covering rally that had found new commercial selling. Ideas continue that production remains strong and demand does not. Inventories inside the state are significantly higher than a year ago. The oranges harvest remains active in Florida as the new crop begins to develop. The early and mid-harvest is over and producers are concentrating on harvesting Valencias. Fruit is developing and ideas are that the next crop is off to a very good start. Irrigation is being used frequently to help protect crop condition. Mostly good conditions are reported in Brazil.

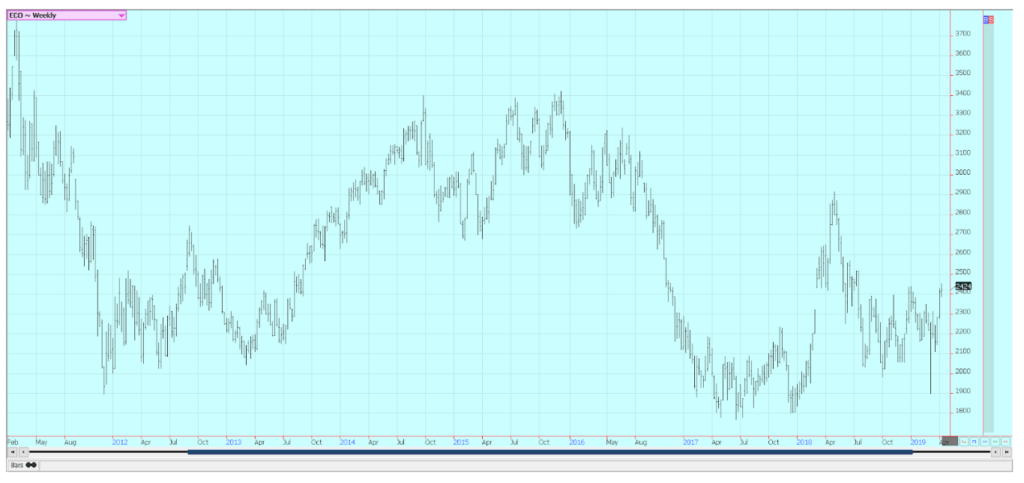

Weekly FCOJ Futures ©Jack Scoville

Coffee

Futures were lower for the week and made new lows for the move in both markets. Weakness in the Brazilian Real caused some speculative selling in New York, while reports of increased offers from Asia hurt Robusta in London. The trade is still worried about big supplies, especially from Brazil and low demand. Brazil is dominating the market right now, and other exporters are having a lot of trouble finding buyers. Prices are generally below to well below the cost of production for world producers, and prices are getting to that point for producers in Brazil and Vietnam.

The inventory data from ICO and others shows ample supplies in the world market. Brazil had a big production year for the current crop, but the next crop should be less as it is the off year for production. Ideas are that the next crop might still be big as the weather has been good for the trees so far. El Nino is fading but remains in the forecast, and coffee areas in Brazil could be affected by drought that could hurt production even more. Mostly dry conditions are in the forecast for this week. Vietnam is active in its harvest and the export pace has been good so far this year.

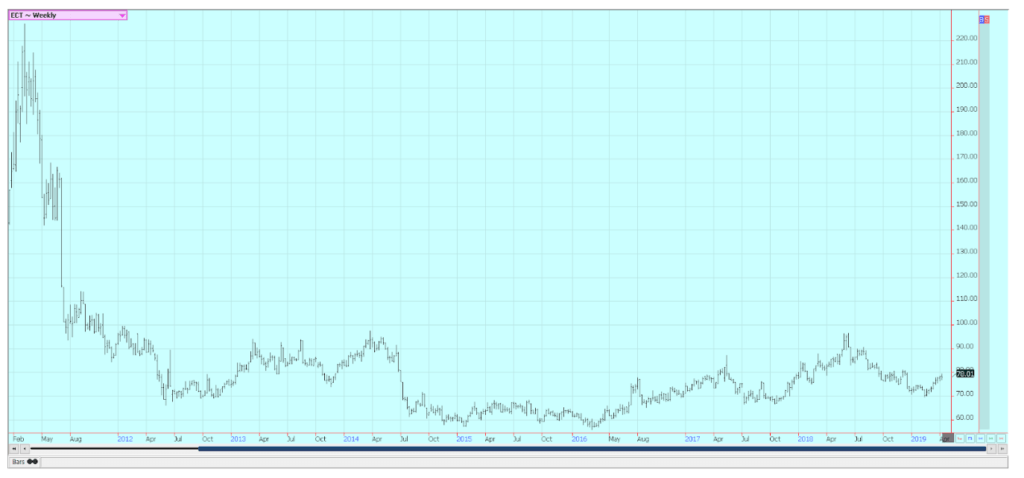

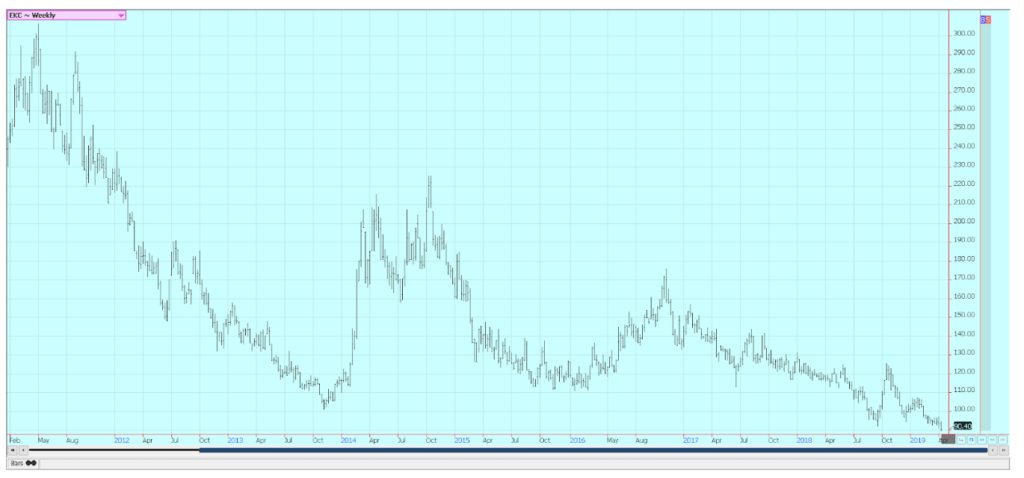

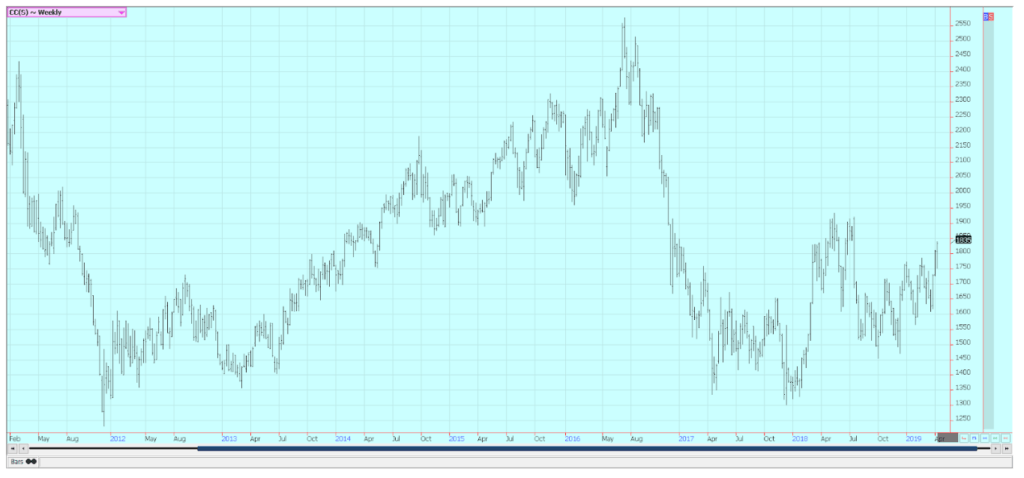

Weekly New York Arabica Coffee Futures ©Jack Scoville

Weekly London Robusta Coffee Futures ©Jack Scoville

Sugar

Futures were little changed last week as the trade waits for news of some kind to trigger a move. Chart patterns on the weekly charts are sideways in New York and sideways to down in London. The fundamentals still suggest big supplies, and the weather in Brazil has improved to support big production ideas. Brazil weather is improving in all areas as there is less rain in southern areas and more to the north. However, it has turned drier in northern areas and there is a concern that the dry season is starting early this year. Brazil has been using a larger part of its sugarcane harvest to produce ethanol this year instead of sugar, but Thailand has shown increased production this year. Ideas that production in India and Pakistan is being hurt by news that Indian mills are asking the government not to force them to sell Sugar into a depressed world market in order to try to maintain some control over operating losses. Very good conditions are reported in Thailand.

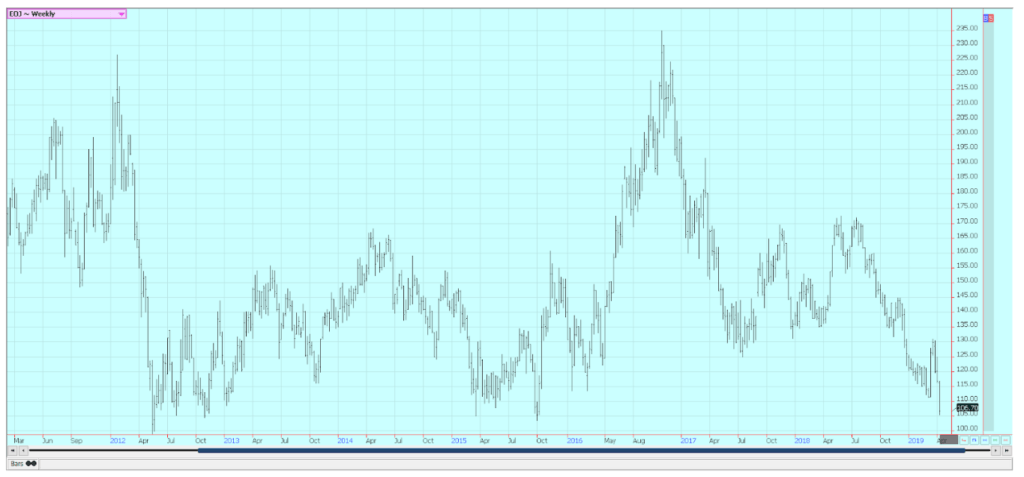

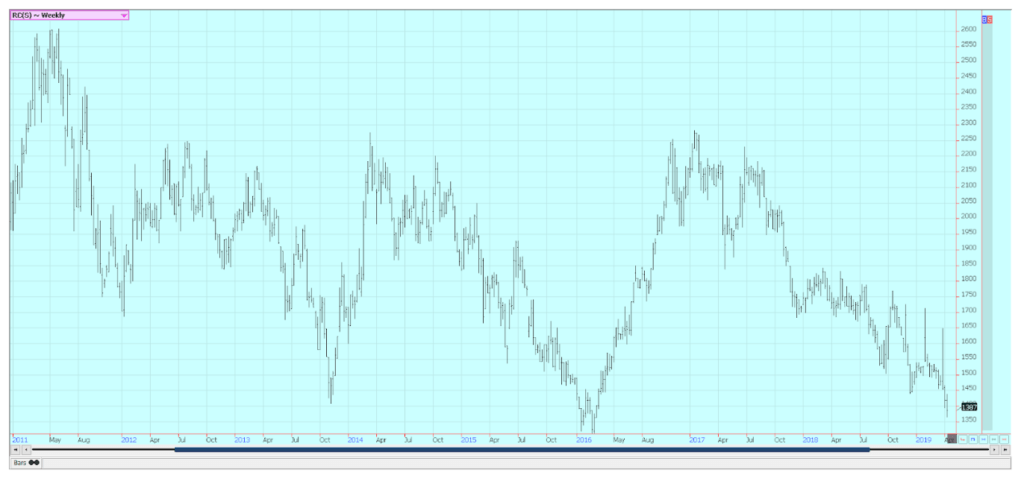

Weekly New York World Raw Sugar Futures ©Jack Scoville

Weekly London White Sugar Futures ©Jack Scoville

Cocoa

Futures closed higher in both markets. Trends are up. The main crop harvest should be about over and mid-crop harvest is still a month or more away. Ivory Coast arrivals are strong as are the exports. The weekly arrivals pace is about 10 percent higher than a year ago and is holding this level. Arrivals were reported strong in the rest of West Africa as well. Demand appears strong and the market is expecting stronger grind data when the quarterly grind is released in the EU, North America, and Asia over the next couple of weeks.

Growing conditions are generally good in West Africa. Some early week showers and cooler temperatures were beneficial, and most in West Africa expect a very good mid-crop harvest. Cameroon and Nigeria are reporting less production and prices there are reported strong. Conditions appear good in East Africa and Asia, but East Africa has been a little dry as has Malaysia.

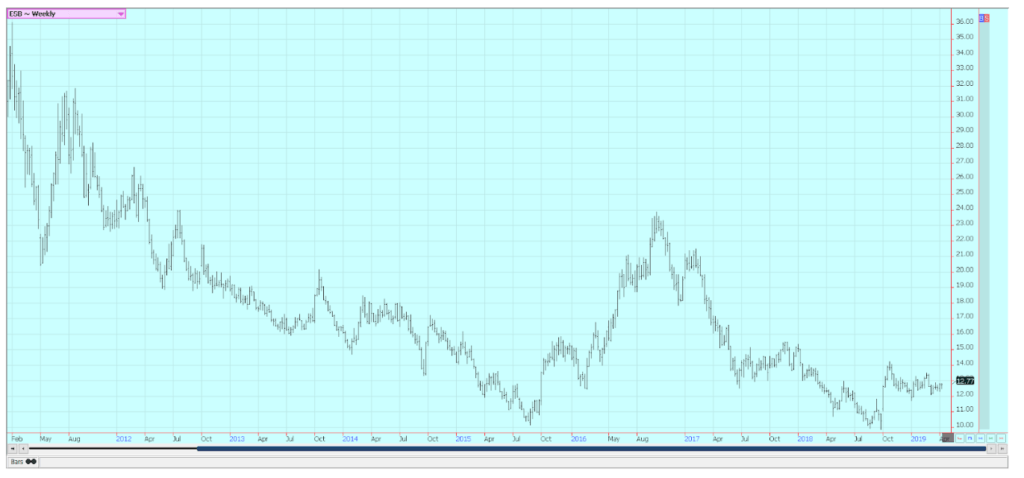

Weekly New York Cocoa Futures ©Jack Scoville

Weekly London Cocoa Futures ©Jack Scoville

(Featured image by Ilja Generalov via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Hosting.com Affiliates]

-

Africa3 days ago

Africa3 days agoAir Algérie Expands African Partnerships

-

Crypto1 week ago

Crypto1 week agoEthereum Pushes AI Integration With ERC-8004 and Vision for Autonomous Agents

-

Business5 days ago

Business5 days agoDow Jones Near Record Highs Amid Bullish Momentum and Bearish Long-Term Fears