Business

China signed a protocol to allow imports of U.S. rice

China imported just over 486,000 tons of rice in May and has now imported 1.815 million tons for the calendar year.

Weekly news in the commodities market: The process of selling rice to China took a big step forward last week as China signed a protocol to allow imports of US rice.

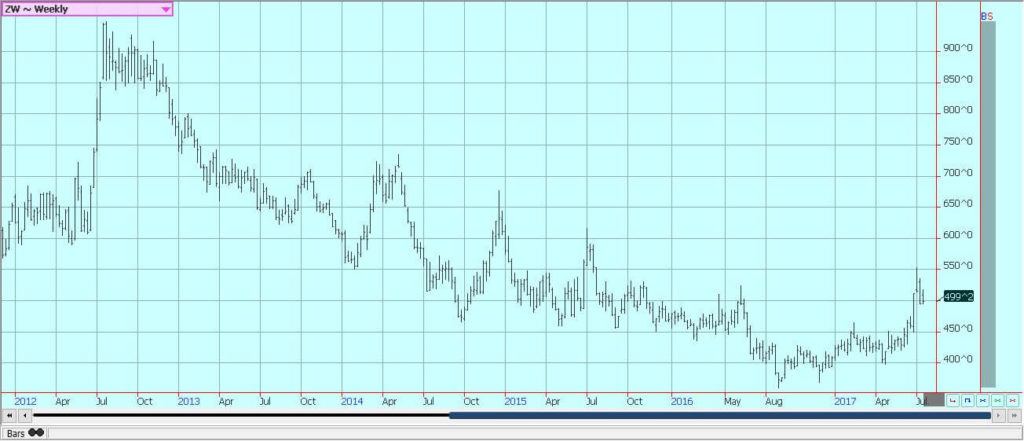

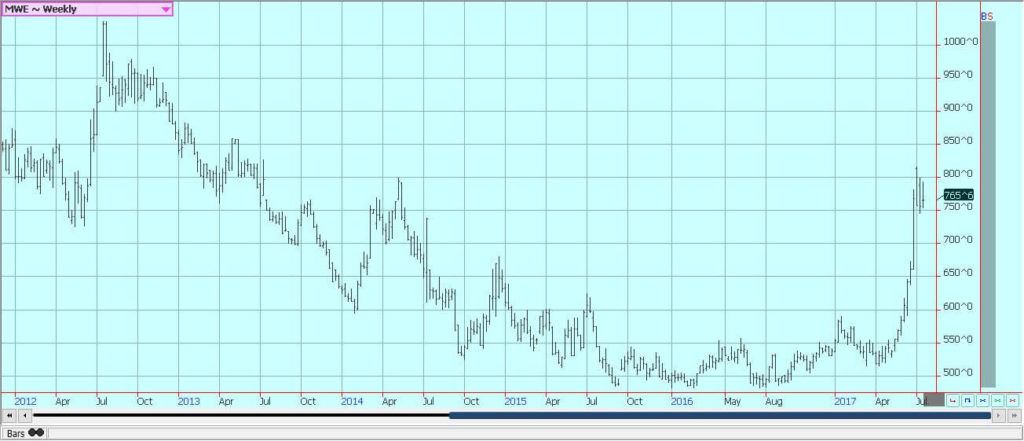

Wheat

US markets were generally lower in reaction to some rains that hit parts of the Dakotas and Minnesota late last week. The rains then moved further into the Corn Belt and might have interrupted the Soft Red Winter harvest over the weekend. However, the market noted the rains in the Dakotas and generally thought that the rains were beneficial, or at least would stabilize conditions in much of North Dakota and eastern South Dakota. Conditions in western Minnesota got a little better as well. Even so, the market expects Spring Wheat conditions to drop again in the USDA reports on Monday. Minneapolis Spring Wheat markets continued to react to the extreme weather in the US northern Great Plains and the Canadian Prairies until the rains appeared on Friday. World growing and harvesting conditions have been mixed in the last week. Russia and Ukraine are reporting mixed yields and there are questions about European Wheat production. Australia has been hot and dry and production estimates are falling. Some now suggest that the crop there could be less than 20 million tons, from initial expectations closer to 24 million tons. China imported just over 500,000 tons of Wheat in May, with almost 289,000 tons sourced from the US and much of the rest of Australia. The weekly charts still show the potential for Wheat prices to move significantly higher.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

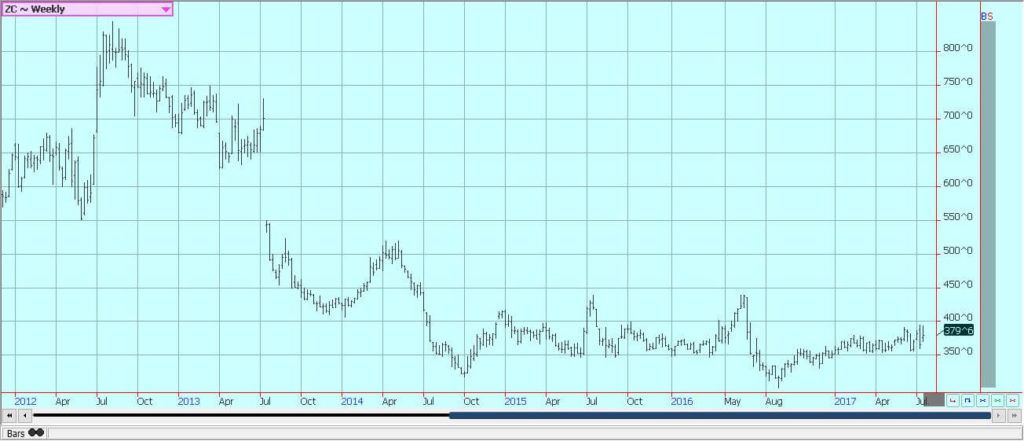

Corn

Corn was higher and oats were a little lower last week, although some selling was seen on Friday as speculators decided to reduce exposure to the potential for a change in the weather forecasts. Trends remain up on the daily and weekly charts for corn, and the weekly charts imply that rallies to 403 and 430 basis the nearby contract are possible. The Corn Belt weather forecasts call for the hot and dry weather to invade western areas while northern and eastern areas could continue to get frequent rains. However, long range forecasts have shown various forecasts over the last few days, so ideas about the growing conditions moving forward are mixed. There are reports that parts of central Illinois are too dry, although stress has not been reported yet. Eastern production areas show the effects of heavy rains in many areas, particularly on later planted crops. Pollination is seen on some fields, but other areas might not move to pollination until the end of the month or the beginning of August. Ideas are already that the top edge of yield potential is gone, although the potential for very good production is still very much there. Even so, analysts are reducing yield ideas, with ideas of national yields now no higher than 168 bushels per acre.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

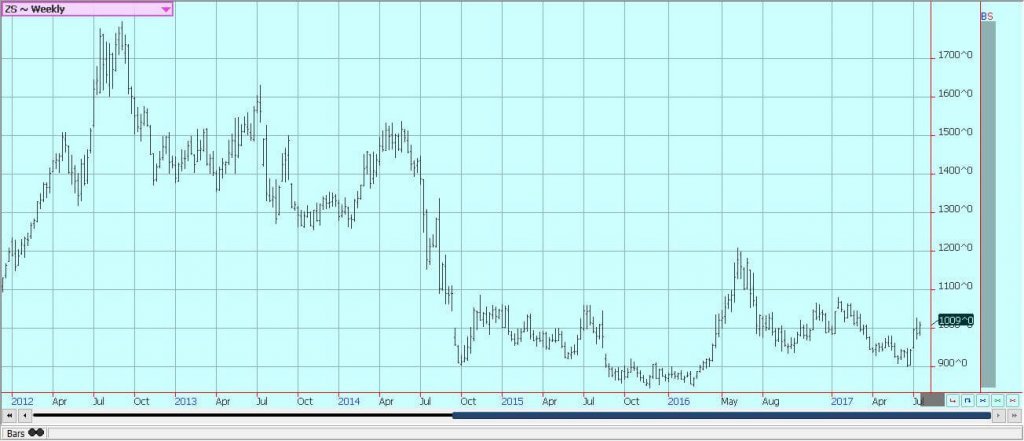

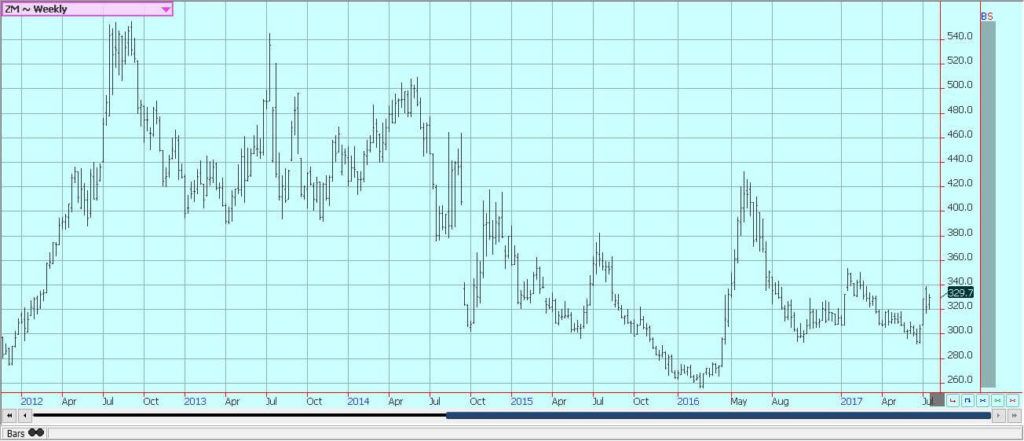

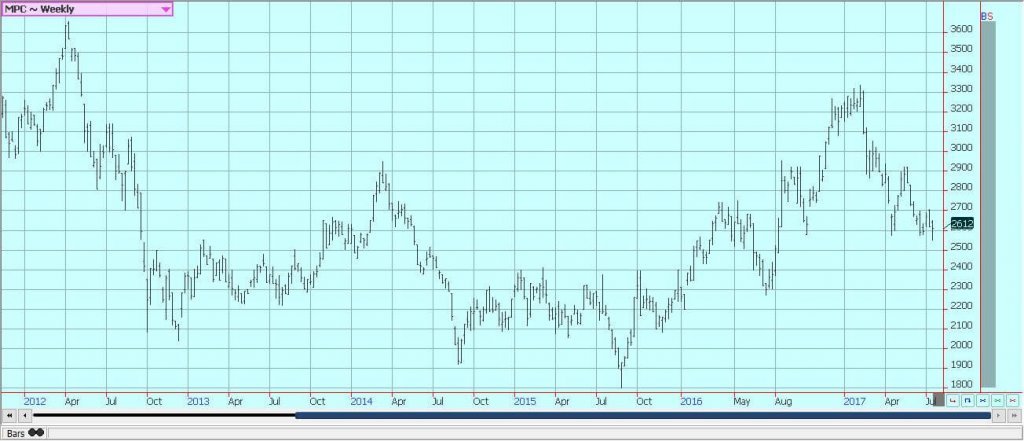

Soybeans and soybean meal

Soybeans and Soybean Meal were higher last week on variable weather forecasts. Hot and dry weather is still forecast to move into western production areas from the Great Plains this week. Parts of Iowa and Minnesota had already been dry and topsoil moisture levels are low, so the hot and dry forecast is coming at a bad time for these areas. However, there were some beneficial rains reported in parts of western Iowa and most of southern Minnesota last week to improve conditions in some areas. Crop ratings are not as high as expected, but could show some deterioration in the data that will be released on Monday afternoon. The weekly charts are showing the potential for a rally from current levels. China imported 9.586 million tons of Soybeans in May, with 7.939 million coming from Brazil. The US exported 1.470 million tons ot China. China has now imported 37 million tons of Soybeans, with 18.6 million tons coming from the US and 16.7 million tons coming from Brazil.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice closed higher last week. The major news came from USDA and China. China has finally signed a protocol to allow imports of US rice. The protocol has been in talks for years, so getting the signed document was big for the US industry. No one expects sales to begin right away as Chinese officials now must conduct photo inspections of US facilities and begin to certify facilities as able to export US rice to China. This will not be easy in all cases as Chinese buyers, in fact, all buyers from Asia, have the reputation for being very choosing in their rice. So the facility and the price offers will have to be at the top of the class. Growing conditions are improved in India as the monsoon has been better, but coverage of rains has been spotty until now and there are still chances for weaker production than expected in India this year. The US rice production is moving forward. Texas is in good to very good condition. California has good looking crops, but the crops were planted late so top yields are not likely. Texas could begin to harvest this week, and parts of Southwest Louisiana are already harvesting. Reports from Louisiana suggest average to below average yields and good quality. The weekly charts show that the rally could move higher over time, with final targets near 1275 basis the nearest futures contract possible.

Weekly Chicago Rice Futures © Jack Scoville

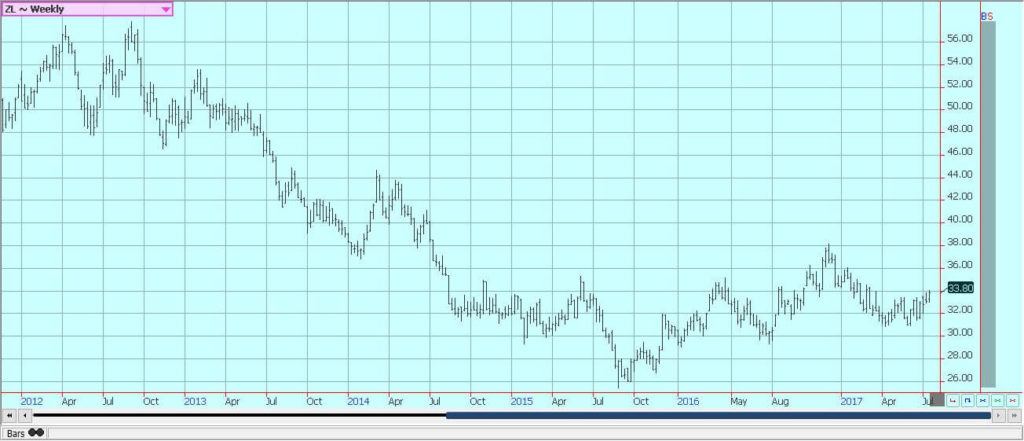

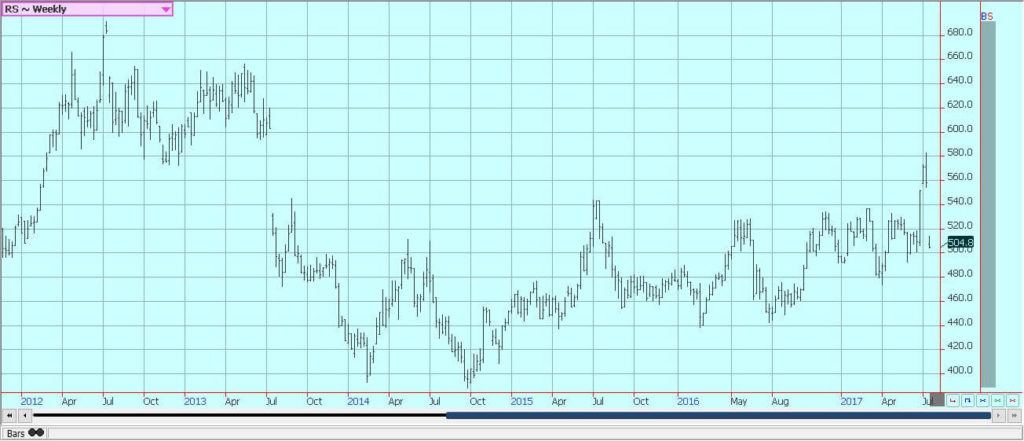

Palm oil and vegetable oils

World vegetable oils markets were slightly lower last week after moving lower to start the week and then showing a good recovery. Palm oil futures closed at the top of the weekly range on better than expected demand. Export reports from the private sources so far this month are higher than last month, and this comes after a strong finish to exports last month. The weekly charts show that futures are broke through some very important support areas, but then recovered well. Soybean oil was higher on domestic and export demand along with reduced production as seen in the monthly NOPA data. Crude oil futures have been range bound, but are generally trading at levels that should provide bio fuels producers a chance to make money. Canola remains relatively strong amid tight Canadian market conditions and adverse growing conditions. A primary negative for prices has been the strength in the Canadian Dollar against the US Dollar. The crops are emerging and growing. Western areas of the Prairies remain too dry, but did get some beneficial showers last week. Eastern areas have seen good rains, but many eastern areas have seen too much rain and crop production potential is suffering. Demand from both the processor side and the export side has been strong enough to generally support the market.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was higher in consolidation trading last week. Export demand was better in the reports last week to support buying, but the market seems more concerned about the US growing weather. Trends remain down on the weekly charts, but the daily charts show the potential for a low to be forming. The growing weather in the eastern half of the US is generally good and crop conditions are reported to be good by producers and observers. These areas include parts of Texas, the Delta, and the Southeast. Warmer temperatures have arrived and there has been enough rain. Texas and the desert Southwest and into California has seen extreme heat and mostly dry weather and dryland crops are suffering. The US and maybe the world will produce much bigger crops this year, with US crops bigger due as much to increased planted area as yield potential. China imported 85,430 tons of Cotton in May, up 9.25% from last year. Calendar year to date imports are now 564,819 tons, up 58% from last year.

Weekly US Cotton Futures © Jack Scoville

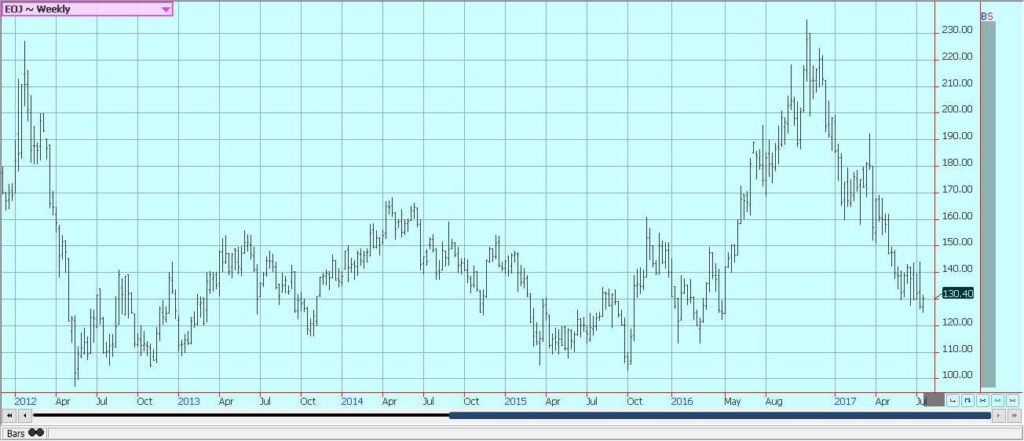

Frozen concentrated orange juice and citrus

FCOJ closed higher last week, but trends are turning down on weekly charts and are sideways on daily charts. Florida weather is now good as rains continue in the state. Trees have responded to the improved conditions and overall conditions now appear very good. There are no systems in the Atlantic to cause concern about tropical storm development that could be detrimental to trees and fruit. The demand side remains weak and there are plenty of supplies in the US. Brazil has been exporting FCOJ to the US to cover the short Florida crop. Domestic production remains very low due to the greening disease and drought. Trees now are showing fruit of varying sizes and overall conditions are called good because of the irrigation and the recent rains. Brazil crops remain in mostly good condition.

Weekly FCOJ Futures © Jack Scoville

Coffee

It was a higher week in New York as that market continued to move away from the recent lows. New York futures are breaking down trends that have been in place on the daily charts since last November. Objectives for the up move are 140.00 and 150.00 September. London has also held firm and is battling important resistance as the new week gets underway. The cash market was animated last week as the prices moved higher. New York has featured some buying support from speculators as they have become more two sided in trading the market as the Winter season is ner its most important time in Brazil. There have been a couple of scares, but only small chances for damage. There is also a lot of rain that has delayed harvest and could be causing an outbreak of broca worm that could really hurt yields. They were also buying as the Real moved higher and the US Dollar moved lower against just about all other currencies. London had been stronger as news surfaced that supplies in the cash market are tight due to reduced Vietnamese selling and tight supplies in the country. Offers are less and seen at high prices from Robusta countries such as Vietnam. Indonesia and Brazil are also very low on supplies. The Robusta market is still relatively strong compared to Arabica and due to the short supplies available to the market as it works to curb demand through the higher prices.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures New York were higher last week, but London moved sharply lower. New York appears to have been oversold and is finding support in part on US Dollar weakness. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months as the Sugarcane harvest moves to its peak. UNICA in Brazil is now starting to reflect the production now in its reports of Sugar and Ethanol production. Production in India and Thailand is expected to improve in the coming year as both countries are seeing better monsoons than the failed monsoons of last year. It is raining in parts of India now as the monsoon arrived a few weeks ago, and most Sugarcane areas appear to be getting good rains. Thailand also hopes for an improved monsoon season this year and is getting rains now. China imported more sugar last month than last year for about the first month of the year. It had been limiting imports to world down government stocks. It is also working to lower support programs for producers and needs to find domestic demand that had gone to imports as world sugar prices were much lower than those charged in the domestic market. The weather in Latin American countries away from Brazil appears to be mostly good. Most of Southeast Asia has had good rains and rains continue.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

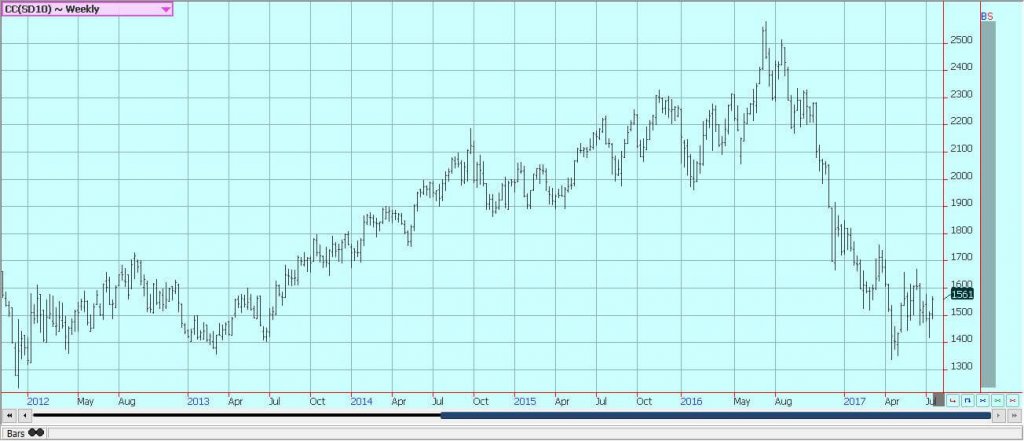

Cocoa

Futures markets were higher last week. The grind data has now been released for the second quarter and in general it showed better demand. The European grind was up about 2% and the Asian gring increased 9% from last year, but the North American grind dropped 1% from last year. Futures were able to hold and close on a firm note on Friday despite the North American grind data. Harvest activities for the previous crop in West Africa are completed. Ivory Coast said last week that it had already sold more that 1.0 million tons of the next crop. That means that there is less offer in the cash market as much of this Cocoa has already been sold. It also reported some local flooding that could keep initial deliveries down. About 20% less delivery can now be expected for the first couple of months of the harvest. The demand should continue to increase if prices remain relatively cheap. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

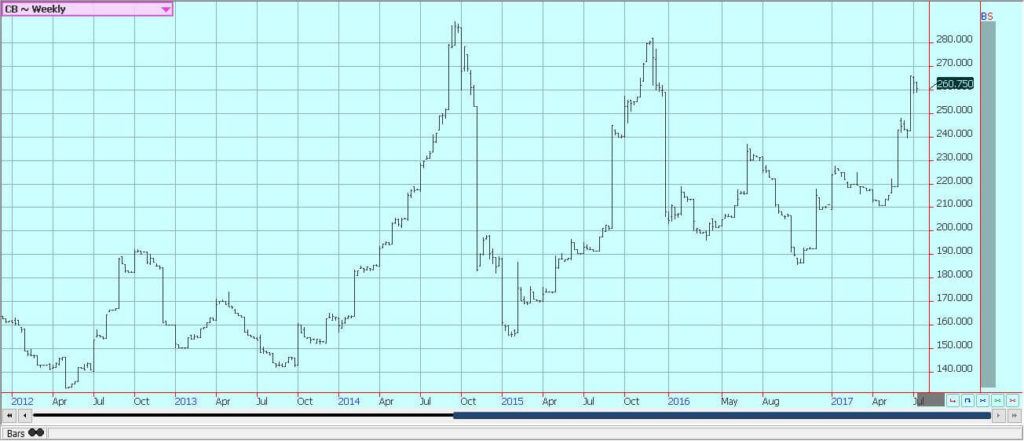

Dairy and meat

Dairy markets were higher last week, and longer term trends remain up. Butter prices have been the strength of the market on reports of very good demand and adequate supplies. Cheese prices have been relatively weak. Demand is good for cream, but cream has generally been available to meet the demand. However, there are some shortages of cream in a few locations.

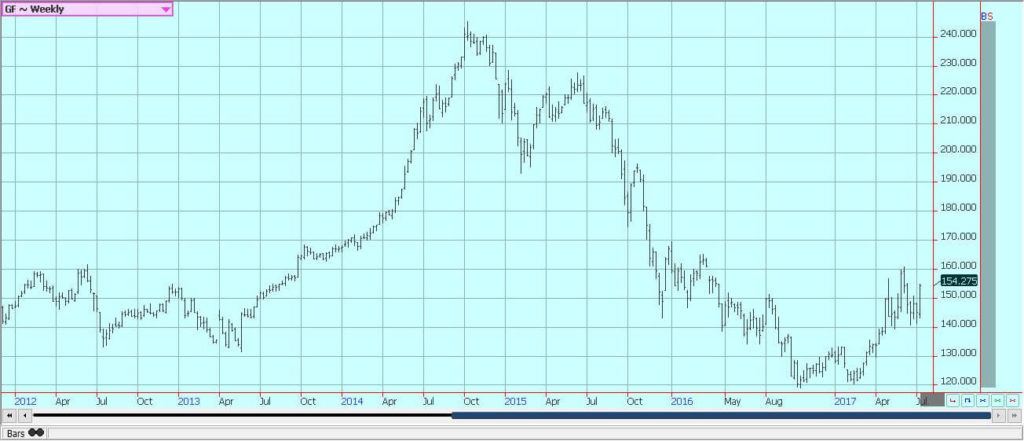

US cattle and beef prices were lower and trends in cattle futures remain down. The beef market remains weaker in the last couple of weeks, but cattle prices have held relatively firm. Feedlots are very current with supplies and are concerned about extreme heat in feedlots that could hurt weight gain. However, ideas are that more supplies are coming as weight per carcass is stable and more cattle is coming to the market.

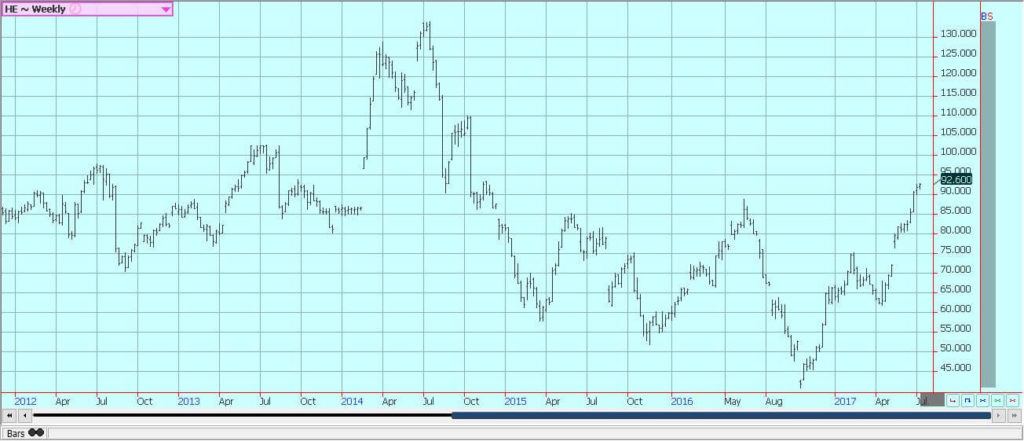

Pork markets and Lean Hogs futures were weaker as the market anticipates a trend change due to a seasonal trend to lower demand. Demand has been lower for the last couple of weeks and this has affected pricing. Demand starts to work lower as most of the Summer buying is done. There are big supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

-

Cannabis2 weeks ago

Cannabis2 weeks agoRecord-Breaking Mary Jane Fair in Berlin Highlights Cannabis Boom Amid Political Uncertainty

-

Crypto2 days ago

Crypto2 days agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Biotech2 weeks ago

Biotech2 weeks agoVytrus Biotech Marks Historic 2024 with Sustainability Milestones and 35% Revenue Growth

-

Crypto7 days ago

Crypto7 days agoRipple Launches EVM Sidechain to Boost XRP in DeFi

You must be logged in to post a comment Login