Featured

Brazil Farmers Have Sold About 82% of the Coffee This Year, From 74% Average

New York and London coffee futures closed a little lower as the logistical and production problems in Brazil are still around but are slowly being resolved. Vietnamese producers have been selling so differentials have gone down in that market and it now pays to send Coffee to London and the rest of Europe. Trends in London have turned down but trends in New York are still sideways or up.

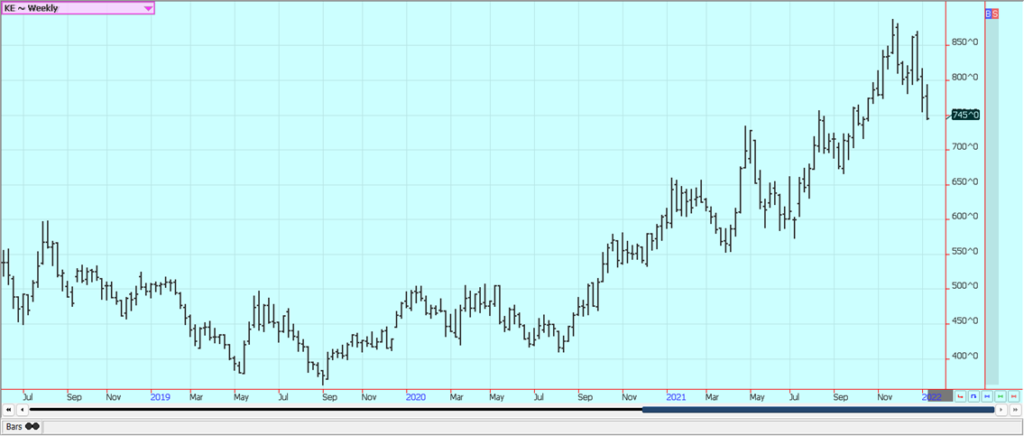

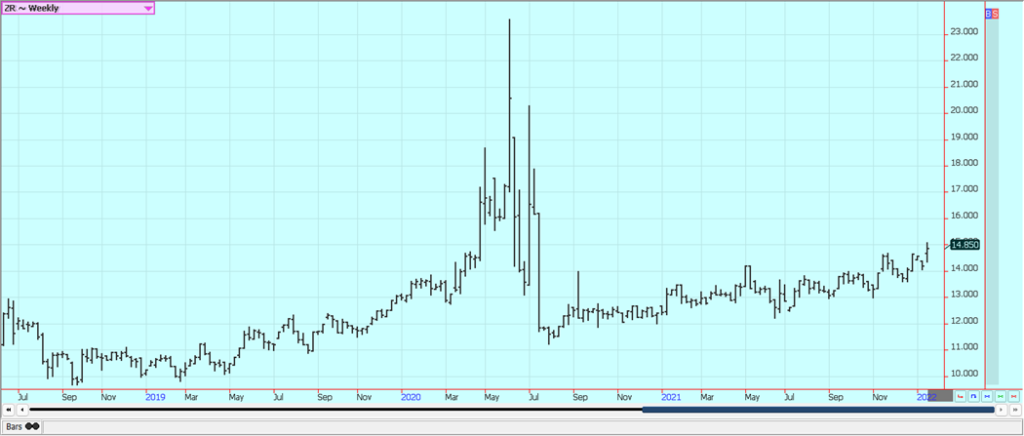

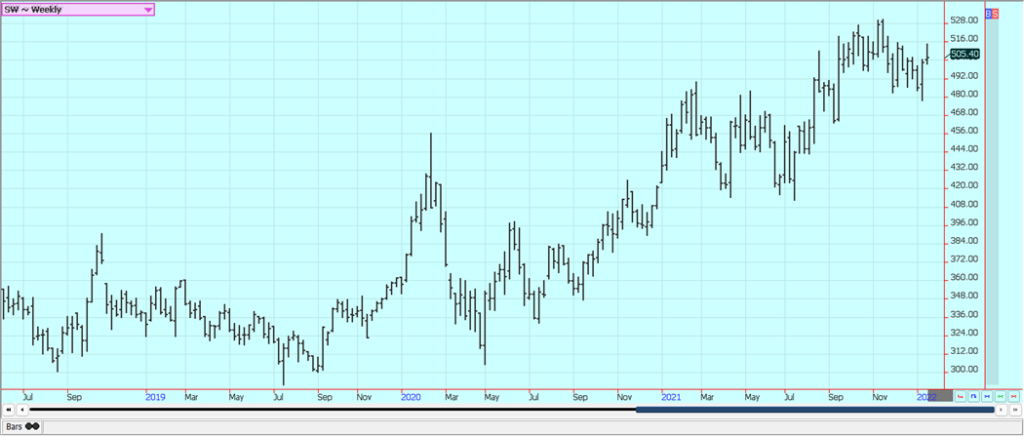

Wheat: Wheat markets closed lower again last week as the weekly export sales report once again showed poor demand. The USDA reports released Wednesday showed less domestic and export demand and higher than expected ending stocks levels. The Wheat seedings report showed more than expected planted area, especially for Soft Red Winter. It remains dry in the western Great Plains with no real relief in sight. Ideas had been that the US will have good demand for Wheat as the rest of the northern hemisphere is short production this year but so far demand has been average or less against previous years. Futures have been moving lower since late November because of the poor export demand and might be finding a bottom now. Offer volumes are down in Europe. Dry weather in southern Russia, as well as the US Great Plains and Canadian Prairies, caused a lot less production. The lack of production has reduced the offers and Russia has announced sales quotas. Australian crop quality should be diminished.

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

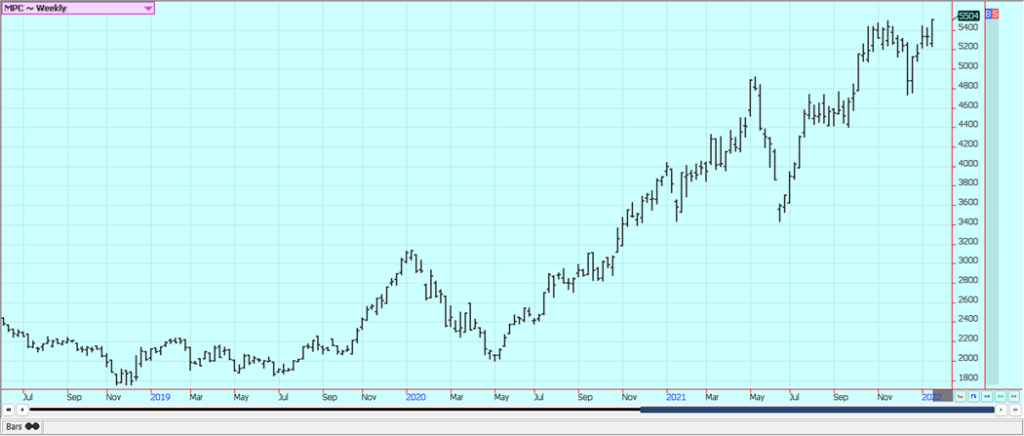

Corn: Corn closed higher on Friday and higher for the week. USDA showed good export sales in the weekly report on Friday and rains have arrived to help dry soils in South America. USDA a couple of weeks ago increased US Corn production by a little bit and did not cut Argentine and Brazilian Corn production estimates as much as it could have. Demand was also trimmed on the domestic and export side. The markets heard about potential improvement in growing conditions in South America. Central Argentina got the best rains again and the other areas were still dry or got significantly less rain. Showers are now predicted for southern Brazil and the rest of Argentina and Paraguay and the situation there should become more stable. Northern Brazil is expected to be drier to help with conditions there.

Weekly Corn Futures

Weekly Oats Futures

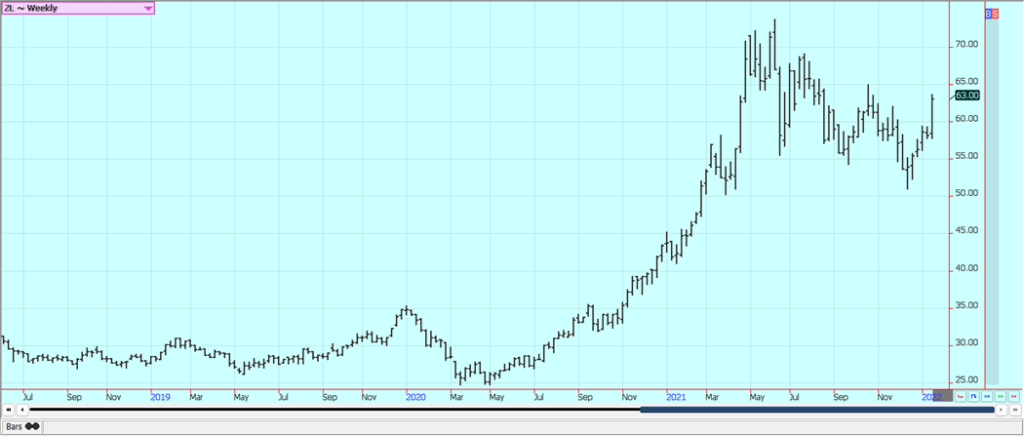

Soybeans and Soybean Meal: Soybeans and the products closed higher on ideas of new demand as rains returned to dry soils in South America last week and are likely to continue. However, the benefits will be felt mostly in central Argentina and perhaps southern Argentina. Showers are forecast for southern Brazil, Paraguay, and much of Argentina early this week as well. New demand is now thought to come from China as rumors of new business with that destination hit the floor. Soybean Oil was higher on price strength in Palm Oil and Crude Oil. The rains last week mostly fell in northern Brazil with southern Brazil, much of Argentina, and Paraguay still mostly dry. The drier areas are getting some precipitation now but central Argentina will get the best rains. Only scattered showers are forecast for the other areas although conditions are slated to improve somewhat in all of the dry areas. Trends are up on the daily and weekly charts.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher last week and made new contract highs for the March contract. Trends are still up in the market. The USDA reports showed less production and imports and smaller ending stocks. Demand was trimmed as well, but the supply was cut more. Futures and cash market trading have been quiet until now and the cash market is still quiet but domestic mill business is around everywhere. Many producers are not interested in selling. Mills are showing more interest in the market as previously bought supplies start to run low. The cash market is reported to be relatively strong as prices have held firm and as activity increases.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was higher last week and moved to new contract highs. Crude Oil made new highs and Indonesia is once again using its own Palm Oil to produce biofuels and also announced plans to restrict exports to promote lower costs at home for cooking oil. There are still poor production conditions in Malaysia and Indonesia. Traders are mostly worried about demand from India who has been buying Soybean Oil in the US instead of Palm Oil from Malaysia and Indonesia and is also worried about China and its demand for Palm Oil for biofuels. Production conditions have been very poor and workers are not often in the fields. Canola was higher last week along with the price action in Chicago. The rain in South America is no longer hurting Canola and Soybeans prices. Farmers are bullish and reluctant to sell because of the sharp reduction in Canola production in Canada this year. The buy-side thinks that Canola is fully priced but the farmers are still holding out for more. Chart trends are mixed for the daily charts.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton futures closed lower again Friday in correction trading but higher for the week. Traders were keeping an eye on the weakness in the stock markets as a reason to sell Cotton. It’s been a demand market and prices have been sideways waiting for demand to catch up to the price. Ideas are that demand remains strong for US Cotton even with the weaker export sales reports over the last couple of weeks. Analysts say the Asian demand is still very strong and likely hold at high levels for the future. US consumer demand has been very strong as well despite higher prices and inflation. Good US production is expected for next year as planted area is expected to increase due to high cotton prices and the expense of planting Corn. Chart trends are still mostly up in this market.

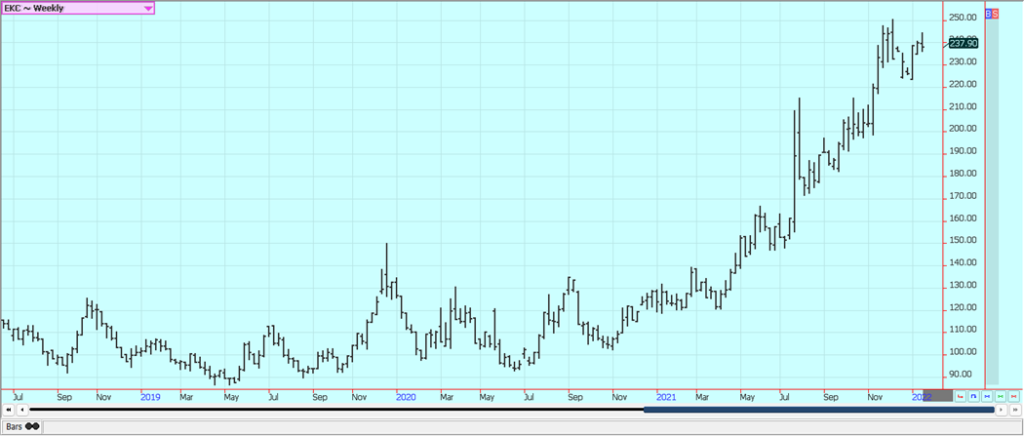

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was slightly higher on Friday on what appeared to be some speculative buying primarily based on inflation concerns. The trends are still up on the daily charts on the reduced Florida Oranges production estimates seen last week. Futures were higher for the week but stalled against resistance areas near 158.00 March USDA cut its Oranges production estimate for Florida, but increased production when compared to the last report for the whole of the US. Production overall remains less on a year-to-year basis. The freeze season has arrived in Florida but the weather remains generally good for production in Florida and around the world. Brazil has some rain and conditions are rated very good. Brazil production was down last year due to dry conditions at flowering time and then a freeze just before harvest. Weather conditions in Florida are rated mostly good for the crops with a couple of showers and warm temperatures. Mexican crop conditions in central and southern areas are called good with rains. Northern and western Mexico is rated in good condition.

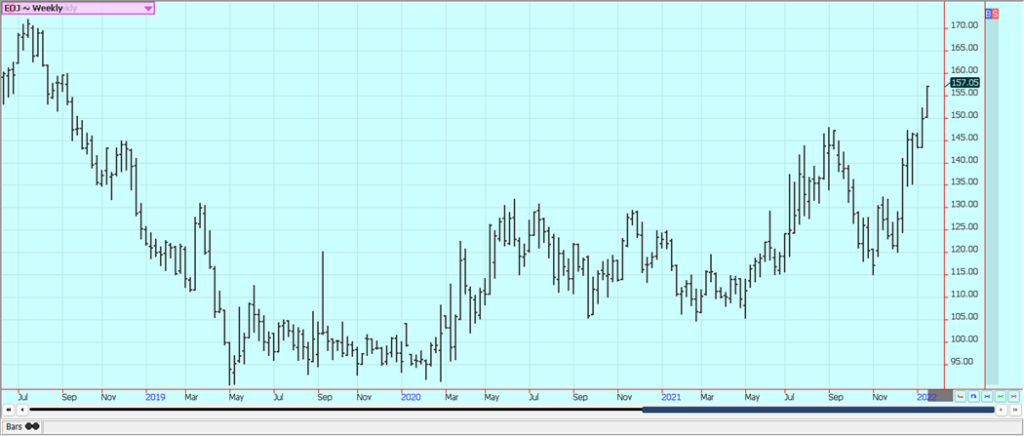

Weekly FCOJ Futures

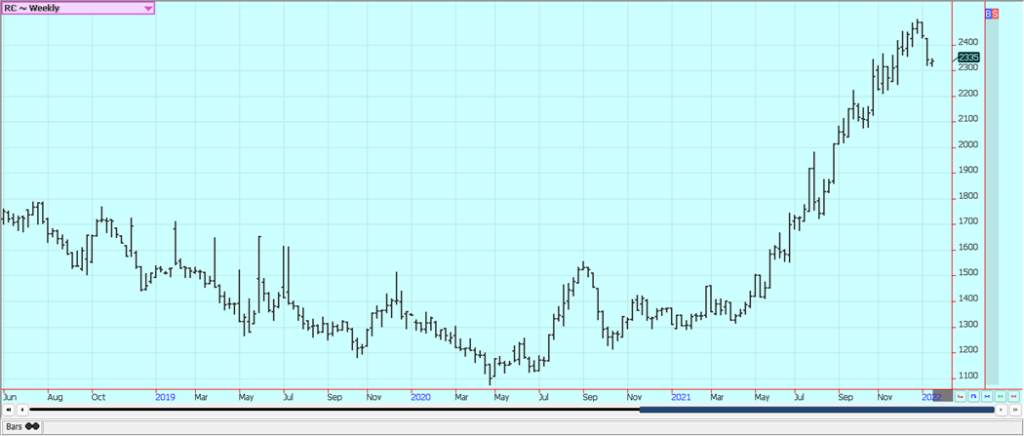

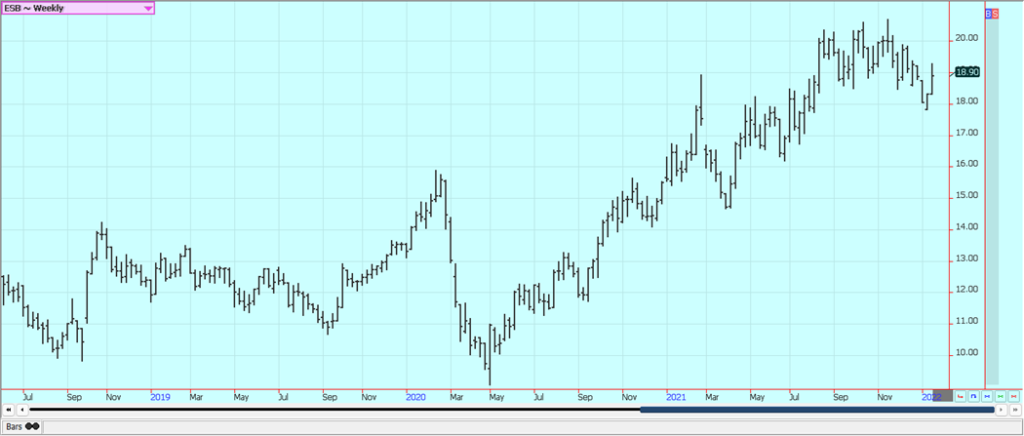

Coffee: New York and London closed a little lower as the logistical and production problems in Brazil are still around but are slowly being resolved. Vietnamese producers have been selling so differentials have gone down in that market and it now pays to send Coffee to London and the rest of Europe. Trends in London have turned down but trends in New York are still sideways or up. The dry weather and then the freeze in Brazil have created a lot of problems for the trees to form cherries this year. Big rains more recently in some Brazil growing areas have hurt cherry formation as well. Containers are not available in Vietnam or in Brazil to ship the Coffee, but the Brazil logistical situation has eased in recent weeks as Cecafe noted still below normal, but improving, exports for December. Conab noted the extreme weather when it estimated total Brazil Coffee production at just over 55 million bags last week. Brazil farmers have sold about 82% of the Coffee this year, from 74% average. They have forward sold about a third of the next crop. Vietnam producers are also selling and some of the Robusta is going to the exchange in London as differentials have weakened. The harvest in Vietnam is now about 90% complete. Vietnam is getting scattered showers on the coast but dry conditions inland. The rest of Southeast Asia should get scattered showers in the islands and mostly dry conditions on the mainland. Production conditions for the next crop in Colombia are not good.

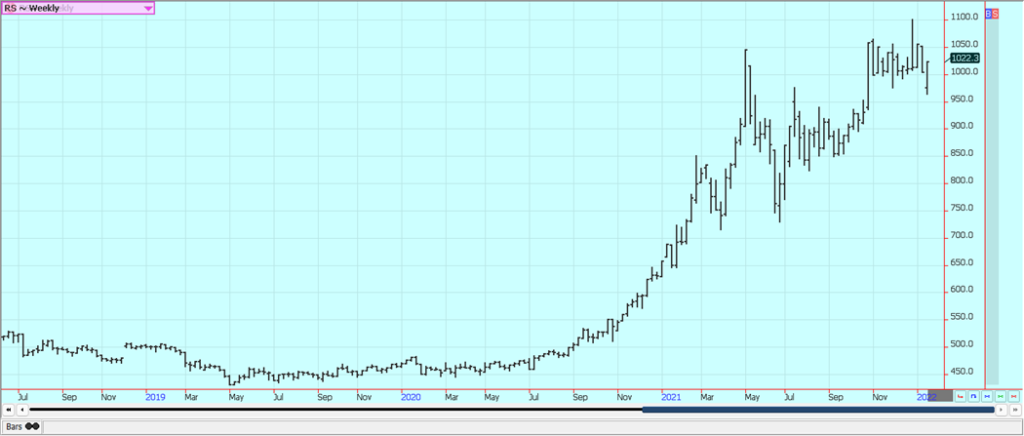

Weekly New York Arabica Coffee Futures

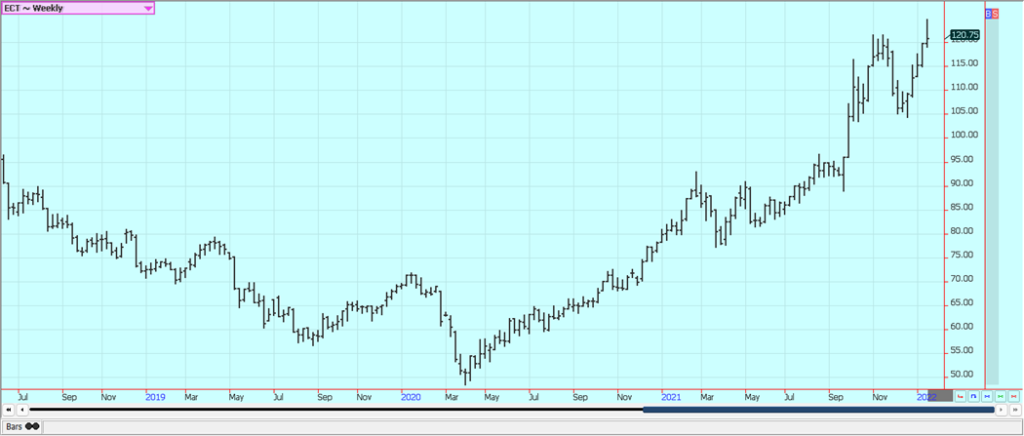

Weekly London Robusta Coffee Futures

Sugar: New York and London were a little lower on Friday in correction trading, but higher for the week as the market tries to ensure that there will be enough White Sugar production and imports from India and Thailand. Ideas are that stronger Crude Oil prices imply stronger ethanol prices for more ethanol production and less Sugar production in Brazil and those ideas help keep Sugar prices supported. Crude Oil closed higher again yesterday. There have been reports of improved growing conditions for the crops in central-south areas of Brazil. Showers were reported in central south areas last weekend and will continue into much of this week and crops should benefit from the return of moisture to the region. Ideas are that the supplies are available from India and Thailand as harvests there are off to a good start but it will take a stronger price to get them into the market. Trends are still up in the market as futures have formed a bottom on the daily charts.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

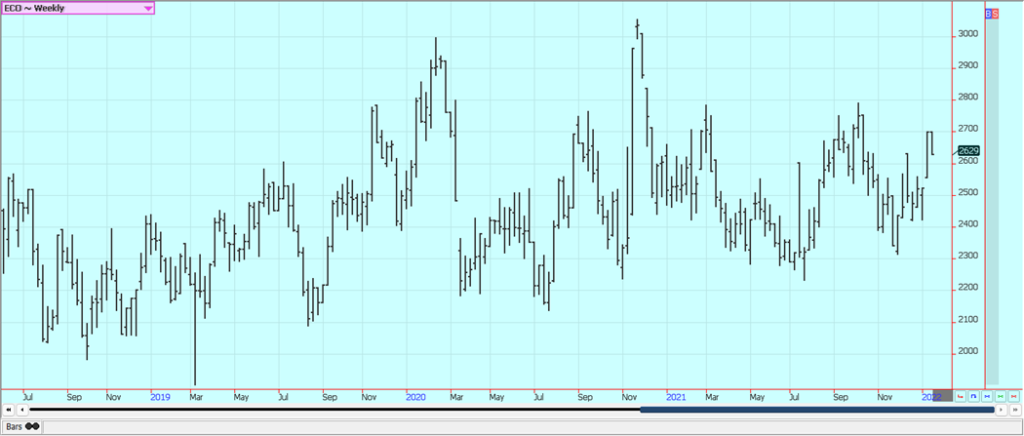

Cocoa: New York closed mixed to lower and London was a little lower yesterday in range trading and on ideas of better demand as the weather is generally good for West Africa and Southeast Asia. There were some reports of Ivory Coast hedging in the market yesterday and today. Trends are turning up again in both markets. Ideas are that demand will only improve slightly if at all and production in West Africa appears to be good this year. Both Ivory Coast and Ghana are reporting improved weather as it is now mostly sunny with some scattered showers around. Some farmers want more rain for the best Spring harvest results. The European grind was up 6.3% from a year ago and was considered very strong. The North American grind fell 1.2%

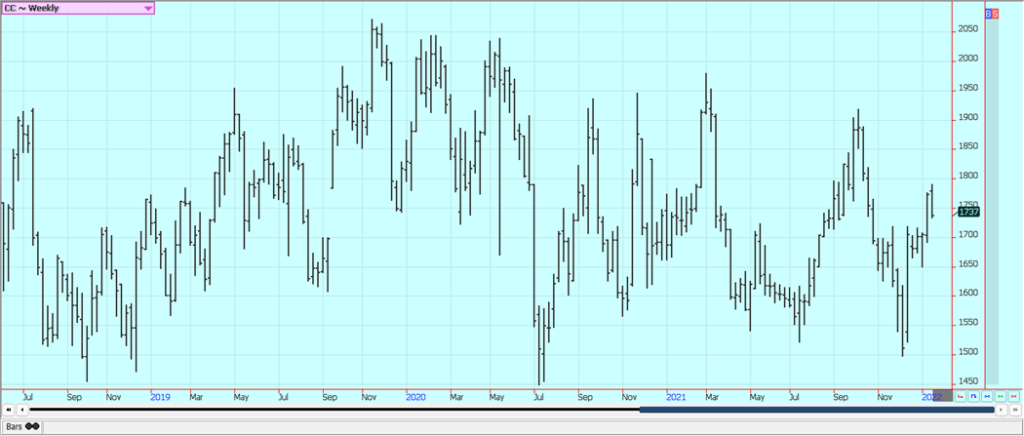

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by ?? Janko Ferlič via Unsplash)

DISCLAIMER: This article was written by a third-party contributor and does not reflect the opinion of Born2Invest, its management, staff, or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crypto5 days ago

Crypto5 days agoThe Crypto Market Rally Signals Possible Breakout Amid Political Support and Cautious Retail Sentiment

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEuropeans Urge Strong Climate Action Amid Rising Awareness and Support

-

Crypto1 day ago

Crypto1 day agoBitcoin Hits New Highs in USD, But Euro Investors See Limited Gains

-

Crypto1 week ago

Crypto1 week agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up