Business

China imports milk from New Zealand, sugar prices in India increase

Export demand for New Zealand has increased due to stronger demand from China.

Latest news in the commodities market: Argentina struggles with milk production, China imports milk from New Zealand, sugar prices in India increase and much more.

Wheat

US markets were closed lower after making a reversal down in the daily charts at midweek. Cash market brokers note that US Wheat has gotten a little high priced when compared to the world competition. Egypt bought from East Europe and Russia late last week at prices ranging from $195.00 to #197.50 per ton FOB, which seems steady to higher from previous purchases. But, the main reason for the selling seemed to be the potential for improved rains in the Great Plains as the crop looks to start breaking dormancy. It has turned very warm in the Midwest and Great Plains, with many areas reporting record or near record high temperatures for the date. The Spring like temperatures are causing grasses everywhere to turn green and start to grow, and Wheat in many areas is no exception. Demand for US Wheat remains solid at this time as the US has been able to be a more important player in the world market for higher protein wheats. Ideas are that competition for sales will remain strong from East Europe and Russia and will start to increase from Australia. That country is in the process of harvesting and selling a record large crop and will need to sell. It will concentrate marketing efforts on Southeast Asia and the Middle East, and is likely to find a lot of buying interest. Chart trends turned down on the daily charts fin all three US futures markets. The weekly charts show that Hard Red Winter and Hard Red Spring markets are now testing important support areas.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

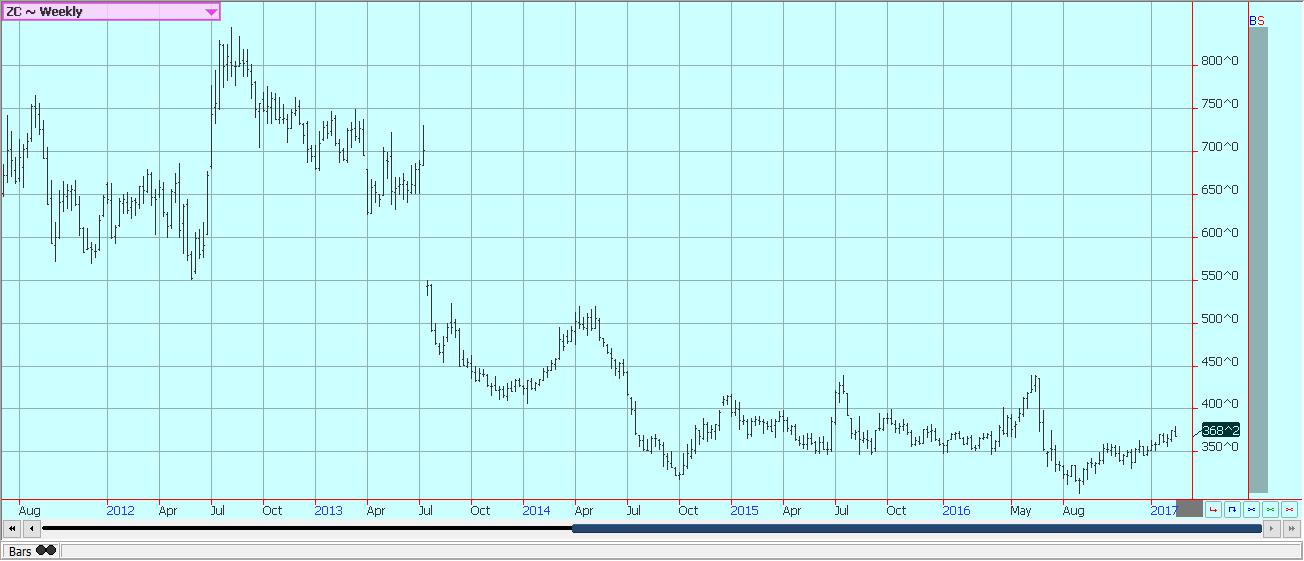

Corn

Corn closed moderately lower after making new highs for the move. It was disappointing late week price action for the bullish traders at daily chart trends are showing the potential for a short term price correction. Weekly chart trends remain up. Futures got close to a lot of selling objectives from both farmers and speculators for nearby months by trading to 380 March before fading. It also took out some resistance on the weekly charts at 374.25 basis the front month that was made in the middle of last July. The market might be in a correction mode, but the price action in general has remained strong. It is possible that March could move to between 355 and 360 before finding much new buying interest. There is a lot of farm selling to absorb and farmers have expressed interest in selling on rallies from current levels. The market also fears selling from South America, but any exports from that part of the world might not take place until later this Summer as Brazil ran out of Corn last year and must restock pipelines before selling much into the world market. US farmers are preparing to plant the next crop in some parts of Texas and making final plans everywhere else. The trade expects lower planted area for Corn this year due to the generally weak and unprofitable prices paid in the country, but just how much less is still a matter for debate. Ideas range from two to four or five million acres either planted to something else or left fallow. Farmers are not really interested in selling any of the next crop at current levels, but will most likely continue to move old crop supplies into the market.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

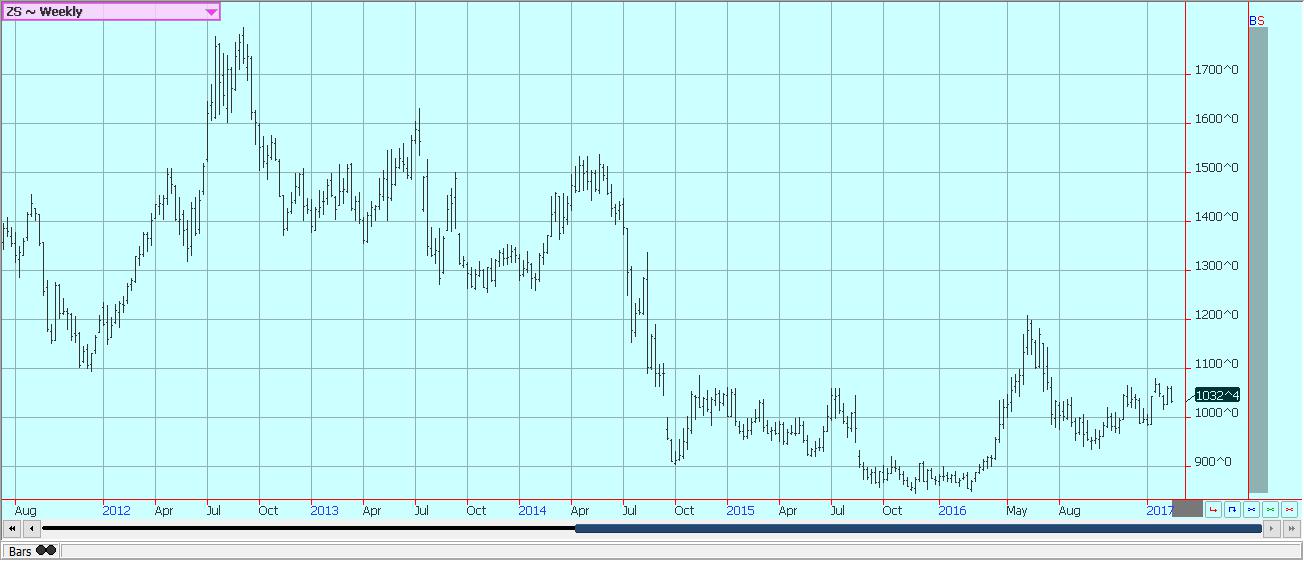

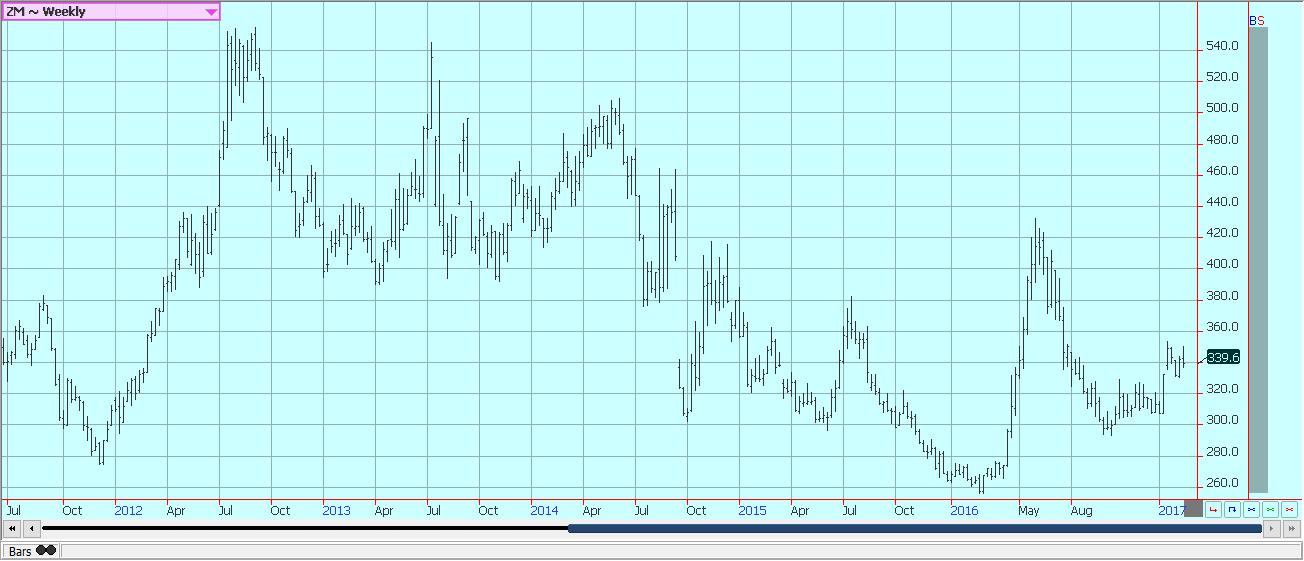

Soybeans and soybean meal

Soybeans and Soybean Meal were lower last week as the potential for sales in the world market from South America started to increase. Much of the feat of increased sales has to do as much with the calendar as anything else. The harvest progress in Brazil remains very rapid, but producers there are not really selling anything. The Real remains very strong against the US Dollar and closed last week at about 32.2 cents. It was at 28 cents on the first of December. The harvest in Brazil has been moving right along. Mato Grosso is already over one half harvested, and harvest is increasing around the rains in other states. Production ideas currently appear to be near or above 105 million tons. Argentina has seen improved crop conditions due to recent rains in southern areas and drier conditions in flooded areas. These general weather trends are expected to continue this week. Production estimates for Argentina now range from 52 to 55 million tons, down from 55 to 57 million tons early in the growing season. US farmers are expected to make a significant increase in planted area to Soybeans this year as it is the more profitable crop at this time. The trade expects an increase in area of three to four million acres.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures © Jack Scoville

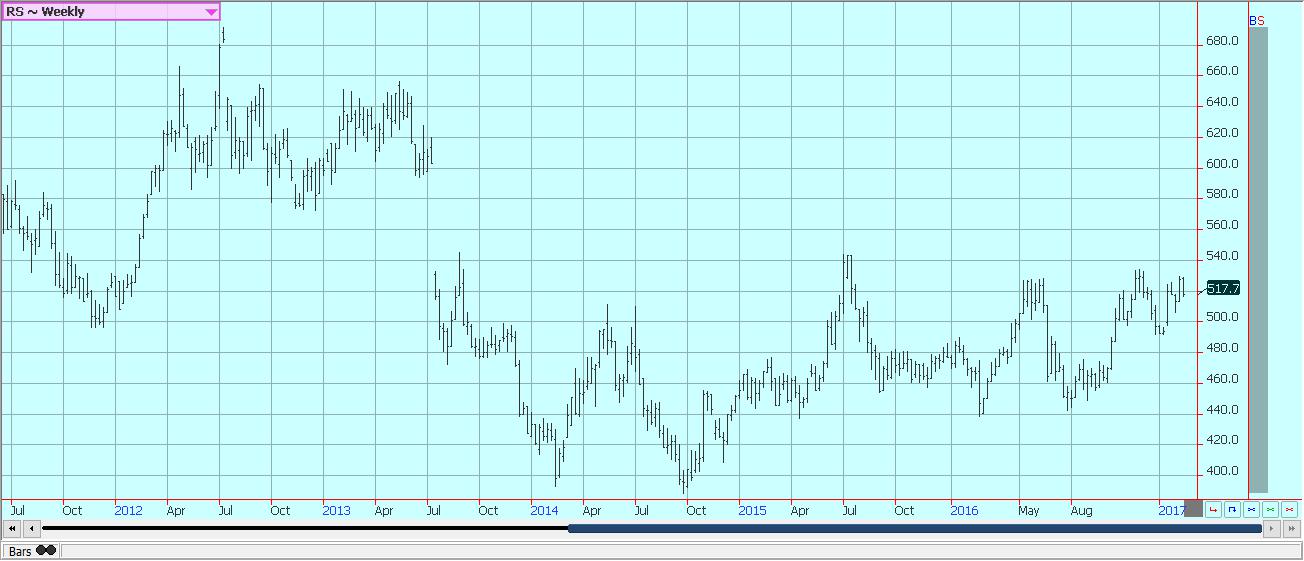

Rice

US futures moved lower and made new lows for the move. Futures are now getting close to some major lows on the weekly charts. These are lows that have held for many years, but many are wondering if they can be breached in the next few weeks. The domestic cash market remains quiet and weak. Bid prices are still well below the cost of production for most producers, but the producers are selling in small amounts just to keep cash flow alive. But, many are unhappy and those that can are considering Soybeans or other crops this year. It is expected that less than 3.0 million acres will get planted to Rice in the US this year, and planted area could drop to 2.7 million acres or less. US export demand has been good for long grain paddy exports and also milled medium and short grain exports, but bad for long grain milled exports. The lack of export demand along with only slightly stronger US domestic demand and the big production have led to projections for big ending stocks this year. The big ending stocks projections are the main reason for the weak prices inside the US. World markets were mixed last week. Asian prices were mostly steady or narrowly mixed. South American prices remain high, but trade talk indicates that Iraq has bought 30,000 tons of Argentine Rice recently at prices a little below those of the US.

Weekly Chicago Rice Futures © Jack Scoville

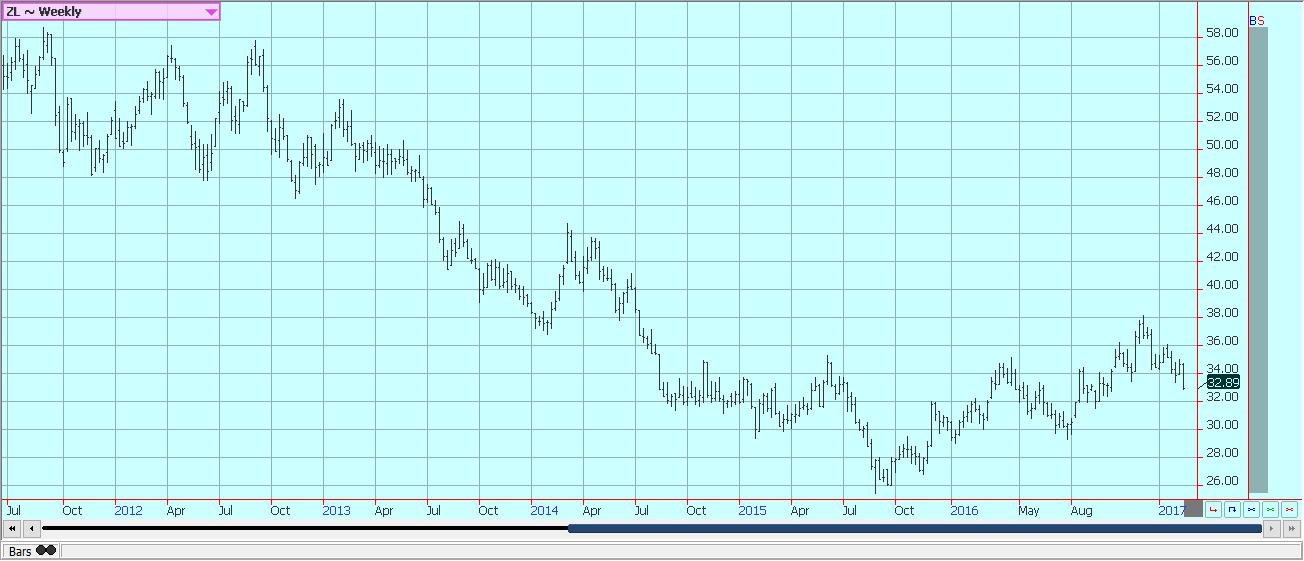

Palm oil and vegetable oils

World vegetable oils markets were lower last week and trends turned down on both the daily and weekly charts. Palm Oil demand was not exceptional in data released from the private surveyors last week, and Soybean Oil demand was moderate for export sales. The market seems more concerned with supply side issues at this time. Palm Oil production is expected to seasonally increase over the next few weeks, and the current weaker demand profile has the market pricing in higher stocks levels inside Malaysia and Indonesia. Soybean Oil also is starting to break down as supplies are available to the market. The NPA crush data last week showed good supplies, and there should be increased competition for sales soon from Argentina and Brazil. Palm Oil futures have now failed after making new highs for the move a couple of weeks ago, so the liquidation and new selling could be strongest in this market for this week. Malaysia and Indonesia are seeing scattered showers that are maintaining tree condition, but not really impeding harvest progress. Prices will probably move lower now in search of better demand.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures were lower for the week and trends turned down on the daily and weekly charts. US weekly export sales improved, but were still below levels seen just a few weeks ago. The market is also concerned about US trade policy and how it could affect agriculture, and specifically Cotton. The largest importer of US Cotton is Mexico, and the clothes worn by many are made there and sent to the US. Trade problems there would hurt many people on both sides of the border. Other big buyers are located in Southeast Asia, and they will now start to look at Australian and South American Cotton as well as offers from the US. The Middle East could also start to see more competing offers. The US demand base overall should hold strong for now as the US Cotton is available and ready to move. But, that could start to change soon. US producers are deciding on what will be planted, and it appears likely that US Cotton planted area will be expanded. Cotton profitability is not that great, and the government support program is not considered very useful. However, competing crop prices are no better or are worse, making Cotton a better alternative.

Weekly US Cotton Futures © Jack Scoville

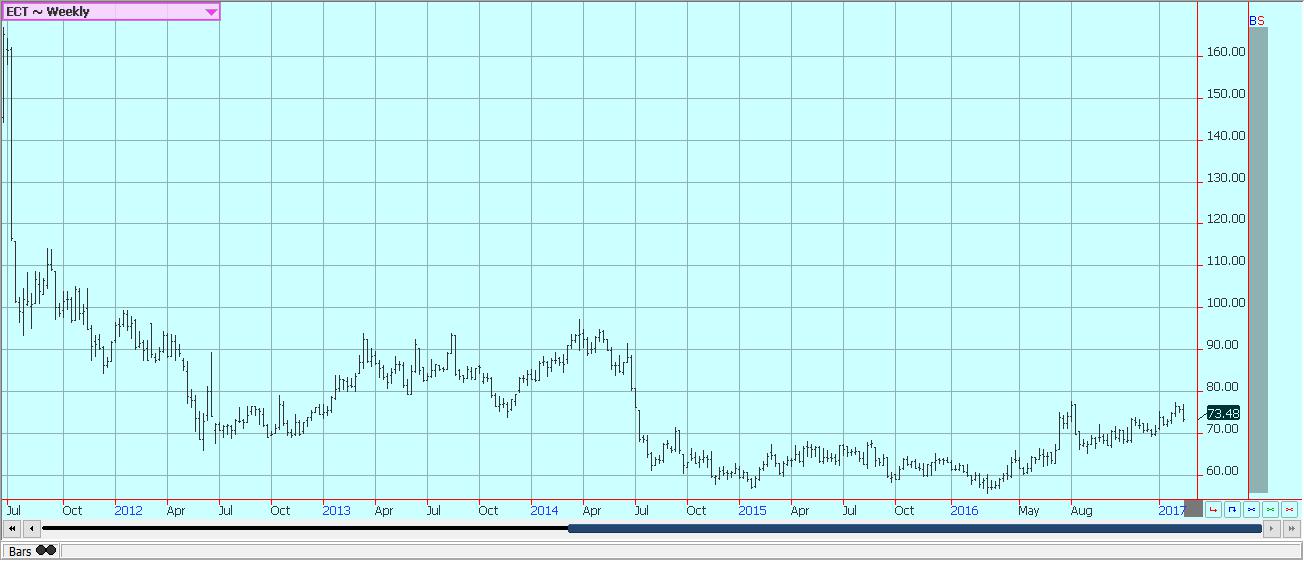

Frozen concentrated orange juice and citrus

FCOJ closed higher last week and appears to be completing a low in this area. It is turning into a weather market as Florida has been very dry. This is great for harvesting, but not good for development of the next crop. Trees are in full bloom in some areas of the state, but just starting in other areas. Good rains are needed for the bloom and initial frui development. Irrigation is being heavily used to prevent loss. The market is still caught between low production and low demand. USDA now estimates Florida Oranges production at 70 million boxes, a very low amount. The Greening Disease remains the overriding factor for reduced production. The Florida harvest remains active. Early and Mid oranges are being harvested for processing. The Valencia harvest is moving quickly. Demand for Orange Juice inside the US is still a big problem. It is currently at its lowest level since records started being kept in 2002, and there are no real prospects for improvement right now as consumers have plenty of alternatives. Sao Paulo state is getting good weather and crop conditions are called good.

Weekly FCOJ Futures © Jack Scoville

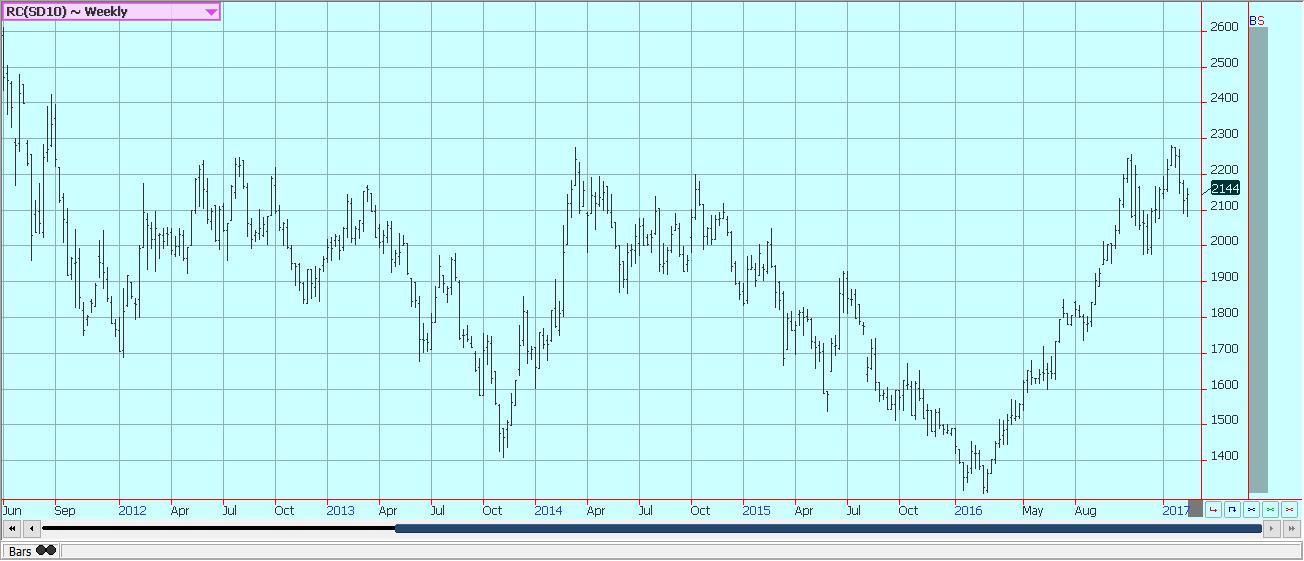

Coffee

Futures closed firm and there are indications that the current move lower is coming to an end. New York is trying to complete a bottom on the daily charts, and London is showing the potential to start higher. The demand side of the market got more animated near the end of the week as futures prices started to hold. Demand was best for good qualities. Demand for inferior qualities was noted as Brazil moves to open up its market to imports. There is buying on ideas that inferior Arabica would actually be more cost effective for the market as prices would be relatively cheaper and shipping would be easier. There is less production in Brazil this year due to the drought in northeast Brazil. Production ideas range from 45 to 50 million bags. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Vietnamese prices have started to drop a little bit as demand has shifted to other countries. The demand has been great for inferior qualities of Coffee from the rest of Latin America, although prices paid remain low and differentials paid remain weak. Differentials for better qualities are stable.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

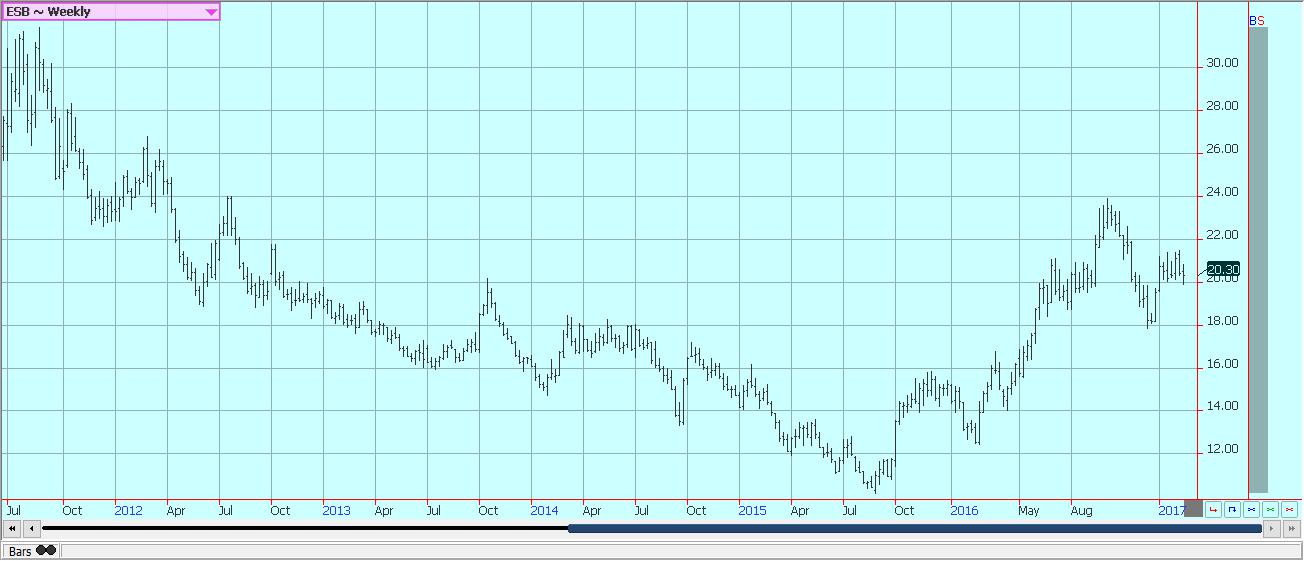

Sugar

Futures closed lower, but held support and remains in an overall trading range. New York closed within the range seen for the last month and a half. Part of the selling is coming as the March contract will go into delivery in New York at the end of the month. London March went off the Board last week. Long speculators are closing out positions, and for now the commercial is only providing partial buying interest. News of less than expected production in Brazil combined with less on offer from India and Thailand provide the best reasons for strong prices. India continues to debate the need for imports, and most analysts expect the country to import at least some Sugar. The government is still saying no imports are needed and has maintained a high import tariff. However, mills are closing early this year as there is little Cane to process. Internal prices are moving higher. China has imported significantly less sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remain too dry. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures © Jack Scoville

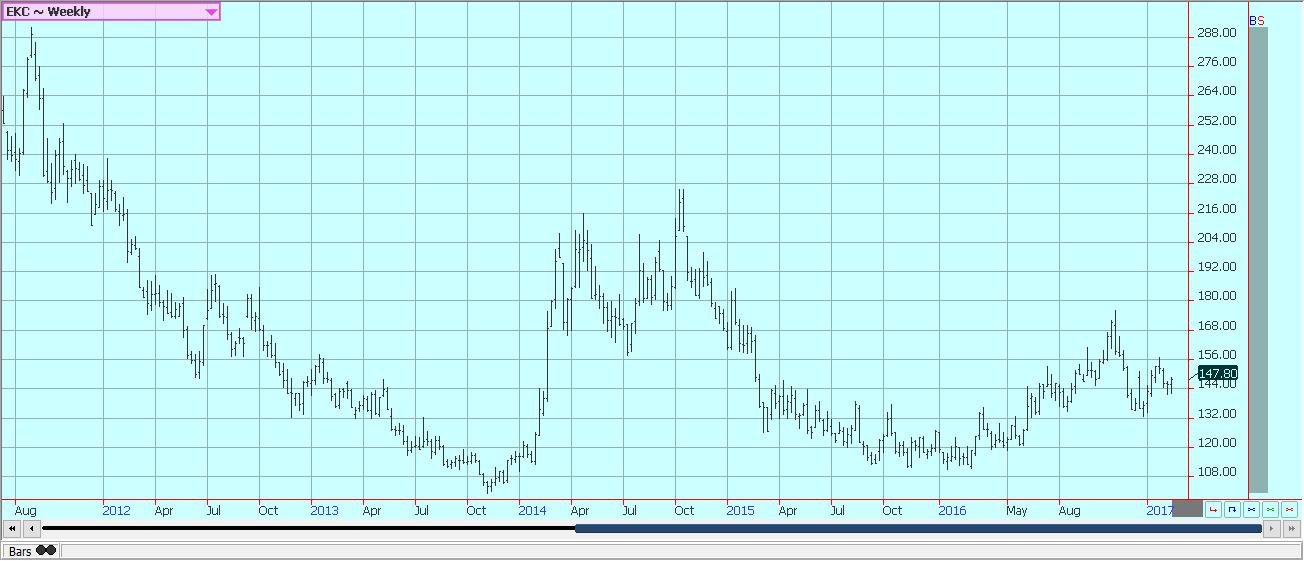

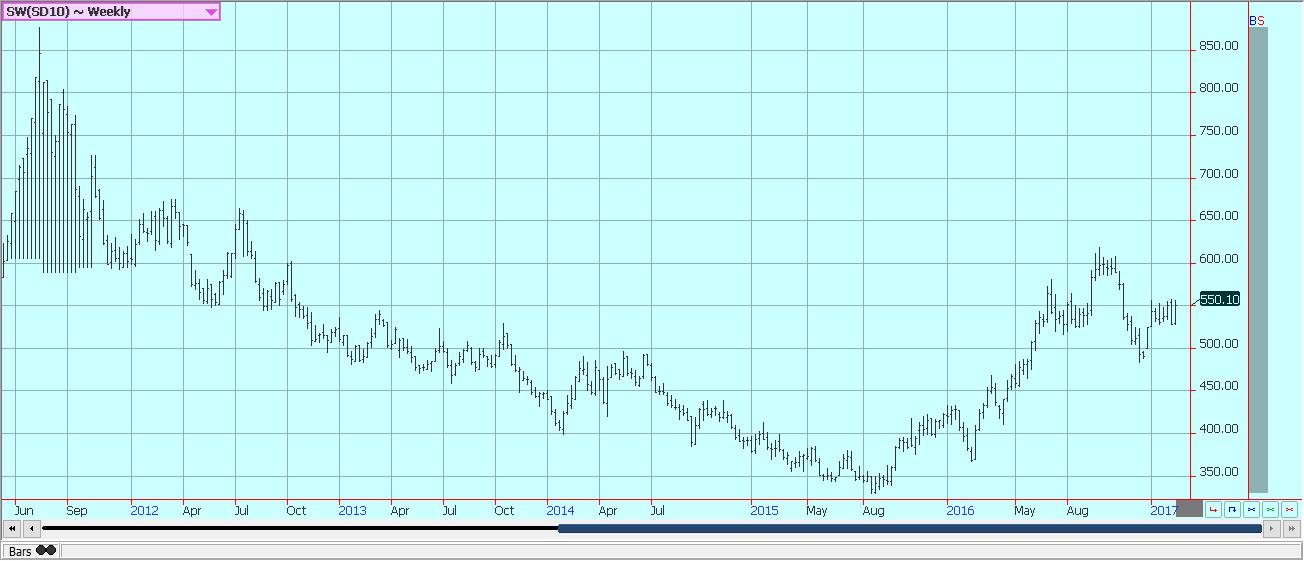

Cocoa

Futures markets were higher after a big rally at midweek to correct oversold conditions on the charts. A one day strike by Ivory Coast producers last week reminded everyone that prices are now very low. The internal market problems in Ivory Coast have made the market situation even worse for the producers. Some producers are leaving pods on trees and letting them rot as there is no money to be made by picking and processing. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. However, the price action last week could start the beginning of a low. The demand from Europe is reported improved, but still weak over all, and the North American demand has been weaker than anticipated. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Traders will watch now to see if Harmattan winds develop that could decimate the mid crop. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures © Jack Scoville

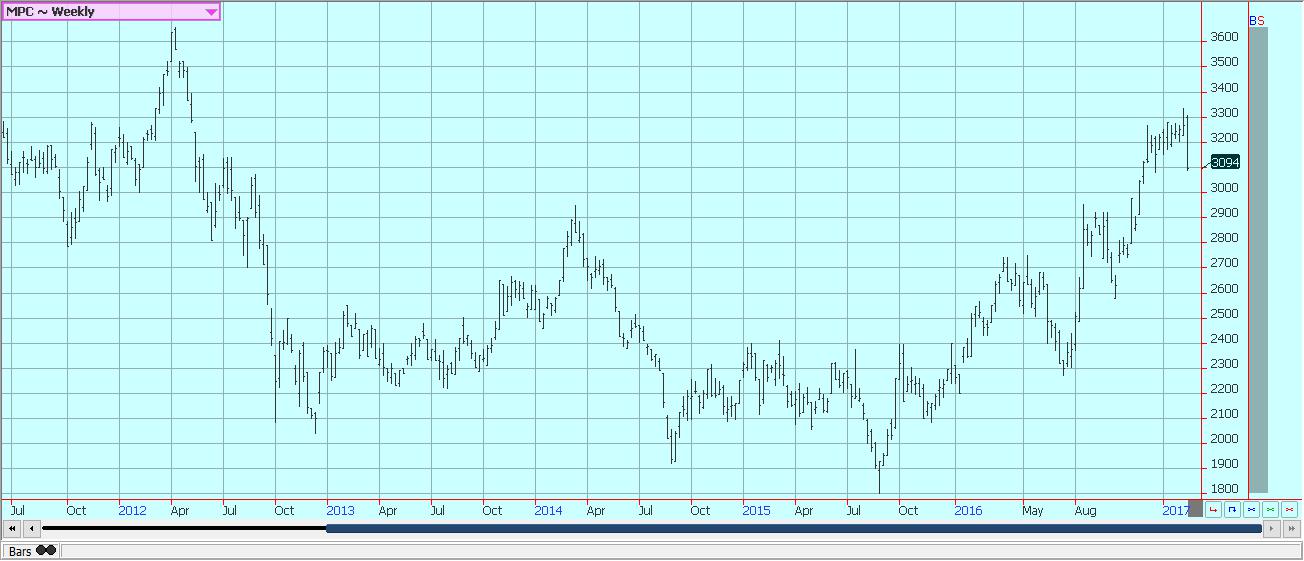

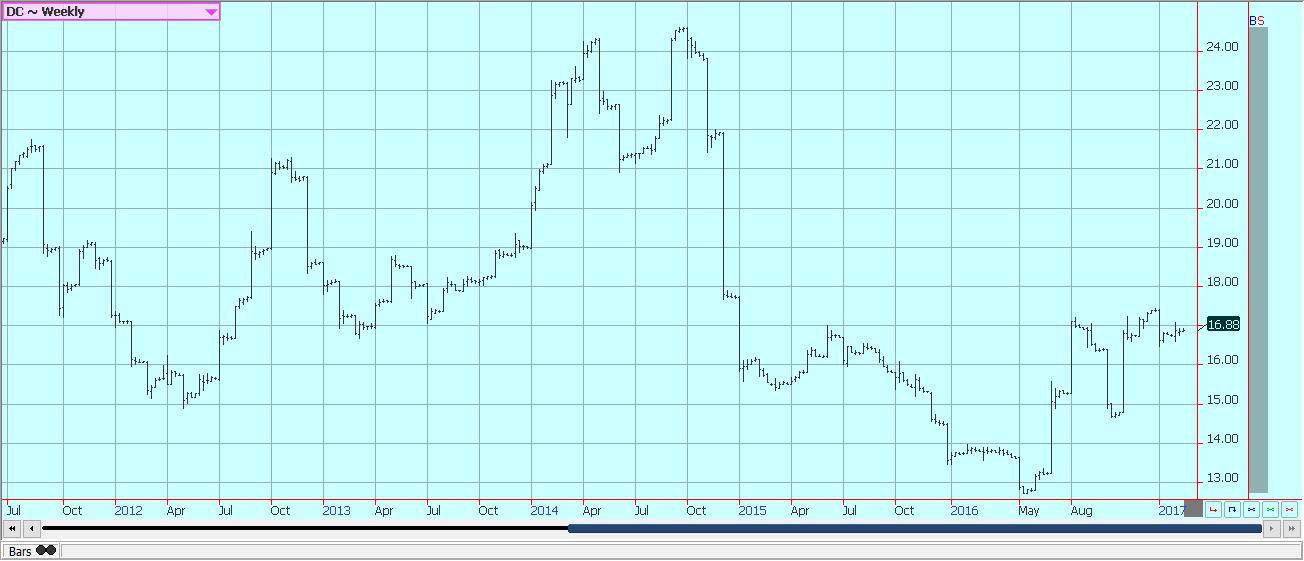

Dairy and meat

Dairy markets were mostly a little lower in choppy trading as good supplies of milk remain available to the market. Demand is good for cream, but cheese makers have started to back away from the market. Bottled milk demand has been mostly strong, but the Midwest is reporting less demand. Production has been seasonally strong in the east and west and stable in the Midwest. Production has been lower in the mountains due to recent bad weather. Butter and cheese manufacturers report that inventories are starting to increase as there is a lot of milk available. This is especially true for Butter, where bulk supplies are going to storage. Cheese supplies are increasing and much of the production is going into aging coolers. Midwest cheese makers are pulling back on taking new milk. Butter manufacturers are mostly producing bulk butter for inventories. Aged inventories are increasing. Dried products prices are mixed. Whey prices are mixed to strong, and whole milk prices are stable. NDM prices are stable to weak. International markets are featuring higher prices due to reduced production. Production is less in Europe and Russia. Export demand for New Zealand has increased due to stronger demand from China. Production is in a short-term decline due to poor pasture conditions. Australian milk production remains lower and supplies are called tight. South American prices are firm as raw milk production goes into a seasonal decline. Argentina is seeing weaker production due to big storms in central and northern areas that has also affected production in parts of Uruguay. Export demand from both countries has been strong, especially from Brazil and Russia. Brazil production is down.

US cattle and beef prices were firm last week amid firm beef prices. Feedlot offers were good, but weights are down, and there is talk that Cattle supplies might be light for the next several weeks. The Cattle on Feed and semiannual inventory reports showed that there is plenty of cattle out there. However, it appears that a lot of the cattle is not yet ready for market. Packers appear short bought. Ideas are that prices can hold at higher levels for now, but that weaker prices will be seen once feedlot offers start to increase in a few months. The weekly export sales report was not strong, but overall beef exports have been very strong this marketing year.

Pork markets were weaker and Lean Hog futures were weaker. Pork Bellies were lower to create some weakness in Hogs futures. Pork demand remains stronger than expected and ham prices have been contra seasonally strong. The monthly supply and demand updates from USDA showed that strong pork demand can continue on the domestic and export fronts. The demand should help keep supplies available to the market under control at a time when hogs production remains very strong. Pork prices have trended higher in retail and wholesale markets. Export prices have been strong as well. Packer demand has been very good as packers move to meet the strong domestic and world demand. There are big supplies out there for any demand. The charts show that the market could remain higher, and strong demand ideas should continue to support the market overall.

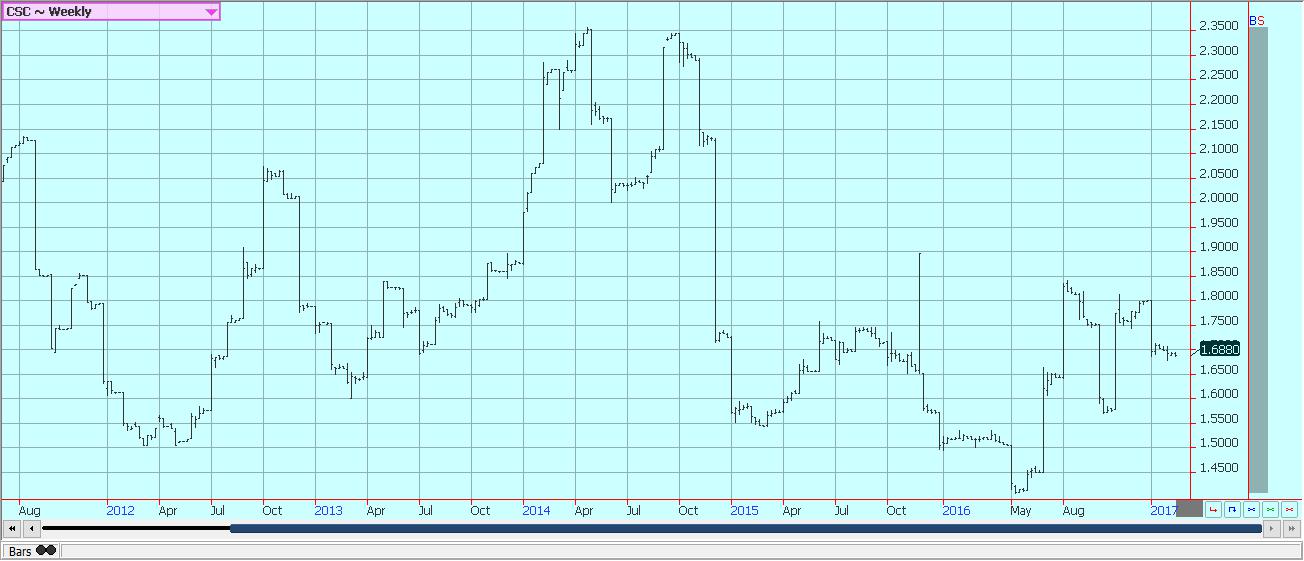

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

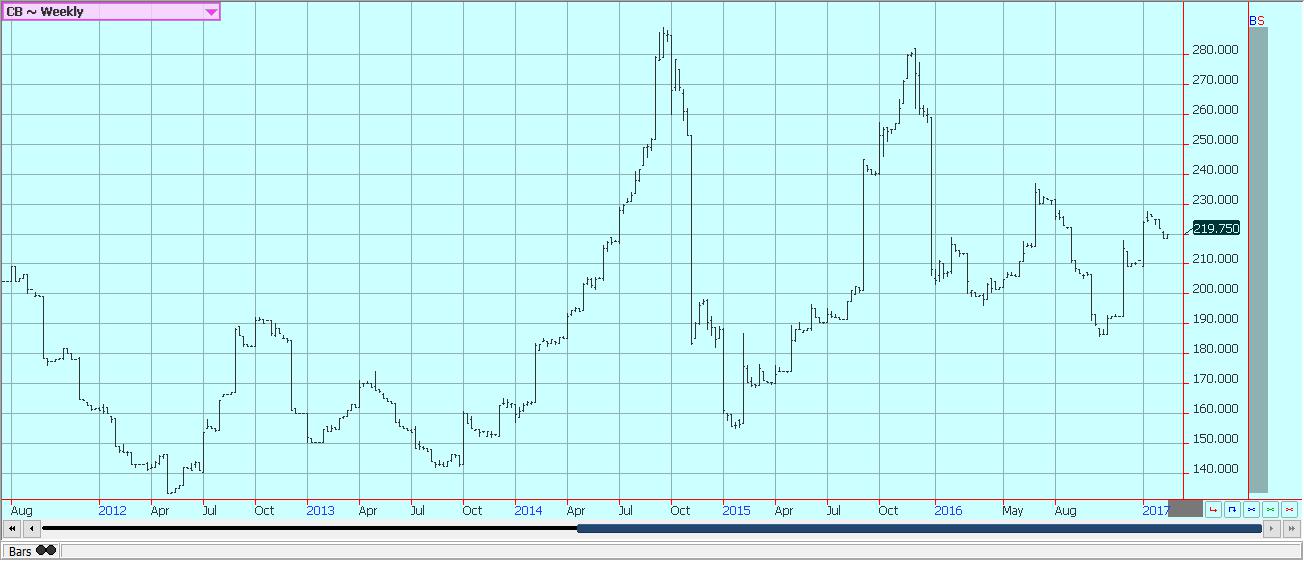

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Africa1 week ago

Africa1 week agoBLS Secures 500 Million Dirhams to Drive Morocco’s Next-Gen Logistics Expansion

-

Fintech2 weeks ago

Fintech2 weeks agoRipple Targets Banking License to Boost RLUSD Stablecoin Amid U.S. Regulatory Shift

-

Impact Investing3 days ago

Impact Investing3 days agoSustainable Investments Surge in Q2 2025 Amid Green and Tech Rebound

-

Biotech1 week ago

Biotech1 week agoBiotech Booster: €196.4M Fund to Accelerate Dutch Innovation

You must be logged in to post a comment Login